Are you looking for a way to manage your finances more effectively? Creating a budget sheet can help you take control of your expenses and plan for the future. Whether you’re a business owner, a freelancer, or simply want to track your personal finances, this article will provide you with a step-by-step guide on how to create a budget sheet that fits your needs.

Step 1: Research and Find the Right Tools

The first step in making a budget sheet is to find the right tools and resources to help you along the way. There are many free budgeting templates available online, such as those from Google Spreadsheets or NerdWallet, which can be a great starting point. Do some research and download a template that suits your preferences and financial goals.

Step 2: Open the Template and Assign Categories

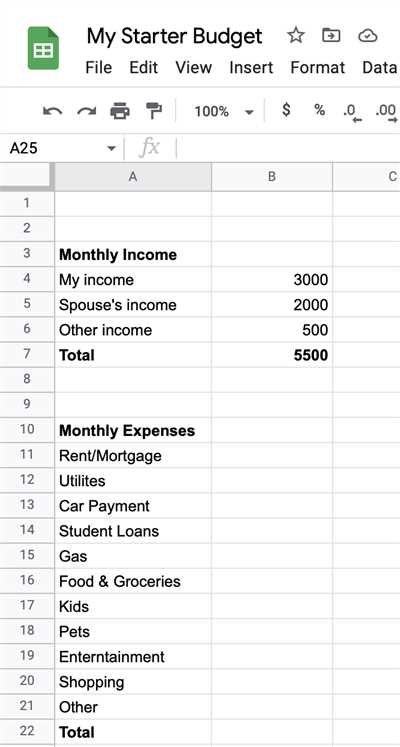

Once you have found an appropriate budgeting template, open it in a spreadsheet program like Excel or Google Sheets. The template will already have some pre-set categories, but you can customize them to fit your needs. Assign categories for your expenses, such as rent, groceries, transportation, entertainment, and so on.

Step 3: Enter your Income and Expenses

Next, enter your monthly income and expenses into the appropriate sections of the budget sheet. Be sure to include every expense, no matter how small. This will give you a comprehensive view of where your money is going. Remember to be honest and accurate when entering your expenses to get a clear picture of your financial situation.

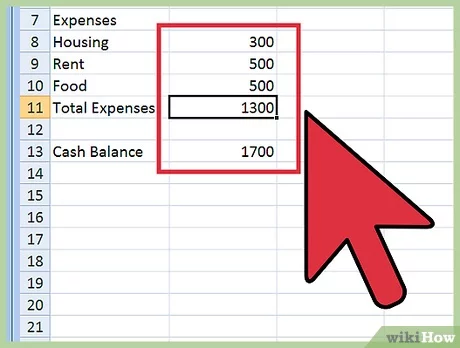

Step 4: Let the Spreadsheet Do the Math

One of the great advantages of using a budget sheet is that it can automatically calculate the totals for you. As you enter the amounts, the spreadsheet will do the math and give you a summary of your income, expenses, and the difference between the two. This will help you see how much money you have left at the end of the month or if you’re overspending.

Step 5: Review and Adjust

Once you have filled out all the necessary information, take some time to review your budget sheet. Analyze your expenses and income to see if there are any areas where you can cut back or save more. Use this information to adjust your budget and make necessary changes to meet your financial goals.

In conclusion, creating a budget sheet is an essential step in taking control of your finances. By following the steps outlined in this article, you will be able to create your own budget sheet and gain a better understanding of your financial situation. Don’t let your expenses go unaccounted for – start budgeting today and pave the way to financial success.

- 5 Free Budgeting Templates Excel Spreadsheets

- Step 2 Enter your income in your budget template

- To the Budget Template and Beyond

- Did you find this article helpful? Share it!

- Step 3: Use a Template or Create Your Own Spreadsheet

- FAQs about budget templates for Google Sheets

- What is a budget plan

- Is there a budget template in Google Sheets?

- How do I make a budget spreadsheet

- Videos:

- ACCOUNTANT EXPLAINS: Money Habits Keeping You Poor

5 Free Budgeting Templates Excel Spreadsheets

If you’re looking to create a budget or a financial plan, using a budgeting template in Excel can be a great help. Budgeting templates are pre-designed spreadsheets that can help you track your income and expenses, and plan for your financial needs. Below, I have researched and found five free budgeting templates Excel spreadsheets that you may find helpful.

