Establishing a budget is an essential step towards financial stability and success. It helps individuals and households manage their income and expenses, plan for the future, and achieve their financial goals. Whether you’re struggling with debt, saving for a big purchase, or simply looking to improve your financial health, creating and sticking to a budget can provide you with the framework and discipline needed to accomplish these objectives.

One important aspect of budgeting is knowing exactly how much money is coming in and going out. This includes your income from various sources, such as a job, side gig or investments, as well as your expenses, like rent/mortgage, utilities, groceries, transportation, and other bills. By tracking all of your financial transactions, you can get a clear picture of your spending habits and identify areas where you can cut back or save.

Having an emergency fund is another critical component of a budget. Unexpected expenses, such as medical bills, car repairs, or job loss, can easily derail your financial plans if you don’t have a safety net in place. Aim to set aside at least three to six months’ worth of living expenses in a separate savings account. This way, you’ll be prepared for any unforeseen situations and won’t have to rely on credit cards or overdraft services.

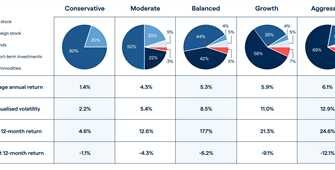

When establishing a budget, it’s also important to consider your long-term financial goals. Are you saving for a down payment on a house or planning for retirement? These goals may require you to adjust your spending and saving habits accordingly. Consulting with a financial adviser or using online tools and resources can help guide you in making informed decisions regarding investing and saving for the future.

Overall, budgeting is a personalized process that should be tailored to your specific situation and financial goals. It’s not about depriving yourself of all fun and enjoyment, but rather finding a balance between your present needs and future aspirations. By knowing where your money is going and having a clear plan in place, you can gain control of your finances and ultimately achieve financial well-being.

Ultimate Guide to Creating a Budget

When it comes to managing your finances, having a budget is essential. A budget helps you control your spending, save for the future, and make sure you have enough money for the things that matter most to you. In this guide, we will walk you through the steps of creating a budget, providing unbiased advice and helpful tips along the way.

Step 1: Assess Your Current Financial Situation

The first step in creating a budget is to assess your current financial situation. Take a close look at your income, expenses, and any debts or financial obligations you may have. This will give you a clear picture of where your money is going and help you identify areas where you can cut back or save.

Step 2: Set Financial Goals

Next, it’s important to set specific financial goals. Do you want to save for a down payment on a house, pay off your student loans, or start an emergency fund? Setting clear goals will give you something to work towards and help you stay motivated.

Step 3: Create a Budget

Now that you know where you stand financially and what your goals are, it’s time to create a budget. Start by determining your monthly income and fixed expenses, such as rent or mortgage payments, car payments, and utilities. Then, allocate a certain percentage of your income towards savings and investments. Remember to leave some room for discretionary spending and fun activities.

Step 4: Track Your Expenses

Tracking your expenses is an essential part of budgeting. There are many tools and apps available that can help you track your spending and stay on top of your budget. Make sure to review your expenses regularly and adjust your budget as needed.

Step 5: Make Adjustments as Needed

Creating a budget is an ongoing process. As your financial situation changes or you reach certain milestones, it’s important to make adjustments to your budget. Be flexible and adapt your budget to fit your current needs and priorities.

Step 6: Seek Professional Advice if Needed

If you’re overwhelmed or unsure about creating a budget, don’t hesitate to seek professional advice. Financial advisors and budgeting experts can provide guidance tailored to your specific situation and help you make informed decisions about your money.

Conclusion

Creating a budget is a crucial step towards financial well-being. It allows you to take control of your money, plan for the future, and achieve your financial goals. By carefully considering your income, expenses, and savings, and making adjustments as needed, you can successfully manage your finances and enjoy a more secure financial future.

Expenses in an establishing budget

When creating a budget, it is important to consider your expenses. These are the costs that you will incur on a regular basis and will need to account for in your budgeting process.

Expenses can be divided into different categories depending on their nature. Some common categories include:

| Category | Description |

|---|---|

| Fixed Expenses | These are expenses that remain the same each month, such as rent or mortgage payments, car loan payments, or insurance premiums. |

| Variable Expenses | These expenses can fluctuate from month to month and include things like groceries, utilities, entertainment, and dining out. |

| Debt Payments | If you have any outstanding debts, such as credit card debt or student loan payments, these should be included in your budget as well. |

| Savings | It is important to allocate a portion of your budget for saving money. This can be for short-term goals, such as a vacation, or long-term goals, such as retirement. |

It is also important to consider any other expenses that may come up during the year, such as annual membership fees or one-time purchases. These can be placed in a separate category or earmarked within the appropriate category.

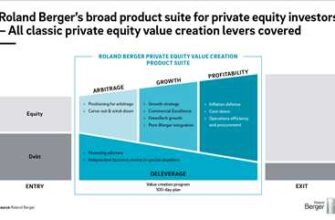

In addition to your regular expenses, it is vital to have a plan for funding your investments. This can include contributing to a retirement account, investing in stocks or mutual funds, or seeking advice from financial advisers to determine the best investment options for your portfolio.

If you are new to investing, you may consider consulting with a financial advisor who can help you navigate the complexities of the investment world and provide guidance on selecting the right investment tools.

