Creating a budget and setting financial goals can sometimes feel overwhelming. That’s where budget binders come in handy. They are a fantastic way to keep track of your expenses, create a plan, and stay on top of your financial game. Whether you are sinking in debt or just want to keep better track of your spending, a budget binder can be a game-changer.

So how does it work? Well, it’s pretty simple. The first step is to gather all the information you need about your current expenses. This includes bills, credit card payments, monthly expenses, and any other financial obligations you may have. Then, you can use templates or create your own categories to organize your expenses in the binder. This can consist of categories like utilities, groceries, transportation, and miscellaneous expenses.

Once you have categorized your expenses, the next step is to set goals. This is where the magic happens. Set realistic goals for yourself, whether it’s saving for a big purchase, paying off your mortgage, or just having some extra cash for discretionary spending. The key here is to be consistent and follow through.

Now, let’s talk about the main tool in your budget binder – the envelopes. Each envelope represents a different category of expenses. For example, you may have envelopes for groceries, utilities, and transportation. Every week, when you get paid, you can transfer the allotted amount of cash into each envelope. This way, you know exactly how much money you have left for each category.

One tip that many people find helpful is to review your budget binder regularly. This will help you stay on track and make adjustments as needed. If there are any changes in your income or expenses, you can simply tweak your budget accordingly. Remember, the goal here is to keep your spending in check and stay within your means.

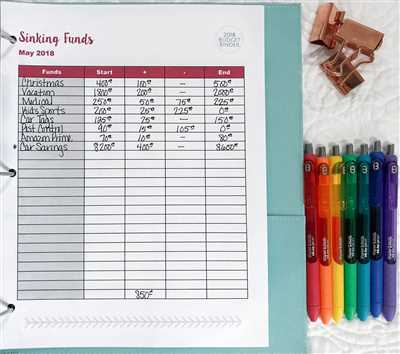

Another great thing about budget binders is that they provide a visual representation of your financial situation. You can see at a glance where your money is going and how much you have left. This can be especially helpful during the holiday season, when it’s easy to get carried away with spending. By using a budget binder, you can keep track of your Christmas expenses and avoid going overboard.

In conclusion, budget binders are a fantastic tool to help you stay on top of your finances. They provide a clear and organized way to track your expenses, set goals, and make adjustments as needed. Whether you choose to create your own binder from scratch or use an online template, the key is to stay consistent and follow through. With a little bit of planning and discipline, you can achieve your financial goals and make your money work for you.

- How To Create a Budget Binder in 2022 Plus Free Templates

- What is a budget binder

- How does envelope budgeting work

- Step 1: Review your current expenses

- Step 2: Set categories and limits

- Step 3: Figure out how much cash to withdraw

- Step 4: Stuff envelopes and spend funds from envelopes until it’s gone

- Step 5: Repeat

- Step 4 Using your budget binder during the month

- Monthly expense log

- Cash envelopes

- Tip 1: Tweak and Adjust

- Tip 2: Pay for things one way

- Tip 3: Use it consistently

How To Create a Budget Binder in 2022 Plus Free Templates

If you want to stay on top of your finances and ensure that you’re saving and spending within your limits, creating a budget binder is a great way to do it. With a budget binder, you can keep all of your financial information in one place and easily track your income and expenses.

Here’s how to create a budget binder for 2022:

- Open a binder: Start by getting a binder that you will dedicate to your budgeting efforts. You can choose a plain binder or one with pockets and dividers to help you organize your documents.

- Create sections: Divide the binder into sections based on your budget categories. Common sections include income, expenses, savings, debt, and financial goals. This will make it easier to find and review your financial information.

- Gather your financial information: Collect all of your financial documents, such as pay stubs, bills, bank statements, and credit card statements. This information will help you track your income and expenses.

- Create a monthly budget template: Design a budget template that you can use every month to track your income and expenses. Include categories for different types of expenses, such as housing, transportation, groceries, entertainment, and discretionary spending.

- Use envelopes or separate sections for bills: If you prefer a physical system, you can use envelopes or separate sections in your binder to organize and track your bills. Label each envelope or section with the name of the bill and the due date.

