In today’s fast-paced world, the size of the fintech industry continues to grow exponentially. One cannot deny the influence of technologies on different aspects of our lives, including finance. Thus, it is not surprising that more and more peoples are turning towards fintech apps for their banking and payment needs.

Building a successful fintech app is no easy task, though. It requires a good understanding of user requirements, proper UI/UX design, advanced security measures, and efficient code development. Moreover, it is necessary to develop the app in a way that both the user and the company benefit from it.

One of the fundamental requirements for a well-developed fintech app is the integration of various features and functionalities. For instance, p2p payments, QR code scanning for transactions, interactive dashboard for account management, and push notifications for personalized updates are some of the most necessary functionalities in a fintech app.

Another important aspect to consider is the cost of building and maintaining a fintech app. It is crucial to weigh the costs against the potential revenue and growth opportunities that the app can bring. Native app development is generally preferred because it offers better performance, access to device functionalities, and a more seamless user experience.

- What is a Fintech App and why you should develop one

- FinTech industry growth

- Transaction value worldwide

- Factors that are driving the digital payments market

- P2P Payment app development services

- Fundamental Features of FinTech Apps

- Sign Up and Sign In

- Dashboard

- Payment Gateway

- Security

- Push Notifications

- QR Code Scanning

- Personalization

- Tips and Explanations

- Factors Influencing the Cost to Develop a FinTech App

- Product Requirements

- Interactive UIUX

- Location of the Development Partner

- Time Required for FinTech Mobile App Development

- App Maintenance

- Advanced Technologies Used

- Tools and Languages Used

- Features Integrated

What is a Fintech App and why you should develop one

A Fintech app is a mobile application that combines banking and financial services with the use of digital technologies. These applications are developed to provide users with quick and easy access to their financial accounts and perform various transactions, such as payments, fund transfers, and account management.

Fintech apps are gaining popularity worldwide, as they offer convenience and efficiency to users. They eliminate the need for individuals to visit physical bank branches and wait in line for services. With a Fintech app, these services are available right at their fingertips, anytime and anywhere they need them.

One of the key features of Fintech apps is the integration of swift and secure payment technologies. Users can make payments using various methods, including card scanning, QR codes, and even biometrics. This makes transactions quick, hassle-free, and secure.

Moreover, Fintech apps are user-centric in terms of design and functionality. They prioritize user experience and provide a seamless and intuitive interface. The UI/UX design is developed in a way that gets users immediately engaged and guides them on how to use the app properly.

Another fundamental feature of Fintech apps is the provision of personalized notifications and alerts. Users are notified about their account balances, transaction alerts, and other essential information. These notifications help users keep track of their finances and make informed decisions.

Developing a Fintech app can bring several benefits to your business or organization. Firstly, it can help you drive revenue by offering premium services or charging transaction fees. Fintech apps have the potential to generate significant amounts of revenue, especially when integrated with value-added features.

Secondly, Fintech apps can attract more customers and expand your user base. By providing a convenient and accessible platform for financial services, you can appeal to a wide range of users who are looking for fast and reliable banking solutions.

Lastly, Fintech apps can significantly reduce operational costs. Traditional banking services often involve high maintenance costs, such as physical branches and a large workforce. With a Fintech app, these costs are minimized, and the entire banking process becomes more efficient and cost-effective.

In conclusion, a Fintech app is a valuable tool in today’s digital world. Its user-centric design, swift payment technologies, personalized notifications, and other features make it a must-have for any business or organization in the banking and financial sector. By developing a Fintech app, you can provide your customers with easy access to essential financial services while driving revenue and reducing costs.

FinTech industry growth

The FinTech industry has experienced tremendous growth in recent years. With the advent of digital technologies and the increasing popularity of mobile applications, more and more people are turning to FinTech services for their financial needs. This growth has been influenced by several factors.

Firstly, the convenience and ease of use of FinTech apps make them a necessary tool in today’s modern world. With just a few taps on your smartphone, you can sign up for an account, access your financial information, make transfers, and manage your funds. This level of convenience is especially important for busy individuals who don’t have hours to spend at a physical bank.

Another factor driving the growth of the FinTech industry is the increased security that comes with using these services. Fintech apps employ sophisticated security features such as biometric scanning and multi-factor authentication to ensure that your personal and financial information is protected from unauthorized access.

In addition, the user-friendly design and intuitive UI/UX of many FinTech apps have made them popular among users. This is because FinTech companies understand the importance of providing a seamless and engaging user experience. By incorporating user-friendly features and designs, these apps are able to attract and retain users.

Furthermore, the integration of advanced technologies into FinTech apps has also contributed to their success. For example, many apps now offer personalized recommendations and insights based on your financial data. This level of personalization helps users make better financial decisions and manage their money more effectively.

FinTech apps are also influenced by market trends and user requirements. In order to stay competitive, companies need to continuously adapt and update their products. This means building new features and tools, supporting multiple payment platforms, and using the latest technologies.

The cost of building a FinTech app can vary depending on several factors. Native apps, which are developed specifically for a single platform like iOS or Android, generally cost more than cross-platform apps. Additionally, the complexity of the app, the number of features, and the level of customization required can also impact the cost of development. Maintenance costs should also be taken into account, as apps require regular updates and bug fixes.

In conclusion, the FinTech industry is experiencing rapid growth due to the increasing demand for digital financial services. The development of user-friendly and secure apps with integrated features and advanced technologies has played a fundamental role in this growth. As the market continues to evolve, it is important for FinTech companies to stay up-to-date with the latest trends and technologies in order to meet the changing needs of their users.