- EveryDollar: This budgeting template is created by Dave Ramsey’s team and is designed to help you assign every dollar of your income to a specific category. You can enter your monthly income and expenses, and the template will automatically calculate how much you have spent and how much you have left to budget.

- NerdWallet’s Budgeting Spreadsheet: NerdWallet’s budgeting template is an example of a comprehensive and customizable budgeting tool. It allows you to enter your income, expenses, and savings goals, and provides a clear visual representation of your financial situation.

- Google Sheets Budget Planner: If you prefer using Google Sheets, this budgeting template is a great option. It is easy to use and allows you to track your income and expenses in a simple and organized manner. You can also customize the template to match your own financial goals and needs.

- The 50/30/20 Budgeting Spreadsheet: This budgeting template follows the popular 50/30/20 rule, which suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings. This template can help you better understand how much you should be spending on different categories and make adjustments accordingly.

- Personal Budget Spreadsheet from Vertex42: This budgeting template is a simple yet effective tool. It allows you to enter your income, expenses, and savings goals, and provides a clear visual representation of your financial situation. The template also includes a helpful FAQ section to assist you in using the spreadsheet effectively.

Using budgeting templates in Excel can save you time and effort in creating your own budget from scratch. These free templates provide a solid foundation for tracking your finances and can be customized to meet your specific needs. Whether you’re a freelancer in California or a writer for newspapers, having a budgeting tool can help you better manage your money and plan for the future.

Step 2 Enter your income in your budget template

Once you have identified your expenses, it’s time to enter your income into your budget template. Your income is the money you earn, whether it’s through a job, freelance work, or any other source.

Before you start entering your income, it’s important to do some research and gather all the necessary information. Find out how much money you earn every month and whether it’s a fixed or variable amount. For example, if you have a regular job, you might have a fixed income. But if you’re a freelancer, your income might vary from month to month.

Below is an example of what your budget template might look like:

Income

- Job 1: $2,000

- Job 2: $1,500

- Freelance work: $800

- Other: $200

Of course, your budget template will be different based on your specific income sources and their amounts. You can copy the above example and customize it according to your needs. There are also many budgeting tools available, such as EveryDollar or Google Sheets, which provide pre-made templates to help you with your budgeting process.

It’s important to enter the appropriate income amount for each source in your budget template. Make sure to follow the steps provided by the template and enter the information accurately. If you’re not sure about a certain income source or how to categorize it, do some research or consult a financial planner to help you.

Once you’ve entered your income, you can move on to the next step of your budgeting process. In the following article, we’ll go beyond the income and explore how to track your expenses and create a spending plan.

To the Budget Template and Beyond

Creating a budget is an essential step in managing your finances. With the help of a budget spreadsheet template, you can easily track your income and expenses, making it easier to stay on top of your financial goals and make informed decisions about your spending.

There are many free budget spreadsheet templates available online, but how do you choose the right one for your needs? It’s important to consider the amount of detail you want to track and whether you prefer an Excel spreadsheet or a Google Sheets template.

If you’re new to budgeting, a simple template with predefined categories may be a good starting point. However, if you have more complex financial needs, such as tracking multiple income sources or business expenses, you may need a more advanced template.

Once you find the appropriate budget template, you can open it in Excel or Google Sheets and enter your own income and expenses. The spreadsheet will automatically calculate your total income and expenses, as well as the amount you have left to save or spend each month.

But budgeting is not just about numbers. It’s important to set financial goals and create a plan to achieve them. For example, if you want to save for a vacation, enter the amount you need to save each month into your budget and track your progress.

Beyond the budget template, there are also helpful tools and resources available to assist you in managing your finances. Financial planning apps like EveryDollar can help you set goals and track your spending. Websites like NerdWallet offer articles and FAQs to help you better understand personal finance.

Remember, a budget is only as good as the effort you put into it. Take the time to research and download a template that fits your needs, and then follow the steps to create your own budget. If you’re not sure where to start, copy a budget template from a trusted source and modify it to fit your own circumstances.

Whether you’re a seasoned budgeter or just starting out, a budget template can be a great tool to help you take control of your finances. And with the right financial management tools and a little math, you can go beyond the budget template and achieve your financial goals.