- Set spending limits: Determine how much you want to spend in each budget category and write it down in your budget template. This will help you stay on track and avoid overspending.

- Track your expenses: As the month goes on, record your expenses in your budget template or envelope. Keep your receipts and make note of the amount spent and the date.

- Review and tweak your budget: At the end of each month, review your budget and see how well you followed it. Adjust your budget for the following months based on your spending habits and financial goals.

Here are some tips to help you create an effective budget binder:

- Be consistent: Make it a habit to track your expenses every day or every few days. This will help you stay aware of your spending and prevent any surprises at the end of the month.

- Know your priorities: Determine what your financial priorities are and allocate your money accordingly. This will help you make decisions about where to cut back if necessary.

- Use online resources: Take advantage of online tools and resources to make budgeting easier. There are many budgeting apps and websites that can help you track your spending and manage your finances.

- Keep discretionary spending in check: Be mindful of your discretionary spending, such as eating out or shopping. Set limits for yourself and stick to them to avoid emptying your wallet too quickly.

- Withdraw cash for certain expenses: If you find that you tend to overspend when using a credit or debit card, consider withdrawing cash for certain expenses. This can help you stay more aware of how much you’re spending.

- Have a sinking fund: Set aside money each month for irregular expenses or upcoming bills. This will help you avoid stressing about money when those expenses arise.

Creating a budget binder can be a game-changer for your financial well-being in 2022. It will help you stay organized, track your income and expenses, and make informed financial decisions. Take the time to set up your budget binder and start taking control of your finances today!

What is a budget binder

A budget binder is a tool used for budgeting and keeping track of finances. It consists of various sections and compartments to help organize and manage your money. This physical binder serves as a centralized location where you can store important financial documents, track expenses, set financial goals, and keep tabs on your overall financial health.

One of the main purposes of a budget binder is to help you create a budget and stick to it. It provides a clear overview of your income and expenses, allowing you to see where your money is going and make necessary adjustments. By consistently using a budget binder, you can gain better control of your finances and work towards achieving your financial goals.

In a budget binder, you may have sections dedicated to different categories such as bills, groceries, transportation, entertainment, and miscellaneous expenses. Each section typically includes a log where you can record your expenses, as well as an envelope or pocket where you can store receipts and other relevant documents.

For example, if you have a section for monthly bills, you can create separate envelopes for each bill (e.g., rent/mortgage, utilities, credit card payments) and transfer the corresponding amount of cash into each envelope at the beginning of the month. As you make payments, you can log them in the binder and keep the receipts in the envelopes.

Some budget binders also include sections for specific financial goals, such as saving for a vacation or paying off debt. This allows you to track your progress towards these goals and adjust your budget accordingly.

Budget binders can be purchased online or at stationery stores, but you can also create your own DIY budget binder using any empty binder and household supplies you have on hand. There are also free printables and templates available online that you can use to customize your budget binder to fit your needs.

The main idea behind a budget binder is to have a physical, tangible tool to help you stay organized and accountable for your finances. It serves as a visual reminder of your financial goals and helps you stay on track. Whether you’re new to budgeting or have been consistently sinking in debt, a budget binder can be a helpful tool to make positive changes and take control of your financial future.

Here are some tips for using a budget binder effectively:

- Set clear financial goals: Before setting up your budget binder, take some time to think about your short-term and long-term financial goals. This will help guide your budgeting decisions and motivate you to stick to your budget.

- Organize your categories: Determine the main categories you want to track in your budget binder, such as bills, groceries, transportation, and discretionary spending. You can further divide these categories into subcategories if needed.

- Figure out your budgeting strategy: Decide whether you want to use a zero-based budgeting approach (where every dollar is allocated to a specific category) or a more flexible approach that allows for discretionary spending.

- Track your expenses consistently: Make it a habit to log your expenses in your budget binder every day or at least once a week. This will help you stay aware of your spending habits and identify areas where you may need to adjust your budget.

- Review and adjust regularly: Set aside time each month to review your budget, track your progress towards your financial goals, and make any necessary adjustments. This will help you stay on track and ensure that your budget reflects your current financial situation.

Remember, a budget binder is just a tool. It’s up to you to follow through with your budgeting plans and make conscious decisions about your spending. Stay committed and disciplined, and you’ll see positive changes in your financial situation over time.

