Investing your money is an important step to achieve your long-term financial goals. If you want to build a well, invested portfolio, you need to understand the different types of investments that are available to you. By diversifying your investments, you can spread your risk and potentially achieve higher returns. In this guide, we’ll take you through the steps of creating a portfolio investment that meets your needs, whether you’re looking for something conservative or more aggressive.

First, you’ll need to identify your investment goals and risk tolerance. What’s your time horizon for investing? Are you looking for long-term growth or immediate income? Once you have a clear understanding of your needs, it’s time to consider the different types of investments that can help you achieve them.

There are three key elements to building a balanced portfolio: asset allocation, diversification, and research. Asset allocation is the process of dividing your investment capital across different asset classes, such as stocks, bonds, and cash. Diversification involves spreading your investments within each asset class to reduce risk. And research is an ongoing process of understanding the market and identifying investment opportunities.

When it comes to asset allocation, you need to consider your risk tolerance and investment goals. If you’re a conservative investor, you may want to allocate more of your capital to less risky investments, like bonds or large-cap stocks. On the other hand, if you’re more aggressive, you may consider allocating a larger portion of your capital to small-cap stocks or high-risk investment funds.

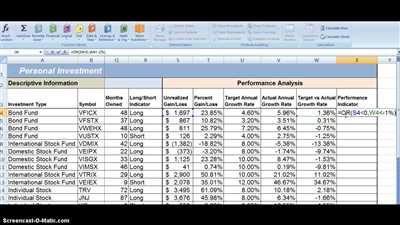

As you’re building your portfolio, it’s important to do your own research and understand the investments you’re considering. Look into the fundamentals of the companies or funds you’re interested in, and evaluate their historical performance. Consider factors such as their management team, the market they operate in, and any upcoming changes that could impact their performance.

Finally, once you have a well-diversified portfolio, it’s important to regularly review and rebalance your investments. This means adjusting your allocation based on market conditions and the performance of your investments. By doing so, you can ensure that your portfolio remains aligned with your goals and risk tolerance.

Remember, building a portfolio investment takes time and patience. Don’t be afraid to seek help from trusted sources, such as financial advisors or online investment platforms, to guide you through the process. With the right strategy and a balanced approach, you can create a portfolio that works for you and helps you achieve your long-term financial goals.

- How to start an investment portfolio

- Identify the different elements of a diversified portfolio

- Types of Investment Portfolios

- Conservative Portfolio

- Aggressive Portfolio

- Moderate Portfolio

- How to start your investment portfolio

- Look around you

- Do your research

- Additional Resources

- Videos:

- Warren Buffett | How To Invest For Beginners: 3 Simple Rules

How to start an investment portfolio

Investing in the market can be a great way to grow your wealth over time. However, it’s important to have a clear plan and understanding of the steps involved in creating an investment portfolio. Here’s a guide to help you get started:

- Set your goals: Before you start investing, think about what you want to achieve with your portfolio. Are you looking for long-term growth or regular income? Understanding your goals will help you determine your investment strategy.

- Assess your risk tolerance: Investing in the market comes with risks, and it’s important to understand your comfort level with those risks. Are you willing to take on aggressive investments with higher potential returns but also higher volatility, or do you prefer a more conservative approach?

- Research and choose your investments: Once you know your goals and risk tolerance, it’s time to consider different types of investments. You can invest in individual stocks of large companies, mutual funds, or exchange-traded funds (ETFs) which offer more diversification.

- Allocate your assets: Decide how much money you want to allocate to each type of investment. This will depend on your goals, risk tolerance, and research. A balanced portfolio typically includes a mix of stocks, bonds, and cash.

- Open an account: To start investing, you’ll need to open an investment account. There are various types of accounts available, such as a brokerage account or a retirement account like an Individual Retirement Account (IRA) or a 401(k).

- Work with a financial advisor: If you’re new to investing or need help, consider working with a financial advisor who can guide you through the process and help you make informed decisions.

- Start building your portfolio: With your goals, risk tolerance, and research in mind, start investing your money in the chosen investments. Make sure to regularly review and make adjustments as needed.

- Monitor and review regularly: It’s essential to regularly monitor your investments and review their performance. Keep an eye on market trends and news that may impact your portfolio.

