If you want to take control of your finances and reach your financial goals, creating a budget plan is a crucial step. A budget allows you to track your income and expenses, determine where your money is going, and make necessary adjustments to ensure you’re on the right track. By following a budget, you’re likely to make better financial decisions and save money for the things that matter most to you.

When setting up a budget plan, it’s important to start by identifying your sources of income and your fixed expenses. This includes your monthly salary, any additional income you may have, and fixed expenses like rent, insurance, and debt repayment. Once you have a clear understanding of your income and fixed expenses, you can determine how much money you have left to spend on variable expenses.

Variable expenses are things like groceries, entertainment, and transportation, which can vary from month to month. To create a budget plan that works for you, it’s important to track your variable expenses and categorize them accordingly. This will help you see where you’re spending the most money and identify areas where you can cut back if needed.

In a city like Los Angeles, where the cost of living is high, budgeting is even more important. With so many expenses to consider, including housing, transportation, and health insurance, it’s easy to overspend if you don’t have a budget in place. By following a budget plan, you can ensure that you’re making the most of your income and saving for the future.

There are many resources available to help you create a budget plan. Websites like MarketWatch and newspapers like the Los Angeles Times often feature articles and tips on budgeting. Additionally, there are budgeting apps and software that can help you track your expenses and stay on top of your financial goals.

One important tip to keep in mind is to always have an emergency fund. Unexpected expenses can arise at any time, so it’s important to set aside some money each month for emergencies. By having an emergency fund, you’ll have peace of mind knowing that you’re prepared for whatever comes your way.

In conclusion, creating a budget plan is a crucial step in taking control of your finances. By tracking your income and expenses, categorizing your spending, and setting aside money for emergencies, you can ensure that you’re making the most of your money and working towards your financial goals.

Budgeting 101: How to Budget Money

Creating a budget plan is an important step towards financial health. When it comes to budgeting your money, it’s important to start with what you have and determine your income sources. This includes your monthly paycheck, as well as any additional sources of income you may have, such as freelance work or rental income.

To create a budget, you’ll also need to take into account your expenses. Start by listing all your fixed expenses, such as rent, insurance, and loan repayments. These are expenses that stay the same month to month. Then, make a list of variable expenses, which are those that can fluctuate, such as groceries, entertainment, or transportation costs.

Once you have a clear picture of your income and expenses, you can start setting financial goals. Determine what you want to achieve with your money, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

When setting your goals, it’s always a good idea to make them specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of saying “I want to save money,” set a goal such as “I want to save $500 in the next three months for a new laptop.”

During the budgeting process, it’s also important to make sure you prioritize your spending. Take into account your needs versus your wants, and allocate your money accordingly. This will help you make sure your essential expenses are covered before you spend on non-essential items.

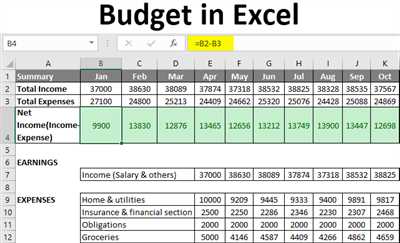

Keeping track of your spending is also crucial. You can use tools such as budgeting apps or spreadsheets to track your expenses and see where your money is going. This will help you identify areas where you can cut back if necessary, and make adjustments to stay on track with your budgeting goals.

Remember, budgeting is an ongoing process. Life changes, unexpected expenses arise, and priorities shift. It’s important to review and adjust your budget regularly to reflect these changes. By staying proactive and making budgeting a habit, you’ll be more likely to achieve your financial goals and improve your overall financial health.

In conclusion, budgeting is an essential skill for everyone. Whether you’re a college graduate just starting your career or an experienced professional, having a budget plan can lead to financial success. So, take control of your money today, create a budget, and start working towards your financial goals.

Determine Your Income

When it comes to creating a budget plan, one of the most important steps is to determine your income. This will help you understand how much money you have coming in each month, and how much you can allocate towards your expenses.

Start by gathering all your sources of income. This can include your salary from work, any freelance or side gig income, investment income, government assistance, or any other sources of money you receive regularly. Make sure to account for all income sources, as even small amounts can add up over time.

Once you have a list of your income sources, you need to determine how much you actually make from each source. If you have a fixed salary, this is easy – simply look at your paycheck or bank statement. However, if you have a variable income, such as from freelance work or investment returns, you’ll need to take a closer look at your earnings over the past few months to get an average.

If you’re not sure how much you make from a particular income source, take the time to track your earnings for a few months. This will give you a better idea of what you can expect to earn on a regular basis.

