Creating a budget plan is an essential step in managing your finances. Whether you are a freelancer or working for a company, having a well-thought-out budget can help you stay financially secure. In this article, we will publish a step-by-step guide on how to create a budget plan for yourself.

The key role of a budget plan is to help you allocate your money to cover your various expenses and savings goals. By dividing your income into different categories and assigning an amount to each, you will be able to keep track of your spending and ensure that you are on track towards achieving your financial objectives.

Below are the five stages that you need to go through to create an effective budget plan:

- Step 1: Define Your Income and Expenses

- Step 2: Categorize Your Expenses

- Step 3: Set Budget Amounts

- Step 4: Track Your Actuals

- Step 5: Review and Adjust

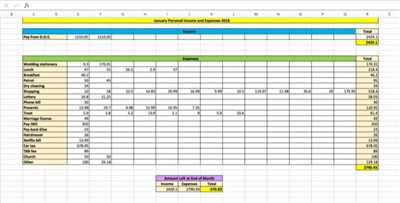

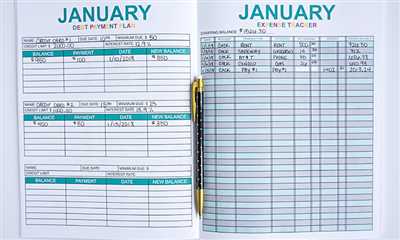

The first step in budgeting is to gather all the necessary information about your income and expenses. This includes your housing costs, bills, savings, and any additional sources of income. Make sure to enter these numbers into a spreadsheet or an online budgeting tool, such as Excel.

Next, you need to categorize your expenses. You can create a hierarchy of categories based on your needs. For example, you can have a main category called “Bills” with subcategories such as “Electricity,” “Water,” and “Internet.” By organizing your expenses in this way, you will be able to see how much money you are spending in each category.

After categorizing your expenses, you can now assign budget amounts to each category. This is where you decide how much money you want to spend on each expense. It is important to be realistic and set amounts that are within your means.

Once you have your budget plan in place, it’s time to start tracking your actual expenses. This can be done by filling in the actual amounts you spent in each category. By comparing your actuals to your budgeted amounts, you will be able to see if you are staying on track or if you need to make any changes to your spending habits.

Reviewing your budget plan on a regular basis is essential. This will help you identify any areas where you may be overspending or where you can save more money. If necessary, make adjustments to your budget by reallocating funds from one category to another.

By following this budgeting process, you will be able to effectively manage your finances and achieve your financial goals. Remember, budgeting is an ongoing exercise, and it’s important to keep track of your expenses and make adjustments as needed. With the right plan in place, you can take control of your money and make sure that you are in a secure financial position.

- Step 2: Enter Your Income in Your Budget Template

- Exercise 1 Configuration

- Task 1: Create Organizational Hierarchy

- Task 2 Configure user security

- Task 3 Create scenarios

- Task 4: Create budget plan columns

- Task 5: Create budget plan document layouts and templates

- Task 6: Create a budget planning process

- Why budgeting is important

- Key statistics on spending and savings

- Keep going

- Video:

- How to create Ultimate Personal Budget in Excel

Step 2: Enter Your Income in Your Budget Template

Once you have set up your budget template, it’s time to start entering your income. This is an important step in the budgeting process as it allows you to track your earnings and see how much money you have available to allocate towards different categories and expenses.

Here’s how you can enter your income in your budget template:

- Open your budget template in Excel or any other accounting software that you are using. If you don’t have a budget template yet, there are many free templates available online that you can download.

- Go to the “Income” section of your budget template. This is typically located on the first page or tab of the template. Look for a section dedicated to recording your income or earnings.

- Start by recording your regular income sources, such as your salary or wages. You can also include any freelance income, grants, or other sources of income that you typically receive.

- If your income varies from month to month, you may want to create different scenarios or columns to account for different income levels. This will help you plan and budget for months with higher or lower income.