How does envelope budgeting work

Envelope budgeting is a popular method of budgeting that helps people keep track of their finances and stay on top of their spending. It is a simple and visual way to manage your money by using physical envelopes to allocate funds for different categories or expenses. Here’s how it works:

- Set up your budget: Start by creating a budget for the month or week. Determine how much money you have coming in, your current bills and expenses, and what needs to be paid off.

- Figure out your limits: Decide how much money you want to allocate for different categories such as groceries, entertainment, utilities, and more. This will help you stay within your spending limits and avoid overspending.

- Create separate envelopes: Get a set of envelopes and label them according to your budget categories. For example, you might have envelopes for groceries, entertainment, transportation, and more.

- Allocate funds: Take the amount of money you have budgeted for each category and put it in the corresponding envelope. For example, if you have allocated $100 for groceries, put $100 cash in the grocery envelope.

- Track your expenses: Whenever you make a purchase or spend money on something, take the required amount of cash from the appropriate envelope. For example, if you spend $20 on groceries, take $20 from the grocery envelope.

- Log your expenses: Keep a record of your expenses by tracking them in a notebook or using a budgeting app. This step will help you remember where your money has gone and stay organized.

- Repeat until empty: Continue to spend money from the corresponding envelopes until they are empty. This system will help you stay accountable and aware of your spending habits.

- Tweak your budget: If you find that you are consistently running out of money in certain categories or need to allocate more funds to others, you can adjust your budget accordingly. It’s important to be flexible and make changes as needed.

Envelope budgeting is a tried and tested method that has been used for years. By using physical envelopes and cash, it allows you to see exactly how much money you have left for each expense category. This can help you make more mindful spending decisions and avoid overspending. Plus, it is a great way to visualise your financial goals and track your progress. So if you want to take control of your finances in 2022, give envelope budgeting a try!

Step 1: Review your current expenses

One of the first steps in creating a budget binder is to review your current expenses. This will help you get a clear understanding of where your money is going and how much you’re spending in each category.

Start by gathering all your bills, receipts, and financial documents. Separate them into categories such as housing, transportation, groceries, entertainment, and so on. Remember to include both fixed expenses (e.g., rent or mortgage payments) and variable expenses (e.g., dining out or shopping).

Use binders or folders to keep everything organized. Having separate sections for each category makes it easier to find and review your expenses later on.

Next, think about what expenses you can cut back on or eliminate completely. Are there any subscription services or memberships you no longer use? Can you reduce your entertainment spending? Look for areas where you can make adjustments to save money.

Take a close look at your credit card statements as well. It’s important to know exactly how much you owe and what interest rates you’re paying. This will help you budget your funds effectively and avoid unnecessary debt in the future.

Review your expenses over the past few months to identify any trends. Have there been any significant changes in your spending habits? Are there certain categories where you consistently spend too much? Understanding your spending patterns will allow you to make more informed decisions about your budget.

Once you have a clear picture of your current expenses, it’s time to create your budget. This can be done using a budgeting app, spreadsheet, or even just a pen and paper. Start by listing all your income sources and then subtracting your expenses. The goal is to ensure that your expenses do not exceed your income.

Keep in mind that budgeting is a continuous process. It’s not something you set once and forget about. Review and adjust your budget regularly, especially as your income or expenses change. If you find that you’re consistently overspending in a certain category, consider transferring funds from one category to another to stay within your budget.

Remember, learning how to budget takes time and practice. Don’t get discouraged if it doesn’t work perfectly the first time. Keep repeating the steps above and make adjustments as needed. With consistency and diligence, budgeting can become a helpful tool to manage your finances and achieve your financial goals.

Step 2: Set categories and limits

When it comes to budgeting, most people find it easier to categorize their expenses. It allows you to have a clear idea of where your money is going and how much you can allocate for each category. Below are some examples of common categories that you can use in your budget:

- Housing (rent or mortgage payment)

- Utilities (electricity, gas, water)

- Transportation (car payment, gas, maintenance)

- Groceries

- Entertainment (dining out, movies, hobbies)

- Health and wellness (gym membership, healthcare expenses)

- Debt repayment (credit cards, loans)

- Savings

- Miscellaneous (anything that doesn’t fit into other categories)

Feel free to adjust these categories to fit your own spending habits and financial situation. You can also create subcategories within each main category to provide more detailed information about your expenses.

