Creating a budget is an essential step towards financial success. It allows you to effectively manage your money and ensures that you are spending it wisely. Budgeting may sound like a daunting task, but with the right approach, it can be both manageable and rewarding.

One of the first steps in budgeting is to track your expenses. This can be done either on paper or using online tools or apps. Start by listing all your sources of income, such as your salary or any freelance work. Then, write down all your expenses, such as rent or mortgage payments, utilities, transportation costs (like gasoline or public transport), groceries, eating out, entertainment, and any other fixed payments you have. This will give you a clear overview of where your money is going each month.

Once you have a clear picture of your income and expenses, you can begin to prioritize your spending. Identify the areas where you can cut back and make adjustments. For example, if you find that you are spending too much money on eating out, you can set a specific goal to reduce those expenses. This doesn’t mean you can’t enjoy a meal at a restaurant anymore, but it means being mindful of how often you eat out and setting a budget for it.

The next step involves setting financial goals. Having goals in mind will help you stay motivated and focused on your budget. Whether you want to save for a vacation, pay off debt, or increase your emergency fund, having a clear goal in mind will give you a sense of direction. Start by estimating how much money you will need to reach your goal, and then break it down into smaller, more manageable monthly targets.

Keeping track of your progress is crucial. Review your budget regularly to see if you are sticking to it and if you need to make any adjustments. It’s important to be flexible and adapt your budget as needed. Unexpected expenses may arise, so having some extra money left in your budget each month will help you deal with those situations without derailing your financial plans. Remember, budgeting is a long-term commitment, so stay consistent and persevere even when it’s challenging.

In conclusion, starting a budget can seem overwhelming at first, but with the right approach, it can be a great tool for improving your financial situation. By tracking your expenses, prioritizing your spending, setting goals, and regularly reviewing and adjusting your budget, you will be well on your way to achieving financial success.

- How to do a budget

- Step 2: Track your spending

- How to Make a Budget in 5 Steps

- Step 1: List Your Income

- Step 2: List Your Expenses

- Step 3: Subtract Expenses From Income

- Step 4 Track Your Expenses All Month Long

- Step 5: Make a New Budget Before the Month Begins

- Get your accounts sorted

- How do I use my budget

- Sources

- Videos:

- How to Start Budgeting | Budgeting 101 | My Budget Process from Start to Finish | Sara Marie |

How to do a budget

Creating a budget is an essential step in managing your finances effectively. It allows you to allocate your money to specific expenses and helps you stay on track with your financial goals. There are various budgeting methods you can follow, but one popular approach is called zero-based budgeting.

In a zero-based budget, you assign every dollar you have a specific job. This means that you prioritize your expenses and ensure that your income minus your expenses equals zero. By giving each dollar a purpose, you have a clear understanding of where your money is going.

The first step in creating a budget is to gather all your financial information. This includes your bank statements, utility bills, and any other necessary documentation. It is important to have a complete overview of your income and expenses.

Next, list out all your regular monthly expenses. This may include rent, utilities, transportation costs, groceries, eating out, entertainment, and any other necessary expenditures. Be as specific as possible and account for every category of spending.

Once you have your expenses listed, subtract them from your income. This will help you see if you have any money left over or if you need to make adjustments in your spending. If your expenses exceed your income, you may need to cut back on certain categories or find ways to increase your income.

One useful budgeting tool you can use is EveryDollar. It is an online tracking tool that helps you track your expenses and reach your financial goals. It allows you to input your income and expenses and provides a clear visualization of where your money is going.

When making your budget, it’s important to account for both month-specific expenses and irregular expenses that may occur throughout the year. For example, if you know you have a car insurance payment every six months, divide that total by 12 and set aside that amount in your budget each month.

It’s also important to have an emergency fund in your budget. This is an extra amount of money that you set aside for unexpected expenses or emergencies. It will help prevent you from overspending and ensure you have funds available when you need them.

Finally, track your spending regularly to see if you are staying within your budget. Make adjustments as necessary and be mindful of your financial goals. Budgeting requires discipline and willpower, but by sticking to it, you can reach your financial milestones and have more control over your money.

In conclusion, budgeting is a necessary step in managing your finances effectively. By following the steps outlined above and using tools such as EveryDollar, you can create a budget that works for you and helps you reach your financial goals. Take control of your money and start budgeting today!

Step 2: Track your spending

Once you have created your budget, the next step is to track your spending. This is one of the most important steps in budgeting as it helps you keep a record of where your money is going and ensure that you are staying within your planned budget.

