Creating a budget can make a huge difference in your financial life. It can help you plan for your future, keep track of your expenses, and make sure you’re making the most of your money. Whether you’re budgeting for yourself or for your business, it’s important to take some time to understand the basics of budgeting and how it can help you reach your financial goals.

When you start budgeting, the first step is to gather all your financial information. This includes your income sources, expenses, and any savings or investments you may have. Once you have all this information in one place, you can start to put it together in a format that makes sense to you. Some people like to use an online tool or a spreadsheet, while others prefer to create their budget on pen and paper.

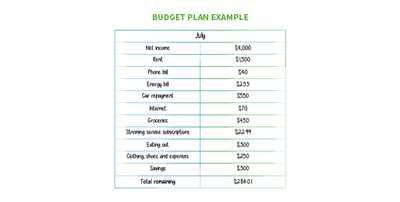

Next, you’ll want to take a look at your monthly income and expenses. This will help you get a sense of where your money is going and where you can make some changes. It’s important to be realistic when looking at your expenses, and to make sure you’re accounting for all your regular costs as well as any extra spending you may do from time to time.

Once you’ve looked at your income and expenses, you can start to make some decisions. Decide how much money you want to put towards each category, and set goals for yourself. Do you want to save more money? Pay off debt? Start an emergency fund? Whatever your goals are, you’ll need to decide how much money you can allocate towards each one.

Now that you’ve got a plan, it’s time to put it into action. Stick to your budget as best as you can, and make adjustments as needed. Budgeting is not a one-time thing, it’s an ongoing process. You’ll need to review your budget regularly and make changes as necessary. This could mean finding ways to cut costs, or it could mean finding ways to increase your income. The key is to keep working at it and to stay motivated.

Lastly, don’t forget to keep track of your progress. Take note of how much money you have left at the end of each month, and how you’ve been able to improve your financial situation. This will help you stay motivated and will show you how far you’ve come. Remember, budgeting is hard work, but with the right tools and a little bit of math, you can take control of your money and start building a better future.

How to create a budget

Creating a budget is an important step in managing your finances. It helps you understand your income and costs, plan for the future, and achieve your financial goals. Here is a guide to help you create a budget:

- First, put together all your sources of income. This could include your salary, any side hustles, or passive income sources. Make sure to take into account how often you receive income, whether it’s monthly, weekly, or on a different schedule.

- Next, list all your expenses and costs. This includes your rent or mortgage, utilities, groceries, transportation, debt payments, insurance premiums, and other regular expenses. Don’t forget to also factor in any irregular or unexpected expenses, such as medical bills or car repairs.

- Now that you have an idea of your income and expenses, it’s time to create a plan. Decide how much you want to save and allocate funds towards different categories. You can use a spreadsheet or budgeting tools available online to help you with the math.

- When creating your budget, take into account your financial goals. Do you want to pay off your student loans, save for a down payment on a home, or start an emergency fund? By having specific goals, you can allocate funds accordingly.

- It’s always a good idea to consult with a financial advisor to get personalized advice and guidance. They can help you create a budget that suits your needs and also provide insight into different savings and investment options.

- Remember that your budget should be flexible and adaptable. It’s important to review and adjust it periodically, especially during major life changes or when certain expenses increase or decrease.

- A budget is a tool to help you manage your finances, so make sure you have all the necessary information. Look at your bank statements and track your spending to get a sense of where your money is going. This will help you identify areas where you can potentially cut back.

- When creating a budget, it’s also useful to have an emergency fund. This is a separate savings account that can cover unexpected expenses, such as medical emergencies or home repairs.

By following these steps and creating a budget, you can take control of your finances and work towards a more secure financial future.

Decide your budget format

When it comes to budgeting, it’s important to find a certain format that works best for you. Having a clear and organized budgeting plan can help you track your spending, set saving goals, and improve your financial management. Here are some steps to help you decide your budget format:

1. Determine your budget period: Decide whether you want to create a monthly budget, where you plan your expenses and income for each month, or a weekly budget, where you break down your expenses and income on a weekly basis. This will depend on your personal preference and the frequency of your financial transactions.

2. Choose the tools you want to use: There are various budgeting tools available, such as online budgeting apps or mobile banking apps, that can help you track your expenses and income. You can also opt for a traditional budgeting method using pen and paper or a spreadsheet on your computer. Choose what works best for you.

