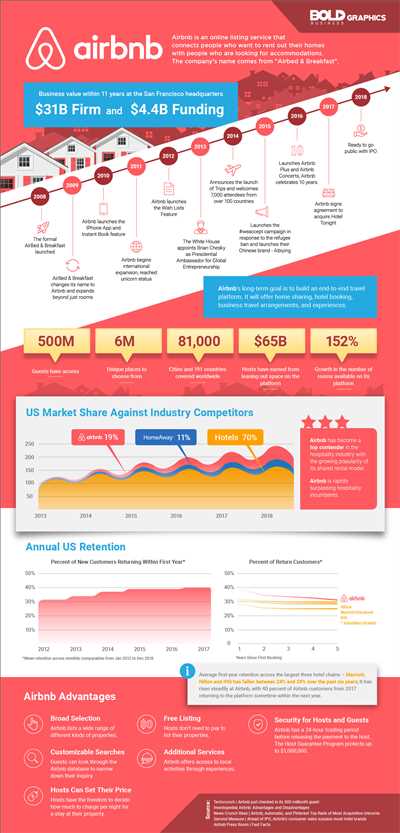

Starting an Airbnb business can be an exciting venture that allows you to break out of the traditional 9-5 work routine and become your own boss. With over 5 million listings worldwide and a presence in over 190 countries, Airbnb has revolutionized the way people find accommodations and opened up a new form of income for property owners.

Before you decide to become an Airbnb host, there are several factors to consider. Firstly, you should assess whether your property is suitable for hosting guests. This includes looking at factors such as location, size, amenities, and utilities. Additionally, you’ll need to check whether your local regulations and homeowners association allow short-term rentals.

Once you’ve determined that your property is suitable for hosting, you’ll need to create a budget and consider the costs involved. Purchasing furniture, linens, and other amenities can add up quickly. You should also factor in expenses such as maintenance, cleaning, marketing, and mortgage, if applicable. It’s vital to be realistic about the potential income you can generate and whether it aligns with your personal financial goals.

When it comes to setting the right price for your Airbnb listing, you’ll need to take into account market rates, competition, and any additional services or perks you offer. Research similar listings in your area and consider what unique selling points your property has to offer. Providing exceptional customer service and attention to detail can significantly impact your guest’s experience and the reviews they leave, which in turn can influence future bookings.

Before you open your doors to guests, there are some legal and administrative details you’ll need to address. This includes obtaining any necessary licenses or permits, setting up the right legal structure for your business, and ensuring compliance with local regulations regarding taxes, safety, and privacy. Clear communication with your guests, especially when it comes to house rules and expectations, is also essential for a successful hosting experience.

Finally, you should consider the marketing aspect of your Airbnb venture. While Airbnb provides a platform for exposure, you’ll still need to put in some effort to stand out from the crowd. High-quality photographs, a well-written description, and strategic use of keywords can enhance your listing’s visibility and attract potential guests. Utilizing social media and other online marketing channels can also help amplify your reach and attract more bookings.

Starting an Airbnb business is not without its challenges, but with careful planning, attention to detail, and a focus on delivering exceptional guest experiences, you can create a successful and profitable venture. So, if you’re ready to embark on this exciting journey, it’s time to start climbing the Airbnb hosting mountain!

- How to Start an Airbnb Business

- Getting started – Airbnb business basics

- Short-term rental permits

- Short-term rental taxes

- Airbnb fees

- How Does Airbnb Hosting Work

- 1 Decide on Your Budget

- 2 Choose Your Rental Market

- 3 Name Your New Airbnb Host Business

- 4 Form a Legal Business Entity

- 5 Get Your Taxes in Order

- 6 Choose a Location

- 7 Sort Out Permits and Licenses

- 8 Open a Business Bank Account

- 9 Acquire Business Insurance

- 10 Look at Properties on the Market

- 11 Buy the Property

- Create an Airbnb Business Plan

- 13 Create Your Airbnb Listing

- 14 Be Successful Small Business Owners of an Airbnb Business

- Video:

- How to start an Airbnb business in 2023 | THE ULTIMATE FREE COURSE

How to Start an Airbnb Business

Starting an Airbnb business can be an exciting venture, but it requires careful planning and consideration. There are several key factors to keep in mind when getting started:

- Research the market: Before diving in, it’s essential to research the market in your area. Take a look at other Airbnb rentals, especially those that are similar to what you envision for your own. This will help you determine the demand and whether there is room for your business to thrive.

- Understand local regulations: Each state, city, and even neighborhood may have different regulations and zoning rules for short-term rentals. Make sure you are familiar with all the legal requirements and obtain any necessary permits to ensure you are in compliance.

- Create a business plan: Having a solid business plan will help guide your decisions and keep you on track. It should include details on your target market, pricing strategy, marketing plan, and financial projections. A thorough analysis of expenses and potential income is crucial.

- Open a bank account: Separate your personal finances from your Airbnb business by opening a dedicated bank account. This will make it easier to track your income and expenses, as well as provide a structured financial standing for your venture.

- Furnish and equip your rental: A well-furnished and well-equipped rental will attract guests and ensure they have a comfortable stay. Consider purchasing furniture, linens, kitchen supplies, and other essentials. Make sure everything is in good condition and meets the standards of your target market.