Tracking your spending involves keeping a record of all your expenses. Start by listing out all your fixed expenses, such as rent or mortgage payments, utilities, transportation costs, and any other regular bills you may have. Then, take a look at your bank account statements and write down any additional expenses you have had in the past few months.

If you’re new to budgeting, tracking your spending may seem overwhelming at first. But don’t worry, there are great tools available to help you with this. Many banks have online banking platforms that categorize your transactions automatically, making it easier for you to see where your money is going. There are also budgeting apps, such as Mint or YNAB, which can help you track your spending and provide you with useful insights about your finances.

When tracking your spending, don’t forget to account for those small, everyday expenses. Things like eating out, buying coffee, or shopping at the grocery store can add up over time. Look at your past transactions and make a list of these expenses. You might be surprised to see how much those little purchases can add up to.

Once you have everything sorted out, subtract your expenses from your income. This will give you an idea of how much extra money you have to use for other needs or wants. If you find that your expenses are greater than your income, don’t panic. This just means that you need to adjust your budget and find ways to cut back on certain expenses.

Tracking your spending is an ongoing process. You should aim to do it regularly, such as once a week or once a month. By consistently keeping track of your expenses, you’ll have a better understanding of where your money is going and be able to make more informed financial decisions.

Also, don’t be too hard on yourself if you have some slip-ups. Budgeting and tracking your spending takes time and practice. It’s okay if you make a few mistakes along the way. Just learn from them and keep moving forward.

So, now that you know how to start budgeting and tracking your spending, it’s time to put it into action. Remember, creating a budget and tracking your spending doesn’t mean restricting yourself from enjoying life. It’s about giving yourself the freedom to make choices and stay in control of your finances for the long run.

How to Make a Budget in 5 Steps

When it comes to budgeting, having a plan in place is crucial for financial success. With the right tools and strategies, you can take control of your money and reach your financial goals. Here are five steps to help you create a budget:

Step 1: Determine Your Income

The first step in creating a budget is to figure out how much money you have coming in every month. This includes your regular paycheck as well as any additional sources of income you may have, such as freelancing or side hustles. Make sure to take into account taxes and deductions, so you have an accurate number to work with.

Step 2: Calculate Your Expenses

Next, you’ll want to determine how much money you’re spending each month. Take a look at your bank statements and receipts to get a clear picture of your expenses. Categorize them into fixed expenses (such as rent or mortgage payments, utilities, and loan payments) and variable expenses (such as groceries, eating out, entertainment, and gas). This will help you see where your money is going and identify areas where you can cut back.

Step 3: Create a Zero-Based Budget

A zero-based budget is a budgeting method where your income minus your expenses equals zero. This means that every dollar you earn has a specific purpose, whether it’s for bills, savings, or discretionary spending. In this budgeting approach, you allocate all of your income to different categories, making sure that you’re not overspending in any area.

Step 4: Track Your Spending

Once you’ve created your budget, it’s important to track your spending to make sure you’re staying on track. Use a budgeting tool or a spreadsheet to record all of your income and expenses. This will help you see where your money is going and identify any necessary changes you may need to make. For example, if you notice that you’re spending too much on eating out, you might decide to cook more at home to save money.

Step 5: Adjust and Stay Committed

Making a budget is not a one-time thing. It’s an ongoing process that requires regular review and adjustments. As your income or expenses change, you’ll need to update your budget to reflect these changes. Additionally, unexpected expenses may come up, so having an emergency fund is a good idea to cover these costs. Stay committed to your budget and make it a habit to review and adjust as necessary.

By following these five steps, you can create a budget that works for you and helps you reach your financial goals. Remember, budgeting is all about taking control of your money and making it work for you.

Step 1: List Your Income

The first step in starting a budget is to list all of your sources of income. This includes not only your regular paycheck if you’re working a steady job, but also any additional income you may have from freelancing or other side hustles.

Make sure to write down each source of income and the amount you expect to receive from each one. It’s important to be as accurate as possible, but if you’re not sure about a specific amount, it’s better to estimate on the lower side.

If you’re working on a month-specific budget, take into account any irregular or one-time income you may receive in that month. This could be a bonus or a payment for a freelance project. These additional income sources should also be included on your list.

Once you’ve listed all of your income sources, add up the total amount. This will give you a clear picture of your monthly income and will serve as the starting point for creating your budget.

Remember that a budget is about giving every dollar a job. Your income is what allows you to cover your needs, wants, and priorities. By knowing exactly how much money you have coming in, you can better plan where it needs to go.

For a zero-based budget, this step is especially important. Zero-based budget means that you allocate every dollar you earn to a specific category or line in your budget. This method ensures that you’re intentionally spending your money and helps you avoid overspending.