When it comes to tracking your expenses and having control over your budget, there are several tools and resources available. Many banks offer online banking services that allow you to monitor your spending and categorize your expenses. There are also budgeting apps and software programs that can help you set spending limits and track your progress.

Having a budget is not only about controlling your expenses, but also maximizing your profits. By allocating your funds wisely and making smart investment choices, you can ensure that your money is working for you.

Remember, it is important to regularly review and adjust your budget as needed. Expenses may change, and you may discover new opportunities for savings or investments. Stay informed about market trends and consult with your financial advisor to make sure your budget aligns with your financial goals.

Registering establishing costs

When establishing a budget, it is important to consider the various costs associated with registering your business or investment. These costs can include fees for permits, licenses, and legal documentation. It is crucial to budget for these expenses as they can add up quickly and impact your overall financial plan.

If you are setting up a business, you may need to register with government bodies or regulatory agencies, depending on the nature of your operations. This could involve filing paperwork, paying registration fees, and providing certain information about your business. Be sure to consult reliable sources to understand the specific requirements and costs associated with establishing your type of business.

If you are considering investing in stocks or trading on the stock market, there may be additional costs to consider. For example, some online trading platforms charge a commission for each trade you make. It’s important to factor these trading costs into your budget and evaluate how they may impact your investment returns.

Furthermore, if you’re planning to invest in mutual funds or exchange-traded funds (ETFs), you may incur costs such as purchase fees, annual management fees, and redemption fees. It is essential to review the fund’s prospectus and consult a financial advisor before making any investments to fully understand the associated costs.

There may also be costs associated with obtaining legal advice or consulting services regarding your investment or business. A lawyer or financial advisor can provide valuable guidance and help ensure that you are making informed decisions. However, it is important to select an advisor who is unbiased and has your best interests in mind.

When it comes to budgeting for establishing costs, it’s important to consider any potential risks or losses you may face. For example, if you are starting a business, there is a risk of initial losses as you establish your customer base or face unexpected expenses. Similarly, if you are investing in stocks or funds, the value of your assets may fluctuate and result in financial losses.

It is also crucial to be aware of any fees associated with banking or financing your business or investment activities. For instance, if your business requires an overdraft facility, the bank may charge fees or interest on the borrowed funds. By understanding and accounting for these fees, you can make more accurate budget projections.

Lastly, make sure to account for any subscriptions or memberships that are linked to your business or investments. This could include professional association dues, software license fees, or investment research subscriptions. Including these costs in your budget will help ensure you have a comprehensive understanding of your financial obligations.

Earmark money for fun too

Establishing a budget doesn’t mean sacrificing all your fun and entertainment. It’s important to allocate a portion of your income toward leisure activities and personal enjoyment. Budgeting should not only focus on saving and investing but also on allowing yourself some well-deserved rewards.

There are various ways you can earmark money for fun activities while still maintaining financial control:

- Set aside a specific amount each month for entertainment purposes. This could include dining out, going to the movies, or attending events.

- Create a separate “fun” category in your budget to track your spending on leisure activities. This will help you understand how much you are allocating to entertainment and if any adjustments are necessary.

- Consider using a budgeting app or tool that allows you to categorize your expenses. This will give you a clearer picture of where your money is going and help you identify areas where you can cut back.

- Explore free or low-cost activities and events in your community. This can include visiting parks, attending local concerts or festivals, or exploring hiking trails.

- Plan ahead for larger purchases or experiences that bring you joy. By setting money aside in advance, you can enjoy these treats without feeling guilty or compromising your budget.

- Involve your family or friends in the budgeting process. By discussing your financial goals and limitations with loved ones, you can find ways to have fun together that align with your budget.

Remember, budgeting is about making informed choices and prioritizing your spending. By setting aside money for fun activities, you can achieve a healthy balance between enjoying your life and achieving your financial goals.

Sources

When it comes to establishing a budget, there are various sources that can affect your financial planning. Here are some of the key sources to consider:

1. Income: Your income is one of the primary sources for budgeting. It includes the money you earn from your job or business, as well as any additional funds from investments or side gigs.

2. Expenses: Your expenses are the costs you need to cover on a regular basis. This can include bills, rent or mortgage payments, groceries, transportation, and other day-to-day expenditures.

3. Savings: Saving money is an important source for budgeting. It allows you to build up an emergency fund and plan for future expenses or investments.

4. Investments: Investments can be a source of income if managed wisely. They can include stocks, bonds, real estate, or other assets that generate profits over time.

5. Advisory services: If you require professional help with your budgeting, you can consult financial advisors or advisory institutions. They can provide guidance on budgeting, investing, and other financial matters.

6. Government funding: Depending on your situation, you may be eligible for government assistance or grants that can help with your budgeting needs.

7. Social connections: Friends and family can also be a source of support when it comes to budgeting. They can provide advice, share experiences, or recommend financial tools or resources.

8. Membership benefits: Some organizations or companies offer membership benefits that can help with budgeting. These can include discounts, access to financial tools or advice, or other perks that contribute to your financial well-being.

9. Environmental concerns: When establishing a budget, it’s important to consider environmental factors that may impact your finances. This can include costs associated with energy efficiency, sustainability, or other eco-friendly initiatives.

By considering these sources, you can make sure that your budgeting plan is well-rounded and effective. Remember to shop around for the best deals, consult with a financial advisor if needed, and save a percentage of your income for future goals. Budgeting is all about finding the right balance and making informed decisions about your money.