Investing in the financial market can be a daunting task, especially for those who are new to the industry. The sheer number of stocks, funds, and indices can overwhelm even the most seasoned investors. However, there is an alternative for those who want more control over their investments and want to avoid hefty management fees – creating a DIY portfolio. In this article, we will explore the steps to make your own portfolio, the tools you can use, and the advantages of taking control of your investments.

Before we dive into the nitty-gritty of creating a DIY portfolio, let’s first understand why it is important. Many investors who rely on financial advisors or fund managers to handle their investments often find themselves at the mercy of market fluctuations. When the market takes a hit, their investments suffer as well. By taking matters into your own hands, you have the power to bend your investment strategy to best suit your needs and risk tolerance. This level of control can provide a sense of security and peace of mind.

Creating a DIY portfolio starts with defining your investment goals. Are you looking for long-term growth or immediate returns? Are you a conservative investor or are you willing to take on more risk for higher potential gains? Once you have a clear idea of what you want to achieve, it’s time to choose the right tools to help you reach your goals.

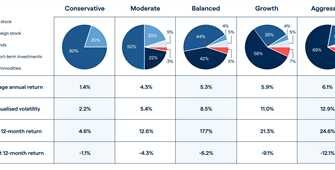

One popular approach to building a DIY portfolio is diversification. Instead of putting all your eggs in one basket, you can spread your investments across different asset classes, such as stocks, bonds, and real estate. This way, if one industry or company performs poorly, your overall portfolio is less likely to suffer significant losses. Diversifying also means investing in different regions and markets, allowing you to benefit from international growth opportunities.

When it comes to choosing individual stocks or funds for your DIY portfolio, it’s essential to do thorough research. Don’t just rely on media hype or the latest investment trends. Take the time to analyze the company’s financial statements, management team, and overall industry performance. Look for evidence of consistent growth, stable earnings, and prudent financial management. Consider reaching out to your network or contacting the company directly to get a true picture of their operations and future prospects.

A key advantage of a DIY portfolio is the ability to adjust your investments as needed. You can take advantage of market opportunities, such as buying stocks when they are undervalued or selling when they are overpriced. If you feel that particular industry or asset class is too risky, you can reduce exposure or entirely avoid it. This agility allows you to adapt to changing market conditions and potentially increase your returns.

In conclusion, creating a DIY portfolio gives you control over your investments and the opportunity to maximize your returns. It requires careful research, consideration of your investment goals, and the use of appropriate tools. By taking a DIY approach, you can bypass hefty management fees, increase your financial literacy, and potentially achieve your long-term financial objectives.

- Make a Drawing Portfolio

- Step 1 Bend It

- Expand your network

- Tell your story with an about page

- Let visitors get in touch through a contact page

- Reach your audience with email and social media tools

- The Simple DIY Portfolio That Has Beaten The Pros

- Videos:

- DIY PORTFOLIO FOLDER | Simple and Easy Folder Design Ideas

Make a Drawing Portfolio

If you’re someone with a passion for drawing, creating a drawing portfolio can be a great way to showcase your talent and creativity. Whether you’re an aspiring artist or looking to establish yourself in the industry, a well-curated portfolio can open doors and attract opportunities.

The first step in creating a drawing portfolio is to gather your best artwork. Choose drawings that represent your style, skill, and unique perspective. Consider including a variety of subjects and mediums to showcase your versatility.

Next, organize your drawings in a logical and visually appealing manner. You can arrange them chronologically or group them by theme or style. Use a physical portfolio or create a digital one by scanning your drawings and creating a website or online gallery.

When putting together your portfolio, be sure to include a brief artist statement. This statement should give a concise overview of your artistic goals, inspirations, and philosophy. It provides context for your work and helps viewers understand your artistic journey.

To add professionalism to your portfolio, consider including a resume or CV highlighting your education, exhibitions, awards, and any relevant experience. This will show potential employers or clients that you are serious about your craft and have a track record of success.

