If you’re looking for a convenient and secure way to send and receive money, Zelle is the perfect solution. Whether you’re paying your mortgage or splitting the bill with friends, Zelle allows you to quickly transfer funds from your bank account to another individual’s account. With a few simple steps, you can enroll in Zelle and start enjoying its many benefits.

First, you’ll need to have a checking or savings account with one of the participating banks, such as Wells Fargo, Chase, or JPMorgan. If you already have an account with one of these banks, you’re all set to enroll in Zelle. If not, you can easily open an account with them to get started.

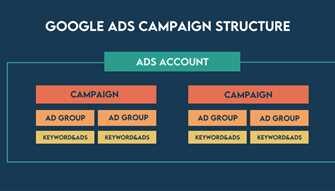

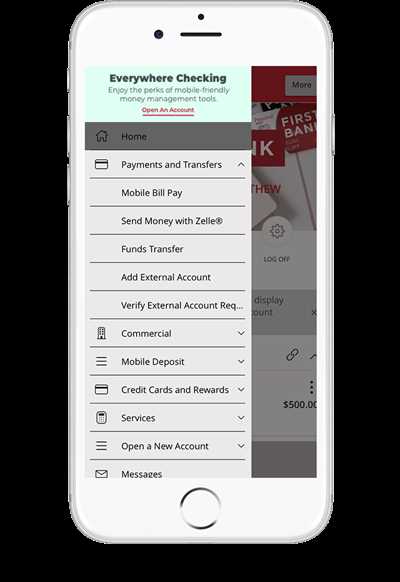

Next, visit your bank’s online banking page and look for the Zelle option. It may be located in the menu or under the “Services” or “Payments” section. Once you find it, click on the Zelle link to begin the enrollment process. You may be asked to enter your personal information, such as your name, email address, and phone number. This information will be used to verify your identity and help protect your account.

After you have provided your personal information, you will be asked to choose the bank account you want to link to Zelle. You can select your checking or savings account, and you may also have the option to link multiple accounts if you prefer. Once you have selected your account, you will need to enter the account number and routing number to complete the enrollment process.

Once you’re enrolled in Zelle, you can start sending and receiving money right away. To send money, you’ll need to know the recipient’s email address or mobile phone number. Simply enter their contact information, choose the amount you want to send, and confirm the transaction. The recipient will receive a notification and can choose to accept the money and have it deposited directly into their bank account. If you’re receiving money, you’ll receive a notification as well and can choose to accept the funds.

With Zelle, you can also request money from others, set up one-time or recurring payments, and even split bills with a group of friends or family members. Zelle makes it easy to keep track of your transactions, as all activity is displayed right in your online banking center. You can see who you’ve sent money to, who has paid you, and any pending requests. Zelle also offers security features to protect your account from unauthorized activity.

In summary, enrolling in Zelle is a simple and convenient process. By following a few easy steps, you can start sending and receiving money with just a few clicks. Whether you need to pay your mortgage, transfer money to a friend, or split a bill, Zelle is there to help. So why wait? Enroll in Zelle today and start enjoying the benefits of fast and secure money transfers.

- How do I enroll to receive money with Zelle

- Online banking steps

- Send Money with Zelle ®

- Follow us

- Checking Accounts

- Savings Accounts CDs

- Credit Cards

- Mortgages

- Auto

- Chase for Business

- Investing by JP Morgan

- Chase Private Client

- About Chase

- Sports Entertainment

- Banking Services

- Mortgages and Home Equity

- Insurance Products

- Wealth Management

- J.P. Morgan Private Bank

- Zelle®

- Chase Security Center

- Other Products & Services

- We hope to see you again soon

- Video:

- Avoid these 5 Things to PROTECT Your Sisterlocks| Don’t Do THIS!!!

How do I enroll to receive money with Zelle

Enrolling to receive money with Zelle is a simple and convenient process. Whether you are already a customer of JPMorgan Chase or another participating bank, you can take advantage of this service. Here are the steps you need to follow:

- If you haven’t already, download the Zelle app on your mobile device or visit the Zelle website.

