Creating and managing a budget for your department or business is a crucial step in achieving your goals and tracking your financial resources. A budget sheet is a powerful tool that helps you define and communicate your financial objectives, evaluate your progress, and make necessary adjustments to ensure a better future. In this article, we will outline the steps to prepare an effective budget sheet.

Step 1: Define your objectives

Before you can start creating a budget, it’s important to have a clear understanding of what you want to achieve. Outline your department or business goals and identify the major expenses or resources required to reach them. This will help you gather the necessary data and ensure that your budget accurately reflects your objectives.

Step 2: Gather data and identify sources of income

Gather all the relevant financial data from the previous year and any interim reports. Identify the sources of income or revenue for your department or business. This includes the money you have coming in from various sources, such as sales, investments, or grants.

Step 3: Create a budget template or spreadsheet

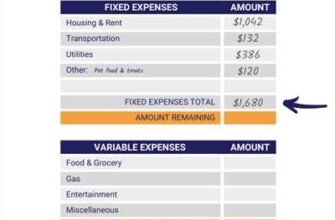

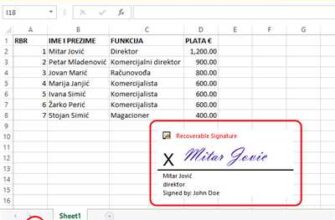

Using a budgeting platform or software, such as Smartsheet, create a budget template or spreadsheet that meets your specific needs. This template will serve as the basis for your budget sheet and should include the necessary categories and headings to track your expenses and income.

Step 4: Build your budget sheet

Allocate the resources and expenses to the appropriate categories in your budget sheet. This includes assigning specific amounts for each expense and source of income. Be sure to consider any variances or adjustments that may need to be made based on your department or business objectives.

Step 5: Gather feedback and get approval

Once your budget sheet is complete, share it with the relevant stakeholders, such as managers or executives, for their input and approval. This step ensures that everyone is on the same page and provides an opportunity for any necessary adjustments or changes.

Step 6: Evaluate and manage your budget

The budgeting process does not end with the final approval. It’s important to regularly evaluate and manage your budget to ensure that you are staying on track and achieving your goals. Monitor your actual results against the planned budget and make any necessary adjustments.

By following these steps and using an effective budget sheet, you can better track and manage your financial resources, communicate your objectives, and ultimately achieve success for your department or business.

- How to Build a Budget Spreadsheet in 5 Steps

- What Are the Steps to Budget Preparation

- Budget Preparation – Step 1: Define Major Goals and Objectives

- Budget Preparation – Step 2 Gather Data

- Budget Preparation – Step 3: Prepare the Model

- Budget Preparation – Step 4: Approve the Budget

- Budget Preparation – Step 5 Communicate the Budget

- Budget Preparation – Step 6: Report Interim Results

- Evaluate any significant variances

- Better Manage and Track Annual Business Budgets with Smartsheet

- Sources

How to Build a Budget Spreadsheet in 5 Steps

Creating a budget spreadsheet is an essential part of managing your finances, whether you are an individual or a business. By gathering and organizing your financial data, you can better track and manage your money, make adjustments when necessary, and plan for future goals. In this article, we will outline the five steps to building a budget spreadsheet that can help you effectively manage your budget.

- Gather your financial data: The first step in building a budget spreadsheet is to gather all the necessary financial data. This includes gathering information on your income, expenses, and any other financial resources or goals you want to track. You should also gather any interim or annual budgets that your department or firm may have.

- Define your budget objectives: Once you have gathered the necessary data, you need to define your budget objectives. This involves setting specific financial goals that you want to achieve and determining the overall budget for each goal. For example, if you want to save a certain amount of money each year, you would define that goal and set a budget that allows you to achieve it.

- Create a budget template: After defining your budget objectives, the next step is to create a budget template. This template will serve as the foundation for your budget spreadsheet and will include the necessary columns and rows to track your financial data. You can use software like Microsoft Excel or smartsheet to create your budget template.

- Input and evaluate your financial data: With your budget template created, you can now input your financial data into the spreadsheet. This includes entering your income, expenses, and any other relevant financial information. Once your data is inputted, you can begin evaluating your budget by tracking variances between your planned and actual expenses.

