Budgeting your monthly income is a smart financial move that can help you take control of your finances and plan for the future. It’s important to know where your money is going, how much you have coming in, and how much you should allocate for various expenses. This can be especially useful if you’re living on a tight budget or trying to save for a specific goal.

The first step in budgeting your monthly income is to take a close look at your income sources. Line up all the different sources of income you have, like your paycheck, side hustles, or any other sources. Determine how much you earn in a month and make a note of it. This will give you a clear picture of how much money you have to work with.

Once you know how much you’re earning, the next step is to plan how much you want to allocate to different expenses. Take stock of your household expenses, like rent, utilities, groceries, and transportation. Also, consider any other expenses you may have, like debt payments or savings goals. This will help you determine how much you should allocate to each category.

Learning the basics of budgeting can be helpful if you’re new to budgeting or if you’ve struggled with it in the past. It can also be helpful if you like having a structured plan to follow. Budgeting helps you build a financial foundation, where you’re always aware of where your money is going and how much you have left. It’s a powerful tool that can help you stay on track and reach your financial goals.

How to Budget Monthly Household Expenses

When it comes to managing your finances, having a budget is essential. A budget is a plan that helps you build a financial foundation, so you can take control of your money and achieve your financial goals. If you’re new to budgeting, it’s important to learn the basics and understand how to budget your monthly household expenses.

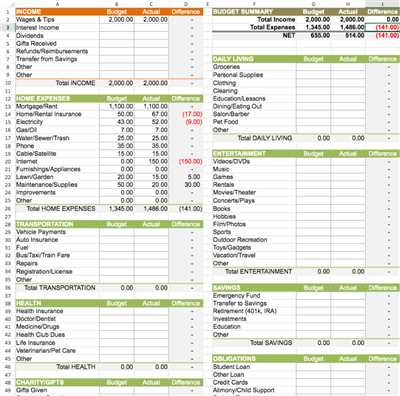

The first step in budgeting is to open up a spreadsheet or grab a piece of paper and write down all of your monthly income sources. This could include your paycheck, any side gigs or part-time jobs, and any other sources of income you have. Then, write down all of your monthly expenses. This includes your rent or mortgage payment, utilities, groceries, transportation costs, debt payments, and any other regular expenses you have.

Once you have your income and expenses written down, it’s time to analyze your budget. Take a hard look at your expenses and determine which ones are essential and which ones you can cut back on. Look for areas where you can save money, like cooking at home instead of eating out, or canceling unused subscriptions. By making small changes to your spending habits, you can free up more money to put towards your financial goals.

Next, set a budget for each category of expense. This will help you stay on track and ensure that you’re not overspending in any one area. Allocate a certain amount of money for groceries, transportation, and entertainment, and stick to those limits. Remember to prioritize your savings and debt payments, as these are crucial for building a solid financial future.

Tracking your expenses is just as important as creating a budget. Keep a record of all your spending, either on a spreadsheet, using a budgeting app, or even with pen and paper. This will help you see exactly where your money is going and spot any areas where you may be overspending. It will also allow you to make adjustments to your budget as needed.

Budgeting may feel restrictive at first, but it’s a powerful tool that can help you take control of your finances. By creating a budget and sticking to it, you’ll be able to build a solid financial foundation, pay off debt, save for the future, and achieve your financial goals. So, take the time to learn how to budget your monthly household expenses and enjoy the long-term benefits it will bring.

Budgeting by paycheck

When it comes to managing your finances, budgeting by paycheck can be an effective strategy. This method helps you allocate your monthly income and expenses based on each paycheck you receive.

First, you need to establish the basics of your monthly budget. Take into account how much income you have coming in each month, including all sources such as your job, investments, or any side hustles. Then, make a list of all your fixed expenses like rent or mortgage payments, utilities, and monthly subscriptions.

Once you have a clear understanding of your income and expenses, you can then start to build your budget around your paychecks. Open a spreadsheet or use a budgeting app to help you keep track of your finances. List all your income sources and their amounts, and then calculate how much you will receive from each paycheck.

Next, assign your expenses to each paycheck. Start by covering the essential expenses like rent, utilities, and groceries. Then, allocate a portion of your income for savings and emergency funds. It’s important to prioritize these savings to ensure financial stability in the long run.

