When it comes to financial management, budgeting is key. Whether you’re looking to increase your savings, pay off your mortgage, or simply handle your expenses better, having a budget in place is a must. In this article, we will guide you through the steps needed to create a budget that works for you.

The first thing you need to do is define your goal. What are you looking to achieve with your budget? Do you want to save for a vacation or for a rainy day? Knowing your goal will help you prioritize your expenses and make the necessary adjustments to your spending habits.

Once you’ve set your goal, it’s time to start planning. Take a look at your income and your expenses and determine how much money you have coming in and going out each month. This will give you an idea of how much you can allocate towards your savings or other financial goals.

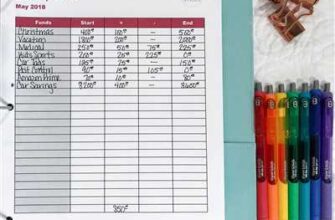

Next, you’ll want to monitor your budget closely. Keep track of your income, expenses, and savings on a regular basis. This will help you stay on track and make any necessary adjustments along the way. For example, if you notice that you’re spending too much on dining out, you can make a conscious effort to cut back and allocate that money towards your savings instead.

Now that you know how to create and monitor your budget, it’s time to expand your knowledge on different budgeting techniques. There are various types of budgets that you can implement, such as the zero-based budget or the envelope system. Each of these methods has its own advantages and disadvantages, so it’s important to find the one that works best for you.

In conclusion, budgeting is a necessary skill for financial success. By following the steps outlined in this article, you can build a budget that will help you achieve your financial goals. Remember to be flexible and make adjustments as needed. With the right knowledge and plan in place, you’ll be well on your way to financial freedom.

Budgets: Everything You Need To Know

When it comes to financial management, knowing how to build and stick to a budget is key. Whether you’re looking to save for a big purchase, like a new car or a down payment on a house, or simply want to increase your savings and have a better handle on your money, creating a budget is a must.

But what’s the best way to start? How do you know what budgeting method is right for you? In this article, we’ll expand on the idea of budgeting and cover everything you need to know, from the types of budgets to the 5 key steps to follow when creating a budget.

First and foremost, let’s take a look at what a budget is. Budgets are financial plans that outline your income, expenses, and savings goals. They provide a roadmap for how you will allocate your money and can help you make informed financial decisions.

There are different types of budgets to consider, depending on your individual needs and goals. Some common budgeting methods include the 50/30/20 budget, where 50% of your income goes to needs, 30% to wants, and 20% to savings; the envelope system, where you allocate cash to different envelopes for different expenses; and zero-based budgeting, where every dollar has a specific purpose.

Now, let’s dive into the 5 steps you need to follow to create a budget:

- Set your goal: Determine what you want to achieve with your budget. Whether it’s paying off debt, saving for retirement, or something else entirely, having a clear goal will help you stay motivated.

- Track your income: Know exactly how much money is coming in each month. This includes your salary, any side income, and other sources of funds.

- Monitor your expenses: It’s important to track where your money is going. Keep a record of your monthly expenses, including bills, groceries, and discretionary spending. This will give you an overview of your spending habits.

- Create a plan: Based on your income and expenses, create a plan for how you will allocate your money. This includes setting aside funds for savings, paying bills, and managing everyday expenses.

- Review and adjust: Regularly review your budget to see if it’s working for you. Make adjustments as needed to ensure you’re on track to meet your financial goals.

Following these steps will not only help you build a budget, but also develop the knowledge and skills needed to handle your money effectively. Budgeting is a valuable tool that can empower you to take control of your finances and make informed financial decisions.

In conclusion, budgets are essential for financial management. They provide a roadmap for your financial journey and help you make the most of your money. By following the 5 steps outlined above, you can create a budget that works for you and brings you closer to your financial goals. So start budgeting today and take charge of your financial future!

Key Takeaways

When it comes to building a budget, there are several key takeaways you need to keep in mind:

- Start by assessing your financial situation. Take a look at your income, expenses, and savings to determine how much money you have available to work with.

- Set clear goals for your budget. Decide what you want to achieve, whether it’s saving for a specific purchase or paying off debt.

