In today’s world, e-commerce is becoming the most popular way to do business. With the rise of digital currencies and the increasing need for secure and convenient payment solutions, creating a payment app has become a necessity for many businesses, both big and small. Whether you want to provide a mobile payment option for your customers or strategize your financial transactions, having your own payment application allows you to customize the features and functionality to suit your specific needs.

There are many reasons why you should consider creating a payment app. First and foremost, it allows you to provide a secure and easy-to-use platform for your users to make digital transactions. You can select from multiple payment gateways and choose the one that best suits your business type. With the right payment gateway, you can ensure the security of transactions and authenticate the users to prevent any fraudulent activities. Moreover, having your own payment app gives you the freedom to customize the design and user experience to match your brand’s identity.

When creating a payment app, there are several factors you should consider. First, you need to select a reliable platform or development tools. Shoutem, for example, is an Android and iOS app builder that makes the process of creating a payment app much easier. It provides a variety of features and tools that allow you to customize the app according to your specific requirements. You can also integrate multiple payment gateways and currencies to cater to customers from all around the world. This allows you to expand your business globally and provide a seamless payment experience to customers worldwide. Moreover, the app builder also provides free technical support and updates, ensuring that your payment app is always up-to-date and functioning correctly.

Once you have selected the platform or app builder, you can start building your payment app. The first step is to choose a catchy app name that reflects its purpose. Once you have picked the right name, you can start designing the user interface and layout. Make sure to create a user-friendly interface that makes it easy for users to navigate and complete transactions. You should also strategize the flow of the app, ensuring that it leads users to the right page and allows them to complete the payment process smoothly. Additionally, make sure to offer multiple payment options, such as credit/debit cards, e-wallets, and even cash on delivery, to cater to the different preferences of your customers.

Lastly, make sure that your payment app complies with all the legal and regulatory requirements. Check your country’s laws and regulations regarding financial transactions and ensure that your app follows all the necessary regulations. This includes having the proper licenses and certificates to operate as a financial service provider. Being legally compliant not only protects your business but also provides trust and confidence to your customers. Once you have completed all these steps, you can launch your payment app and start providing a convenient and secure payment solution to your customers.

- How to Build a Payment App Like Zain Cash

- Why You Should Create Your Own Payment App

- 9 Best Payment Gateways in the Market Right Now

- Why Should You Choose Appy Pie’s Payment App Builder

- Check out PayAngel – Money Transfer App Development Solution

- 1 Select The Type of Payment Application

- 2 Pick a Mobile Platform

- 3 Strategize the App Features

- 4 Check Legal and Security Issues

- 5 Select the Correct Tech Stack

- P2P Payment App Builder FAQ

- How do I build a mobile payment system

- How to create your own payment gateway for free

How to Build a Payment App Like Zain Cash

In today’s digital economies, having a payment app has become more popular than ever. With the rise of e-commerce and the need for secure and convenient payment solutions, there is now a growing number of tech-savvy users who prefer to do most of their financial transactions online.

If you are looking to build your own payment app, there’s good news – you don’t have to start from scratch. There are many open-source platforms and existing solutions out there that you can customize to fit your specific needs. One excellent example is Zain Cash, a standalone payment app for Android and iOS.

Why choose Zain Cash? Well, it not only provides the basic functionalities like sending and receiving money but also has additional features like bill payment options and integration with other popular platforms. Zain Cash has also strategized to provide the most secure and legal solution possible, ensuring the safety of users’ finances.

When building a payment app like Zain Cash, it is important to select the right tech stack. You should consider using multiple gateways to provide users with a variety of payment options. Also, security should be a top priority, as users will be entrusting you with their financial information.

Here are some key features and functionalities that your payment app should have:

- Secure P2P money transfer

- Integration with popular payment platforms

- Bill payment options

- Customizable user interface

- Multiple gateways for easy payments

By providing these features, you can make your payment app a go-to solution for users looking for a safe and convenient way to manage their finances on a mobile platform.