- Open the app or website and select the option to enroll/signup.

- Provide your email address or mobile number, which will be used to link your Zelle account.

- Create a unique and private code, which will serve as your security measure when sending or receiving money.

- Enter your personal and banking information, including your Chase or other participating bank account details.

- Verify your identity by following the steps provided by Zelle.

- Once enrolled, you will be able to send and receive money with Zelle.

Once you have completed the enrollment process, you can start enjoying the benefits of this service. Zelle allows you to easily send and receive money from friends, family, or businesses. The funds are transferred directly between bank accounts, ensuring a quick and secure transaction. Additionally, Zelle provides a dedicated customer service center to help you with any questions or issues you may encounter.

It’s important to note that the service is available only for customers enrolled with participating banks. If you’re not currently enrolled, you can check with your bank to see if they offer Zelle or similar services.

Zelle is a great tool for a range of activities, from splitting monthly bills with friends to paying for goods and services. It can also be used for sending money to loved ones as a gift or helping out in times of need. The funds sent and received through Zelle are insured by the FDIC, providing you with an added level of protection.

So, if you’re looking for a fast and convenient way to transfer money, consider enrolling with Zelle and start enjoying the benefits of this service today!

Online banking steps

- Check if you already have an account with the bank you want to enroll in online banking with. If not, you’ll need to open one.

- Visit the bank’s website and look for a page about online banking or mobile banking. There you will find information on how to enroll.

- Choose the type of account you want to enroll in online banking. This can include checking, savings, credit cards, mortgages, or even investment products like CDs.

- Follow the steps provided on the website to enroll in online banking. You may need to enter personal information, such as your name, email address, and social security number.

- Set up a username and password for your online banking account. Make sure to choose a strong password that is not easily guessable.

- Verify your identity using the security measures provided by the bank. This could include entering a one-time code sent to your mobile phone or answering security questions about your account activity.

- Once enrolled, you can now access your online banking account. You will be able to view account balances, transfer funds between accounts, and even send money to other people using services like Zelle.

- Take advantage of the benefits of online banking, such as the ability to check your account activity, set up automatic transfers, and pay bills online.

- Be sure to regularly check your online banking account for any unauthorized activity and report it to your bank immediately.

- If you have any questions or need assistance with online banking, most banks have a dedicated customer service center that can help you.

We hope this guide has been helpful in showing you the steps to enroll in online banking. Online banking can provide a convenient and secure way for you to manage your finances and access a range of banking products and services.

Send Money with Zelle ®

When you send money with Zelle, your funds are sent directly from your bank account to the recipient’s bank account, without the need for checks or cash. Zelle uses industry-leading security measures to protect your transactions, so you can feel confident that your money is safe and secure.

To send money with Zelle, follow these simple steps:

- Enroll: If you are not already enrolled in online banking, visit the Wells Fargo or J.P. Morgan website and select the “Enroll” option to open an account.

- Select Zelle: Once enrolled, log in to your account and select Zelle from the main menu.

- Enter recipient’s information: Enter the recipient’s email address or mobile phone number, along with the amount you want to send.

- Confirm: Review the information to make sure it’s correct, and then confirm the payment.

- Send: Once confirmed, the money will be sent to the recipient’s account instantly.

With Zelle, you can send one-time payments or set up recurring payments for common expenses like rent, utilities, and more. Zelle is a convenient and secure way to send and receive money with your friends, family, and other trusted contacts.

As a reminder, Zelle is available for select Wells Fargo and J.P. Morgan banking customers. If you’re not enrolled in Zelle or don’t see it on your banking page, please reach out to your bank’s customer service center for assistance.

Enrolling in Zelle also allows you to receive money from others. If someone sends you money with Zelle, you will receive an email or a notification in your banking app with instructions on how to receive the funds.

Send money with Zelle today and experience the benefits of fast and secure money transfers!

