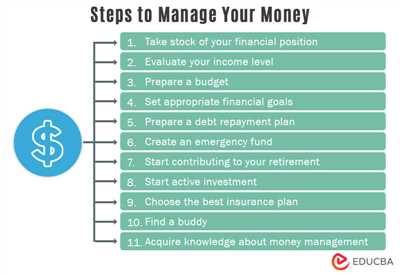

Managing your money is an essential skill in today’s fast-paced world. It’s something that everyone needs to do, regardless of their financial situation. Whether you’re just starting out in your career or you’re a seasoned professional, taking control of your finances can improve your financial health and make it easier to achieve your long-term goals.

One of the first steps to managing your money is creating a budget. A budget is a plan that helps you determine how much money you have coming in each month, how much you’re spending, and where your money is going. To start, you’ll need to track your expenses for at least a month to get an accurate picture of your spending habits. This will help you determine where you might be overspending and where you can cut back.

Once you have a good idea of your monthly income and expenses, you can start allocating your money to different categories. For example, you might allocate a certain amount each month for savings, a certain amount for groceries, and a certain amount for entertainment. This will help you prioritize your financial needs and make sure you’re saving enough for your short-term and long-term goals.

Another key tip for managing your money is to open separate accounts for different purposes. For example, you might have a checking account for your day-to-day expenses, a savings account for your emergency fund, and an investment account for your long-term goals. This will make it easier to track your money and ensure that you’re not using funds earmarked for one purpose for something unrelated.

Finally, it’s important to think about your financial goals and the impact they will have on your life. This might include things like paying off your mortgage, saving for a big purchase, or planning for retirement. By setting clear goals and creating a plan to achieve them, you’ll be more motivated to stick to your budget and make the necessary sacrifices to reach your goals.

In conclusion, managing your money is a crucial skill that everyone needs to learn. By creating a budget, tracking your expenses, and setting clear goals, you can take control of your finances and improve your financial health. It may take some time and effort, but with the right strategies and mindset, you’ll be on your way to a more secure financial future.

Creating a budget

When it comes to managing your money, one of the first steps you’ll need to take is creating a budget. A budget is a plan that helps you allocate your available funds to meet your financial goals and needs. It’s a great way to take control of your finances and track your spending.

To start creating a budget, you’ll first need to determine your monthly income. This includes your salary, any additional sources of income, and any fixed expenses such as mortgage or rent payments. Once you have a clear idea of how much money you have coming in each month, you can begin to allocate it towards different categories.

One of the tips for creating a budget is to think about both short-term and long-term goals. Short-term goals might include saving for a vacation or paying off debt, while long-term goals might include saving for retirement or investing in a home. By setting aside money for these goals, you’ll be able to watch your savings grow and make progress towards your financial aspirations.

It’s also important to track your expenses and make adjustments as needed. This will help you determine where your money is going and identify any areas where you might be overspending. By keeping a close eye on your spending, you can make more informed decisions about how to manage your money.

Creating a budget can also have a positive impact on your overall financial health. It can help you prioritize your spending, so you’re not wasting money on unnecessary or expensive purchases. It can also help you manage your savings and investments, ensuring that you’re making wise choices with your money.

Remember to also prioritize self-care when creating your budget. Your finances are just one aspect of your life, and it’s important to allocate some money towards activities or items that bring you joy and improve your well-being. This might include things like fitness classes, hobbies, or treating yourself to something special now and then.

As you start managing your money and creating a budget, be sure to educate yourself about personal finance. There are many resources and content available that can help you improve your understanding of money management and make better financial decisions.

By taking the time to create a budget, you’ll be on your way to better financial management and achieving your goals. It may take some time and effort to get started, but in the long run, it will be well worth it for your financial well-being.

Related content

When it comes to managing money, there are several related topics that you should educate yourself on in order to improve your financial management skills. Below are some tips and resources that can help you start taking control of your finances:

Budgeting:

Creating a monthly budget is a good way to allocate your salary and determine your financial priorities. Start by tracking your spending and think about what needs and goals are most important to you. This will help you make sure you’re allocating your money properly.

