Diversification is a crucial strategy when it comes to investing your money. In reality, no matter how smartasset you are, you can never predict with certainty how the market will perform or how different assets will behave. That’s why diversifying your portfolio is so important. By spreading your investments across a wide range of industries, assets, and even countries, you can reduce the impact of a single investment’s poor performance while also increasing your chances of earning more stable, long-term returns.

When it comes to diversifying your portfolio, there are several options you can consider. The most common ones include investing in different types of stocks, bonds, and even alternative assets like hedge funds or real estate. Each investment option comes with its own level of risk and potential returns, so it’s important to carefully consider your investment goals and risk tolerance before making any decisions.

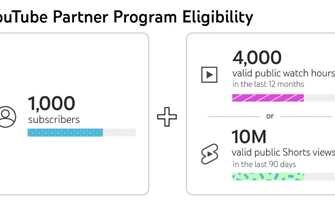

One popular way to diversify your portfolio is by investing in mutual funds or exchange-traded funds (ETFs). These funds pool money from multiple investors and invest in a variety of assets, such as stocks, bonds, or a mix of both. By investing in a mutual fund or ETF, you gain exposure to a diversified portfolio without having to individually select and manage each asset.

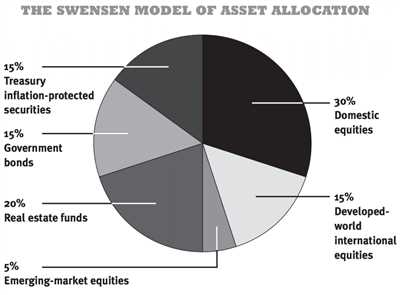

Another important aspect of diversification is asset allocation. This refers to the way you spread your investments across different asset classes, such as stocks, bonds, and cash. The specific allocation will depend on factors such as your investment goals, time horizon, and risk tolerance. Generally, a diversified portfolio includes a mix of different asset classes to balance risk and potential returns.

One specific type of diversification is geographic diversification. This involves investing in assets located in different countries or regions. By spreading your investments globally, you can reduce the impact of a single country’s economic or political issues on your portfolio. Additionally, investing in emerging markets can provide opportunities for greater returns, although with increased volatility.

It’s important to note that diversification does not guarantee profits or protect against losses. However, it can help reduce the impact of market volatility and increase the potential for long-term gains. By diversifying your portfolio, you can spread your risk across different assets, sectors, and geographic regions, providing you with more stability and potentially higher returns over time.

In summary, diversifying your investment portfolio is a good strategy to consider, especially in a volatile and unpredictable market. By spreading your investments across different asset classes, industries, and even countries, you can reduce the impact of any single investment’s poor performance and increase your chances of earning more stable, long-term returns. Remember, diversification is not a one-time event, but rather a continuous process that requires regular assessment and adjustments to ensure your portfolio remains aligned with your investment goals.

- How To Help Create Wealth With A Diverse Portfolio

- What does it mean to diversify your investments

- Diversify across asset classes

- 1. Reduce risk

- 2. Enhance performance

- 3. Capitalize on market opportunities

- 4. Manage risk tolerance

- 5. Factor in historical performance

- Diversify globally

- Diversify across industries and sectors

- Diversify across bond types

- Diversify using mutual funds and ETFs

- Why Diversifying Your Portfolio Is Crucial

- The impact of asset allocation on long-term performance and short-term volatility

- Video:

- Ray Dalio’s All Weather Portfolio: How To Properly Diversify Your Investments And Lower Risk

How To Help Create Wealth With A Diverse Portfolio

Creating a diversified portfolio can be a key strategy for investors looking to help create wealth over the long term. Diversification involves spreading your investments across a variety of different asset classes and sectors, which can help to mitigate risk and potentially improve returns compared to owning a large concentration of securities in the same sector or industry.

