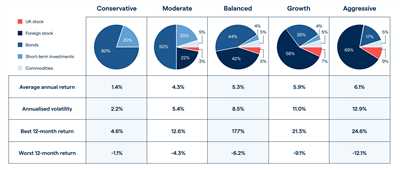

Building a well-diversified portfolio is key to long-term investment success. The correlation between different asset classes such as stocks, bonds, and real estate can greatly affect the overall performance of your investments. By investing in a mix of assets, you can reduce risk and potentially earn higher returns over time.

When determining how to diversify your portfolio, it’s important to consider your own needs and risk tolerance. Some investors may be more comfortable with a conservative portfolio that focuses on income generation and capital preservation, while others may be willing to take on more risk in exchange for potentially higher returns.

One of the most frequently recommended strategies for diversification is to invest in different sectors. By spreading your investments across sectors, you can protect yourself from the fluctuations in any one sector. For example, if the tech sector experiences a downturn, your portfolio may still be on track if you have investments in other sectors such as healthcare or consumer goods.

Another important aspect of diversification is spreading your investments across different asset classes. This includes stocks, bonds, real estate, commodities, and more. Each asset class has its own level of volatility and expected performance, so having a mix can help balance your portfolio and reduce risk.

Regularly rebalancing your portfolio is also crucial to maintaining diversification. Over time, some investments may outperform others, causing your portfolio to become imbalanced. By rebalancing, you can sell some of the outperforming assets and buy more of the underperforming ones, bringing your portfolio back into line with your target allocation.

In 2022, diversification is expected to fall under increased scrutiny as investors look for ways to protect their portfolios from potential market events. With the basics of asset management and diversification in mind, consider the following FAQs:

- How do you determine the right asset allocation for your portfolio?

- What are the different strategies for diversification?

- What are the most important asset classes to consider?

- How frequently should you rebalance your portfolio?

- What are the risks and benefits of investing in high-yield bonds?

- How can diversification help track the performance of your investments?

- Are there any sector or market-specific events to watch out for in 2022?

By answering these questions and taking into account the unique needs and risk tolerance of each investor, diversifying your portfolio can help you navigate the ups and downs of the market, and increase the likelihood of meeting your financial goals.

- Why It’s Important to Diversify Your Investing Portfolio

- The basics

- 7 strategies to diversify your portfolio

- 1 Determine correlation

- 2 Diversify across asset classes

- 3 Diversity within asset classes

- 4 Diversify by location

- 5 Explore alternative investments

- 6 Rebalance your portfolio regularly

- 7 Consider your risk tolerance

- Frequently asked questions FAQs

- Can you over-diversify a portfolio

Why It’s Important to Diversify Your Investing Portfolio

Diversifying your investment portfolio is crucial to managing risk and maximizing returns. When you invest in various assets and markets, you reduce the likelihood of experiencing significant losses in a single investment or market downturn. By spreading your investments across different assets and classes, you can protect yourself from unforeseen events and market volatility.

One of the main reasons why diversification is important is that it helps you build a portfolio that aligns with your investment goals and risk tolerance. Different investments perform differently in different market conditions, and by diversifying, you can increase the chances of achieving your desired outcomes. For example, if you’re investing for the long term and want steady growth, you might choose to include a mix of equities, bonds, and real estate holdings within your portfolio. Each asset class has its own unique risk and return characteristics, so having a diversified portfolio can help you achieve a balance that meets your financial needs.

Another reason why diversification is crucial is that it helps you manage risk within your portfolio. Investment portfolios that are too heavily weighted in a single asset or market are more susceptible to significant losses if that asset or market underperforms. By diversifying, you can spread your risk across different assets and classes, reducing the impact of any single investment on your overall portfolio. For example, if you have a high-yield bond fund that makes up 25% of your portfolio and it experiences a significant decline, the impact on your overall portfolio would be less if you also have investments in equities, commodities, or other asset classes.

In addition to managing risk, diversification can also help you take advantage of opportunities across different markets and sectors. By investing in a range of assets, you can benefit from the performance of different markets and sectors that may be outperforming at any given time. This allows you to potentially achieve higher returns and beat market benchmarks. For example, if the technology sector is performing exceptionally well, having exposure to technology stocks within your diversified portfolio can help you capitalize on that trend.