- As you enter your income, make sure to categorize it based on the needs of your budget. For example, you can create categories such as “Salary,” “Freelance Income,” or “Miscellaneous Income.”

- Keep in mind that not all income needs to be allocated towards expenses. It’s important to set aside a portion of your income for savings, emergency funds, or investments.

- Once you have entered all your income, take a moment to review your budget template. Make any necessary changes or adjustments to ensure that your income accurately reflects your financial situation.

- If you have any unplanned or irregular income, such as bonuses or commissions, you can still include them in your budget template. Simply add a new row or column to account for these additional sources of income.

Remember, the goal of budgeting is to help you keep track of your income and expenses, and to plan for both the short and long term. By entering your income in your budget template, you are taking an important step towards financial stability and security.

Clicking the “Save” or “Publish” button will activate your budget template and make it ready to use. This means that you can start working on your budget plans and track your spending based on the categories you have created. Your budget template will serve as a central hub to manage your finances and stay organized.

By creating a budget template and entering your income, you are not only learning how to manage your money but also taking control of your financial future.

Exercise 1 Configuration

Before you start budgeting, you’ll need to configure the settings and parameters. This exercise will guide you through the initial setup process.

Step 1: Activate the BudgetingSetup page by clicking on the “BudgetingSetup” button. This will grant you access to the budget planning sheet.

Step 2: Configure the organizational hierarchy by creating each entity and assigning users to the appropriate levels. This will ensure that the budget planning process aligns with your company’s structure and goals.

Step 3: Set up the budget templates. Budget templates are pre-defined sheets that simplify the budgeting process by providing columns for different categories such as income, savings, housing, bills, and more.

Step 4: Set up the necessary security and access levels. This will ensure that only authorized users can view, edit, or approve budget-related decisions.

Step 5: Configure the fiscal year and period settings. This is essential for accurate tracking of financial statistics and analysis.

Step 6: Name and configure scenarios. Scenarios allow you to create multiple versions of the budget plan based on different assumptions or what-if scenarios.

Note: The exercise assumes that you already have an Excel budget template in place. If you don’t, you can just use the default template provided.

Once the above steps are done, you are ready to begin the budgeting process. The configuration exercise covers the essential aspects of setting up the budget plan in order to cover both planned and unplanned expenses.

Task 1: Create Organizational Hierarchy

Creating an organizational hierarchy is an important step in budget planning. By organizing your company’s structure, you’ll be able to establish clear lines of responsibility and track spending more effectively. This section will guide you through the process of creating a hierarchy for your budget plan.

1. Start by logging in to the budgeting software as an admin user. If you don’t have an account yet, you can create one by clicking on the “Sign Up” option on the login page.

2. Once you’re logged in, go to the “Configuration” section of the software. Here, you’ll find all the tools and settings you need to configure your budget plan.

3. In the configuration menu, select the “Organizational Hierarchy” option. This will open a new page where you can define the structure of your company’s departments, teams, and other entities.

4. In the hierarchy configuration page, you’ll see a table with different fields and categories. Fill in the appropriate information for each entity you want to create in your hierarchy. You can also select an existing entity and click on the “Edit” button to make changes if needed.

5. While filling in the hierarchy fields, note that you can select a parent entity for each department or team. This allows you to create a hierarchical structure for better organization and decision-making processes.

6. In the “Security Settings” section, you can grant access to different users or companies based on their roles and responsibilities. This ensures that only authorized individuals can view or edit the budgeting data for specific departments.

7. Once you’ve created your hierarchy and configured the security settings, click on the “Save” button to save your changes.

8. The next step is to define the budget templates for each entity. Budget templates are pre-configured layouts that you can use as a starting point for budget planning. By creating multiple templates, you give yourself more flexibility in the budgeting process.

9. In the “Templates” section, click on the “Create” button to create a new template. Enter a name for the template, select the appropriate entity, and configure the budgeted amount and other relevant fields.