After taking care of the necessary expenses and savings, you can allocate the remaining funds for discretionary spending. This includes things like entertainment, dining out, or non-essential shopping. It’s important to set a realistic limit for yourself and stick to it to avoid overspending.

By budgeting by paycheck, you can ensure that all your expenses are covered and that you’re not living beyond your means. It provides a structured plan for your financial goals and helps you stay on track. Monitoring your budget regularly will also help you identify any areas where you can cut back or make adjustments.

In conclusion, budgeting by paycheck can be a helpful approach to managing your finances and staying on top of your monthly expenses. It allows you to take control of your financial situation and build a solid foundation for a healthy financial future.

Household Budget Basics

Creating a household budget is a crucial first step in building a strong financial plan. By learning how to budget your monthly income, you take control of your financial future and ensure you’re on the right track towards achieving your goals.

The first thing you need to do is open a line of communication with yourself and your paycheck. Take a long look at your income sources and determine how much you will have to work with each month. This will help you get a clear picture of your financial situation and allow you to set realistic goals.

Once you know how much money is coming in, it’s time to take a closer look at your expenses. Start by listing your recurring monthly bills like rent or mortgage payments, utilities, and insurance. Then, factor in other expenses like groceries, transportation, and entertainment. Be thorough and include every expense, no matter how small.

Now that you have a clear picture of your income and expenses, it’s time to create your budget. This is where a budgeting tool or app can be a big help. There are many online resources and apps available that can assist you in creating and managing your household budget.

With a budget in place, you can track your spending against your income and make adjustments as needed. It helps you stay on track and avoid overspending. A budget also gives you the opportunity to see where you can cut back on expenses and save for future goals, whether it’s a vacation, a new car, or retirement.

Remember, budgeting is not a one-time task. It’s an ongoing process that requires regular review and adjustments. As your income or expenses change, you should update your budget accordingly to ensure it remains accurate and effective.

By mastering the basics of household budgeting, you’ll be in a better position to manage your finances, reduce debt, and save for the future. So take the time to learn how to budget, and you’ll be on your way to financial success!

The bottom line

In order to build a strong financial plan for your household, budgeting is key. By learning how to budget your monthly income, you will have a better understanding of how much money you have coming in and what expenses you need to cover. This will help you open up new sources of financial help and allow you to have a clearer picture of your overall financial health.

The basics of budgeting are simple. First, you need to take a long and hard look at your paycheck and determine how much money you have each month. Then, you need to list all of your expenses, like your rent or mortgage payment, utilities, groceries, and transportation costs. By subtracting your expenses from your monthly income, you can see how much money you have left over.

Once you have the bottom line, you can then decide how you want to allocate that money. It’s important to prioritize essential expenses like housing, food, and utilities, but you should also make room for saving and investing. Think about your financial goals and how you can use the money you have to help achieve them.

| Income | Expenses |

|---|---|

| Paycheck | Rent/Mortgage |

| Additional income | Utilities |

| Groceries | |

| Transportation | |

| Other |

By creating a budget and sticking to it, you can avoid overspending and ensure that your financial future is secure. Budgeting helps you take control of your finances and make sure you have enough money to cover your expenses and save for the future. It may take some time and effort to find the right budgeting strategy that works for you, but the benefits are well worth it.

Sources

When it comes to budgeting, it’s important to know where your money is coming from. Understanding your sources of income will help you build a solid budget.

The first step is to take a long, hard look at your monthly paycheck. This is the bottom line that you will be working with when creating your budget.

Then, open up your financial statements and look at any additional sources of income you may have. This could include things like side gigs or rental properties.

By learning how much money you have coming in each month, it will be easier to plan your expenses and make sure you are living within your means.

Building a budget helps you prioritize your expenses and allocate your income effectively. It also helps you identify areas where you can cut back and save more money.

Household expenses like rent or mortgage, utilities, groceries, and transportation should be taken into account when creating your budget.

If you’re feeling overwhelmed, don’t worry. There are plenty of resources available to help you. Financial apps and online tools can assist you in budgeting effectively and keeping track of your expenses.

Remember, budgeting is a process, and it takes time to get the hang of it. But with practice and dedication, you will be well on your way to financial stability.