Creating a budget is a crucial step to take if you want to take control of your finances. It can help you keep track of your spending, plan for the future, and make sure that you always have enough money to cover your expenses. But budgeting is not just about keeping a list of your income and expenses. It’s about making conscious decisions about how you want to spend your hard-earned money.

There are many tools and methods that can help you with budgeting, such as using financial apps like EveryDollar or tracking your expenses with spreadsheets. But budgeting is not just about numbers and statements – it’s about understanding your own financial situation and making informed choices about where your money should go.

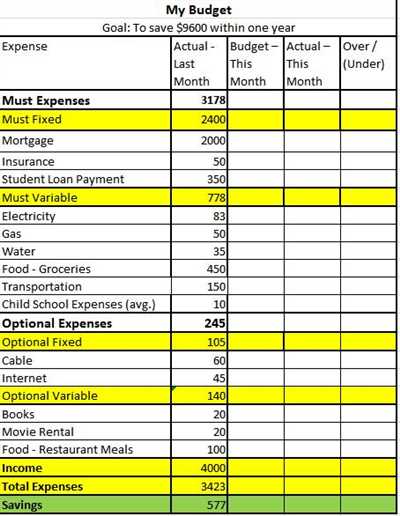

Before you begin creating your budget, it’s important to know about the different areas where your money goes. These may include your rent or mortgage, transportation expenses, utilities, groceries, eating out, entertainment, and much more. By knowing where your money goes, you can focus on those specific areas and make necessary adjustments.

When it comes to budgeting, every dollar counts. That’s why it’s crucial to track your expenses regularly and make adjustments whenever needed. By keeping a close eye on your spending, you can identify areas where you can cut back and make extra savings. For example, you may realize that you’re spending too much on eating out or transportation, and by making changes in these areas, you can save a significant amount of money over the course of a month.

Creating a budget also means accounting for unexpected expenses. Life is full of surprises, and it’s always a good idea to have a contingency fund to cover those unexpected costs. By setting aside a portion of your income for emergencies, you can be better prepared for whatever comes your way.

So, how do you begin creating a budget? It’s not as complicated as it may seem. Start by listing all your sources of income – whether it’s from your regular job, a side hustle, or a business you run. Next, make a list of all your planned expenses, such as rent, utilities, transportation, groceries, and so on.

Once you have these lists, think about how much money you want to allocate to each expense category. It’s important to be realistic and prioritize your needs over wants. For example, if you want to increase your savings or pay off debt, you may need to cut back on discretionary expenses like eating out or entertainment.

Remember, budgeting is an ongoing process. It’s not something you set and forget – it requires regular review and adjustment. As your income or expenses change, you may need to make changes to your budget. And that’s totally fine – budgeting is a flexible tool that can adapt to your changing financial situation.

By following these steps and developing a budget that works for you, you’ll be able to take control of your finances and make smarter financial decisions. No matter how much or how little money you have, budgeting can help you make the most of it and achieve your financial goals.

- Six Steps to Budgeting

- How to create a budget from scratch

- How to Make a Budget in 5 Steps

- Step 1: List Your Income

- Step 2: List Your Expenses

- Step 3: Subtract Expenses From Income

- Step 4: Track Your Expenses All Month Long

- Step 5: Make a New Budget Before the Month Begins

- Identify ongoing expenses

- Video:

- How to Prepare an Annual Budget for a Company

Six Steps to Budgeting

Creating a budget is an essential step towards taking control of your financial situation. By understanding your income and expenses, you can make informed decisions about where your money is going and how to achieve your financial goals. Here’s a six-step process to help you get started:

- Identify your income: Start by listing all sources of income, such as your salary, side hustle, or rental business. Add up the total amount you expect to receive in a month.

- List your expenses: Write down all your monthly expenses, including rent or mortgage payments, transportation costs, groceries, eating out, utilities, and any other regular bills you have. Be as detailed as possible and track your spending for a month to get a clear understanding of where your money goes.

- Categorize your expenses: Group your expenses into categories, such as housing, transportation, food, entertainment, and savings. This will help you see where you’re spending the most and where you can cut back if needed.

- Create a zero-based budget: With a zero-based budget, you assign every dollar a specific purpose. Subtract your expenses from your income to see if you have any extra money left over. If not, you may need to re-evaluate your spending and adjust accordingly.

- Set goals: Determine what financial goals you want to achieve, such as saving for a down payment on a house or paying off debt. Break these goals down into smaller, achievable milestones to stay motivated.

