Building a diversified portfolio is an essential strategy for today’s investors, especially for those who are risk-averse or beginner in the investment world. Diversification allows investors to spread their money across different asset classes and take advantage of the potential growth in various markets. It is crucial to determine the right asset allocation and investment strategy to achieve long-term goals and protect against major swings in the market.

One of the main reasons why diversification is so important is to avoid putting all your eggs in one basket. By spreading your investments across different types of assets, such as stocks, bonds, and real estate, you can reduce the risk of loss if one of these asset classes performs poorly. Diversification also allows you to generate higher returns by investing in the best-performing assets while protecting your capital against potential losses.

To start building a diversified portfolio, you need to determine your risk tolerance and investment goals. If you are a risk-averse investor, you may want to allocate a larger portion of your portfolio to lower-risk investments, such as bonds or index funds. On the other hand, if you are willing to take on more risk for potentially higher returns, you could allocate a higher percentage to growth stocks or other high-risk assets.

Today’s modern investors have access to a wide range of investment options, including mutual funds, exchange-traded funds (ETFs), and individual stocks. These investment vehicles allow you to diversify your portfolio by investing in various companies, sectors, or regions. It is important to research different investment options and choose those that align with your investment goals and risk tolerance.

Once you have set your asset allocation and investment strategy, it is crucial to ride out the ups and downs of the market. Markets can be volatile, and it is not uncommon to experience wild swings in the value of your investments. However, by staying invested and avoiding emotional decisions based on short-term market movements, you can take advantage of the long-term growth potential of a diversified portfolio.

In conclusion, building a diversified portfolio is a crucial step for any investor willing to achieve long-term growth while minimizing the risk of major losses. By spreading your investments across different asset classes and adopting a well-researched investment strategy, you can take advantage of the best-performing investments while protecting your capital against potential downturns. Start building your diversified portfolio today and enjoy the benefits it can bring in the future.

- Building a diversified set of investments

- Determine Asset Allocation

- Why Is it Crucial to Have a Modern Portfolio Diversification Strategy Today

- Avoid Major Capital Loss

- Generate Higher Returns

- Take Advantage of Today’s Best-Performing Asset Classes

- 6 Strategies to Build a Diversified Investment Portfolio for Long-Term Growth

- Is it possible to be diversified as a beginner investor

- Video:

- Building a Diversified Portfolio: My 13 Crore Journey | Investing for Beginners 2023 | Warikoo Hindi

Building a diversified set of investments

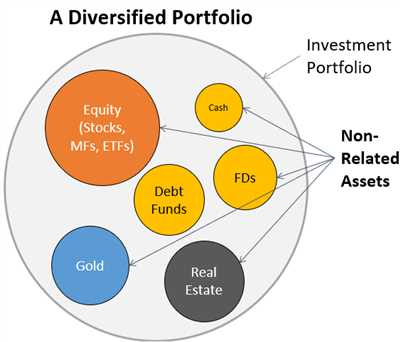

Building a diversified portfolio is crucial for any investor, whether you’re a beginner or experienced in the world of finance. Diversification is a strategy that helps investors avoid putting all their eggs in one basket. It allows you to have a mix of different asset classes and investments within your portfolio, which can help spread the risk across various types of assets.

Why is diversification important? The main reason is to reduce risk. When you have a diversified portfolio, the performance of one investment is less likely to have a significant impact on your overall portfolio. If one asset class is performing poorly, the other investments may be able to offset those losses due to their own growth. By diversifying your investments, you can potentially increase the chances of achieving long-term returns while minimizing the effect of market swings.

How does one build a diversified set of investments? There are several strategies you can take:

1. Determine your risk tolerance: Before you start building your portfolio, it’s important to determine how much risk you’re willing to take. Are you a risk-averse investor who wants to prioritize capital preservation, or are you more open to risk in exchange for potentially higher returns? This will help guide your asset allocation decisions.

2. Have a mix of different asset classes: Different asset classes have different levels of risk and return potential. By including a mix of stocks, bonds, cash, and other assets within your portfolio, you can spread the risk across multiple investments. This can help balance out the performance in different market conditions.

3. Invest across different markets: Investing in different markets can also help diversify your portfolio. By investing globally, you can take advantage of growth opportunities in different countries and regions. This can help reduce your exposure to any one market and increase the potential for returns.

4. Consider index funds and ETFs: Index funds and exchange-traded funds (ETFs) are investment vehicles that offer diversification within a single investment. These funds typically track a specific index, such as the S&P 500, and provide exposure to a broad range of companies. They can be a cost-effective and efficient way to gain exposure to a diversified set of investments.

