Investment portfolios are a crucial part of building wealth and securing a stable financial future. Whether you are new to investing or have been saving for some time, understanding how to build a portfolio stock is essential. In this article, we will explore the process of creating a portfolio that suits your financial goals and risk tolerance.

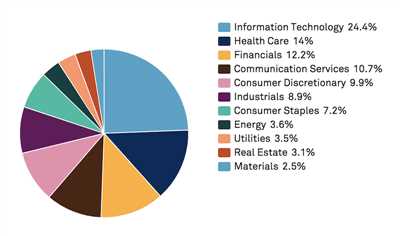

Before diving into the details, it’s important to consider the basic building blocks of a portfolio. One key factor is the selection of stocks and other investments. Stock picking can be a challenging task, as it requires careful consideration of various factors such as performance, risk, and cost. Building a diversified portfolio can help mitigate risk by spreading investments across different sectors and asset classes, such as stocks, ETFs, and bonds.

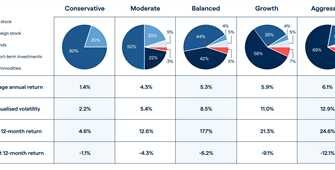

When investing, it’s crucial to determine your risk tolerance and time horizon. Understanding these factors will help you determine what kind of investments are suitable for your portfolio. For example, if you’re comfortable with taking on more risk to potentially achieve higher returns, you may choose to invest in individual stocks. On the other hand, if you’re more risk-averse, ETFs or mutual funds may be a better option.

Another important consideration is the cost structure of your portfolio. It’s necessary to assess the fees associated with purchasing and maintaining the investments in your portfolio. High fees can erode your returns over time, so it’s important to weigh the potential benefits of an investment against the costs involved. Furthermore, keeping an eye on inflation and adjusting your portfolio accordingly can help preserve the value of your savings.

In conclusion, building a portfolio stock is a comprehensive process that requires careful consideration of various factors. By diversifying your investments, understanding your risk tolerance, and keeping an eye on costs, you can create a portfolio that aligns with your financial goals. Remember, always do thorough research and consult with a financial advisor before making any investment decisions, as the stock market is subject to fluctuation and there’s always a risk of loss.

How To Build a Stock Portfolio

Building a stock portfolio is a process that involves investing in a variety of stocks to spread risk, aiming for a good balance between risk and reward. It is a very important investment decision that requires some research and consideration. Here’s a step-by-step guide on how to build a stock portfolio:

| Step 1: Determine Your Investment Profile |

| Before you start building your stock portfolio, it’s important to consider your risk profile. Assess how much risk you are willing to take and how much time you have to invest. This will help you determine the right investment strategy and asset allocation. |

| Step 2: Set Clear Investment Goals |

| Define your investment goals and objectives. Are you looking to grow your savings over time or generate income? This will determine the type of stocks and investments that you should consider. |

| Step 3: Consider Diversification |

| Diversification is key to building a successful stock portfolio. Invest in a mix of stocks from different sectors and industries to spread risk. Consider investing in ETFs (exchange-traded funds) which offer a diversified portfolio with lower costs. |

| Step 4: Research and Selection |

| Do thorough research before picking individual stocks. Consider the company’s performance, financial health, management team, and industry trends. Look for stocks that have a good potential for growth and offer a better risk-to-reward ratio. |

| Step 5: Watch for Costs |

| Keep an eye on the costs associated with your investments. High fees and expenses can eat into your returns over time. Consider low-cost index funds or ETFs to minimize costs while still gaining exposure to the stock market. |

| Step 6: Monitor and Rebalance |

| Regularly monitor the performance of your portfolio and make necessary adjustments. Rebalance your portfolio periodically to ensure it stays in line with your investment goals and risk profile. Consider the impact of inflation on your investments. |

| Step 7: Withdraw and Reinvest |

| If you need to withdraw money from your portfolio, do it strategically. Consider tax implications and the impact on your overall portfolio. Reinvest the money wisely to maintain a balanced and well-structured portfolio. |

Building a stock portfolio requires careful consideration and research. By following these steps and considering the important factors, you can build a well-diversified portfolio that aligns with your investment goals and risk profile.

Stock Portfolios Intro

Welcome to the world of stock portfolios! If you’re a beginner investor or someone looking to better understand how to build and structure your portfolios, this intro will provide you with some valuable insights.

Before diving into the process of building a stock portfolio, it’s important to consider a few key factors. The first is your risk profile – how much risk are you willing to take with your investments? This will help determine the selection of stocks or funds that you choose to invest in.

Another important consideration is your time horizon. Are you investing for the short-term or the long-term? If you’re looking to build wealth over a longer period of time, you may be able to take on more risk in your portfolio. However, if you have a shorter time horizon, it may be better to focus on lower-risk investments.

The next step in building your portfolio is determining how much money you have available to invest. This will help you decide whether you want to invest in individual stocks or opt for exchange-traded funds (ETFs). ETFs can provide a more cost-effective way to diversify your holdings and reduce the risk of loss.

When it comes to selecting individual stocks or funds, it’s important to do your research. Look for stocks or funds that have a solid performance history, strong management teams, and are aligned with your investment goals. Additionally, consider the cost of investing – transaction fees and fund expenses can eat into your returns over time.

Once you have a better understanding of these factors, you can start the process of building your stock portfolio. Consider diversifying your holdings across different sectors, industries, and asset classes to reduce the risk of loss. Furthermore, ensure that you’re regularly reviewing and rebalancing your portfolio to keep it aligned with your investment goals.