When it comes to building a payment app like Zain Cash, there are a number of sources and tools available that can help you out. Some platforms like Shoutem provide an excellent platform for creating media-centric applications, while others may offer more in-depth functionalities. It all depends on your requirements and the scale at which you want to operate.

In conclusion, building a payment app is no longer a difficult task. With the right resources, technology, and a clear understanding of the legal and security aspects involved, you can create a payment app that stands out in the global market.

So why wait? Get started now and make your mark in the world of mobile payments!

If you have any more questions or need further assistance, please check out our FAQ section or reach out to us on social media. We’re here to help.

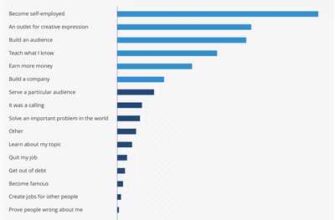

Why You Should Create Your Own Payment App

In today’s tech-savvy world, payment applications have become increasingly popular. With the rise of e-commerce and P2P services, more and more people are choosing mobile apps as their preferred payment method. So, why should you consider creating your own payment app?

1. Convenience: Payment apps make it easy for consumers to pay for goods and services with just a few taps on their mobile devices. It eliminates the need for cash transactions and provides a faster and more efficient way to complete purchases.

2. Security: With the correct functionality and robust security measures, payment apps can offer a secure platform for users to transfer money. They use encryption and authentication tools to protect sensitive information and prevent unauthorized access.

3. Customization: By creating your own payment app, you have the freedom to customize it according to your business needs. You can add specific functionalities or tailor it to cater to a specific target audience.

4. Standalone Solution: Having your own payment app allows you to provide a standalone solution to your customers. They don’t have to rely on third-party payment gateways or applications, giving you more control over the payment process.

5. Global Reach: With a payment app, you can expand your business worldwide. It allows you to provide services to customers from different countries, making it easier for them to make payments in their own currency.

6. Business Opportunities: Creating your own payment app opens up new business opportunities. You can offer your app as a solution to other businesses or partner with existing platforms to enhance their payment functionalities.

7. More Than Just Payments: Payment apps can offer more than just the ability to pay. They can integrate additional services like bill payments, financial tools, and authentication systems to make them more versatile and useful to users.

8. Popularity: As mobile usage continues to grow, payment apps have become increasingly popular. By creating your own app, you can tap into this market and cater to the growing demand for mobile payment solutions.

9. Legal and Compliance: When you create your own payment app, you have control over the legal and compliance aspects. You can ensure that your app follows all the necessary regulations and provides a safe and secure environment for users.

10. Branding and Recognition: Having your own payment app can help you build brand recognition and loyalty. It allows you to showcase your business’s identity, logo, and personalized user experience, making it more memorable for your customers.

In conclusion, creating your own payment app can be a smart and strategic move for any business. It offers convenience, security, customization options, and business opportunities. With the right functionalities and a well-designed app, you can provide a seamless payment experience to your customers and stay ahead of the competition in today’s digital world.

9 Best Payment Gateways in the Market Right Now

When creating a mobile payment app, it is essential to have the correct payment gateway integrated into your system. Choosing the best payment gateway can make or break your app’s success, so it’s crucial to strategize and select the right one for your needs. Here are nine of the best payment gateways available in the market right now:

- PayPal: PayPal is one of the most popular and widely used payment gateways, offering a secure and flexible solution for small businesses and e-commerce applications. It allows users to make payments using their PayPal account or with a credit card, and it also provides a number of customization tools and functionalities.

- Stripe: Stripe is an excellent choice for developers, as it provides an easy-to-use and flexible payment system. It allows users to accept payments from around the world in multiple currencies, making it a global payment gateway. It also offers top-notch security features and has become the go-to choice for many tech companies and startups.

- Braintree: Braintree, owned by PayPal, is another popular payment gateway that offers a seamless and secure payment solution. It provides a unique feature called “Drop-in UI,” which allows users to customize their payment user interface easily. Braintree also supports various payment methods, including PayPal, credit cards, and Venmo.