Transaction value worldwide

The size of the fintech industry is continuously growing, and one of the most fundamental factors contributing to this growth is the worldwide transaction value. Transactions are an essential part of any fintech app and must be properly designed and managed to provide a seamless user experience. In today’s mobile-first world, where time is of utmost importance, transactions need to be simple, secure, and fast.

There are several different factors that influence the transaction value, which is why it is necessary to develop advanced features and tools to meet the requirements of each user. Payment gateways, peer-to-peer transfers, and personalization are just some of the applications that must be integrated into the app to properly handle transactions.

One key feature that must be developed is real-time notifications. Notifications give users instant updates about their transactions, ensuring that they are always up-to-date with their financial activities. This interactive feature not only enhances user experience but also adds an extra layer of security, as users can quickly identify any suspicious or unauthorized transactions.

Another important feature that must be part of the app design is location-based services. By using location data, fintech apps can provide users with personalized recommendations and offers based on their location. This not only adds value to the app but also increases user engagement and satisfaction.

Security is another crucial aspect of transaction management. Fintech apps must implement robust security measures to protect users’ personal and financial information. This includes using secure payment gateways, incorporating two-factor authentication, and encrypting data to prevent unauthorized access.

The transaction value worldwide is influenced by the growth of digital banking and the increasing adoption of fintech services. Fintech apps are now used by people of all ages, making it necessary to provide user-friendly interfaces and ensure that the app can be easily navigated by all users. Additionally, multilingual support is essential to cater to the diverse user base.

In conclusion, building a fintech app without proper transaction management features is like having a car without maintenance tools. Transaction value plays a significant role in the success of a fintech app, and developers must consider all the necessary factors and requirements to create a product that meets the needs of the industry and its users. By integrating advanced features, ensuring security, and providing an intuitive user interface, fintech apps can thrive in this rapidly growing market.

Factors that are driving the digital payments market

In today’s modern world, the digital payments market is experiencing significant growth and is being influenced by various factors. This growth is driven by a combination of technological advancements, changing consumer habits, and the need for more efficient and convenient payment options.

One of the key factors that is driving the digital payments market is the growing number of mobile applications and fintech services. With the development of new technologies, it has become easier and more cost-effective to build and integrate digital payment solutions into mobile apps. This allows users to make transactions without the need for physical cash or card payments, which is especially convenient in situations where carrying cash is not possible or preferred.

Another influencing factor is the security and simplicity that digital payment solutions offer. With the use of secure gateways and integrated security features, users can make payments without worrying about the safety of their personal and financial information. Additionally, the user interface and user experience of digital payment apps have been designed in a way that is simple and intuitive, making it easy for users to adopt and use these services.

Furthermore, the rise of QR code scanning technology and push notifications has also played a role in driving the digital payments market. QR codes allow for quick and easy scanning of payment details, enabling users to make payments in a matter of seconds. Push notifications, on the other hand, provide instant updates and notifications about transaction statuses, payment reminders, and other important information.

The global nature of the digital payments market is yet another factor that contributes to its growth. With the ability to make payments worldwide, regardless of location or currency, digital payment solutions have become an attractive option for both individuals and businesses. This global reach not only benefits users by providing them with more options and flexibility, but it also opens up new revenue streams and business opportunities for fintech companies.

Finally, the increasing demand for digital payment solutions has been driven by the need for more efficient and convenient payment options. With traditional payment methods often involving long wait times, complex processes, and high transaction costs, many people are turning to digital payment solutions for a better and more convenient payment experience. Whether it’s a native app developed by a fintech industry player or a partnership with an established financial institution, digital payment solutions are becoming a necessity for anyone looking for a more streamlined and efficient way to manage their financial transactions.

These are just a few of the factors that are driving the digital payments market. As the industry continues to evolve, it is important for businesses to stay up to date with the latest trends and technologies in order to build and offer the necessary features and services that both consumers and businesses demand. By understanding and leveraging these factors, businesses can position themselves as leaders in the digital payments market and capitalize on the opportunities that it presents.

P2P Payment app development services

In today’s world, where everything is becoming more and more simplified with the help of technologies, P2P payment apps have become an essential tool in people’s lives. P2P stands for peer-to-peer, and it refers to the transfer of funds from one individual to another without the need for intermediaries.

P2P payment apps are gaining popularity worldwide because of their simplicity and personalization features. These apps allow users to send and receive money instantly, making transactions fast and convenient.

The development of a P2P payment app requires advanced coding and building skills. Developers must have a deep understanding of the fundamentals of app development and be skilled in using the necessary tools and programming languages.

One of the most important aspects of P2P payment app development is security. Since these apps deal with financial transactions, it is crucial to have robust security measures in place to protect users’ sensitive information. Integrated security gateways and interactive features are a must to ensure the safety of each transaction.

QR code scanning is another essential feature that P2P payment apps should have. This allows users to transfer funds by simply scanning a QR code, eliminating the need for entering lengthy account numbers or other details.

The size and complexity of a P2P payment app can influence its development time and cost. More features and an extensive range of services will generally require more development hours and, consequently, increase the final cost of the app.

One driving force behind the growth of P2P payment apps is their cost-effectiveness. Traditional methods of fund transfers, such as wire transfers, often involve high fees and lengthy processing times. With P2P payment apps, these costs and delays are significantly reduced, making them an attractive option for users.

Furthermore, P2P payment apps are influenced by the revenue model behind them. Some apps generate revenue through transaction fees, while others offer premium services to generate income. The choice of revenue model depends on the target audience and market demand.

In conclusion, P2P payment app development services are crucial in today’s digital world. These apps provide a swift and convenient way for users to send and receive payments, eliminating the need for intermediaries. With proper design and advanced technologies, P2P payment apps have the potential to revolutionize the way we make financial transactions.

