PayPal is a wise choice for managing your financial transactions, whether you are sending or receiving money. It is an online platform that facilitates secure and convenient transfers, making it easier for you to work with clients or customers without the need for cash or physical payments. One of the key advantages of PayPal is that it is accepted virtually everywhere, both locally and abroad.

So, how do you get PayPal? The first step is to open a PayPal account, which you can easily do online through their website or mobile application. You will need to enter your personal details, such as your name, email, and phone number, to create an account. PayPal doesn’t charge any fees to open an account, making it an attractive option for anyone who wants to start managing their finances online.

Once you have created an account, you can link it to your bank account or credit cards to fund your PayPal account. This allows you to make payments directly from your PayPal balance or choose to have the funds deducted from your bank account or credit card. PayPal also offers a range of services, like the ability to send money through email or mobile phone, which makes it even more convenient for users.

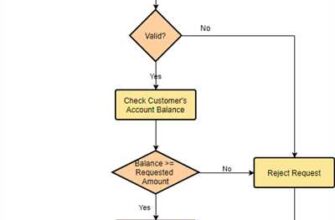

PayPal makes it easier to trust the financial activity taking place through their platform because they offer secure transactions and buyer protection. In the case of any disputes or issues with transactions, PayPal acts as a mediator to help resolve the problem and recover the funds if necessary. This provides users with peace of mind and builds trust in using PayPal as a reliable financial platform.

When using PayPal, it is important to note that the fees for their services may vary depending on the type of transaction you are making. Sending money to friends and family is typically free, but there may be fees associated with selling goods or services, receiving payments from abroad, or using PayPal for cryptocurrency exchanges. It is recommended to review PayPal’s terms and conditions to understand the costs associated with your specific needs.

In conclusion, getting PayPal is a simple and straightforward process that can be done online or through their mobile application. By creating a PayPal account, you gain access to a trusted platform that offers secure financial transactions and helps you manage your money more efficiently. Whether you are an employer sending funds to your remote employees or an individual making online purchases, PayPal is a reliable and convenient solution for all your financial needs.

Online Money Tips: What is PayPal

PayPal is an online platform that allows individuals and businesses to receive and send payments in different currencies without the need for a bank account. It provides a convenient and secure way to make transactions, whether you are buying goods or services, sending money to friends or family, or receiving payments for goods or services you have sold.

One of the main advantages of using PayPal is the simplicity and ease of use. To create an account, all you need is a valid email address. Once your account is set up, you can link it to your bank account or credit card to make deposits or receive payments. PayPal also offers a direct deposit service where you can have funds deposited directly into your PayPal account.

When you make a payment or receive funds through PayPal, there may be fees associated with the transaction. It is important to check the terms and conditions of each transaction to understand the costs involved. Fees may vary depending on the type of transaction, the currency used, and the country you are in.

PayPal also offers additional services such as buyer and seller protection, which can help you recover funds if there is an issue with a transaction. They also have a customer support team that can assist you with any questions or concerns.

It is important to note that PayPal is not a bank and does not offer the same protections as a bank account. While they take measures to ensure the security of your account and transactions, it is always wise to be cautious and protect your account from unauthorized activity.

Another benefit of using PayPal is the ability to make payments or receive funds in different currencies. This is particularly helpful if you travel abroad or do business in different countries. PayPal offers exchange services that allow you to convert currencies at competitive rates.

Overall, PayPal is a trusted and popular platform for online transactions. Whether you are buying, selling, or sending money, PayPal offers a convenient and secure way to make transactions in the digital age.

Here are some key takeaways about PayPal:

- PayPal is an online platform for making payments and receiving funds.

- To use PayPal, you need a valid email address.

- You can link your PayPal account to your bank account or credit card.

- Fees may apply for certain transactions.

- PayPal offers additional services such as buyer and seller protection.

- PayPal is not a bank and does not offer the same protections as a bank account.

- PayPal allows you to make transactions in different currencies.

- PayPal offers exchange services for currency conversions.

- PayPal is a trusted and popular platform for online transactions.

What Is PayPal

PayPal is a popular online payment platform that allows individuals and businesses to send and receive money electronically. It was founded in the early 21st century and has since become one of the most trusted names in online financial services.

With PayPal, you can link your bank account or credit card to your PayPal account, allowing you to easily transfer funds between the two. This makes paying for goods and services online much easier, as you can simply enter your PayPal login information instead of having to input your card details every time.

One of the major advantages of using PayPal is the level of trust it offers. Since PayPal has been around for so long, many people are familiar with its brand and feel confident using it for their online transactions. PayPal also offers buyer protection, which means that if you don’t receive the item you purchased or it doesn’t match the seller’s description, you can file a claim to recover your money.