- Authorize.Net: Authorize.Net is a trusted payment gateway that provides a comprehensive set of tools for businesses of all sizes. It offers excellent security features, including fraud detection and prevention, along with recurring billing and invoicing capabilities. Authorize.Net is compatible with a wide range of e-commerce platforms, making it a versatile choice for businesses.

- 2Checkout: 2Checkout is an all-in-one payment gateway that allows businesses to accept a variety of payment options, including credit cards, PayPal, and more. It also offers multiple language support, making it a convenient choice for businesses with a global customer base.

- PayU: PayU is a popular payment gateway that caters to the needs of businesses in emerging economies. It has a strong presence in countries like India, Brazil, and Turkey and offers locally tailored payment solutions. PayU also provides easy integration with popular e-commerce platforms.

- Payza: Payza is a versatile payment gateway that allows users to send and receive money globally. It supports multiple currencies and provides various security features to ensure safe transactions. Payza is an excellent choice for businesses that have an international customer base.

- PayPal Here: PayPal Here is a mobile payment gateway that allows businesses to accept payments on the go. It provides a free app and a mobile card reader, enabling businesses to process payments anywhere, anytime. PayPal Here is an ideal choice for small businesses and individuals who need a simple and portable payment solution.

- PayAngel: PayAngel is a payment gateway that specializes in cross-border transactions. It offers competitive exchange rates and allows businesses to receive payments in multiple currencies. PayAngel also provides real-time reports and analytics to help businesses track their financial transactions effectively.

When choosing a payment gateway for your mobile payment app, consider factors such as security, ease of integration, support for multiple payment methods, and compatibility with your chosen app builder. The nine gateways mentioned above are some of the best options available in the market right now. Evaluate your specific requirements and choose the one that best aligns with your business needs.

Why Should You Choose Appy Pie’s Payment App Builder

Appy Pie’s Payment App Builder provides a global platform for businesses to create their own payment app. With the increasing popularity of cashless transactions, having a payment app has become a necessity for every type of business. Appy Pie’s Payment App Builder offers a number of features and services that make it the right choice for businesses looking to provide a secure and convenient solution for their users.

One of the standout features of Appy Pie’s Payment App Builder is its ability to customize the app to suit the specific needs of the business. The platform allows businesses to select the functionalities they require, allowing them to strategize and provide the most efficient payment app. Appy Pie’s Payment App Builder also provides excellent security features, ensuring that every transaction is secure and protected.

Appy Pie’s Payment App Builder is a standalone platform, meaning businesses don’t need to rely on other platforms like PayPal or foreign payment services. This makes it easier for businesses to operate within their own ecosystem and provides greater control and flexibility over the payment system. The platform supports multiple payment options, including P2P transfers, bill payments, e-commerce transactions, and more.

Another advantage of using Appy Pie’s Payment App Builder is its compatibility with multiple platforms, such as Android and iOS. This ensures that businesses can reach a wider audience and cater to users on different devices. The platform also provides social media-centric features, allowing businesses to leverage social media platforms for marketing and promotion.

Appy Pie’s Payment App Builder also offers excellent tech support and assistance, ensuring that businesses can easily navigate the app creation and development process. The platform provides a user-friendly interface and step-by-step guidance, making it easy for even those with limited technical expertise to create a professional and functional payment app.

Appy Pie’s Payment App Builder is not only popular among small businesses but also well-established enterprises. Its user-friendly interface, excellent security features, and customizable functionalities make it an ideal choice for any business looking to create a payment app. With the world becoming more digital and cashless, having a payment app has become a necessity for businesses. Appy Pie’s Payment App Builder allows businesses to meet this growing demand and stay ahead in the competitive market.

| 1. Global platform | 2. Standalone system | 3. Multiple payment options |

| 4. Customizable features | 5. Excellent security | 6. Compatibility with multiple platforms |

| 7. Social media-centric features | 8. Tech support and assistance | 9. Cashless and digital solution |

Check out PayAngel – Money Transfer App Development Solution

PayAngel is an excellent solution for creating a mobile payment app that allows users to send and receive money securely. This convenient and secure system is popular among businesses and individuals, providing a hassle-free way to transfer money and make payments.

