Creating a share portfolio is a crucial part of building wealth and securing financial stability. As an investor, it is important to know how to effectively manage your investments and maximize returns while minimizing the associated risks.

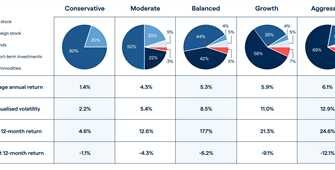

When it comes to creating a share portfolio, there are several things that you should take into account. Firstly, you need to determine your risk tolerance. This will help you decide on the types of stocks and subclasses within the share market that you prefer to invest in.

Next, note that having a diversified portfolio is essential. Investing solely in one stock or a few stocks can be risky, as any loss associated with those stocks will directly impact your overall portfolio. By spreading your investments across different stocks and even subclasses, such as large-cap, small-cap, and so on, you can mitigate the risk and potentially enhance your returns.

It’s also important to do thorough research before investing in any stock. Look into the company’s history, financials, market trends, and other relevant factors that may influence its performance. This will help you make informed decisions and build a well-performing portfolio.

Remember that the key is to seek value within the market. Look for stocks that have the potential for growth and offer good returns over time. A stock with a consistent track record of positive performance and healthy financials will likely be a preferred option for your portfolio.

Avoid making hasty decisions or letting emotions drive your investment choices. Always consider your long-term goals and stay focused on your investment journey. It’s important to have a clear investment strategy and stick to it, even during market fluctuations.

In conclusion, creating a share portfolio requires careful planning and consideration. It’s vital to have a diversified portfolio, understand your risk tolerance, and make informed investment decisions. By following these steps, you can build a portfolio that aligns with your financial goals, maximizes returns, and provides you with long-term wealth and financial security.

create-portfolio-share¶

Creating a share portfolio is an important matter for most investors. It involves selecting and buying stocks of different companys to create a diversified portfolio. A portfolio is a collection of stocks and other investments that an investor holds in a shared account. In this article, we will discuss what a share portfolio is, why it is crucial to create one, and how to go about creating a share portfolio.

When creating a share portfolio, it’s essential to consider your investment goals, risk tolerance, and the amount of capital you have available. The first step is to decide what type of stocks you want to include in your portfolio. There are different subclasses of stocks, such as large-cap, small-cap, and mid-cap, each with their own characteristics and potential returns.

It’s recommended to diversify your portfolio across different sectors and industries to spread the risk. This means investing in stocks from various sectors, such as technology, healthcare, finance, and consumer goods. By diversifying your portfolio, you reduce the impact of any single company’s performance on your overall returns.

Before building your portfolio, it’s important to note that investing in the stock market comes with risks. Stock prices can fluctuate, and there is always a possibility of loss. It’s crucial to do thorough research and analysis before investing in any stock. Following the history and performance of companies you are considering is necessary to make informed decisions.

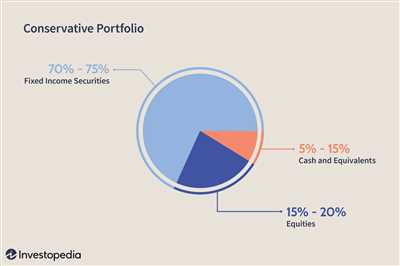

When creating your portfolio, you should also take into account your risk tolerance. Some investors prefer a conservative approach and focus on stable, blue-chip stocks, while others may have a higher tolerance for risk and invest in more speculative stocks with the potential for higher returns.

One of the possible ways to create a share portfolio is by investing in index funds or exchange-traded funds (ETFs). These funds hold a basket of stocks that represent a specific market index, such as the S&P 500. By investing in these funds, you can get exposure to a broad range of stocks without having to select individual companies.

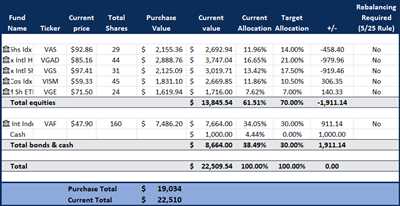

Another important thing to note is that the value of your share portfolio will fluctuate with the market. It’s crucial to regularly review and rebalance your portfolio to ensure it aligns with your investment goals. This can be done by selling some stocks that have performed well and buying stocks that have the potential for future growth.

Building a share portfolio is a journey that requires patience, research, and consistent monitoring. It’s important to stay informed about market trends, economic factors, and any escalations in the companies you are invested in. Additionally, investors should keep an eye on the performance of their portfolio and make adjustments as necessary.

Overall, creating a share portfolio can be a rewarding way to build wealth over time. By diversifying your investments and staying informed, you can potentially achieve long-term returns and reach your financial goals. It’s always recommended to consult with a financial advisor or do thorough research before making any investment decisions.