3. Look at your income and expenses: Take note of all your sources of income, whether it’s from your job, a side business, or any other source. Then, look at your expenses and categorize them into different categories, such as rent/mortgage, utilities, groceries, transportation, entertainment, and savings.

4. Determine your financial goals: What do you want to achieve with your budget? Do you want to pay off debts, save for a down payment on a home, or start a retirement fund? Knowing your financial goals will help you allocate your money more effectively.

5. Stick to your budget: Once you have decided on a budget format and set your goals, it’s important to stick to your budget. This may require some discipline and hard work, especially when unexpected expenses arise. However, staying committed to your budget will help you stay on track towards your financial goals.

By deciding on a budget format and sticking to it, you will be able to have a clear view of your income and expenses, and better manage your money. Remember, creating a budget is not a one-time task–it’s an ongoing process. Review and adjust your budget as needed to meet your financial needs and goals.

Note your income and expenses

When it comes to budgeting, it’s important to have a clear understanding of your income and expenses. This will help you make tax-efficient decisions and plan for the future.

Start by noting down exactly how much income you receive each month. This includes your salary, any side hustles, and any other sources of income. Be sure to account for any taxes or deductions that may be taken out.

Next, make a list of all your expenses. It’s helpful to categorize them so you can easily see where your money is going. Some common categories include housing costs (such as rent or mortgage), utilities, transportation, groceries, entertainment, and savings. If you’re not sure where to start, look at your bank statements from the last few months to get an idea of your spending habits.

Once you have your income and expenses listed, you can start to make a plan. Decide how much you want to save each month and how much you want to put towards each spending category. Be sure to leave yourself some room for unexpected expenses or emergencies.

To keep track of your budget, you can use a spreadsheet or a budgeting tool. There are many online tools and mobile apps available that can help you with this. Some popular ones include Mint, YNAB (You Need a Budget), and Personal Capital. Experiment with different tools to find what works best for you.

When looking at your expenses, see if there are any areas where you can cut back. For example, do you really need that daily latte from the expensive café? Can you find a cheaper insurance provider? By making small changes, you can improve your overall financial management and potentially find some extra money to put towards your savings or debt payments.

It’s also a good idea to note any upcoming expenses or financial goals. Do you have a vacation planned in six months? Are you looking to buy a house in the next year? By noting these future expenses, you can start planning for them now and adjust your budget accordingly.

If budgeting is hard for you or you’re unsure where to start, consider consulting with a financial advisor or using online resources. They can help you create a personalized budget and provide advice on how to reach your financial goals.

Remember, budgeting isn’t just a one-time thing. It’s an ongoing process that requires regular check-ins and adjustments. Make it a habit to review your budget monthly or even weekly to make sure you’re staying on track. And if you do go over budget in a certain category, don’t beat yourself up–just adjust and try again next month. With time and practice, budgeting will become easier.

In summary, note your income and expenses to create a budget. Keep track of your spending and look for areas where you can cut back. Use online tools or a spreadsheet to help you stay organized. And remember to review and adjust your budget regularly. By taking control of your finances now, you’ll be better prepared for the future.

Make a plan

Creating a budget requires careful planning and consideration. To start, you’ll need to gather all your financial information together, such as your income, expenses, and savings goals. It may be helpful to consult with a financial advisor or utilize online budgeting tools to help guide you through the process.

First, determine your income sources and exactly how much money you receive each month. This can include your salary, any additional income from side jobs or investments, and any government benefits you may receive. Once you have a clear picture of your income, you can then decide how much you want to allocate to different categories, such as housing, transportation, food, and entertainment.

Next, you’ll need to look at your expenses and determine where you can make cuts or improvements. This could mean finding ways to lower your utility bills, reducing your dining out expenses, or cutting back on unnecessary subscriptions. Be honest with yourself and look for areas where you can save.

When creating your budget, it’s important to also consider future expenses and goals. For example, if you’re saving for a down payment on a home or planning for a tax-efficient retirement, you’ll want to incorporate those savings goals into your budget. You may also want to set aside some funds for emergencies or unexpected expenses.

To make your budget more manageable, you can break it down by period, such as weekly or monthly. This will allow you to see how much you have to spend and help you stick to your financial goals. Some online banking tools and apps offer budgeting features that can show you your spending trends and help you stay on track.

