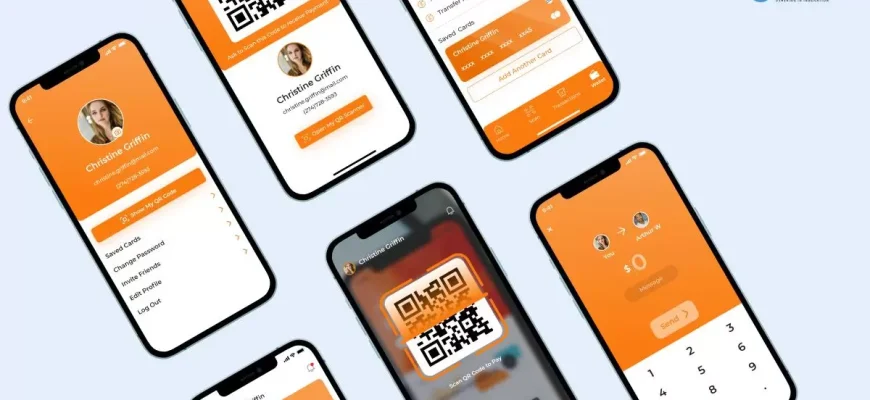

When it comes to building a payment app, there are a plethora of options available at your disposal. From peer-to-peer transactions to global banking platforms, the world of financial services now offers multiple reliable and secure sources for users to pay and receive funds. Today, we will dive into some of the most essential features that should be considered when developing a payment application.

First and foremost, trust is a must-have when it comes to handling financial transactions. Users should feel confident in the security and reliability of the platform they are using to make payments. Platforms like PayPal, Venmo, and Ayden have become synonymous with secure and convenient payment services, making them a popular choice for users worldwide.

In addition to security, convenience is another key factor to consider. Standalone e-wallets like Apple Pay, Google Pay, and Snapcash allow users to create their own account and link it to their bank accounts or credit cards, making it easy to pay for goods and services without the need to carry physical cash or cards. These applications often have features like social media integration or in-app messaging (such as Facebook Messenger), further enhancing the user experience and making the payment process more seamless.

Furthermore, investing in a good payment app should also take into account the different needs of users. Some may prefer a more centric approach, utilizing services like Popmoney or Dwolla to facilitate bank-to-bank transfers. Others may prioritize a worldwide reach, opting for platforms like PayPal or Ayden that allow for transactions in multiple currencies. It’s important to do your research and understand which features are most important to your target audience.

Now, let’s take a closer look at the top 9 must-have essentials for building a payment app:

- Security: Users should feel confident that their money and personal information are safe.

- Reliability: The app should be stable and functional, with minimal downtime or technical issues.

- Convenience: The payment process should be easy and efficient, with features like biometric authentication or auto-fill for card details.

- Multiple payment sources: Giving users the option to link different bank accounts or e-wallets to their payment app allows for flexibility and convenience.

- Social media integration: Integrating with popular social media platforms like Facebook or Instagram can make it easier for users to send and receive payments within their existing networks.

- Global reach: If you plan on targeting an international audience, consider implementing features that support transactions in different currencies and comply with local regulations.

- High transaction volume: The app should be able to handle a high volume of transactions without compromising speed or performance.

- Financial features: In addition to basic payment functionality, consider offering additional financial features like budgeting tools or investment options to differentiate your app from competitors.

- User-centric design: A user-friendly interface and intuitive navigation are key to ensuring a positive user experience.

By prioritizing these essentials, you can create a payment app that not only meets the needs of users today but also has the potential to become a trusted and widely used service in the future.

- Essentials of Payment App Development

- The Must-Have Features of a Good Payment App

- Types of Applications to Look at Before Investing in Peer-to-Peer App Development

- 1 Standalone Services PayPal and Venmo

- 2 Bank Centric Dwolla Zelle and Popmoney

- 3 Social Media Centric Facebook Messenger SnapCash Google Pay

- Why You Should Create Your Own Payment App

- 9 Best Payment Gateways in the Market Right Now

- Why Should You Choose Appy Pie’s Payment App Builder

- Sources

Essentials of Payment App Development

When it comes to payment app development, there are a few must-have features that you need to consider. Let’s take a look at the essentials:

1. Security: One of the high priorities in payment app development is ensuring the security of user’s financial and personal information. Trust is crucial, and users must feel comfortable entering their sensitive data.