- Consider additional resources: If you need more help or want to learn more about investing, there are many resources available such as books, online courses, and financial websites. These can provide valuable insights and educational materials.

Remember that investing involves risk, and the market can fluctuate. It’s important to be patient and not make hasty decisions based on short-term market movements. Your investment portfolio should align with your long-term goals and financial needs.

Identify the different elements of a diversified portfolio

When you’re working on creating a portfolio investment strategy, it’s important to consider diversification. Diversification involves spreading your investments across different asset types, which can help to mitigate risk and potentially increase returns.

A diversified portfolio typically consists of a mix of stocks, bonds, and cash. Each of these asset classes has its own level of risk and return potential, so by combining them in a portfolio, you can achieve a more balanced investment strategy. This means that if one asset class performs poorly, the others may help to offset the losses.

Here are some elements to consider when identifying the different elements of a diversified portfolio:

1. Investment Goals: Start by determining your investment goals. Do you want to grow your capital over the long term or are you looking for more moderate returns with lower risk?

2. Risk Tolerance: Understand your risk tolerance level. Some investors are comfortable with higher levels of volatility and are willing to take on more aggressive strategies, while others prefer a more conservative approach.

3. Asset Allocation: Decide how much of your portfolio should be invested in each asset type. A balanced portfolio might include a mix of stocks, bonds, and cash, while a more aggressive portfolio might have a higher allocation to stocks.

4. Research: Do your research on the different types of investments available to you. Look into the performance, volatility, and potential growth of each asset class.

5. Company Size: Consider investing in both large-cap and small-cap companies. Large-cap companies tend to be more stable and less volatile, while small-cap companies can offer higher growth potential.

6. Market Conditions: Keep an eye on the market and be aware of any changes or trends that may impact your investments. Market conditions can play a significant role in the performance of your portfolio.

By identifying these different elements, you can create a diversified portfolio that suits your needs and helps you achieve your investment goals. Remember that diversification does not guarantee a profit or protect against losses, but it can help to reduce risk and increase the potential for returns.

Types of Investment Portfolios

When it comes to creating a portfolio of investments, there are various types to consider. The type of portfolio you choose will depend on your investment goals, risk tolerance, and time horizon. Here are some of the different types of investment portfolios you may want to consider:

- Conservative Portfolio: This type of portfolio is designed to prioritize capital preservation and generate income. It typically includes investments such as bonds and blue-chip stocks, which are considered more stable.

- Moderate Portfolio: A moderate portfolio strikes a balance between growth and income. It may include a mix of stocks, bonds, and other investment vehicles to achieve this balance.

- Aggressive Portfolio: An aggressive portfolio is geared towards growth and can include a higher proportion of stocks, especially small-cap or high-growth stocks that have the potential for greater returns but also carry more risk.

- Balanced Portfolio: A balanced portfolio is designed to provide both income and growth. It typically includes a mix of stocks and bonds, allocating the assets in a way that suits the investor’s risk tolerance and goals.

- Diversified Portfolio: A diversified portfolio spreads investments across different asset classes, sectors, and geographies. This helps to reduce risk by not relying too heavily on any single investment.

It’s important to note that there is no one-size-fits-all approach when it comes to investment portfolios. Each individual’s investment needs and goals will differ, which is why working with a trusted advisor or doing thorough research is crucial. When creating a portfolio, consider your risk tolerance, time horizon, and investment strategy. Regularly review and adjust your portfolio as needed to ensure it remains aligned with your goals.

Keep in mind that the market and your investment needs may change over time. It’s essential to regularly assess your portfolio and make any necessary adjustments. Remember to diversify your investments, so you are not overly exposed to any single stock or sector. This diversification can help mitigate risk and increase the potential for long-term returns.

Regardless of the type of portfolio you create, it’s important to identify your goals, needs, and risk tolerance. This will guide your investment decisions and help to ensure that your portfolio is suited to your individual circumstances.

In summary, there are different types of investment portfolios to choose from, such as conservative, moderate, aggressive, balanced, and diversified portfolios. Each type has its own risk and return characteristics, so it’s crucial to consider your individual needs and goals when selecting the right portfolio for you. Working with a trusted advisor or doing thorough research can help guide you in creating a portfolio that aligns with your investment objectives.

Conservative Portfolio

A conservative portfolio is a type of investment strategy that aims to protect the capital invested while still generating income. It is suitable for investors who have a relatively low tolerance for risk and seek stability in their portfolio.