- Create a listing: Having an appealing and informative listing is crucial to attracting potential guests. Take high-quality photos, write a detailed description, and highlight any unique features or amenities. Additionally, consider having a flexible cancellation policy to prompt bookings.

- Market your rental: Once your listing is live, it’s time to market your rental. Utilize social media, online travel platforms, and other marketing channels to reach your target audience. Engage with potential guests and respond promptly to inquiries to build a positive reputation.

- Ensure privacy and safety: Guests value their privacy and safety, so make sure your rental meets their expectations in this regard. Install secure locks, provide clear guidelines on property access and security measures, and have a plan in place to address any emergencies that may arise during their stay.

- Check for local tax requirements: Depending on your location, you may be required to collect and remit lodging taxes. Check with your local tax office to understand the tax obligations associated with your Airbnb business.

By considering these factors and following the guidelines outlined above, you can start your Airbnb business on the right foot. Remember, acquiring a real estate investment, understanding market demand, and marketing your rental effectively are keys to success in this growing industry.

Getting started – Airbnb business basics

Starting an Airbnb business is an exciting opportunity to create a new source of income and provide a unique experience for travelers. However, before you jump right into it, there are some basics you need to consider and understand to ensure a successful venture.

1. Understand the market: Research the local market to get insights into the demand for vacation rentals. Identify the attractions and target audience that the area offers. Consider factors like the appeal of the location and any travel trends that may impact bookings.

2. Determine your target audience: Decide on the type of travelers you want to attract. Do you prefer families, couples, or business professionals? Knowing your target audience will help you tailor your property and marketing efforts accordingly.

3. Acquire or create an appealing property: If you don’t already have a property, consider purchasing one or transforming an existing space into an attractive rental. Keep in mind that acquiring a property comes with costs like purchasing fees, repairs, and maintenance.

4. Consider insurance and permits: Look into insurance options that cover potential damages caused by guests. Additionally, check local regulations and acquire necessary permits for operating an Airbnb. Failure to do so can result in fines or other legal issues.

5. Set the right price: Determine the price for your listing by considering factors like location, size, amenities, and market rates. Take into account expenses like utilities, cleaning fees, and taxes when setting your nightly rate.

6. Create an attractive listing: Invest time in creating a visually appealing listing with high-quality photos and a detailed description of your property and its amenities. Highlight unique features that make your rental stand out from the competition.

7. Communicate promptly with potential guests: Respond to inquiries and booking requests in a timely manner. Prompt communication can help build trust and encourage potential guests to choose your rental.

8. Take personal factors into account: Consider the amount of time and effort you are willing to invest in hosting. Hosting guests often involves tasks like cleaning, maintenance, and addressing customer concerns.

9. Familiarize yourself with tax obligations: Check with your local tax authorities regarding any filing requirements or tax obligations. Keep track of your expenses and income related to your Airbnb business to ensure you meet all tax obligations.

10. Think about additional services or perks: To make your listing more appealing, consider offering additional services like breakfast, airport pick-up, or pet-friendly accommodations. These extras can attract more guests and potentially increase your earnings.

11. Understand the terms of Airbnb: Read and familiarize yourself with Airbnb’s terms and conditions. Be aware of the fees charged by the platform and any policies regarding cancellations, refunds, and guest behavior.

12. Keep communication open with guests: Once bookings are made, maintain open communication with guests to address any questions, concerns, or issues that arise during their stay. This will help ensure a positive experience and encourage positive reviews.

By following these basics, you can set yourself up for success in starting your Airbnb business. With the right preparation and attention to detail, you can create a profitable and enjoyable venture.

Short-term rental permits

If you’re planning to start an Airbnb business, one vital aspect to consider is obtaining short-term rental permits. These permits are required to legally offer your property for open short-term rentals. Without the proper permits, you could face legal issues and fines.

Depending on your location, the process of acquiring short-term rental permits could vary. You may need to fill out a form, provide personal and business information, and pay fees. Some cities also require you to have certain licenses or meet specific criteria regarding the structure, size, and safety of your property.

Before deciding to offer your property as a short-term rental, take the time to research and understand the regulations and requirements in your area. Make sure you’re willing to comply with all the necessary guidelines and expenses associated with obtaining the permits.

In some cases, you may also need to consider the standing of your property in the market. Analyze the competition and offer a unique selling proposition. This could include having lower prices, enhanced amenities such as free Wi-Fi or pet-friendly accommodations, or a prompt communication and personalized guide for travelers.

Furthermore, keep in mind that short-term rentals come with additional expenses. You may need to purchase extra linens, towels, and furniture to accommodate the guests. Property maintenance and cleaning costs should also be taken into account.

When creating a pricing strategy, consider the cost of utilities, such as electricity and water, as well as any filing or permit fees. It’s essential to ensure that the rental price covers all your expenses and leaves you with a profit.

Finally, having a clear and detailed policy regarding cancellations, pets, check-in/out times, and house rules is crucial for a successful short-term rental business. Travelers appreciate transparency and knowing what to expect during their stay.

In summary, acquiring the necessary short-term rental permits is a crucial step in starting an Airbnb business. It requires understanding the legal requirements, analyzing the market, and ensuring you can cover all the associated costs. By following these guidelines and providing a positive experience for your guests, you can create a successful and profitable venture.