A great tool to assist you in tracking your income is an online budgeting app like EveryDollar. With this app, you can easily input your income and track your spending in one place. It also helps you to stay organized and not forget about any expenses or payments.

Here’s a breakdown of how to begin your budget once you’ve listed your income:

- Begin with a piece of paper or a new document on your computer. This will be the place where you’ll write down all of your budgeting information.

- Write down your total income. This is the sum of all the amounts you listed for each income source.

- Estimate and write down your expenses. Start with your necessary expenses such as rent/mortgage, utilities, groceries, gasoline, and other regular bills.

- Next, consider your wants and goals. These are the things that you would like to spend money on but are not necessary for your basic needs. It could be eating out at restaurants, a new coffee machine, or saving for a vacation.

- Adjust your budget as necessary. If your total expenses exceed your total income, you may need to make some adjustments. Look for areas where you can cut back on spending or find ways to increase your income.

By following these steps and tracking your income and expenses, you’ll have a clearer understanding of where your money is going and be better able to achieve your financial goals.

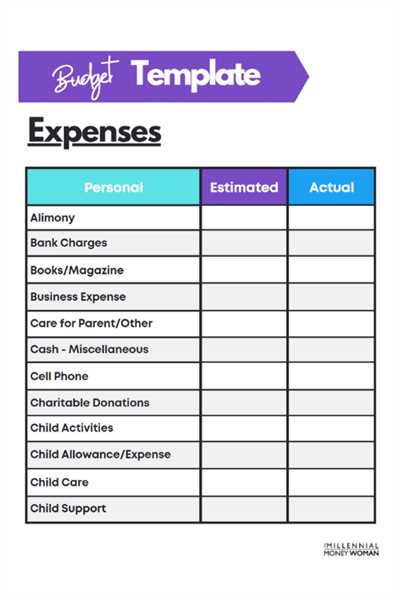

Step 2: List Your Expenses

Once you have a clear understanding of your income and financial goals, it’s time to start listing all of your expenses. This step is crucial in creating a budget that works for you.

Begin by making a list of all the necessary expenses you have each month. This includes things like rent or mortgage payments, utilities, transportation costs, and other bills that you can’t avoid. It’s important to be as accurate as possible when estimating these expenses, so take a look at your past bank statements and bills to get a clear picture of how much you typically spend in each area.

Next, list down your month-specific expenses. These are expenses that may not occur every month but are necessary to consider when creating your budget. This could include things like annual insurance premiums, quarterly taxes, or other periodic costs.

Once you have listed all of your necessary expenses, it’s time to move on to the next step – listing your discretionary spending. This includes things like entertainment, dining out, and other non-essential expenses. Be honest with yourself about how much you typically spend in these areas, but also consider where you might be able to cut down or adjust your spending.

A helpful tool for tracking your expenses is a zero-based budget. This means that every dollar you earn is assigned a job – whether it’s for necessary expenses, savings, or discretionary spending. It’s a good way to ensure that your money is being used effectively and that you’re not overspending in any area.

There are various tools and online platforms available to help you track your expenses and create a zero-based budget. Some popular sources include EveryDollar, Mint, and You Need A Budget (YNAB). Find one that you love and that works for you.

Once you have your expenses listed, take some time to review them and see if there are any areas you can cut back on. Are there any unnecessary expenses that you can eliminate? By making some adjustments, you may find that you have more money left over at the end of the month to put towards your financial goals.

Remember, budgeting is a dynamic process, and it’s okay to make changes along the way. If you find that your expenses are higher than your income, you may need to make some choices about what you truly need versus what you want. Building a budget that aligns with your goals and values is an important step towards financial success.

Step 3: Subtract Expenses From Income

Now that you have your income and expenses sorted, it’s time to subtract your expenses from your income to see how much money you have left at the end of the month.

Start by listing all of your regular monthly expenses, such as rent or mortgage payments, utilities, groceries, transportation costs, and any other fixed bills you have. Be sure to include any irregular expenses, like car maintenance or medical costs, that you may need to budget for.

Next, deduct your total expenses from your total income. This will give you an idea of how much money you have left over each month after covering all of your bills. It’s important to be honest with yourself during this step and track your expenses carefully. Even small expenses, such as a daily coffee from a favorite cafe, can add up over time and impact your budget.

If your expenses are greater than your income, you will need to make some adjustments. Take a closer look at your spending habits and see where you can cut back. Perhaps you can eat out at restaurants less frequently or find ways to reduce your grocery bill. You might also consider finding ways to increase your income, such as taking on a part-time job or freelancing in your spare time.