To create a conservative portfolio, you will need to follow a few steps. First, you need to identify your investment goals and time horizon. This will help you determine how much risk you can take and how long you are willing to invest your money.

Next, you need to understand your risk tolerance. Conservative investors typically prefer lower levels of volatility and are not comfortable with the wild swings of the market. They prefer investments that focus on preserving capital rather than achieving high returns.

Once you have identified your goals and risk tolerance, you can start building your portfolio. A conservative portfolio usually consists of a mix of different asset classes, such as stocks, bonds, and cash. The proportion of each asset class will vary depending on your investment strategy and goals.

When selecting stocks, conservative investors tend to focus on larger, well-established companies with stable earnings and a history of paying dividends. Blue-chip stocks like Disney or Johnson & Johnson are often included in conservative portfolios due to their relatively low volatility and reliable income streams.

Bonds, on the other hand, are considered less risky than stocks and provide a fixed income stream. Government bonds or investment-grade corporate bonds are popular choices for conservative investors looking for a steady income with relatively low risk.

Finally, cash or cash equivalents like money market funds can be used to provide stability and liquidity to the portfolio. These assets can help you meet any short-term needs and also act as a buffer during market downturns.

It’s important to note that while a conservative portfolio aims to protect your capital, it may result in lower returns compared to more aggressive portfolios. However, the main goal of a conservative portfolio is to provide stability and preserve the invested money rather than chasing after high returns.

To achieve a balanced and conservative portfolio, it is recommended to seek guidance from a financial advisor. They can help you understand your investment options, diversify your portfolio, and make informed decisions based on your individual financial situation and goals.

Remember, building a conservative portfolio is all about finding the right balance between risk and reward. By considering your goals, risk tolerance, and investment strategy, you can create a portfolio that aligns with your needs and helps you navigate the ups and downs of the market.

Aggressive Portfolio

When it comes to creating a portfolio investment, there are different strategies that you can adopt depending on your risk tolerance, investment horizon, and financial goals. One of these strategies is known as the aggressive portfolio.

An aggressive portfolio is characterized by a higher proportion of investments in high-risk assets such as small-cap stocks or companies with much higher volatility than the market. This type of portfolio is suited for investors who have a long time horizon and a high tolerance for risk.

To create an aggressive portfolio, you need to understand the elements of risk and how they can help you achieve your investment goals. Start by doing thorough research on different types of investments and their performance. Look for companies that you believe in and that have the potential for high returns.

Next, diversify your portfolio by investing in a mix of different asset classes, such as stocks, bonds, and mutual funds. This will help you spread out your risk and minimize the impact of any single investment on your overall portfolio performance.

Investing in individual stocks can be risky, so it’s important to have a good understanding of the company and its financials. Look at their past performance, earnings reports, and any news or events that may impact their stock price. If you’re not comfortable picking individual stocks, you can also consider investing in index funds or exchange-traded funds (ETFs) that track a specific market index.

Working with a financial advisor can also be helpful in building an aggressive portfolio. They can provide you with guidance and help you make educated investment decisions based on your financial goals and risk tolerance.

Keep in mind that an aggressive portfolio can result in higher potential returns, but it also comes with higher levels of risk. Make sure you’re comfortable with the level of risk you’re taking and that it aligns with your financial goals. Regularly review and rebalance your portfolio to ensure it stays aligned with your investment strategy.

Overall, an aggressive portfolio can be a suitable option for investors who are willing to take on higher levels of risk in order to potentially achieve higher returns. However, it’s important to do thorough research, understand the different risk elements involved, and work with a trusted advisor to create a well-diversified portfolio.

Moderate Portfolio

When building a portfolio, investors need to consider their risk tolerance, time horizon, and investment goals. For those looking for a balanced approach, a moderate portfolio may be a suitable option.

A moderate portfolio is a diversified investment strategy that aims to achieve a relatively stable return while still allowing for some growth. This type of portfolio typically includes a mix of both conservative and aggressive elements, such as cash, bonds, and stocks.

Investors with a moderate portfolio need to be open to some level of risk. While there is potential for higher returns compared to conservative portfolios, there is also a higher level of volatility. The key is to find the right proportion of investments that meets your needs and helps you achieve your financial goals.

