When planning a project or activity, one of the first and most important steps is to create a budget. A budget is a detailed breakdown of the costs and expenses associated with the project, and it provides a solid foundation for overall financial management. By understanding the details of the budget, you can better allocate resources, track expenses in real-time, and successfully collaborate with other team members.

Before diving into the budgeting process, it is essential to understand the objectives and deliverables of the project. This will help you identify the specific activities and categories that need to be included in the budget. For example, if you are working on a research project, you might have categories such as transportation, equipment, and subawards. By dividing the project into these specific elements, you can ensure that you have included all the necessary costs.

When creating a budget, it is also important to consider the location and timeframe of the project. If you are planning to travel for work, make sure to include appropriate costs for airfare, accommodation, and meals. Additionally, factor in any specific requirements or regulations that may apply to your project, such as health and safety guidelines. By considering these factors beforehand, you can allocate the right amount of resources and avoid unexpected costs down the line.

A helpful tip when budgeting is to use a budgeting tool that provides a clear overview of your expenses. This can be a spreadsheet or a dedicated software program that allows you to input and track your budget in real-time. By using such a tool, you can easily look up and stick to your budgeted amounts for each category, making it easier to manage your finances and stay on track.

In summary, budgeting is an essential step in the planning and management of projects and activities. By understanding the details and components of your budget, you can ensure that you allocate resources appropriately, track expenses effectively, and collaborate successfully with others. Remember to take into account the specific requirements and objectives of your project, and use a budgeting tool to support your budgeting efforts. With these approaches in place, you can build a strong foundation for your project’s financial management and support its overall success.

- Proposal Budgets

- Typical budget items

- Add up your expenses

- What to include in a project budget proposal

- Project name and goal

- Budget summary

- Breakdown of all costs in phases tasks and activities

- Project Timeline

- Project budget tracking

- Acceptance form

- Creating a Horizon Europe budget proposal that will impress the reviewers

- Tip 1: Choose the appropriate tool to collaborate on budget creation

- Tip 2 Stick to one of the following approaches Top down or Bottom up

- Video:

- How to Create a Successful Project Budget | Project Budgeting | PMP Training | Invensis Learning

Proposal Budgets

When writing a proposal for a project, it is important to have a clear understanding of the budgetary requirements. A budget is a financial plan that outlines the estimated costs and expenses for the project. It helps in tracking the amount of money needed to successfully complete the project and ensures that both the organization and the funder are on the same page with regards to the financial aspects of the project.

Before starting the budgeting process, it is important to have a clear understanding of the goals and objectives of the project. This will help in determining the appropriate budgetary requirements to support the project’s activities and deliverables. It is also helpful to have a solid understanding of the project’s timeline and phases, as this will impact the budget accordingly.

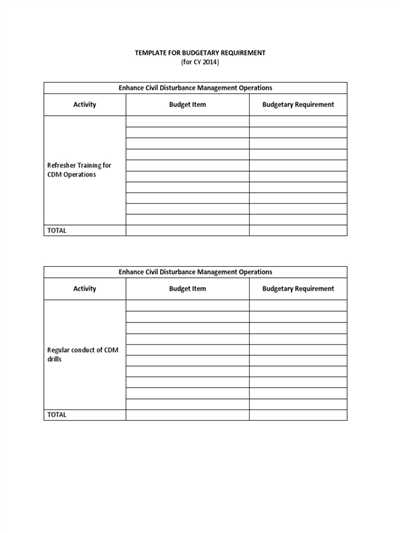

The following steps outline the process of creating a proposal budget:

- Identify the key tasks and activities that need to be completed in order to successfully achieve the project goals. This may include hiring staff, purchasing equipment, or conducting research.

- Estimate the costs associated with each task or activity. This can be done by conducting a thorough analysis of the expenses involved, such as salaries, travel costs, or equipment maintenance.

- Divide the budget into categories, such as personnel costs, travel expenses, or office supplies. This will help in organizing the budget and tracking the expenses more effectively.

