If you’re looking for a quick and easy way to send and receive money with friends and family, look no further than Zelle®. With Zelle, you can make fast and secure payments, with funds typically available within minutes. Whether you need to split a bill, pay your share of rent, or send money to a loved one in need, Zelle offers a convenient and hassle-free solution.

Zelle is offered by a wide range of financial institutions, including major banks and credit unions. To get started, all you need is a bank account in the United States that is enrolled in Zelle. You can easily enroll in Zelle through your bank’s website or mobile app.

Once you have enrolled in Zelle, you can start sending and receiving money right away. Zelle offers a user-friendly interface that makes it simple to navigate and use the service. Whether you’re sending money to a friend across town or splitting a bill with colleagues, Zelle provides a seamless and efficient experience.

One of the great things about Zelle is that it’s not just limited to personal use. Many businesses also use Zelle to make payments to their suppliers and vendors. With Zelle, you can make secure and prompt payments, ensuring that you always stay on top of your financial obligations.

So, if you’re tired of writing checks or dealing with the hassle of cash, consider making a Zelle account today. With Zelle, you can easily and securely send and receive money, making your financial transactions simple and efficient.

- Bank of Hawaii Together with Zelle ®

- What is Zelle and how does it work

- How to Send Money With Zelle®

- Step 1

- Step 2

- Step 3

- Disclosures

- Investment and Insurance Products

- Limited English Proficiency Support

- New York City residents

- Borrowers with Limited English Proficiency (LEP) needing information can use the following resources

- Sources

Bank of Hawaii Together with Zelle ®

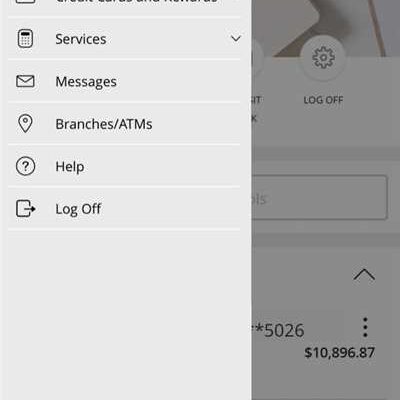

Bank of Hawaii has partnered with Zelle®, a wise and convenient way to send money to friends, family, and other recipients. Zelle® is available within Online Banking and the Bank of Hawaii Mobile App, making it easy to make payments and exchange money.

What is Zelle®? Zelle® is a service that allows you to send money from your bank account to another enrolled bank account within the United States. Zelle® offers fast and secure transfer of funds, and the recipient will typically receive the money within minutes.

How to make a Zelle® account:

- Enroll in Online Banking or the Bank of Hawaii Mobile App, if you haven’t already.

- Make sure your bank account is correct, and speak to our customer support if you need any assistance.

- Once enrolled, you can access Zelle® through the app or Online Banking.

- Follow the steps provided to set up your Zelle® account.

Bank of Hawaii together with Zelle® supports both English and Korean proficiency, ensuring that our customers, including LEP (Limited English Proficient) residents, can make use of the service. We adhere to the federal guidelines provided by the CFPB (Consumer Financial Protection Bureau) and FINRA (Financial Industry Regulatory Authority) regarding Zelle® usage and information.

Bank of Hawaii, its affiliates, and subsidiaries, including Zelle®, McGriff Insurance Services, Inc., Trust Advisory Group, and Pacific Capital Advisors, LLC, offer a wide range of products and services, including specialty and mortgage services. Bank of Hawaii is a member of FDIC (Federal Deposit Insurance Corporation) and an Equal Housing Lender.

For more information about Zelle® and its services, you can visit the Bank of Hawaii website or contact our customer support. Bank of Hawaii also provides resources and disclosures regarding Zelle® on our website, along with the Zelle® registry of participating banks and credit unions.

What is Zelle and how does it work

Zelle is a quick and convenient way to send money to friends, family, and other people you trust. It is an online payment service that allows you to transfer funds directly from your bank account to the recipient’s account, without the need for cash or checks. Zelle is available through many banks and financial institutions, making it easy to send and receive payments.

When you use Zelle, you can send money to anyone who is enrolled with Zelle, which includes most major banks. To send money, you’ll need the recipient’s email address or mobile phone number. Zelle will then prompt you to enter the amount you want to send and confirm the transaction. The funds will be transferred instantly to the recipient’s bank account.