2. Multiple Payment Options: To cater to a wider user base, your payment app should support various payment methods. This includes credit and debit cards, bank transfers, e-wallets, and even cryptocurrencies like Bitcoin.

3. Peer-to-peer Payments: Peer-to-peer payment services have become increasingly popular. Users now expect the ability to send money to friends and family without any hassle. Venmo, PayPal, and Snapcash are some of the most used apps in this market.

4. Integration with Banks and Payment Gateways: To facilitate seamless transactions, your payment app should integrate with various banks and payment gateways. This ensures the smooth flow of funds between accounts and provides users with a wider range of options.

5. Global Support: In today’s global market, your app should support multiple currencies and be accessible to users across the world. Adapting to different financial systems is essential for success.

6. Social Media Integration: Social media platforms have become more than just communication channels. They now offer payment services as well. Integrating with platforms like Facebook Messenger allows users to make payments within their favorite apps.

7. Reliable APIs: APIs are essential for connecting different services, applications, and platforms. Using reliable APIs from trusted sources ensures that your payment app functions smoothly and securely.

8. Standalone or Platform-based: You need to decide whether you want to create a standalone payment app or build on an existing platform. Both have their advantages, so choose the option that aligns with your business goals.

9. User-Centric Design: A user-friendly interface is crucial for any app, but especially for a payment app. It should be intuitive and easy to navigate, ensuring a seamless user experience.

10. Investing Options: To stay competitive, some payment apps even offer investing options. This allows users to grow their money within the app and provides an additional source of revenue.

In conclusion, when building a payment app, it is important to consider these essentials. By incorporating security features, supporting multiple payment types, integrating with banks and payment gateways, and creating a user-friendly design, you can create a reliable and successful payment app.

The Must-Have Features of a Good Payment App

When it comes to building a payment app, it is important to include the right features to ensure that your app is secure, reliable, and convenient for users. In this article, we will look at some of the must-have features that every good payment app should have.

First and foremost, a good payment app should be secure. Users need to trust that their personal and financial information is being protected. To achieve this, you can integrate with reliable payment gateways like Dwolla or PayPal, which have a proven track record in secure transactions. Another way to enhance security is by implementing two-factor authentication, requiring users to provide a second form of verification, such as a code sent to their mobile device, before they can complete a transaction.

In addition to security, a good payment app should also offer convenience. Many users today are looking for ways to easily send and receive money without the hassle of going through banks. Peer-to-peer payments have become increasingly popular, and apps like Venmo and Popmoney have capitalized on this trend. By offering peer-to-peer payment capabilities, your app can tap into this market and provide users with an easy way to transfer funds.

Furthermore, a good payment app should be versatile when it comes to payment sources. Users may have different preferences or types of payment accounts they wish to use. By integrating with multiple types of payment sources, such as bank accounts, credit cards, or even social media platforms like Google or Facebook, your app can cater to a wider range of users.

Another must-have feature for a payment app is a standalone banking system. This allows users to keep their funds within the app, eliminating the need for additional bank accounts. By offering a built-in banking system, users can easily manage their finances and make payments directly from the app.

Finally, a good payment app should also be user-centric. This means providing a user-friendly interface that is easy to navigate and understand. Additionally, it should offer features that make transactions quick and seamless, such as the ability to save favorite payment recipients or schedule recurring payments. By focusing on the user experience, your app can stand out in the crowded payment app market.

In conclusion, when developing a payment app, it is important to consider the must-have features that will set your app apart from the competition. By focusing on security, convenience, versatility, and user-centric features, you can create a payment app that users will love and trust.

| Features of a Good Payment App |

|---|

| Secure transactions |

| Two-factor authentication |

| Peer-to-peer payments |

| Integration with multiple payment sources |

| Standalone banking system |

| User-friendly interface |

| Quick and seamless transactions |

Types of Applications to Look at Before Investing in Peer-to-Peer App Development

When it comes to building a payment app, there are several types of applications to consider before investing in peer-to-peer app development. These applications have become more popular as people are now able to easily pay for goods and services using their mobile phones.

One type of app to look at is a banking app. This allows users to link their bank accounts or credit cards to the app, making it convenient for them to make payments. These apps also offer secure transactions, so users can trust that their money is being transferred safely.

Another type of app is a social media payment app. This allows users to send money to their friends or family through popular social media platforms. Apps like Zelle and Venmo have become must-have apps for many users, as they offer a quick and easy way to pay others.