- Approve, communicate, and track: The final step in building a budget spreadsheet is to approve your budget and communicate it to the relevant stakeholders. This may involve sharing your budget with managers, department heads, or other individuals who need to be aware of the financial plan. Once approved, you can begin tracking your budget on a regular basis to ensure you are sticking to your planned financial goals.

By following these five steps, you can build a budget spreadsheet that will help you effectively manage your finances. Remember to regularly review and update your budget as needed to make any necessary adjustments and to stay on track with your financial goals.

What Are the Steps to Budget Preparation

Preparing a budget requires several steps to ensure effective financial management for a business or department. These steps help define the overall objectives and track the use of resources throughout the year. Here are the typical steps in the budget preparation process:

- Gather Data: Before any budgeting can take place, gather all the necessary data from various sources within the firm. This includes financial reports, production levels, and any other relevant information that will help in the budgeting process.

- Define Objectives: Determine the key objectives that the budget is meant to achieve. These objectives can vary from year to year or for specific projects. Clearly defining these objectives will help guide the budgeting process.

- Create a Budget Template: Use a spreadsheet or budgeting software to create a template that will be used to build the budget. This template should include categories for income, expenses, and any other relevant financial data.

- Allocate Resources: Determine how much money is allocated to each department or area of the business. This step requires evaluating the needs of each department and balancing the available resources accordingly.

- Evaluate and Adjust: Once the budget is created, evaluate it to ensure that it aligns with the defined objectives. Make any necessary adjustments to the budget to improve its effectiveness.

- Communicate and Approve: Communicate the final budget to the relevant people within the organization. This step involves obtaining approval from managers or stakeholders who have the authority to sign off on the budget.

- Track and Report: During the year, track the actual financial results against the budgeted amounts. This allows for the identification of any significant variances and facilitates timely adjustments as needed.

- Stick to the Budget: It is crucial to monitor and manage spending throughout the year to ensure that the budget is followed. This requires discipline and adherence to the budgeted amounts.

- Evaluate and Improve: At the end of the budget period, evaluate the overall effectiveness of the budgeting process. Identify areas for improvement and make any necessary changes to the budgeting model for future years.

By following these steps, businesses can prepare budgets that align with their objectives and allow for effective financial management. Whether using a spreadsheet or budgeting software like Smartsheet, the budget preparation process typically requires careful planning and collaboration among various levels of the organization.

Budget Preparation – Step 1: Define Major Goals and Objectives

When preparing a budget, the first step is to define the major goals and objectives for your business or department. This step is crucial to ensure that your budget aligns with the overall vision and mission of your organization.

By clearly defining your goals and objectives, you can better allocate resources and make informed decisions about where to invest your budget. This will help you prioritize your spending and focus on initiatives that will drive the most significant results for your business.

Start by gathering input from key stakeholders, such as department managers and the people who will be responsible for managing the budget. The input from these individuals will provide valuable insights into the specific objectives that need to be addressed in the budget.

Consider the future needs and planned initiatives of your business or department. Are there any significant projects or investments on the horizon? What are the key areas where you want to see improvements or growth? Answering these questions will help you define the objectives that should be included in your budget.

Collaborate with other departments and evaluate past budget performance to identify areas where adjustments may be necessary. Look at variances in your previous budgets and determine if there were any unexpected costs or inefficiencies. This will help you build a better budget template and make more accurate projections for the future.

Use budgeting software or a spreadsheet platform to create a budget model that aligns with your objectives. This will allow you to track and manage your budget effectively, making it easier to communicate and report on the progress of your initiatives.

Remember to consider the interim and annual levels when preparing your budget. Your budget should cover the short-term needs of your organization while also aligning with the long-term goals and objectives.

Once you have defined your major goals and objectives and have gathered the necessary data, you can move on to the next steps of the budget preparation process. This includes gathering input from relevant stakeholders, creating a budget structure, and finalizing your budget for approval.

| Key Points: |

|---|

| 1. Define the major goals and objectives for your business or department. |

| 2. Gather input from department managers and key stakeholders. |

| 3. Consider the future needs and planned initiatives. |

| 4. Evaluate past budget performance and make adjustments if necessary. |

| 5. Use budgeting software or a spreadsheet template to create a budget model. |

| 6. Ensure your budget aligns with interim and annual levels. |

Budget Preparation – Step 2 Gather Data

Once you have defined your business goals and objectives in Step 1, it is time to gather the necessary data to prepare your budget. Gathering data is a crucial step in the budgeting process as it helps you better understand your current financial situation and make informed decisions for the future.