Fundamental Features of FinTech Apps

In today’s digital world, FinTech apps have become an integral part of our daily lives. These apps provide users with a wide range of financial services, making managing finances easier and more convenient than ever before. In this article, we will explore the fundamental features that make FinTech apps so popular and user-friendly.

| Feature | Description |

| User-Friendly | FinTech apps are developed with the user in mind, offering a simple and intuitive user interface (UI) and user experience (UX). This allows users to navigate through the app with ease, regardless of their level of technical expertise. |

| Personalization | FinTech apps provide personalized services and financial recommendations based on the user’s financial goals, preferences, and spending patterns. This personalization helps users make informed financial decisions and achieve their financial goals. |

| Mobile-Friendly | FinTech apps are designed to be mobile-friendly, allowing users to access their financial information and perform transactions on the go. Whether using an iOS or Android device, users can access their accounts anytime and anywhere. |

| Security | Security is a top priority for FinTech apps. They offer multi-factor authentication, encryption techniques, and secure servers to protect users’ sensitive financial information from unauthorized access. |

| Real-Time Notifications | FinTech apps provide real-time notifications to keep users informed about their account activities, such as transactions, deposits, and bill payments. This helps users stay on top of their finances and prevents fraudulent activities. |

| Payment Gateway Integration | FinTech apps integrate with popular payment gateway platforms, allowing users to make payments easily and securely. By partnering with trusted payment providers, FinTech apps ensure smooth and seamless transactions. |

| Peer-to-Peer (P2P) Payments | FinTech apps offer P2P payment functionality, enabling users to send and receive money directly from their app. This feature eliminates the need for cash or checks and makes transferring funds between individuals quick and convenient. |

| Expense Tracking | FinTech apps provide tools for users to track their expenses and categorize their spending. This helps users gain insight into their spending habits, identify areas for saving, and budget more effectively. |

| Market Data | FinTech apps often feature real-time market data and personalized investment recommendations. By providing users with up-to-date financial information, these apps empower users to make informed investment decisions. |

| Integrations | FinTech apps integrate with other financial platforms and services, such as budgeting apps or investment platforms. This allows users to manage all their financial activities in one central location, streamlining their financial management process. |

These are just some examples of the fundamental features that are necessary for FinTech apps. However, it’s important to note that the requirements for FinTech apps can vary depending on the target audience, market size, and the specific financial services they offer. Ultimately, the goal is to provide users with a seamless and convenient digital banking experience that meets their unique needs.

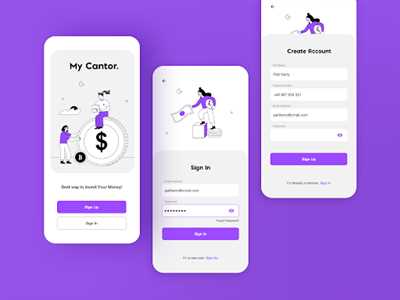

Sign Up and Sign In

One of the key features of a fintech app is the ability for users to sign up and sign in. This allows individuals from around the world to access the services provided by the app and engage in financial transactions.

When it comes to signing up, users will be required to provide personal information such as their name, email address, and possibly even their location. This information is necessary for the app to create an account for each user and ensure proper management of their account.

Once users have signed up, they can easily sign in to the app using their credentials. This allows for a swift and interactive user experience, as they are able to access their account and the app’s features within a matter of seconds.

In addition to the traditional sign up and sign in methods, many fintech apps now offer alternative options for users to register and log in. For instance, a popular method used is QR code scanning, where users scan a code to gain access to their account.

Fintech apps often partner with other services to provide integrated features. For example, apps may partner with payment gateway providers to facilitate seamless and secure transactions. This not only simplifies the user experience but also contributes to the app’s revenue through transaction fees.

Furthermore, fintech apps must prioritize security and personalization. Users should receive notifications when there are any changes or potentially suspicious activity on their account. This level of attention to security helps build trust and ensures that user data is properly protected.

In order to properly develop a fintech app, it is important to consider both the UI/UX and backend requirements. The app’s user interface should be intuitive and user-friendly to ensure a positive experience for all users. The backend, on the other hand, must be robust and capable of handling the financial transactions and data management.

It’s also worth noting that the size of the fintech industry is driving the need for more advanced technologies. Factors such as real-time data updates, push notifications, and personalized recommendations are influencing app development in this industry.

In summary, the sign up and sign in process is a crucial aspect of any fintech app. The app must provide a seamless user experience while also meeting the security and regulatory requirements of the banking industry. By properly considering these factors and following industry best practices, developers can build a successful fintech app that meets the needs of users worldwide.

| Sign Up and Sign In Tips |

|---|

| 1. Prioritize user personalization and security. |

| 2. Partner with payment gateway providers for integrated services. |

| 3. Consider alternative sign up and sign in options like QR code scanning. |

| 4. Pay attention to UI/UX for a seamless user experience. |

| 5. Ensure backend capabilities for financial transactions and data management. |

| 6. Stay updated with the latest fintech industry trends and technologies. |

Dashboard

The dashboard is an essential component of any fintech app. It serves as the central hub for the user, driving their interaction with the app and providing a comprehensive view of their financial information. Fintech apps are used by millions of people worldwide to manage their finances, make payments, and monitor their investments.

When building a fintech app, the dashboard must meet certain requirements to ensure it meets the needs of the user. It should have a user-friendly interface (UI) and a well-designed user experience (UX) to provide a seamless and intuitive user journey.

The dashboard can be used to display various features and functionalities such as transaction history, account balance, payment gateway, notifications, and more. It can also be used to access different tools and resources, such as budgeting tools, financial calculators, and investment management tools.