Short-term rental taxes

When starting an Airbnb or any other short-term rental business, it is crucial to understand the tax obligations that come with it. Here are some insights regarding short-term rental taxes:

- Tax obligations: As a short-term rental host, you will be required to pay taxes on the income you earn from renting out your property. This includes both federal and state taxes, so it is essential to keep accurate records and report your earnings.

- Local taxes: In addition to federal and state taxes, many cities and municipalities also impose local taxes on short-term rentals. These taxes can vary significantly from place to place, so it is essential to research and understand the local tax requirements in your area.

- Tax deductions: The good news is that as a short-term rental host, you may be eligible for certain tax deductions. For example, you may be able to deduct expenses such as cleaning fees, supplies, and marketing costs. However, it is crucial to keep detailed records and consult with a tax professional to ensure you take advantage of all eligible deductions.

- Entity structure: Choosing the right entity structure for your short-term rental business can also have tax implications. For instance, setting up a separate legal entity, such as an LLC, may provide certain tax benefits and protect your personal assets.

- Communicating with guests: Effective communication with your guests is essential to ensure a smooth and enjoyable stay. However, it is essential to keep in mind that any fees you charge for amenities or services, such as towels or kitchen use, may be subject to tax.

- Price your rental correctly: Setting the right price for your rental property is crucial to attract bookings and maximize income. However, it is also important to consider the tax implications. Higher rental prices may result in higher tax obligations, so finding a balance between profitability and market competitiveness is key.

- Privacy and data: When operating a short-term rental business, it is important to handle customer data and ensure privacy. Make sure to comply with applicable data protection laws and regulations to avoid any legal issues.

Remember that tax laws and regulations can vary, so it is always best to consult with a tax professional or accountant who can provide personalized advice based on your specific circumstances.

Airbnb fees

When starting an Airbnb business, it is crucial to consider the fees associated with the platform. Understanding these fees is vital for creating a budget and ensuring a profitable operation.

One of the main fees that hosts need to keep in mind is the Airbnb service fee. This fee is charged to buyers as a percentage of the total booking cost. It helps cover the costs of customer support, marketing, and the overall maintenance of the platform. The exact percentage varies based on factors like the location and duration of the stay.

In addition to the service fee, hosts should also consider the costs of listing their property. Airbnb offers different advertising options, such as enhanced listings, which can help boost visibility and attract more potential guests. These options come at an additional cost, but they can significantly enhance a listing’s appeal and increase bookings.

Another important fee to consider is the Airbnb cleaning fee. Many hosts opt to charge a separate fee for cleaning services, which covers expenses like laundry, towels, and general upkeep. This fee is especially crucial for hosts who offer a hotel-like experience, as it helps cover the costs of maintaining high standards of cleanliness.

Airbnb also offers the option for hosts to charge a security deposit to protect against any potential damage to the property. The specific amount is determined by the host, and it is returned to the guest after their stay, provided there are no damages. This fee helps ensure that guests will take care of the property during their vacation.

Hosts should also keep in mind the taxes they may need to pay on their Airbnb income. While laws and regulations vary from location to location, it is important to consult with a tax professional or research local regulations to understand the tax obligations associated with hosting on Airbnb. Understanding and complying with these tax laws is crucial for legal and financial reasons.

In some areas, hosts may also need to meet certain zoning or licensing requirements. These regulations ensure that properties used for short-term rentals comply with local laws and ordinances. It is essential to research and understand the zoning laws and licensing requirements in your area to avoid any legal complications.

Finally, it’s important to consider any extra costs or expenses that may arise from hosting on Airbnb. These can include maintenance and repair costs, utilities, insurance, and potential fees for additional amenities like Wi-Fi, parking, or pet accommodation. Conducting a thorough analysis of the potential expenses and budgeting accordingly is crucial to ensure a successful and profitable hosting business.

| # | Fee |

|---|---|

| 1 | Airbnb service fee |

| 2 | Listing costs (enhancements) |

| 3 | Cleaning fee |

| 4 | Security deposit |

| 5 | Taxes |

| 6 | Zoning and licensing requirements |

| 7 | Additional expenses (maintenance, utilities, amenities, etc.) |

By understanding and accounting for these fees, hosts can make informed decisions and create a solid financial plan for their Airbnb business.

How Does Airbnb Hosting Work

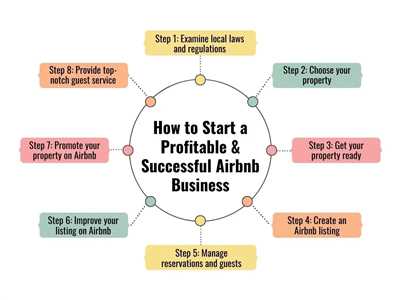

When starting your own Airbnb business, it’s important to have a clear understanding of how the hosting process works. Here is a step-by-step guide to help you get started:

- Decide on the Type of Property: Before you can start hosting on Airbnb, you should determine the type of property you will be renting out, whether it’s a small apartment, a vacation home, or a room in your own house.

- Make Sure Your Property Meets Local Laws and Regulations: Check if there are any zoning or licensing requirements in your area that permit short-term rentals. Additionally, consider if your property needs to meet any specific safety or health standards.

- Get Your Property Ready: Prepare your property to ensure it is clean, well-maintained, and has all the necessary amenities that guests would expect.