- Collaborate with relevant stakeholders, such as project partners or employees, to gather the necessary information and input. This will ensure that the budget reflects the needs and requirements of all parties involved.

- Use a budget tracking tool, such as an excel spreadsheet or budgeting software, to create a real-time overview of the budget. This will help in monitoring the expenses and making any necessary adjustments as the project progresses.

It is important to note that the budget should not only focus on the costs of the project, but also on the impact and outcomes it aims to achieve. Clearly explain how the proposed budget supports the project’s objectives and how it aligns with the funder’s priorities and requirements.

When it comes to budgeting for international projects, additional considerations might be needed. These can include factors such as exchange rates, insurance costs, or location-specific expenses (e.g. visas, permits, or taxes). These should be taken into account and included in the budget accordingly.

In summary, proposal budgets play a crucial role in supporting the successful implementation of a project. By following the steps outlined above and considering the specific needs and requirements of the project, organizations can create comprehensive and realistic budgets that will help them achieve their goals and secure the necessary financial support.

Typical budget items

When creating a budget for a project, it’s important to consider the typical budget items that are relevant to your specific situation. Here are some common budget items to keep in mind:

- Personnel Expenses: This includes the cost of employees, such as their salary, benefits, and taxes. It’s important to understand the requirements for federal funding and ensure that the salaries are within the allowable limits.

- Travel Costs: Depending on the nature of the project, you may need to budget for travel expenses. This could include airfare, transportation, accommodation, and meals.

- Equipment and Supplies: If the project requires specific equipment or supplies, you’ll need to estimate the amount needed and the associated costs. It’s also important to review what is considered an allowable expense.

- Subawards and Consultants: In some cases, you may need to collaborate with partners or hire outside experts. Budgeting for subawards and consultants is crucial to ensure that you have the necessary resources.

- Software and Technology: Depending on the project’s scope, you may need to budget for software licenses, tech support, and other technology-related expenses.

- Production and Delivery: If the project involves the production and delivery of materials or products, you’ll need to account for the costs associated with these processes.

- Postdoc or Independent Researcher: If you plan on hiring a postdoc or an independent researcher, make sure to include their salary and any associated costs in your budget.

- Analysis and Evaluation: Budgeting for data analysis and evaluation is essential to ensure that you can measure the project’s success and meet the objectives.

- Financial Management: It’s important to allocate funds for financial management and ensure that someone is responsible for tracking expenses and meeting reporting requirements.

By including these typical budget items in your proposal, you can impress reviewers and demonstrate that you have a solid plan for managing the project’s finances. Remember to stick to the appropriate budgetary approaches and provide thorough explanations of each item’s purpose and justification.

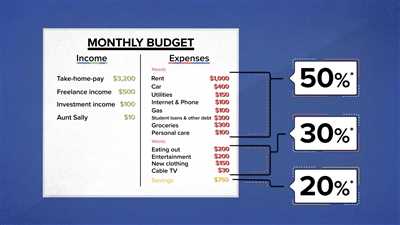

Add up your expenses

When creating a budget, it is important to understand and calculate all of your expenses accurately. By keeping track of the details of your expenses, you will be able to set clear goals and objectives for your budget. This step is essential for successfully managing your finances.

First, make a list of all the specific items and costs that you will need to budget for. This could include things like mortgage or rent payments, utility bills, groceries, transportation costs, and any other regular expenses that you have. Be as thorough as possible to ensure that you don’t miss any potential expenses.

In addition to these regular expenses, you may also have other financial responsibilities and goals that you want to include in your budget. For example, if you have student loans or credit card debt, you will need to factor in the payments for these as well. It’s also important to consider any long-term financial goals you might have, such as saving for a vacation or retirement.

Next, it can be helpful to use technology to assist you in tracking and organizing your expenses. There are many budgeting apps and tools available, such as Google Sheets or financial tracking apps, that can make this task easier. These tools provide real-time insights into your spending habits and help you stay on track with your budget.