One of the key features of a fintech app dashboard is personalization. Users should be able to customize the dashboard according to their preferences and priorities. For instance, they can choose which widgets to display, change the layout, or add new ones. This personalization allows users to tailor the dashboard to their specific needs and make it more efficient for them.

Moreover, the dashboard should be responsive and optimized for mobile devices. As more and more people access fintech apps through their smartphones, it’s necessary to develop a dashboard that provides a good user experience on smaller screens. This includes proper sizing, easy navigation, and clear accessibility of the dashboard’s features.

When developing a fintech app dashboard, you have the option to build it using native or hybrid technologies. Native applications are developed for a specific platform, such as Android or iOS, and offer advanced capabilities and performance. Hybrid applications, on the other hand, are built using web technologies and can be used across multiple platforms. The choice between native and hybrid depends on factors such as development time, cost, and target audience.

In summary, the dashboard is a crucial part of any fintech app. It provides users with a holistic view of their financial information and allows them to manage their finances efficiently. By using modern technologies and advanced features, fintech apps can offer a user-friendly and personalized dashboard experience. With proper development and maintenance, the dashboard becomes a powerful tool for users to navigate the digital financial world.

Payment Gateway

A payment gateway is a crucial component of a fintech app. It allows users to make secure online transactions by enabling the transfer of funds from their bank account to the merchant’s account. In this section, we will explore the various aspects of payment gateway development and its significance in the fintech industry.

When building a fintech app, you need to consider multiple factors to ensure a smooth and secure payment experience for your users. First and foremost, you must partner with a reliable payment gateway provider that offers advanced security features, such as encryption and fraud detection, to protect sensitive user information and prevent unauthorized transactions.

Another important aspect of payment gateway development is integrating various payment methods. You should support both traditional methods like credit/debit cards and modern digital wallets like Apple Pay and Google Pay to cater to different user preferences. Providing users with more payment options increases the chances of successful transactions and improves user satisfaction.

Moreover, a payment gateway should be easily accessible and user-friendly. You can develop a native app for each platform (iOS, Android) or use cross-platform technologies like React Native or Flutter to save development time and costs. Regardless of the platform or technology you choose, the payment gateway should be seamlessly integrated into the app’s user interface and provide an intuitive payment flow.

Personalization is another key factor driving the success of a payment gateway. By tailoring the payment experience based on user preferences, such as saved payment methods, address, and currency, you can enhance user engagement and simplify the checkout process. Additionally, push notifications can be used to provide real-time updates on payment status and keep users informed about their transaction history.

Furthermore, a payment gateway should have robust reporting and analytics capabilities. An advanced dashboard that provides insights into transaction volume, revenue, and other key metrics can help you make data-driven decisions and optimize your app’s performance. It is also necessary to integrate proper revenue management tools so that you can track and manage payments efficiently.

In conclusion, a payment gateway is a fundamental feature of fintech apps, enabling secure and convenient online transactions. By choosing the right payment gateway, integrating multiple payment methods, and prioritizing user experience and security, you can build a successful fintech app that meets the market’s demands and drives revenue growth.

Remember, when developing a payment gateway, it is important to consider the different factors that influence its costs, such as security measures, required integrations, and the size of your target market. The tips and explanations provided in this guide should help you make better decisions and ensure a good return on your investment in payment gateway development.

Security

Security is one of the most fundamental requirements when building a fintech app. The value of personal and financial data is high, so it is necessary to properly design and develop the app with strong security measures.

First and foremost, the app must ensure the security of user accounts. This can be achieved by using advanced authentication and encryption techniques. Additionally, a secure payment gateway should be integrated to facilitate safe and secure transactions.

In the digital world, both users and developers need to be aware of the risks and take necessary precautions. As a user, you should always be cautious about sharing sensitive information and accessing your account from a secure location.

Developers, on the other hand, must understand the different security requirements influenced by the market they are building for. For instance, banking applications may have more stringent security measures compared to simple payment apps.

When developing a fintech app, it is also important to consider the cost of security. While advanced security technologies may increase the development and maintenance costs, they are necessary to protect user data and maintain trust in the app.

One good practice is to use native code for app development, as native apps are generally considered more secure than hybrid or web-based applications. Native code allows for better control over security features and reduces the risk of vulnerabilities.

Another important security feature is personalization. Users should be able to customize their app’s security settings based on their preferences and requirements. This can include features like biometric authentication, two-factor authentication, and more.

In addition to secure authentication, the app should also provide a secure transaction dashboard, where users can view their total funds and track their transactions. This ensures transparency and helps users detect any unauthorized activity.

QR code scanning is another feature that can enhance security. By using QR codes, users can securely share their details with merchants or other users without manually entering sensitive information.

Overall, security is a driving factor for the growth of fintech apps. Users want to feel confident that their personal and financial information is safe, and it is up to developers to deliver secure and trustworthy products. By following the tips and explanations mentioned above, developers can ensure the security of their fintech app and build trust in the market.

- Ensure strong user authentication and encryption techniques

- Integrate a secure payment gateway for safe transactions

- Be cautious about sharing sensitive information and access accounts from secure locations

- Understand the security requirements influenced by the market

- Consider the cost of security in development and maintenance

- Use native code for better control over security features

- Allow personalization of security settings for users

- Provide a secure transaction dashboard for transparency

- Implement QR code scanning for secure data sharing

Push Notifications

Push notifications are an essential feature in the development of fintech applications. They allow app developers to send real-time updates and notifications to users, keeping them informed about their financial transactions, account balance, and other important information.

In the fast-paced world of banking and finance, where time is of the essence, push notifications play a crucial role in influencing user behavior and driving engagement. By providing timely and relevant information, fintech apps can create a seamless and user-friendly experience for their customers.

Push notifications are necessary for several reasons. Firstly, they help users stay informed about their financial activities. Whether it’s a notification about an incoming transaction or a reminder to pay a bill, push notifications keep users up to date on their account activity.