In addition to facilitating online payments, PayPal also offers a range of other services. You can use PayPal to send money to friends or family, receive payments for selling goods or services, or even use it to make purchases at select physical stores. PayPal also offers a debit card, which allows you to access funds from your PayPal account directly and make purchases wherever Mastercard is accepted.

When it comes to using PayPal, there are a few tips and tricks to keep in mind. First, make sure you have a verified PayPal account. This involves linking your account to a bank account and confirming your identity. This step is important in order to increase your transaction limits and ensure the security of your account.

It’s also wise to check the fee structure for using PayPal, as fees can vary depending on the type of transaction you are making. For example, sending money to another country or using a credit card to fund your PayPal account may incur additional fees.

If you ever have questions or need help with your PayPal account, there is a support team available to assist you. You can contact PayPal directly through their website or by phone, and they will be happy to answer any inquiries you may have.

Overall, PayPal provides a convenient and secure way to manage your money online. Whether you’re using it for personal transfers, selling goods and services, or making purchases online, PayPal offers a reliable platform that millions of people trust.

Key Takeaways

Here are the key takeaways about how you can get PayPal:

- PayPal is an online platform that facilitates payments and helps you manage your financial activities.

- To open a PayPal account, you need to have an email address and a bank account or credit card.

- PayPal allows you to send and receive money online, making it easier for both individuals and businesses to transact.

- You can link your PayPal account to your eBay account for easy buying and selling.

- Paying with PayPal is generally safe and secure, as the platform offers buyer and seller protection.

- PayPal charges fees for certain transactions, like currency exchange or receiving payments from abroad.

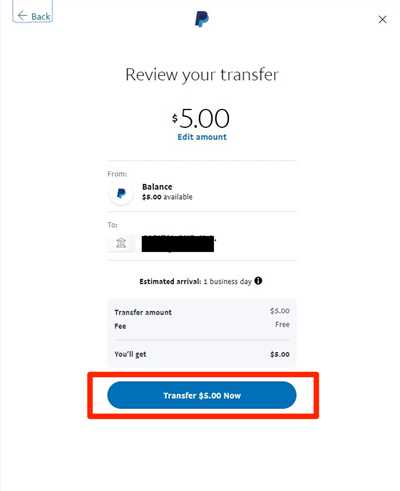

- You can withdraw money from your PayPal account and deposit it directly into your bank account.

- If you want to send money to someone who doesn’t have a PayPal account, you can do so with PayPal’s “Pay Anyone” feature.

- PayPal also supports cryptocurrency transactions, allowing you to buy, sell, and exchange digital currencies.

- If you ever have questions or need help with your PayPal account, you can contact their customer support.

These key takeaways should help you understand how PayPal works and how it can be used to send and receive money, manage your financial activities, and make online payments more convenient and secure.

Receive like a local in 10 currencies with Wise

Are you tired of paying high fees and dealing with complicated processes when it comes to receiving money from abroad? With Wise, you can receive money from anywhere in the world without any hassle.

Wise offers a range of banking services that make it easy to receive money in different currencies. Whether you need to receive payments from your employer, customers, or a selling platform, Wise has got you covered.

When you open an account with Wise, you can receive deposits in 10 currencies, which include USD, EUR, GBP, AUD, and more. This is particularly useful if you’re frequently receiving money from different countries or if you’re a digital nomad who is always on the move.

One of the biggest advantages of using Wise is that it offers real exchange rates, which means you get more money in your account compared to traditional banks. Plus, Wise guarantees a much lower fee compared to platforms like PayPal.

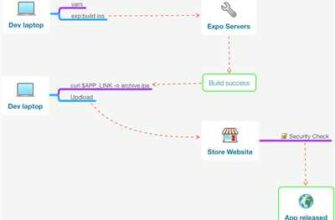

So, how does Wise work? It’s simple! Once you sign up for an account, Wise will provide you with local bank details such as an account number and routing number. You can share these details with your payors to receive money directly into your Wise account.

If you prefer, Wise also offers a debit card that you can use to withdraw money or make purchases online or in-store.

With Wise, managing your financial activity has never been easier. You can track your transactions, set up alerts for incoming and outgoing payments, and even convert currencies within your Wise account.

Wise also offers a great customer support service that is available to assist you whenever you have questions or need help with any aspect of your Wise account.

Takeaways:

- Receive money in 10 different currencies

- Avoid high fees and complicated processes

- Get real exchange rates

- Withdraw money using a debit card

- Manage your financial activity easily

- Enjoy excellent customer support

Getting paid in foreign currencies has never been easier with Wise. Say goodbye to expensive bank fees and complicated procedures, and start receiving money like a local. Sign up with Wise today and experience a simpler and more convenient way to receive money from around the world!