With PayAngel, you have the flexibility to customize and build a standalone app or integrate its functionality into existing applications. It supports multiple services, such as bill payments and e-wallets, making it a versatile solution for both domestic and international transactions.

One of the key features of PayAngel is its excellent security measures. The app uses state-of-the-art encryption technology to ensure that all financial transactions are secure and protected. It also provides a robust system for verifying users’ identities before processing any transfers or payments.

PayAngel is powered by Shoutem, a popular app builder platform that offers a range of tools and features to streamline the app development process. With Shoutem, you can easily create a customized and user-friendly interface for your app, ensuring a seamless experience for your users.

Whether you are an individual looking to send money to friends and family or a business looking to strategize foreign payments, PayAngel is the ideal solution for you. It allows you to select from a range of services and provides the flexibility to cater to your specific needs.

PayAngel also offers a comprehensive FAQ section, where you can find answers to most of your questions regarding the app’s functionality and services. This helps users navigate through any issues they may encounter and makes the overall experience more user-friendly.

In today’s digital age, where most transactions are being done through mobile apps, having a secure and convenient money transfer app is essential. PayAngel provides all the tools and functionality you need to create such an app, offering users a seamless and reliable way to send and receive money.

So why pick PayAngel? It’s simple. The app provides excellent security, convenience, and versatility, making it one of the most popular choices for individuals and businesses around the world. Whether you want to check your balance, send money to friends, or pay bills, PayAngel has got you covered.

In addition, PayAngel is integrated with Zain, a global media-centric platform that allows users to connect and interact with each other. This integration gives users access to a wide range of media-centric features, such as sharing photos and videos, creating groups, and connecting with friends and family.

| Key Features of PayAngel | Key Benefits for Users |

|---|---|

| Convenient and secure money transfer | Quick and easy way to send money |

| Integration with popular e-wallets | Flexibility in choosing payment methods |

| Robust security measures | Peace of mind knowing your transactions are safe |

| Customizable app interface | A user-friendly and personalized experience |

| Integration with Zain | Access to a wide range of media-centric features |

In conclusion, PayAngel is the perfect solution for businesses and individuals looking to create a mobile payment app. Its secure and convenient system, along with its integration with popular platforms and services, makes it a reliable choice for money transfer and financial transactions. So don’t wait, start building your own payment app with PayAngel today!

1 Select The Type of Payment Application

In the world of cashless transactions, payment applications have become a popular choice for businesses and individuals alike. These apps provide a convenient and secure way to make payments, send money to others, and even open up new opportunities for users.

When it comes to creating a payment app, there are several types to choose from. Each type offers different features and benefits, so it’s important to pick the right one for your needs.

One option is to create a standalone payment app. These apps are designed to provide a complete solution for sending and receiving payments. They often come with built-in security features and allow users to customize their app’s interface.

Another option is to integrate payment services into an existing mobile app. This can be a great choice for businesses that already have a mobile app and want to add payment functionality to it. By integrating payment services, businesses can provide their customers with a seamless and convenient payment experience.

There are also payment platforms that provide a more comprehensive solution. These platforms offer a range of payment services, including gateway integration, multiple currency support, and authentication tools. They are designed to cater to businesses of all sizes and can be customized to meet specific needs.

Some of the most popular payment platforms include PayPal, Zain, PayAngel, and PayPie’s global payment platform. These platforms not only provide secure and convenient payment services but also support multiple currencies, making them ideal for businesses operating in foreign economies.

Before selecting a payment application type, it is important to check the features and capabilities of each option. Consider factors like security, ease of use, customization options, and compatibility with existing systems.

