Managing your finances can be overwhelming, especially if you have a lot of expenses and not enough income to cover them. That’s why it’s important to have a monthly budget in place to help you plan and track your spending. With a budget, you’ll know exactly how much money you have coming in and where it’s going, which will make it easier to make informed financial decisions. In this article, we’ll provide you with some tips on how to write a monthly budget that works for you.

The first step in creating a monthly budget is to determine your monthly income. This includes not just the take-home pay from your job, but also any additional sources of income you may have, such as a side business or freelance work. Once you know how much money you’re earning each month, you can start to plan how to allocate it to cover your expenses.

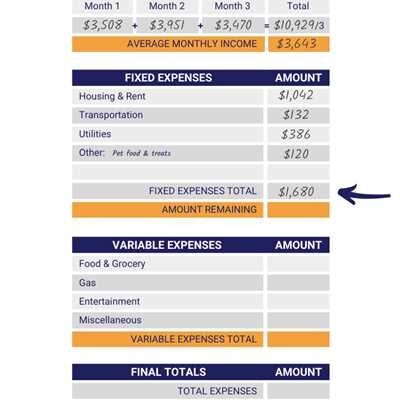

Next, you’ll need to list all of your monthly expenses. This includes both fixed expenses, such as rent or mortgage payments and utilities, as well as variable expenses, such as groceries, entertainment, and transportation. Be as specific as possible when listing your expenses, as this will help you get a more accurate picture of where your money is going.

Once you have a clear idea of your income and expenses, it’s time to start making a budget. You can do this on paper or by using budgeting apps or services, whichever you feel most comfortable with. The key is to allocate your income in a way that covers your expenses and leaves some room for savings or paying off debts. If you find that your expenses are higher than your income, you’ll need to look for ways to reduce your spending or increase your earnings.

Remember, a monthly budget is not set in stone. It’s a living document that can be adjusted as needed. If you find that you’re consistently overspending in one area, you may need to cut back somewhere else. Or if you have a one-off expense that’s not accounted for in your budget, you may need to find extra money to cover it. The key is to be flexible and willing to make changes as your financial situation evolves.

How to plan a monthly budget

Planning a monthly budget is crucial for managing your financials effectively. It allows you to track your income and expenses, ensuring that you live within your means and work towards your financial goals. Below are some tips and steps to help you create an accurate and effective monthly budget:

- Calculate your income: Start by identifying all sources of income you have each month. This can include your salary, rental income, freelance earnings, or any other regular income you receive. Make sure to consider the take-home pay rather than the total salary before taxes.

- Track your expenses: Keep a record of all your monthly expenses. This can be done on paper, using budgeting apps, or online services. Categorize your expenditures to understand where your money is going. This will give you a clear picture of what you’re spending on and help identify areas where you can reduce cost.

- Create a budget plan: Once you have a clear understanding of your income and expenses, it’s time to create a budget plan. Start by allocating a certain amount to cover your essential expenses such as rent/mortgage, utilities, groceries, and transportation. Then, allocate a portion of your income towards your financial goals, such as savings or debt repayment.

- Consider one-off and irregular expenses: In addition to your regular monthly expenses, factor in one-off or irregular expenses such as car maintenance, medical bills, or annual subscription fees. It’s important to set aside some money each month to cover these expenses when they arise.

- Be realistic and flexible: While planning your budget, it’s crucial to be realistic about your income and expenses. Be honest with yourself about what you can afford and prioritize your spending accordingly. Flexibility is also key, as unexpected expenses may pop up during the month. Leave some room in your budget for these unforeseen costs.

- Use budgeting tools: There are many budgeting tools available to help you manage your finances more efficiently. These apps and services can track your expenses, provide insights, and help you make smarter financial decisions. Explore different options and find the one that suits your needs.

- Review and adjust: Your budget is not set in stone. It’s important to regularly review and adjust your budget based on your changing financial circumstances. Keep track of your actual spending and compare it to your planned budget. This will help you identify any areas where you need to make changes.