Once you have set your categories, it’s time to set limits for each one. This is where the real budgeting work comes in. You’ll need to figure out how much you can realistically spend in each category based on your income and financial goals. For example, if your monthly income is $3,000 and you want to save $500 each month, you’ll need to allocate the remaining $2,500 across your various expense categories.

Some people prefer to use a percentage-based approach, allocating a certain percentage of their income to each category. Others prefer to set specific dollar amounts for each category. Whatever method you choose, make sure it works for you and helps you achieve your financial goals.

Reviewing your budget on a regular basis is essential to ensure you are staying on track. Make it a habit to review your budget at least once a month, or whenever there are significant changes in your income or expenses.

During this step, it’s important to keep in mind that your budget is not set in stone. It’s a flexible tool that you can adjust as needed. If you find that you consistently go over your limits in one category, you may need to reevaluate your spending habits and adjust your budget accordingly.

Using budget binders or templates can be a helpful way to keep track of your spending and stay organized. You can use envelopes or separate sections in your binder for each category, and transfer funds from one category to another as needed. For example, if you overspent on entertainment but have some money left in your grocery category, you can withdraw funds from the grocery category and use them to cover the entertainment expenses. Just make sure to keep track of these adjustments so you have an accurate record of your spending.

Setting categories and limits is an important part of the budgeting process. It helps you stay focused on your financial goals and ensures that your money is being used in the most efficient way possible. So, take some time to thoughtfully consider your categories and limits, and make adjustments as needed. This will set you up for success in managing your finances in the upcoming year and beyond.

Step 3: Figure out how much cash to withdraw

Once you have your budget binder set up with all your categories and templates, it’s time to start figuring out how much cash you need to withdraw for your various expenses. This step is important because it helps you stay on track with your spending and ensures that you don’t overspend.

Here are some tips to help you figure out how much cash to withdraw:

1. Determine your most important needs: First, identify the categories that consist of your main financial goals. For example, if your main goal is to save for a down payment on a house, your mortgage category would be a top priority.

2. Review your past spending: Take a look at your past spending patterns to get an idea of how much you usually spend in each category. This will give you an idea of what you need to allocate for each expense.

3. Separate discretionary and non-discretionary expenses: It’s important to separate your expenses into two categories: discretionary and non-discretionary. Non-discretionary expenses are essential and include things like rent, groceries, and bills. Discretionary expenses, on the other hand, are things like entertainment and dining out, which can be adjusted or cut back if needed.

4. Set limits for each category: Based on your past spending and the separation of discretionary and non-discretionary expenses, set limits for each category. For example, you may decide to allocate $200 for groceries and $100 for entertainment each month.

5. Consider special occasions or one-time expenses: Remember to factor in any special occasions or one-time expenses that may arise, such as birthdays, holidays, or car repairs. It’s a good idea to have a separate category for such expenses, so you don’t find yourself dipping into your regular funds.

6. Use the envelope system: One effective way to manage your cash is to use the envelope system. Label each envelope with a specific category and put the allocated cash for that category inside. Then, when you need to spend money, take the cash from the appropriate envelope and use it accordingly. This helps you visually see how much you have left for each category and makes it easier to stay within your limits.

7. Tweak and adjust as you go: It’s important to review and adjust your cash allocations as you go. If you find that you consistently have leftover cash in one category but are always going over budget in another, it may be necessary to transfer funds from one envelope to another. This flexibility allows you to make sure your spending aligns with your needs and goals.

By following these steps and implementing the envelope system, you’ll have a better understanding of how much cash you need to withdraw for your monthly expenses. It’s a practical way to stay on top of your finances and ensure that you’re using your money wisely.

Step 4: Stuff envelopes and spend funds from envelopes until it’s gone

Now that you’ve set up your budget binders and allocated your funds to various categories, it’s time to put your budget into action. The next step is to stuff envelopes with the cash you have allocated for each category and begin spending from those envelopes.