When adding up your expenses, it’s important to be aware of any federal or state-specific requirements that might impact your budget. For example, if you live in Michigan, you may need to account for state taxes or other local expenses. Research and gather all the necessary information before finalizing your budget.

Additionally, if you are working on a project or have work-related expenses, you will need to consider these as well. This could include costs for specific deliverables, techs, or approaches that are needed to successfully complete your work. If you have partners or collaborators, be sure to explain and discuss the financial expectations and responsibilities with them. It’s essential to have a clear understanding of everyone’s role and contribution to the budget.

Lastly, don’t forget about your personal expenses and responsibilities. These could include health insurance premiums, retirement contributions, and any other costs that are relevant to your personal financial situation. By considering all of these factors, you will be able to create a comprehensive budget that addresses all of your needs and goals.

In summary, adding up your expenses is a crucial step in the budget-making process. By taking the time to thoroughly assess and calculate your expenses, you will be able to set clear financial goals and create a budget that accurately reflects your needs and objectives. Remember to stay organized, collaborate with others if needed, and make use of technology to make this process as efficient as possible.

What to include in a project budget proposal

Creating a project budget proposal is an important step in any organization or university. It provides an overall analysis of the financial requirements and expectations of a project, which helps in determining the feasibility and resource allocation for successful implementation. To make sure that the project budget proposal is comprehensive and covers all the necessary elements, it is crucial to understand the key components that should be included. Here are the following elements to consider:

- Timeline: It is essential to have a timeline that outlines the anticipated time frame for completing the project. This timeline should include milestones and key deliverables, helping to allocate budget resources appropriately.

- Work responsibilities: Clearly define the roles and responsibilities of each team member involved in the project. This ensures that everyone understands their tasks and helps in dividing the workload efficiently.

- Expenses: Identify the expenses that are likely to be incurred during the project. This includes considering the cost of materials, equipment, travel, and any other relevant costs.

- Impact analysis: Provide an overview of the expected impact of the project. This helps stakeholders understand the potential benefits and outcomes of the proposed project.

- Categories and subawards: Divide the budget into categories and subcategories to ensure a more detailed breakdown of expenses. This will help in better financial management and tracking of funds.

- Supporting projects: If there are any other projects that are supporting or related to the proposed project, include the necessary budgetary requirements for those projects as well.

- Personnel: Include the financial requirements for all personnel involved in the project. This includes salaries, benefits, and any other costs associated with the staff.

- Allowable expenses: Ensure that all the expenses included in the budget proposal are allowable according to relevant funding agency guidelines or university policies.

- Implementation plan: Provide an overview of how the project will be implemented, including the step-by-step process and any necessary resources or equipment needed.

- Evaluation and review: Consider the costs associated with project evaluation and review, including those for evaluators, reviewers, or postdoc positions if needed.

- Contingency: It is always best to include a contingency budget that accounts for unexpected expenses or changes in project requirements.

By following these guidelines and including all the necessary components in the project budget proposal, you can create a solid and comprehensive document that addresses all financial aspects efficiently. Remember to review the budget proposal thoroughly before submitting it to ensure accuracy and alignment with the project goals and objectives. In addition, it is important to understand any specific requirements or guidelines set forth by the federal government, sponsoring entities, or the university.

Project name and goal

In order to successfully plan and budget for a project, it is essential to have a clear understanding of the project’s goals and objectives. This starts with defining the project name and goal.

The project name should be concise and descriptive, giving a high-level overview of what the project is about. For example, if the project is focused on improving healthcare services in Michigan, a suitable project name could be “Michigan Health Services Improvement Project”. This name captures the essence of the project and gives evaluators a quick understanding of its purpose.

The goal of the project should be specific, measurable, achievable, relevant, and time-bound (SMART). It should clearly state what the project aims to achieve and the timeline within which it will be accomplished. For example, the goal of the “Michigan Health Services Improvement Project” might be to reduce healthcare costs by 10% within two years.