- Seek professional help if needed: If you’re finding it difficult to manage your finances on your own or have a complex financial situation such as running a business, consider seeking professional help. A financial advisor can provide guidance and help you create a more robust budget plan.

Remember, budgeting is a continuous process. It takes time and effort to develop good budgeting habits. Stick to your budget and be disciplined with your spending. With proper planning and budgeting, you’ll be better equipped to achieve your financial goals and have a more secure financial future.

Monthly Business Budget

When running a business, it is important to have a monthly budget in place to track your income and expenses. By doing so, you’ll be able to manage your finances more effectively and make informed decisions about where to allocate your resources.

First, you need to have a clear understanding of your earning sources and how much you can expect to earn each month. Take into account all the services you provide and any other potential sources of income for your business. Importantly, be realistic and accurate when estimating your earnings.

Next, you need to determine all of your monthly expenses. This includes both regular monthly bills, such as rent, utilities, and insurance, as well as one-off costs that may occur from time to time, such as buying new equipment or office supplies. Make sure to track all of your spending to get an accurate picture of your costs.

Once you have a clear idea of your income and expenditure, you can start budgeting. Allocate a specific amount of money for each category of spending and make sure to cover all necessary expenses. It is also helpful to set aside some money for unexpected costs or emergencies.

There are several tips and strategies you can use to help manage your business budget more effectively. For example, you can reduce costs by finding cheaper suppliers or negotiating better deals with your current ones. You can also use budgeting apps and software to track your expenses and income more efficiently. Additionally, regularly reviewing and updating your budget can help you identify areas where you can save money.

Remember, budgeting is a dynamic process, and it may take some time to find a system that works best for you. Be patient and give yourself time to adjust. By having a monthly business budget, you’ll be better equipped to make financial decisions and ensure the long-term success of your business.

Feel free to download and use our free monthly business budget template to help you get started on managing your business finances more effectively. The template is easy to use and can quickly give you a clear overview of your financial situation.

How to budget plan

Budgeting is an essential tool to manage your financial expenditure effectively. By creating a budget plan, you can track your income and expenses, and ensure that you’re spending within your means. Here are some tips on how to create a budget plan:

1. Start with accurate income: Determine how much you earn per month, taking into account your take-home pay after deductions.

2. Track your expenses: Take the time to record and categorize all your monthly expenses. This helps you understand where your money is going and identify areas where you can reduce spending.

3. Identify one-off costs: Make note of any irregular or unexpected expenses that you anticipate in the upcoming month. This could include things like car repairs, medical bills, or home maintenance.

4. Prioritize your spending: Allocate your income towards essential expenses first, such as rent/mortgage, utilities, and groceries. Then, plan for discretionary spending on non-essential items like entertainment or dining out.

5. Use budgeting apps: There are many helpful apps available that can assist with budget planning. These apps can sync with your financial accounts and provide real-time updates on your spending habits.

6. Download or use templates: If you prefer a more traditional approach, you can download budgeting templates or use pen and paper to outline your monthly budget plan.

7. Set financial goals: Determine what you want to achieve through budgeting. It could be saving for a down payment on a house, paying off debt, or building an emergency fund.

8. Adjust and review regularly: It’s important to regularly review your budget plan and make adjustments as needed. Life circumstances may change, and you may need to modify your spending habits accordingly.

9. Educate yourself: Take the time to learn more about personal finance and budgeting. There are many resources available, such as books, online articles, and financial planning courses, that can help you improve your financial literacy.

10. Don’t be too hard on yourself: Budgeting takes time and practice. If you find yourself overspending or making mistakes, don’t be too hard on yourself. Learn from your experiences and continue to strive for improvement.

By following these steps and incorporating budgeting into your financial routine, you’ll be able to better manage your money, reduce unnecessary expenses, and work towards your financial goals. Remember, budgeting is a tool to help you gain control over your finances and make more informed financial decisions.