In addition to your finished drawings, consider including some sketches or works-in-progress. This gives viewers a glimpse into your creative process and shows that you are constantly evolving and experimenting with new ideas.

If you’re looking to take your drawing portfolio to the next level, consider creating a series or narrative. A series of related drawings can tell a story or explore a theme in depth. This adds depth and cohesion to your portfolio and shows your ability to create a body of work.

Lastly, don’t forget to regularly update your portfolio. As you create new drawings, replace older ones with your latest and best work. This shows that you are consistently improving and staying active in your artistic practice.

Remember, creating a drawing portfolio is an ongoing process. It’s a reflection of your artistic journey and a tool for self-promotion. Put time and effort into curating your portfolio, and you’ll be well on your way to attracting the attention of art galleries, exhibitions, and potential clients.

Step 1 Bend It

Once you have an idea of what your DIY portfolio will look like, it’s time to start putting it together. The first step is to bend it to your financial plan and goals. This means creating a page on your website where you can list all of your investments and their respective returns.

When listing your investments, it’s a good idea to include the name of the stock, fund, or financial tool, the amount you’ve invested, and any quarterly or annualized returns you’ve earned. You can also include other important information, such as the risk level and management fees associated with each investment.

While DIY portfolios can be a great way to increase your financial returns, it’s important to exercise caution when relying on them. Investing in individual stocks or riskier investments can lead to higher returns, but they can also lead to losses. That’s why it’s important to diversify your portfolio and not put all of your eggs in one basket.

Another way to bend your DIY portfolio is to think about your audience. If you’re planning on using your portfolio as a tool to attract potential clients or investors, you’ll want to make sure it looks professional and is easy to grasp. Consider using graphics, charts, or other visual tools to make your portfolio more visually appealing.

Lastly, it’s important to expand your network and reach out to others who have done DIY portfolios. This can help you learn from their experiences and avoid making the same mistakes. You can join online communities, attend finance conferences, or simply reach out to professionals in the industry for advice.

Remember, DIY portfolios can be a great way to take control of your investments and potentially earn higher returns. While they may not be for everyone, if you’re willing to put in the time and effort, you could achieve financial success on your own terms.

Expand your network

If you’ve been putting in the time and effort to create a DIY portfolio, it’s important to consider expanding your network. Networking can open up a vast array of opportunities for you, both professionally and personally.

One way to expand your network is to reach out to professionals in the finance industry. This could mean attending industry events, joining financial forums, or simply reaching out to individuals who have expertise in the area you’re interested in. By networking with these individuals, you can gain valuable insights and potentially even find new investment opportunities.

Social media is another powerful tool for expanding your network. By having a presence on platforms like LinkedIn or Twitter, you can connect with professionals in the finance industry, stay up-to-date on industry news, and even engage with potential employers. Social media lets you reach a much larger audience than simply relying on your personal connections.

Expanding your network also means considering other investment options outside of just stocks. While stocks can be a great investment, they come with their fair share of risks. Consider diversifying your portfolio by investing in other assets like bonds, funds, or even internationally. By spreading your investments across a variety of options, you can decrease your risk and potentially increase your overall return.

Another way to expand your network is to consider participating in employer-sponsored financial programs like a 401(k) or an employee stock purchase plan. These programs offer you the opportunity to invest in your company and potentially earn a higher return. Additionally, participating in these programs shows your employer that you are financially savvy and committed to your long-term financial goals.

Lastly, don’t be afraid to think outside the box when it comes to networking. Consider drawing visitors to your DIY portfolio by having a well-designed website or blog. This lets you showcase your investment strategy and allows others to learn from your experiences. By sharing your insights and expertise, you can position yourself as an authority in the field and attract like-minded individuals to connect with.

Expanding your network is a crucial step in building a successful DIY portfolio. It lets you connect with professionals in the industry, gain valuable insights, and potentially find new investment opportunities. So don’t be afraid to reach out, connect, and let your network grow.

Key Takeaway:

Expanding your network is essential for building a successful DIY portfolio. By networking with professionals, using social media, diversifying your investments, participating in employer-sponsored programs, and thinking outside the box, you can connect with others, gain valuable insights, and find new investment opportunities.