Moreover, push notifications can be an effective marketing tool. Fintech apps can use them to promote new features, inform users about special offers, and engage with customers in a more personalized manner. By sending targeted notifications, fintech apps can increase user engagement and drive revenue growth.

Push notifications can be integrated into fintech apps through various tools and platforms. Whether you are building a native app or a web-based app, there are different tools and languages that can be used to develop push notification functionality.

When developing push notifications, user interface and user experience (UI/UX) design are of utmost importance. The notifications should be designed in a way that captures the user’s attention and provides value. The content should be concise, clear, and compelling.

It is also important to consider the frequency and timing of the notifications. Too many notifications may annoy users, while too few may cause users to miss important information. Finding the right balance is key.

Push notifications must also be developed with the necessary backend infrastructure in place. This includes server-side development, a notification gateway, and a dashboard for managing and monitoring notifications. A robust backend ensures that notifications are sent out in a timely and efficient manner.

In summary, push notifications are a crucial part of fintech app development. They are an effective way to keep users informed about their financial activities and engage with them in a personalized manner. With the right tools and design considerations, push notifications can drive user engagement, increase revenue, and enhance the overall user experience.

QR Code Scanning

QR code scanning is a feature that is becoming increasingly popular in the fintech industry. It is a growth-driving factor for many fintech applications because it offers an interactive and user-friendly way to access different services and perform various transactions.

This feature is necessary because it allows users to quickly scan QR codes using their mobile devices, which gives them easy access to a wide range of services and functionalities. For example, users can scan QR codes to make payments, transfer funds between accounts, or even sign up for new services.

QR code scanning is one of the most fundamental features of a fintech app because it allows users to quickly and securely complete transactions. It is used worldwide and has influenced the development of many fintech platforms.

When building a fintech app, QR code scanning should be one of the first features to consider because it adds value to the product and offers a more user-friendly experience. QR codes can be used for various purposes, such as accessing account balances, managing investments, or even providing personalized notifications based on the user’s location.

QR code scanning can be influenced by various factors, such as the design and user interface (UI/UX) of the app. The app should have a clear and intuitive design that guides the user through each step of the scanning process. It should also provide explanations and tips on how to use the QR code scanning feature efficiently.

Security is another important factor to consider when implementing QR code scanning. The app must ensure the security of personalization information and prevent unauthorized access to user accounts. It should use secure encryption algorithms and follow best practices for data protection.

In summary, QR code scanning is a valuable feature in fintech apps because it provides an easy and user-friendly way to access different services and perform various transactions. It is influenced by factors such as design, security, and user interface, and should be one of the first features to consider when developing a fintech app.

Personalization

Personalization is a fundamental feature of modern digital banking apps. In the worldwide banking industry, personalization is driving the growth of fintech apps. It is necessary to build a good mobile banking app with personalized features because it adds value and enhances user experience.

Personalization in fintech apps can be influenced by factors such as location, transaction history, and user preferences. For instance, an app can use the user’s location to push notifications about nearby banking services or offer personalized product recommendations based on past transactions.

One of the most important features of a fintech app is the ability to personalize the user interface (UI) and user experience (UX). This can be done by properly integrating interactive explanations and user-friendly tools into the app. Users need clear explanations and easy-to-use tools to understand and manage their accounts and transactions. Personalization can help simplify complex financial concepts and make them more accessible to the average user.

Another factor that drives the need for personalization in fintech apps is the swift and efficient transfer of funds. Using advanced payment gateway tools, users can make payments and transfers within hours or even minutes. Personalization allows the app to remember user preferences and streamline the payment process, making it quick and hassle-free.

Personalization can also help in cost management. By tracking and analyzing the spending habits of users, fintech apps can provide valuable insights and recommendations that help users save money and manage their finances more efficiently. For example, a dashboard that shows spending patterns and offers tips on how to cut costs can be a valuable tool for users.

Personalization is not just about personal financial management. It also plays a crucial role in the banking industry, where institutions want to offer customized services to their clients. Fintech apps with personalization features can provide customized reports and notifications to clients based on their specific needs and preferences.

In conclusion, personalization is a key feature in fintech apps. It helps create a more engaging and personalized user experience, simplifies financial management, and provides customized services. With the use of advanced technologies and personalization features, fintech apps can meet the ever-growing demands of users in the digital world.

Tips and Explanations

In the rapidly growing world of fintech, developing a fintech app has become a must for businesses worldwide. Fintech apps provide users with easy access to various financial services and make transactions quick, secure, and user-friendly.

When developing a fintech app, there are several factors to consider. First, you need to understand the requirements of your target market. Different regions may have different preferences and regulations that must be adhered to in order to properly serve the users in that market.

One of the most important features that a fintech app must have is security. Since financial transactions will be conducted through the app, it is necessary to implement robust security measures to protect user data and prevent unauthorized access.

Another crucial factor to consider is the design and user experience (UI/UX) of the app. Fintech apps should be simple and intuitive to use, with a well-designed dashboard and interactive features. This allows users to easily navigate the app and perform necessary actions without any confusion.

Modern fintech apps often integrate advanced technologies to enhance their value. For example, biometric scanning can be used for secure authentication, push notifications can be used to provide real-time updates, and P2P payment platforms can be used to facilitate easy money transfers between users.

It is also important to partner with the right technology platforms and tools when developing a fintech app. These partnerships can help you access the most advanced features and ensure that your app is compatible with different devices and operating systems.

The cost of developing a fintech app can vary depending on the complexity and features required. However, it is important to focus on the quality of the app rather than solely considering the cost. A well-developed app will ultimately provide more value to both the business and its users.