Remember, building a diversified portfolio takes time and careful consideration. It’s important to regularly review your investments and make adjustments as necessary. The investment world continues to change, and what may be the best-performing asset class today may not be tomorrow. By staying disciplined and sticking to your investment strategy, you can build a portfolio that helps you achieve your long-term financial goals while minimizing risk.

Determine Asset Allocation

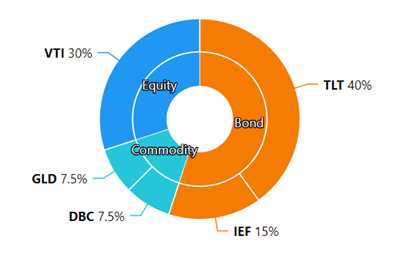

One of the key steps in building a diversified portfolio is to determine your asset allocation. Asset allocation refers to the set of strategies you choose to allocate your investments across different asset classes.

Today’s portfolios have a wide range of asset classes to choose from, such as stocks, bonds, real estate, commodities, and more. Each asset class has its own level of risk and return potential. For risk-averse investors, it is crucial to set an asset allocation that helps reduce the risk of significant loss and generate long-term investment returns.

If you’re a beginner investor, it is best to start building a diversified portfolio with a balanced allocation across different asset classes. This can help you avoid putting all your eggs in one basket and spreading the risk across multiple investments.

Modern portfolio theory offers a helping hand in determining asset allocation. It suggests that by diversifying your investments across different asset classes, you can reduce volatility and potentially increase returns over the long term.

One of the main advantages of diversification is that different asset classes tend to perform differently in various market conditions. For example, while stocks may perform well in a bullish market, bonds may perform better during economic downturns. By having a diversified portfolio, you can take advantage of the growth potential of different asset classes while minimizing risk.

To achieve diversification, investors typically allocate their capital among several asset classes with different levels of risk and return potential. One way to measure the diversification level within a portfolio is through the use of the correlation coefficient, which measures the relationship between the returns of different assets. The goal is to have a correlation coefficient as close to zero as possible, meaning that the returns of the assets are not highly correlated.

An optimal asset allocation for diversification can depend on various factors such as your risk tolerance, investment goals, and time horizon. However, a common rule of thumb is to allocate a percentage of your portfolio to stocks, bonds, and other asset classes. This allocation can be adjusted as your financial situation and investment objectives change.

As the saying goes, “don’t put all your eggs in one basket.” Diversification is key, as it helps reduce risk and increase the potential for long-term returns. By determining your asset allocation and spreading your investments across different asset classes, you can build a diversified portfolio that is better equipped to navigate through the ups and downs of the market.

In conclusion, determining asset allocation is a crucial step in building a diversified portfolio. By spreading your investments across different asset classes and maintaining a balance between risk and return, you can take advantage of potential growth opportunities while minimizing the impact of market swings. Remember that diversification does not guarantee profits or protect against losses, but it can help manage risk in your investment strategy.

Why Is it Crucial to Have a Modern Portfolio Diversification Strategy Today

Diversification is a crucial strategy for any investor looking to build a successful portfolio and achieve long-term growth. In today’s volatile markets, having a diversified portfolio is more important than ever.

One of the main advantages of diversification is that it helps to reduce risk. By spreading your investments across different asset classes and types, you decrease the likelihood of a major loss. If one investment performs poorly, the others are there to potentially offset the losses. This can be particularly beneficial for beginner investors who may be less willing to take on high levels of risk.

Another reason why diversification is crucial today is that it allows you to take advantage of the potential growth in different markets and asset classes. No one can accurately predict which sectors or individual securities will be the best-performing in the future. By diversifying your portfolio, you increase your chances of capturing some of that growth wherever it may occur.

Modern portfolio diversification strategies go beyond simply allocating your money across a set number of asset classes. They take into account factors such as correlation coefficients and historical performance to determine the best allocation for your specific goals and risk tolerance. These strategies also consider the various types of risk that exist within each asset class.

Furthermore, diversification helps to smooth out the volatility that can come with investing in the stock market. By spreading your investments across different asset classes, you can avoid wild swings in the value of your portfolio. This can be especially important for risk-averse investors who want to generate stable, consistent returns over the long term.

In today’s world of uncertainty and market fluctuations, having a modern portfolio diversification strategy is essential. It helps to protect your capital against potential losses and allows you to take advantage of growth opportunities in different markets. Whether you’re a beginner investor or an experienced one, building a diversified portfolio is one of the best ways to generate long-term wealth.