So why wait? Begin your budgeting journey today and see how a budget template can help you on your path to financial success.

Did you find this article helpful? Share it!

If you found this article on budgeting helpful, why not share it with others who may also benefit from it? Budgeting is an essential aspect of personal finance, and learning how to create a budget sheet can greatly improve your financial well-being.

When it comes to managing your finances, finding the right tools and resources is key. Whether you’re a freelancer, a business owner, or simply trying to better manage your monthly expenses, a budget sheet can help you stay organized and in control of your money.

There are many budgeting tools available, from free spreadsheet templates like Excel to online platforms such as EveryDollar. With these resources, you can easily enter your income and expenses, track how much you’ve spent, and plan for your financial needs.

For example, NerdWallet writer Kathy Hinson recommends using Google Sheets or Excel to create your own budget sheet. She advises starting with your income, whether it’s from a steady job or freelance work, and then entering your expenses. It’s important to research and be realistic about the amount you spend on things like rent, bills, groceries, and even shopping.

Following three simple steps, you can create an appropriate budget for yourself: (1) research your income and expenses, (2) enter the data into a budget template, and (3) review and adjust your budget as needed. By doing so, you can gain a better understanding of where your money is going and make proactive financial decisions.

Copywriter Lauren Bundrick wrote a helpful article on the NerdWallet website, Beyond the 50/30/20 Budget: The Right Budgeting Strategies for You. In this article, she discusses different budgeting techniques that go beyond the traditional 50/30/20 rule, such as zero-based budgeting or the envelope system.

Whether you’re new to budgeting or have been using budget sheets for years, it’s always good to explore new methods and ideas. The NerdWallet website offers informative articles, FAQs, and even a budget planner tool to guide you on your financial journey.

So, if you found this article helpful, don’t hesitate to share it with your friends, family, or colleagues. Budgeting is an important skill to have, and by spreading the word, you can help others gain control of their finances as well.

Step 3: Use a Template or Create Your Own Spreadsheet

If you’re looking for a quick and easy solution, there are many free budget templates available online. You can simply do a Google search for “budget spreadsheet template” and find a variety of options to choose from. Some popular choices include EveryDollar, a free budgeting tool created by Dave Ramsey, and a monthly budget planner template from NerdWallet.

If you prefer to create your own spreadsheet, you can start with a blank Excel sheet or any other spreadsheet software. This allows you to customize the layout and formulas to better suit your specific needs. For example, if you’re a business owner, you may want to include additional columns for income and expenses related to your business.

Whether you choose to use a template or create your own spreadsheet, the next step is to enter your income and expenses. This is where the math comes in. You’ll need to enter the amount you earn each month, as well as how much you plan to spend on different categories such as groceries, shopping, and bills.

It’s important to be as accurate as possible when entering your expenses. To help with this, it can be helpful to look back at your bank statements or receipts from the past few months to see how much you typically spend in each category. This will give you a better idea of what to budget for in the future.

Once you’ve entered all your income and expenses, the spreadsheet will automatically calculate totals and give you a clear view of your monthly budget. You can then adjust your spending as needed to ensure you’re staying within your means.

To make it even easier, below is an example of a budget spreadsheet table:

| Category | Budgeted Amount | Actual Amount Spent |

|---|---|---|

| Groceries | $300 | $250 |

| Shopping | $200 | $150 |

| Bills | $500 | $450 |

| Total | $1,000 | $850 |

Feel free to customize this table to fit your own budgeting needs. Remember, budgeting is a personal finance experience, and what works for one person may not work for another.

By using a template or creating your own spreadsheet, you’ll have a better understanding of where your money is going and how much you can save. This will help you make better financial decisions and reach your goals faster.

FAQs about budget templates for Google Sheets

Q: What is a budget template?

A: A budget template is a pre-designed spreadsheet that helps you track your income and expenses. It provides a structured format for organizing your financial information and can be customized to fit your specific needs.

Q: How can a budget template help me?

A: A budget template can help you create a plan for your finances, track your expenses, and make better financial decisions. It provides a visual representation of your income and expenses, making it easier to see where your money is going and identify areas for improvement.

Q: How do I use a budget template in Google Sheets?

