Passive income is a goal that many people strive for, as it offers the possibility to earn money without having to work actively for it. In a world where work-life balance is increasingly important, passive income provides an opportunity to create a steady stream of revenue while having more time for yourself and your loved ones. If you want to achieve financial freedom and make passive income in 2023, it’s essential to have a plan and open yourself up to new ideas.

First and foremost, it’s important to understand what passive income is and how it works. Passive income refers to the money earned from sources that don’t require actively working on them. This can include investments in properties, like real estate or stocks, as well as creating and selling products, books, or online courses. To start earning passive income, you need to find the right sources, invest wisely, and build a community around your work.

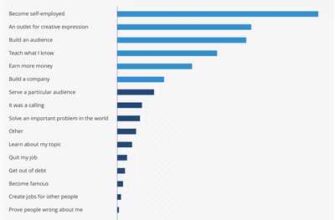

One of the best ways to generate passive income is to write a book. Books have been a popular source of passive income for many authors, as they continue to earn money even when the author is not actively promoting or selling them. If you have a passion for writing and a topic you’re knowledgeable about, consider writing a book that can provide valuable information or entertainment to readers. With the right marketing and distribution plan, your book can become a steady source of passive income.

In addition to writing books, there are many other ideas and opportunities to earn passive income. Some popular options include creating and selling online courses, investing in rental properties, dividend-paying stocks, or peer-to-peer lending platforms. The key is to find a source of passive income that aligns with your interests and skills, as well as offers good potential for revenue generation.

Ultimately, the goal of passive income is to achieve financial independence and improve your overall wellbeing. By diversifying your income streams and building a solid foundation of passive income, you can work towards the freedom to choose how you spend your time and earn a full-time income from sources that you enjoy. So why not start planning and exploring passive income opportunities today?

10 Passive Income Ideas for 2023

Looking to make some extra money in 2023? Passive income is a great way to supplement your full-time work and improve your financial wellbeing. By investing time and effort upfront, you can create income streams that continue to generate money with minimal ongoing work. Here are 10 passive income ideas to consider for 2023:

- Write a book: If you have a passion for writing, consider writing a book on a topic you know well. Once you publish it, you can earn royalties from book sales.

- Create an online course: Share your knowledge and expertise by creating an online course. You can sell the course to interested learners and earn passive income from course sales.

- Invest in dividend-paying stocks: Research companies that offer regular dividend payments to shareholders. By investing in these stocks, you can earn a percentage of the company’s profits.

- Start a rental property business: If you have the capital, consider purchasing properties to rent out. Rental income can provide a steady stream of passive income.

- Open an e-commerce store: Set up an online store and sell products that align with your interests. With proper marketing and management, your store can generate passive income.

- Build a mobile app: If you have programming skills or can hire someone who does, consider developing a mobile app. You can generate income from app downloads or in-app purchases.

- Create an online community: Build a platform or forum where like-minded individuals can connect and share resources. You can monetize the community through membership fees or advertising.

- Invest in real estate crowdfunding: With real estate crowdfunding platforms, you can pool your money with others to invest in properties. You can earn passive income from rental returns or property appreciation.

- Start a blog: If you enjoy writing, start a blog on a topic you are passionate about. With consistent effort and quality content, you can monetize your blog through advertising, sponsored posts, or affiliate marketing.

- Create and sell digital products: Develop digital products like ebooks, online courses, or graphic design templates. You can sell them on platforms like Etsy or your own website.

These are just a few ideas to get you started on your passive income journey in 2023. Choose the ones that align with your skills, interests, and financial goals. Remember, passive income requires upfront work, but the rewards can be well worth it. Start planning and exploring your options to diversify your income sources and achieve financial independence.

What is passive income

Passive income is a way to earn money without actively working for it. It is income that you receive regularly, even if you are not actively involved in generating it. With passive income, you have the opportunity to generate revenue from your investments, properties, or other sources without having to put in continuous effort or time into the work.

Passive income can come from various sources such as rental properties, investments, royalties from books or music, affiliate marketing, online courses, or even creating and selling digital products. The key is to create a plan and set up multiple streams of passive income to achieve financial stability and reach your goals.

One popular idea for creating passive income is to write a book. Once you have written a book, you can earn royalties from book sales and licensing deals. This allows you to earn income from your work even after the initial effort of writing the book is over.

Investing in real estate is another common way to generate passive income. By purchasing properties and renting them out, you can earn a steady stream of income without having to actively manage the properties. This can be a great long-term investment strategy to achieve financial freedom.

In the digital age, there are also opportunities to earn passive income through online communities. Building a community around a specific niche or interest and monetizing it through ads, sponsorships, or selling products can be a lucrative source of passive income.

The goal of passive income is to ultimately achieve financial freedom. By setting up multiple streams of passive income, you can work towards earning enough money to cover all your expenses and achieve your financial goals. Whether it’s earning enough to retire early or having the freedom to pursue your passions full-time, passive income provides the opportunity to create a life of financial wellbeing.

It’s important to note that passive income is not a get-rich-quick scheme. It requires upfront effort, time, and investment to set up the income streams. However, once established, passive income allows you to earn money with minimal ongoing effort. Additionally, passive income can provide a sense of security and stability, as it is not reliant on a single source of income.

In summary, passive income is a way to earn money without actively working for it. There are numerous sources and ideas to generate passive income, including investments, rental properties, royalties from books or music, online communities, and more. The key is to have a plan, diversify your income streams, and work towards achieving your financial goals. With the right strategy and mindset, passive income can provide the opportunity to earn income and create a life of financial freedom.