If your income is greater than your expenses, congratulations! This means that you have extra money that you can put towards savings or other financial goals. However, it’s important to stay disciplined and avoid the temptation to overspend. Stick to your budget and resist the urge to make unnecessary purchases.

Remember, budgeting is a long-term commitment, and it’s a good idea to review and adjust your budget regularly to account for any changes in your financial situation. By tracking your income and expenses, you can stay on top of your finances and reach your financial goals.

Here’s a suggested method for tracking your expenses called the “EveryDollar” budgeting plan:

- Open an online bank account or use a budgeting app to keep track of your income and expenses.

- Write down every expense you make, no matter how small. This will help you see where your money is going and identify areas where you can cut back.

- Categorize your expenses into different categories, such as groceries, transportation, entertainment, etc. This will make it easier to see where you’re spending the most.

- Add up your expenses in each category and compare them to your budgeted amounts. This will help you see if you’re staying within your planned spending limits.

By following this method, you can gain a clearer understanding of your spending habits and make more informed financial decisions.

Step 4 Track Your Expenses All Month Long

Once you have created a budget and allocated your income to various categories, it’s important to keep track of your expenses. Tracking your expenses will help you see where your money is going and identify areas where you can make changes to stay within your budget.

When tracking your expenses, start by making a list of all the necessary expenses you have each month. This includes things like rent or mortgage payments, utilities, transportation costs (such as gasoline or public transportation), grocery bills, and any regular payments you have for things like loans or subscriptions.

Next, look at all the other expenses you have that are not fixed amounts. These could include eating out at restaurants, shopping for new clothes or gadgets, or any other non-essential purchases you make during the month. It’s important to include these expenses in your tracking, even if they are not part of your budget.

There are various tools you can use to track your expenses, both online and on paper. Some people prefer to use a spreadsheet or budgeting app, while others like to use a pen and paper. Whichever tool you choose, make sure it’s something that you will consistently use throughout the month.

As you make purchases and have expenses throughout the month, be sure to record them in your tracking tool. This can be done by writing them down on a physical piece of paper or entering them into an online budgeting tool. Make sure to include the date, amount, and category of each expense.

At the end of the month, take some time to review your expenses. Look at each category and see how much you spent compared to your budget. Subtract your total expenses from your income to see how much money you have left over or if you went over budget.

If you find that you went over budget in certain areas, take a closer look at those expenses. Are there any changes you can make to reduce the amount you spend? For example, if you spent a lot on eating out, you could try cooking at home more often or setting a limit on how much you can spend on restaurants each month.

Tracking your expenses all month long will help you see where your money is going and ensure that you stay on track with your budget. It may take some time to get used to this process, but once you do, it will become second nature and you’ll have a better understanding of your spending habits.

Step 5: Make a New Budget Before the Month Begins

Creating a new budget before the month begins is a crucial step in effective budgeting. By taking the time to review and adjust your budget each month, you can ensure that it remains relevant to your current financial situation and goals.

Here are the steps to follow when making a new budget:

1. Review Last Month’s Budget: Start by looking at your budget from the previous month. Take note of any areas where you went over or under budget, and make adjustments accordingly.

2. Write Down Your Income: Make a list of all the money you expect to earn during the upcoming month. This includes regular income sources such as your salary, as well as any additional income you may receive.

3. Subtract Fixed Expenses: Next, deduct your fixed expenses such as rent or mortgage payments, utilities, and insurance premiums. These are expenses that do not change from month to month.

4. Plan for Variable Expenses: Estimate how much you will spend on variable expenses like groceries, transportation, entertainment, and eating out. Remember to consider any upcoming events or planned purchases.

5. Set Aside Money for Savings and Goals: Allocate a portion of your income towards savings and any financial goals you have. This could be saving for an emergency fund, a vacation, or paying off debt.

6. Adjust your Budget if Necessary: If your expenses exceed your income, go back and make adjustments. Look for areas where you can cut back or find ways to increase your income to balance the budget.

7. Track Your Spending: Throughout the month, keep track of your expenses to ensure you are staying within your budget. Consider using online budgeting tools or apps to help you stay organized.

8. Stay Flexible: Remember that your budget is not set in stone. Life happens, and unexpected expenses may arise. Be ready to adjust your budget as needed, but make it a priority to stick to your financial plan as much as possible.

By making a new budget before each month begins, you can stay on top of your finances and reach your financial goals. It’s called a zero-based budget because every dollar has a purpose, whether it’s for bills, savings, or spending.