A: To use a budget template in Google Sheets, you can start by downloading a free template from sources like NerdWallet, Nerdbudget, or other trusted websites. Once you’ve downloaded the template, open it in Google Sheets and enter your income and expenses in the appropriate cells. The template will automatically calculate the total amount spent and the remaining balance.

Q: Are there any free budget templates available?

A: Yes, there are many free budget templates available for Google Sheets. You can find them by doing a quick search online or checking out websites that offer templates specifically designed for budgeting.

Q: Can a budget template help with my business finances?

A: Absolutely! Budget templates can be used for personal finances as well as business finances. You can customize the template to include specific categories for your business expenses and track your income and expenses accordingly.

Q: How often should I update my budget template?

A: It is recommended to update your budget template on a monthly basis. This will allow you to track your spending and adjust your budget as needed. However, you can choose to update it more frequently if you prefer.

Q: What if I don’t have any experience with budgeting?

A: Budget templates are designed to be user-friendly, even for those with no prior experience in budgeting. They provide a clear structure and instructions on how to enter your financial information. Additionally, there are plenty of online resources and articles available to help you learn more about budgeting and how to use a budget template effectively.

Q: Can I use Excel instead of Google Sheets?

A: Yes, you can use Excel instead of Google Sheets if you prefer. Many budget templates are available in both formats. Simply download the template in Excel format and open it in Microsoft Excel to start using it.

Q: How can I create my own budget template?

A: If you want to create your own budget template, you can start by identifying the categories you want to track (e.g., rent, groceries, transportation). Then, create columns to enter your income, expenses, and calculate the total amounts. You can also add additional features like graphs or conditional formatting to make your budget template more visually appealing and informative.

Q: Are budget templates only for personal finances?

A: No, budget templates can be used for both personal and business finances. They are flexible tools that can be customized to suit your specific needs and financial goals.

Q: Can I share my budget template with others?

A: Yes, you can share your budget template with others by providing them with access to the Google Sheets file. This can be helpful if you need someone else to review or collaborate on your budget.

Q: How do I trust the budget templates available online?

A: When downloading budget templates from online sources, it’s important to do some research first. Look for templates from reputable websites or sources that you trust, such as financial institutions or well-known personal finance writers. Read reviews or comments from other users to get an idea of their experiences with the templates.

Q: What if the budget template doesn’t meet my specific needs?

A: If the budget template you’ve downloaded doesn’t meet your specific needs, you can customize it to better fit your requirements. Adding or deleting categories, adjusting formulas, or assigning budget amounts to different expense categories can help make the template more tailored to your individual goals and spending patterns.

What is a budget plan

A budget plan is a financial tool that helps you create a plan for how you will spend and allocate your income. It is a crucial step in managing your finances and ensuring that you are able to meet your financial goals. Whether you are a business owner or an individual, budgeting is an important practice that can help you better understand your financial situation and make informed decisions about your spending and saving.

Creating a budget plan involves three key steps:

- Assessing your income: Start by determining how much money you will have coming in each month. This may include your salary, freelance income, or any other sources of income. It’s important to have an accurate estimate of your income, as it will guide your budgeting decisions.

- Evaluating your expenses: Next, you’ll need to review your expenses and identify how much you spend on various categories such as housing, transportation, food, and entertainment. It’s helpful to gather your receipts, bills, and bank statements to get a clear picture of where your money is going. This step will help you identify areas where you can cut back and save.

- Assigning appropriate amounts: Once you have a clear understanding of your income and expenses, you can start assigning appropriate amounts to each category. This means deciding how much you want to allocate to necessities, savings, debt repayment, and discretionary spending. It’s important to remember that your budget should be realistic and flexible, allowing for unexpected expenses.

There are various tools and resources available to help you create a budget plan. For example, you can use spreadsheets such as Excel or Google Sheets to manually enter your income and expenses and track your budget. There are also budgeting apps and online platforms, such as EveryDollar, that automatically sync with your bank accounts and categorize your expenses for you.

Additionally, you can find free budget templates and examples online, which can serve as a starting point for creating your own budget plan. These templates often include pre-defined categories and formulas that will do the math for you.

Creating a budget plan may seem intimidating at first, but with some research and guidance, it can become a helpful tool for managing your finances and achieving your financial goals. Don’t be afraid to seek help or advice from a financial planner or a trusted friend or family member who has experience with budgeting. Remember, budgeting is a skill that improves with practice, so keep at it and you’ll see positive changes in your financial health.

