When it comes to planning for retirement, one of the most important factors to consider is how to build a portfolio that will provide enough return to meet your needs. There are many investment strategies and options available, each with their own risks and potential rewards. This article will discuss some general strategies and considerations to ensure you’re managing your financial assets effectively and making the most of your retirement savings.

One approach to consider is diversifying your investments within your retirement portfolio. This means spreading your investments among different asset classes, such as stocks, bonds, mutual funds, and annuities. Each of these asset classes has its own risks and potential for return, so by diversifying, you can help mitigate the impact of any one investment going south while still potentially achieving your desired return.

Before investing in any specific asset class, it’s important to think about your goals and risk tolerance. If you’re looking for stability and a fixed income over a long period of time, you might consider bonds or fixed annuities. On the other hand, if you want to achieve a higher potential return over the long term, stocks and equity mutual funds might be more suitable.

Managing Your Retirement Portfolio

When it comes to managing your retirement portfolio, there are a few general strategies you’ll want to consider. One important thing to think about is the sources of income that will provide stability and diversify your portfolio. This includes fixed funds, annuities, and investments in mutual funds.

Annuities can be an attractive option for retirement planning because they offer a guaranteed monthly income for a specified period of time. However, they also come with some risks, such as being subject to change and potential loss of their value. Before investing in an annuity, you’ll want to carefully consider whether it aligns with your financial goals and needs.

Another approach to managing your retirement portfolio is to diversify your investments. This means spreading your funds across various assets, including stocks, bonds, and real estate, among others. This helps to ensure that your portfolio is balanced and that you have enough potential for return while minimizing the risks.

One strategy that many people use is creating a bond ladder, which is a portfolio of bonds with varying maturity dates. This can provide a steady stream of income over time and help protect against interest rate changes. Additionally, investing in mutual funds can be a good way to achieve diversification because they spread your investment across many different companies and industries.

Before making any investment decisions for your retirement portfolio, it’s always important to do thorough research and consider your own personal circumstances. What works for one person may not work for another, so it’s crucial to tailor your approach to managing your retirement portfolio to your specific needs and goals.

| Approach | Advantages | Disadvantages |

|---|---|---|

| Annuities | Provide a guaranteed monthly income for a specified period of time | Subject to change and potential loss of value |

| Diversification | Helps balance portfolio and minimize risks | May not provide as high of returns as concentrated investments |

| Bond Ladder | Offers a steady stream of income over time | May not have as high of potential return as other investments |

| Mutual Funds | Spreads investment across many different companies and industries | Investors have less control over specific investments |

In summary, managing your retirement portfolio requires careful consideration of your financial needs and goals. It’s important to diversify your investments and consider different strategies, such as annuities, bond ladders, and mutual funds. Ultimately, the goal is to create a balanced portfolio that provides enough income and stability to support you throughout your retirement years.

Consider an annuity

When building your retirement portfolio, one subject you should consider is an annuity. An annuity is a financial product that provides a guaranteed income for a specified period of time, typically for the rest of your life.

Annuities can be an important tool in retirement planning, as they offer stability and income that you can rely on. Whether you choose a fixed annuity or a variable annuity depends on your financial needs and goals.

Fixed annuities provide a steady income stream, while variable annuities allow you to invest in mutual funds, among other funds, and potentially earn a higher return. However, variable annuities also come with more risks, as their value can fluctuate depending on the performance of the underlying investments.

One approach to consider when managing your retirement portfolio is to diversify your assets. By including annuities within your portfolio, you can ensure a balanced and stable income stream. Annuities can provide a guaranteed monthly income that can supplement other sources of income, such as Social Security or a pension.

Before investing in an annuity, it is important to carefully consider the terms and conditions. Some annuities may come with fees, surrender charges, or other limitations that you should be aware of. Additionally, you should think about whether an annuity aligns with your investment goals and risk tolerance.

While annuities can offer stability and income in retirement, they may not be the right choice for everyone. You’ll want to make sure that you have enough assets invested in other vehicles, such as stocks and bonds, to achieve your desired retirement income. Annuities are just one tool in a comprehensive retirement strategy.

Overall, annuities can be a valuable addition to your retirement portfolio. They offer the potential for a steady income stream and can help you diversify your investments. However, it is important to do your research and carefully consider whether an annuity is the right choice for your specific financial situation and retirement goals.

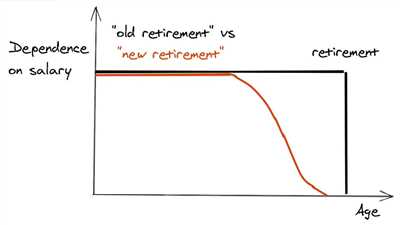

Total Return vs Income

When it comes to building a retirement portfolio, two main approaches are often considered: total return and income. Both strategies have their own advantages and it’s important to understand the differences between them.

If you want to focus on total return, you are primarily concerned with the overall growth and potential of your portfolio, including both capital appreciation and dividends or interest. This approach often involves investing in a mix of assets such as stocks, bonds, and mutual funds, with the goal of achieving long-term growth over time. While this strategy can provide higher returns, it also comes with higher risks and the potential for loss.