Invest in wellbeing first

When it comes to building passive income, it’s essential to invest in your wellbeing first. Many people dive headfirst into trying to earn money passively, but they neglect the importance of taking care of themselves and their communities.

But what does it mean to invest in wellbeing? First and foremost, it means prioritizing your physical and mental health. Without a healthy body and mind, it’s challenging to perform at your best and sustain long-term success.

So, what can you do to invest in your wellbeing? Start by taking the time to assess your current state. Are you getting enough exercise? Are you eating a balanced diet? Are you taking care of your mental health? These are essential questions to ask yourself.

Once you have a clear understanding of where you are, you can begin to plan for the future. Set specific goals for your wellbeing, such as exercising three times a week, meditating daily, or reading a book each month.

In addition to personal goals, investing in your community can also enhance your overall wellbeing. Get involved in local initiatives, volunteer your time, or join groups that align with your values. Connecting with others and contributing to something meaningful can bring a sense of fulfillment and purpose.

Furthermore, investing in your wellbeing means exploring new ideas and finding what truly makes you happy. Are there hobbies or interests that you’ve always wanted to pursue? Make time for them. Whether it’s painting, writing, or playing a musical instrument, find activities that bring you joy.

Investing in your wellbeing can also lead to new opportunities for passive income. By taking care of yourself and exploring your passions, you may stumble upon business ideas or work opportunities that align with your interests and values.

As you invest in your wellbeing and explore new avenues, keep an eye out for passive income sources. Whether it’s a rental property, dividends from investments, or royalties from a book you write, there are many possibilities. Just remember that building passive income takes time and effort, so be patient and stay committed.

In conclusion, before you dive into the world of passive income, remember to invest in your wellbeing first. Take care of your body and mind, connect with your community, explore new ideas, and plan for a balanced and fulfilling life. By doing so, you’ll be better equipped to earn passive income and enjoy the fruits of your labor in years to come.

Write a Book

If you have a passion for writing and love books, then writing a book can be a great way to earn passive income. Writing a book can be a fulfilling and creative endeavor, and it has the potential to generate income for years to come.

Getting started on writing a book can be overwhelming, but with proper planning and dedication, it is definitely achievable. The first step is to decide what you want to write about. Think about your interests, knowledge, and ideas that you can share with others. Having a clear goal in mind will help you stay focused and motivated throughout the writing process.

In order to earn passive income from your book, it is important to have a plan in place. Set a timeline for when you want to finish writing and publishing your book. Aim to have it ready for publication by a specific date, such as the end of 2023. This will give you a sense of urgency and help you stay on track.

Once you have completed your book, you can explore different sources of passive income from it. Self-publishing platforms like Amazon Kindle Direct Publishing (KDP) offer a simple and straightforward way to publish and sell your book online. You can earn royalties from each sale, and the income can continue to flow in even when you are not actively promoting your book.

Another income source can be creating a community around your book. Engage with your readers through social media, email newsletters, and other platforms. Build a loyal fan base who can support you by buying your book, leaving reviews, and recommending it to others.

It’s also a good idea to invest in marketing and promotional efforts to increase the visibility and reach of your book. Consider running ads, reaching out to influencers, and participating in book fairs and events to attract more readers.

Furthermore, you can explore other ways to monetize your book. For example, you could consider licensing your book to be turned into a movie or TV series, or even selling merchandise related to your book.

Writing a book can be a long-term investment that can generate passive income for years to come. It may require hard work and dedication, but if done well, it can be a rewarding and fulfilling endeavor both for your wellbeing and your financial goals. Start today and open the doors to a world of opportunities!

Источники

When it comes to earning passive income, there are various sources that you can tap into. Here’s a list of some popular options:

1. Books: Reading books on passive income can provide you with valuable knowledge and insights. There are many books available that cover different passive income ideas and strategies.

2. Investing: Investing your money in stocks, real estate properties, or other financial instruments can be a great way to generate passive income. However, it’s important to do thorough research and have a solid investment plan in place.

3. Create an Online Business: Starting an online business can offer you the opportunity to earn passive income. This could include selling products or services, creating a blog or website, or even becoming an affiliate marketer.

4. Rental Properties: Owning rental properties is a popular way to generate passive income. By owning and renting out properties, you can earn a steady stream of income without actively working for it.

5. Join a Community or Network: Being a part of a passive income community or network can provide you with support, resources, and ideas. You can learn from others who have already achieved passive income success.

6. Diversify Your Income: Don’t rely on just one source of passive income. Instead, aim to diversify your income by having multiple sources. This can help mitigate risk and ensure a more stable income.

7. Set Financial Goals: Having clear financial goals will give you a sense of direction and motivation. Set realistic and achievable goals, and develop a plan to reach them.

8. Start Small: If you’re new to passive income, start by taking small steps. This could be as simple as opening a savings account or investing in a low-risk opportunity. Slowly build up your income streams over time.

9. Work towards Financial Independence: The ultimate goal of passive income is financial independence, where you no longer have to rely on a full-time job for income. Identify what financial independence looks like for you and create a plan to achieve it.

10. Learn and Evolve: Keep learning and evolving your passive income strategies. Read books, attend seminars, and stay up-to-date with the latest trends and opportunities. Adapt and refine your approach as needed.

Remember, passive income isn’t something that happens overnight. It requires time, effort, and patience. Stay focused on your goals and take consistent action to create a passive income stream that can support your financial wellbeing.

As the famous saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.” So, start taking steps towards your passive income goals today, and you could be on track to achieving financial freedom by 2023.