- Create a Listing: Use the Airbnb platform to create a detailed and accurate listing for your property. Include attractive photos, a compelling description, and specify any house rules or special instructions.

- Pricing and Availability: Set the price for your rental and decide on the availability calendar. Consider the demand in your area, the seasonality of bookings, and the costs of running and maintaining the property.

- Communicate with Potential Guests: Respond promptly to inquiries and booking requests from potential guests. Answer any questions they may have and provide them with all the necessary information about your property.

- Accepting Bookings: Once a guest decides to book your property, you’ll receive a notification from Airbnb. You can review the guest’s profile and ratings before deciding whether to accept or decline the booking.

- Meeting and Welcoming Guests: When the guest arrives, make sure to greet them personally, provide a tour of the property, and answer any questions they might have. This will help create a positive experience for your guests.

- During the Stay: Be available to address any concerns or issues that may arise during your guests’ stay. Maintain open communication and ensure their privacy and comfort.

- After the Stay: Once the guest checks out, you should inspect the property for any damage or repairs that may be needed. Provide feedback to the guest and leave them a review as well. This will help maintain your standing as a successful host.

Starting an Airbnb business can be a profitable venture, especially in areas with popular attractions like mountain resorts or beach destinations. By offering a unique and well-managed rental experience, you can attract more guests and generate higher profits.

Additionally, it’s important to consider the costs involved in running an Airbnb business. Along with the initial investment of purchasing or preparing the property, there are ongoing costs such as cleaning services, maintenance, insurance, and taxes. Make sure to factor in these expenses when deciding on the right price for your rental.

By understanding how Airbnb hosting works and following the necessary steps, you can create a successful rental business that provides a positive experience for both you and your guests.

1 Decide on Your Budget

Before starting your Airbnb venture, it’s essential to decide on your budget. Sit down and take a look at your finances to determine how much you can afford to invest in this endeavor. Consider expenses such as purchasing or renting the property, ongoing costs like utilities and insurance, and any potential repairs or updates that may be needed.

It’s also crucial to conduct a market analysis to understand the potential returns on investment. Look at similar properties in your area, especially those listed on Airbnb or other short-term rental platforms. Take note of their rental rates, occupancy rates, and any additional fees they charge.

In addition, familiarize yourself with local laws and regulations related to short-term rentals. Some cities or states may have zoning restrictions or require permits to operate vacation rentals. Ensure that your property is in compliance with these regulations to avoid any legal issues in the future.

Furthermore, consider the target audience you want to attract. Will you cater to budget travelers or luxury seekers? This will impact how you furnish and decorate your space. Think about the items you’ll need to provide, such as furniture, towels, and kitchen supplies, and include these costs in your budget.

2 Choose Your Rental Market

When starting an Airbnb, it’s important to choose the right rental market for your business. The first thing to consider is your local market. Look into the demand for short-term rentals in your area and see if there is a need for Airbnb accommodations. Additionally, consider the state laws and regulations regarding short-term rentals to ensure you are legal.

You should also decide whether you want to offer your entire home, a single room, or some other type of accommodation. While offering your entire home may bring in more money, it also comes with more responsibilities, such as keeping it clean and maintained. On the other hand, offering a single room may require less work and cleanliness, but may result in less income.

The next step is to meet the needs of your target market. Consider what type of guests you want to attract and what amenities you can offer them. For example, if you’re targeting business travelers, having a dedicated workspace and reliable Wi-Fi may be important. If you’re targeting vacationers, proximity to local attractions and a comfortable living space may be a priority.

It’s also important to consider the location of your property. A central location may attract more guests, but it may also come with higher price points and more competition from hotels. On the other hand, a less central location may be more affordable, but may have less demand.

Additionally, you need to take into account any legal issues and regulations that may affect your ability to operate as an Airbnb host. Some cities and states have strict laws regarding short-term rentals, and others may require permits or licenses. Make sure you do your research and ensure you are in compliance with all laws before starting your Airbnb venture.

Insurance is another important consideration. While Airbnb does offer some coverage for hosts, it may not be sufficient for all situations. Look into getting additional insurance to protect yourself against any issues that may arise. You may also want to consider utilities and other expenses that you’ll need to cover as a host.

When it comes to financing your Airbnb, you should check with your bank or financial institution to see if there are any specific loans or financing programs available for short-term rental businesses. Acquire the necessary funds to cover expenses such as property purchase, renovations, and ongoing maintenance.

Lastly, name your Airbnb. Having a catchy and memorable name can help you stand out and attract more guests. Make sure the name is descriptive and reflects the unique aspects of your property and location.

3 Name Your New Airbnb Host Business

Choosing a name for your new Airbnb host business is an important step in getting started. The right name can help attract guests and create a strong brand presence. Here are some factors to consider when naming your business:

- Target audience: Think about the type of guests you want to attract. Consider the location of your properties and the attractions nearby.

- Brand personality: Your business name should reflect the unique features and ambiance of your properties.

- Entity structure: It’s important to understand the legal and financial implications of different business structures. Consult with a professional to determine the best structure for your business.

- Insurance coverage: Ensure you have proper insurance coverage to protect your property and guests from any damage or issues that may arise.

- Budget and cost: Consider the expenses involved in running your business, such as permits, licenses, fees, and purchasing supplies like towels and toiletries.