Rebalancing your portfolio regularly is an important part of maintaining diversification. By reallocating your investments periodically, you can ensure that your portfolio remains aligned with your desired asset allocation and risk profile. For example, if one asset class has significantly outperformed others, you may need to sell some of those assets and invest in other areas to rebalance your portfolio.

| Frequently Asked Questions (FAQs) |

|---|

| 1. Why should I diversify my portfolio? |

| Investing in a diversified portfolio helps manage risk and increase the likelihood of achieving your financial goals. |

| 2. How do I diversify my investments? |

| Diversify your investments by spreading them across different asset classes, such as equities, bonds, real estate, and commodities. You can also diversify within asset classes by investing in different sectors and geographic locations. |

| 3. Is it possible to over-diversify? |

| While diversification is important, it is possible to over-diversify by spreading your investments too thin. It’s important to strike a balance and diversify appropriately based on your investment goals and risk tolerance. |

| 4. When should I rebalance my portfolio? |

| You should regularly review and rebalance your portfolio to ensure it remains in line with your desired asset allocation. This could be done annually or as needed based on market conditions. |

| 5. What are the risks of not diversifying my portfolio? |

| If you don’t diversify your portfolio, you’re at a higher risk of suffering significant losses if a particular investment or market underperforms. Diversification helps spread your risk and reduces the potential impact of any single investment on your overall portfolio. |

The basics

Diversification is an essential strategy for investors looking to manage risk and optimize returns in their portfolios. By spreading investments across different asset classes, sectors, and geographic locations, investors can reduce the volatility of their overall portfolio.

Here are 5 key basics to consider when creating a diversified portfolio:

- Asset allocation: Determine how much of your portfolio you want to allocate to different asset classes, such as stocks, bonds, and alternative investments. This decision will depend on your risk tolerance, time horizon, and investment goals.

- Diversify across sectors: Investing in a variety of sectors, such as technology, healthcare, and finance, can help balance out the performance of your portfolio and reduce the impact of any one sector’s underperformance.

- Invest internationally: Don’t limit yourself to just domestic investments. Investing in foreign markets can provide exposure to different economies and potentially enhance returns.

- Consider correlations: Consider the correlation between different investments when selecting assets for your portfolio. Assets that have a low or negative correlation can help diversify risk and smooth out investment returns.

- Regularly rebalance: Rebalancing involves periodically adjusting your portfolio back to its original target allocation. This ensures that your portfolio stays in line with your desired risk profile and investment objectives.

By following these basics, you can create a well-diversified portfolio that has the potential to deliver consistent returns while managing risk. Remember to regularly review your portfolio to ensure it aligns with your changing needs and goals.

Here are some frequently asked questions about portfolio diversification:

- What is diversification? Diversification is the strategy of spreading investments across different assets to reduce risk and optimize returns.

- Why is diversification important? Diversification helps reduce the impact of any one investment’s underperformance on your overall portfolio.

- How many investments should I have in my portfolio? There is no one-size-fits-all answer to this question. The number of investments in your portfolio will depend on your risk tolerance, investment goals, and time horizon.

- Can I diversify within a single asset class? Yes, you can diversify within a single asset class by investing in different sectors, industries, or types of assets.

- What are some alternative investments? Alternative investments include commodities, real estate, hedge funds, private equity, and more.

- How often should I rebalance my portfolio? The frequency of portfolio rebalancing depends on your individual needs and preferences. Some investors rebalance annually, while others do so more regularly.

Remember, diversification is not a guarantee against loss, and it does not ensure a profit. However, it is a prudent strategy to help manage risk and potentially enhance returns within your investment portfolio.

7 strategies to diversify your portfolio

Diversification is a crucial aspect of building and managing a successful investment portfolio. By spreading your investments across different asset classes, sectors, and regions, you can reduce the risk of losing all your money in a single investment. Here are 7 strategies you can implement to effectively diversify your portfolio:

| Strategy | Description |

|---|---|

| 1. Invest in multiple asset classes | Investing in different asset classes, such as stocks, bonds, and alternative investments, can help you spread the risk and take advantage of different market cycles. Additionally, having a mix of assets with varying levels of risk can generate a more stable flow of income. |

| 2. Diversify within asset classes | Even within a single asset class, like equities or bonds, there are different types and sectors to consider. By diversifying within asset classes, you reduce concentration risk and increase the potential for profit. For example, within equities, you can invest in tech stocks, healthcare stocks, and others. |