Trust the way you pay

When it comes to money, trust is of utmost importance. In the digital era, where everything is online and transactions are made in the blink of an eye, it’s essential to have a secure and reliable platform. That’s where PayPal comes in.

PayPal isn’t just a regular online payment service – it’s a trusted and widely recognized name in the industry. One of the reasons why PayPal is so popular is because it offers a safe and convenient way to send and receive money. Whether you’re buying goods or services, or simply transferring funds between friends and family, PayPal is there to help you manage your payments securely.

When you use PayPal, you don’t have to worry about giving out your bank details or credit card information to every service provider or seller you come across online. Instead, you can link your PayPal account to your local bank account or credit cards and make payments or receive money without revealing your sensitive information.

PayPal also provides protection for both buyers and sellers. If you’re selling goods or services, PayPal offers seller protection, which ensures that you get paid for your products or services. On the other hand, if you’re a buyer, PayPal’s buyer protection guarantees a refund if the product or service you receive doesn’t match the description or is not delivered at all.

With PayPal, you can send and receive money in a matter of seconds, regardless of the time or location. It’s a fast and efficient way to pay, especially when compared to traditional methods like checks or bank transfers that can take days to process.

One of the great things about PayPal is that it supports a wide range of currencies and can facilitate international payments and currency exchange. This makes it easier for businesses and individuals to engage in global transactions without worrying about the costs and fees associated with traditional banks.

PayPal’s customer service is also top-notch. If you have any questions or concerns, you can check their comprehensive online help center, or contact them directly via phone or email. They are always ready to assist you and resolve any issues you may encounter.

In today’s digital age, trust is key when it comes to financial transactions. With PayPal, you can trust that your money is in good hands. Whether you’re a buyer or a seller, PayPal offers a safe and reliable platform that ensures your financial activities are secure, transparent, and protected.

So, if you’re looking for a trustworthy and convenient way to pay, look no further than PayPal. Sign up and experience the ease and peace of mind that comes with using this 21st-century payment platform.

Find it on eBay

When it comes to finding sources to fund your PayPal account, eBay can be a great option. eBay offers a wide range of products and services that can help you get the money you need into your PayPal account. Whether you’re selling something on eBay or simply want to make a purchase, eBay provides a platform for both buying and selling where you can easily find what you’re looking for.

With eBay, you have the option to pay for your purchases using various payment methods. PayPal is one of the most popular and trusted payment services available on the platform. When shopping on eBay, you can select PayPal as your preferred payment method and easily enter your PayPal details to complete the transaction. This makes it convenient and secure for both the buyer and the seller.

Using PayPal on eBay also offers some additional benefits. For example, eBay’s Money Back Guarantee protects your purchases, ensuring you receive the item you paid for. PayPal also provides a level of buyer and seller protection, giving you peace of mind when making transactions.

Another advantage of using PayPal on eBay is the ability to receive payments quickly and securely. Once a buyer has paid for an item, the funds are deposited directly into your PayPal account. From there, you can easily transfer the funds to your linked bank account or use them for other online purchases. This eliminates the need for checks or waiting for funds to clear, making the process much faster and more convenient.

In addition, PayPal’s global network allows you to receive payments from buyers located anywhere in the world. PayPal automatically converts currencies for you if needed, saving you the hassle of dealing with exchange rates. This is particularly helpful if you’re selling internationally or working with customers abroad.

Overall, eBay provides an easy and reliable way to find and purchase items while using PayPal to make secure payments. Whether you’re a buyer or a seller, leveraging both platforms can help you successfully manage your financial transactions.

So if you’re looking for a reliable and convenient way to fund your PayPal account, eBay is definitely worth considering. With its wide range of products and services, eBay offers a trusted platform where you can find what you need and easily pay for it using PayPal.

Sources

There are several sources that can help you get started with PayPal:

- PayPal Help Center: If you’re new to PayPal or need assistance with your account, the PayPal Help Center provides comprehensive information and step-by-step guides to make it easier for you to understand and use PayPal’s services.

- PayPal Phone Support: If you need immediate assistance, PayPal offers phone support to help answer any questions or resolve any issues you may have.

- Online Tutorials and Tips: Many websites and blogs provide useful tips and tutorials on how to open and manage a PayPal account, as well as how to use PayPal for online payments, selling or buying on eBay, and much more.

- Financial Institutions: Many banks and credit unions offer PayPal services and support. Check with your local bank to see if they offer PayPal account opening and support services.

- PayPal Customer Support: PayPal’s customer support team is available to assist you with any questions or concerns you may have regarding your PayPal account or transactions.

- PayPal Community: The PayPal Community is an online forum where users can ask questions, share experiences, and seek advice from other PayPal users.

These sources can provide you with the necessary information and support to help you get started with PayPal and make the most of its features and services.