- Profitability: Look at the potential income you could generate through bookings and calculate your expected return on investment.

- Customer services: Having great customer service is crucial for a successful Airbnb host business. Plan how you will meet guests’ needs and enhance their experience.

- Location: Your business name could reflect the location of your properties or the unique features of the area.

- Legal and regulatory compliance: Make sure you understand and comply with any local laws and regulations regarding short-term rentals.

- Differentiation: Consider how you can differentiate your business from other hosts in the area. What unique services or amenities do you offer?

- Long-term goals: Think about your long-term goals for your Airbnb host business and choose a name that aligns with those goals.

Additionally, you should create an Airbnb host account and familiarize yourself with the platform’s policies and requirements. Keeping detailed records of your business activities and expenses is also important for tax purposes.

Remember, the name you choose for your Airbnb host business should be memorable, unique, and reflect the essence of your brand.

4 Form a Legal Business Entity

Before starting an Airbnb, it is important to form a legal business entity. This will help protect your personal assets and ensure that you are operating in compliance with the law. Here are some steps to guide you through the process:

- Choose a business name: Select a name that reflects the nature of your Airbnb business and is not already in use by another company.

- Decide on the type of entity: Determine whether you want to operate as a sole proprietorship, a partnership, a limited liability company (LLC), or a corporation. Each has its own advantages and disadvantages, so it’s essential to do thorough research and analysis to understand what would best meet your needs and targets.

- File the necessary paperwork: Depending on the type of entity you choose, you will need to file the appropriate documents with the relevant government authorities. This may include registering your business name, obtaining a tax identification number, and applying for any required permits or licenses.

- Consider insurance: Insurance is crucial for protecting your property and guests. Airbnb offers a Host Guarantee providing coverage for certain damages, but it’s wise to also invest in additional insurance that will cover any expenses or repairs that fall outside of Airbnb’s coverage. Speak with an insurance agent to determine the best policy for your specific needs.

- Understand zoning laws: Familiarize yourself with local zoning regulations and ensure that your property is allowed to be used for short-term rentals. Some areas have strict rules regarding vacation rentals, and you could face fines or penalties if you operate without proper authorization.

- Set up a separate bank account: Open a business bank account to keep your personal and business finances separate. This will make managing your income, expenses, and taxes much easier and provide a clearer picture of your business’s financial health.

- Market your Airbnb: Create a comprehensive marketing plan to attract potential guests. Consider utilizing online platforms, social media, and other marketing channels to reach a larger target audience. Highlight the unique amenities, attractions, and experiences your Airbnb can offer.

- Keep track of bookings and expenses: Implement a system for managing bookings and tracking expenses related to your Airbnb. This will help you stay organized and ensure that you are properly accounting for income and deducting eligible expenses when it comes time to file your taxes.

- Comply with laws and regulations: Familiarize yourself with any laws and regulations that pertain to operating an Airbnb in your area. This includes understanding your tax obligations and making sure you are collecting and remitting any required sales or occupancy taxes.

- Consider getting professional advice: Starting and running an Airbnb can involve complex legal and financial issues. Consider consulting with an attorney, accountant, or other qualified professionals who can provide insights and guidance specific to your situation.

By forming a legal business entity and following these guidelines, you can start your Airbnb venture with confidence and ensure smooth operations while minimizing risk in the long run.

5 Get Your Taxes in Order

When you start an Airbnb business, it’s important to understand the tax implications. Here are some steps to help you get your taxes in order:

- Understand the Basics: Familiarize yourself with the tax rules and regulations in your state or country. Each jurisdiction may have different requirements for Airbnb hosts.

- Keep Track of Your Expenses: Maintain accurate records of all the expenses related to your Airbnb rental. This includes furniture, repairs, utilities, and any other costs incurred in hosting guests.

- Report Your Income: Airbnb will send you a form 1099 at the end of the year, detailing your earnings. Make sure to report this income on your tax return.

- Claim Deductions: As an Airbnb host, you could be eligible for certain deductions such as cleaning fees, insurance premiums, and expenses for linens and towels.

- Get Professional Help: Consider hiring a tax professional who specializes in short-term rentals or consult with a tax advisor to ensure you’re taking advantage of all available deductions and meeting your tax obligations.

By getting your taxes in order, you can avoid issues with the tax authorities and ensure that you’re keeping your Airbnb business on the right side of the law.

6 Choose a Location

Choosing the right location for your Airbnb property is vital in order to attract the right kind of travelers and keep your bookings standing strong. When deciding on a location, there are several factors to consider.

Firstly, you need to look into the local zoning and licensing requirements. Make sure that you are allowed to rent out your property for short-term stays and that you have the necessary permits and licenses to run an Airbnb. Bypassing these legal issues can result in costly fines and legal matters down the line.

Next, consider the cost of acquiring a property in your desired location. Look into the real estate market and do a thorough budget analysis to determine if your budget aligns with the prices of properties in the area. Additionally, take into account the ongoing expenses such as mortgage payments, utilities, repairs, and insurance.

Once you have found a location that fits your needs and budget, it’s time to think about the property itself. The type of property you choose will greatly impact the kind of travelers you attract and the price you can charge. Consider whether a small apartment, a big house, or even a mountain cabin is the right fit for your target audience.