But what does diversification really mean, and why is it so important? Diversification is the practice of spreading your investments across different securities, such as stocks, bonds, and alternative investments. The goal is to have exposure to a wide range of assets that may perform differently under various market conditions. By doing so, you can reduce the impact of any single investment’s performance on your overall portfolio.

When building a diversified portfolio, it’s important to consider your investment goals, risk tolerance, and time horizon. Your goals will help determine the level of risk you’re willing to take, while your risk tolerance will dictate how much volatility you can handle. Additionally, your time horizon will determine the length of time you can stay invested and potentially benefit from market returns.

A diversified portfolio should typically include a mix of assets based on factors such as historical performance, expected returns, and your own unique circumstances. For example, you may want to consider adding exposure to different geographic regions, such as developed and emerging markets, as well as specific industry sectors.

One way to achieve geographic diversification is by using a global index, such as the MSCI World Index, which tracks companies across multiple countries. Allocating to different sectors can be done by investing in sector-specific exchange-traded funds (ETFs) or mutual funds. This can help ensure that you have exposure to a variety of industries and can potentially benefit from the performance of different sectors over time.

It’s also important to consider the impact of quality and volatility when building a diversified portfolio. For example, having exposure to high-quality bonds can help provide stability during market downturns, while owning stocks can offer long-term growth potential. Alternatives, such as real estate or commodities, can also be considered to further diversify your portfolio.

However, diversification alone does not guarantee profits or protect against losses. It is still important to regularly review and rebalance your portfolio to ensure that it remains aligned with your goals and risk tolerance. Additionally, while diversification can help mitigate risk, it does not eliminate the possibility of experiencing losses.

When it comes to diversification, one common misconception is that owning a large number of securities means you have a diversified portfolio. While having a large number of holdings can help spread risk to some extent, it’s important to ensure that those holdings are truly diversified across different asset classes and sectors. Simply owning multiple securities within the same sector or industry may not provide the level of diversification you need.

In conclusion, diversification is an important strategy for investors who want to help create wealth over the long term. By spreading your investments across different asset classes, sectors, and geographic regions, you can potentially reduce risk and improve returns compared to a concentrated portfolio. Remember to consider your goals, risk tolerance, and time horizon when building a diversified portfolio and regularly review and adjust your allocation based on market conditions and your own changing circumstances.

What does it mean to diversify your investments

When it comes to investing, diversification refers to spreading your assets across different types of investments, such as stocks, bonds, and mutual funds. By doing so, you can reduce the overall risk of your portfolio while potentially increasing your returns.

Diversification can also involve investing in different sectors and industries, both domestically and internationally. This helps to ensure that your investments are not overly concentrated in one area, reducing the impact of any downturns or negative events that may affect specific markets or industries.

When determining how to diversify your investments, it’s important to consider your goals and risk tolerance. Different investments have different levels of risk, so it’s important to choose a mix of investments that align with your financial objectives and comfort level with risk.

One common way to diversify is by investing in a range of asset classes. For example, you might allocate a portion of your portfolio into stocks, another portion into bonds, and a smaller portion into alternative investments such as real estate or commodities.

Investing in different countries can also be a way to diversify your portfolio. By investing in markets outside of your home country, you can potentially take advantage of different economic conditions and gain exposure to different currencies.

Furthermore, diversification can also be pursued by investing in different types of funds. For example, you might invest in both actively managed mutual funds and passively managed index funds. This provides a mix of investment strategies and can help to ensure that your portfolio is not solely reliant on the performance of one specific approach.

When diversifying your portfolio, it’s important to look beyond just the short-term gains or losses. Diversification is a long-term strategy that aims to manage risk and enhance overall portfolio performance over the course of many years.

Tracking the performance of your investments is also crucial. By regularly reviewing and rebalancing your portfolio, you can make sure that your investments are still aligned with your goals and risk tolerance. This may involve selling off assets in certain areas and buying more in others, in order to maintain diversification.

In conclusion, diversifying your investments means spreading your assets across different investment options, including different asset classes, countries, and types of funds. By doing so, you can reduce the risk of your portfolio and potentially increase your long-term wealth. Remember to consider your goals, risk tolerance, and investment horizon when determining how to diversify.