What is my take-home pay

When it comes to budgeting, one of the most important factors to consider is your take-home pay. This is the amount of money you actually receive after taxes and deductions have been taken out of your paycheck.

Calculating your take-home pay can be a bit complicated, but there are tools and resources available to help you do it quickly and accurately. Many online services and apps are available that can calculate your take-home pay based on your salary, tax bracket, and other factors.

It’s important to have an accurate understanding of your take-home pay because it will determine how much money you have available to spend and save each month. This is why it’s crucial to factor in your take-home pay when creating your monthly budget.

If you’re not sure what your take-home pay is, there are a few steps you can take to figure it out. First, you’ll need to gather some information such as your gross income (the amount you earn before taxes), any pre-tax deductions (such as contributions to retirement accounts), and your tax bracket.

Once you have this information, you can use an online calculator or a budgeting app to determine your take-home pay. These tools will take into account factors such as federal, state, and local taxes, Social Security and Medicare contributions, and any other deductions that may apply to you.

By knowing your take-home pay, you can better plan and allocate your monthly budget. This information will help you understand how much money you’ll have available for essential expenses, such as rent or mortgage payments, utilities, and groceries, as well as discretionary spending, such as entertainment and dining out.

Creating a budget that aligns with your take-home pay helps you avoid overspending and ensures that you’re living within your means. It can also help you identify areas where you can reduce your expenses and save more money.

Understanding your take-home pay is especially important if you’re self-employed or have a variable income. In these situations, your monthly earnings may fluctuate, making it even more crucial to accurately determine your take-home pay and plan your budget accordingly.

Once you have a clear picture of your take-home pay, you can start making a monthly budget that suits your financial goals and priorities. Budgeting apps and online resources can provide helpful tips and tools to assist you in the process.

Remember, budgeting is not a one-off task. It’s an ongoing process that requires regular review and adjustment. As your financial situation changes, so too should your budget.

By taking the time to plan and manage your finances, you’ll feel more in control of your money and be better equipped to cover unexpected expenses or save for future goals. Budgeting can make it easier for you to achieve financial stability and peace of mind.

What is my monthly expenditure

When it comes to creating a monthly budget, one of the first steps you need to take is knowing your monthly expenditure. This will help you understand how much money you have coming in and how much you are spending.

Start by looking at your take-home pay. Take note of how much you are earning each month after taxes and other deductions. This will be the amount you have available to cover your monthly expenses.

Next, you’ll want to track your spending. Keep a record of everything you spend money on for one month. This can be done with a pen and paper or by using budgeting apps or services that help you manage your finances.

Once you have a record of your spending, you can analyze where you are spending too much and where you can reduce your expenses. Look for areas where you can cut back, such as eating out less or buying fewer unnecessary items. This will help you have a more accurate understanding of your monthly expenditure.

Managing your monthly expenditure becomes easier when you have a plan in place. Take the time to sit down and create a budget for yourself. Determine how much money you need to allocate to each expense category, such as rent or mortgage, utilities, groceries, transportation, and entertainment.

Consider including one-off expenses in your budget, such as annual subscriptions or quarterly insurance payments. This will help you ensure that you have enough money set aside for these expenses when they arise.

If you’re not sure where to start with budgeting, there are many resources available to help. You can download budgeting templates online or seek help from financial apps or services that provide budgeting tools and tips.

Remember, a budget is a living document that can be adjusted over time. As your financial situation changes, you may need to reevaluate how you allocate your money. Regularly reviewing your budget will help you stay on track and make any necessary adjustments.

By understanding your monthly expenditure and creating a budget, you’ll be able to take control of your finances and work towards your financial goals.

Am I spending more than I earn

When it comes to managing your monthly budget, it’s important to ask yourself the question: “Am I spending more than I earn?” Having an accurate understanding of how much you’re earning and how much you’re spending is essential for financial planning.

If you find yourself struggling to make ends meet and constantly running out of money before the end of the month, it’s likely that you’re spending more than you earn. This can quickly lead to financial stress and put you in a difficult position.