By picking the right payment application type, businesses can provide their customers with a reliable and convenient way to make payments. This can lead to increased customer satisfaction and loyalty, as well as improved business efficiency.

| Payment Application Type | Examples |

|---|---|

| Standalone Payment App | PayPie |

| Integration with Existing Mobile App | Zain |

| Payment Platforms | PayPal, PayAngel |

In conclusion, selecting the right type of payment application is crucial for businesses who want to offer their customers a convenient and secure payment experience. Consider the available options, evaluate their features and make an informed decision that will benefit your business and your customers.

2 Pick a Mobile Platform

One of the key factors to consider is convenience. Android has a larger market share worldwide, making it a popular choice for app development. However, iOS users tend to spend more on apps and in-app purchases, so if monetization is your primary goal, iOS might be a better option.

Security is also a major concern when it comes to mobile payments. Both Android and iOS have strong security features in place, but iOS is often regarded as the more secure platform. iOS offers features like app sandboxing and strict app review guidelines, making it a preferred choice for those who prioritize security.

Another consideration is the development process itself. Android development allows for more customization and freedom, while iOS development follows stricter guidelines. Depending on your app’s features and the user experience you want to provide, you may find one platform to be more suitable than the other.

It’s important to note that having a mobile payment app means dealing with legal and regulatory requirements. You need to ensure that your app complies with the rules and regulations in every country you plan to operate in. Both Android and iOS have tools and resources to help you navigate these requirements, but it’s crucial to do your homework and understand the legal aspects of providing financial services.

When it comes to integrating payment gateways into your app, there are multiple options available. Both Android and iOS support a wide range of gateways, allowing you to choose the one that best suits your needs. Some popular payment gateways include PayPal, Stripe, and Square, among others. Make sure to check their features, pricing, and compatibility with your chosen mobile platform.

Apart from payment gateways, you may also consider integrating digital wallets into your app. E-wallets like Apple Pay and Google Pay have become increasingly popular, offering users a convenient way to make cashless payments. Having these options in your app can attract more users and enhance the overall user experience.

To summarize, when picking a mobile platform for your payment app, consider factors like convenience, security, customization, legal requirements, payment gateways, and digital wallet integration. Strategize your development process based on your app’s target audience and the features you want to offer. Remember that there is no one-size-fits-all solution, and what works for one app may not work for another. Do thorough research, weigh the pros and cons, and make sure to pick the right platform for your payment app.

3 Strategize the App Features

When creating a payment app, it is essential to strategize the features that will set your app apart from others in the global market. Here are some key considerations to keep in mind:

- Multiple Currency Support: Select a payment gateway that allows users to make transactions in multiple currencies. This will cater to users from around the world and provide a seamless experience for international businesses.

- P2P Transfers: Having a peer-to-peer transfer system makes it easier for users to send and receive money directly from their contacts. This feature helps individuals and businesses make quick and secure cash transfers.

- Security: Security should be a top priority for any payment app. Choose a development platform that offers excellent security features, such as encryption and secure authentication, to protect user data.

- Integration with Other Services: To make your payment app more versatile, consider integrating it with other popular services. For example, integrating with PayPal will allow users to link their PayPal accounts for seamless payments.

- Customization: Users should have the ability to customize their payment app according to their preferences. A user-friendly app builder like Shoutem or Stack allows users to customize the user interface and tailor the app to their specific needs.

- Standalone E-Wallets: A stand-alone e-wallet feature enables users to store their digital money within the app. This makes it convenient for users to manage their funds and access them whenever necessary.

- Media-Centric Solutions: In today’s media-centric world, integrating features such as QR code scanning and barcode support can enhance the user experience. These features make it easier for users to make payments and redeem offers.

- Legal Compliance: Ensure that your payment app complies with all legal requirements and regulations in the countries where it operates. This is crucial for building trust among users and avoiding any legal issues in the future.

- FAQ and Customer Support: Provide users with a comprehensive FAQ section within the app to answer common questions and address any concerns they might have. Additionally, having a dedicated customer support service helps users resolve any issues they encounter while using the app.