In order to gather data, you will need to collect information from various sources within your organization. This can include financial reports, production records, sales data, and any other relevant information. It is important to gather data from multiple departments and levels of your organization to ensure that all aspects of the business are taken into account.

One major source of data for budget preparation is your accounting system or software. This system should be able to provide you with the necessary financial and operational data to create your budget. If you don’t have a dedicated accounting system, you can use a spreadsheet to track and organize your data.

When gathering data, it is important to be as detailed as possible. You want to gather enough data to build an accurate and effective budget, but you also don’t want to overwhelm yourself with too much data that is not relevant to your goals. Stick to the data that is necessary for planning and decision making.

In addition to financial data, you also need to gather data on non-financial aspects of your business. This can include information on your production process, resources available, and any other factors that could impact your budget. By gathering this information, you can ensure that your budget takes into account all the necessary variables.

Once you have gathered all the necessary data, the next step is to create a budget template or model. This template will serve as the foundation for your budget and will help you organize and analyze the data you have collected. There are many budgeting platforms and software available that can assist you with this process, such as Smartsheet.

After creating your budget template, you will need to communicate with the relevant people in your organization, such as department managers or executives, to gather their input and make any necessary adjustments. Budgeting is not a one-person job, and it requires collaboration and input from different stakeholders.

Once you have received input and made any adjustments, you can then finalize your budget and prepare to present it to your firm’s management for approval. It is important to communicate your budget effectively and clearly to ensure that everyone understands the goals and objectives it represents.

During the budgeting process, it is also important to track and evaluate your actual results against the budget. This will help you identify any variances and make any necessary adjustments to stay on track with your financial goals.

In conclusion, Step 2 of budget preparation involves gathering the necessary data from various sources within your organization. This data will serve as the basis for building an accurate and effective budget. By using a budget template or software, you can organize and analyze the data to create a budget that aligns with your overall business goals.

Budget Preparation – Step 3: Prepare the Model

When it comes to budgeting, effective preparation is key. One of the most important steps in the budget preparation process is to prepare the budget model. This model serves as a template that can be used for any budgets you need to create, whether they are annual, interim, or department-specific budgets.

To prepare the budget model, you’ll need to gather all the necessary data and resources. This includes financial data, such as revenue and expenses, as well as any other relevant information, like sales projections or production goals. Gathering this data will help you define your budget objectives and goals.

There are several tools you can use to create the budget model. Spreadsheet software, such as Microsoft Excel or Google Sheets, is a popular choice. There are also specialized budgeting software platforms available, like Smartsheet, that can help you create and manage your budget more efficiently.

Once you have chosen your preferred platform, you can start building the budget model. This typically involves creating a spreadsheet or entering the data into the software. Make sure to define the levels of detail you want to track, such as different departments or expense categories.

After the budget model is created, you can start entering the planned budget amounts for each category. This will give you a better idea of how your budget aligns with your goals and objectives. As you work on this step, it’s essential to communicate with the relevant managers or departments to gather input and ensure their goals and needs are considered.

Once the budget model is complete, you can evaluate the results and make any necessary adjustments. Some firms prefer to perform a “what-if” analysis to evaluate different scenarios. This can help you understand how changes in revenue or expenses may impact the overall budget. By reviewing the results, you can identify any significant variances and make appropriate changes.

Finally, when the budget model is finalized and approved, it’s important to stick to it throughout the year. However, it’s also crucial to be flexible and make adjustments when necessary. Budgets are not set in stone, and unforeseen circumstances may require modifications. Regularly review the budget and track actual performance to ensure you stay on track.

Overall, the process of preparing the budget model requires attention to detail and careful planning. By following these steps and using an effective budgeting model, you can better manage your financial resources and stay on top of your business goals.

Budget Preparation – Step 4: Approve the Budget

Once you have gathered all the necessary data and built your budget spreadsheet template, the next step in the budget preparation process is to evaluate and approve the budget. This step is crucial as it ensures that the budget aligns with the objectives and goals of your business.