- Track and adjust: Regularly review your budget and compare it with your actual spending. Make adjustments as needed to stay on track and ensure you’re making progress towards your goals.

Remember, budgeting is an ongoing process. It may take some time to get used to managing your money in this way, but with practice, it will become easier. By taking control of your finances and being intentional with your spending, you can achieve financial stability and work towards building a secure future.

How to create a budget from scratch

Creating a budget is always a good idea, whether you are starting with zero or have some money saved up. By budgeting, you will know exactly where your income is going and how to allocate it in the most efficient way. The process may seem overwhelming at first, but with a clear plan and some discipline, you can create a budget that works for your needs.

Step 1: Assess your current financial situation. Take a look at your bank statements, bills, and income sources to get a clear picture of your financial standing. Make sure you track every little expense, such as groceries, rent, transportation, and other monthly-specific costs. By accounting for each penny, you’ll be able to focus on how much money you’re making and where it is all going.

Step 2: Set specific financial goals. Determine what you want to achieve with your budget. Whether it’s paying off debt, saving for a down payment on a house, or funding a family vacation, having clear goals will help you stay motivated and focused.

Step 3: Start with a zero-based budget. A zero-based budget means that every dollar of your income is accounted for and allocated to different categories. Begin by subtracting your planned expenses from your income. If you still have money left over, allocate it towards your financial goals. This way, you ensure that you aren’t overspending and everything has a purpose.

Step 4: Track your expenses. Once you have your budget in place, it’s important to track your spending to see if you are staying on track. Use tools such as budgeting apps or spreadsheets to keep a record of your expenses. By making this a monthly habit, you’ll be able to make adjustments and catch any overspending behaviors.

Step 5: Make adjustments as needed. Budgeting is not a one-time thing; it’s a continuous process. As your financial situation changes or unforeseen expenses arise, be prepared to make adjustments to your budget. Flexibility is key to staying on track with your financial goals.

By following these steps, you can create a budget from scratch that aligns with your financial goals and helps you take control of your money. Remember, budgeting may require some discipline and sacrifice, but in the long run, it will provide you with financial freedom and peace of mind.

How to Make a Budget in 5 Steps

Creating a budget is an essential step in managing your finances effectively. It allows you to track your expenses, identify areas where you can save money, and work towards your financial goals.

Here are five steps to help you make a budget:

- Step 1: Identify your income and expenses: Before you begin budgeting, you need to know how much money you have coming in and going out. Take into account all sources of income, such as your salary, side hustle, or any other income streams. On the expense side, list all your regular expenses, such as rent/mortgage, utilities, groceries, transportation, and any other recurring expenses.

- Step 2: Track your spending: To create an accurate budget, you need to know where your money is currently going. Keep track of every penny you spend for a month. This will help you identify areas where you can cut back or make adjustments.

- Step 3: Establish your financial goals: Knowing what you want to achieve financially will help guide your budgeting decisions. Whether you want to save for a down payment on a house, pay off debt, or build an emergency fund, having specific goals will give your budget a clear direction.

- Step 4: Create a budget: Now that you have all the necessary information, it’s time to create your budget. There are various budgeting methods you can choose from, such as the zero-based budget, where every dollar is accounted for. Allocate funds for each expense category, including savings and debt payments. Be realistic and adjust your budget as needed.

- Step 5: Review and adjust: Budgeting is an ongoing process. Regularly review your budget and compare it to your actual spending. Make adjustments as necessary to ensure that you are staying on track towards your financial goals. If there are any unexpected expenses or changes in your income, make the necessary adjustments to your budget.

By following these five steps, you will be on your way to creating a budget that works for you. Remember, budgeting is not about restricting yourself from spending money but rather being intentional about where your money goes. So, take the time to plan and track your expenses, and you will have better control over your finances and be able to achieve your financial goals.

Step 1: List Your Income

Before you can begin budgeting, it’s important to know exactly how much money you have coming in each month. This will help you determine how much you can afford to spend in other areas.

Start from scratch and make a list of all your sources of income. This can include your regular paycheck, any side hustles or additional jobs, rental income, or income from a business you own. Be as specific as possible and include both fixed and variable income.

Once you have your list, add up all the amounts to get your total monthly income. This is the amount of money you have available to allocate towards your expenses and savings.

It’s always a good idea to have an ongoing account of your income, so consider setting up a separate bank account specifically for budgeting purposes. This means you can easily track your income and keep it separate from your regular spending.

