If you’re a little tired of the nine-to-five grind, looking for an avenue outside of your regular job to generate income may be the ideal solution for you. One option worth exploring is building a rental portfolio through real estate investing. By following the tips and advice laid out in this article, you can better understand how to navigate the real estate market, build your own rental portfolio, and potentially create a lucrative source of income.

One of the most important aspects of building a rental portfolio is finding the right properties to invest in. It’s essential to conduct thorough research and have a deep understanding of the neighborhoods you are considering. Look for areas with increasing property values, which will not only generate higher rental rates but also potentially provide long-term benefits. Additionally, having a clear understanding of your own financial capabilities and limitations is crucial when it comes to building a rental portfolio.

Owning multiple properties as a rental investor means having to deal with the expenses and management of each property. This is where professional property management can be a huge help. By incorporating a property management company into your business, you can offload many of the day-to-day tasks and ensure that your properties are being efficiently managed. While it may come at a cost, the benefits and potential for success far outweigh the expenses.

BUILDING A RENTAL PORTFOLIO: TIPS AND TRICKS FOR INVESTING IN RENTAL PROPERTIES

Building a rental portfolio refers to the process of acquiring and managing multiple rental properties as a means of generating a potentially lucrative stream of rental income. This can be a great option for those who want to invest in real estate but do not want to deal with the hassles of owning and managing a single property. By building a rental portfolio, you can spread the risk across multiple properties and potentially increase your profits.

Before diving into the rental property market, it is important to understand the tips and tricks that can help you build a successful rental portfolio. In this blog post, we will provide some insights and advice to help you get started.

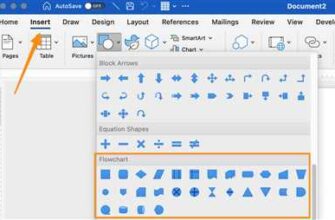

1. Plan your approach: Before investing in rental properties, it is crucial to have a well-defined plan. Understand the market conditions, research the neighborhoods, and analyze the potential rental rates. This will help you make informed decisions and set realistic goals for your portfolio.

2. Receive professional advice: The rental property market can be complex, especially for those who are new to the field. Consider seeking advice from a professional, such as a real estate agent or a property management company, to gain insights into market trends and rental property management activities.

3. Find the right properties: Look for properties that have the potential for high rental rates and appreciation. Consider neighborhoods where rental demand is high, and properties are in limited supply. This will help you build a competitive rental portfolio that can generate higher-rate returns.

4. Consider financing options: Owning multiple rental properties can be expensive, so explore different financing options to fund your portfolio. This may include securing a higher-rate mortgage or seeking partnerships with other investors.

5. Manage your expenses: Having a rental portfolio means dealing with various expenses, such as maintenance, repairs, and property management fees. Make sure to budget for these expenses and ensure that the rental income generated can cover them.

6. Follow tenant screening procedures: Tenant selection is crucial for a successful rental portfolio. Implement a thorough screening process to find reliable tenants who will pay on time and take care of your properties. This can help reduce the risk of rental income loss and property damage.

Building a rental portfolio requires careful planning, research, and informed decision-making. By following these tips and tricks, you can start on the path to building a successful and profitable rental portfolio today.

| Tips for Building a Rental Portfolio: |

|---|

| – Plan your approach |

| – Receive professional advice |

| – Find the right properties |

| – Consider financing options |

| – Manage your expenses |

| – Follow tenant screening procedures |

Is it better to build a property portfolio in a limited company

When it comes to building a property portfolio, many investors often wonder whether it is better to do so in a limited company or as an individual. There are various factors to consider when making this decision, and it is important to understand the advantages and disadvantages of each option.

One of the main benefits of incorporating a limited company for property investment is the tax advantages it offers. Expenses related to the rental activities, such as mortgage interest payments, property management fees, and repairs, can be tax-deductible when held under a limited company. This can result in significant tax savings, especially for higher-rate taxpayers.

Moreover, rental income generated through a limited company can be exempt from certain taxes, such as the higher rate of income tax. This can provide additional financial benefits to property investors.

In addition to tax benefits, another advantage of incorporating a limited company is the ability to cover multiple properties under one entity. This can simplify the management and financing of the portfolio, as all properties are owned by the company rather than individuals. Furthermore, if the company needs to sell a property, it can do so more easily without affecting the ownership of other properties in the portfolio.

However, it is important to note that incorporating a limited company for property investment also comes with certain disadvantages. For instance, the costs associated with setting up and running a company can be higher compared to investing as an individual. There may also be additional administrative tasks and regulations to comply with.

Funding can also be more challenging for limited companies, as lenders may have stricter criteria for company mortgages compared to individual mortgages. Moreover, some lenders may require personal guarantees from the directors or shareholders of the company.

Ultimately, whether it is better to build a property portfolio in a limited company or as an individual depends on various factors, including the investor’s goals, financial situation, and expertise in property management. It is important to conduct thorough research, seek expert advice, and consider the long-term implications before making a decision.

Many successful property investors have incorporated limited companies for their rental activities, while others have found success as individual property owners. The choice depends on individual circumstances and preferences. Before making any decision, it is crucial to understand the benefits and challenges of each option and choose what aligns best with one’s goals and aspirations in the field of real estate investment.