Remember, budgeting is an ongoing process. It’s important to review and adjust your budget regularly, especially if your income or expenses change. By staying proactive and committed to your financial plan, you’ll be on your way to achieving your goals and improving your financial management.

Stick to the plan

When it comes to budgeting, it’s important to stick to the plan you have created. This means being disciplined and following your budgeting guidelines. Here are some tips to help you stick to your budget:

- First, you need to create a budget. This will involve looking at your expenses and income, deciding on your financial goals, and planning how much you will allocate to each category.

- When creating your budget, it’s also important to take into account any future expenses that you may need to save for, such as a down payment on a house or car.

- Make sure to note any extra income you have, like a bonus from work or a tax refund. This can be put towards your savings or towards paying off debt.

- Use budgeting tools available online or through your mobile banking provider. These tools can help you keep track of your expenses and show you exactly where your money is going.

- Keep in mind that budgeting is a continuous process. It’s not something you do once and forget about. Revisit your budget each month or every few months to make sure it’s still working for you.

- If you’re having trouble sticking to your budget, consider enlisting the help of a financial advisor or using a budgeting app. These resources can provide guidance and support to help you stay on track.

- Remember that budgeting doesn’t mean depriving yourself of things you enjoy. It’s about making conscious decisions about how you spend your money and finding a balance between your needs and wants.

- One way to stick to your budget is to set aside money for unexpected expenses, such as car repairs or medical bills. Having an emergency fund can provide a sense of security and prevent you from dipping into other budget categories.

By sticking to your budget, you’ll be able to better manage your money and work towards your financial goals. It may take some time to adjust to this new way of budgeting, but with perseverance and discipline, you’ll soon see the benefits.

What is a budget

A budget is a financial tool that helps you plan and track your income and expenses. It is a way to take control of your money and make sure you are using it in the most efficient and effective way possible.

When you create a budget, you need to look at all your sources of income and all of your expenses. This means you will need to gather information from your bank account, credit card statements, and any other financial documents that show where your money is coming from and where it is going.

The goal of a budget is to help you make sure your income is more than your expenses, so you can start saving for the future and working towards your financial goals. It can also help you identify areas where you may be overspending and find ways to improve your spending habits.

There are many tools available to help you create a budget, from simple spreadsheets to mobile apps. Choose the format that works best for you and that you feel comfortable using, as this will make it easier for you to stick to your budget.

Once you have gathered all the information you need and decided on your budgeting tool, you can start putting your budget together. Divide your income and expenses into categories, such as housing, transportation, food, and entertainment. This will help you see exactly where your money is going each month.

When making your budget, it is important to be realistic and keep in mind any future expenses you may have, such as a mortgage or emergency fund. Consider any tax-efficient saving vehicles like a 401(k) or IRA and decide how much you want to put towards these funds each month.

A budget is a guide for your financial management, and it can help you stay on track and make informed decisions about your money. It is a tool that can give you peace of mind and help you achieve your financial goals.

Put It All Together and Do the Math

Now that you have a good understanding of budgeting and the various categories that need to be accounted for, it’s time to put it all together and do the math. Creating a budget is an important tool for financial planning and can help you achieve your goals in the future.

Start by gathering all of your financial information, including bank statements, income statements, and any other relevant documents. This will give you a clear picture of your current financial situation. Take note of any recurring expenses, such as your mortgage or rent payments, utility bills, and insurance costs.

Next, determine your monthly income. This could be from your job or any other source of income you have. It’s important to be as accurate as possible. If your income varies from month to month, use an average or take the lowest figure to be on the safe side.

Now it’s time to create a spreadsheet or use a budgeting tool that will help you organize your expenses and income. There are many online tools and apps available that can assist in this process. Look for tools that also provide a tax-efficient account and help with saving and investing.

When categorizing your expenses, be as detailed as possible. For example, instead of just listing “groceries,” break it down further into subcategories like “produce,” “meat and dairy,” and “household items.” This will give you a better understanding of where your money is going and how you can improve your spending habits.

Once you’ve categorized your expenses, start assigning a cost to each one. This can be done by estimating the amount you spend on each category on a weekly or monthly basis. Be conservative with your estimates to account for any unexpected costs that may arise.