Zelle is a service provided by Early Warning Services, LLC, a company that specializes in payment and risk management. It is backed by a consortium of banks, including Bank of America, Capital One, JPMorgan Chase, and Wells Fargo. Zelle is also regulated by the Consumer Financial Protection Bureau (CFPB) and follows the same legal and regulatory framework as other banking services.

It’s important to note that Zelle is only available for sending money within the United States. It does not support international payments or currency exchange. If you need to send money to someone outside the U.S., you’ll need to use a different service.

Zelle offers a number of resources and support services for its users. If you have any questions or need assistance, you can speak to a customer service representative who can help you with any issues or concerns. Zelle also has an online support center where you can find answers to frequently asked questions, as well as step-by-step guides on how to use the service.

For your security, Zelle uses industry-standard encryption and other security measures to protect your personal information and ensure the correct transfer of funds. It is important to only send money to people you know and trust, as Zelle does not offer any recourse for incorrect or unauthorized payments.

In summary, Zelle is a convenient and secure way to send money to friends, family, and trusted individuals within the United States. It offers quick and instant transfers, with the funds being deposited directly into the recipient’s bank account. If you have a bank account with a participating financial institution, you can easily enroll in Zelle and start sending money today.

How to Send Money With Zelle®

If you’ve been wondering how to send money with Zelle®, you’re in luck! Zelle® is an online service that allows you to send and receive money quickly and securely. Whether you’re sending money to a friend, family member, or even paying bills or making payments for goods and services, Zelle® makes it easy to do so.

Here’s a step-by-step guide on how to send money with Zelle®:

- First, make sure that you have a Zelle® account. If you don’t have one already, you can quickly and easily enroll in Zelle® through your online banking service or mobile banking app.

- Once you’re enrolled, log in to your Zelle® account. You’ll need to provide your name, email address, and phone number. Zelle® may also require additional verification information to ensure the security of your account.

- After you’ve logged in, you can start sending money with Zelle®. Simply enter the recipient’s email address or mobile phone number and the amount you want to send. Make sure the recipient’s information is correct to ensure the money goes to the right person.

- Zelle® will then send a notification to the recipient, letting them know that they have received a payment from you. They can then accept the payment and transfer the funds to their bank account. If the recipient is not enrolled in Zelle®, they will receive instructions on how to enroll to receive the payment.

It’s important to note that Zelle® can only be used for domestic payments, so if you need to send money internationally or in a different currency, you’ll need to use other services or methods, such as wire transfer or international money exchange services.

When using Zelle®, you can have peace of mind knowing that your transactions are protected and secure. Zelle® works with major banks and financial institutions, and your information is encrypted and safeguarded. Additionally, Zelle® is backed by the FDIC, so your money is insured up to $250,000.

For more information on how to send money with Zelle®, including any fees or limitations, it’s wise to check with your bank or financial institution. They will be able to provide you with specific details regarding the use of Zelle® with your accounts.

In conclusion, Zelle® offers a convenient and quick way to send money to friends, family, and others. It’s a secure and reliable service that is easy to use, making it a popular choice for online payments and transfers. Follow the steps outlined above, and you’ll be sending money with Zelle® in no time!

Step 1

To make a Zelle account, you will need to have a bank account. If you don’t have one, you can set up a new account with Sterling Bank & Trust. The bank offers a wide range of services, including online banking and investment management. To open an account, you will need to provide the following information: your name, address, social security number, and email address. You will also need to know your bank account number and routing number. Once you have enrolled in online banking, you can use Zelle to send and receive money.

Zelle is a quick and easy way to send money to friends, family, or anyone else you trust. It is available to most residents in the United States and can be used with most banks. Zelle provides support for English, Spanish, and Korean speakers, so you can speak to a representative in your preferred language.

To send a payment using Zelle, you will need to have the recipient’s email address or mobile number. You can then enter the recipient’s information in your Zelle account and select the amount you want to send. The money will be sent directly from your account to the recipient’s account, with no needing for cash or checks.

Step 2

Once you have completed Step 1 and have created your Zelle® account, you can proceed to Step 2 to start using the Zelle® service.

The Zelle® service is provided by Zelle®, a service of Early Warning Services, LLC. Zelle® is a fast, safe, and easy way to send money directly between bank accounts in the U.S. Zelle® is available to bank account holders in the U.S., including residents of Puerto Rico and U.S. Territories, and is offered through participating banks and credit unions. To use Zelle®, you must have an eligible bank account in the U.S.