It’s always a good idea to be conservative when estimating your income. It’s better to underestimate your income and have extra money than to overestimate and fall short on funds.

Once you have determined your income, make sure to label it clearly on your budget plan. This will help you keep track of where your money is coming from and make it easier to review and adjust your budget as needed.

Remember, creating a budget plan is all about understanding your finances and setting financial goals. Knowing your income is an essential step towards managing your expenses effectively and ensuring you have enough money to cover your needs and wants.

Create a list of monthly expenses

In order to create an effective budget plan, it is essential to have a comprehensive list of all your monthly expenses. This will help you understand where your money is going and make necessary adjustments to your spending habits. Here are some steps to help you create a well-organized list:

1. Start by gathering all your financial statements, including bank statements, credit card statements, and any other relevant documents. This will give you a clear picture of your income and spending patterns.

2. Divide your expenses into fixed and variable categories. Fixed expenses are those that stay the same every month, such as rent or mortgage payments, loan repayments, and insurance premiums. Variable expenses, on the other hand, are those that can fluctuate from month to month, such as groceries, entertainment, and clothing.

3. Label each expense with its corresponding category and amount. For example, if your rent is $1,000 per month, label it as a fixed expense under the “Housing” category. If you spend an average of $300 on groceries per month, label it as a variable expense under the “Food” category.

4. Consider including specific categories for healthcare, transportation, utilities, and personal care. This will help you have a more accurate representation of where your money is going.

5. If you’re not sure how much you spend on certain expenses, review your bank statements or credit card statements for the past few months. This will give you a good estimation of how much you typically spend in those categories.

6. Take into account any upcoming expenses that you know will occur in the next few months. For example, if you’re planning a vacation or have a birthday party to attend, include those expenses in your list.

7. Use a budgeting tool or spreadsheet to keep track of your expenses. There are many free online tools available, such as NerdWallet, Mint, or Huntington Bank’s Financial 101. Alternatively, you can use a simple spreadsheet program like Microsoft Excel or Google Sheets.

8. Follow your budget plan consistently and make adjustments when necessary. It’s important to regularly review your spending habits and make sure you’re staying within your budget.

By creating a list of your monthly expenses and following a budget plan, you will be able to take control of your finances and work towards achieving your financial goals. Remember, budgeting is a skill that takes time and practice, so be patient with yourself as you begin this journey of financial management.

| Category | Expense | Amount |

|---|---|---|

| Housing | Rent/Mortgage | $1,000 |

| Transportation | Car Payment | $300 |

| Utilities | Electricity | $150 |

| Food | Groceries | $300 |

| Personal Care | Haircut | $30 |

Huntington Customer Tip

Creating a budget is an essential financial tool that can help you take control of your expenses. It allows you to determine how much money you have coming in and how much you’re spending. Follow this customer tip from Huntington Bank to create a budget plan that works for you.

First, gather all your sources of income, including your monthly paycheck and any other sources of income you may have. Make sure to label each income source and determine whether it is fixed or variable.

- Fixed income includes sources like your salary, which remains the same month after month.

- Variable income includes sources like commissions or freelance work, which may vary from month to month.

Next, make a list of all your monthly expenses. Start with fixed expenses, such as rent or mortgage payments, utilities, and insurance premiums. Then, list your variable expenses, including groceries, transportation costs, and entertainment expenses.

It’s important to be as detailed as possible when listing your expenses. For example, if you spend money on newspapers or magazines, make sure to include that in your list. If you’re not sure how much you spend on certain categories, keep track of your spending for a few months to get a better idea.

Once you have a complete list of your income and expenses, it’s time to create a budget. Start by subtracting your expenses from your income to determine how much money you have left at the end of each month. This leftover money can be used for savings or to pay off debt.

If you find that you’re not able to cover all your expenses with your income, you may need to make some adjustments. Look for areas where you can cut back on spending or find ways to increase your income. Remember, budgeting is a dynamic process, and it may take some trial and error to find what works best for you.

Setting financial goals is another important aspect of budgeting. Whether you want to save for a vacation, pay off debt, or build an emergency fund, having clear goals can help you stay motivated and focused on your budget.

Keep in mind that budgeting is a skill that takes time to develop. It’s important to always revisit and update your budget as your financial situation changes.

Take control of your finances today by creating a budget plan that suits your needs. By following these tips from Huntington Bank, you’ll be on your way to financial success.

Label fixed and variable expenses

When it comes to creating a budget plan, one of the most important steps is to label your fixed and variable expenses. Understanding which expenses fall into each category is crucial for effective financial management.