Diversify across asset classes

When it comes to creating a diversified portfolio, one of the most important factors to consider is diversification across asset classes. Asset classes are different categories of investments that have unique characteristics and behave differently in the market.

By diversifying across asset classes, you can spread your investment risk and reduce the impact of market volatility on your portfolio. Different asset classes include stocks, bonds, real estate, commodities, and cash.

Here’s why diversifying across asset classes is crucial:

1. Reduce risk

Investing in a single asset class can be risky, especially if the market falls or if there is a significant economic downturn. By including different asset classes in your portfolio, you can mitigate the risk associated with any one investment.

2. Enhance performance

Different assets perform better in different market conditions. By diversifying across asset classes, you can potentially benefit from the relative performance of different investments. For example, if stocks are underperforming, bonds may offer a more stable return.

3. Capitalize on market opportunities

By including various asset classes in your portfolio, you can capitalize on market opportunities that may arise. For instance, if a particular country experiences a credit rating upgrade, you may want to consider investing in securities from that country.

4. Manage risk tolerance

Some asset classes are more sensitive to market volatility than others. By including a mix of assets with different risk levels, you can create a portfolio that aligns with your risk tolerance. This can help you manage short-term fluctuations while staying focused on your long-term investment goals.

5. Factor in historical performance

Historical performance of different asset classes can provide insights into how they may perform in the future. By including assets with a good track record, you can increase the likelihood of achieving your financial goals.

When diversifying across asset classes, it’s important to consider the correlation between different assets. A correlation of +1 means that two assets move in the same direction, while a correlation of -1 means they move in opposite directions. By including assets with low or even negative correlation, you can further reduce risk within your portfolio.

Exchange-traded funds (ETFs) and mutual funds are good options for diversifying across asset classes. These funds usually invest in a diverse range of securities, including stocks from different sectors, bonds with varying maturities, and even commodities. They can provide an additional level of diversification compared to individual securities.

In conclusion, diversifying across asset classes is crucial in creating a diverse portfolio. By including different asset classes, you can reduce risk, enhance performance, capitalize on market opportunities, manage risk tolerance, and factor in historical performance. Consider working with a financial advisor or using online tools like SmartAsset to determine the best asset allocation based on your life goals and risk tolerance.

Diversify globally

Diversifying your investment portfolio is crucial to managing risk and potentially improving performance. While you might be tempted to only invest in familiar markets and sectors, it’s important to look beyond and consider adding global assets.

Including international securities in your portfolio helps to mitigate risk by spreading your investments across different countries, economies, and industries. By doing so, you reduce the impact of any one market or sector on your overall portfolio.

For example, if a large portion of your investments are in one country and its economy experiences a downturn, your entire portfolio could suffer significant losses. However, by diversifying globally, you can reduce the potential negative impact of any single market or economic event.

Adding international investments can be accomplished through various options, such as mutual funds, exchange-traded funds (ETFs), or even directly purchasing securities on foreign exchanges. These options provide access to a diverse range of assets and help you achieve your investment goals.

When choosing global assets, it’s important to consider factors such as the quality and performance of the securities. Look for funds or ETFs that have a solid track record of performance and are managed by reputable issuers.

Additionally, diversifying globally doesn’t mean you should over-diversify. It’s important to maintain a balance and not spread your investments too thin. Too much diversification can lead to average returns as it becomes challenging to track and manage a large number of holdings.

Research shows that, historically, US stocks have outperformed non-US stocks. However, this trend can change over time, and therefore, it’s important not to limit your investment strategy based solely on historical data. By diversifying globally, you gain exposure to opportunities outside of your home country and can potentially benefit from the growth of international markets.

Including international investments in your portfolio can also help reduce volatility. Different countries and regions may experience economic growth or decline at different times, and by including assets from various countries, you can potentially smooth out the performance of your portfolio.