| 3. Consider international markets | Investing in foreign markets can provide opportunities for growth and diversification. Different countries may have different economic cycles, and investing globally can help buffer against any specific country’s economic downturn. |

| 4. Regularly rebalance your portfolio | Over time, the performance of different investments within your portfolio will vary, and your asset allocation may shift. Regularly rebalancing your portfolio ensures that you maintain the desired level of diversification and risk exposure. |

| 5. Avoid over-diversification | While diversification is important, it’s also crucial not to over-diversify. Investing in too many investments can dilute your returns and make it challenging to monitor and manage your portfolio effectively. |

| 6. Assess the risk and volatility | When choosing investments to diversify your portfolio, consider the risk and volatility associated with each asset. Some investments, such as high-yield bonds or tech stocks, may have higher volatility and carry more risk compared to others. Determine your risk tolerance and build your portfolio accordingly. |

| 7. Ask for help if needed | If you’re unsure about how to diversify your portfolio or what investments to choose, it’s always a good idea to seek guidance from a financial advisor. They can help you determine your investment needs and create a diversified portfolio that aligns with your goals. |

By following these strategies, you can create a well-diversified portfolio that is designed to weather market fluctuations and generate sustainable returns over time.

1 Determine correlation

When it comes to investing and building a diversified portfolio, one of the key factors to consider is correlation. Correlation refers to the relationship between the performance of different investments or asset classes. It helps to determine how they move in relation to each other.

By investing in assets that have a low correlation or even negative correlation, you can potentially reduce the risk of your investments falling in value all at the same time. For example, while equities within the same sector may be highly correlated with each other, investing in equities from different sectors can provide diversity and reduce the impact of any one sector falling.

It’s important to note that correlation is not the only metric to consider when diversifying your portfolio. Factors such as risk tolerance, investment goals, and time horizon should also be taken into account. However, understanding and appropriately managing correlation can help you build a well-diversified portfolio that aims to minimize risks and maximize potential returns.

There are several ways to determine correlation within your portfolio:

| Method | Description |

|---|---|

| 1. Compare asset performance | Track the performance of different investments within your portfolio over a given period of time. By comparing how each investment has performed, you can get a sense of their correlation. |

| 2. Use correlation tools | There are various online tools and software that can help you analyze and calculate the correlation between different assets. These tools can provide valuable insights to inform your investment decisions. |

| 3. Ask the experts | If you’re unsure about how to determine correlation or have questions about specific investment strategies, it’s always a good idea to consult with a financial advisor or investment professional for guidance. |

Once you have determined the correlation between your investments, you can make informed decisions on how to diversify your portfolio. The goal is to include a mix of assets that have low or negative correlation with each other, so that when one investment is underperforming, others may be able to offset the losses.

For example, if you have a portfolio that mainly consists of tech stocks, you could consider diversifying by adding bonds, commodities, or foreign equities. By including different asset classes with varying correlations, you can increase the diversity of your portfolio and potentially reduce the overall risks.

Remember that correlation is not a static metric and can change over time. It’s important to regularly review and rebalance your portfolio to ensure it remains diversified and aligned with your investment goals. By regularly monitoring and adjusting your portfolio’s correlation, you can maximize your chances of beating the market and achieving your financial objectives.

2 Diversify across asset classes

One of the most important aspects of creating a diversified portfolio is to invest your money across different asset classes. By diversifying across asset classes, you spread your investment risk and reduce the impact of any one investment on your overall portfolio performance.

Asset classes are categories of investments that exhibit similar characteristics and behavior. The main asset classes include equities (stocks), fixed income (bonds), and commodities (such as gold, oil, or agricultural products). Each asset class has its own risk and return profile, so by investing in a mix of asset classes, you can potentially achieve a more balanced portfolio that is better suited to your needs and risk tolerance.

When you diversify across asset classes, you want to consider a few key factors:

1. Correlation: It’s important to choose asset classes that have a low correlation with each other. This means that their prices tend to move independently of each other. For example, stocks and bonds often have a negative correlation, meaning that when stocks fall, bonds tend to rise. By diversifying between asset classes with low correlation, you can reduce the overall volatility of your portfolio.