Benefits of Having a Rental Property Portfolio

Owning rental properties can be a great way to build wealth and generate passive income. However, investing in just one property may not provide the maximum benefits that come with building a rental property portfolio. In this blog post, we will explore the advantages of having a rental property portfolio and provide tips on how to build one.

One of the most significant benefits of having a rental property portfolio is the potential for higher returns. By owning multiple properties, investors can spread their risk and increase their rental income. Additionally, having a portfolio allows landlords to take advantage of economies of scale, meaning that expenses such as maintenance and property management can be more cost-effective when spread across multiple properties.

Building a rental property portfolio also provides investors with access to a diverse range of properties in different neighborhoods. This diversity helps to mitigate risk by ensuring that potential issues with one property, such as vacancy or market downturns, do not have a significant impact on the overall portfolio.

Furthermore, having a rental property portfolio can give investors a competitive edge in the rental market. With multiple properties, landlords can cater to a broader range of tenants and offer more options in terms of location, size, and amenities. This flexibility can attract higher-quality tenants and allow landlords to command higher rental rates.

Another benefit of owning a rental property portfolio is the potential for capital appreciation. Over time, properties in well-chosen neighborhoods may increase in value, allowing investors to sell them for a profit if desired. This can provide a substantial return on investment for landlords who are in the rental market for the long haul.

Success in the rental property field often requires extensive planning and informed decision-making. Building a rental property portfolio is no exception. It is essential to do thorough research, seek professional advice, and ensure that the numbers add up correctly. This includes determining the correct amount of funding required, planning for potential expenses, and finding the right mortgage and private financing options.

Finally, having a rental property portfolio offers landlords the flexibility to choose their level of involvement and management style. Some investors prefer to take a more hands-on approach, while others outsource property management to professionals. Regardless of the chosen management style, having a portfolio can provide a stream of passive income and potentially free up time for other activities.

In conclusion, owning a rental property portfolio brings many benefits to investors, including higher returns, diversification, access to a competitive rental market, potential capital appreciation, and flexibility. However, it is essential to approach portfolio building correctly, through thorough research, planning, and professional advice. By doing so, landlords can maximize their chances of success in the rental property market.

Want more expert property advice

One popular option for rental property ownership is to form a business and hold the properties through that entity. This can provide some special benefits, such as potentially lower tax rates and the ability to claim certain expenses as tax-deductible. However, it can also be more challenging to manage rental properties within a business, as there are additional legal and administrative requirements.

In April 2020, the UK government introduced stricter regulations for landlords, making it even more important to understand the activities and responsibilities involved in rental property ownership. Landlords now have to consider the safety and well-being of their tenants, as well as the risk of potentially higher-rate mortgages and increasing expenses.

For those who are willing to put in the work and take on the challenges, rental property investment can be a lucrative business. However, it’s important to know that it’s not simply a matter of buying properties and waiting for the rent to stream in. It requires careful planning, understanding of the market, and knowledge of the tricks of the trade.

Having a long-term strategy is crucial, as rental property investment is not a get-rich-quick scheme. It takes time and effort to build a portfolio that will generate a stable and consistent income stream. This is where expert property advice can be invaluable.

There are many real estate professionals and investors who are willing to share their knowledge and provide tips on how to build a successful rental portfolio. These experts can give you insights into the best areas to invest in, how to negotiate favorable mortgage rates, and how to deal with common challenges that landlords face.

By tapping into their expertise, you can avoid common pitfalls and maximize your chances of success in the rental property market. Whether you’re a novice investor or an experienced landlord looking to expand your portfolio, seeking advice from experts can significantly improve your outcomes.

So, if you want to become a better landlord and increase the profitability of your rental properties, don’t hesitate to reach out to those who have the knowledge and experience in this field. They can provide you with the guidance and support you need to make informed decisions and build a thriving rental portfolio.

Sources

When it comes to building a rental portfolio, there are various sources you can utilize to find suitable properties. Understanding the market and staying informed will be key to success in this competitive field.

One of the most popular sources is through real estate agents. They have access to multiple listings and can provide valuable advice and insights on properties that may be available for investment. Additionally, they can help you understand the risks and potential profits associated with different properties.

Another source is through online platforms and property management companies. These platforms allow you to search for properties that meet your investment criteria, often providing detailed information and analytics to help you make informed decisions. Property management companies can also assist with the day-to-day activities of owning rental properties, such as finding tenants and handling maintenance.

Outside of traditional methods, you could also consider investing in real estate investment trusts (REITs) or crowdfunding platforms. These means of investing in property allow you to receive income from rental properties without directly owning and managing them. However, it is important to research and understand the risks associated with these investments.

Furthermore, tax-deductible expenses can be utilized to increase your profits. By keeping track of expenses such as repairs, maintenance, and property management fees, you can generate tax deductions that will effectively reduce your taxable income. Consult a professional accountant or tax advisor to understand how to best incorporate these deductions into your rental portfolio.

Lastly, attending property auctions or searching for off-market deals can be a great way to find properties at lower prices. These auctions are often held by banks or government organizations and can offer opportunities to purchase properties at a discount. However, it is important to thoroughly research the property and understand the potential risks before participating in such auctions.

In conclusion, building a rental portfolio requires time, research, and a deep understanding of the market. By utilizing various sources such as real estate agents, online platforms, property management companies, and alternative investment methods, you can find suitable properties and increase your chances of success in the rental market.