Here’s how it works:

- Review your budgeting categories and determine how much cash you need for each one. For example, if you allocated $200 for groceries this month, you would need to withdraw $200 in cash from your bank account.

- Label the envelopes with the respective categories. For instance, you would label one envelope as “Groceries”.

- Transfer the allocated cash from your current funds to the appropriate envelopes. In this case, you would stuff the “Groceries” envelope with $200 in cash.

- During the course of the month, when you need to make a payment or expense in a particular category, use the cash from the corresponding envelope. For example, when you buy groceries, use the cash from the “Groceries” envelope.

- Repeat this process for all your budgeting categories. Whenever you have an expense that falls into one of the categories, spend the cash from the corresponding envelope until it’s gone.

By using envelopes to hold your cash and actively spending from them, you have a visual reminder of how much money you have left in each category. This helps you stay on track and prevents overspending.

If you find that you have allocated too much or too little money to a specific category, you can adjust the allocations in your next budget review. For example, if you consistently have cash left over in your “Entertainment” envelope and not enough in your “Miscellaneous Expenses” envelope, you can transfer some funds from one envelope to the other during your next budget review.

Remember, the goal is to make your finances easier to manage and to help you stay on track with your financial goals. By using budget binders and the envelope system, you can take control of your spending and make sure every dollar has a purpose.

Step 5: Repeat

Once you have set up your budget binder and allocated your money into different categories, it’s important to remember that budgeting is an ongoing process. You should review and adjust your budget regularly to make sure it still meets your needs and financial goals.

Every week, take some time to review your spending and make any necessary adjustments. This is especially important if you have irregular or unpredictable expenses, such as medical bills or car repairs.

One way to keep track of your spending is to use cash for certain categories. For example, you could withdraw a set amount of money each week for discretionary expenses like entertainment or dining out. Once the cash is gone, you know it’s time to cut back until the next week.

Another tip is to open separate bank accounts or credit cards for specific categories. This can make it easier to track your spending and ensure that you don’t overspend in one area. For example, you could have a separate account for bills, a separate account for groceries, and a separate credit card for online shopping.

If you find that you consistently have money left over in certain categories each month, you may want to adjust your budget and allocate more money to other areas that need it. On the other hand, if you often find yourself sinking into debt or going over your budget, it may be time to cut back and reevaluate your spending habits.

Remember, a budget is not set in stone. It’s meant to be a flexible tool that helps you manage your finances and make smarter financial decisions. By regularly reviewing and adjusting your budget, you can stay on track and achieve your financial goals.

Step 4 Using your budget binder during the month

Once you have your budget binder set up and organized, it’s time to put it to use throughout the month. Here are some tips on how to effectively use your budget binder:

- Review your budget regularly: Take some time each week to review your budget and see how you’re doing. Look at your spending in each category and compare it to your budgeted amounts. This will help you stay on track and make any necessary adjustments.

- Track your expenses: As you make purchases or pay bills, be sure to record them in your budget binder. This way, you can see where your money is going and keep track of how much you have left in each category.

- Use categories and templates: Organize your expenses into categories, such as groceries, housing, transportation, and entertainment. You can use templates or create your own to help you stay organized.

- Set realistic goals: Think about what you want to achieve with your finances and set specific, achievable goals. Whether it’s saving for a vacation or paying off debt, having goals will give you something to work towards.

- Be flexible: Your budget isn’t set in stone. If you find that you need to adjust your spending limits in certain categories, go ahead and make changes. Just be sure to stay within your overall budget.

- Plan for the unexpected: Life happens, and there will be times when you have unexpected expenses. It’s important to have some flexibility in your budget to account for these situations.

- Use cash or credit wisely: Some people find that using cash for certain expenses, like groceries or entertainment, helps them stick to their budget. Others prefer to use credit cards for the convenience and rewards. Use whichever method works best for you, but always use them with care.

- Stay motivated: It’s easy to get discouraged or tempted to give up on budgeting. Find ways to stay motivated, whether it’s by tracking your progress, rewarding yourself for meeting financial goals, or seeking support from others.

- Repeat the process: Budgeting is an ongoing process, and you’ll need to repeat these steps each month. As you learn more about your spending habits and financial needs, you can tweak your budget to better align with your goals and priorities.