Furthermore, consider furnishing the property with the necessary items such as furniture, linens, towels, and kitchen equipment. These details can greatly enhance the overall experience for your guests and set you apart from other hosts.

In addition to the property, cleanliness is an important aspect that cannot be overlooked. Guests expect a clean and tidy space, so make sure to allocate time for regular cleanings and inspections.

Lastly, don’t forget about insurance coverage. It is essential to have a proper insurance policy that covers your property and protects you from any potential damages or liabilities caused by guests.

By taking the time to thoroughly research and consider these factors, you can ensure that you are starting your Airbnb venture on the right foot and setting yourself up for success.

7 Sort Out Permits and Licenses

In order to open your property for rentals on Airbnb, you need to check with your local government and understand the permits and licenses required.

Depending on your location, there may be different regulations and requirements for short-term rentals. Some cities or counties have zoning laws that restrict vacation rentals in certain areas or require specific permits for operating as a short-term rental host.

First, you should research the local zoning laws and regulations to ensure that your property is suitable for short-term rentals. Additionally, you may need to acquire a business license or permit in order to legally operate as an Airbnb host. Check with your local government to understand the specific requirements for your area.

It is important to note that having the necessary permits and licenses is not only a legal requirement, but it also gives travelers confidence in staying at your property. They can have trust in your hosting business knowing that you have followed all the necessary procedures and regulations.

When purchasing an insurance policy for your Airbnb property, do a thorough analysis of your coverage options. Some insurance policies may not cover short-term rentals, so you need to choose the right policy that specifically includes coverage for vacation rentals. You should also consider additional coverage for potential damage caused by guests.

Moreover, keeping prompt and open communication with your guests is crucial for a successful hosting experience. Whether it is providing a smooth check-in process, addressing any issues during their stay, or ensuring their needs are met, strong customer service and communication can significantly impact your guest’s satisfaction.

Before leaving your property in the hands of travelers, make sure to sign a rental agreement that clearly outlines the terms and conditions of their stay, such as the length of their stay, the price for the rental, and any rules or restrictions they should follow.

| Permits and Licenses Checklist: | Essential Tasks: |

|---|---|

| 1 | Check local zoning laws and regulations |

| 2 | Acquire necessary permits and licenses |

| 3 | Purchase appropriate insurance coverage |

| 4 | Consider additional coverage for potential damage |

| 5 | Keep open and prompt communication with guests |

| 6 | Create and sign a rental agreement |

By sorting out permits and licenses, understanding local regulations, and ensuring proper insurance coverage, you will be on the right track to operate a successful Airbnb hosting business.

8 Open a Business Bank Account

Once you have decided to become an Airbnb host, it’s crucial to create a separate business bank account. Having a dedicated account for your vacation rental business is essential for several reasons:

- It helps you keep your personal and business finances separate, making it easier to manage your expenses and track your rental income.

- Having a separate account provides a clear paper trail for tax purposes, making it easier to track and report income and expenses related to your Airbnb business.

- It establishes a professional standing for your vacation rental venture, making it easier to create partnerships or secure business loans or mortgages in the future.

- It allows you to offer a seamless booking experience for your guests. By having a separate business account, you can make it easier for travelers to pay and book their stays, knowing they are dealing with a legitimate host.

- Insurance and local licenses may require you to have a separate business account before allowing you to operate as an Airbnb host legally.

When choosing a bank, consider factors such as local convenience, fees, and the level of customer service they offer. Many banks offer specific banking packages for small business owners, so do some analysis to find the one that best suits your needs.

It’s also a good idea to open a separate savings account for your vacation rental business. This can be used to set aside funds for maintenance and repairs, or to save for future property investments.

Finally, remember to keep accurate records of all financial transactions related to your Airbnb business. This will make it easier come tax time and can provide valuable insights into the costs and profitability of your rental properties.

9 Acquire Business Insurance

Once you have decided to start your own Airbnb business, it is important to consider getting business insurance. This is especially crucial for short-term rentals, as there are new laws and regulations that could significantly impact your ability to operate legally. Having the right insurance coverage can protect you from potential financial costs and liabilities.

Firstly, you should enhance your understanding of the laws and regulations regarding short-term rentals in your area. Depending on where you live, there may be zoning laws, licensing requirements, and other factors that you need to be aware of. Additionally, you may need to comply with specific health and safety regulations, such as cleanliness standards or providing certain amenities.

In order to acquire the best insurance policy for your Airbnb business, you will need to provide some details about your property and the services you offer. This could include the number of rooms available, the amenities you provide, and any attractions or landmarks nearby. It’s also important to consider the type of guests you will be hosting, whether they are leisure travelers or business travelers.

When it comes to purchasing insurance, there are a few key factors to consider. Firstly, you should look for a policy that covers both property damage and liability, as well as any potential issues that may arise during bookings. You should also account for any additional services you may be providing, such as cleaning services or utilities. It’s a good idea to target a policy that specifically caters to short-term rental properties, as they will have a better understanding of the unique risks involved.

Furthermore, if you are managing multiple properties or own a small business, it may be beneficial to consider a small business insurance policy that covers all of your properties and supplies. This can help streamline the insurance process and potentially save you time and money in the long run.

Lastly, having business insurance can give you peace of mind and protect your investment. Accidents do happen, and having the right coverage can ensure that you are financially protected in case of any unforeseen circumstances. Whether it’s a guest damaging your property or a legal issue that arises, having insurance can provide you with the necessary coverage to keep your business running smoothly.