Follow us

Follow us on social media to stay updated on the latest news and offers:

Facebook: Visit our Facebook page to see what we’re up to and get helpful tips on managing your finances.

Twitter: Join our Twitter community for real-time updates, financial advice, and customer insights.

Instagram: Follow us on Instagram for a behind-the-scenes look at our business and exclusive content.

LinkedIn: Connect with us on LinkedIn to stay connected with our professional network and industry updates.

We value your feedback and we’re here to help! If you have any questions or need assistance, please don’t hesitate to contact our Customer Service Center by phone or online.

Please note: JPMorgan Chase Bank, N.A. (JPMCB) and its affiliates (collectively “JPMCB”) offer investment products, which may include bank managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (JPMS), a member of FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS, and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Investment products: Are Not FDIC Insured • Are Not Bank Guaranteed • May Lose Value

Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC

Mortgage and home equity products: Are offered by JPMorgan Chase Bank, N.A. and its affiliates. Certain restrictions apply. Subject to credit approval.

Chase is a marketing name for certain businesses of JPMorgan Chase & Co. and its subsidiaries.

Mobile and online banking are also available with Chase. Enrolling in their services allows you to manage your accounts, transfer money, send money with Zelle®, and much more from the convenience of your mobile device or computer.

We hope to see you soon!

Checking Accounts

When it comes to banking services, checking accounts are a must-have. With a checking account, you can enroll in various services and enjoy the convenience of managing your finances online.

By enrolling in a checking account, you will have access to features like online bill payment, transferring and sending money to others, and more. You can also use your checking account to receive direct deposits, such as your salary or payments from clients.

Wells Fargo offers a range of checking accounts to choose from, including options for small businesses, students, and high-net-worth individuals. You can open a checking account online or visit a Wells Fargo branch to get started.

Once you have enrolled in a checking account, you can enjoy the benefits of Wells Fargo’s security features. With features like Zelle® for easy money transfers and JP Morgan access for investment products, you can protect your financial information and make the most of your money.

Checking accounts at Wells Fargo are insured by the FDIC, so you can have peace of mind knowing that your deposits are protected. Plus, with Wells Fargo’s range of other products and services like savings accounts, credit cards, mortgages, and insurance, you can have all your financial needs covered in one place.

For more information about Wells Fargo’s checking accounts and to open an account, visit the Wells Fargo website or contact a Wells Fargo representative. They will be happy to help you choose the checking account that best fits your needs and guide you through the enrollment process.

So don’t wait, open a Wells Fargo checking account today and start enjoying the benefits of convenient, secure banking.

Savings Accounts CDs

When it comes to saving and investing your money, there are a range of common banking services and products available to help you. One such option is a savings account or a certificate of deposit (CD). These are both commonly used investment vehicles that many people choose to open to save and grow their funds.

Savings accounts are a type of bank account that allows you to deposit and withdraw money at your convenience. You can visit a bank branch, use online banking, or even access your funds through a mobile banking app. By enrolling in a savings account, you can enjoy the benefits of a dedicated savings account that is separate from your checking account.

CDs, on the other hand, are a fixed-term investment where you agree to leave your money with the bank for a set period of time. In return, you typically receive a higher interest rate than you would with a regular savings account. It’s a great way to grow your money over a fixed period of time, but withdrawals before the CD matures may incur penalties.

Both savings accounts and CDs are FDIC insured, which means that your funds are protected up to $250,000 per depositor, per bank. This provides peace of mind knowing that your money is safe.

If you’re interested in opening a savings account or a CD, here are the steps you can follow:

- Visit your bank or go online to choose the savings account or CD that suits your needs.

- Fill out the necessary forms and provide any required identification or documentation.

- Transfer funds from your existing bank account or make a deposit if you’re a new customer.

- Enroll in any additional services, such as online banking or mobile banking, if available.

- Receive your account details and start using your new savings account or CD.