10. Once you’ve created the template, you can activate it and publish it to the users who will be working on the budget planning process. Activating a template lets you enter actuals data and track the budget progress against the planned amounts.

11. Repeat the steps above to create templates for all the entities in your hierarchy, or pick and edit existing templates to save time.

12. Note that budget templates can be created at different stages of the budgeting process. You can start with a high-level template for the entire company and then create more detailed templates for each department or team. This allows you to break down the budgeting process into smaller, more manageable chunks.

By following the steps above, you’ll be able to create a comprehensive organizational hierarchy and configure budget templates that suit your specific needs. Remember, budget planning is an ongoing process, so you may need to make changes and adjustments as the month progresses. The budgeting software ensures that you have all the tools and data at your fingertips to make informed decisions and keep your spending on track.

Task 2 Configure user security

When creating a budget plan, it is important to configure user security to ensure that only authorized individuals have access to sensitive financial information. This step is essential in maintaining the privacy and integrity of your budgeting process.

To configure user security in your budget plan, follow these steps:

Step 1: Go to the user configuration section of your budget plan, which can be found in the settings menu.

Step 2: Select the users or entities that will have access to the budget plan. This can be done by clicking on the respective columns in the user configuration page.

Step 3: Determine the level of access each user or entity will have. For example, you may grant some users the ability to view and fill out the budget plan, while others may only have permission to view and approve it.

Step 4: If needed, create specific roles or departments within your budget plan to further categorize user access. For example, you may have a finance department that has access to all financial categories and a marketing department that only has access to marketing-related categories.

Step 5: Fill in the necessary fields for each user or entity, such as their name, email, and job description. This information will help you keep track of who has access to the budget plan.

Note: It is recommended to use strong passwords and regularly change them to enhance security.

Why is user security configuration important?

User security configuration is important for several reasons. Firstly, it ensures that only authorized individuals have access to sensitive financial information, protecting the confidentiality of your budget plan. Additionally, it allows you to give different levels of access to different users based on their role or responsibilities in the budgeting process. This helps you maintain control over who can make changes to the budget plan.

By configuring user security in your budget plan, you can have peace of mind knowing that your financial information is protected and accessible only to those who need it.

Task 3 Create scenarios

When it comes to budget planning, it’s important to consider different scenarios that may impact your finances. Scenarios can be created to help you understand the potential outcome of different situations, such as changes in income or unexpected expenses.

To create scenarios, you’ll need to set up hierarchies and entities within your budgeting system. Hierarchies allow you to view your budget at different levels of detail, such as department or account. Entities help you organize your budget by categorizing expenses and income.

Here are the steps to create scenarios:

- Activate the budgeting setup in your financial system. This will enable you to use the budgeting features and configure your organizational hierarchy.

- Configure your organizational hierarchy by creating the necessary departments, entities, and other key fields. This will help you cover all the areas that need to be included in your budget plan.

- Enter the budget amounts for each entity and category. You can either enter the amounts manually or import them from an external source, such as an Excel file or financial statistics.

- Pick a goal for each entity or category. This goal can be based on previous actuals, average spending, or a percentage increase or decrease from the previous year.

- Switch to the scenarios view to see how your budget plan changes based on different scenarios. You can create multiple scenarios to compare different what-if situations.

- Make necessary changes to your budget plan based on the scenarios. You can adjust the amounts, goals, or hierarchies to learn how different decisions can impact your finances.

- Approve and publish the budget plan once you’re satisfied with the scenarios and changes. This will make the budget plan available to all users in your organization.

By creating scenarios, you can simply switch between different views and learn how different factors can affect your budget. Whether it’s changes in income, housing expenses, or working for multiple companies as a freelancer, scenarios can help you make informed financial decisions. So start creating scenarios and take control of your finances!

Task 4: Create budget plan columns

Now that you have set up the workflow and viewed the budget plan, it’s time to create the columns for your budget plan. This step is essential in organizing and tracking your finances.