It’s important to note that diversifying globally doesn’t guarantee profits or eliminate the possibility of losses. Markets are unpredictable, and past performance is not indicative of future results.

In summary, diversifying globally is an important strategy to consider when building a diversified portfolio. Adding international assets helps mitigate risk, reduce volatility, and potentially increase returns. By factoring in different countries, economies, and industries, you can create a more robust and resilient investment portfolio.

Diversify across industries and sectors

One key strategy for creating a diversified portfolio is to spread your investments across different industries and sectors. This can help mitigate the impact of short-term market fluctuations and reduce the risk of over-diversifying by adding too many assets to your portfolio.

Why is diversifying across industries and sectors important? By investing in a variety of industries, you can reduce the risk of your portfolio being heavily dependent on the performance of a single industry. If you only invest in a specific sector and that sector experiences a downturn, your portfolio could significantly suffer.

When determining how much to allocate to each industry or sector, it’s important to consider factors such as historical returns, income generated by the industry, and the length of time you want to remain invested. You may also want to consider investing in emerging markets or countries, as they could provide greater growth potential compared to more mature markets.

Diversifying across industries and sectors can be done by investing in individual stocks or by using mutual funds or exchange-traded funds (ETFs) that track specific industry or sector indexes. By investing in these funds, you can gain exposure to a wide range of companies within a given sector without having to pick individual stocks.

It’s also important to consider the impact of sector and industry sensitivity to economic factors. Different sectors and industries have varying degrees of sensitivity to factors such as interest rates, inflation, and market cycles. By diversifying across industries and sectors, you can help mitigate the risk of your portfolio being significantly impacted by changes in these factors.

For example, during a period of rising interest rates, sectors such as utilities and real estate investment trusts (REITs) may be more sensitive to interest rate changes and could experience a decline in prices. On the other hand, sectors such as technology or consumer discretionary may be less sensitive to interest rates and could perform well during this period. By diversifying across industries and sectors, you can potentially capture gains in sectors that are performing well while reducing the impact of sectors that are underperforming.

Adding exposure to different industries and sectors can also help enhance the overall quality of your portfolio. By investing in sectors that have strong growth potential, you can benefit from the potential upside while reducing the risk of heavily investing in a single industry or sector.

In conclusion, diversifying across industries and sectors is a good strategy to create a well-balanced and diversified portfolio. By spreading your investments across different industries and sectors, you can reduce the risk of your portfolio being heavily influenced by the performance of a single industry or sector. Additionally, diversifying across industries and sectors helps mitigate the impact of short-term market fluctuations and can potentially enhance long-term returns. Consider using mutual funds or ETFs that track specific industry or sector indexes to gain exposure to a wide range of companies within those sectors. Remember to also consider the impact of economic factors on different sectors and industries when determining your asset allocation.

Diversify across bond types

When it comes to creating a diversified investment portfolio, it’s important to include a mix of assets that can provide a stable return over time. One asset class that can help achieve this goal is bonds.

Bonds are debt securities issued by various entities, including governments, municipalities, and corporations. They are usually considered less volatile than stocks and can help hedge against market downturns. By investing in different types of bonds, you can diversify your portfolio and potentially mitigate risk.

There are many bond types to choose from, including government bonds, corporate bonds, municipal bonds, and international bonds. Each type has its own characteristics and can offer different returns based on factors such as the issuer’s credit quality and the prevailing interest rates.

Diversifying across bond types means investing in different categories of bonds. This helps spread risk and ensures that you’re not solely reliant on one specific type of bond. For example, investing only in government bonds may provide a certain level of safety, but it may not help you achieve your investment goals if interest rates rise.

A diverse bond portfolio may include bonds from various industries or sectors to provide exposure to different segments of the economy. This can be achieved by investing in bond funds or exchange-traded funds (ETFs) that hold a mix of bonds from different issuers and sectors.