By choosing Wells Fargo as your banking partner, you have access to a range of banking services and products, including savings accounts, CDs, online banking, and more. We are dedicated to helping you with your financial needs and providing the tools and services to help you achieve your goals.

Additionally, we offer a range of other services, such as mortgages, auto loans, credit cards, and wealth management. Whether you’re looking to buy a home, finance a new car, or grow your wealth, we have the expertise and resources to assist you.

Banking with Wells Fargo also gives you access to our award-winning mobile app, which allows you to conveniently check your account balance, transfer funds, and even send money to friends and family. You can also use our online banking platform to monitor your activity and receive email alerts for certain transactions.

So, if you’re already a Wells Fargo customer or considering opening a savings account or CD, we are here to help. We pride ourselves on our excellent customer service and are always ready to assist you with any questions or feedback you may have.

Follow us in our journey to help you achieve your financial goals. We hope you choose Wells Fargo as your bank of choice for all your banking and investment needs.

Credit Cards

Enrollment is required and dollar and frequency limits apply. Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Select the credit card that’s right for you, from a range of Wells Fargo credit cards.

See benefits, what you need to know about credit cards, and how to apply.

Choose from Wells Fargo Visa Credit Cards and American Express credit cards with low intro rates, no annual fee, and more.

| Cash Wise Visa® Card | Wells Fargo Propel American Express® Card | Propel 365 American Express® Card | Wells Fargo Visa Signature® Card |

| Daily rewards, no annual fee | 3x points on dining, gas, and travel | Unlimited 1.5% cash rewards | 2x rewards points |

Already have a Wells Fargo Credit Card, but don’t have a username and password? Get started with online access or enroll today.

With a Wells Fargo Credit Card, you’ll have secure access to your account online. You can also request a balance transfer or change your pin.

Save the Wells Fargo Credit Card phone number and email address to your contacts. It may be used if you need to dispute a transaction or report fraud.

Protect yourself with Wells Fargo Platinum Card’s security features. It includes advanced fraud monitoring and zero liability protection for unauthorized charges.

Get entertainment, travel, and other benefits with Wells Fargo Rewards Card. Earn rewards points with qualifying purchases and get access to exclusive experiences.

Explore the range of business credit cards available from Wells Fargo, and choose the one that’s right for your business.

Do you want to open a new credit card or need help with an existing credit card account? Call the phone number listed on the back of your credit card.

Wells Fargo credit cards are designed for a wide range of needs – from everyday expenses to travel, major purchases, and unexpected expenses.

By enrolling your Wells Fargo credit card in Overdraft Protection, you can help prevent declined purchases, returned checks, and other overdrafts if your linked checking account doesn’t have enough funds.

Already have a Wells Fargo Mortgage? You can use your Wells Fargo credit card to make a one-time payment or set up automatic payments.

Wells Fargo Credit Cards are subject to credit qualification, income verification, and employment verification for employment check. Individual applicants must be at least 18 years of age when they apply.

Mortgages

At Zelle, we are dedicated to helping you achieve your dream of owning a home. With our range of mortgage products, you can choose the one that suits your needs and financial goals. Whether you’re a first-time homebuyer or already own a house, we offer competitive rates and flexible terms.

When you apply for a mortgage with Zelle, you can have peace of mind knowing that your loan is insured by the FDIC. This means that in the unlikely event that something happens to your mortgage, you are protected and will not lose your investment.

Once you have enrolled in Zelle, you will have access to a wide range of banking services. You can open a checking or savings account to manage your money, transfer funds to other Zelle users, or send money to anyone with an email address or mobile number. We also offer a one-time transfer option, so you can quickly move funds from your Zelle account to another bank.

With Zelle, you can also take advantage of our wealth management services. Whether you’re interested in investing or need help planning for the future, our dedicated team of financial advisors is here to assist you. From retirement planning to insurance and estate planning, we can provide the guidance you need to achieve your financial goals.

If you’re interested in enrolling for a mortgage with Zelle, the process is simple. Just visit our website and follow the steps to enroll. Once you’re enrolled, you can use our mortgage calculator to see what your monthly payments will be and choose the term that works best for you.