The first thing you need to do is switch to the “Budget Planning” view. This view will show you only the budgeted and actual amounts for each category and entity, making it easier to focus on your budget plan.

To switch to the “Budget Planning” view, simply click on the “-” button next to the “View” dropdown and select “Budget Planning” from the list.

Once you’re in the “Budget Planning” view, you will see a list of categories and entities on the left-hand side of the screen. This is where you’ll be creating your budget plan columns.

To create a new column, click on the “Add a column” button at the top of the screen. A dialog box will appear asking you to select a template for your column. You can either pick one of the pre-configured templates or create one yourself from scratch.

When selecting a template, keep in mind your budgeting goal and needs. Each template is based on a different budgeting goal or configuration, so choose the one that best suits your needs.

After selecting or creating a template, you can enter a name for your column, such as “Monthly Expenses” or “Freelance Income”. You can also add descriptions to provide more context for yourself or other users who will be using the budget plan.

Once you’ve entered the column name and descriptions, click “Done” to create the column. It will now appear in the list of columns on the left-hand side of the screen.

Repeat this process to create as many columns as you need for your budget plan.

Note that you can also configure the column to be auto-published or published with approval. This means that the budget plan data entered in the column will either be automatically published for all users to see or will require approval from an admin before being published.

Now that you have created the columns, it’s time to fill them with data. Select a column from the list on the left and click on it to open the column sheet. Here, you’ll be able to enter the budgeted and actual amounts for each category and entity.

To fill in the data, simply enter the amounts in the cells below the categories and entities. You can either enter specific values or use formulas such as averages or percentages.

It’s important to note that the budget plan is created on a month-to-month basis. So, if you want to plan for more than one month, you’ll need to create multiple columns, each representing a different month.

Once you’re done filling in the data for a column, you can save and close the column sheet. The data will be saved and you can always come back to it later to make any necessary adjustments.

Below the list of columns, you’ll be able to see a summary of your budget plan. This summary will show you the total budgeted and actual amounts for each category and entity, as well as any savings or deficit.

To get a closer look at the budget plan data, you can click on the categories or entities to see a breakdown of their individual hierarchies.

Keep in mind that the budget plan is a living document, which means that it will change over time. As you pay bills, receive income, or have any other financial changes, you’ll need to update your budget plan accordingly.

That’s it! You have now created the columns for your budget plan. The next step is to configure the layouts and process for your budget plan, which we will cover in the next task.

Task 5: Create budget plan document layouts and templates

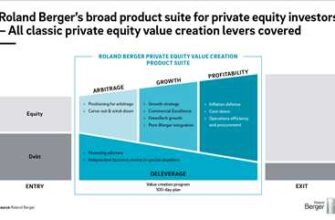

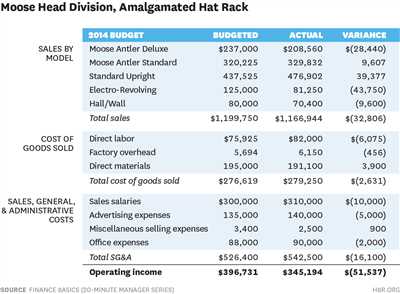

In the planning process, companies need to configure their budgeting setups and create appropriate document layouts and templates. This step is important because it provides organizations with a structured framework for budgeting and helps them make informed financial decisions.

By clicking on the “Create budget plan” button, the admin is able to switch to a page where they can create budget plan templates. For each budget plan, they can grant access to select users and specify the fiscal year it covers.

The budget plan templates have several key sections, such as income, expenses, and savings. In the income section, users can add descriptions and select the appropriate account from a dropdown menu. They can also specify whether the income is auto-generated or entered manually.

The expenses section lets users add descriptions and select the appropriate account for each expense. They can also indicate whether the expense is a bill that occurs monthly or a one-time expenditure. In addition, users have the option to mark certain expenses as unplanned, which is useful for scenarios where unexpected costs arise.