Proper project management is crucial when developing a fintech app. This includes setting clear goals and deadlines, regularly reviewing progress, and ensuring effective communication between all team members involved in the development process.

In conclusion, developing a fintech app requires careful planning and consideration of various factors. By following this guide and understanding the tips and explanations provided, you can create a successful fintech app that meets the needs of your target market and provides a seamless and secure financial experience for your users.

Factors Influencing the Cost to Develop a FinTech App

Developing a FinTech app involves various factors that can influence the overall cost. Here are some key factors to consider when estimating the cost of developing a FinTech app:

- App Features: The cost of developing a FinTech app will depend on the features you want to include. For example, if you want to provide advanced transaction management or P2P fund transfer, it will require more development time and effort.

- User Interface (UI) and User Experience (UX) Design: The complexity of UI/UX design is another factor that affects the cost. A modern and interactive design will cost more than a simple and basic one.

- Security and Compliance Requirements: FinTech apps must meet stringent security and compliance standards. Implementing robust security measures and ensuring regulatory compliance will increase development costs.

- Platform Choice: Developing a FinTech app for both Android and iOS platforms will increase the overall cost. Native app development requires separate coding for each platform.

- Location and Time Zone: The location of the development team also impacts the cost. Development rates vary worldwide, with developers in North America generally charging more than those in other regions.

- Integration of Third-Party Tools: If you plan to use third-party tools or APIs for features like payment gateways or push notifications, it can add to the cost of development.

- Languages and Localization: Developing the app in multiple languages will require additional development hours. Localization is crucial for reaching a wider audience and ensuring a good user experience.

- Maintenance and Support: After the initial development, your app will require ongoing maintenance and support. This should be factored into the cost estimation.

- Revenue Generation: If you plan to generate revenue through your FinTech app, additional features such as in-app purchases or subscription models may need to be developed, which can increase the cost.

Considering these influencing factors can help you estimate the cost to develop a FinTech app more accurately. It is important to carefully analyze your requirements and choose the right development approach to ensure a successful and cost-effective app development process.

Product Requirements

When building a fintech app, there are certain product requirements that must be met in order to provide a seamless and secure user experience. These requirements include:

- Transfers: The app must allow users to make transfers between accounts easily and securely.

- Tips: The app should provide helpful tips and guidance to users to assist them in managing their finances.

- Sign-in: The app must have a secure sign-in process to protect user information.

- App size: The app should be designed to be as small as possible to minimize storage space on users’ devices.

- Android value: For Android users, the app must be designed with native code and features to provide a more seamless experience.

- P2P payments: The app should have an integrated P2P payments gateway to allow users to send and receive money easily.

- Personalization: The app should offer personalization options to cater to the unique needs and preferences of each user.

- Push notifications: The app must be able to send push notifications to alert users of important updates and reminders.

- Good user experience: The app should have a clean and intuitive design, making it easy for users to navigate and perform tasks.

- Simple transactions: The app should make it simple and straightforward for users to perform financial transactions.

- Revenue dashboard: The app should provide a comprehensive dashboard that allows users to track their financials and view revenue data.

- Mobile-first design: The app should be built with a mobile-first design approach, as mobile devices are the primary platform for accessing fintech services.

- Integrated scanning: The app should have integrated scanning capabilities to allow users to easily scan and upload documents.

- Worldwide access: The app should be accessible to users worldwide, without any geographical restrictions.

- Cost-effective maintenance: The app should be designed using cost-effective technologies to minimize maintenance costs.

- Industry-standard security: The app must adhere to industry-standard security measures to protect user data and ensure a secure environment.

- Multiple languages: The app should support multiple languages to cater to users from different regions and backgrounds.

- Driving revenue: The app should have features that drive revenue, such as in-app purchases or premium services.

- Comprehensive explanations: The app should provide comprehensive explanations and guidance to help users understand financial concepts and use the app effectively.

- Influencing tools: The app should provide tools that help users understand and manage their financial decisions, such as budgeting and investment calculators.

- Easy maintenance: The app should be designed in a way that makes it easy for developers to maintain and update.

- Influenced by user feedback: The app should be influenced by user feedback, with regular updates and improvements based on user needs and preferences.

By meeting these product requirements, a fintech app can provide a seamless and intuitive user experience, driving the success of the app in the competitive fintech industry.

Interactive UIUX

One of the fundamental factors driving the growth of fintech apps is the development of interactive UIUX. As more and more peoples are using mobile devices for their daily services, fintech companies should focus on delivering a good user experience through their apps.

For instance, notifications are a necessary feature in fintech apps. Users should be properly informed about their account transactions, payments, and any other important updates. Interactive UIUX allows for easy sign up, quick access to account details and personalized notifications.

In addition, modern technologies like QR codes can be integrated into fintech apps to make transactions swift and easy. Users can simply scan the QR code and complete the payment or transfer of funds in a matter of seconds. This not only saves time but also helps in the proper management of transactions.

Furthermore, interactive UIUX must be developed for both Android and iOS platforms. Each platform has its own UIUX design guidelines and requirements, so the app should be developed properly to ensure compatibility and a seamless user experience on both platforms.

Another important factor to consider in interactive UIUX is personalization. Users want an app that feels tailored to their needs and preferences. Personalized features can include language options, location-based services, and customized account settings.

Finally, cost is another influencing factors when it comes to interactive UIUX. Developing an app with interactive UIUX requires expert UI/UX designers, which can drive up the development costs. However, the value that this feature brings to the app and its potential to attract and retain users is worth the investment.

In conclusion, interactive UIUX is a key feature to consider when building a fintech app. It enhances the user experience, provides personalized features, and improves the overall usability of the app. By integrating interactive UIUX, fintech companies can create a modern and user-friendly app that meets the needs of their customers in the fast-paced world of finance.