Note

When it comes to creating a share portfolio, note that the escalation of risk is crucial. Investors should have a tolerance for risk and diversify their investments across different sectors and asset classes. No matter how small or large your portfolio is, it is important to build it without associated blobs.

One important thing to note is that the market value of a share portfolio can go up and down over time. It is important to have a long-term perspective and not to get discouraged by short-term losses. Investors should focus on the overall returns and the history of the companys they have invested in.

Building a share portfolio is a journey, and it should be done with a conservative approach. Investors can consider including both large-cap and small-cap stocks, depending on their preferences and risk tolerance. Research and chat with other investors to gain knowledge and insights on where to invest and what stocks to include in your portfolio.

Investors should also note that the Indian market has a diverse range of investment options. It is possible to create a share portfolio with a variety of stocks from different sectors. However, it is important to carefully evaluate the potential risks and returns associated with each stock before making investment decisions.

In summary, note that creating a share portfolio is a way to build wealth over time. It is crucial to have a diversified portfolio, taking into account risk tolerance and preferred asset classes. Investors should also note that losses are a part of the journey and should not be discouraged by short-term market fluctuations.

Creating a portfolio

Creating a portfolio is a crucial part of an investor’s journey. It is a way to build wealth over time and achieve their desired financial goals. However, creating a portfolio should not be done without having a clear understanding of the investor’s risk tolerance and investment objectives.

A portfolio is a collection of investments such as stocks, bonds, mutual funds, and other assets. It is important to note that a well-diversified portfolio should include a mix of different asset classes, sectors, and company sizes.

When creating a portfolio, investors should consider their risk tolerance, which will determine the level of volatility they are willing to bear. Some investors might prefer a conservative approach and invest in large-cap stocks, which are well-established companies with a track record of stability. Others might be more comfortable investing in small-cap stocks, which have the potential for higher returns but also come with higher risks.

It is also important to consider the historical performance of different asset classes. Past performance does not guarantee future returns, but it can give investors an idea of how different investments have performed over time.

One way to create a portfolio is by investing in a diversified mix of stocks, including both large-cap and small-cap stocks. This can help to spread the risk across different sectors and reduce the impact of any single stock’s performance.

Another important aspect of creating a portfolio is having a well-defined investment strategy. Investors should have a clear idea of how long they plan to hold their investments, as well as their preferred allocation of assets.

It is also advisable for investors to regularly review and rebalance their portfolios. Market conditions can change, and the performance of different investments can vary. Regular monitoring can help investors make necessary adjustments to their portfolio to maximize returns and minimize losses.

Building a share portfolio is a matter of personal preference. Some investors may prefer to invest in specific sectors or industries that they are familiar with or believe will perform well in the future. Others may prefer a more diversified approach by investing in index funds or exchange-traded funds (ETFs) that track the broad market.

When creating a share portfolio, it is important to do thorough research and analysis on the companies or funds being considered for investment. Investors should evaluate the company’s financials, management team, competitive position, and long-term growth prospects. This will help to ensure that the investments are aligned with the investor’s goals and risk tolerance.

In conclusion, creating a portfolio is a crucial step in building wealth and achieving financial goals. It requires careful consideration of risk tolerance, investment objectives, and diversification. By taking a disciplined approach and regularly reviewing the portfolio, investors can increase their chances of achieving favorable returns and minimizing losses.

Building a Portfolio with ChatGPT

When it comes to building an investment portfolio, there are many things to consider. One crucial aspect is having a clear understanding of what kind of investor you are and what your risk tolerance is. This will help you determine how conservative or aggressive you should be with your investments.

With the help of ChatGPT, it is possible to gain insights and recommendations on creating a well-diversified portfolio. When building a portfolio, it is important to note that no single stock or sector should account for a significant portion of your overall investment. Diversification is key to managing risk and maximizing potential returns.

ChatGPT can assist in creating a portfolio by providing information about different asset classes, including stocks. It can offer suggestions on which sectors or specific companies to consider based on your investment preferences and risk tolerance. For example, if you are a conservative investor, it may recommend larger-cap stocks or established companies with a history of stable returns.

In the Indian market, a diversified portfolio may consist of shares from various sectors such as technology, healthcare, finance, and consumer goods. It is important to consider the potential risks associated with each sector and the overall market before making investment decisions.

Creating a portfolio with ChatGPT is a collaborative journey. By inputting relevant information about your investment goals, risk tolerance, and preferences, you can receive personalized recommendations. Additionally, ChatGPT can help you understand the current market trends and evaluate potential investments.

While there are different portfolio management strategies such as small-cap, large-cap, or value investing, it is important to note that there is no one-size-fits-all approach. The key is to build a portfolio that aligns with your investment goals and risk tolerance.