Diversifying across bond types can also help manage the impact of inflation on your portfolio. Some bonds, such as Treasury Inflation-Protected Securities (TIPS), are specifically designed to guard against inflation. Including these types of bonds in your portfolio can help preserve your purchasing power over time.

Another benefit of diversifying across bond types is that it can help balance the overall risk of your portfolio. While some bonds may be more volatile than others, having a mix of bonds with different levels of risk can help smooth out the overall volatility of your portfolio.

It’s important to note that diversifying across bond types does not guarantee a profit or protect against loss. However, it can help reduce the impact of any single bond’s performance on your overall portfolio.

When determining the appropriate mix of bonds for your portfolio, consider factors such as your investment goals, time horizon, and risk tolerance. You may also want to consult with a financial advisor or do further research to ensure that you’re making smart investment decisions.

In conclusion, diversifying across bond types is an effective strategy for creating a well-rounded and resilient investment portfolio. By including bonds with different characteristics and from various issuers, you can help mitigate risk, manage inflation, and potentially achieve your investment goals.

Diversify using mutual funds and ETFs

Investors who want to diversify their portfolios also need to consider adding alternative investments such as mutual funds and exchange-traded funds (ETFs). These investment vehicles offer a way to invest in a diversified portfolio without having to manage individual stocks and bonds. Mutual funds and ETFs are managed by professionals who have a deep understanding of the markets and are able to allocate assets across different types of investments, industries, and sectors.

One common way to diversify using mutual funds and ETFs is by investing in funds that focus on different asset classes. For example, you could invest in a mutual fund that focuses on stocks, bonds, international markets, or emerging markets. By diversifying across different asset classes, you can spread your risk and potentially increase your returns.

Another way to diversify is by investing in funds that focus on different sectors or industries. For example, you could invest in a mutual fund that focuses on technology companies, healthcare companies, or financial companies. By investing in funds that focus on different sectors, you can further diversify your portfolio and reduce the impact of any one sector’s performance on your overall returns.

Furthermore, mutual funds and ETFs allow investors to diversify within a specific asset class or sector. For example, within the bond asset class, you could invest in mutual funds or ETFs that focus on government bonds, corporate bonds, or municipal bonds. Within the technology sector, you could invest in mutual funds or ETFs that focus on software companies, hardware companies, or internet companies. By diversifying within these asset classes and sectors, you can benefit from the potential outperformance of specific areas while still maintaining a diversified portfolio overall.

Another advantage of using mutual funds and ETFs to diversify is that they offer access to quality investments that individual investors may not be able to achieve on their own. For example, mutual funds and ETFs often invest in large, well-established companies that have a track record of consistent performance and positive earnings. By investing in these funds, you can benefit from the expertise of the fund manager and gain exposure to these high-quality investments.

It’s important to note that while mutual funds and ETFs provide an easy way to diversify your portfolio, they still carry risks. These risks include factors such as market volatility, performance of the underlying investments, and credit risk. Investors should also be aware of the fees associated with mutual funds and ETFs and how they can impact overall returns.

In conclusion, diversifying your portfolio using mutual funds and ETFs can help you achieve your investment goals. Whether you’re saving for retirement, looking to generate income, or want to preserve and grow your wealth, diversifying across different asset classes, sectors, and types of investments can help you accomplish those goals. By investing in mutual funds and ETFs, you can take advantage of the expertise of professional fund managers and gain exposure to a wide range of investments.

Why Diversifying Your Portfolio Is Crucial

Diversifying your portfolio is crucial for several reasons. Firstly, it helps reduce the risk associated with investing. By spreading your investments across different assets, sectors, and geographical regions, you can minimize the impact of any single investment’s poor performance on your overall portfolio.

Secondly, diversification can help to hedge against the volatility of specific investments or sectors. For example, if you have a large portion of your portfolio invested in stocks, adding bonds or alternative assets such as ETFs can help balance out the risk and potentially provide more stable returns.