Take note of any areas where you could potentially cut back on spending. This could include eating out less or finding a more cost-effective cell phone plan. Small changes can add up over time and help you stick to your budget.

When calculating your expenses, don’t forget to also account for savings and other long-term goals. Set aside a certain amount of money each month for an emergency fund or future investments. This will ensure that you have a financial cushion for unexpected expenses and that you’re working towards a stable financial future.

Finally, do the math. Add up all of your expenses and subtract them from your income. The result should be a positive number, meaning you have money left over each month. If the result is negative, you’ll need to reassess your expenses and find ways to reduce costs or increase your income.

Remember, budgeting is an ongoing process. It’s important to regularly review your budget and make adjustments as necessary. Life changes and so do financial circumstances. By staying on top of your budget, you’ll be better prepared for any financial challenges that may come your way.

| Financial provider | Benefits |

|---|---|

| Morgan Stanley | Expert advice and financial planning |

| Banking provider | Convenient access to your accounts |

| Insurance provider | Insured protection for your home, car, and more |

| Business management tool | Helps you keep track of expenses and income |

Your Guide to Tax-Efficient Planning

Tax-efficient planning is a crucial aspect of personal finance that can help you maximize your income and minimize your tax liabilities. By implementing strategic financial practices, you can create a plan that ensures you make the most of your money and take advantage of all available tax deductions and credits.

One of the first steps in tax-efficient planning is to establish a budget. This means taking a close look at your income, expenses, and savings goals. Create a spreadsheet or use an online budgeting tool to track your monthly income and expenses. Categorize your expenses into different categories, such as housing, transportation, groceries, entertainment, and savings.

When making your budget, it’s important to note that certain expenses may be tax-deductible, such as mortgage interest or business-related costs. Consult with a financial advisor or tax professional to determine which expenses you can deduct and how to properly document them.

Once you have a clear sense of your income, expenses, and potential tax deductions, you can create a tax-efficient plan to improve your financial situation. Start by looking for areas where you can reduce your spending and increase your savings. For example, you may want to cut back on eating out or find ways to save on your monthly mobile phone bill. Small changes like these can add up over time and improve your overall financial health.

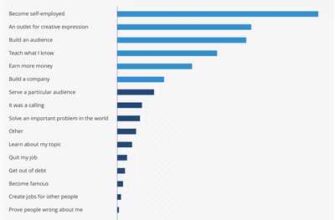

In addition to reducing expenses, consider how you can increase your income. Are there any additional sources of income you can tap into? Can you take on a part-time job or freelance work? By diversifying your income, you can create a more stable financial future.

Another important aspect of tax-efficient planning is managing your investments and savings strategically. Consider working with a financial advisor who can help you create a diversified investment portfolio that takes advantage of various tax-saving strategies, such as contributing to tax-advantaged retirement accounts or using tax-efficient investment vehicles.

It’s also crucial to stay organized when it comes to tax documents and records. Keep all your receipts, bank statements, and documentation in one place so that you can easily access them when tax season rolls around. This will make the process of filing taxes much smoother and can potentially save you money by ensuring you don’t miss any deductions or credits you’re entitled to.

Lastly, regularly review and update your tax-efficient plan. Life circumstances can change, and what worked for you last year may not be applicable this year. Stay proactive and make adjustments as needed to ensure your plan remains optimized for your current financial situation.

In summary, tax-efficient planning is a valuable tool that can help you make the most of your money and minimize your tax burden. By creating a well-thought-out plan, managing your expenses and income strategically, and staying organized, you can create a tax-efficient financial future for yourself and your family.

Keep going

Creating a budget is just the first step in taking control of your finances. Now it’s time to keep going and stick to your budget. Here are some tips to help you stay on track:

Do what works for you: Every person is different, so find a budgeting method that suits your needs. Whether it’s using a spreadsheet, a budgeting app, or simply pen and paper, choose the method that you’re most comfortable with and that you’re more likely to stick to.

Each category has a meaning: When you allocate money to each category in your budget, it’s important to understand what that category means and what expenses it should cover. Take the time to properly define and categorize your expenses so that you know exactly where your money is going.

Make sure you’re insured: Your budget should include money for insurance premiums. Whether it’s health insurance, car insurance, or home insurance, being properly insured will provide you with financial protection in case of an emergency or unexpected event.