Fixed expenses are those that stay the same month to month, such as rent or mortgage payments, car loan repayments, and insurance premiums. These expenses are necessary and non-negotiable, making them an essential part of your budget plan. To determine your fixed expenses, make a list of all your monthly bills, including utilities and subscriptions.

Variable expenses, on the other hand, are the ones that can vary from month to month, such as groceries, entertainment, dining out, and transportation costs. These expenses are more flexible and can be adjusted based on your financial situation. To determine your variable expenses, take a look at your spending habits over the past few months and categorize them accordingly.

Labeling your expenses helps you prioritize and allocate your income effectively. Make sure to review your bank statements, credit card bills, and other financial records to get a clear picture of your spending patterns. By tracking your expenses, you’ll be able to identify areas where you can cut back and save money.

By labeling your fixed and variable expenses, you can better understand where your money is going each month, and make necessary adjustments to create a budget that suits your financial goals. Following a budget plan can lead to improved financial stability and help you achieve long-term financial success.

Remember that setting a budget is an ongoing process. It’s important to regularly review and update your budget as your income and expenses may change over time. The more you practice budgeting, the better you’ll become at it.

Whether you’re new to budgeting or looking to improve your current plan, knowing how to label your expenses is a crucial step. By staying organized and aware of your spending habits, you can take control of your financial situation and work towards your financial goals.

An Important Financial Statement

When it comes to setting a budget, one crucial component is understanding your financial statement. This statement is a snapshot of your money situation, helping you determine your income, expenses, and how much money you have left over each month.

Your financial statement includes both fixed and variable expenses. Fixed expenses are those that stay the same each month, such as rent or mortgage payments, insurance premiums, and loan repayment. Variable expenses, on the other hand, can change from month to month, including things like groceries, entertainment, and transportation.

To create your financial statement, you need to start by listing all your sources of income. This could include your salary, freelance work, or any passive income you may have. It’s important to account for all your sources of income to get an accurate picture of your financial situation.

Next, you’ll want to make a list of your monthly expenses. Be sure to label each expense, so you can easily categorize them later. Include everything from fixed expenses like rent and insurance to variable expenses like groceries and entertainment.

Once you have listed all your income and expenses, you can determine how much money you have left over each month. This is an important step in budgeting because it helps you allocate funds to different categories.

If you’re not sure how much you’re spending in each category, a good tip is to track your expenses for a few months. You can use a budgeting app or simply write down your expenses in a journal. This will give you a clear picture of your spending habits and help you identify any areas where you may be overspending.

Remember, creating a budget is a continuous process. As your income and expenses change, you’ll need to update your financial statement accordingly. By keeping track of your finances and regularly reviewing your budget, you can stay on top of your financial goals.

So, whether you’re hunting for that dream job in Los Angeles, California or working with a great team at NerdWallet, it’s always important to follow good budgeting practices. And knowing how to create and maintain a financial statement is an essential part of that process.

Sources

When it comes to creating a budget plan, it’s important to consider and evaluate various sources of income and expenses. Here are some potential sources you should take into account:

| Income |

| – Monthly salary from work |

| – Side income or freelance work |

| – Rental income |

| – Interest or dividends from investments |

| – Repayment from loans or debts |

| – Support from family or friends |

It’s important to have a clear understanding of how much money you have coming in each month so you can accurately determine your budget.

| Expenses |

| – Rent or mortgage payments |

| – Utility bills (electricity, water, etc.) |

| – Transportation costs (car payments, fuel, public transportation) |

| – Food and groceries |

| – Health insurance |

| – Debt repayment (credit cards, loans, etc.) |

| – Entertainment and leisure activities |

By listing out all your expenses, including both fixed and variable, you can have a better understanding of where your money is going each month.

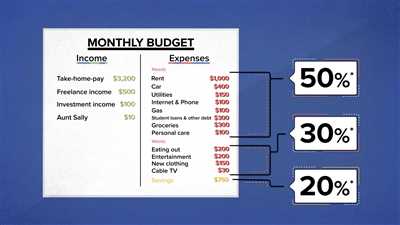

Remember to always follow the 50/30/20 rule of budgeting, which suggests that 50% of your income should go towards necessities, 30% towards wants, and 20% towards savings or investments.

Additionally, here are some recommended sources for further budgeting tips and advice:

- : This website offers a wealth of resources, including budgeting tools and guides.

- : Their page on financial education has numerous articles on budgeting and managing money.

- : MarketWatch is a financial news website that often features articles on budgeting and personal finance.

- : This section of the newspaper covers financial news, including budgeting tips.

- : Credit.com is a great resource for information on credit and budgeting.

By considering these sources and following the best practices of budgeting, you can make sure you’re setting yourself up for financial success!