One way to approach a moderate portfolio is to invest in different asset classes such as large-cap and small-cap stocks, bonds, and real estate. By diversifying across different sectors and asset classes, investors can spread their risk and potentially improve their overall return.

Working with a financial advisor can also be helpful when creating a moderate portfolio. An advisor can guide you through the investment process and provide expertise on market trends, company analysis, and risk management.

While there is no one-size-fits-all approach, investors who are considering a moderate portfolio should think about their investment horizon, risk tolerance, and income needs. They should also consider how much time and resources they are willing to dedicate to their investments.

If you already have a moderate portfolio and are looking to make some changes, consider adding more aggressive or conservative elements to adjust the risk level. For example, you may want to increase your exposure to high-growth stocks or decrease your allocation to bonds.

Keep in mind that building a portfolio is an ongoing process. As your goals and financial situation change, your portfolio may need to be adjusted accordingly. Regularly reviewing and rebalancing your investments is important to ensure that your portfolio continues to meet your needs and align with your investment strategy.

Remember, when it comes to investing, there is no one-size-fits-all solution. Moderate portfolios can be a good fit for investors who want to achieve a balance between growth and income while managing risk. However, it’s important to trust your own judgment and make decisions that align with your personal financial goals.

By considering the elements mentioned above and working with a trusted advisor, you can create a moderate portfolio that aligns with your investment objectives and helps you work towards achieving your financial dreams.

How to start your investment portfolio

Building a portfolio is an important step for anyone looking to achieve their long-term financial goals. It allows you to diversify your investments and potentially grow your wealth over time. If you’re wondering how to start your investment portfolio, here are three key steps to get you on the right track.

Step 1: Identify your investment goals and risk tolerance

Before you dive into the world of investing, it’s important to determine what you want to achieve with your portfolio. Do you want to generate income for retirement, save for a down payment on a house, or something else? Having clear goals will help guide your investment strategy. Additionally, consider your risk tolerance. Some investors are comfortable with more aggressive investments and higher levels of volatility, while others prefer a more conservative approach with lower risk.

Step 2: Do your research and seek professional advice

Once you’ve identified your goals and risk tolerance, it’s time to do some research. Look for reliable sources of information, such as financial news websites or investment books, to learn more about different types of investments. Additionally, consider seeking advice from a financial advisor who can help you navigate the investment landscape and provide personalized recommendations based on your specific needs and objectives.

Step 3: Start with a diversified portfolio

When it comes to investing, don’t put all your eggs in one basket. A diversified portfolio helps spread the risk by investing in different asset classes, such as stocks, bonds, and real estate. This way, if one investment performs poorly, others may help offset the losses. Consider allocating your capital across different investments in a proportion that aligns with your risk tolerance and investment goals.

It’s important to note that building an investment portfolio is an ongoing process. As your financial situation and goals change, your portfolio should also change to reflect those changes. Regularly review and rebalance your portfolio to ensure it remains well diversified and meets your investment objectives.

Now that you know how to start your investment portfolio, it’s time to take action. Remember to always do your due diligence, seek professional advice, and invest based on your own research and risk tolerance. Building a successful portfolio requires time, patience, and a long-term perspective.

Look around you

When it comes to creating a portfolio investment, there are various elements to consider. Let’s take a look at some strategies that can guide you in building your own investment portfolio.

First and foremost, it is important to understand your risk tolerance and investment goals. Are you a conservative investor who prefers a relatively low level of risk, or are you more aggressive and willing to accept higher levels of volatility? Identifying your risk tolerance will help you determine the proportion of funds you should allocate to different types of investments.

Next, consider your time horizon. How long are you planning to keep your money invested? If you have a long time horizon, such as retirement that is many years away, you may have the ability to take on more risk and potentially achieve higher returns. On the other hand, if you have a shorter time horizon, you may want to focus on more stable investments with lower volatility.

Diversification is an important strategy to consider when building your portfolio. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can help reduce the impact of any single investment on your overall portfolio. This can help protect your investments in case one sector of the market experiences a downturn.

Furthermore, it is important to understand the role of an advisor. Working with a trusted advisor can provide you with additional guidance and expertise. They can help you identify your investment needs and create a well-balanced portfolio that aligns with your goals and risk tolerance.