Zelle is a service provided by JPMorgan Chase Bank, N.A. (“JPMCB”). Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Products and services are offered by JPMCB. JPMCB and JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states. Please read the Legal Notices and Feedback page for important information.

| Affordable Mortgage Options | Insured by FDIC | Flexible Terms |

| Competitive Rates | Wealth Management Services | Easy Enrollment Process |

| Online and Mobile Banking | Wide Range of Investment Products | Secure and Convenient |

With Zelle, you can have the peace of mind that comes with knowing your mortgage is insured by the FDIC. We’re here to help you achieve your homeownership goals, so enroll in Zelle today!

Auto

Auto is one of the many services and products offered by Zelle, a secure online banking platform created by JPMorgan Chase. With Zelle, you can easily send and receive money from your checking or savings accounts. Plus, Zelle is available for both personal and small business use.

Zelle offers a range of benefits, like fast and secure transfers, dedicated customer service, and FDIC insurance for eligible accounts. When you enroll in Zelle, you can send funds to anyone with an email address or mobile phone number, even if they don’t have Zelle yet.

To enroll in Zelle and access the Auto service, you must have a checking or savings account with JPMorgan Chase or another participating bank. If you already have an account, simply select the Auto service from the Zelle home page. If you don’t have an account, you can visit the JPMorgan Chase website to see what steps you need to take to open one.

Once you’re enrolled in Zelle and have access to the Auto service, you can choose to send a one-time transfer or set up recurring monthly transfers. Zelle also offers a range of other products and services, like mortgages, credit cards, and investment accounts. If you need assistance or have any feedback, there is a dedicated customer service center available to help you.

Auto is a great way to automate your savings or send funds to pay off your mortgage faster. It can also be used for other purposes, like investing, entertainment, or buying sports tickets. Zelle’s security features protect your money and personal information, so you can use Auto with peace of mind.

So, if you’re looking for a convenient and secure way to manage your finances and transfer money, Zelle’s Auto service is a must-try. Enroll today and start enjoying the benefits of online banking with Zelle.

Chase for Business

If you’re a small business owner, Chase for Business offers a range of services to help you manage your funds and grow your wealth. Chase for Business gives you access to a variety of banking and savings accounts, credit cards, and investment options.

To enroll in Chase for Business, follow these steps:

- Visit the Chase for Business website

- Select the “Enroll Now” button

- Choose the type of account you want to open

- Enter your personal and business information

- If you already have a Chase banking or savings account, enter your account number

- Create a username and password for online banking

- Agree to the terms and conditions

- Select your preferred security code display

- Verify your email address

- Complete the enrollment process

Once enrolled, you can enjoy a variety of benefits with Chase for Business. You can easily manage your accounts and track your activity online or through the Chase mobile app. You can also receive feedback and guidance from the Chase team to help you make the most of your financial decisions.

If you’re interested in sending or receiving money, Chase for Business offers the convenient Zelle® service. With Zelle, you can transfer money to and from other Chase users or users of participating banks, all from the Chase mobile app or online banking. It’s a fast and secure way to send money to family, friends, or vendors.

Chase for Business also offers a range of insurance options to protect your business and its assets. Whether you need coverage for your property, liability, or vehicles, Chase has you covered. They also provide options for healthcare, life insurance, and employee benefits.

In addition to banking and insurance, Chase for Business offers mortgage and lending services. Whether you’re looking to purchase a new property, refinance an existing one, or secure a small business loan, Chase can help. The dedicated team at Chase will work with you to find the right solution for your needs.

With Chase for Business, you can have the peace of mind knowing that your money is safe and insured. Your deposits are FDIC-insured up to the maximum limits allowed by law. This means that even if something were to happen to Chase, your funds would still be protected.

Whether you’re a small business owner just starting out or a seasoned entrepreneur, Chase for Business has the tools and resources to support your financial goals. Visit the Chase for Business website to enroll today and start taking advantage of these valuable services.