To get a clearer picture of your financial situation, take a look at your monthly income. This includes your take-home pay from work, any additional sources of income you may have (such as a side business or freelance work), and any government benefits or support you receive.

Next, analyze your expenses. Start by listing all your regular monthly bills, such as rent/mortgage payments, utility bills, and loan repayments. Then, consider your discretionary spending, such as groceries, transportation costs, eating out, and entertainment. Be honest with yourself and write down each expenditure.

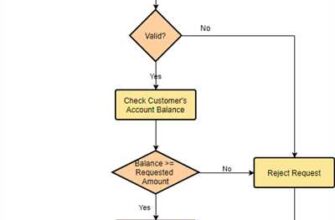

Once you have a comprehensive record of what you spend, compare it to your earnings. Are you spending more than you earn? If the answer is yes, it’s time to make some changes. Here are a few tips to help you get back on track:

| 1. | Create a budget: | Download a budgeting app or use a simple spreadsheet to outline your income and expenses. This will help you see where your money is going and identify areas where you can reduce spending. |

| 2. | Track your spending: | Keep a record of every purchase you make for a month. This will give you a better understanding of where your money is really going and help you identify unnecessary expenses. |

| 3. | Cut back on non-essential purchases: | If you’re spending too much on one-off costs or luxury items, try to reduce or eliminate those expenses. Focus on buying only what you need and prioritize your budget accordingly. |

| 4. | Find ways to increase your income: | If you’re struggling to cover your expenses, look for opportunities to earn extra money. This can be through taking on additional work, starting a side business, or finding creative ways to monetize your skills and hobbies. |

By taking these steps and being proactive with your budgeting, you’ll be able to manage your finances more effectively. Remember, it’s never too late to start making positive changes. Don’t be afraid to seek help from financial planning services or consult with a professional if you need guidance. With the right tools and mindset, you can get your spending back on track and achieve your financial goals.

Tips for accurate budgeting

Accurate budgeting can help you gain control over your finances and ensure that you’re making the most of your earnings. Here are some tips to help you create an accurate monthly budget:

1. Plan your budget using a paper or electronic tracking system

Start by writing down or using a budgeting app to track your income and expenses. This will give you a clear picture of where your money is going and help you identify areas where you can reduce spending.

2. Determine your income sources

Take into account all your sources of income, such as your salary, side jobs, or any other earning sources you have. This will give you a realistic view of how much money you have to work with.

3. Identify your fixed expenses

Fixed expenses are the costs that remain the same every month, such as rent or mortgage payments, utilities, or loan payments. These expenses are essential and should be the first items on your budget.

4. Understand your variable expenses

Variable expenses, such as groceries, entertainment, or dining out, may vary from month to month. It’s important to estimate how much you generally spend in each category, so you can allocate the appropriate amount in your budget.

5. Set financial goals

Setting financial goals can help you stay motivated and focused on your budget. Whether it’s saving for a vacation or paying off debt, having a goal in mind will make it easier to stick to your budget and reduce unnecessary spending.

6. Track your spending

Keep track of your expenses throughout the month to ensure that you’re staying within your budget. This will help you identify any areas where you may be overspending and allow you to make adjustments as needed.

7. Review and adjust regularly

Review your budget on a regular basis, such as monthly or quarterly, to assess your progress and make any necessary adjustments. Life circumstances and financial goals can change, so it’s important to keep your budget up to date.

By following these tips, you can create an accurate budget that will help you manage your finances effectively and achieve your financial goals.

If you’re spending more than you are earning

If you find yourself in a situation where you are spending more money than you are earning, it is important to take immediate action to get your finances back on track. Here are some tips to help you manage your budget effectively:

1. Assess your financial situation: Take a careful look at your income and expenses. Identify areas where you can cut back on unnecessary spending and reduce your expenditure.

2. Create a budget: Plan your monthly budget meticulously. Start by listing all of your income sources and then categorize your expenses. This will give you a clear picture of where your money is going.

