Creating a budget is an essential step in managing your finances. It allows you to track your spending, plan for future financial goals, and ensure that you are using your funds wisely. Without a budget, it can be easy to overspend and find yourself in debt. So, when it comes to budgeting, it is important to start early and have a clear understanding of your income and expenses.

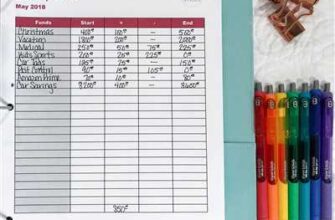

There are several ways to create a budget. One option is to use a budgeting calculator or online services that can help you track your spending and create a budget based on your financial goals. Another option is to do it yourself using a spreadsheet or pen and paper. Whatever method you choose, the key is to gather all the necessary information about your income, expenses, and savings before creating your budget.

A healthy budget typically includes categories such as housing, transportation, food, entertainment, and savings. Start by listing all your sources of income for the month, including any investment or rental property income. Next, calculate the amount you spend on each category and set spending restrictions if needed. It is best to aim for having at least 20 percent of your monthly income allocated to savings or investment purposes.

When creating a budget, it is important to be realistic and take into account any financial restrictions or limitations you may have. Consider any upcoming bills or expenses that you know you’ll have to pay in the next few months. It’s also a good idea to get advice from financial advisors or use online resources from reputable sources like Bank of America (BoFA) or the FDIC to help you make informed decisions about your budget.

Keep in mind that budgeting is not a one-time task. It is an ongoing process that requires regular monitoring and adjustments. Review your budget at the end of each month to see how well you’ve stuck to it and make any necessary changes for the next month. By having a well-planned and managed budget, you can ensure that you are making the most of your income and working towards your financial goals.

How to create a healthy startup budget in 6 steps

Creating a budget is a crucial step for any startup. It helps you establish a clear financial plan and ensure that you are using your funds wisely. Here are six steps to help you create a healthy startup budget.

Step 1: Assess your financial situation

The first step in creating a startup budget is to assess your financial situation. Determine how much money you have to invest in your startup, whether it’s from personal savings, loans, or investments from others.

Step 2: Calculate your monthly expenses

Next, calculate your monthly expenses. This includes rent, utilities, payroll, marketing, and any other costs that you will incur on a regular basis. Be realistic about the amount you will need to spend each month.

Step 3: Identify your sources of income

Identify the sources of income for your startup. This could include sales revenue, investment returns, or any other income streams. It’s important to have a clear understanding of where your money will be coming from.

Step 4: Set financial goals

Set financial goals for your startup. Determine what you want to achieve in terms of revenue, profit margins, and growth. These goals will help guide your budgeting decisions and keep you on track.

Step 5: Allocate funds accordingly

Once you have assessed your financial situation and set your goals, allocate funds accordingly. Divide your budget into different categories such as marketing, operations, and research and development. Allocate funds based on the priority and importance of each category.

Step 6: Review and adjust your budget regularly

Lastly, it’s important to regularly review and adjust your budget. This can be done on a monthly or quarterly basis, depending on the needs of your startup. Reviewing your budget allows you to track your spending, identify any areas where you may be overspending, and make necessary adjustments to stay on track.

By following these six steps, you can create a healthy startup budget that helps you effectively manage your finances and achieve your business goals.

Creating a budget

Creating a budget is an essential step in managing your finances. Whether you’re just starting out or you’ve been living paycheck to paycheck, having a budget can help you take control of your money and plan for the future.

Before you begin creating your budget, you’ll need to gather some information. Start by gathering your pay stubs, bank statements, and any other sources of income or expenses. This will give you a clear picture of how much money you have coming in and going out each month.

The first step in creating a budget is to calculate your monthly income. Add up all of your sources of income, including your salary, investments, and any side gigs or freelance work. This will give you an idea of how much money you have to work with each month.

Next, it’s important to track your spending. Keep a record of all of your expenses, whether it’s on a spreadsheet, a paper and pen, or using a budgeting app or calculator. This will help you see where your money is going and identify areas where you may be overspending.

Once you have a clear picture of your income and expenses, you can start creating categories for your budget. Some common categories include housing, transportation, groceries, entertainment, and savings. Allocate a certain amount of money to each category, being mindful of your financial goals and restrictions.