When it comes to choosing specific investments, there are various types of funds and securities to consider. Large-cap, small-cap, and international stocks all have their own characteristics and levels of risk. It is important to do your research and understand the potential rewards and risks associated with each type of investment.

One example of a well-diversified portfolio is the “Three-Fund Portfolio.” This strategy involves investing in three different types of funds: a total stock market index fund, a total bond market index fund, and an international stock market index fund. This allocation provides exposure to different market sectors and helps balance risk and reward.

As you start building your own investment portfolio, don’t forget to regularly review and rebalance your holdings. The market and your own financial situation may change over time, and it is important to make adjustments accordingly. Regularly reviewing your portfolio and making necessary changes can help ensure that your investments are aligned with your long-term goals.

In conclusion, creating a portfolio investment requires careful consideration of various elements. By understanding your risk tolerance, time horizon, and investment goals, you can create a well-diversified portfolio that aligns with your needs. Working with a trusted advisor can provide additional guidance and expertise. Remember, investing is a long-term strategy, so stay focused on your goals and make informed decisions.

Do your research

Before you start building your portfolio, it’s important to do your research. This means taking the time to understand your investment goals, risk tolerance, and time horizon. Some investors may prefer a more conservative approach with lower risk levels, while others may be more open to taking on higher levels of risk for the potential of higher returns.

Start by looking into different investment options such as individual stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each of these has its own set of risks and potential rewards, so it’s important to educate yourself on how they work and what their historical performance has been like.

Additionally, consider the specific companies or funds you are interested in investing in. Look at their financial reports, understand their business model, and try to identify any potential risks or opportunities. For example, if you like a company such as Disney, you may want to look into their recent earnings reports, any upcoming movies or theme park expansions, and any potential challenges they may be facing in the industry.

Next, consider your asset allocation. This is the proportion of your portfolio that will be invested in different asset classes, such as stocks, bonds, and cash. It’s important to have a balanced allocation that aligns with your goals and risk tolerance. For example, if you have a relatively long time horizon and a higher tolerance for risk, you may choose to allocate a higher proportion of your portfolio to stocks, including small-cap or high-growth companies. On the other hand, if you have a shorter time horizon or a more conservative strategy, you may want to allocate more of your portfolio to bonds or cash.

Another important element to consider is diversification. Diversifying your portfolio means spreading your investments across different asset classes and sectors. This can help reduce risk and increase your chances of achieving your investment goals. For example, if you have a portfolio that is heavily weighted towards one company or sector, you may be more exposed to the risks associated with that company or sector. By diversifying, you can help mitigate this risk.

Lastly, don’t forget to look into the fees and expenses associated with different investment options. Some investments, like mutual funds and ETFs, may charge management fees or expense ratios. These can eat into your returns over time, so it’s important to understand how much you’ll be paying and whether the potential returns justify the costs.

By doing your research and understanding these key elements, you’ll be better equipped to create a portfolio that aligns with your needs and helps you achieve your financial goals. Remember, investing is a marathon, not a sprint, so take the time to do your due diligence and make informed decisions.

Additional Resources

When it comes to creating a portfolio investment, there are a number of additional resources that can help you make informed decisions and achieve your financial goals:

- Financial Advisor: Consider working with a financial advisor who can guide you through the steps and help you identify the types of investments that best meet your needs and risk tolerance.

- Research: Take the time to do your own research and understand the role different types of investments can play in your portfolio.

- Market Guides: Look for market guides that can give you an overview of different investment options and how they may fit into your portfolio.

- Investment Books: There are many investment books available that can provide valuable insights and strategies for building a balanced portfolio.

- Investment Websites: Explore investment websites to stay up to date with market trends and find additional resources to help you make informed decisions.

- Stock Market News: Follow financial news sources like The Wall Street Journal or CNBC to stay informed about current economic trends and events that may impact your investments.

Remember, investing comes with risk, so it’s important to have a good understanding of the investments you’re considering and the potential risks involved. Diversification can help reduce risk by spreading your investments across different asset classes, sectors, and geographic locations. Ultimately, the key is to find the right balance between risk and potential return that aligns with your financial goals and risk tolerance.

Keep in mind that everyone’s investment needs and goals are unique, so it’s essential to tailor your portfolio to your specific situation. If you’re unsure about how to invest or which investments are best for you, consult a financial advisor who can provide personalized guidance based on your individual circumstances.