There are also apps that focus on international money transfer. These apps allow users to send money worldwide, using different currencies and payment gateways. Apps like Dwolla and Ayden are good examples of these types of applications.

Peer-to-peer app builders like Bocasay have made it easier than ever to build your own payment app. They offer essential features and services that are necessary for a successful payment app, such as secure transactions and user-friendly interfaces.

Before investing in peer-to-peer app development, it’s important to learn more about these types of applications and understand why they are being used by so many people today. Convenience, trust, and secure transactions are some of the reasons why these apps have become so popular, and it’s important to choose the right type of app for your own needs.

- A banking app allows users to link their bank accounts or credit cards to the app for easy payments.

- A social media payment app like Zelle and Venmo allows users to send money to friends through popular social media platforms.

- An international money transfer app like Dwolla and Ayden allows users to send money worldwide using different currencies and payment gateways.

By considering these different types of applications, you can make an informed decision on what features and functionalities your peer-to-peer payment app should have.

1 Standalone Services PayPal and Venmo

If you are looking to create a payment app that allows users to pay from their own convenience, there are multiple standalone services you can choose from. One of the most popular and reliable options is PayPal. With PayPal, users can pay for goods and services, transfer funds, and even invest in different currencies. It is a global service that is widely used and trusted by millions of people.

Venmo is another popular standalone service that allows peer-to-peer payments. With Venmo, users can easily send money to their friends, split the bill, and pay for various goods and services. Venmo also has a social aspect, as users can see and like their friends’ transactions.

Having a standalone payment service like PayPal or Venmo is a great option for app developers looking to integrate payments into their applications. These services provide a secure and reliable way for users to pay without the need for a bank or credit card. They are also highly trusted platforms that have established themselves as leaders in the financial services industry.

When developing your own payment app, it is important to look into different payment gateways and services to find the one that best meets your needs. PayPal and Venmo are both good choices, but there are also other options available such as Zelle, Dwolla, Popmoney, and SnapCash. Each of these services has its own advantages and features, so it’s worth taking the time to learn about them before making a decision.

In conclusion, standalone services like PayPal and Venmo are great options for app developers who want to integrate payment functionality into their apps. These services offer secure, reliable, and convenient ways for users to make transactions. Whether you choose PayPal, Venmo, or another standalone service, incorporating payment capabilities into your app can greatly enhance its functionality and user experience.

2 Bank Centric Dwolla Zelle and Popmoney

When it comes to building a payment app, there are a variety of options to choose from. While popular apps like Venmo and PayPal have their own features and advantages, there are other bank-centric options that allow users to transfer money directly from their bank accounts.

Dwolla is one such financial app that allows users to transfer funds directly from their bank accounts to another individual or business. Unlike Venmo or PayPal, Dwolla doesn’t rely on social media or having your own platform. Instead, it acts as a gateway between different bank accounts, making it a secure and trusted option for transferring funds.

Zelle is another popular bank-centric app that allows users to send and receive money from their bank accounts. It’s a peer-to-peer service that is now integrated into many banking apps, making it easy for users to send money without having to download a standalone app. Zelle offers a high level of trust and security, making it one of the most popular options in the market today.

Popmoney is another bank-centric app that allows users to send money directly from their bank accounts. Like Zelle, it’s integrated into many banking apps, allowing users to send money without having to download a separate app. Popmoney also offers the ability to request money from others, making it a convenient option for peer-to-peer transactions.

These bank-centric apps are becoming more popular because of their direct integration with users’ existing bank accounts. This eliminates the need to sign up for another financial service and allows users to easily transfer money between accounts. Additionally, these apps offer a high level of trust and security, as they are backed by established financial institutions.

Before you create your own payment app, it’s important to consider these bank-centric options. They offer essential features and must-have services that users are looking for in a payment app. While popular apps like Venmo and PayPal are still widely used, the popularity of bank-centric apps like Dwolla, Zelle, and Popmoney is growing rapidly.

Now that you’ve learned about these bank-centric options, you can choose the right platform for your payment app development. Whether you decide to go with one of these bank-centric apps or create your own standalone app, having multiple payment gateways is essential to attract users and meet their banking needs.

3 Social Media Centric Facebook Messenger SnapCash Google Pay

When it comes to building a payment app, there are multiple platforms and services to choose from. Social media centric payment solutions have become increasingly popular, with platforms like Facebook Messenger, SnapCash, and Google Pay leading the way in this market.