By implementing these strategic features into your payment app, you can differentiate your app from competitors and attract a larger user base. Remember to continuously improve and update your app based on user feedback to stay ahead in the ever-evolving payment app market.

4 Check Legal and Security Issues

When creating a payment app, it’s crucial to ensure that your solution is secure and complies with legal requirements. Here are some key aspects to consider:

Legal issues:

- Check the legal regulations in the countries where you plan to operate. Different countries have different regulations regarding online payments, so make sure your app complies with all applicable laws.

- Research the legal steps and requirements for setting up a payment app in your target market. This may include obtaining necessary licenses or certifications.

- Ensure that your terms of service and privacy policy are comprehensive and transparent for your users. Clearly outline how you handle their personal and financial information and address any possible disputes or liabilities.

Security:

- Implement strong security measures to protect user data and prevent unauthorized access or fraud. Use encryption technologies to secure sensitive information and regularly update your app’s security features.

- Partner with reputable payment gateway providers to ensure secure and reliable transactions.

- Regularly test your app for vulnerabilities and implement necessary patches or updates to address any security risks.

By checking legal and security issues, you not only protect your users but also ensure the trust and credibility of your payment app in the market.

5 Select the Correct Tech Stack

The choice of the right tech stack is crucial when developing a payment app. It determines the security, functionality, and convenience of the app for users. Here are some key factors to consider:

- Security: Security is of utmost importance when it comes to payment apps. The tech stack you choose should have robust security features to ensure the safety of users’ financial data and transactions.

- Functionality: Your payment app should offer a wide range of functionalities to meet the needs of every user. It should support various payment gateways, currencies, and bill payment services to provide a comprehensive solution.

- Convenience: Convenience is a key factor in the adoption of payment apps. The tech stack should enable smooth and hassle-free transactions, allowing users to send and receive money with ease.

- Compatibility: The tech stack you select should be compatible with different platforms and devices. It should support both Android and iOS operating systems to cater to a larger user base.

- Popular Payment Gateways: Integrating popular payment gateways like PayPal in your app can make it more versatile and user-friendly. It allows users to link their accounts and make transactions using their preferred payment methods.

By selecting the right tech stack, you can create a secure, convenient, and feature-rich payment app that meets the needs of users worldwide. Consider the above factors to strategize your app development and build a successful cashless payment solution that provides a secure gateway to the financial world.

P2P Payment App Builder FAQ

Creating a P2P payment application is a great way to provide a secure and convenient financial solution to your users. Here are some frequently asked questions (FAQ) to help you strategize and build your own P2P payment app:

1. How do P2P payment apps work?

P2P payment apps allow users to send and receive payments from their mobile devices. Users can link their bank accounts or e-wallets to the app, select the recipient, and send money instantly. The app acts as an intermediary, ensuring secure transactions and providing excellent features for the users.

2. What are the benefits of using a P2P payment app?

P2P payment apps offer multiple advantages, such as convenience, security, and speed. Users can easily split bills, pay friends, or make online purchases without having to carry cash. The app also allows users to check their transaction history and customize their preferences.

3. Can businesses use a P2P payment app?

Yes, businesses can use a P2P payment app to receive payments from their customers. Some apps offer additional features for businesses, such as integrating with popular e-commerce platforms and providing payment gateways to process transactions.

4. Can I create my own P2P payment app?

Yes, you can create your own P2P payment app using a payment app builder like PayAngel or Appy Pie. These tools provide a user-friendly interface that allows you to customize the functionalities of your app and select the payment gateways that best suit your business needs.

5. What legal issues should I consider when creating a P2P payment app?

When creating a P2P payment app, you should ensure that you comply with the local regulations and obtain the necessary licenses for operating a financial service. It’s important to consult legal experts to ensure that your app is compliant and secure.

6. Are P2P payment apps secure?

Yes, P2P payment apps prioritize security and use multiple layers of encryption to protect users’ financial information. However, it’s essential to regularly update the app and stay informed about the latest security measures to address any potential issues.