For example, if you’re a couple working and you both have separate incomes, you can either combine them into one joint account or keep them separate in individual accounts. Whatever works best for you and your situation.

By listing your income and knowing exactly how much money is coming in each month, you will be better equipped to create a budget that aligns with your financial goals and needs.

Step 2: List Your Expenses

Now that you have a good understanding of your income and financial goals, it’s time to take a closer look at your expenses. Budgeting begins with identifying all of your ongoing and month-specific expenses. This step is crucial because it will give you a clear picture of where your money is going and what changes you may need to make in order to achieve your financial goals.

Here’s how you can begin listing your expenses:

- Start with your regular monthly bills, such as your mortgage or rent payment, utilities, transportation costs, and any other fixed expenses that you have. Keep in mind that these expenses are ongoing and will need to be paid every month.

- Next, identify those expenses that are not fixed but still occur regularly, such as groceries, eating out, entertainment, and transportation needs. These expenses may vary from month to month, but they are still an important part of your budget.

- Now, consider any personal or business expenses that you may have. If you’re a business owner, you’ll need to separate your personal and business expenses to get a clear picture of your financial situation. Make sure to include sales and income statements if you have them.

- Don’t forget about those little expenses that can add up over time, such as coffee, snacks, or subscriptions. Even though these expenses may seem insignificant, they can have a big impact on your budget if you’re not tracking them.

- Finally, create a contingency line in your budget. This means setting aside some extra money for unexpected expenses that may come up during the month. It’s always good to have a little extra in case something unexpected happens.

Tracking your expenses can be a time-consuming process, but it’s worth the effort. By regularly reviewing and updating your budget, you’ll gain a better understanding of your spending habits and be able to identify areas where you can cut back or make changes. Remember, the more you know about your expenses, the better you can control your finances and work towards your financial goals.

Step 3: Subtract Expenses From Income

Once you have accounted for all your income and identified your specific expenses, it’s time to subtract your expenses from your income to create a budget. This step is crucial in budgeting as it helps you see where your money is going and if you’re spending more than you earn.

A good way to approach this step is by creating a zero-based budget. This means that every dollar you have coming in is accounted for and allocated towards a specific expense or savings goal. By giving every dollar a job, you can ensure that you’re using your money intentionally and not overspending in any area.

Here’s an example of how this step works:

| Income | Expenses | Remaining |

|---|---|---|

| $2,500 (monthly income) | $1,000 (rent) | $1,500 |

| $300 (utilities) | $1,200 | |

| $200 (groceries) | $1,000 | |

| $100 (transportation) | $900 | |

| $50 (entertainment) | $850 | |

| $200 (savings) | $650 |

In this example, the person’s total income is $2,500 per month, and their expenses amount to $1,850. This leaves them with $650 remaining, which they can use for additional savings or any unexpected expenses that may come up.

Remember, creating a budget is an ongoing process, and it’s important to regularly review and adjust your budget based on changes in your income or expenses. By following this step-by-step process, you can gain more control over your finances and work towards your financial goals.

Step 4: Track Your Expenses All Month Long

Now that you have created a zero-based budget, it’s time to start tracking your expenses. This step is crucial in ensuring that you stay on track with your budget and achieve your financial goals.

You’re probably wondering how exactly tracking your expenses works. Well, it’s simple. Each time you make a purchase or spend money, you need to record it. This can be done in various ways, depending on what works best for you.

One popular method is called the “EveryDollar” app. It’s a budgeting app that allows you to track all your expenses in one place. Another option is to use a spreadsheet or a budgeting software program like Mint or YNAB.

Regardless of the method you choose, the key is to track your expenses regularly and consistently. This means that you need to make it a habit to record every penny you spend throughout the month.

By tracking your expenses, you can identify areas where you may be overspending and make necessary adjustments. For example, if you notice that you’re spending too much on groceries, you can make a conscious effort to cut back.

Tracking your expenses also helps you stay accountable to yourself and your financial goals. It’s easy to lose track of your spending if you’re not actively monitoring it. When you see how much you’ve spent in a specific category, it can be a wake-up call to change your habits.

Moreover, tracking your expenses allows you to see the progress you’ve made. You can compare your actual spending with your budgeted amounts and make any necessary changes along the way.

For example, let’s say your monthly mortgage payment is $1,200, but you realize you’ve been consistently budgeting $1,300 for it. By tracking your expenses, you can easily identify this discrepancy and adjust your budget accordingly.