Tell your story with an about page

When it comes to creating a DIY portfolio, one important aspect is telling your story. Providing an about page on your portfolio website allows potential investors to get to know you and your background, helping them feel more connected to your investment journey.

But crafting an effective about page requires some caution. While it’s essential to share details about your investment experience, it’s also crucial to strike a balance. Avoid sharing too much personal information that could compromise your security.

Start by outlining your investment journey. Tell your audience what initially sparked your interest in finance and how you began investing. Did you have a mentor who guided you? Or did you learn on your own through books and online resources?

Highlight any notable achievements or successes you’ve earned along the way. For example, maybe you’ve consistently achieved above-average returns on your investments or have successfully navigated through industry downturns.

Be humble and transparent about the risks involved in investing. Share any mistakes or losses you’ve encountered and what you learned from them. This demonstrates that you have a realistic grasp of the ups and downs of the market and the importance of diversifying your investment portfolio.

If you have any direct experience in specific sectors or international markets, mention those as well. This can provide potential investors with confidence that you have a broader perspective and are not solely relying on familiar stocks and fixed-income investments.

When describing your investment philosophy, think about how you can best showcase your approach. Do you lean towards conservative investments or prefer to embrace riskier opportunities? Are you more focused on long-term growth or short-term gains?

Lastly, if you have any relevant education or certifications in the field of finance or investing, be sure to include those details. This helps establish your credibility and expertise.

Overall, your about page should be an honest and compelling story of your investment journey. By sharing your experiences, successes, and lessons learned, you can build trust with potential investors and show them why they should consider investing with you.

Let visitors get in touch through a contact page

When you post your DIY portfolio online, it’s important to give visitors the opportunity to get in touch with you. One way to do this is by including a contact page on your website.

A contact page lets visitors reach out to you via email or through a form on your site. This is a crucial component of any portfolio, as it allows potential clients or employers to get in touch with you for opportunities or inquiries.

Having a contact page is especially important if you’re using your DIY portfolio as part of your job search or freelancing efforts. It provides an easy way for employers to reach out to you and schedule interviews or discuss potential projects.

When creating your contact page, there are a few things to consider. First, make sure to include a professional email address that you regularly check. This will ensure that you don’t miss any important messages from potential clients or employers.

You can also include a form on your contact page that visitors can use to send you a message directly through your site. This can be a secure and convenient way for visitors to get in touch without having to open their email client.

Keep in mind that while a contact page is important, it’s also essential to manage your expectations. Not every visitor will reach out to you, and that’s okay. Some may simply browse your portfolio and move on, while others may prefer to contact you through social media or other means.

Overall, including a contact page in your DIY portfolio lets visitors know that you’re open to communication and interested in hearing from them. It shows that you value their input and are willing to engage with your audience. So don’t forget to add a contact page to your portfolio and make it easy for visitors to get in touch!

Reach your audience with email and social media tools

Email and social media tools are powerful means of reaching your target audience and promoting your DIY portfolio. Whether you’re an individual investor or a small business owner, utilizing these tools can help you expand your reach and increase your chances of success.

One of the most effective ways to reach your audience is through email marketing. Building a list of subscribers who are interested in your portfolio and sending them regular updates can keep them engaged and informed. By providing them with valuable content, you can build trust and establish yourself as an authority in your industry.

Using social media platforms such as Facebook, Twitter, and LinkedIn can also help you connect with your audience. These platforms allow you to share your portfolio updates, industry news, and valuable insights with your followers. By engaging with your audience on a personal level, you can build relationships and attract new visitors to your website or social media pages.

When it comes to investing, diversification is key. A DIY portfolio allows you to bend and mold your investments to suit your individual needs and goals. By diversifying your portfolio across different asset classes, industries, and geographies, you can reduce the risk of any one investment negatively impacting your overall returns.