Once the project name and goal are determined, it is important to break down the goal into smaller, more manageable objectives. These objectives should be specific actions or outcomes that, when achieved, contribute to the overall goal. For example, some objectives of the “Michigan Health Services Improvement Project” might include:

- Increasing the efficiency of healthcare delivery

- Improving access to healthcare services

- Enhancing the quality of healthcare services

By clearly defining the project name, goal, and objectives, you provide a solid foundation for the rest of the budgetary requirements and planning. This information will help budgeting reviewers understand the purpose and scope of the project, which can give them helpful context when reviewing and evaluating budget proposals.

Budget summary

The budget summary is an important part of a project or program’s budgeting and planning. It provides an overview of the overall financial picture, including the amount of money that will be needed, when payments will be made, and what they will be used for. Understanding the budget is essential for effective project management and for impressing funders, including sponsors and independent evaluators.

A solid budget begins with a thorough understanding of the goals and objectives of the project or program. Dividing these goals into specific activities and items helps to give a clear picture of what will be needed and how much effort and time will be required for their implementation.

When building a budget, it is important to include all the elements that will impact the project, including personnel, services, utilities, and other necessary costs. It is also helpful to follow a timeline or plan that breaks down the project into phases, with specific budgets for each phase.

In terms of payment, it’s important to consider rates, including those for tuition or any subcontractor or subaward costs. Evaluators and sponsors will likely look for a detailed breakdown of how the funds will be used and what deliverables will be provided.

Google might be a helpful solution when looking for rates and specific budgeting approaches. They’ll provide you with a horizon of what others have done, which can be helpful when planning your own budget.

- Include a budget summary that gives an overview of the overall amount of funds needed and how they will be allocated.

- Break down the budget into specific items or activities, explaining why each is important and how it contributes to the overall project objectives.

- Divide the budget into phases or timelines, making it easier to manage and track spending.

- Consider all elements that will impact the budget, including personnel, services, utilities, and other necessary costs.

- Provide specific rates or costs for each item or activity in the budget.

- Consider the impact of the budget on the project’s goals and objectives, as well as on the overall timeline and deliverables.

By following these budgeting tips and including a comprehensive budget summary, you’ll be able to better manage your project finances and impress funders and stakeholders.

Breakdown of all costs in phases tasks and activities

In order to make accurate budgetary requirements, it is important to breakdown all of the costs associated with each phase, task, and activity. This allows for a comprehensive understanding of the financial needs for the project.

When budgeting for a project, it is important to consider all costs that may arise. This includes but is not limited to subawards, transportation, insurance, employee salaries, and any other necessary expenses. By taking the time to analyze each cost item, a more solid and realistic budget can be created.

One of the first steps in budgeting is to determine the specific phases, tasks, and activities that need to be included in the proposal. This will help to outline the overall scope of work and set specific goals for the project.

For each phase, task, and activity, it is important to provide an estimate of the costs involved. This estimate should include not only the direct costs, but also any indirect or overhead costs that may apply.

For example, if a project requires the support of an independent evaluator, the cost of their services would need to be included in the budget. Similarly, if the project requires travel, the cost of transportation, lodging, and meals would need to be accounted for.

When estimating costs, it is always a good idea to check with the sponsoring office or foundation to see if there are any specific guidelines or requirements that need to be followed. They may have specific budgeting categories or limits that need to be adhered to.

Additionally, it is important to consider any supporting services that may be needed for the project. This could include tech support, building maintenance, or other services that are necessary for the project’s success.

It is important to follow a logical and systematic approach when budgeting for a project. This means breaking down the costs into specific phases, tasks, and activities, and then estimating the costs associated with each. By following this step-by-step approach, it is easier to track and manage the budget in real-time.