Tracking your expenses also helps you be prepared for any unexpected or irregular expenses that may arise. Life happens, and there may be times when you need to spend a little extra money, like when your car breaks down or when you have a medical emergency. Having a contingency fund accounted for in your budget can help you handle these situations without derailing your financial progress.

Overall, tracking your expenses is an ongoing process that goes hand in hand with budgeting. It may take a little time and effort to get into the habit, but once you do, it becomes second nature.

It’s important to involve your spouse or any other family member you share finances with in tracking your expenses. This way, you’re both on the same page and can support each other in sticking to the budget.

Remember, tracking your expenses is not about micromanaging every single purchase. It’s about having a clear picture of where your money is going and making sure it aligns with your financial goals.

By tracking your expenses all month long, you’ll be able to see how you’re doing and make any necessary adjustments. This will help you stay in control of your finances and ultimately achieve financial freedom.

Step 5: Make a New Budget Before the Month Begins

Once you have gone through the previous steps of budgeting and have accounted for all your expenses, it’s time to make a new budget before the month begins. This is called a zero-based budget.

With a zero-based budget, you start with zero and allocate every dollar towards specific areas. This means that every penny you have coming in is accounted for, whether it’s going towards groceries, rent, mortgage, or your savings goals.

Here’s how to make a new budget for the upcoming month:

- Review your current budget: Take a look at your last month’s budget and see where you’ve spent more or less than you planned. Identify areas where you may need to adjust your spending.

- Set realistic goals: Based on what you’ve learned from your review, set realistic goals for the next month. For example, if you’ve been spending too much on eating out, you may want to focus on cooking at home more often.

- Allocate your income: Take into account your expected income for the next month. Subtract your fixed expenses like rent or mortgage payments from your income to determine how much you have left for discretionary spending.

- Create a budget for each category: Divide your remaining funds into different categories, such as groceries, transportation, entertainment, and savings. Be specific about how much you want to allocate to each category.

- Track ongoing expenses: Throughout the month, keep track of your expenses and compare them to your budget. This will help you stay on top of your spending and make adjustments as needed.

Remember, budgeting is an ongoing process. You may need to make adjustments as your financial situation changes or unexpected expenses arise. It’s important to regularly review your budget and make necessary changes to ensure you stay on track with your financial goals.

By following these steps, you’ll be able to create a new budget before each month begins. This will help you stay organized, save money, and achieve your financial objectives. Good luck!

Identify ongoing expenses

When creating a budget, it’s important to begin by identifying your ongoing expenses. These are the expenses that you have every month and are necessary for your day-to-day living. They include things like rent or mortgage payments, utilities, groceries, transportation, and any other regular expenses you may have.

To start, make a list of all your expenses and categorize them into different groups. This will help you see where your money is going and allow you to make necessary adjustments. For example, you may realize that you’re spending too much on eating out and not enough on savings. Knowing this information will allow you to make changes and be more intentional with your spending.

One good way to track your ongoing expenses is to look at your past bank statements and credit card statements. This will give you a clear picture of where your money has been going and how much you’ve been spending each month.

Next, think about any upcoming expenses that may not occur on a monthly basis. These could be things like annual insurance premiums, property taxes, or car maintenance. While these expenses may not be happening every month, they should still be accounted for in your budget.

Once you have a clear understanding of your ongoing and upcoming expenses, you can begin to create a budget based on your income. It’s important to be realistic and not to overestimate your income. If you’re self-employed or rely on irregular income such as sales commissions, it’s best to base your budget on your lowest expected monthly income.

Don’t forget to include a contingency fund in your budget. This is money set aside for unexpected expenses or emergencies. Having a contingency fund will give you peace of mind and help you stay on track even when unexpected expenses arise.

Lastly, it’s always a good idea to involve your spouse or partner in the budgeting process. Their input and involvement can help ensure that your budget reflects both of your needs and goals.

In summary, identifying your ongoing expenses is the first step in creating a budget. By tracking your expenses and knowing where your money is going, you can make informed decisions about how to best allocate your income.

| 1. | Focus on month-specific expenses such as rent or mortgage payments, utilities, and groceries. |

| 2. | Don’t forget to account for irregular expenses like annual insurance premiums and car maintenance. |

| 3. | Track your expenses by looking at past bank and credit card statements. |

| 4. | Make a contingency fund for unexpected expenses or emergencies. |