Step 2: Enroll Your Accounts

In order to start using Zelle®, you will need to enroll your bank account. To do this, please follow the steps provided by your bank. Once you have enrolled your account, you will be able to send and receive payments using Zelle®.

Please note that some banks may require additional verification steps before allowing you to use Zelle®. These steps may include providing additional information or completing a one-time verification process. Contact your bank for more information.

Important Disclosures:

Zelle® payments are not limited to just the banks and credit unions offered through Zelle®. Zelle® is also available for use by customers of participating banks and credit unions that have joined the Zelle® network.

Zelle® is provided by Zelle® and processed through the Zelle® network. Zelle® is not responsible for and does not endorse any third party products or services that may be offered through the Zelle® network. Zelle® is not responsible for the content or operation of external websites linked to from the Zelle® website. Zelle® payments are not insured by the FDIC or any other government agency, are not guaranteed by a bank, and may lose value.

To ensure the security and privacy of your Zelle® transactions, please be cautious when sharing your Zelle® account information with others. Do not share your Zelle® account information with anyone you do not trust.

Zelle® is a registered trademark of Early Warning Services, LLC. NMLS #967396 and/or FDIC Equal Housing Lender. © 2022 Early Warning Services, LLC. All rights reserved. Zelle® and the Zelle related marks are property of Early Warning Services, LLC.

Step 3

Once you’ve enrolled in Zelle®, you can start using it to send and receive money. It’s important to know that Zelle® is not a bank. Rather, it is a service provided by Truist Bank and Bank of America, N.A., Members FDIC. Zelle® does not offer an account of its own, but it works with your existing bank account.

If you’re already a Truist Bank or Bank of America customer, you can simply use the Zelle® option available within your online banking account. If you’re not a customer of either bank, you can still use Zelle® by downloading the Zelle® app and linking it to a bank account you already have.

Keep in mind that while Zelle® allows for quick and convenient money transfers, it does not support international payments. Zelle® is only available for use within the United States.

If you need any more information or support regarding Zelle®, you can contact Truist Bank or Bank of America directly. They will be able to assist you with any questions or concerns you may have.

For New York residents, Zelle® payments are provided by Truist Bank, with additional disclosures available at www.truist.com. Zelle® is a registered trademark of Early Warning Services, LLC.

For Navy Federal Credit Union members, Zelle® payments are provided by Truist Bank, with additional disclosures available at www.navyfederal.org.

For McGriff Insurance Services, Inc., Zelle® payments are provided by Truist Bank, with additional disclosures available at www.mcgriffinsurance.com.

The Consumer Financial Protection Bureau (CFPB) offers resources on how to use Zelle® securely and what to know about it. To learn more, visit www.consumerfinance.gov.

The Financial Industry Regulatory Authority (FINRA) provides resources on investor proficiency and offers a registry of brokers and advisory firms. To learn more, visit www.finra.org.

Truist Bank, Bank of America, and their affiliates, including Truist Securities, Inc. (member FINRA and SIPC), Truist Advisory Services, Inc., and Truist Wealth, offer investment advisory products and services and maintain a trust, exchange, and specialty life insurance products registry. Regulatory information regarding trade names and countries where accounts and accounts for legal entities are restricted can be obtained by calling Truist Bank.

NMLS #411535

This information is correct as of [enter current date].

Disclosures

By using Zelle, you agree to the following disclosures:

| Zelle Payment Service | Zelle® is a quick and easy way to send and receive money from friends, family, or anyone else you trust. By enrolling with Zelle through your bank’s mobile app, you can securely send money directly to the recipient’s bank account. |

| Banking Services | Zelle is offered by participating banks and financial institutions. Make sure to check with your bank to see if they offer Zelle. If they do, you can access Zelle through their mobile banking app. |

| Investment Services | Zelle does not offer investment or advisory services. It is important to know that any information provided on Zelle’s website or other sources should not be considered as financial or investment advice. |

| Insurance Services | Zelle does not offer insurance services. Any insurance products or services mentioned on Zelle’s website are offered by affiliated or third-party insurance companies. |

| Legal Services | Zelle does not provide legal services. If you have any legal questions or concerns, it is wise to speak with a qualified attorney. |

| Specialty Services | Zelle does not offer any specialty services such as trust, estate, or trade registry services. Please consult the appropriate professionals for these services. |

| Information Accuracy | Zelle makes every effort to provide accurate information on its website and other platforms. However, Zelle cannot guarantee the accuracy or completeness of the information provided. |

| Security and Privacy | Zelle takes the security and privacy of your personal and financial information seriously. Zelle uses encryption and other security measures to protect your data as it is transmitted and stored. |

| Financial Regulations | Zelle is regulated by the Consumer Financial Protection Bureau (CFPB) and follows federal banking regulations. Zelle is not available in Hawaii and New York. Payments made through Zelle are not FDIC-insured. |

| Third-Party Services | Zelle may offer links and resources to third-party websites or services. Zelle is not responsible for the content or availability of these third-party sites and services. |