Location of the Development Partner

When it comes to developing a fintech app, the location of your development partner can be a crucial factor that influences the success and cost of your project. With the mobile app development industry constantly evolving, it is important to find a partner who is well-versed in the latest technologies and trends.

A development partner located in a technologically advanced country, such as the United States or Europe, can bring a wealth of experience and expertise to your project. These regions are known for their modern infrastructure and a large pool of highly skilled developers. They can offer you valuable insights and help you develop a more user-friendly and secure app.

On the other hand, choosing a development partner from a location with lower labor costs, such as India or Eastern Europe, can significantly reduce the development costs without compromising the quality of your app. These locations are known for their cost-effective development services, making it a viable option for start-ups and small businesses.

Another factor to consider is the time zone difference. If you are located in the US and your development partner is in a different time zone, it can be beneficial. This means that your app development can progress even when you are not working, allowing you to save time and meet your project deadlines more efficiently.

Furthermore, the location of your development partner can also influence the ease of communication. If they are located in a country that speaks the same language as you, communication barriers are minimized, making it easier to convey your requirements and ensure they are properly understood.

Additionally, the location of your development partner can also affect the maintenance and support of your app. If your app gets developed and maintained by the same team, having them in close proximity can make it easier to address any issues or implement necessary updates in a timely manner.

- Tips for choosing the right location:

- Consider the size and requirements of your project

- Evaluate your budget and cost limitations

- Assess the growth potential of your app in different markets

- Take into account the industry regulations and security standards

- Look for a development partner with experience in building similar applications

- Ensure that the partner is well-integrated with the latest technologies and tools used in the industry

- Consider the user base and target audience of your app

- Verify if the partner has experience in developing native apps or hybrid apps

- Check if they offer personalized features like push notifications and QR code gateway

Finally, remember that location is just one factor to consider when choosing a development partner for your fintech app. It is important to find a balance between the cost, quality, and requirements of your project. With the right partner, you can develop an app that meets the needs of your users and drives the growth of your business.

Time Required for FinTech Mobile App Development

Developing a fintech mobile app requires careful planning and execution. The time required for development can vary based on various factors, such as the complexity of the app, the number of features, the level of integration with other systems, and the availability of resources. In this article, we will discuss the time required for developing a fintech mobile app and some tips to expedite the process.

Building a fintech mobile app involves integrating various services and features such as account management, P2P transfers, personalized notifications, and more. Each of these features requires time to be developed and tested thoroughly to ensure a seamless user experience.

The complexity of the app is also a major factor influencing the development time. For example, a simple banking app may take a few weeks to develop, while a more advanced app with features like advanced account management, investment tools, and gateway access may take several months to complete.

Another major factor influencing the development time is the UI/UX design. A well-designed user interface can significantly reduce the development time as it provides a clear roadmap for developers. Similarly, using advanced tools and frameworks can speed up the development process, as they offer pre-built components and libraries that can be easily integrated.

Moreover, the availability of resources and the size of the development team can influence the development time. A larger team can work on different components of the app simultaneously, reducing the overall development time. However, coordination among team members and timely communication are crucial to avoid delays.

The maintenance and updates required for the app also add to the development time. In the ever-evolving world of fintech, keeping up with the latest technologies and constantly updating the app to meet the changing requirements is essential for success. Therefore, developers must allocate time for future enhancements and bug fixes.

In conclusion, the time required for developing a fintech mobile app can vary significantly depending on factors like complexity, UI/UX design, team size, and technology used. By following industry best practices, using modern tools, and staying up-to-date with the latest trends, developers can optimize the development process and deliver a high-quality app within the expected timeline.

App Maintenance

App maintenance is a fundamental aspect of building a fintech app. Without proper maintenance, an app can quickly become outdated and less user-friendly, which can negatively impact user experience and drive users away.

There are different factors that contribute to the costs of app maintenance. One of the most significant factors is the size and complexity of the app’s codebase. The more advanced and interactive features a fintech app has, the more it will require regular updates and bug fixes.

Another cost factor is the integration of payment gateway services. Fintech apps typically involve digital transactions, and having a payment gateway integrated into the app is necessary to facilitate these transactions. However, payment gateway services may require additional costs for maintenance and usage.

App maintenance is not just about fixing bugs and adding new features. It also involves ensuring that the app functions properly on different platforms and devices. For instance, if the app was initially built for Android devices, it may require additional maintenance and updates to work well on iOS devices.

App management and growth should also be considered when planning for app maintenance. This includes managing user accounts, driving user engagement through notifications, and providing a user-friendly dashboard for easy access to app services.

App maintenance is also necessary for security reasons. As the fintech industry grows, so do the threats and vulnerabilities that hackers may exploit. Regular maintenance helps ensure that the app stays secure and protects user data from potential breaches.

App maintenance is a continuous process that involves regular monitoring, updates, and improvements. It is a necessary investment for the long-term success of a fintech app.

Advanced Technologies Used

Fintech apps have become more advanced and user-friendly, driving the growth of the industry. These apps require modern technologies to properly build and maintain them. One of the most necessary technologies is native app development for both Android and iOS platforms. Native apps have the advantage of accessing the device’s features and tools, such as GPS location and scanning QR codes, which are required for different fintech applications.

Another advanced technology used in fintech apps is the use of secure payment gateways. Security is a fundamental factor in fintech apps, as they handle people’s financial transactions and account information. Robust security measures are necessary to protect user data and ensure safe transactions. Advanced gateway features like two-factor authentication and encryption techniques play a vital role in providing a secure environment for users.