10 Look at Properties on the Market

When starting your Airbnb hosting journey, one of the first steps is to look at properties on the market. Finding the right property is crucial for your success as a host, as it will be the foundation of your business. Here are some factors you should consider when looking at properties:

- Location: Choose a property that is in a desirable location for travelers. Look for properties near popular attractions, business districts, or in trendy neighborhoods.

- Size: Consider how many guests you want to accommodate. A smaller property with two bedrooms may be sufficient, while a larger property with multiple bedrooms could attract more guests.

- Condition: Look for properties that are in good standing and require less repairs. This will save you time and money in the long run.

- Kitchen: A well-equipped kitchen is a must-have for many travelers. Make sure the property has a functional and clean kitchen space.

- Utilities: Consider the cost of utilities, such as electricity, water, and internet. These costs should be factored into your budget.

- Zoning Laws: Check the local zoning laws to ensure that short-term rentals are allowed in the area. Some areas may have restrictions or require permits.

- Mortgage or Rent Costs: Determine whether you will be buying a property or renting one. Analyze the costs and choose the option that suits your financial situation best.

- Insurance Coverage: Look into insurance policies that cover short-term rentals. Having adequate coverage will protect your investment.

- Communication and Promptness: Good communication with your guests is essential for a positive hosting experience. Ensure that the property allows for prompt communication.

- Cleanliness and Maintenance: A clean and well-maintained property will attract more guests. Consider the time and cost needed for cleaning and repairs.

By considering these factors, you can enhance your chances of finding the perfect property to start your Airbnb hosting journey. Remember to always keep local laws and regulations in mind to ensure that you are operating legally.

11 Buy the Property

Once you have gone through all the necessary steps, from getting insights into the vacation rental market to understanding the legal issues, it is time to buy the property that will become your future Airbnb rental. This step is crucial and requires careful consideration and planning.

Here are some factors to consider when choosing a property:

Location and Zoning: Decide on the location that will appeal to the target travelers you want to attract. Make sure that the property is located in an area where short-term rentals are allowed, as zoning laws may vary from one area to another.

Property Budget: Determine your budget and set a limit for how much you are willing to spend on acquiring the property. Take into account not only the initial purchase price but also any necessary repairs or renovations that may be needed.

Financial Standing: Make sure that you are financially capable of buying a property. If needed, consult with a bank or other financial institution to secure financing.

Property Inspection: Before making any final decisions, have the property thoroughly inspected to ensure that there are no major structural or maintenance issues that could significantly increase your costs.

Legal and Permits: Make sure that you have all the necessary permits and licenses required to operate your property as an Airbnb rental. Familiarize yourself with local regulations and ensure that you are in compliance with them.

Furniture and Amenities: Consider the furnishings and amenities that you will provide in your rental. This includes everything from linens and towels to kitchen utensils. The more amenities you offer, the more attractive your property will be to potential guests.

Utilities and Expenses: Take into account the costs of utilities such as electricity, water, and internet. Also, consider other expenses such as property taxes, insurance coverage, and any fees associated with operating as an Airbnb rental.

Working with Real Estate Agents: Consider enlisting the help of a real estate agent who specializes in vacation rental properties. They can provide valuable insights and assist you throughout the buying process.

Communication and Bookings: Ensure that the property you buy is in a location that will attract a high number of bookings. Being in a popular travel destination or near tourist attractions can significantly increase your occupancy rate.

By carefully choosing and acquiring the right property, you are laying the groundwork for a successful Airbnb venture. Take the time to understand all the basics and ensure that everything is in order before leaving this step behind and moving onto the next one.

Create an Airbnb Business Plan

When it comes to starting an Airbnb business, it’s crucial to have a well-thought-out business plan in place. This will help guide you through the process and ensure you’re making informed decisions every step of the way.

Here are some key steps you should consider when creating your Airbnb business plan:

| 1 | Understanding the Airbnb Market |

| Before getting started, it’s important to thoroughly research and understand the Airbnb market. This includes getting familiar with the local regulations and laws regarding short-term rentals, as well as analyzing the competition in your area. | |

| 2 | Choosing the Right Property |

| Having the right property is key to a successful Airbnb business. Look for properties that are in desirable locations with easy access to attractions and services. Consider the costs of purchasing or renting the property, as well as any necessary renovations or upgrades. | |

| 3 | Setting the Price and Managing Costs |

| Setting the right price for your Airbnb listing is crucial for attracting guests and maximizing revenue. Take into account factors such as location, property size, amenities, and market demand. Additionally, keep track of your operating costs, such as utilities, insurance, taxes, and cleaning fees. | |

| 4 | Furnishing and Enhancing the Property |

| Having a well-furnished and appealing property is important for attracting guests. Make sure to invest in comfortable furniture, linens, towels, and other amenities. Consider adding a fully-equipped kitchen and providing some basic toiletries and supplies. | |

| 5 | Staying in Compliance with Legal Requirements |

| Ensure that you acquire any necessary permits and licenses required for operating an Airbnb business in your area. Familiarize yourself with any regulations regarding safety, zoning, and taxes. It’s crucial to operate within the legal boundaries to avoid any potential issues. | |