A typical breakdown of costs may look something like the following:

| Phase/Task/Activity | Cost |

|---|---|

| Phase 1: Planning and Proposal Writing | $10,000 |

| Phase 2: Implementation and Evaluation | $15,000 |

| Phase 3: Reporting and Follow-up | $5,000 |

This breakdown provides a clear overview of the expected costs for each phase, task, and activity. It also allows for easy analysis of the budget and helps to explain the financial expectations to evaluators, sponsors, and other stakeholders.

In conclusion, making budgetary requirements involves breaking down all of the costs associated with each phase, task, and activity. By following a systematic approach and providing detailed cost estimates, it is possible to create a comprehensive and accurate budget that will impress stakeholders and support the project’s goals.

Project Timeline

Creating a project timeline is a crucial step in any budgetary requirement. It helps the team to track progress and achieve project goals within the specified timeframe. The project timeline consists of various phases, each with its own specific goals, expectations, and deliverables.

Before writing the budget, it is necessary to understand the project timeline. The timeline acts as a roadmap, outlining the various activities and their expected durations. It helps in estimating the resources needed, including financial, employee, and tech resources.

When creating a project timeline, it is important to include the following elements:

1. Goal Identification: Clearly identify the main goals of the project. These goals serve as a check against which the progress and success of the project can be evaluated.

2. Phases and Activities: Divide the project into different phases and outline the specific activities that need to be completed in each phase. This helps in planning the individual steps and ensuring a smooth implementation of the project.

3. Time Estimate: Estimate the time required for each activity. This will help in scheduling and allocating resources appropriately.

4. Dependencies: Identify any dependencies between activities. Some activities may be dependent on the completion of others before they can start. Understanding these dependencies will help in avoiding delays and ensuring that the project stays on track.

5. Deliverables: Clearly specify the deliverables for each phase and activity. This provides evaluators with specific information to assess the progress and success of the project.

6. Technology and Tools: Identify the technology and tools that will be needed to support the project. This includes software, hardware, and other resources that are necessary for the implementation of the project.

7. Support and Resources: Determine the support and resources required for each phase. This includes the availability of supporting staff, office space, utilities, and any other resources that are necessary for the project.

8. Budget Estimation: Based on the timeline, estimate the budget required for each phase and activity. This includes the cost of resources, techs, and any other expenses that may be incurred during the project.

A well-defined project timeline makes it easier to manage the project and ensures that everyone is on the same page. It provides a clear roadmap for the team and enables effective communication among stakeholders. By understanding the project timeline, the team can better plan and allocate resources, avoiding any potential delays or oversights.

For example, if a project involves developing a new technology for airports, the project timeline may include phases such as research, development, testing, and implementation. Each phase would have specific activities and deliverables, and the timeline would help in coordinating the efforts of the team.

In summary, the project timeline plays a vital role in budgetary requirements. It helps in understanding the overall scope of the project and provides a roadmap for the team to follow. By creating a comprehensive and well-planned timeline, the project can be managed effectively, ensuring successful implementation and delivery of the desired outcomes.

Project budget tracking

Tracking the budget of a project is a solid foundation for successful budgetary management and overall project success. It involves keeping a close eye on the financial aspects of the project to ensure that all expenses are accounted for and that the project stays within the allocated budget.

When creating a project budget, it is essential to include all the necessary items and services needed to deliver the project’s goals and objectives. This includes transportation, tuition fees (if applicable), location-specific expenses, and any other relevant costs.

One of the first steps in budget tracking is to estimate the overall project expenses. This can be done by analyzing the project plan and identifying all the different elements and phases involved. It is important to be thorough in this analysis and to consider all the specific requirements and responsibilities that need to be fulfilled.

After creating the budget, it is important to stick to it and keep track of all expenses. This can be done by regularly reviewing the financial details, comparing them with the projected budget, and making any necessary adjustments. This process allows for better financial management and helps ensure that the project stays within its financial limits.

There are various tools and techniques available for budget tracking, including software solutions and manual tracking systems. The choice of tracking method depends on the project’s specific requirements and the expectations of the project team and stakeholders.