Avoid Major Capital Loss

Building a diversified portfolio is one of the best-performing strategies for long-term investment growth. Modern investors understand the importance of diversification and why it is crucial to have a diversified portfolio. By spreading your investments across different asset classes, you can take advantage of the potential increase in returns while minimizing risk.

One way to avoid major capital loss is by determining your risk tolerance and setting a clear investment strategy. As a beginner investor, it is important to understand that the best-performing asset classes today may not be the same in the future. By diversifying your investments, you can ride out the wild swings of the markets and avoid putting all your money in a single asset class or index.

One key concept to consider is the coefficient of correlation, which helps determine the degree of correlation between different assets. By investing in assets that have a lower coefficient of correlation, you can potentially reduce the risk of major capital loss. This means that if one asset performs poorly, assets with a different correlation will have a higher chance of performing well, thus balancing out the overall performance of your portfolio.

Another advantage of diversification is that it can help protect your portfolio against the impact of a particular market or sector. For example, if the tech industry experiences a slowdown, having investments in other sectors can mitigate potential losses.

When building your diversified portfolio, it is important to consider the allocation of your assets. Allocating your investments based on your risk tolerance, goals, and time horizon is crucial. This will help generate returns while protecting against major capital loss.

A diversified portfolio should also include a mix of different investment strategies. Some investments may focus on growth, while others may focus on generating income. By including a variety of strategies, you can increase your chances of achieving long-term investment success.

Remember, no investment is without risk, but by diversifying your portfolio, you can minimize the potential for major capital loss. By spreading your investments across different asset classes and investment strategies, you can build a portfolio that is more resilient to market fluctuations and better positioned to achieve your financial goals.

Generate Higher Returns

One of the key goals of building a diversified portfolio is to generate higher returns. By spreading your investments across different asset classes and strategies, you can take advantage of the best-performing sectors and increase your chances of achieving higher returns.

Modern portfolio theory advocates for diversification as a way to minimize risk while maximizing returns. By allocating your capital across various investment types, such as stocks, bonds, and real estate, you can protect your portfolio against wild swings in any one asset class.

Diversification helps to smooth out the ups and downs of different markets and investments. For example, if you’re a risk-averse beginner investor, you may choose to invest in index portfolios that include a mix of different stocks and bonds. This way, even if one investment performs poorly, the others may still generate positive returns.

| Asset classes | Risk coefficient |

| Stocks | 0.8 |

| Bonds | 0.25 |

| Real Estate | 0.3 |

By determining your risk tolerance and setting a diversified portfolio allocation within these asset classes, you can start to generate higher returns while managing your risk. The risk coefficient represents the volatility of each asset class – the higher the coefficient, the more volatile the investment. By selecting assets with different risk coefficients, you can optimize your portfolio’s risk-return profile.

It is crucial to have a long-term perspective when building a diversified portfolio. Short-term market swings may cause temporary losses, but over time, a well-diversified portfolio can generate consistent growth. By taking advantage of the different growth rates and market cycles of various asset classes, you can increase your chances of generating higher returns.

Remember, diversification does not guarantee against a loss, and it does not eliminate the risk of investment. However, by implementing a diversified portfolio strategy and spreading your investments across different asset classes and strategies, you can mitigate risk and potentially generate higher returns.

Start building your diversified portfolio today by assessing your risk tolerance, determining your asset allocation, and selecting investments that align with your investment goals. By taking advantage of the benefits of diversification, you can ride out market fluctuations and increase your chances of achieving higher returns.

Take Advantage of Today’s Best-Performing Asset Classes

When building a diversified portfolio, it is crucial to take advantage of today’s best-performing asset classes. This can help generate higher returns and reduce the risk of loss. However, it is important to avoid being too heavily invested in these assets, as their performance can change over time.

One strategy for building a diversified portfolio is to allocate your capital across different asset classes. By investing in a set of major asset classes, you can achieve a balance between growth and risk. This is because different asset classes tend to perform differently in various market conditions.

For beginner investors or those who are more risk-averse, it may be helpful to start with index funds. These funds allow you to invest in a wide range of assets within a particular asset class, reducing the risk of overexposure to any one investment. It’s a great way to achieve diversification without having to select individual securities.

To determine which asset classes to invest in, you should consider the modern portfolio theory. This theory suggests that by combining assets with low or negative correlation coefficients, you can achieve a more diversified portfolio. This means investing in assets that have a tendency to move in different directions. For example, when stock markets are down, bonds tend to perform better.

Today, some of the best-performing asset classes include technology stocks, renewable energy, and emerging markets. These asset classes have seen significant growth in recent years and continue to be areas of opportunity. Investing in these asset classes can help increase your chances of achieving higher returns.