In addition to security, the user interface (UI) and user experience (UX) design are crucial factors for the success of a fintech app. The app should have a user-friendly and visually appealing design, which can be achieved through modern UI/UX tools and frameworks. A well-designed dashboard and easy navigation can make the app more intuitive and efficient for users to manage their finances.

Advanced technologies also play a significant role in the development and maintenance of fintech apps. For instance, Swift code is often used for iOS app development, which enables faster and more efficient coding. Additionally, cloud technologies are utilized to store and handle the vast amount of data generated by fintech apps. Cloud platforms offer scalability, cost-effectiveness, and reliability, allowing fintech apps to handle large user bases and provide seamless services.

Furthermore, peer-to-peer (P2P) payments have become more popular in the fintech market. Apps with P2P payment features enable users to send and receive money quickly and securely. These apps often use advanced encryption techniques to ensure the safety of financial transactions between peers.

It is important to note that the choice of advanced technologies depends on the specific requirements and goals of a fintech app. The development team needs to partner with experts who understand the modern fintech landscape and can leverage the right technologies to drive the app’s success in the market.

In summary, fintech apps require advanced technologies to provide the necessary features, security, and user-friendly experience. Native app development, secure payment gateways, modern UI/UX design tools, cloud technologies, and P2P payment features are some of the key technologies influencing the development of fintech apps in today’s digital world.

Tools and Languages Used

Developing a fintech app requires a careful selection of tools and languages to ensure that the app meets the account requirements and driving needs of the users. In this guide, we will explore the most commonly used tools and languages in the fintech industry.

First and foremost, a fintech app must have a simple and user-friendly interface (UI/UX) to ensure that the users can easily navigate through the app’s features and services. To achieve this, many developers choose to use platforms such as Android or iOS to develop their apps. These platforms provide a modern and advanced development environment that is capable of integrating various APIs and services.

When it comes to coding, developers have a range of options. For Android app development, Java and Kotlin are the most commonly used programming languages. On the other hand, iOS app developers often choose Swift as the preferred language for its simplicity and ease of use.

Notifications are a fundamental feature in fintech apps. Push notifications play a crucial role in keeping the users updated about their account activities, payment reminders, and other important notifications. Therefore, it is essential to properly integrate push notification services into the app to ensure that the users are timely informed.

QR code scanning has become increasingly popular in the fintech industry. With QR codes, users can easily make payments, access their account information, and perform various other actions. Therefore, integrating QR code scanning into the app is a necessary feature to provide a seamless and convenient user experience.

Influencing factors such as location, personalization, and size of the app greatly impact the user experience. For instance, personalization allows users to customize the app according to their preferences, while location-based services enable users to find nearby banking services or ATMs. These factors require proper development and integration into the app to ensure their effectiveness.

In the fintech industry, security and the management of personal and financial data are of utmost importance. Therefore, developers must use industry-standard security measures and follow best practices to ensure that the app is robust and secure. For example, implementing two-factor authentication and encryption techniques are necessary to protect user information.

In terms of revenue, fintech apps have different monetization strategies. Many apps generate revenue through in-app purchases, premium features, or subscription plans. Therefore, it is important for developers to carefully consider their revenue model during the development phase.

Overall, developing a fintech app requires a good understanding of the market, user requirements, and industry trends. By using the right tools and languages, developers can create a user-friendly and feature-rich app that meets the needs and expectations of the users in the ever-evolving fintech world.

Features Integrated

When building a fintech app, it is important to consider the features that you will integrate into your platform. These features will not only enhance the user experience but also drive revenue for your business. Here are some advanced features that you can develop using different tools and technologies:

- Mobile Payments: Integrating mobile payment services allows users to make secure and convenient transactions using their smartphones. With this feature, users can easily pay bills, make peer-to-peer (P2P) transactions, and send money to their friends and family.

- QR Code Scanning: QR code scanning is another useful feature that can be integrated into your app. With this feature, users can scan QR codes to access information or make payments.

- Personalization: The ability to personalize the app is an important factor in today’s modern world. Users appreciate apps that can be customized to their preferences and needs. By incorporating personalization features, you can provide a more tailored experience for your users.

- Secure Account Access: Security is a top priority in the fintech industry. Integrating advanced security features, such as two-factor authentication and biometric authentication, ensures that user accounts are protected from unauthorized access.

- 24/7 Access to Services: Fintech apps should provide round-the-clock access to their services. Users should be able to access their accounts, make transactions, and get customer support at any time of the day.

- Integration with other Platforms: To reach a wider audience and increase your app’s visibility, it is necessary to integrate your app with other platforms. For instance, partnering with popular payment gateways or integrating with social media platforms can help expand your user base.

- Multi-Language Support: As fintech apps are used worldwide, supporting multiple languages is crucial. This feature allows the app to cater to users from different regions and improve their overall experience.

- Advanced UI/UX: The user interface (UI) and user experience (UX) of your app play a significant role in its success. A good UI/UX design ensures that users can navigate your app easily and complete their desired tasks without any confusion.

- Low Development and Maintenance Costs: Building and maintaining a fintech app can be costly. By utilizing advanced development tools and technologies, you can reduce the development and maintenance costs associated with your app.

- Swift Transaction Processing: Users expect fast and efficient transaction processing. Integrating advanced payment processing systems ensures that transactions are executed swiftly and accurately.

- Real-Time Notifications: Keeping users informed about their account activities is essential. Real-time notifications can be integrated into your app to provide users with instant updates on their transactions, account balances, and other important information.

In conclusion, when developing a fintech app, integrating these features will help you meet the requirements and expectations of your users. Each feature adds value to your app and makes it more competitive in the market. Finally, don’t forget to consider the size of your app as well as the costs and necessary resources for building and maintaining it. By considering these factors, you can develop a successful fintech app that meets the needs of the modern user.