In addition to tracking expenses, it is important to track the progress and impact of the project’s deliverables. This involves monitoring the timeline and milestones, as well as assessing the overall success of the project. This information is crucial for understanding the project’s financial impact and making informed decisions for its implementation.

When tracking the budget, it is also important to review the project’s financial documentation and ensure that all expenses are appropriately categorized and allocated. This includes reviewing invoices, receipts, and other financial records.

A tip for successfully tracking a project budget is to set aside a specific time each week or month to review the financial information and update the tracking system. This allows for regular monitoring and helps identify any potential issues or discrepancies early on.

Overall, project budget tracking is a vital aspect of project management. It provides a solid foundation for financial management, allows for better decision-making, and ensures that the project stays on track towards its goals and objectives. By successfully tracking the budget, you’ll impress reviewers and demonstrate your ability to effectively manage project finances.

To add a solid foundation to your budget tracking, it’s important to consider the allowable expenses and ensure that all financial items are included. This provides a clear guideline for managing expenses and helps avoid any unexpected costs.

Acceptance form

The acceptance form is an essential part of creating a budgetary requirement, especially when it comes to sponsored projects or activities. In the state of Michigan, the acceptance form is used to review and approve the financial plan before any funds are allocated. It also helps to ensure that all expenses adhere to the specific requirements set by the sponsoring university or federal agencies.

Before submitting a budget proposal, it is important to understand the financial guidelines and rates that will be applicable. This includes a breakdown of travel expenses, utilities, techs, and other project-specific costs. It is best to stick to the approved rates and follow a clear plan that includes a realistic breakdown of the expenses. This can help reviewers and financial analysts to easily review and evaluate the proposal.

In the acceptance form, it is important to include a clear explanation of the tasks and deliverables that the budget will support. This may include supporting financial documents or real-time analysis to justify the amount requested. It is also helpful to include a timeline or horizon for the project, outlining the specific timeframes for each task or activity.

To make the acceptance form more comprehensive, it is common to include a checklist of specific categories or expenses that need to be addressed. This could include items such as airfare, accommodation, production costs, or any other project-related expenses. By including a checklist, it ensures that all necessary costs are accounted for and helps to avoid any oversights.

When developing the acceptance form, it is important to collaborate with partners or team members who have a clear understanding of the project’s financial requirements. Their input and expertise can help in estimating the specific expenses and ensuring that the overall budget is accurate and feasible.

Overall, the acceptance form is a helpful tool in the budgetary requirement process. It helps to provide a clear breakdown of expenses, ensure adherence to specific guidelines, and support the overall financial planning of a project or activity.

Creating a Horizon Europe budget proposal that will impress the reviewers

When creating a budget proposal for Horizon Europe, it is essential to impress the reviewers by presenting a well-structured and detailed plan. To achieve this, you need to collaborate effectively with your partners and carefully plan your budget in accordance with the specific requirements and objectives of the Horizon Europe program.

First and foremost, it is important to define the categories and payment rates that will be included in your budget proposal. This will give the reviewers a clear understanding of how the funds will be allocated and how they will contribute to the overall goals of your project. Make sure to break down your budget into specific items and provide all the necessary information to support your costs.

One approach that can be helpful is to create a timeline that shows the phases of your project and the corresponding budget requirements for each phase. This will allow the reviewers to see how the budget will be managed over time and how the funds will be allocated to different activities.

When preparing your budget proposal, it is important to consider the allowable costs and make sure that all the expenses are within the specified limits. This will ensure that your proposal is in line with the Horizon Europe guidelines and increase the chances of acceptance.

In order to impress the reviewers, it is also important to provide a clear summary of your budget proposal. This should include the overall budget, the responsibilities of each partner, and the key deliverables that will be achieved. By presenting this information in an organized and concise manner, you’ll demonstrate your ability to manage the funds effectively and achieve the objectives of your project.