3. Prioritize your expenses: Identify which expenditures are essential and which ones can be reduced or eliminated. Make sure to cover your basic needs such as rent/mortgage, utilities, and groceries first before allocating funds for discretionary expenses.

4. Track your expenses: Keep a record of all your purchases and expenses. This will help you understand where your money is going and identify areas where you can make adjustments.

5. Use budgeting apps: There are many budgeting apps available which can help you track your expenses, set financial goals, and keep you on track with your monthly budget. Some popular budgeting apps include Mint, YNAB (You Need a Budget), and PocketGuard.

6. Download your bank statements: To get a more accurate picture of your spending habits, download your bank statements. This will help you identify any hidden costs or recurring bills that you may have overlooked.

7. Seek professional help: If you’re having trouble managing your finances on your own, consider seeking help from a financial planner or advisor. They can provide invaluable guidance on how to get your finances back on track.

Remember, it’s never too late to start managing your finances effectively. By taking control of your spending and creating a realistic budget, you can quickly get back on track and start working towards your financial goals.

If you are earning more than you are spending

If you find yourself in the fortunate position of earning more money than you are spending each month, you have the opportunity to take control of your finances and set yourself up for future success. Budgeting is still important, even when you have a surplus of income, as it allows you to allocate your money strategically and plan for any unforeseen financial circumstances that may arise.

Here are some tips to help you manage your money effectively when you have more coming in than going out:

| 1. Create a budget | Make a monthly budget that outlines your income and expenses. This will give you a clear picture of where your money is going and allow you to identify areas where you can reduce your expenditure. |

| 2. Set financial goals | Create financial goals that align with your long-term aspirations. Whether it’s saving for a down payment on a house or starting your own business, having specific goals will help you prioritize your spending and make informed financial decisions. |

| 3. Allocate surplus money wisely | Instead of spending the extra money on one-off purchases or luxuries, consider putting it towards your financial goals. This will allow you to make progress towards your aspirations more quickly and reduce the risk of lifestyle inflation. |

| 4. Take advantage of budgeting apps | There are many free and paid budgeting apps available that can help you track your income and expenses, set budgets, and monitor your progress. These apps can provide valuable insights into your spending habits and make budgeting much easier. |

| 5. Automate your savings | Set up automatic transfers from your checking account to a savings account or investment vehicle to ensure that you save a portion of your income each month. This way, you won’t be tempted to spend all of your surplus money. |

Remember, even if you are earning more than you are spending, it’s still important to budget and plan for the future. By following these tips and staying disciplined with your finances, you can make the most of your income and set yourself up for long-term financial success.

Sources

When it comes to making a monthly budget, your sources of income need to be taken into account. Knowing where your money is coming from is just as important as knowing how to spend it. Here are some tips on how to earn and manage your money for a monthly budget:

1. Take-home pay: This is the amount of money you receive after taxes and other deductions are taken out of your paycheck. It is the most common source of income for individuals who work for a company or organization.

2. Self-employment: If you have your own business or work as a freelancer, your sources of income may vary from month to month. You will need to plan ahead and budget accordingly to account for any fluctuations in income.

3. Investments: If you have invested your money in stocks, bonds, or real estate, you may receive regular payments such as dividends or rental income. These sources can help cover your monthly expenses.

4. One-off income: Sometimes, you may receive a lump sum payment from sources such as a tax refund, inheritance, or a bonus. While these may not be regular sources of income, they can provide a significant boost to your budget if managed wisely.

5. Side gigs: If you have any skills or talents that can be monetized, consider taking on freelance work or side jobs to supplement your main income. This can help you earn extra money that can be put towards your budget.

6. Digital services: There are various online platforms and apps that allow you to earn money by providing services such as tutoring, writing, graphic design, or virtual assistance. These can be a great way to generate additional income on your own time.

Remember, the key to successful budgeting is to have accurate and realistic expectations of your income. Be mindful of your spending habits and identify areas where you can reduce costs. With proper planning and the right tools, managing your finances can become easier and less stressful.