Additionally, diversification allows you to take advantage of different market trends and opportunities. By investing in a mix of asset classes, you can capture gains from different sectors or regions that are performing well while mitigating the impact of underperforming areas.

Moreover, diversifying your portfolio can align your investments with your long-term goals and risk tolerance. Depending on your investment objectives and time horizon, you may want to allocate your assets differently. For example, if you’re investing for retirement, you might want to have a higher allocation in fixed-income assets, such as bonds, to generate steady income and preserve capital.

Furthermore, diversification can help you navigate through varying economic conditions. Different asset classes tend to perform differently during economic cycles. By diversifying your portfolio, you can reduce the risk of being heavily exposed to a single sector or investment that could suffer during certain economic conditions.

It’s important to note that diversification does not mean over-diversify. Adding too many investments without a clear strategy can lead to a portfolio that is difficult to manage and may not perform as desired. It’s essential to have a clear understanding of what your investment goals are and how diversification can help you achieve them.

In summary, diversifying your portfolio is crucial because it can help reduce risk, open up more investment options, and align your investments with your goals. By spreading your investments across different asset classes, geographic regions, and sectors, you can build a portfolio that is less sensitive to short-term market volatility and more capable of generating long-term gains.

- Diversification reduces risk and helps mitigate the impact of poor-performing investments.

- It allows you to take advantage of different market trends and opportunities.

- Diversifying your portfolio can align your investments with your long-term goals and risk tolerance.

- It helps navigate through varying economic conditions by reducing exposure to specific sectors or investments.

- Over-diversification should be avoided as it can lead to a portfolio that is difficult to manage and may underperform.

The impact of asset allocation on long-term performance and short-term volatility

When it comes to investing, the most important thing to remember is that diversification is key. Diversifying your investment portfolio can help mitigate risk and improve long-term performance. One way to diversify your portfolio is through asset allocation.

Asset allocation refers to the strategy of dividing your investments among different asset classes, such as stocks, bonds, and cash. The goal of asset allocation is to create a portfolio that is balanced and aligned with your investment goals and risk tolerance.

There are several factors to consider when determining your asset allocation. One of the main factors is your time horizon. If you are a long-term investor, you might have a greater tolerance for short-term volatility and can afford to invest in higher-risk assets, such as stocks. On the other hand, if you are nearing retirement, you may want to focus on preserving your wealth and invest more in lower-risk assets, such as bonds or cash.

Another important factor to consider is your investment goals. Are you looking for growth or income? Different asset classes have different characteristics and can provide different levels of returns. For example, stocks may provide potentially higher returns but also come with higher volatility, while bonds may offer more stable returns but lower overall growth potential.

One of the benefits of asset allocation is that it allows you to diversify your investments across different sectors and industries. This means that if one sector or industry experiences a downturn, your overall portfolio may be less affected. For example, if you have a diversified portfolio that includes investments in technology, healthcare, and consumer goods sectors, a downturn in one sector may be offset by gains in another.

It is also important to note that asset allocation is not just about owning different asset classes, but also about investing in different markets. Investing in international markets can provide additional opportunities for diversification and potentially higher returns. For example, owning international stocks through ETFs or mutual funds can expose you to companies and industries that are growing outside of your home country.

Furthermore, asset allocation can help you reduce the impact of specific company or sector risks on your portfolio. By diversifying across different asset classes and sectors, you can reduce the risk of being heavily invested in a single company or sector that may be sensitive to certain economic conditions or events.

To illustrate the impact of asset allocation, let’s consider a hypothetical example. Suppose you have invested all your savings in a single stock. If that stock performs poorly, your entire investment could suffer. However, if you have a diversified portfolio that includes various asset classes and sectors, the poor performance of one investment may be offset by the gains of others.

In conclusion, asset allocation is an important strategy to consider when building a diversified investment portfolio. It can help manage risk, improve long-term performance, and reduce short-term volatility. By diversifying your investments across different asset classes, sectors, and markets, you can increase the likelihood of achieving your investment goals and weathering market fluctuations.