Furthermore, it is important to highlight any specific approaches or management tools that you plan to use to track and monitor your budget. This will show the reviewers that you have a clear plan for budget management and will increase their confidence in your ability to deliver the project successfully.

For example, you can mention that you will use a specific budget tracking software or that you have an experienced project manager who will oversee the financial aspects of the project. These details will give the reviewers additional assurance that your budget proposal is well thought out and will be effectively managed.

In summary, creating a Horizon Europe budget proposal that will impress the reviewers requires careful planning, collaboration with partners, and attention to detail. By following the specific requirements and providing all the necessary information, you’ll increase the likelihood of your proposal being approved. Furthermore, by demonstrating your ability to effectively manage the budget and achieve the project’s objectives, you’ll inspire confidence in the reviewers and increase the chances of your proposal being selected.

Tip 1: Choose the appropriate tool to collaborate on budget creation

When it comes to creating a budget, it’s important to choose the right tool to collaborate with your team. This will ensure that everyone involved has access to the necessary information and can contribute effectively to the budget creation process.

There are several options available for collaborating on budget creation, including office productivity suites like Microsoft Office or Google Docs. These tools provide features that allow multiple users to work on the budget simultaneously, making it easier to track changes and modifications made by team members.

Before selecting a specific tool, it’s essential to understand the specific needs of your team and the role they will play in the budget creation process. For example, if your team is spread across different locations or departments, an online collaboration tool like Google Docs may be the best option.

Another important consideration is the level of access and security needed for the budget information. Some organizations may have strict regulations regarding the sharing of financial data, requiring a more secure platform for collaboration.

It’s also worth considering the availability of resources when choosing a tool. For example, if your team is already familiar with a certain office productivity suite, it may be more efficient to use that tool rather than introducing a new one.

Ultimately, the goal is to find a tool that allows for efficient collaboration and meets the specific requirements of your team and organization. By choosing the appropriate tool, you can streamline the budget creation process and ensure that everyone is on the same page.

Tip 2 Stick to one of the following approaches Top down or Bottom up

When creating budgetary requirements, it is essential to have a clear plan and goals in mind. One effective way to approach this is by dividing the budget into specific categories, including transportation expenses, resources, and production costs. Sticking to either the top-down or bottom-up approach can help you better allocate the funds.

The top-down approach involves starting with a specific amount of money and then dividing it among the different elements of the project. This approach is best suited for projects where the overall budget is already known and a solid plan is in place. It allows for a clear understanding of the total amount of money available and how it will be allocated to different aspects of the project.

On the other hand, the bottom-up approach involves starting with the individual items that make up the project and then systematically building up the budget from there. This approach is best suited for projects that require a more detailed breakdown of costs or for those that are still in the proposal or planning phase. By starting with specific items, such as tuition, travel expenses, or insurance costs, you can give evaluators a more comprehensive view of how the funds will be allocated.

For example, if you are creating a budget for a university research project, the bottom-up approach might involve starting with specific items such as tuition fees, travel expenses, and office services. You would then divide each category into more specific subcategories, including transportation costs, location expenses, and the cost of building partnerships. By breaking down the budget in this way, you can better explain the resources needed for each phase of the project and make a more solid case for the funding you are requesting.

When deciding between the top-down and bottom-up approaches, it is important to consider the impact and expectations of the budget proposal. In some cases, the evaluators might be more impressed with a top-down approach that clearly outlines the overall budget and goals. In other cases, a bottom-up approach might be more appropriate, especially if there are specific items or subawards that need to be included in the budget.

Whichever approach you choose, it is important to understand that budgeting is a critical tool in the implementation of projects. It helps ensure that resources are allocated effectively and that the project stays on track. By following the tip of sticking to either a top-down or bottom-up approach when creating your budget, you can improve your chances of getting your budget approved and successfully implementing your project.

| 1 | Google Ads | $500 |

| 2 | Building Rent | $1,000 |

| 3 | Evaluation Services | $750 |