When creating your budget, it’s important to prioritize savings. Aim to save at least 10-20 percent of your income each month. This will help build an emergency fund and also allow you to save for longer-term goals, such as buying a property or investing in your retirement.

It’s also important to have a plan for unexpected expenses. Set aside some funds each month for emergencies or unforeseen circumstances. This will help you avoid having to rely on credit cards or loans when unexpected expenses arise.

Once you’ve created your budget, it’s important to review and adjust it regularly. Your budget should be a living document that reflects your changing financial situation. Make sure to revisit your budget every few months or whenever there are significant changes in your income or expenses.

Remember, creating a budget is just the first step. Stick to your budget and be disciplined with your spending. If you find yourself having trouble sticking to your budget, consider enlisting the help of a financial advisor or using budgeting services offered by banks or financial institutions.

By creating and sticking to a budget, you can take control of your finances and work towards building a healthy financial future.

How to budget when you get paid

Creating a budget is an essential step in managing your finances. When you get paid, it’s important to have a plan in place for how you will allocate your funds. This guide will walk you through the steps of creating a budget that works for you.

1. Start by gathering information about your income and expenses. Take a look at your monthly paycheck and any additional sources of income you may have. This could include side jobs, investment returns, or rental income from a property you own.

2. Next, determine your fixed expenses. These are the costs that you have to pay each month, such as rent or mortgage payments, utility bills, and subscriptions for services like internet or streaming platforms.

3. Subtract your fixed expenses from your monthly income to calculate your disposable income. This is the amount of money you have left after paying your bills.

4. Now it’s time to create categories for your discretionary expenses. These are the expenses that can vary from month to month and include things like groceries, dining out, entertainment, and personal care products.

5. Decide how much you want to allocate to each category. It’s important to be realistic and mindful of your financial goals. For example, if you’re saving to buy a house or pay off debt, you may want to allocate a larger percentage of your discretionary income to savings.

6. Consider using a budgeting tool or spreadsheet to track your expenses. This can help you stay organized and ensure that you’re not overspending in any one category.

7. Pay yourself first. Before you start sending your money out to pay bills or cover expenses, make sure you prioritize savings. Even if it’s just a small amount, having a healthy savings account is important for unexpected expenses or future investments.

8. If you’re having trouble sticking to your budget, consider using cash envelopes. Withdraw the allocated amount of cash for each category and only spend what’s in the envelope. This can help limit excessive spending and keep you on track.

9. Review your budget regularly. As your income or expenses change, you may need to adjust your budget. It’s important to stay proactive and make changes as needed.

10. Seek advice from financial advisors or use budgeting tools provided by your bank or financial institution. They can offer guidance specific to your financial situation and help you make the most of your money.

Remember, creating a budget is an ongoing process. Whether you get paid weekly, bi-weekly, or monthly, it’s crucial to regularly review and adjust your budget to best meet your financial goals.

| Benefits of Budgeting: | Steps to Budgeting: |

|---|---|

| – Helps you save money | 1. Gather information about your income and expenses |

| – Reduces financial stress | 2. Determine your fixed expenses |

| – Allows you to prioritize your spending | 3. Calculate your disposable income |

| – Helps you reach financial goals | 4. Create categories for discretionary expenses |

| – Provides a sense of control over your money | 5. Allocate funds to each category |

Sources

When creating a budget, it is important to consider the sources of your income and the funds available to you. Whether you are working for a startup, receiving a monthly salary, or have investment returns, knowing where your money is coming from can help you allocate it properly.

Here are some common sources of income that you may have:

| Source | Description |

|---|---|

| Salary | Regular income from your job or employment. |

| Investments | Income earned from investments such as stocks, bonds, or real estate. |

| Side Gig | Additional income from a freelance job or a part-time gig. |

| Business | Income generated from your own business or self-employment. |

| Gifts | Money received as a gift from family or friends. |

| Government Assistance | Income received from government programs or benefits. |

These sources will vary from person to person, so it is important to identify the ones applicable to your situation. Understanding your income sources will allow you to better plan your budget and ensure the allocation of funds aligns with your financial goals.