- Create a plan that fits your needs. There are different types of budgets, such as the 50/30/20 rule or zero-based budgeting. Choose the approach that works best for you.

- Monitor your budget regularly. Keep track of your income and expenses to ensure you’re staying on track and making progress towards your goals.

- Don’t be afraid to make adjustments. Budgets are not set in stone, and if something isn’t working, don’t hesitate to make changes to improve your financial situation.

- Increase your financial knowledge. The more you know about personal finance, the better equipped you’ll be to handle any challenges that come your way.

- Consider seeking help if needed. If you’re struggling with budgeting or managing your finances, don’t hesitate to reach out to a financial advisor or seek resources to assist you.

Building a budget is an important step towards achieving your financial goals. By following the steps outlined in this article, you’ll have a good idea of where your money is going and how to make the most of it. Whether you’re looking to save for a down payment on a house or simply want to improve your financial management, budgeting is a key tool to help you get there.

Remember, budgeting is not about restricting yourself, but rather about being aware of your spending and making intentional choices with your money. Start small, track your progress, and celebrate your successes along the way. With practice and perseverance, you can build a budget that suits your needs and helps you achieve your financial goals.

Key takeaway: Building a budget is a necessary step for financial management. Follow the steps outlined in this article to take control of your finances, expand your savings, and achieve your financial goals.

How to Make a Budget

Creating a budget is an essential step towards financial management. It helps you monitor and handle your expenses, increase savings, and achieve financial goals. In this article, we will provide you with the best steps to follow in order to build a budget that suits your needs.

- Determine your goal: Before making a budget, you need to know what you’re aiming for. Whether you want to save for a down payment on a mortgage, pay off debts, or simply have more financial freedom, having a clear goal will guide you in the budgeting process.

- Analyze your income and expenses: Takeaways from the article show that you need to know how much money is coming in and going out each month. Make a list of all your income sources and track your expenses. This will give you a clear idea of whether you need to make any adjustments.

- Identify necessary expenses: Some expenses are essential, like rent/mortgage, utilities, groceries, etc. Make sure to include these in your budget to ensure you can cover them each month.

- Eliminate unnecessary expenses: Look for expenses that you can cut down or eliminate. This could include eating out less, canceling subscriptions you don’t use, or finding more cost-effective options for things like entertainment or transportation.

- Build an emergency fund: It’s important to set aside some savings for unexpected expenses. Aim for saving at least 3-6 months’ worth of living expenses in case of emergencies.

- Create a budgeting plan: Based on your income and expenses, allocate specific amounts for different categories such as groceries, transportation, entertainment, etc. This will help you stay on track with your spending.

- Monitor and adjust: Regularly review your budget to see if it’s working for you. If you find that you’re consistently overspending in certain areas, adjust your budget accordingly to stay on track.

Remember, everyone’s budget will be different, so make sure to tailor it to your own needs and financial situation. Building a budget takes time and effort, but the benefits are worth it. Start taking control of your finances today!

For Example

When it comes to budgeting, there are many different ways to create a budget and track your spending. One example of a budgeting plan is the 50/30/20 rule, where 50% of your income goes towards needs, like rent or mortgage payments, 30% goes towards wants, like eating out or entertainment, and 20% goes towards savings or debt payments.

Another example is the envelope system, where you create envelopes for different categories of spending and put cash in each envelope. This helps you visually see how much money you have left for each category and can prevent overspending.

If you’re looking for something more high-tech, there are also budgeting apps and software available that can help you track your spending and create a budget. These apps often sync with your bank accounts and credit cards, making it easier to monitor your expenses and savings.

Knowing your financial goals is key when creating a budget. Whether you’re looking to pay off debt, save for a big purchase, or simply improve your money management skills, having a goal in mind can help guide your budgeting decisions.

In the article by Morgan Stanley mentioned earlier, they highlight five key takeaways when it comes to budgeting. These takeaways include the importance of knowing your income and expenses, creating a realistic budget, monitoring your spending, making adjustments as needed, and seeking professional help if necessary.

It’s also important to remember that budgets should be flexible and adaptable. As your financial situation changes, your budget may need to change as well. The goal is to find a budget that works for you and helps you achieve your financial goals.