One of the advantages of leveraging ChatGPT in creating a portfolio is that it can provide insights into a wide range of investments, including shares, without the need for extensive research or market knowledge. It can help you identify investment opportunities across different asset classes and make informed decisions based on the information provided.

In conclusion, building a portfolio with ChatGPT is a valuable tool in creating a diversified investment strategy. By using the insights and recommendations provided, investors can make informed decisions and enhance their chances of achieving their investment goals.

How do I create a share portfolio

Creating a share portfolio is one of the most effective ways to build wealth over time. A share portfolio is an account where an investor can buy, sell, and hold shares of different companies listed in the stock market. Whether you are a beginner or an experienced investor, having a share portfolio is crucial to diversify your investments and increase potential returns.

Here are the steps to create a share portfolio:

- Define your investment goals: Before starting your journey to create a share portfolio, it’s important to define your investment goals. Determine the purpose of your investments, such as long-term wealth accumulation, saving for retirement, or funding a specific financial goal.

- Assess your risk tolerance: Understanding your risk tolerance is key to creating a portfolio that aligns with your comfort level. Some investors are comfortable with the potential for higher returns and are willing to take on more risk, while others prefer a more conservative approach.

- Evaluate your financial situation: Take note of your financial situation, including your income, expenses, and existing investments. Consider how much capital you are willing to invest in the share portfolio without having a significant impact on your day-to-day life.

- Research the market: Research is crucial when it comes to building a share portfolio. Learn about different sectors, industries, and companies. Consider factors such as company’s history, market value, earnings, and potential for growth.

- Diversify your investments: Diversification is key to managing risk and increasing potential returns. Invest across different sectors and subclasses of stocks, such as large-cap, small-cap, and mid-cap stocks. Avoid having all your investments concentrated in one stock or sector.

- Decide on the number of shares: Determine how many shares you want to hold within your portfolio. Consider the amount of capital you have available for investing and plan accordingly.

- Monitor your portfolio: Once your portfolio is created, it’s important to regularly monitor and review the performance of your investments. Keep track of any news or updates associated with the companies in which you have invested.

- Make adjustments when necessary: Over time, you may need to make adjustments to your portfolio based on changes in the market or your investment goals. Be prepared to buy or sell shares as needed to optimize your portfolio.

Remember, creating a share portfolio is a continuous process. It’s important to stay informed and adapt your portfolio as the market evolves. Consider seeking advice from a financial advisor or doing further research to ensure the best possible outcomes.

How to Build Stock Portfolio in Indian Stock Market

Investing in the stock market can be a lucrative way to build wealth over time. However, it is important to approach this journey with caution and a well-thought-out plan. Creating a stock portfolio requires careful consideration of various factors, including your risk tolerance, preferred investment sectors, and the amount of capital you are willing to invest.

Here are some key steps to follow when building a stock portfolio in the Indian stock market:

1. Define your investment goals: Before starting your investment journey, it is crucial to define your goals. Are you looking for long-term growth or short-term gains? Do you want to focus on conservative investments or are you comfortable with taking higher risks? Clearly defining your investment goals will help you make informed decisions along the way.

2. Research different sectors: India’s stock market offers various sectors to invest in, including small-cap, large-cap, and mid-cap stocks. Each sector has its own risks and returns associated with it. Researching and understanding these sectors will allow you to make well-informed investment decisions based on your risk tolerance and investment goals.

3. Diversify your portfolio: Diversification is a key principle in building a stock portfolio. By investing in different sectors and companies, you can spread out your risks and potentially maximize your returns. Aim to have a mix of stocks from various sectors to create a well-diversified portfolio.

4. Evaluate company fundamentals: When selecting stocks for your portfolio, it is important to evaluate the company’s fundamentals. Look at their financial history, earnings growth, and debt levels. Understanding the company’s financial health will give you an idea of its growth potential and stability.

5. Monitor your investments: Building a stock portfolio is not a one-time task. You should regularly monitor your investments to ensure they are performing as expected. Keep an eye on market trends, news, and any other factors that may impact the performance of your stocks. Regularly review and adjust your portfolio as needed.

6. Note your investment history: Keeping a record of your investment history is important for tracking your portfolio’s performance over time. This will help you understand your returns, losses, and make better investment decisions in the future.

7. Seek professional advice if needed: If you are new to investing or find it challenging, consider seeking advice from a financial advisor. They can guide you in creating a portfolio based on your investment goals and risk tolerance.

Remember, creating a stock portfolio is a long-term journey and should not be driven by short-term market fluctuations. Stick to your investment strategy and make informed decisions based on thorough research and analysis.