Investing by JP Morgan

JPMorgan Chase & Co. has a wide range of investment products and services available to help you achieve your financial goals. Whether you are new to investing or an experienced investor, we have options to suit your needs.

With JPMorgan Chase, you can choose from a variety of investment products, such as stocks, bonds, mutual funds, and more. Our dedicated team of financial advisors can help you navigate the complex world of investing and choose the right products for your portfolio.

Investing with JPMorgan Chase is easy and convenient. You can access your investment accounts online or through our mobile banking app. Our online platform provides a wealth of resources and tools to help you make informed investment decisions and track the performance of your investments.

We understand that security is a top concern when it comes to investing. That’s why JPMorgan Chase has implemented industry-leading security measures to protect your sensitive information and ensure the safety of your investments. You can rest assured that your personal and financial information is safe with us.

Enrolling in JPMorgan Chase investment services is quick and simple. If you already have a JPMorgan Chase bank account, you can easily add investment accounts to your existing profile. If you are new to JPMorgan Chase, you can open a new account online or visit one of our branches to get started.

Once you are enrolled in JPMorgan Chase investment services, you can transfer funds between your bank and investment accounts with ease. You can also set up automatic transfers to make regular contributions to your investment accounts. Our online banking platform allows you to conveniently manage your investments and track your investment activity.

In addition to traditional investment products, JPMorgan Chase offers a range of other investment options to meet your specific needs. We have insurance products to help protect your wealth, as well as retirement planning services to help you save for the future. Our team of experts is dedicated to helping you achieve your financial goals, whatever they may be.

Whether you’re a small business owner looking to invest excess cash, an individual looking to save for retirement, or a seasoned investor looking to diversify your portfolio, JPMorgan Chase has the products and services to help. Visit our website or contact one of our financial advisors to learn more about how JPMorgan Chase can help you with your investment needs.

Chase Private Client

Chase Private Client is a service offered by Chase to help individuals manage their wealth and financial goals. By enrolling in Chase Private Client, you gain access to a range of benefits and services designed to meet your unique needs.

With Chase Private Client, you have a dedicated team of professionals who are committed to helping you achieve your financial goals. They can provide guidance on investment strategies, assist with mortgage and loan applications, and offer personalized advice tailored to your specific situation.

One of the key features of Chase Private Client is the ability to open and manage multiple accounts through a single dashboard. This makes it easy to see all of your accounts in one place and monitor your financial activity. You can also choose to receive email alerts to stay informed about any important changes or updates.

In addition to managing your accounts, Chase Private Client offers a range of other services to help protect and grow your wealth. This includes access to insurance products, such as auto, home, and life insurance, as well as investment options, like CDs and savings accounts.

If you’re interested in enrolling in Chase Private Client, you can visit the Chase website or contact your local Chase branch. Once enrolled, you’ll have access to a dedicated team who can assist you with any questions or concerns you may have.

Chase Private Client is just one of the many ways Chase is committed to helping individuals achieve their financial goals. Whether you’re saving for a house, planning for retirement, or starting a small business, Chase has a range of products and services to support you every step of the way.

| Benefits of Chase Private Client: |

|---|

| Access to a dedicated team of professionals |

| Personalized advice and guidance |

| Manage multiple accounts from one dashboard |

| Email alerts for important updates |

| Access to insurance and investment products |

Chase Private Client is committed to providing exceptional service and security. All deposits are insured by the FDIC up to the maximum allowable limit, and Chase has implemented industry-leading security measures to protect your personal and financial information.

If you’re already a Chase customer, you can easily enroll in Chase Private Client by using the code sent to your email. Once enrolled, you’ll have access to all the benefits and services offered by Chase Private Client.

Chase Private Client is part of the J.P. Morgan family of companies, including J.P. Morgan Securities LLC and J.P. Morgan Chase Bank, N.A. (JPMCB). Additional investment products and services are offered by JPMorgan Chase Bank, N.A.