Saving:

Having a savings plan in place is crucial for both short-term and long-term financial management. Determine how much you can afford to save each month, and make it a priority to put that money into your savings account. You’ll be surprised how quickly your savings can grow!

Expenses:

Watch your monthly expenses and think twice before making expensive purchases. By controlling your spending and making sure you’re only buying what you really need, you can save a lot of money over time. Prioritize self-care, but be mindful of the impact these expenses might have on your long-term savings goals.

Investment:

Consider investing some of your savings for the long-term. There are many available investment plans that can help you grow your money, such as a retirement fund or a mortgage plan. Educate yourself on the options available to you and determine which ones align with your goals and risk tolerance.

Remember, managing your money is a journey, not a one-time task. Be sure to regularly review and adjust your budget, savings, and investment plans as your circumstances change. By staying proactive and staying on top of your finances, you’ll be well on your way to financial stability and success.

Track your spending to improve your finances

One of the key steps to managing money effectively is to track your spending. By keeping an eye on where your money goes each month, you can gain a better understanding of your financial habits and make necessary adjustments to improve your finances.

Tracking your spending may seem daunting at first, but it’s a good habit to develop. It becomes easier over time, especially with the help of online tools and apps that can automatically categorize your expenses for you. You might be surprised to find out how much you’re actually spending on certain items or activities.

By tracking your spending, you can identify areas where you can cut back or make changes. For example, you might notice that you’re spending a significant portion of your income on dining out, and realize that cooking at home more often could save you money. Or you might see that you’re spending more on entertainment than you thought, and decide to allocate some of that money towards savings or to pay off debt.

Creating a budget is an important part of tracking your spending. It allows you to prioritize your financial goals and determine how much you can allocate towards each one. A budget also helps you to plan for short-term and long-term expenses more effectively.

When you track your spending, you also gain more control over your financial health. You’ll be able to see patterns and trends in your spending habits and make adjustments as needed. This can make a big impact on your long-term financial goals, such as saving for retirement or paying off a mortgage.

One of the key tips in tracking your spending is to be honest with yourself. It’s important to accurately record all of your expenses, even if they might be considered “small” or “insignificant.” Every expense adds up, and by capturing them all, you can get a more accurate picture of your financial situation.

Using a calendar or a budgeting app can help you stay organized and make it easier to track your spending. Set aside time each month to review your expenses and make any necessary adjustments to your budget. This will ensure that you’re staying on track and making progress towards your financial goals.

Lastly, tracking your spending can also help you identify areas where you might need to educate yourself further. For example, if you notice that you’re spending a large portion of your income on medical expenses, you might want to look into ways to lower your healthcare costs or find better insurance options.

In conclusion, tracking your spending is a crucial step in managing your money effectively. It allows you to understand where your money is going and make informed decisions about your financial priorities. By keeping a watchful eye on your spending and creating a solid budget, you’ll be well on your way to improving your finances and reaching your long-term goals.

Educate Yourself

When it comes to managing your money, it’s important to educate yourself on the best practices and strategies. By understanding your financial needs and goals, you can make informed decisions about how to allocate your money each month.

One of the first steps in educating yourself about money management is to track your expenses. Keep a record of all your spending, from fixed expenses like rent or mortgage payments to more variable expenses such as groceries or self-care. This will help you determine where your money is going and where you might be able to make adjustments.

Creating a budget is another key component of money management. A budget is a plan that helps you allocate your money and plan your spending. By setting specific financial goals, such as saving for a short-term expense or investing for the long-term, you can prioritize your spending and make sure your money is being used in a way that aligns with your priorities.

As you educate yourself about money management, you may also want to open a savings account. By putting aside a portion of your salary each month, you can start building an emergency fund or save for larger financial goals. This will make it easier to handle unexpected expenses and improve your overall financial health.