On the other hand, if you prefer an income-focused approach, you’re more concerned with generating a steady stream of income to cover your retirement expenses. This can be done by investing in assets that provide regular cash flow, such as dividend-paying stocks, fixed income investments like bonds or annuities, or even by creating a bond ladder. Income-focused strategies provide more stability and ensure you’ll have enough money coming in to meet your monthly needs. However, they might not achieve as much growth as a total return strategy.

Before deciding which approach is right for you, it’s important to consider your own financial goals and needs. If you have enough assets to cover your expenses and simply want to ensure stability during retirement, an income-focused approach may be the way to go. On the other hand, if you’re looking to grow your nest egg and don’t mind some potential fluctuations in income, a total return strategy might be more suitable.

It’s also worth noting that both approaches have their own risks and limitations. Total return strategies are subject to market volatility and past performance doesn’t guarantee future results. Income-focused investments, such as annuities, may provide a fixed income but can also incur fees and limitations on access to your funds. Diversification is important in both strategies, as it helps to spread the risk among different assets.

In conclusion, whether you choose a total return or income-focused approach for your retirement portfolio, the key is to ensure that your investments align with your financial goals and risk tolerance. Consider speaking with a financial advisor who can help you create a balanced portfolio that meets your specific needs.

Diversify for stability

When it comes to building a retirement portfolio, diversification is key. Diversifying your investments helps to spread out risk and ensure stability for your financial future.

One approach to diversify your retirement portfolio is to have a balanced mix of different types of assets. This can include a combination of stocks, bonds, mutual funds, annuities, and life insurance. By having a mix of these different investment sources, you’ll be more protected against any potential loss or changes in the market.

For example, stocks and mutual funds provide potential for higher returns, but they also come with higher risks. Bonds and fixed income assets, such as annuities, offer a more stable and predictable income stream. By investing in a variety of these assets, you can balance the potential for higher returns with the stability provided by fixed income sources.

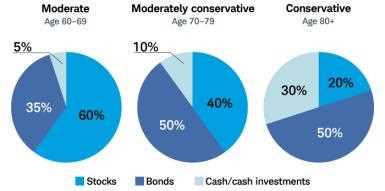

It’s important to consider your own risk tolerance and financial goals when diversifying your portfolio. Some people may be comfortable taking on more risk in order to potentially achieve higher returns, while others may prefer a more conservative approach to ensure stability.

One strategy for diversifying your retirement portfolio is to use a “laddering” approach. This means staggered investments in different assets over time, which can help to smooth out fluctuations in the market. For example, you might invest a portion of your assets in stocks, another portion in bonds, and another portion in annuities. This way, if one asset class is performing poorly, the others will help to offset any potential losses.

When considering how to diversify your retirement portfolio, it’s also important to think about the tax implications. Some investments, such as annuities, may provide tax-deferred growth, while others, such as dividend-paying stocks, may generate taxable income. By understanding the tax implications of your investments, you can make sure that you are balance your portfolio in a tax-efficient manner.

In summary, diversification is crucial for achieving stability in your retirement portfolio. By diversifying your investments among different asset classes and sources of income, you can ensure a more balanced and stable financial future. Remember to consider your own risk tolerance and financial goals, as well as the tax implications of your investments, to make sure you are building a well-diversified retirement portfolio that meets your needs.

Consider all your income sources

When building your retirement portfolio, it’s important to consider all of your potential income sources. This will help ensure that you have enough funds to support your financial needs during your retirement years.

One of the main sources of income for retirees is dividends from stocks and shares. Dividends are a portion of a company’s profits that are distributed to shareholders. They can provide a stable income stream, but their return is subject to the performance of the companies in which you’re invested. You’ll want to make sure you diversify your portfolio to minimize the potential loss from any one investment.

Another income source you might consider is an annuity. An annuity is a financial product that provides a fixed income over a period of time, usually for the rest of your life. They can offer stability and predictability, but they also come with certain risks. Before investing in an annuity, make sure you understand how they work and whether they align with your retirement goals.

Fixed income investments, such as bonds or bond funds, can also provide a steady stream of income. They pay interest at regular intervals and are generally considered safer than stocks. However, they might not generate as high returns as stocks over the long term.

It’s important to have a balanced approach when considering your income sources. You’ll want to make sure you’re managing your investments in a way that provides enough monthly income to meet your needs, but also allows for potential growth to keep up with inflation.

Mutual funds can be a good option for retirement income because they allow you to invest in a variety of assets, including stocks and bonds. They are managed by professionals who can help you diversify your investments and ensure a balanced portfolio. However, keep in mind that mutual funds are subject to market fluctuations and can incur fees, so it’s important to carefully consider the funds you choose.

Overall, when building your retirement portfolio, it’s important to consider all of your income sources and ensure you have a diversified approach. This will help you achieve a balance between stability and potential growth, and ensure that your income will last throughout your retirement years.