7. Can a P2P payment app work with multiple currencies?

Yes, many P2P payment apps allow users to send and receive money in different currencies. This feature is particularly useful for international transactions and users who frequently travel or have connections in different financial economies.

8. How can I make my P2P payment app stand out?

To make your P2P payment app stand out, you can focus on providing unique features, excellent user experience, and reliable customer support. It’s also important to keep an eye on the market trends and address the users’ needs and preferences.

9. What are some popular P2P payment app builders?

Some popular P2P payment app builders include PayAngel, Appy Pie, and Shoutem. These builders offer a stack of tools and functionalities to help you create an application that meets your business requirements.

By following the correct steps and using the right tools, you can create a P2P payment app that provides a secure and convenient way for users to send and receive money.

How do I build a mobile payment system

Next, you will need to select a payment gateway. This is crucial for providing secure and correct transfer of money. There are many options available, including PayPal, PayAngel, and others. Choose the one that best fits your needs and aligns with your system requirements.

You also need to consider the global aspect of your app. If you want your mobile payment system to be used worldwide, make sure it supports different currencies. Zain, for example, is an excellent choice for having a wide range of currencies.

When it comes to building your app, you can either hire a developer or use an app builder like Appy Pie. Both options have their pros and cons. Hiring a developer gives you more control and flexibility, while using an app builder is quicker and more cost-effective.

Security is a top priority for any mobile payment system. Make sure to incorporate the necessary security features to protect your users’ financial information. Also, provide convenient features to your users, like P2P transfer and bill payment functionality.

In conclusion, building a mobile payment system requires careful planning and consideration. By selecting the right tech stack, payment gateway, and app development platform, you can create a secure and convenient solution for your users. Keep in mind the global nature of the app, select the right currencies, and prioritize security to make your mobile payment system a success.

How to create your own payment gateway for free

In the world of cashless transactions, having your own payment gateway can be a great advantage for businesses. With the rise of e-commerce and the need for secure and convenient payment solutions, payment gateways have become an essential part of the digital payment system.

While there are popular payment gateways like PayPal and Stripe, some businesses may want to have their own payment gateway for various reasons. This can include wanting to have full control over the payment process, creating a unique user experience, or avoiding the fees associated with using third-party platforms.

If you’re considering creating your own payment gateway, here are some steps to get you started:

| 1 | Pick a development platform |

| 2 | Choose the tools and technologies |

| 3 | Build the payment app |

| 4 | Implement secure authentication |

| 5 | Provide multiple payment options |

When choosing a development platform, you can go for an open-source solution like Zain or opt for a paid platform like Shoutem. Both platforms offer excellent functionalities and can be used to build a secure and functional payment gateway.

Next, you should choose the tools and technologies that will be used to develop your payment app. This can include technologies for user authentication, sending and receiving payments, and currency conversion. Having a secure and reliable tech stack is essential for creating a payment gateway that users can trust.

Now, it’s time to build the payment app itself. Follow the best practices and guidelines provided by your chosen platform to ensure that your app is secure and performs well. Test the app extensively to make sure it can handle the expected load and is free from any issues or bugs.

Implementing secure authentication is crucial to protect your users’ data and prevent any unauthorized access to their e-wallets. Make sure to use industry-standard protocols and encryption algorithms to secure user information and transactions.

In addition to secure authentication, offering multiple payment options is also essential. Users should be able to choose from different payment gateways, currencies, and payment methods like credit cards, bank transfers, or P2P transfers. This will make your payment gateway more versatile and appealing to a wider market.

Creating your own payment gateway can be a rewarding and profitable venture. With the right platform, tools, and development approach, you can build a secure and functional payment gateway that meets the needs of businesses and users around the world. By providing a convenient and reliable solution for digital payments, your payment gateway can become an integral part of the cashless economy.

Now that you understand how to create your own payment gateway, it’s time to get started. Explore the available platforms, choose the one that suits your requirements, and begin the development process. With determination and the right resources, you can build a successful payment gateway that revolutionizes the way transactions are made in the digital world.