Is there a budget template in Google Sheets?

If you’re looking for an easy and convenient way to create a budget, Google Sheets offers a variety of budget templates that you can use. Whether you’re new to budgeting or just want to make your budgeting process more efficient, these templates can help you get started.

With a budget template in Google Sheets, you can make better use of your hard-earned money by tracking your income and expenses. By entering your monthly income and assigning amounts to different expense categories, you can create a comprehensive plan for managing your finances.

Here are the steps to open and use a budget template in Google Sheets:

- Open Google Sheets.

- Go to the “Template Gallery” by clicking on the “Template Gallery” button on the top right of the homepage.

- Search for “budget” in the search bar.

- Explore the different budget templates available. You can preview each template to find the one that best suits your needs.

- Once you’ve found a template you like, click on it to open a copy.

- You can then edit the template to fit your specific income and expenses. You can add or remove categories, change the amounts, and personalize it to your liking.

- As you enter your income and expenses, the template will automatically calculate the totals and provide you with a clear view of where your money is being spent.

These budget templates in Google Sheets can help you in more ways than one. They provide you with a great starting point, but you can go beyond that. If you have some experience with spreadsheets or are willing to do a little research, you can customize the template to suit your specific needs.

If you’re a freelancer or have a small business, there are also budget templates available that can help you manage your business finances. These templates are designed to help you keep track of your income, expenses, and profits.

To find budget templates in Google Sheets, you can trust reputable sources like NerdWallet, which provides a variety of free templates for different financial needs. The following are some commonly asked questions about budgeting in Google Sheets:

- How do I create a budget in Google Sheets?

- What tools can help me with budgeting in Google Sheets?

- Is there a budget template in Google Sheets that I can use for my shopping expenses?

- Can I download a budget template in Google Sheets and use it in Excel?

By following the steps and using the appropriate budget template, you can create your own budget in Google Sheets and take control of your finances. Budgeting doesn’t have to be a complicated math exercise – with the right tools and a little experience, you can make it easier and more effective.

So, if you’re looking for a budget template to help you track your income and expenses, consider checking out the budget templates in Google Sheets. They can provide you with a reliable and customizable way to manage your finances.

Remember, a budget is your financial planner that can help you make better decisions about your money. Start budgeting today and take charge of your financial future!

How do I make a budget spreadsheet

Creating a budget spreadsheet can be a great way to take control of your finances and plan for your financial needs. Whether you’re a freelance writer or a business owner, making a budget spreadsheet can help you track your income, expenses, and savings goals. Here are some steps to help you create your own budget spreadsheet:

Step 1: Do your research

Before you start creating your budget spreadsheet, it’s important to gather all the necessary information about your income and expenses. Take a look at your bank statements, receipts, or other financial documents to gather accurate data.

Step 2: Find the right tool

There are several tools available to create a budget spreadsheet, including Microsoft Excel, Google Sheets, or free budgeting templates that you can download from websites. Choose the tool that you are most comfortable with and that meets your needs.

Step 3: Open a new spreadsheet

Open the chosen spreadsheet software and start a new sheet to begin creating your budget spreadsheet. Assign column headings for income, expenses, and any other categories you may need.

Step 4: Enter your income and expenses

Enter your monthly income in the appropriate column and amount earned for each income source. Then, enter your monthly expenses and the amount spent for each expense category. This will help you track your total income and expenses.

Step 5: Use math formulas

To make your budget spreadsheet more helpful, you can use math formulas to automatically calculate totals or perform calculations. For example, you can use formulas to find the sum of your expenses or to calculate the difference between your income and expenses.

Step 6: Plan for the future

Beyond just tracking your past expenses, a budget spreadsheet can also help you plan for the future. Use the tools available in your chosen spreadsheet software to create charts or graphs that visualize your financial data. This can help you identify trends, set savings goals, and make better financial decisions.

By following these steps, you can create your own budget spreadsheet and take control of your finances. Remember to regularly update and review your budget to ensure it aligns with your current needs and financial goals.

Copy of some useful resources:

1. Kathy Hinson’s article on budgeting:

2. Free budget templates from Bundrick Finance:

3. Google Sheets budget template:

Feel free to share this article with anyone who can benefit from it!