1. Facebook Messenger

Facebook Messenger has become much more than just a messaging app. It now provides users with the ability to send and receive money through its standalone payment feature. This app allows you to transfer money to friends and family without having to go through a bank. The app is user-friendly, safe, and reliable, making it a must-have for any payment app builder.

2. SnapCash

SnapCash is a peer-to-peer payment service developed by Snapchat and powered by Square. It allows users to send funds to one another within the app, making it convenient and easy to split bills or pay back friends. SnapCash is a good option for those who want to incorporate social media into their payment app.

3. Google Pay

Formerly known as Google Wallet, Google Pay is a popular payment app that supports multiple currencies and allows for easy money transfer. This app has integrated various bank gateways, making it accessible to users across different banks and financial institutions. Google Pay also offers a wide range of features and services, including the ability to invest in e-wallets. It has become one of the most reliable payment apps in the market today.

In conclusion, when building a payment app, it is important to look at social media centric platforms like Facebook Messenger, SnapCash, and Google Pay. These apps offer users the convenience of peer-to-peer transactions and the ability to send and receive money without having to rely solely on traditional banking services. With their user-friendly interfaces and multiple features, these platforms should definitely be considered by any app builder.

Why You Should Create Your Own Payment App

In today’s global and digital world, having a secure and reliable payment app is essential. With the rise of social media and peer-to-peer transactions, users are looking for ways to transfer money without being tied into traditional financial gateways. This is where creating your own payment app comes in.

By creating your own payment app, you can choose the right features and services that best suit your users’ needs. You can also integrate multiple payment gateways and support different currencies, making your app accessible worldwide. This flexibility allows your users to send and receive money internationally, making it easier for them to conduct business and manage their finances across borders.

One of the most popular types of payment apps today is the peer-to-peer payment app. Apps like Venmo, Zelle, and Snapcash have become media darlings because they allow users to send money to friends and family with just a snap. These apps have revolutionized the way people split bills, share expenses, and make payments in general.

But what if you want to go beyond just splitting bills? What if you want to offer more advanced financial services to your users? This is where creating your own payment app shines. You can incorporate features like e-wallets, user-to-bank transactions, and even becoming a platform for investing and transferring money across different currencies.

When creating your own payment app, you have the freedom to choose the platforms and technologies that will best serve your needs. You can learn from the best practices of existing apps like PayPal, Ayden, and Dwolla, and build upon their success. But you can also provide something unique and different that sets your app apart from the competition.

Investing in the development of your own payment app can be a good choice, as it allows you to have control over all aspects of the app, from its security features to its user interface. You can choose a reliable app builder platform like Bocasay to ensure high-quality development and performance.

So, why create your own payment app? Because it allows you to provide a secure and efficient way for your users to handle their financial transactions. It gives you the power to offer innovative features and services that meet the demands of today’s digital-savvy users. And most importantly, it positions you as a global player in the ever-expanding world of electronic payments.

9 Best Payment Gateways in the Market Right Now

When building a payment app, you must have a reliable and secure payment gateway integrated into your service. With so many options available in the market, it can be challenging to choose the right one for your app. In this article, we will take a look at the 9 best payment gateways available in the market right now.

1. PayPal

PayPal is the world’s most popular payment gateway, trusted by millions of users worldwide. It offers multiple payment types and has essential features like being able to create your own e-wallets and even integrate with social media platforms like Facebook.

2. Google Pay

Google Pay is another must-have payment gateway when it comes to global transactions. Users can easily pay for goods and services without having to rely on banks or other financial institutions. With Google Pay, you can trust that your money is secure.

3. Zelle

Zelle is a peer-to-peer payment gateway that allows users to send and receive money with just a few taps. It is known for its high transaction speed and good user experience.

4. Ayden

Ayden is a popular payment gateway used by many applications and services. It offers worldwide coverage and supports multiple currencies to cater to a global audience.

5. Popmoney

Popmoney is a standalone payment gateway that provides users with an easy way to send and receive money. It is known for its simplicity and reliability.

6. Messenger Banking

Messenger Banking, a feature offered by some banks, allows users to make transactions within messaging apps. This convenience makes it a popular choice among users.

7. Pie’s E-Wallets

Pie’s E-Wallets is a payment gateway that offers a range of different e-wallets for users to choose from. It provides a seamless payment experience with advanced security features.