Investment and Insurance Products

Truist offers a wide range of investment and insurance products to its members. Whether you’re looking to save for retirement, trade stocks, or protect your family with life insurance, Truist has the resources and expertise to help you make wise financial decisions.

Our investment products include advisory services, mutual funds, and exchange-traded funds (ETFs). We also offer specialty products, such as Korean Won (KRW) and other international currency exchange services.

When it comes to insurance, Truist provides a variety of options for your needs. From life insurance to mortgage payment protection, our team of professionals will work with you to find the right coverage.

As a member of Truist, you can also take advantage of our online banking services, including Zelle® for quick and secure money transfers. Whether you need to send money to friends or pay bills, Zelle® makes it easy and convenient.

Please note that investment and insurance products are not FDIC insured, not bank guaranteed, and may lose value. Truist Bank, Member FDIC. Equal Housing Lender. Truist Financial Corporation. Banking products and services, including loans and deposit accounts, are provided by Truist Bank. Some trust and investment management services, such as brokerage accounts, are offered through Sterling, Truist Bank or its affiliates. Securities and insurance products are offered through McGriff Insurance Services, Inc. (McGriff), a subsidiary of Truist Bank. Insurance products are offered through Truist Insurance Holdings, Inc. (Truist Insurance), a subsidiary of Truist Bank.

Truist Bank, Truist Financial Corporation and its subsidiaries, including Truist Securities, Inc., Member FINRA and SIPC. Truist Securities is the trade name for the corporate and investment banking services of Truist Financial Corporation and its subsidiaries, including Truist Securities, Inc., member FINRA and SIPC. Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. Trust and investment management services are provided by Truist Bank, a division of Truist Bank or Truist Financial Corporation, Member FDIC, and its subsidiaries, including Truist Investment Services, Inc., member FINRA and SIPC.

Truist Bank and its representatives do not provide tax or legal advice. Each individual’s tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

Limited English Proficiency Support

Zelle® is committed to providing support to individuals with limited English proficiency (LEP). Understanding that not everyone speaks English fluently, Zelle offers services to assist LEP customers in managing their accounts and making payments.

If you need assistance in a language other than English, you can speak with a Zelle representative who can provide guidance and advisory regarding Zelle products and services. Zelle has resources available to help LEP customers, ensuring that they have access to the information and support they need.

Zelle, together with its subsidiaries and affiliates, offers a specialty in international banking and payment services. Whether you are sending money to friends and family in another country or paying for an online purchase, Zelle can help facilitate the quick and secure transfer of funds.

It is important to note that Zelle is not a bank. Zelle is a service offered by participating banks and financial institutions. To use Zelle, you must have a bank account in the United States and be enrolled in online banking with your financial institution. Zelle is available through a number of participating banks, and you can find the complete list of participating banks on the Zelle website.

Zelle is not responsible for any recourse or damages resulting from incorrect or unauthorized payments. It is your responsibility to ensure that you have the correct recipient information before initiating a payment.

Zelle also provides information and disclosures regarding legal and investment advisory services. Please note that Zelle does not offer legal or investment advisory services. Zelle is a payment service, and any legal or investment advice should be obtained from a qualified professional.

Zelle is committed to ensuring the privacy and security of its users. Zelle has implemented industry-standard security measures to protect the personal and financial information of its customers. However, it is always important to be cautious when sharing personal information online and to follow best practices for online security.

If you are a borrower needing assistance with a mortgage or have questions regarding Zelle’s services, you can contact Zelle directly or speak with a representative from your financial institution. Zelle has a team of dedicated professionals who can provide guidance and support to borrowers.

For additional information and resources regarding Zelle’s limited English proficiency support, you can visit the Zelle website or contact Zelle’s customer service. Zelle is committed to helping LEP customers effectively use their services and ensuring that they have access to the information they need.