It’s important to approach investing with caution and humility. While it may be tempting to try and time the market or chase high returns, evidence has shown that it’s nearly impossible for individual investors to consistently beat the market. Instead, focus on creating a well-diversified portfolio that aligns with your long-term financial goals.

If you’re unsure of where to start, a simple DIY portfolio is often the best option. By investing in low-cost index funds or ETFs that track the performance of a specific market index, you can achieve broad market exposure and minimize the risk of individual company failures. This strategy lets you take advantage of market gains while still maintaining a level of caution.

Remember, investing is a long-term game. Instead of getting caught up in short-term market fluctuations, focus on the overall performance of your portfolio over time. A true measure of success is not how your portfolio looks on any given day, but rather how it has grown over the years.

To summarize, reaching your audience through email and social media tools is essential for promoting your DIY portfolio. By providing valuable content, engaging with your audience, and diversifying your investments, you can increase your chances of success and grow your wealth over time.

The Simple DIY Portfolio That Has Beaten The Pros

If you’re interested in investing and want to increase your returns, but don’t have the means to hire a financial advisor or don’t trust the stock pickers, DIY investing may be the right choice for you. DIY investing allows individuals to take control of their own investment portfolio and manage their money directly, without relying on professionals.

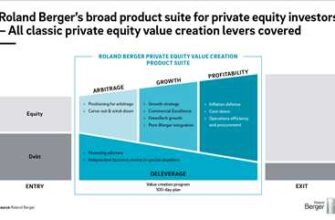

One simple DIY portfolio strategy that has consistently beaten many professional investors is to invest in a diversified mix of low-cost index funds. Index funds are a type of mutual fund or exchange-traded fund (ETF) that aim to replicate the performance of a specific market index, such as the S&P 500. These funds typically have lower fees and are passively managed, meaning they aim to match the index’s return instead of trying to outperform it.

The key to a successful DIY portfolio is diversification. By investing in a variety of different asset classes, such as stocks, bonds, and real estate, you can spread your risk and potentially increase your returns. This diversification can be achieved by investing in a mix of index funds that cover different sectors and regions, both domestically and internationally.

When building your DIY portfolio, it’s important to think long-term and not get caught up in short-term market fluctuations. Investing should be a marathon, not a sprint. Stay focused on your goals and resist the temptation to make frequent changes to your portfolio. Remember that investing is about patience and discipline.

One step at a time, you can start by opening an account with a reputable brokerage firm or financial institution. Many offer easy-to-use online platforms that allow you to buy and sell investments directly. Once your account is open, you can begin to research and select the index funds that align with your investment objectives.

It’s also a good idea to periodically review and rebalance your DIY portfolio. Rebalancing means adjusting the weightings of your investments to maintain your desired asset allocation. This can help ensure that your portfolio stays diversified and aligned with your long-term goals.

While DIY investing can be a conservative approach compared to riskier investment strategies, it’s important to remember that all investing involves some degree of risk. It’s crucial to do your own research and stay informed about market trends and potential risks. Having a well-rounded understanding of the investment industry will help you make informed decisions.

One advantage of a DIY portfolio is that it gives you control over your own financial future. You can customize your portfolio according to your risk tolerance, time horizon, and investment goals. Whether you’re saving for retirement, a down payment on a house, or simply building wealth, a DIY portfolio allows you to take charge of your financial destiny.

Recent evidence shows that DIY investors can achieve annualized returns that are just as good, if not better, than those of professional money managers. The rise of online brokers and financial technology has made it easier than ever for individuals to invest on their own, without the need for an employer-sponsored retirement plan or expensive financial advisor.

Having said that, it’s crucial to approach DIY investing with caution and humility. No strategy is foolproof, and investing always carries some level of risk. It’s important to diversify your portfolio, stay informed, and be willing to admit when you’ve made a mistake. DIY investing requires discipline and a long-term mindset.

In conclusion, a simple DIY portfolio consisting of low-cost index funds can beat the pros while still being accessible to individual investors. By drawing caution, staying informed, and investing for the long haul, DIY investors have the potential to achieve their financial goals and build wealth over time.