So, whether you’re just starting out on your budgeting journey or looking to expand your knowledge, building a budget is an essential step in financial management. Take the time to understand your income, expenses, and goals, and create a budget that reflects those priorities. With the right tools and mindset, you can take control of your finances and build a solid financial foundation.

| Key Takeaways |

| – Create a budget that aligns with your financial goals |

| – Understand your income, expenses, and savings |

| – Monitor your spending and make adjustments as needed |

| – Seek professional help if you need assistance |

| – Be flexible and adapt your budget to your changing financial situation |

Looking to expand your financial knowledge

When it comes to money management, having a solid understanding of financial concepts and strategies is key. Whether you’re just starting out or looking to improve your current financial situation, expanding your financial knowledge can help you make better financial decisions and achieve your financial goals.

One of the best ways to start expanding your financial knowledge is to create a budget. Budgeting is the process of creating a plan for how you will allocate and manage your money. It involves identifying your income and expenses, setting financial goals, and tracking your spending to ensure you’re staying on track.

Here is a step-by-step guide to help you build a budget:

1. Determine your financial goals: Start by identifying what you want to achieve financially. This could include saving for a down payment on a house, paying off debt, or building an emergency fund.

2. Assess your income and expenses: Take a look at your current income and expenses to get a clear picture of where your money is going. This will help you identify areas where you can cut back and save.

3. Track your spending: Monitor your spending for a month or two to see where your money is going. This will help you identify any patterns or areas where you may be overspending.

4. Create a budget: Once you have a clear understanding of your income, expenses, and spending habits, you can create a budget. This involves allocating your income towards different categories such as housing, transportation, groceries, and entertainment, and setting limits for each category.

5. Follow the budget: Stick to your budget by tracking your spending and making adjustments as needed. Regularly review your budget to ensure you’re staying on track towards your financial goals.

By following these steps, you’ll be able to build a budget that suits your needs and helps you achieve your financial goals. Remember, budgeting is an ongoing process, and it may take some time to find the right balance. But with patience and persistence, you can gain the financial knowledge and skills needed to handle your money effectively.

So, whether you’re a budgeting pro or just starting out, expanding your financial knowledge is always a good idea. It can help you increase your savings, make better financial decisions, and ultimately achieve financial success.

In conclusion, building a budget is just one step towards expanding your financial knowledge. By following the steps outlined in this article, you can start to take control of your finances and work towards your financial goals. Remember, financial success is achievable for everyone, no matter your income level or financial situation. So take the first step today and start building your budget!

How to make a budget in 5 steps

When looking to build a budget, there are several key steps you need to follow in order to create a plan that will help you achieve your financial goals. Whether you’re just starting out or have been budgeting for a while, these steps are essential to ensure you have a clear idea of where your money is going and how to make the most of it.

- Identify your financial goals: Before you can start budgeting, you need to know what you’re working towards. Are you looking to save for a down payment on a house or pay off your student loans? Knowing your financial goals will help you prioritize your spending and determine how much you’ll need to budget for each category.

- Calculate your income and expenses: Take stock of your current financial situation by listing all sources of income and all of your expenses. This will give you a clear picture of your cash flow and help you determine how much money you have available to allocate towards your goals.

- Track your spending: To create an effective budget, you need to know where your money is going. Start monitoring your expenses by tracking every purchase you make for a month or two. This will give you a better understanding of your spending habits and identify areas where you can cut back.

- Allocate your income: Once you have a clear idea of your expenses, you can allocate your income accordingly. Start by covering your essential expenses like housing, utilities, and groceries. Then, allocate funds towards your financial goals and savings. Finally, allocate money for discretionary expenses like dining out or entertainment.

- Monitor and adjust: A budget is not a one-time task; it requires ongoing monitoring and adjustment. Regularly review your spending and compare it to your budget to see if you’re on track. If you notice any areas where you’re consistently overspending, look for ways to cut back and make adjustments to your budget as needed.

Following these steps will help you build a budget that puts you in control of your finances and sets you on the path to achieve your financial goals. Remember, budgeting is a skill that takes time and practice to master, so don’t get discouraged if it takes some trial and error to find the best budgeting approach for your needs. With knowledge and persistence, you can build a budget that will help you increase your savings, handle unexpected expenses, and expand your financial opportunities.