| 6 | Marketing and Sales |

| Develop a marketing strategy to promote your Airbnb listing and attract potential guests. Utilize online platforms, social media, and word-of-mouth marketing techniques to increase your property’s visibility. Provide detailed descriptions, high-quality photos, and highlight the unique features of your listing. | |

| 7 | Effective Communication |

| Establishing clear and prompt communication with your guests is crucial for a positive experience. Respond to inquiries and requests in a timely manner and provide detailed instructions and information about the property. This will help build trust with your guests and encourage positive reviews. | |

| 8 | Keeping guests happy |

| Providing exceptional guest experiences is key to running a successful Airbnb business. Ensure the cleanliness of the property, offer additional services such as airport transfers or guided tours, and address any issues or concerns promptly. Offering privacy and flexibility in terms of check-in and check-out times can also enhance guest satisfaction. | |

| 9 | Managing Bookings and Finances |

| Keep track of bookings, including dates, rates, and guest information. Have a system in place for managing finances, including income and expenses. Set aside funds for maintenance, repairs, and unexpected expenses. | |

| 10 | Property Maintenance and Upkeep |

| Regularly inspect and maintain your property to ensure it is in good condition for guests. Address any maintenance or repair issues promptly to prevent negative reviews or guest dissatisfaction. Consider hiring cleaning services or property management companies to assist with upkeep. | |

| 11 | Personal Safety and Privacy |

| Take necessary measures to ensure the safety and privacy of your guests. Install secure locks, smoke detectors, and provide emergency contact information. Respect guests’ privacy and make sure their personal information is protected. | |

| 12 | Evaluating and Adjusting |

| Regularly evaluate the performance of your Airbnb business and make necessary adjustments. Analyze feedback from guests, monitor occupancy rates, and assess your financials. Continuously look for ways to enhance the appeal and profitability of your vacation rental. |

By following these steps and creating a comprehensive Airbnb business plan, you’ll be well on your way to starting a successful venture in the short-term rental market.

13 Create Your Airbnb Listing

When starting your Airbnb hosting business, creating an appealing and informative listing is crucial. Here are some key factors to consider:

| 1 | Offer the Basics |

| – | Make sure your listing includes all the basic amenities, such as beds, linens, towels, and kitchen supplies. |

| 2 | Choose the Right Name |

| – | Select a catchy and memorable name for your property that will appeal to potential guests. |

| 3 | Highlight Unique Features |

| – | Showcase any unique or standout features of your property, such as a pool, stunning view, or proximity to attractions. |

| 4 | Provide Accurate Description |

| – | Describe your property accurately and honestly, including its size, amenities, and any rules or restrictions. |

| 5 | Add High-Quality Photos |

| – | Include clear and attractive photos that showcase different areas of your property to entice potential guests. |

| 6 | Set Competitive Pricing |

| – | Research similar properties in your area to determine the best price for your listing, taking into consideration factors like location, amenities, and demand. |

| 7 | Consider Taxes and Insurance |

| – | Understand the tax laws and insurance requirements of your location to ensure you are compliant and adequately covered. |

| 8 | Think About Security and Safety |

| – | Implement measures to ensure the security and safety of your guests, such as having functional locks, smoke detectors, and first aid kits. |

| 9 | Consider Offering Additional Services |

| – | Enhance your guests’ experience by offering services like airport transfers, tour guides, or cleaning during their stay. |

| 10 | Communicate Effectively |

| – | Be prompt and professional in your communication with guests, answering their inquiries and providing necessary information. |

| 11 | Manage Bookings and Calendar |

| – | Keep track of your bookings and update your calendar regularly to avoid double bookings and ensure a smooth process. |

| 12 | Consider Professional Support |

| – | If managing your rental property becomes overwhelming, you could consider hiring a property management service to assist you. |

| 13 | Don’t Forget the Final Touches |

| – | Before guests arrive, ensure the property is clean, well-stocked with essentials, and the final touches are in place to create a welcoming and comfortable environment. |

By following these steps, you can start your Airbnb hosting journey on the right foot and increase the chances of attracting guests and generating positive reviews.

14 Be Successful Small Business Owners of an Airbnb Business

Starting an Airbnb business can be a rewarding venture, but it comes with its fair share of challenges. To be successful in this industry, you need to navigate through various aspects, including legal, financial, and operational issues. Here are 14 insights from small business owners who have made their mark in the Airbnb world:

| 1 | Research local laws and regulations |

| 2 | Ensure you have the proper zoning permits |

| 3 | Keep your rentals clean and in good condition |

| 4 | Invest in quality linens and towels |

| 5 | Provide amenities that travelers value |

| 6 | Communicate promptly with your guests |

| 7 | Consider having a local contact for check-ins |

| 8 | Set a fair and competitive rental price |

| 9 | Keep track of your expenses, especially for utilities and supplies |

| 10 | Understand your tax obligations as an Airbnb host |

| 11 | Consider acquiring insurance coverage for your rental property |

| 12 | Make sure your listing stands out with good photos and an attractive description |

| 13 | Build a strong online presence to attract guests |

| 14 | Provide a high level of customer service to gain positive reviews |

By following the advice of these successful small business owners, you can increase your chances of operating a thriving Airbnb business. Remember, attention to detail, professionalism, and understanding local laws and regulations are key to your success.