It’s also important to think about the impact of your spending on your financial goals. Before making a purchase, ask yourself if it aligns with your priorities and if it is a necessary expense. By being mindful of your spending, you can avoid overspending on items that are not essential and ensure that your money is being used in the most effective way.

Lastly, don’t be afraid to seek out tips and advice from others who have experience with money management. There are many resources available, such as books, online content, or financial advisors, that can provide valuable insights and strategies for managing your money effectively.

By educating yourself about money management, you will be better equipped to start taking control of your finances. With a solid plan in place and an understanding of your financial goals, you can make informed decisions and start building a better financial future.

| Tips for Managing Your Money |

|---|

| – Track your expenses |

| – Create a budget |

| – Open a savings account |

| – Think about the impact of your spending |

| – Educate yourself through books, online content, or financial advisors |

Determine your financial priorities

When it comes to managing your money, it’s important to determine your financial priorities. This will help you allocate your resources effectively and make sure you’re spending and saving in line with your goals. Here are some tips to help you determine your financial priorities:

| – Watch your spending: | Track your monthly expenses and determine where your money is going. This will give you a good idea of where you might be overspending or where you can make cuts. |

| – Evaluate your needs: | Think about your fixed expenses, such as rent or mortgage payments, as well as your basic needs like food, transportation, and healthcare. Make sure you have enough money allocated for these expenses. |

| – Set short-term and long-term goals: | Consider what you want to achieve in the short-term, such as paying off debt or saving for a vacation. Also, think about your long-term goals, such as buying a house or investing for retirement. |

| – Prioritize your goals: | Rank the importance of each goal and determine how much money you’re willing to allocate towards each one. This will help you stay focused and make strategic decisions about your finances. |

| – Educate yourself: | Take the time to learn about money management, budgeting, and investment strategies. The more you know, the easier it will be to make informed decisions about your finances. |

| – Take care of yourself: | Don’t forget to prioritize self-care in your financial plan. This can include budgeting for things like vacations, hobbies, or other activities that bring you joy and improve your overall well-being. |

| – Open a savings account: | Having a separate savings account can help you save money for emergencies or unexpected expenses. It’s important to make saving a priority and set aside a portion of your salary each month. |

| – Make sure your plans are realistic: | While it’s important to dream big, it’s also important to be realistic about your financial situation. Make sure your goals and plans align with the income and resources that are available to you. |

By determining your financial priorities, you’ll be able to take control of your finances and make better decisions about how to allocate your money. Whether it’s paying off debt, saving for the future, or investing in your health, having a clear plan will help you achieve your goals and improve your financial well-being.

Short-term goals

When it comes to managing your money, it’s important to make sure you have clear goals in mind. Short-term goals are essential for creating a solid financial plan. These goals are typically achievable within a year or less and can have a positive impact on your long-term financial health.

One of the first steps in setting short-term goals is to determine your priorities. Think about what you want to achieve in the next few months and what areas of your finances need improvement. For example, you might have a short-term goal to save a certain amount of money each month or to pay off a fixed mortgage. By prioritizing these goals, you can make sure you allocate your money and resources effectively.

It’s also important to track your spending to make sure you’re on track with your goals. A budget is a helpful tool for managing your finances, and there are many budgeting apps and tools available that can make it easier to keep an eye on your spending. By tracking your expenses, you’ll be able to identify areas where you can save more money and make adjustments as needed.

Another tip for managing your short-term goals is to open a separate savings account specifically for your short-term goals. By keeping your savings separate, you can see exactly how much progress you’re making and avoid dipping into those funds for unrelated expenses. This can also help you stay motivated as you see your savings grow.

When setting short-term goals, it’s important to be realistic and consider your available time and resources. If you have a busy schedule, try to set goals that are manageable within your current obligations. It’s also important to consider the impact that achieving your short-term goals might have on other areas of your life. For example, if you’re saving for an expensive vacation, you might need to adjust your monthly spending to make sure you’re on track.