Chase Private Client is more than just a wealth management service – it’s a commitment to helping you achieve your financial goals. Whether you’re saving for a house, planning for retirement, or starting a small business, Chase Private Client has the expertise and resources to help you succeed.

About Chase

Chase is a bank that offers a wide range of financial services to its customers. From checking and savings accounts to credit cards and mortgages, Chase is dedicated to helping you manage your money and achieve your financial goals. With their online banking services, you can easily view your account activity, transfer funds, and protect your accounts from unauthorized access.

Whether you’re sending money to friends and family or investing for the future, Chase provides the tools and resources you need. Their mobile app allows you to enroll in Zelle, a service that lets you send money to anyone with a U.S. bank account. And if you’re interested in investing, Chase offers a variety of options, such as CDs and J.P. Morgan Wealth Management services.

If you’re in need of a mortgage or auto loan, Chase can help you with that too. Their dedicated team of professionals will guide you through the process and find the right solution for your needs. And if entertainment is your thing, Chase offers exclusive access to sports and entertainment events for their cardmembers.

When it comes to security, Chase takes it seriously. Their banking services are protected by advanced security measures, and they offer tools like the Chase Security Center to help you protect your personal information. Additionally, all deposits with Chase are insured by the FDIC up to the maximum amount allowed by law.

So whether you’re already enrolled with Chase or thinking about opening an account, you can trust that Chase is committed to providing excellent service and helping you achieve your financial goals.

Sports Entertainment

At JPMorgan Chase Bank, N.A. (“JPMCB”), we understand the importance of sports and entertainment in our lives. That’s why we offer a range of products and services designed to help you enjoy these activities to the fullest. Whether you’re a sports enthusiast or a dedicated entertainment lover, we have something for everyone.

Banking ServicesWith our banking services, you can open a checking or savings account, apply for a credit card, or choose from a range of investment products. Our online banking platform allows you to manage your accounts, transfer funds, and receive alerts for any account activity. | Mortgages and Home EquityIf you’re looking to buy a home or refinance your existing mortgage, we can help. Our dedicated mortgage team will guide you through the process and find the best solution for your needs. We also offer home equity loans and lines of credit, so you can leverage the equity in your home. |

Insurance ProductsProtecting what matters most is important. That’s why we offer a range of insurance products, including auto, home, and life insurance. With our insurance options, you can have peace of mind knowing that you and your loved ones are covered. | Wealth ManagementIf you’re looking to grow and manage your wealth, our experienced team of wealth advisors is here to help. From investment services to retirement planning, we offer a comprehensive range of solutions to meet your financial goals. |

J.P. Morgan Private BankIf you have substantial assets and complex financial needs, our J.P. Morgan Private Bank provides tailored solutions. With a dedicated team of experts, we offer banking, investment, and lending services designed exclusively for high-net-worth individuals. | Zelle®Zelle is a fast, safe, and easy way to send and receive money. With Zelle, you can send money to friends, family, or anyone else with a U.S. bank account, using just their email address or mobile phone number. Enroll in Zelle today and enjoy the convenience of sending money in minutes. |

Whether you’re looking to bank, invest, or protect your assets, JPMCB is here to help. Visit our website or contact us to learn more about our services and how we can assist you with your financial needs.

Chase Security Center

The Chase Security Center is dedicated to protecting your financial information and providing a range of security services for your Chase accounts. Whether you’re sending or receiving funds, using our online banking services, or accessing your account from a mobile device, we prioritize the security of your information.

When you use Chase, you have access to a wide range of security benefits. We employ industry-leading technology to protect your account information, and our dedicated security team works around the clock to monitor for any suspicious activity. Our advanced security measures include encryption and multi-factor authentication to ensure that only you can access your accounts.

If you have any concerns about the security of your Chase account, we hope you’ll visit our Chase Security Center. On this page, you’ll find information about the steps we take to protect your information, as well as tips on how to keep your accounts safe. Additionally, you can find resources for reporting any unauthorized activity and get help with recovering your account.