8. Bocasay

Bocasay is a reliable payment gateway known for its high level of security and user-friendly interface. It offers a wide range of features for businesses to manage their transactions effectively.

9. Your Own Custom Payment Gateway

For those looking for a customized payment gateway, creating your own can be a good option. This allows you to tailor the features and functionalities to meet your specific needs.

Before investing in a payment gateway, it is essential to learn more about each option and understand the features they offer. By choosing the right payment gateway, you can ensure a smooth and secure payment experience for your app users.

Why Should You Choose Appy Pie’s Payment App Builder

Building a payment app can be a complex task, requiring high levels of technical expertise and extensive development knowledge. However, with Appy Pie’s Payment App Builder, you can create your own payment app effortlessly and without any coding skills.

Appy Pie’s Payment App Builder is a reliable and user-friendly platform that allows you to build payment applications for different platforms, including iOS and Android. With this builder, you can create a standalone app that can be used by your users to pay, transfer funds, and perform other financial transactions.

One of the must-have features of Appy Pie’s Payment App Builder is its compatibility with multiple payment gateways. You can integrate popular payment gateways like PayPal, Stripe, Ayden, and more, allowing users to pay using their credit/debit cards or other banking services.

Appy Pie’s Payment App Builder also supports peer-to-peer payment services like Venmo, Zelle, and Popmoney, making it easier for users to transfer funds to their friends and family. Whether it’s splitting bills or sending money for a gift, these social payment services will help your application become more user-centric.

Another reason why Appy Pie’s Payment App Builder stands out is its global reach. It allows you to build payment apps that can be used worldwide, supporting different currencies and banking services. This means that no matter where your users are located, they can trust your application for secure and reliable transactions.

The development of a payment app involves high-end security measures to protect users’ data and financial information. Appy Pie’s Payment App Builder understands this need and ensures that its applications are built with top-notch security features. Your users can pay without worrying about the safety of their transactions or personal information.

Appy Pie’s Payment App Builder also comes with some additional features that make it stand out from the competition. For instance, it allows you to integrate your app with popular messaging apps like WhatsApp and Facebook Messenger, making it easier for users to pay directly from these platforms.

With Appy Pie’s Payment App Builder, you have the flexibility to choose the best payment gateway for your app. You can choose from various popular gateways, including PayPal, Stripe, Ayden, and Dwolla, ensuring that your users have multiple options to pay.

In addition to the payment features, Appy Pie’s Payment App Builder allows you to add more functionalities to your app. You can include features like bill splitting, transaction history, analytics, and more, enhancing the overall user experience.

To sum it up, Appy Pie’s Payment App Builder is the best choice for building a payment app. It offers a user-friendly interface, compatibility with multiple payment gateways, global reach, top-notch security, and additional features to enhance user experience. Whether you are a developer or a business owner, Appy Pie’s Payment App Builder is the go-to platform for building a reliable and successful payment app.

Sources

When it comes to building a payment app, there are several sources you can choose from to guide you through the development process. These sources will provide you with valuable information about different payment app types, their features, and the essentials of payment app development. Here are some reliable sources you can look into:

1. Market leaders: To learn more about payment apps, it is essential to look at market leaders like PayPal, Venmo, and Ayden. These platforms have been in the market for a long time and can provide insights into the most successful payment apps.

2. Peer-to-peer payment apps: Apps like Zelle, Snapcash, and Popmoney allow users to transfer money directly to their peers. These apps are widely used for everyday transactions and offer convenience and secure services.

3. E-wallets: E-wallets are standalone applications that allow users to store multiple payment cards and currencies in one place. Apps like Apple Pay and Google Pay are some of the most popular e-wallets used worldwide.

4. Payment gateways: If you’re looking to integrate payment functionality into your app, you must learn about payment gateways. Services like Stripe and Braintree offer good options for developers looking to enable online payments.

5. Banking APIs: Another way to build a payment app is by integrating with banking APIs. Banks now provide APIs that allow developers to access banking services directly in their apps. Understanding these APIs will give you more control over your app’s payment features.

6. Social media payment apps: Social media platforms like Facebook and Snapchat also have their payment apps, such as Facebook Pay and Snapcash. These apps let users pay each other within the social media environment, making transactions more seamless.

By exploring these sources, you will get a good understanding of the different types of payment apps, their features, and the best practices for building a reliable and secure payment app.