2. Regularly rebalance: Over time, the performance of different asset classes can vary. To maintain your desired asset allocation, it’s important to regularly rebalance your portfolio. This involves selling assets that have performed well and buying assets that have underperformed, bringing your portfolio back to its original allocation.

3. Consider your time frame: The timeframe of your investment also plays a role in how you diversify your portfolio. For shorter timeframes, you may want to focus on more stable assets, such as bonds, to protect against market volatility. For longer timeframes, you may be more willing to take on higher-risk assets, such as equities, which have historically delivered higher returns over the long term.

By diversifying across asset classes, you can reduce the risk of any one investment or sector significantly impacting your portfolio. It’s also important to consider diversifying across different locations and currencies, including foreign assets, to further spread risk. However, be careful not to over-diversify, as this can dilute potential returns and complicate your portfolio management.

Overall, diversification is a fundamental principle of investing. By spreading your investments across different asset classes, you can potentially achieve a more balanced portfolio that is better suited to your needs and expected investment outcomes. Diversification helps to protect against events that may impact a specific asset class or sector, providing a more stable and predictable flow of returns over time.

FAQs:

Q: How many asset classes should I include in my portfolio?

A: There is no set number, as the appropriate number of asset classes depends on your individual needs and risk tolerance. However, a portfolio with at least 5-7 distinct asset classes is generally considered well-diversified.

Q: Are there any asset classes I should avoid?

A: Some investors may choose to exclude certain asset classes based on personal preferences or investment strategies. However, it’s generally recommended to have exposure to a wide range of assets to achieve a balanced and diversified portfolio.

Q: Is diversifying across asset classes enough to reduce risk?

A: Diversifying across asset classes is an effective way to reduce risk, but it does not eliminate it entirely. It’s important to regularly monitor and review your portfolio to ensure that it is appropriately diversified and aligned with your investment goals.

3 Diversity within asset classes

When it comes to creating a diversified investment portfolio, it’s not just about spreading your money across different asset classes. It’s also important to have diversity within each asset class.

Asset classes can include stocks, bonds, commodities, real estate, and more. Each asset class has its own risks and potential for returns. By diversifying within asset classes, you can spread your risk even more and potentially increase your chances of beating the market.

There are several ways to achieve diversity within asset classes. One way is to invest in different sectors within a specific asset class. For example, if you’re investing in stocks, you could invest in both tech stocks and foreign stocks. This way, if one sector is performing poorly, you may still have gains in another sector.

Another way to diversify within asset classes is to invest in different types of assets within a specific sector. For example, if you’re investing in the real estate sector, you could invest in both residential real estate and commercial real estate. This way, if one type of property is not performing well, you may still have income flowing in from the other type.

Correlation is also an important factor to consider when diversifying within asset classes. Correlation measures the relationship between two investments – the higher the correlation, the more likely they will move in the same direction. By investing in assets with low correlation, you can further reduce your risk and potentially improve your portfolio’s performance.

Rebalancing your portfolio regularly is key to maintaining diversity within asset classes. Over time, your investments may have different growth rates, causing your portfolio to become unbalanced. By rebalancing, you can ensure that your investments are still aligned with your risk tolerance and investment goals. Rebalancing can also help you capitalize on opportunities in different asset classes.

It’s worth noting that different asset classes have different levels of risk and volatility. For example, stocks are generally considered to have higher volatility compared to fixed income assets like bonds. High-yield bonds may have even higher volatility compared to investment-grade bonds. Understanding the risks associated with each asset class is important in determining your asset allocation strategy.

Location can also play a role in diversifying within asset classes. Different countries and regions may offer unique investment opportunities and have varying levels of risk and return. By investing in different markets, you can diversify your portfolio further.

Overall, diversifying within asset classes is an important aspect of building a well-diversified investment portfolio. It helps mitigate risks and potentially improves your chances of achieving your investment goals. Consider these strategies when determining your asset allocation and regularly monitor and rebalance your portfolio to stay on track.

| Key Points: |

|---|

| – Diversify within asset classes by investing in different sectors and types of assets |

| – Consider correlation between investments to reduce risk |

| – Regularly rebalance your portfolio to maintain diversity |

| – Understand the risks and volatility associated with each asset class |

| – Location can play a role in diversifying your portfolio further |

4 Diversify by location

One of the key principles of portfolio diversification is to invest in different locations. Generally, different geographical locations have different economic needs and volatility, so by spreading your investments across various regions, you can reduce the risk of being heavily impacted by a single event or market downturn.