During the budgeting process, there are usually several levels of approval required. The first level involves department managers or team leaders reviewing and adjusting their department’s budget based on their goals and production needs. The second level involves reviewing the department budgets and making any necessary adjustments at an overall firm or company level.

When evaluating the budget, it is important to compare the planned budget with the actual results from the previous year or any interim budgets. This helps in identifying any significant variances and making adjustments accordingly. It is also essential to track and evaluate the budget periodically to ensure that it remains effective throughout the year.

Most organizations use budgeting software or platforms like Smartsheet to manage and track their budgets. These platforms provide better visibility into the budgeting process, allow for collaboration among different people involved, and help in creating more accurate and reliable budgets.

During the budget approval process, the finance or management team reviews the budget and makes the final approval. This step involves ensuring that the budget aligns with the overall goals and objectives of the business, that the resources needed are allocated properly, and that any significant adjustments or changes have been adequately considered.

Overall, budget approval is a crucial step in the budget preparation process. It ensures that the budget is aligned with the objectives and goals of the business, helps in managing resources effectively, and provides a roadmap for the financial activities of the organization for the coming year.

| Steps in Budget Preparation | What to Do |

|---|---|

| Step 1 | Gather data from various sources |

| Step 2 | Create a budget spreadsheet template |

| Step 3 | Evaluate and adjust the budget |

| Step 4 | Approve the budget |

| Step 5 | Track budget variances and make adjustments |

| Step 6 | Build future budgets based on results |

Budget Preparation – Step 5 Communicate the Budget

Once you have defined your goals, gathered all the necessary data, and created a budget template, it is time to communicate the budget to the relevant people in your organization. Effective communication of the budget is crucial to ensure everyone understands the financial plan and can align their activities with it.

Here are the steps to effectively communicate the budget:

- Identify the key people who need to be informed about the budget. This typically includes department managers, senior executives, and other relevant stakeholders.

- Choose the best platform or method to communicate the budget. This could be through a budget report, a presentation, or a dedicated budget meeting.

- Present the overall budget to the key stakeholders. Explain the major goals and objectives of the budget and how it aligns with the company’s overall strategy.

- Highlight any significant adjustments or variances that were made during the budgeting process. It is important to provide context and reasoning behind these changes.

- Share the budget spreadsheet or any relevant budgeting software with the managers or departments who will be directly responsible for tracking and managing their budget. This will help them better understand their budget allocation and enable them to track their actual spending against the budget.

- Provide clear instructions on how to evaluate and report variances. Managers should know how to identify and explain any deviations from the budget and take appropriate actions to address them.

Remember that budgeting is an ongoing process, not a one-time task. It requires constant monitoring and adjustments throughout the year. Regularly communicate with the relevant stakeholders to keep them informed about any changes or updates to the budget.

By following these steps and effectively communicating the budget, you can ensure that everyone in your organization is well-informed and aligned with the financial goals and objectives.

Budget Preparation – Step 6: Report Interim Results

Typically, the budgeting process requires several reports throughout the year to evaluate the organization’s financial performance. These reports include actual financial data compared to the budgeted amounts, as well as variances indicating any significant deviations.

Department managers play a crucial role in this step. They are responsible for gathering data related to their department’s financial performance and reporting it to the higher management. It is important to communicate openly and openly with department managers to ensure accurate and timely reporting.

When reporting interim results, it is essential to evaluate the financial performance against the objectives defined in the budget. This helps identify areas where adjustments are required to better align the organization’s goals with its financial resources. By doing so, you can ensure that the budget remains an effective tool for managing the organization’s financial resources.

To report interim results effectively, you may need to use budgeting software or a platform like Smartsheet, which provides templates and tools to track and evaluate financial performance. These tools can help automate the reporting process, making it more efficient and timely.

Key steps in this process include:

- Gather interim financial data

- Evaluate the actual financial results against the budgeted amounts

- Identify any significant variances and analyze their causes

- Communicate the results to department managers and higher management

- Work with department managers to make adjustments if needed

- Track the progress towards the final budget goals and objectives

Reporting interim results is critical for better financial management throughout the year. It helps the organization stay on track and ensures that resources are allocated appropriately to achieve the desired outcomes.