The savings section allows users to set goals for their savings and track their progress. They can specify the desired savings amount and the percentage of income that should go towards savings each month.

After creating the budget plan templates, users can publish them and make any necessary changes as the fiscal year progresses. The templates serve as a reference point for budgeting exercise and help users keep track of their financial goals.

Each budget plan document layout consists of columns where users can input their financial data for each month. The columns may include fields for income, planned expenses, unplanned expenses, savings, and any other categories relevant to the budgeting process.

The budget plan templates are designed to provide organizations with a clear overview of their financial situation. They allow users to easily compare their actual income and expenses against the planned values, which helps identify discrepancies and make adjustments accordingly.

Creating budget plan document layouts and templates is an important step in the budgeting process. It enables organizations to establish a structured approach to managing their finances and make informed decisions based on accurate and up-to-date information.

Task 6: Create a budget planning process

Creating a budget planning process is essential for organizations to effectively manage their finances. This process helps individuals and companies allocate their income and savings to meet their financial goals. In this exercise, we will look at how to create a budget planning process using Microsoft Excel.

Step 1: Activate the Budget Planning Template

To begin, open Microsoft Excel and switch to a new document. You can either create a budget planning template yourself or use one of the pre-made templates available in Excel. Pick a template that best suits your organizational needs.

Step 2: Enter Essential Budget Categories

The first step in the budget planning process is to enter the essential budget categories. These could include income, bills, savings, and other specific categories that are relevant to your financial situation. Fill in the necessary fields for each category in the template.

Step 3: Grant Access and Define Hierarchies

In some organizations, multiple users may be working on the budget plan at the same time. To grant access and define hierarchies for each user, click on the “Security” button or a similar option in Excel. This allows you to assign different roles and layouts to different users based on their needs and responsibilities.

Step 4: Edit Budgeted Data

To make changes to the budgeted data, click on the respective fields and enter the updated information. You can enter both fixed amounts and percentages, depending on the budget category.

Step 5: View Statistics and Close Budget Plan

When you are halfway through the budget planning process, you can view statistics and see how much money is allocated to each category. This will give you a better understanding of where your money is going and whether any adjustments need to be made. Once you have reviewed the statistics, close the budget plan.

Step 6: Switch to Working Mode

After the budget plan is closed, switch to working mode by clicking the “Activate” or a similar button. This will allow you to enter actual data and track your expenses in real-time. It is essential to regularly update the budget plan to ensure accurate financial records.

By following these steps, you can create a budget planning process that suits your needs. Excel provides various templates and functionalities to make this task easier for individuals and organizations. Remember to regularly review and update your budget plan to adapt to any changes in your financial situation.

Why budgeting is important

Budgeting is an essential process for individuals, organizations, and companies. It allows them to plan their finances and make informed decisions about how to allocate their resources. Without a budget, it is easy to overspend and find yourself in a financial crisis.

When organizations or companies have a budget plan in place, they can effectively track their income and expenses. This helps them understand what areas they need to focus on and where they can make adjustments. By analyzing data from past spending and income, they can pick up trends and make proactive decisions about their financial future.

For individuals, budgeting lets you take control of your personal finances. By tracking your income and expenses, you can see where your money is going and identify areas where you can save. This exercise helps you create a plan for achieving your financial goals, whether it’s saving for a down payment on a house or paying off debt.

Using templates to create a budget plan can simplify the process. Budget templates provide ready-made layouts and fields where you can fill in your income and expenses. They often include fields for bill descriptions, due dates, and amounts, making it easy to track and pay bills on time. When selecting a budget template, choose one that is appropriate for your needs and fiscal year.

For organizations, budget planning is even more crucial. It plays a key role in the financial security and success of the entity. Organizations often have multiple departments, each with its own budget. Budgeting allows them to allocate resources based on department needs and priorities. By configuring budget templates, organizations can create a hierarchy of budget approval, ensuring that spending is done in order and according to budget limits set by higher-level authorities.