One more thing to consider is inflation. Over time, the purchasing power of your money will decrease. To combat this, it may be wise to invest in assets that have historically outpaced inflation.

Remember, building a stock portfolio is a process that takes time and effort. Don’t be afraid to seek advice from professionals or educate yourself through various sources. Investing in the stock market can be a rewarding experience but always ensure you are comfortable with the risk involved and consult a financial advisor if needed.

Consider your risk-to-reward profile

Before you start building your portfolio, it’s important to consider your risk-to-reward profile. This will help you determine the level of risk you’re willing to take on in order to achieve your desired performance.

One of the most important factors to consider is your time frame. How long do you intend to hold your investments? If you’re investing for the long term, you may be able to tolerate more risk in order to potentially achieve higher returns. On the other hand, if you’re investing for a shorter time frame, you may want to focus on preserving your capital and minimizing losses.

Another factor to consider is your risk tolerance. Some individuals are more comfortable with taking on risk, while others prefer a more conservative approach. It’s important to understand your own risk tolerance and invest accordingly.

There are various investment structures and vehicles that you can consider when building your portfolio. For example, you can invest in individual stocks, ETFs (exchange-traded funds), or even consider alternative investments such as real estate or commodities. Each investment option carries its own level of risk and potential reward, so it’s important to do your research and select investments that align with your risk-to-reward profile.

When picking individual stocks or ETFs, it’s important to diversify your investments by spreading them across different sectors and asset classes. This can help reduce the risk of a single investment impacting your overall portfolio performance. Additionally, consider the cost of investing, including fees and expenses associated with buying and selling stocks or ETFs.

Before making any investment decisions, it’s also important to consider the impact of inflation and taxation. Inflation erodes the purchasing power of your money over time, so it’s important to choose investments that can potentially outpace inflation. Additionally, consider the tax implications of your investments, such as whether to invest in a Roth IRA or a traditional IRA.

Overall, the process of building a portfolio requires careful consideration of your risk-to-reward profile. By taking the time to understand your own risk tolerance and investment goals, you can structure a portfolio that aligns with your needs and objectives. Remember to regularly review and adjust your portfolio as needed to ensure it remains in line with your risk appetite and performance expectations.

Picking the Stocks

When building your portfolio, one of the most important steps is to carefully select the stocks you will purchase. There are various approaches to this process, and it ultimately depends on your investing goals, risk profile, and time horizon.

One approach is to pick individual stocks, where you select shares of specific companies to include in your portfolio. This requires thorough research and analysis of the company’s financials, management team, industry trends, and other factors that may impact the stock’s performance.

Another approach is to invest in funds, such as mutual funds or ETFs (exchange-traded funds). These funds pool money from multiple investors and are managed by professionals, who select a portfolio of stocks that align with a specific investment strategy or objective. This can help diversify your investments and simplify the stock selection process.

Before making any investment decisions, it’s important to consider your risk tolerance and investment goals. Stocks can be volatile and may experience fluctuations in value, leading to potential losses. Therefore, it’s crucial to assess your risk profile and determine the level of risk you’re comfortable with before selecting stocks.

In addition, it’s important to consider the cost and structure of your portfolio. Some investments, such as individual stocks, may require you to pay brokerage fees or commissions. On the other hand, certain funds may have ongoing management fees. Understanding these costs upfront can help you make more informed decisions about your investments.

Furthermore, you should also consider the time horizon for your investments. If you have a longer time horizon, you may be able to tolerate more fluctuations in the stock market and potentially benefit from long-term growth. If you have a shorter time horizon, such as saving for a specific goal in the near future, you may want to focus on more stable investments or diversify your portfolio accordingly.

When picking stocks, it’s also important to consider diversification. Diversifying your portfolio means spreading your investments across different asset classes, sectors, and geographies. This can help reduce the impact of any single investment on your overall portfolio and potentially lower risk.

Overall, the process of picking stocks requires careful analysis and consideration. Whether you choose individual stocks or funds, it’s important to have a clear investment strategy and stick to it. Regularly reviewing and evaluating your portfolio’s performance and making any necessary adjustments is also crucial to maintain a well-balanced and successful portfolio.

Sources

When building a portfolio, it is important to consider the sources from which you will be selecting your investments. Here are some key sources to consider:

- Individual Stocks: Purchasing individual stocks allows you to have more control over the stock selection process. However, it also carries a higher level of risk and cost.

- Exchange-Traded Funds (ETFs): ETFs are a better option for those who are not well-versed in picking individual stocks. They offer a diversified portfolio at a lower cost and are easy to purchase.

- Mutual Funds: Mutual funds are professionally managed investment funds that pool money from many investors to invest in a diversified portfolio of stocks. They are a more passive approach to investing.

- Roth IRA: A Roth IRA is a retirement account that allows you to invest after-tax money and enjoy tax-free growth and withdrawals in the future. It can be a valuable addition to your investment portfolio.

These sources offer different levels of risk-to-reward ratios, so it’s important to educate yourself on each before making any investment decisions. Consider your risk profile, time horizon, and investment goals when structuring your portfolio. Remember that over the long term, inflation can erode the value of your money, so it’s important to select investments that have the potential to outpace inflation and generate decent returns.

Before making any investment, always do your own research and consult with a financial advisor if needed. Building a successful portfolio is a very personal process, and what works for others may not work for you. Take the time to understand the performance and cost of each investment option and select those that align with your investment strategy and goals.