Seek advice from a financial advisor: If you’re unsure about how to allocate your funds or which investments to make, consider consulting with a professional financial advisor. They can help you create a tax-efficient investment plan and guide you in making smart financial decisions.

Saving and investing go hand in hand: Don’t forget to allocate some money towards savings and investments. Setting aside a portion of your income each month can help you build an emergency fund and work towards your future financial goals.

Take advantage of online tools: There are plenty of online tools and apps available that can help you track your spending, manage your budget, and stay organized. Take advantage of these resources to make your budgeting process easier and more efficient.

Stick to your budget: It’s easy to set a budget and forget about it, but it’s important to review your budget regularly and make adjustments as needed. Stay disciplined and committed to your financial goals, and you’ll see improvements in your spending and savings habits.

Put extra money to good use: If you find yourself with extra money at the end of the month, don’t let it go to waste. Consider putting it towards debt repayment, increasing your savings, or investing it in your future. Every little bit counts!

Stay motivated: Budgeting can be hard work, but the benefits are worth it. Keep reminding yourself of the financial freedom and security that comes with effective budgeting. Your hard work will pay off in the long run.

Remember, a budget is a tool that helps you take control of your finances and make better financial decisions. Use it as a guide to show you where your money is going, and make adjustments as necessary. Stick to your budget, keep improving your financial management skills, and you’ll be on the path to financial success.

Sources

- Use a budgeting tool: There are many online budgeting tools available that can help you create and manage a budget. These tools allow you to easily input your income, expenses, and goals, and they will calculate your monthly budget for you.

- Know what you make and spend: To create an accurate budget, you need to know exactly how much money you make each month and how much you spend. This includes all sources of income and all expenses, both fixed and variable.

- Put it all in a spreadsheet: One way to keep track of your income and expenses is to create a spreadsheet. You can use a program like Microsoft Excel or Google Sheets to create a basic budget spreadsheet.

- Open an emergency account: If you want to be prepared for unexpected expenses, you need to have an emergency account. This is a separate bank account that you only use for emergencies, such as medical bills or car repairs.

- Consider business budgeting tools: If you have a small business, you may need more advanced budgeting tools to help you keep track of your expenses and income. There are many options available, so you’ll need to do some research to find the right one for your needs.

- Look for a financial advisor: If you’re unsure of where to start with budgeting, or if you need help improving your financial situation, a financial advisor can help. They can guide you in creating a budget and provide advice on how to manage your money.

- Take advantage of online banking tools: Many banks offer online banking tools that can help you track your spending, categorize your expenses, and create a budget. These tools can make it easier to see where your money is going and how you can improve your saving habits.

- Consider using mobile banking apps: If you’re always on the go, consider using a mobile banking app to help you keep track of your expenses. These apps often have budgeting features that can show you a monthly snapshot of your spending and help you stay on track.

- Make note of your fixed costs: Fixed costs are expenses that stay the same each month, like your mortgage or rent payment. It’s important to include these costs in your budget so you can plan for them each month.

- Plan for future expenses: In addition to your fixed costs, make sure to plan for future expenses, like a vacation or a home renovation. Putting money aside each month for these expenses can help you avoid going into debt or dipping into your emergency fund.

- Decide on a budgeting format: There are different ways to format your budget, such as by category or by percentage of income. Choose a format that works best for you and stick to it.

- Consider insurance costs: When creating your budget, don’t forget to include your insurance costs. This can include health insurance, car insurance, and home insurance.

- Take into account your weekly expenses: While it’s important to understand your monthly expenses, don’t forget about your weekly expenses. These can add up quickly and can have a big impact on your budget.

- Work with what you have: When creating a budget, it’s important to be realistic about what you can afford. Work with the income you have and make adjustments as needed.

- Don’t forget about savings: It’s important to allocate part of your income to savings each month. This can be for both short-term and long-term goals, such as an emergency fund or a down payment on a house.

- Get the whole family involved: If you’re budgeting for a family, make sure to get everyone involved. This will help everyone understand the importance of budgeting and can make it easier to stick to your financial goals.

- Show your budget to a trusted advisor: If you’re unsure of whether your budget is realistic or if you need help making adjustments, show your budget to a trusted advisor. They can provide feedback and help you make any necessary changes.

- Stick to your budget: Creating a budget is only the first step. To see real financial improvement, you need to stick to your budget and make adjustments as needed.