Furthermore, budgeting lets companies and organizations look into the future. By analyzing statistics and market trends, they can make informed decisions about the financial direction of their business. For example, if the Bureau of Labor Statistics predicts a rise in housing costs in September, organizations can adjust their housing budget accordingly.

Lastly, budget plans help users maintain discipline and accountability in their spending. By having a budget in place, individuals and organizations are less likely to make impulsive purchases. Budgeting also allows for greater transparency within an organization, as budget results are often published for all users to view.

In summary, budgeting is an essential exercise for individuals, organizations, and companies. It helps them make informed financial decisions, plan for the future, and stay on track with their financial goals. Whether you are a freelance worker, a student, or a business owner, budgeting is a key process to ensure financial stability and success.

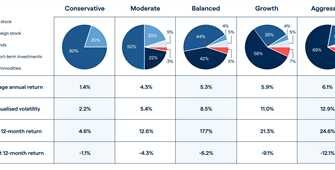

Key statistics on spending and savings

When it comes to managing your finances, having a solid budget plan is essential. One of the first steps in budgeting is to understand your spending and savings habits. By analyzing key statistics, you’ll be able to make informed decisions and set goals for your financial future.

The first step is to gather all your financial data, including income, bills, and expenses. This data can be organized through a budgeting sheet or online tools that can help you track your spending. By looking at your expenses over the course of a month, you can calculate the average amount spent on each category. This will give you an idea of where your money is going and if there are any areas where you can cut back.

Another important aspect to consider is your savings. Setting aside money each month for savings is crucial for achieving your long-term financial goals. Whether it’s for a down payment on a house, retirement, or an emergency fund, having savings gives you security and peace of mind. By analyzing your spending habits, you can determine how much you can realistically save each month and make adjustments accordingly.

Companies and organizations also need to create budget plans. This involves budgeting for each department based on their needs and goals. By using budgeting templates, companies can configure and edit their budget plans to be appropriate for their specific needs. This allows companies to keep track of their spending and make financial decisions that align with their overall goals.

Overall, understanding key statistics on spending and savings is essential for effective budget planning. By analyzing your spending habits and creating a budget plan, you can take control of your finances and make informed decisions. Whether it’s for personal finances or organizational budgets, having a clear view of your financial situation is crucial for success.

Keep going

Once you have set up your budget plan and filled in all the necessary information, you can continue with the workflow of managing your finances. On the main page of the budget plan, you will see an overview of your current financial state. Here, you can view key statistics, such as your average monthly income and spending, as well as the amount of savings you have accumulated so far.

Now it’s time to start making decisions regarding your budget. You can either create new financial entities, such as housing, bills, or department expenses, or edit existing ones. To create a new entity, simply enter a name and click the “Create” button. You can also grant each entity a specific amount of funds by clicking on the “Grant” button below the entity’s description.

Instead of manually creating each entity, you can also use predefined templates to cover common scenarios. Companies usually have predefined budget plans with layouts and hierarchies, which you can simply fill by entering the necessary data. This can save you a lot of time and effort, especially if you are working with a large department with multiple levels of hierarchy.

To keep track of your income and expenses, you can enter them in the corresponding sections of the budget plan. The budget plan lets you enter both planned and unplanned income and expenses. For planned expenses, you can specify the amount and the fiscal month they are associated with. For unplanned expenses, you can add a description and configure them as either one-time or recurring.

It’s important to regularly review and update your budget plan to ensure that you stay on track with your financial goals. You can use the statistics view to monitor your progress and identify areas where you may need to make adjustments. For example, if you notice that you are spending more than planned in a specific category, you can reallocate funds from other categories to cover the difference.

Remember, budgeting is an ongoing exercise that requires diligence and discipline. By keeping a close eye on your finances and making informed decisions, you can stay on top of your financial health and achieve your financial goals.

Close the document