Chase also offers additional security services for specific needs. For example, if you have a mortgage with Chase, you can enroll in our Mortgage Payment Assistance program to protect your credit and receive one-time assistance if you’re experiencing financial hardship. We also provide insurance coverage options for your home, auto, entertainment, and other assets.

To ensure the security of your Chase accounts, we recommend that you follow a few best practices. Always choose strong, unique passwords for your online accounts, and avoid sharing your login credentials with anyone. Regularly monitor your account activity to spot any suspicious transactions, and promptly report any concerns to us.

At Chase, we’re constantly working to improve our security measures and stay ahead of emerging threats. We value your feedback and encourage you to share any suggestions or concerns you may have. Your input helps us enhance our services and better protect your financial information.

Open a Chase account today and experience the benefits of our secure banking services. Whether you need checking, savings, or investment accounts, we have options to suit your needs. With Chase, you can send and receive money, manage your accounts online or through our mobile app, and enjoy the convenience of banking with us.

Visit Chase.com or talk to one of our representatives to learn more about our security services and how to open an account. We look forward to serving you and helping you achieve your financial goals.

Other Products & Services

In addition to the Zelle service, our business offers a wide range of other products and services to cater to your various financial needs. Whether you need assistance with sending money, transferring funds, or managing your wealth, we have got you covered.

If you are looking for a dedicated banking service, we hope you will choose us. With our mobile banking app, you can easily check your account activity, open new accounts, and choose from a range of banking products such as mortgages, credit cards, and insurance.

For those interested in investing, we offer a variety of services to help you grow your wealth. From one-time investments to auto-enrolled savings plans, we have a range of investment options available. Visit our Wealth Management Center to see the benefits of investing with us.

Looking to protect your assets? We also offer insurance products to ensure that you and your loved ones are covered in case of any unforeseen events. Whether it’s private health insurance or car insurance, we have different plans to suit your needs.

If you have any questions about our products and services, please don’t hesitate to reach out to us. We are here to help you make the most of your financial journey.

Disclaimer: JPMorgan Chase Bank, N.A. or its affiliates are not affiliated with Zelle®. Zelle® and the Zelle® related marks (“Zelle® Marks”) are wholly owned by Early Warning Services, LLC and are used herein under license. Products and services described as well as associated fees, charges, interest rates and balance requirements may differ among different geographic locations. Not all products and services are offered at all locations. Please consult your local banking center or our website for more information about products available in your area. Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC.

We hope to see you again soon

At [Bank Name], we value your business and strive to provide you with the best banking experience. Whether you are a new client or have been banking with us for years, we appreciate your trust in our services. We are here to help you achieve your financial goals and make your banking experience seamless and convenient.

With [Bank Name], you can take advantage of a variety of banking options and services. From checking and savings accounts to CDs and mortgages, we offer a wide range of products to suit your needs. Our online and mobile banking services give you access to your accounts 24/7 from the comfort of your home or on the go. You can conveniently transfer funds, pay bills, and even manage investments right from your computer or mobile device.

We understand the importance of security when it comes to your financial information. That’s why we use advanced security measures and encryption to protect your data and ensure that your transactions are safe. Our online and mobile banking platforms are designed to provide you with a secure and user-friendly experience.

When you choose [Bank Name], you also get the benefit of FDIC insurance. Your deposits are insured up to the maximum allowed by law, providing you with peace of mind and confidence in your financial institution. Additionally, we are committed to helping you protect your personal information and prevent fraud through education and proactive measures.

If you have any questions or need assistance, our dedicated customer service team is here to help. You can visit our online support center for answers to common questions, or reach out to us directly via email or phone. We strive to provide timely and helpful support, ensuring that you have a positive experience with [Bank Name].

Thank you for choosing [Bank Name]. We appreciate your business and hope to see you again soon. Your feedback is important to us, so please let us know how we can better serve you. We are constantly working to improve our services and meet the needs of our clients.