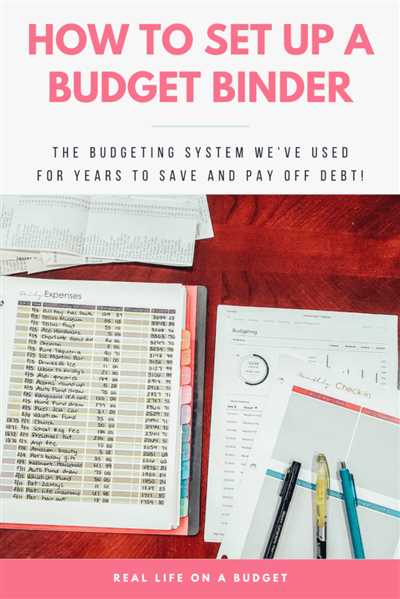

Creating a budgeting system is essential for anyone who wants to take control of their money and improve their financial situation. A budget binder is a great tool to help you with this goal. By seeing your monthly income and expenses on paper, you can gain a better understanding of where your money goes and make informed decisions about how to allocate it.

When it comes to budgeting, one of the first things you need to do is to know your financial details. This includes knowing your income, expenses, debts, and any loans or credit card balances you may have. Writing down these details in your budget binder can help you visualize the numbers and create a plan to tackle them.

Having a budget binder can also be especially helpful when your income or expenses change. As life gets busy, it’s easy to lose track of where your money is going. However, with a budget binder, you can easily track your spending and adjust your budget accordingly. This can help you feel more in control of your finances and avoid any surprises at the end of the month.

In addition to tracking your income and expenses, a budget binder can also help you set financial goals and plan for the future. By including sections for savings, investments, and any financial aspirations, you can stay focused and motivated to reach your goals. This can be particularly helpful when dealing with large purchases or trying to pay off debts.

Nowadays, with many digital tools available for budgeting, you might wonder why you need a physical budget binder. The truth is, using a physical binder can help you stay more organized and focused on your financial goals. Unlike digital apps or spreadsheets, a budget binder allows you to have all your financial information in one place, easily accessible whenever you need it. You can even customize your binder with dividers and labels to make it even more user-friendly.

In conclusion, if you want to take control of your finances and create a budgeting system that works for you, a budget binder is a great tool to have. It can help you track your income and expenses, set financial goals, and stay organized. Whether you prefer a digital approach or a more traditional one, a budget binder can be the solution to your budgeting problem. So why wait? Start creating your own budget binder today and take the first step toward financial success.

- How to Use a Budget Binder to Manage Your Money

- 1. Set Up Your Budget Binder

- 2. Write Down Your Monthly Budget

- 3. Track Your Expenses

- 4. Set Financial Goals

- 5. Wholesale/Drop Card Tracking

- Create a Budget Binder

- How do you use a budget binder

- Product details

- Video:

- SAVINGS BINDER TUTORIAL | CRICUT VINYL CUTTING | 1K SAVINGS CHALLENGE | CASH STUFFING

How to Use a Budget Binder to Manage Your Money

Creating a budget binder can be a game-changer for your finances. It provides you with a centralized system to track your income and expenses, helping you stay organized and in control of your money. Here are some steps to help you effectively use a budget binder:

1. Set Up Your Budget Binder

The first step is to gather all the necessary materials for your budget binder. You will need a sturdy binder, dividers, paper, a hole puncher, and writing utensils. Organize your binder by section, such as income, expenses, debts, and savings.

2. Write Down Your Monthly Budget

Start by creating a monthly budget. Write down your total income and list all your expenses, including bills, loans, and other payments. Be thorough and include even the smallest expenses.

When creating your budget, be realistic. If you set unrealistic goals, you may feel discouraged when you can’t meet them. Your budget should be flexible and adaptable to any changes that may arise.

3. Track Your Expenses

Tracking your expenses is crucial for staying within your budget. Whenever you spend money, write down the details in your budget binder. Include the date, amount spent, and what the purchase was for. This will help you see where your money is going and identify any problem areas.

If you prefer a digital system, you can use budgeting apps or spreadsheets to track your expenses. Just make sure to transfer the information to your budget binder regularly, so you have a physical record of your spending habits.

4. Set Financial Goals

In addition to tracking your expenses, use your budget binder to set financial goals. Whether it’s paying off debts, saving for a down payment, or going on a vacation, having clear goals will help you stay motivated and focused.

Include a section in your budget binder where you can write down your goals. Break them down into smaller, achievable milestones, and track your progress toward them. Seeing your progress can be incredibly rewarding and keep you motivated to stick to your budget.

5. Wholesale/Drop Card Tracking

If you are involved in wholesaledrop or have wholesale/drop cards, you can use your budget binder to keep track of your inventory, sales, and expenses related to this business. It’s essential to separate your business finances from personal finances, especially when it comes to taxes and deductions.

Write down the details of your wholesale/drop transactions in a separate section of your budget binder. Keep track of your income, expenses, and any product changes or returns. This will help you have a clear overview of your business finances and identify any areas that need improvement.