Remember, using a budget binder can make budgeting easier and help you stay on top of your finances. Whether you’re just starting out or have been budgeting for years, having a system in place can give you more control and peace of mind when it comes to your money.

Monthly expense log

One of the main components of a budget binder is a monthly expense log. This log helps you keep track of how much money you’re spending and on what. It’s a way to review your finances and stay on top of your spending habits.

When you create a monthly expense log, you would typically set it up with categories for different types of expenses, such as groceries, entertainment, mortgage or rent, and discretionary spending. You can also create separate categories for things like Christmas or vacation savings.

Each month, you would use the log to keep a record of all your expenses. This includes the amount spent, the date, and the category it falls under. For example, if you went out to dinner on January 15th and spent $50, you would write down “January 15th – Entertainment – $50” in the log.

The monthly expense log can help you track your spending patterns and figure out where you may need to adjust your budget. It allows you to see how much money you’re spending in each category and whether you’re staying within your set limits.

One way to make using the monthly expense log easier is to use templates or pre-made forms. There are many free templates available online that you can tweak to fit your needs. You can either print these templates and insert them into your budget binder, or you can create your own using a word processing program.

Another helpful tip is to use envelopes or separate pockets within the binder to keep receipts and other related paperwork. This way, you have all the necessary information in one place when it’s time to review your spending for the month.

Here’s a step-by-step guide on how to use a monthly expense log:

- At the beginning of each month, set aside an empty envelope or pocket in your budget binder for the month’s receipts.

- As you make purchases throughout the month, collect all your receipts and place them in the envelope or pocket.

- Record your expenses in the monthly expense log, including the date, category, and amount spent.

- Make a note of any transfers or withdrawals from your bank account or credit card.

- At the end of the month, review your spending. Look for any areas where you may have exceeded your budget or need to make adjustments.

- Empty the envelope or pocket and file away any important receipts or paperwork.

Using a monthly expense log can help you stay organized and consistently track your expenses. It’s a useful tool for managing your finances and ensuring that you’re meeting your financial goals.

Cash envelopes

One popular method of managing money within a budget binder is through the use of cash envelopes. Cash envelopes involve physically separating your money into different categories or “envelopes” dedicated to specific expenses. This method can help you better track and control your spending, especially when it comes to discretionary or variable expenses.

Here’s how cash envelopes work:

- First, you’ll need to figure out the different spending categories you want to use for your envelopes. This could include things like groceries, transportation, entertainment, dining out, and more.

- Next, you’ll want to create envelopes for each category. You can use actual envelopes or download and print envelope templates from online sources.

- Then, write the name of the spending category on each envelope.

- At the beginning of each month or whenever you get paid, withdraw the amount of cash you have budgeted for each spending category.

- When you make a purchase, take the necessary amount of cash from the appropriate envelope and pay with it. If you have any change, put it back in the envelope.

- Repeat this process for each expense and each time you make a payment.

Using cash envelopes can help you stay within your budget because it physically limits your spending to the amount of money you have allocated for each category. When the cash is gone from an envelope, you know you have reached your limit for that expense and you need to stop spending.

For example, let’s say you have $200 allocated for your groceries for the month. Once that $200 is gone from your grocery envelope, you can’t spend any more on groceries until next month. This helps you prioritize your spending and avoid overspending.

You can also use cash envelopes to save for specific goals. If, for instance, you want to save $500 for a vacation, you can create a separate envelope specifically for that goal. Each time you have extra money, you can put it into the vacation envelope until you reach your target amount.

It’s important to note, however, that cash envelopes may not be suitable for all expenses. Some bills, like mortgage or online bill payments, won’t require cash. In these cases, you can still use the cash envelope system for discretionary spending and non-online expenses.

Another tip to consider is to create a sinking fund envelope for unexpected expenses. This can help you build an emergency fund to cover unexpected costs that may arise throughout the year. By putting a small amount of money into this envelope every payday, you’ll be better prepared for these situations.

Overall, cash envelopes are a practical and tangible way to manage your budget and control your spending. By following the steps outlined above, you can stay on top of your finances and work toward your financial goals.