So, take the time to create a new budget each month and give yourself the best chance to reach your financial goals and stay in control of your money.

Get your accounts sorted

When it comes to budgeting, one of the first things you need to do is get your accounts sorted. This means gathering all the information about your income and expenses in one place.

You’ll want to start by listing out all your different accounts and income sources. This might include things like your regular job, any side hustles or freelance work, and even income from your spouse or partner. Write down each income source on a piece of paper or in a spreadsheet.

Next, you’ll want to gather your bank statements and any other financial documents that show your expenses. Look through these statements and make note of all your fixed expenses – things like rent or mortgage payments, utilities, and transportation costs. Write all of these expenses down on the same piece of paper as your income sources.

Once you have your income and expenses written down, it’s time to do the math. Start by subtracting your expenses from your income. This will give you an estimate of how much money you have left over each month.

If you find that you’re spending more than you’re making, you’ll need to make some adjustments. Look for areas where you can cut back on spending and create a specific budget for those areas. For example, if you’re spending too much on eating out, create a monthly budget for dining out and stick to it.

If you have any extra income, such as a bonus or side gig, be sure to factor that into your budget as well. This extra money can go towards paying off debt, saving for a specific goal, or just giving yourself a little extra spending money.

Remember, budgeting is all about tracking your income and expenses and making sure you’re not spending more than you’re making. There are many tools out there to help with this, such as EveryDollar, which is a great tool for creating a zero-based budget.

Creating a zero-based budget means that every dollar you earn has a specific purpose. You allocate your income to different categories such as groceries, entertainment, savings, and so on, until you reach zero. This way, you’re ensuring that every dollar is accounted for and there’s no room for overspending.

Budgeting doesn’t mean you have to completely cut out all the things you love. It just means being mindful of your spending and making changes when necessary. By getting your accounts sorted and creating a budget, you’ll be on your way to financial success.

How do I use my budget

Once you have created your budget online using a tool like EveryDollar or on paper, you can start using it to manage your finances effectively. Here are some steps to help you get started:

- Track your expenses: Write down all your expenses, including fixed costs like rent and utilities, as well as variable costs like groceries and entertainment.

- Keep a record: Make a list of all your income sources, whether it’s a single paycheck or freelance work.

- Estimate your monthly income: If your income varies, you might want to calculate an average or use your lowest expected income to be safe.

- Assign every dollar a job: Using the zero-based budgeting method, make sure every dollar you earn is allocated towards a specific expense or savings goal.

- Adjust as needed: If your expenses exceed your income, you’ll need to make some adjustments to your budget. Consider cutting back on non-essential expenses or finding ways to increase your income.

By following these steps, you can start effectively utilizing your budget to keep your finances in check and work towards your financial goals. Remember, your budget is a great tool to help you make informed decisions about how you spend, save, and invest your money.

Sources

When it comes to budgeting, having a clear understanding of where your money is coming from is crucial. Here are some common sources of income:

1. Regular income: This includes your salary, wages, or any other consistent source of money you receive on a regular basis.

2. Freelance or online work: If you have a side hustle or do freelance or online work, this can be a great source of additional income.

3. Part-time jobs: If you have a part-time job in addition to your regular job, it can help boost your income.

Next, you need to look at your expenses to see where your money is going. Here are some common expenses you may have:

1. Rent or mortgage: This is usually the largest expense for most people. Make sure to include it in your budget.

2. Utilities: Include expenses such as electricity, water, internet, and gas in your budget.

3. Grocery store: Food is a necessary expense, but you can make adjustments to save money.

4. Transportation: Gasoline, public transportation, or car maintenance are all areas where you may need to budget.

5. Entertainment: While it’s good to have some fun, don’t forget to allocate some money for entertainment purposes.

6. Debt payments: If you have any outstanding debts, such as credit cards or loans, make sure to account for them in your budget.

Remember, a zero-based budget means that you assign a specific purpose to every dollar you earn. This can be a powerful tool in tracking and controlling your spending. Here’s how it works:

1. Determine your monthly income: Look at your pay stubs or bank statements to get an estimate of your monthly income.

2. Subtract all necessary expenses: Start with fixed expenses such as rent, utilities, and debt payments. Then subtract other necessary expenses like groceries and transportation.

3. Divide the remaining money based on your goals: Allocate funds for each area such as savings, emergency fund, and entertainment. Adjust as needed.

4. Track your spending: Use a tool such as EveryDollar to track your expenses and make sure you’re staying within your budget.

By following these steps and making adjustments as necessary, you will be able to reach your financial goals and have control over your spending.