By following these steps and regularly reporting interim results, you can build an effective budgeting model that enables you to plan, manage, and allocate your firm’s resources more efficiently and effectively.

Evaluate any significant variances

Once you have prepared your budget sheet, it is important to regularly evaluate any significant variances that arise. This evaluation process is critical to ensure that your budget is effective and aligned with your business objectives. Here are some steps to help you manage and evaluate any significant variances:

- Track and compare actual results with the planned budget: Use a budget template or software platform to input and manage your budget data. Take note of any differences between the planned budget and the actual results.

- Define what significant variances are: Determine what constitutes a significant variance for your department or business. This will vary depending on your goals, resources, and overall objectives.

- Communicate with relevant stakeholders: Engage with key people in your department or firm to discuss the significant variances and their implications. This may include managers, team leaders, or other individuals involved in the budgeting process.

- Analyze the causes of the variances: Identify the root causes of the significant variances. This may involve examining factors such as changes in market conditions, production issues, or unexpected expenses.

- Make necessary adjustments: Based on your analysis, determine if any adjustments need to be made to the budget. This could involve reallocating resources, revising production targets, or implementing cost-cutting measures.

- Approve and finalize the revised budget: Once the necessary adjustments have been made, seek approval from relevant stakeholders and finalize the revised budget. This will ensure that your budget reflects the most accurate and up-to-date information.

By regularly evaluating any significant variances and making appropriate adjustments, you can better manage your budget and work towards achieving your business goals. It is important to remember that budgeting is an ongoing process, and future budgets may need to be adjusted based on the results of the evaluation.

Better Manage and Track Annual Business Budgets with Smartsheet

When it comes to managing your business budget, it’s essential to have a robust system in place that allows you to effectively track and manage expenses. Smartsheet, a powerful online collaboration and project management tool, can be the solution you need to better manage and track your annual business budgets.

One of the first steps in budget preparation is to define your goals and objectives for the year. You need to have a clear understanding of what you want to achieve and how much money you have available to work with. Smartsheet provides a budgeting template that can help you gather and organize the necessary data to create a comprehensive budget model.

Once you have defined your goals, the next step is to gather the resources and information needed to create a budget. Smartsheet’s platform allows you to easily input and evaluate data from various departments and levels within your firm. This makes it easier to gather the necessary information and make adjustments as needed.

As you work on budget preparation, it’s important to involve key people in the process. Smartsheet provides a collaborative environment where managers and other stakeholders can review and approve budgeting decisions. This ensures that everyone is on the same page and that the final budget reflects the overall objectives of the business.

One advantage of using Smartsheet for budgeting is that it allows you to track variances between planned and actual budget amounts. This feature is especially useful for interim reporting, as it helps you identify any significant deviations from the original budget and take appropriate action.

Another benefit of using Smartsheet is that it provides a platform for reporting and analyzing budget results. You can easily create reports that show how your budget compares to actual results, allowing you to evaluate the effectiveness of your budgeting process.

Smartsheet also provides a user-friendly interface that does not require extensive training. This means that you can start using the software right away without the need for a steep learning curve.

In summary, if you want to better manage and track your annual business budgets, Smartsheet is a software platform that can provide the tools and resources you need. With its collaborative features, easy-to-use interface, and robust reporting capabilities, Smartsheet can help you streamline your budgeting process and stick with your financial objectives.

Sources

When preparing a budget sheet, there are several sources that managers can utilize to gather the necessary data and resources. Here are some of the major sources typically used:

| Source | Description |

| 1. Annual Budget | An overall budget template that helps a business define its goals and objectives for the year. |

| 2. Interim Budget | A budget prepared to track and evaluate the firm’s financial performance at different levels throughout the year. |

| 3. Financial Reports | Data gathered from financial reports to evaluate the firm’s past performance and make any necessary adjustments. |

| 4. Production Model | Data from the production department, including planned production levels and variances, to better manage resources and budget effectively. |

| 5. Department Goals | Objectives and goals communicated by various departments within the organization. |

| 6. Software or Spreadsheet | Budgeting software or a spreadsheet platform like Smartsheet can be used to create, track, and manage budgets. |

By gathering data from these sources, managers can build an effective budget sheet that aligns with the business’s overall objectives and helps them stick to their planned financial goals.