It is important to note that investing in the best-performing asset classes does come with risks. Markets can be volatile, and what is performing well today may not continue to do so in the future. This is why diversification is so important – it helps spread the risk across different types of assets.

Take advantage of today’s best-performing asset classes, but do so within the context of a well-diversified portfolio. By spreading your investments across different asset classes, you’re able to ride out the wild swings of any one investment or market. This can be especially helpful for long-term investors who have a higher tolerance for risk.

Building a diversified portfolio that takes advantage of today’s best-performing asset classes requires careful consideration and a thoughtful investment strategy. By doing so, you can increase your chances of generating desirable returns while managing risk.

| Asset Class | Performance |

|---|---|

| Technology Stocks | High growth potential |

| Renewable Energy | Increasing demand |

| Emerging Markets | Rapid economic growth |

Remember, diversification is key. Don’t put all your eggs in one basket. Instead, spread your investments across different asset classes to reduce the risk of loss and increase the potential for long-term growth.

6 Strategies to Build a Diversified Investment Portfolio for Long-Term Growth

When it comes to investing, you’re always looking for ways to generate the highest returns possible while minimizing risk. One of the best-performing strategies that most investors use today is diversification. Diversification is the practice of spreading your money across different types of investments in order to reduce the risk of loss.

But why is it that diversification is so crucial when building a portfolio? The answer lies in the concept of correlation. Correlation is a statistical measure that determines how investments move in relation to each other. In other words, it shows how different assets behave within different market conditions.

The goal of diversification is to find investments that have a low correlation with each other. This means that the assets in your portfolio will not all move in the same direction at the same time. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can avoid unnecessary losses and potentially increase your overall returns.

Here are 6 strategies to help you build a diversified investment portfolio for long-term growth:

1. Start with an Asset Allocation Strategy: Determine the percentage of your capital that you want to allocate to each type of asset. This will help you set a balanced portfolio from the beginning.

2. Take Advantage of Modern Portfolio Theory: This theory suggests that by diversifying your investments across different asset classes, you can achieve higher returns for a given level of risk.

3. Consider Index Funds: Index funds are a type of investment that tracks a specific index, such as the S&P 500. They offer diversification within a single investment, making it easy for beginner investors to start building a diversified portfolio.

4. Look for Different Types of Investments: Include a mix of investments within each asset class. For example, if you’re investing in stocks, consider investing in different industries and market sectors to spread your risk.

5. Avoid Overlapping Investments: Be mindful of investing in assets that are highly correlated with each other. This defeats the purpose of diversification and can expose your portfolio to unnecessary risk.

6. Keep Rebalancing: As the market continues to evolve, your portfolio’s asset allocation will shift. Rebalancing involves buying and selling assets to bring your portfolio back to its original allocation. This helps maintain the desired diversification and adjust for changes in market conditions.

Remember, building a diversified investment portfolio takes time and careful consideration. By following these strategies, you can minimize risk and maximize long-term growth potential.

Is it possible to be diversified as a beginner investor

Diversification refers to spreading your investments across different asset classes and types of investments. By diversifying, you are avoiding the risk of putting all of your eggs in one basket. Instead, you are taking advantage of the fact that different assets perform differently over time.

One of the best-performing assets classes for beginners is the index fund. An index fund is a type of investment fund that is made up of a set of stocks or bonds that are designed to mimic the performance of a specific market index. By investing in an index fund, you can achieve instant diversification with just one investment.

Modern portfolio theory suggests that diversification can help to lower the overall risk of a portfolio without sacrificing potential returns. This is because different assets have different correlations – some assets may move in the same direction while others move in the opposite direction. By spreading your investments across assets with different correlations, you can reduce the volatility of your overall portfolio.

Building a diversified portfolio as a beginner investor starts with determining how much risk you are willing to take. Risk-averse investors may choose to allocate a higher percentage of their portfolio to lower-risk assets, such as bonds, while more risk-tolerant investors may be willing to allocate a larger percentage to higher-risk assets, such as stocks.

It’s important to note that diversification does not guarantee a profit or protect against loss. However, by spreading your investments across different assets, you can reduce the impact of any single investment on your overall portfolio. This can help to smooth out the ups and downs of the market and improve the long-term performance of your investments.

So, while the stock market can be wild and unpredictable, diversification can help beginner investors avoid taking a heavy hit in case of market swings. By diversifying their investments across different asset classes and types, beginner investors can build portfolios that have a better chance of generating stable returns in the long run.