Tip 1: Tweak and Adjust

One of the main benefits of using budget binders is that you have the ability to tweak and adjust your budget as needed based on your financial goals and priorities.

When you first create your budget binder, you will need to gather all your financial information and review your monthly expenses, bills, and income. This will help you get a clear picture of where your money is going and where you want to make adjustments.

Using the budget templates provided in the binder, you can separate your expenses into different categories, such as bills, groceries, entertainment, and discretionary spending. This way, you can see how much you need to allocate for each category and where you may be overspending.

Once you have set your budget limits for each category, it’s important to keep track of your spending and make adjustments when necessary. For example, if you find that you are spending too much on dining out, you can tweak your budget by allocating less money to that category and transferring the funds to another category that needs more attention, such as debt repayment or savings.

To help you stick to your budget, it’s a good idea to withdraw cash for certain categories, such as groceries and entertainment. This way, you only have a set amount of cash to spend, and once it’s gone, you know you need to wait until the following month to spend more. This can help prevent overspending and keep you accountable.

Another tip is to review your budget regularly, such as every week or month, to see if any adjustments need to be made. For example, if you have an unexpected expense come up, you may need to reallocate funds from one category to cover it. Or if your income increases or decreases, you may need to adjust your budget accordingly.

Remember, the budget binder is a tool to help you manage your finances and reach your financial goals. It’s important to be flexible and willing to make adjustments along the way. By regularly reviewing and tweaking your budget, you can stay on track and make the most of your money.

Tip 2: Pay for things one way

When it comes to budgeting, one helpful tip is to pay for things using only one method. This could be cash, a debit card, or a credit card, depending on your preferences and financial needs. By sticking to one payment method, you can better track and control your spending.

Here’s how it works:

- Create separate categories in your budget binder for different expenses, such as groceries, bills, miscellaneous expenses, etc.

- Decide which payment method you would like to use for each category. For example, you might use cash for groceries and bills, but prefer to use a debit card for miscellaneous expenses.

- Withdraw the necessary funds for each category at the beginning of the month. This way, you have a set limit for each category and know exactly how much you can spend.

- Open separate envelopes or use different sections in your budget binder to keep track of the cash or receipts for each category.

- Review your expenses regularly. This could be done weekly or at the end of each month. Make sure you stay within your set limits and adjust your spending if needed.

By paying for things one way, you can minimize the chances of overspending or losing track of your finances. It also makes it easier to review your expenses and see where your money is going.

Remember, budgeting is about finding a system that works for you. If you prefer to go cashless and use online payment methods, you can still apply this tip by creating separate categories in your budgeting app or software. The key is to have a clear and organized system to log your expenses and stay on top of your financial goals.

So whether you’re using envelopes, binders, or online templates, the important thing is to find a method that suits your needs and helps you stay on track with your budgeting. Paying for things one way can be a helpful step towards financial stability and peace of mind.

Tip 3: Use it consistently

Consistency is key when it comes to using a budget binder effectively. Once you have set up your budget binder and organized it according to your financial goals, it is important to consistently use it to track and manage your expenses.

Here are some tips to help you use your budget binder consistently:

- Keep it open: Keep your budget binder in a place where it is easily accessible and visible, such as on your desk or kitchen counter. This will serve as a constant reminder to track your expenses.

- Log every expense: Make it a habit to log every expense you make in the appropriate category of your budget binder. Whether it’s a cup of coffee or a utility bill, recording every expense will give you an accurate picture of where your money is going.

- Review regularly: Set aside some dedicated time every month to review your budget binder. Take a look at your spending patterns, figure out where you may need to adjust, and see if you are on track to meet your financial goals.

- Separate categories: Use separate envelopes or tabs within your budget binder to keep track of different categories of expenses. For example, you can have separate sections for fixed expenses like rent or mortgage payments, variable expenses like groceries and entertainment, and discretionary expenses like makeup or eating out.

- Adjust as needed: As your financial situation or goals change, don’t be afraid to adjust your budget binder accordingly. Tweak the categories, update spending limits, or add new sections as necessary to stay on top of your finances.

Using your budget binder consistently will not only help you stay organized, but it will also give you a clear understanding of your financial health and where adjustments may be needed. Remember, the more you put into your budget binder, the more you will get out of it.