New York City residents

If you are a resident of New York City, there are certain disclosures that you should know about before using Zelle®. How you use Zelle can result in fees depending on your banking terms and agreements. Additionally, Zelle is only available for use by individuals residing in the United States, using U.S. dollars, and having a U.S. bank account.

In New York City, Zelle is offered through Zelle partners, including Sterling National Bank, a subsidiary of Truist Bank, Member FDIC. Zelle payments are only available for customers who have enrolled in Zelle through their participating bank or credit union. It’s important to speak with your bank or credit union to see if they offer Zelle and how to enroll.

When making payments with Zelle, you should ensure that you have the correct recipient information, including the recipient’s email address or U.S. mobile phone number. Zelle does not provide a registry or directory of Zelle users, so it’s wise to only send money to friends, family, or others you trust. Zelle does not offer a protection program for authorized payments made with Zelle. It’s important to know and trust who you are sending money to.

If you need support with Zelle, you can contact Zelle customer support or your bank or credit union directly. Zelle customer support is available 24/7 in English and Spanish, and limited support is available in Korean.

In addition to Zelle, there are other specialty banking services available for New York City residents. Sterling National Bank offers a wide range of products and services, including mortgage and personal loans, investment and wealth management, life insurance, and more.

For more information on Zelle and other banking resources available to New York City residents, you can visit the websites of banks like Sterling National Bank, Navy Federal Credit Union, or McGriff Insurance Services. It’s important to use trusted sources when gathering information about your banking options.

Borrowers with Limited English Proficiency (LEP) needing information can use the following resources

If you are a borrower with Limited English Proficiency (LEP) and need information regarding how to make a Zelle® account, there are several resources available to assist you.

Firstly, you can visit the official Zelle® website for step-by-step instructions on how to create an account. The website provides comprehensive details on the registration process, including the necessary information and documents you will need to provide.

Secondly, the Consumer Financial Protection Bureau (CFPB) offers resources for borrowers with Limited English Proficiency (LEP). The CFPB has a Language Services section on their website, where you can find information on your rights and the services provided to LEP borrowers.

If you prefer to speak with someone directly, you can contact your local bank or credit union to inquire about the services they offer for LEP borrowers. Many financial institutions have multilingual staff or access to interpretation services to assist customers who have difficulty communicating in English.

In addition to these resources, there are also community organizations and advocacy groups that may be able to provide assistance. Non-profit organizations, such as the National Association of Mortgage Loan Originators (NMLS) and the Consumer Financial Services Association (CFSA), offer guidance and support to borrowers with Limited English Proficiency (LEP).

It is important to note that while these resources can provide valuable information, it is always wise to consult with a legal professional or financial advisor before making any decisions regarding banking, investment, or loans.

| Resources | Website |

|---|---|

| Zelle® | www.zellepay.com |

| Consumer Financial Protection Bureau (CFPB) | www.consumerfinance.gov |

| National Association of Mortgage Loan Originators (NMLS) | www.nmlsconsumeraccess.org |

| Consumer Financial Services Association (CFSA) | www.cfsaa.com |

Sources

When it comes to making a Zelle account, there are a few quick and easy steps to follow. Zelle is a service that allows you to send and receive money from friends and family instantly. It’s available through participating banks, and works by linking your bank account to your Zelle profile. Here are some sources of information to help you get started:

1. Zelle website: The Zelle website offers a wealth of resources on how to make an account, including step-by-step instructions and frequently asked questions.

2. Your bank: If your bank offers Zelle, they will have information on how to enroll and use the service. Contact your bank directly to get started.

3. The Consumer Financial Protection Bureau (CFPB): The CFPB provides information and resources on how to use Zelle, including tips for safe transactions and what to do if something goes wrong.

4. Zelle customer service: If you’re having trouble with your Zelle account or have specific questions, you can reach out to Zelle’s customer service for assistance. They can provide guidance and answer any inquiries you may have.

5. Zelle mobile app: If you prefer using a mobile app, Zelle has a user-friendly app that you can download onto your smartphone or tablet. This app makes sending and receiving money even more convenient.

6. Financial websites: Many financial websites, such as Wise and NMLS, provide information on Zelle and other money transfer services. These sites offer valuable insights and advice to help you make informed decisions regarding your finances.

7. Your bank’s disclosures: Before using Zelle, make sure to review your bank’s disclosures and terms and conditions regarding the service. This will ensure that you have the correct information and understand the policies and fees associated with using Zelle.

By utilizing these sources, you’ll have all the information you need to make a Zelle account and start sending and receiving money with ease.