A budget binder is a powerful tool that can help you take control of your money and work towards your financial goals. By using it regularly and keeping accurate records, you can make informed decisions about your spending and saving habits. Remember, consistency is key in budgeting, so make it a habit to update your budget binder regularly.

Create a Budget Binder

When it comes to managing your money, having a system in place can help you stay on track and avoid financial problems. One useful tool is a budget binder, which allows you to track and manage your income, expenses, and debts.

The first step is to gather all the materials you need. You can use a simple three-ring binder or a digital system if you prefer. The choice is yours, but make sure it’s something you will be comfortable using consistently.

Next, write down all the details of your finances on paper or in a digital format. This includes your monthly income, expenses, debts, and any financial goals you have. Be as specific as possible, as this will help you create a realistic budget.

Include sections in your budget binder for tracking your income, such as pay stubs or bank statements. This will help you see how much money you have coming in each month. Also, create sections for tracking your expenses, such as bills, groceries, and entertainment. This will give you a clear picture of where your money is going.

Use dividers or tabs to separate different categories in your budget binder. This will make it easier to find and update information as needed. For example, you might have sections for “Housing,” “Transportation,” “Debts,” and “Savings.”

When it comes to budgeting, it’s important to create a plan that works for you. If you have a lot of debts, prioritize paying them off by allocating more money toward those payments. If you’re having trouble tracking your spending, consider using a budgeting app or software to help with this process.

Remember, your budget is not set in stone – it’s a flexible tool that you can adjust as needed. If you find that your income or expenses change, don’t be afraid to make changes to your budget. The goal is to find a system that works for you and helps you achieve your financial goals.

Finally, celebrating small wins along the way can help you stay motivated. For example, if you paid off a credit card or reached a savings milestone, give yourself a pat on the back. Knowing that you’re making progress toward your financial goals can be a great motivator to keep going.

In conclusion, creating a budget binder can help you manage your money and work toward financial freedom. Whether you choose a digital or physical system, the important thing is to have a tool that helps you track your income, expenses, and debts. With careful planning and consistent use, you’ll be well on your way to achieving your financial goals.

How do you use a budget binder

A budget binder is a detailed system that helps you manage your money and keep track of your expenses. When it comes to budgeting, especially if you have debts or credit card problems, you need a system in place to help you stay on track and make positive changes. A budget binder is a great tool for this purpose.

First, you need to create a budget. Write down all your income and expenses, including loans and any other debts you have. This will give you a clear idea of how much money you have coming in and where it goes. You can use a digital spreadsheet or a printable budget worksheet to do this.

Next, you’ll want to organize your binder. Create dividers for different sections, such as income, bills, savings, and debt. This will help you find the information you need quickly and easily.

One important aspect of using a budget binder is tracking your expenses. Every time you make a purchase, write down the details in your binder. Include the date, amount, and what you bought. This will help you see where your money is going and identify areas where you can cut back.

Another useful aspect of a budget binder is setting goals. Write down your financial goals and keep them in your binder. This will help you stay focused and motivated as you work toward achieving them.

As your financial situation changes, be sure to update your budget binder accordingly. If your income increases or decreases, adjust your budget to reflect that. If you have a major life event, such as getting married or having a baby, you may need to make additional changes to your budget.

Using a budget binder can help you stay organized and in control of your finances. It provides a clear system for tracking your expenses and managing your money. It can also be a great visual reminder of your goals and progress toward them. If you’re struggling with budgeting or managing your finances, a budget binder may be just what you need.

Product details

When it comes to budgeting, having a system in place can make all the difference. That’s where a budget binder comes in. It’s a tool that helps you track your income, debts, and expenses in one place, providing you with the details you need to know about your financial situation.

With a budget binder, you can create a monthly budget and see how your money is being spent. It helps you prioritize your expenses and make changes when needed, especially if you have debts or loans to pay off. By keeping all your financial information in one place, you can better manage your money and work towards your financial goals.

One of the advantages of using a budget binder is that it is a tangible resource, which can be especially helpful if you prefer to write things down or have a visual aid. It allows you to physically see your budget, which can help you stay focused and motivated to stick to it.

A budget binder typically includes sections to track your income, expenses, savings, debts, and financial goals. It can also include sections for tracking your credit card spending, especially if it’s a problem area for you. By tracking your expenses, you can identify areas where you may be overspending and make adjustments accordingly.

Another benefit of a budget binder is that it can help you feel more organized and in control of your finances. It eliminates the need to constantly search for important financial documents or wonder where your money goes each month. With a system in place, you can easily find the information you need and make informed financial decisions.

While there are digital tools and apps available for budgeting, a budget binder offers a more hands-on approach. It allows you to physically interact with your budget and gives you a sense of accomplishment as you see your progress. Plus, it doesn’t require an internet connection, so you can use it anytime, anywhere.

In summary, a budget binder is a valuable tool for anyone looking to improve their financial situation. It provides you with the details you need to know about your income, expenses, and debts, helping you create a budget and track your progress towards your financial goals. Whether you prefer a digital system or a tangible binder, having a budgeting system in place can help you better manage your money and work towards a more secure financial future.