Lastly, don’t forget to prioritize your self-care and health when managing your finances. It’s easy to get caught up in the day-to-day responsibilities of budgeting and saving, but it’s important to take care of yourself as well. Make sure to allocate some of your funds and time for activities that bring you joy and improve your overall well-being.

In conclusion, short-term goals are essential for effective money management. By setting clear goals, determining your priorities, and tracking your progress, you can start improving your financial situation. Remember to be realistic, open a separate savings account, and prioritize your self-care. With these tips in mind, you’ll be well on your way to achieving your short-term goals and creating a solid foundation for your long-term financial success.

Long-term goals

When it comes to managing your money, it’s important to set long-term goals. Saving for the future and planning for major life events, such as buying a house or retirement, can help ensure financial stability and security.

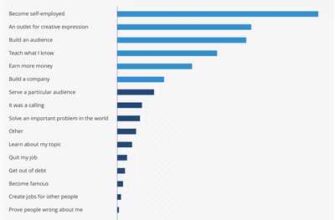

One of the first steps in managing your money is to educate yourself about your financial goals. Take the time to think about what you want to achieve in the long term and how you can make it happen. By setting specific and realistic goals, you can create a budget and plan that will help you achieve them.

It’s important to determine your priorities and allocate your financial resources accordingly. For example, if your long-term goal is to buy a house, you’ll need to make sure you’re saving enough money for a down payment and mortgage payments. By creating a monthly budget and tracking your expenses, you can make sure you’re on track to achieve your goals.

It’s also important to make sure you have a good understanding of your income and expenses. Determine how much you earn each month and how much you spend on fixed expenses, such as rent or mortgage payments, utility bills, and groceries. This will help you determine how much money you have available to allocate towards your long-term goals.

In addition to saving for specific long-term goals, it’s also important to have a plan in place for unexpected expenses and emergencies. Set aside some money each month in a savings account to cover these types of expenses, such as car repairs or medical bills. This will help you maintain financial control and avoid relying on credit cards or loans.

Self-care is another long-term goal that should not be overlooked. Taking care of your health and well-being is important for your long-term financial success. Make sure to budget for regular check-ups, exercise, and healthy food choices.

Managing your money and working towards your long-term goals can be challenging, but with the right tips and strategies, it is possible. By creating a budget, tracking your expenses, and making smart financial decisions, you can improve your financial management skills and make your long-term goals a reality.

Think of money management as self-care

When it comes to managing your money, it’s important to think of it as a form of self-care. Taking control of your finances can have a positive impact on your overall well-being and improve your financial health in the long-term.

One of the first steps in money management is creating a budget. By allocating a fixed amount of your monthly salary to different expenses and goals, you’ll have a clear plan for where your money is going. Prioritize your expenses based on your needs and goals. It’s important to think about both short-term and long-term priorities, such as paying off debt, saving for retirement, or saving for a down payment on a house or car.

Once you’ve created a budget, it’s important to track your spending. Keep a watch on where your money is going and make sure each expense aligns with your priorities and goals. By tracking your spending, you’ll be able to identify areas where you can cut back and save more. For example, you might realize that you’re spending too much on eating out or on expensive coffees, and that cutting back in these areas could free up more money for savings or other important financial goals.

In addition to budgeting and tracking your spending, it’s also important to educate yourself about financial management and investment. There are many resources available, such as books, online content, and financial advisors, that can help you improve your financial knowledge and make more informed decisions about your money. The more you educate yourself, the better equipped you’ll be to determine which investment plans or financial management strategies are best for your needs.

Managing your money is not just about making sure your bills are paid on time or that you have enough for the mortgage each month. It’s about taking care of yourself and your future financial well-being. By thinking of money management as a form of self-care, you’ll be more motivated to stick to your budget, track your spending, and make the necessary changes to improve your financial situation.

Remember, managing your money is an ongoing process. As your life changes, your financial priorities and goals may also change. Stay open to adapting your budget and financial plans to meet your evolving needs. By staying proactive and taking control of your finances, you’ll be on a path towards financial stability and a healthier financial future.