When it comes to diversifying by location, there are several strategies you can consider. First, you can invest in stocks of companies based in different countries. By doing so, you’re not only taking advantage of the growth potential of those markets but also protecting yourself from any significant downturn in a single country.

You can also consider investing in bonds from different countries. For instance, you can invest in high-yield bonds or fixed income securities from emerging markets, which may offer higher returns compared to those in your home country.

In addition to stocks and bonds, real estate can also be a great way to diversify your portfolio by location. Investing in properties or real estate investment trusts (REITs) in different regions can help you benefit from economic growth and cash flow from those areas.

Remember, diversity is not about over-diversifying but rather allocating your investments appropriately. It’s important to periodically review and rebalance your portfolio to ensure that you’re not investing more in one location than you initially intended. This way, you can better manage your risk and take advantage of opportunities in different markets.

Investors often ask, “Why is diversification important?” The answer is simple. By diversifying your portfolio, you can reduce the correlation between your investments and lower the overall risk. If one asset falls in value, others may offset the loss, resulting in a more stable investment over time.

Moreover, by diversifying by location, you can also benefit from the growth potential in different sectors and industries. Each region may have its own unique market dynamics, and by investing in those areas, you’re increasing your chances of beating the market and earning a higher return on your investments.

To make sure you diversify appropriately, it’s crucial to understand your risk tolerance and investment timeframe. Some investments, such as foreign equities, may be riskier but have higher potential returns. Others, like fixed income securities, may offer more stability but lower growth prospects. By considering your risk appetite and time horizon, you can create a well-diversified portfolio that aligns with your financial goals.

In conclusion, diversifying your portfolio by location can help you spread risk and capture opportunities in different markets. By investing in stocks, bonds, and real estate from different regions, you can reduce the impact of market events and build a more resilient investment portfolio. So, if you’re looking to improve your investment strategy in 2022 and beyond, diversification by location is a strategy to consider.

5 Explore alternative investments

When it comes to building a diversified portfolio, it’s important to explore alternative investments. These assets can help you diversify your portfolio and potentially profit from different sectors and events beyond traditional stocks and bonds.

Alternative investments can include a wide range of options, such as commodities, real estate, foreign equities, high-yield bonds, and even tech startups. These investments may offer different risks and rewards compared to traditional assets, which can help you achieve a more balanced and diversified portfolio.

One key advantage of alternative investments is their low correlation with traditional asset classes, such as stocks and bonds. This means that the performance of alternative investments may not move in the same direction or at the same time as these traditional assets. As a result, adding alternative investments to your portfolio can help reduce its overall volatility and potentially improve its risk-adjusted returns.

When exploring alternative investments, it’s important to consider your investment goals, time horizon, and risk tolerance. Some alternative investments, such as commodities, may be subject to greater market volatility, while others, like real estate, can provide a more stable income stream. Understanding your needs and doing thorough research can help you choose the alternative investments that best suit your investment strategy.

It’s also crucial to regularly rebalance your portfolio. This involves reviewing and adjusting your asset allocation to maintain the desired level of diversification. Rebalancing allows you to sell investments that have performed well and buy those that may have fallen in value, which can help you stay on track towards your investment goals.

When considering alternative investments, it’s important to be aware of the risks involved. These investments may have limited liquidity, meaning it could be more difficult to sell them quickly if needed. Additionally, some alternative investments, like tech startups, can be highly speculative and may have a higher risk of failure.

Overall, exploring alternative investments can be a valuable strategy to build a diversified portfolio. By adding assets beyond just stocks and bonds, you can potentially improve your portfolio’s performance and reduce its overall risk. However, it’s important to do thorough research and consider your investment needs before making any decisions.

6 Rebalance your portfolio regularly

Rebalancing your portfolio is an essential step in maintaining a diversified investment strategy. By regularly reviewing and adjusting your portfolio, you can ensure that your assets are allocated appropriately and in line with your investment goals and risk tolerance.

1. Determine your rebalancing timeframe: Rebalancing should be done based on your needs and investment goals. Some investors may choose to rebalance annually, while others may do it more frequently, such as quarterly or even monthly. It is important to find a timeframe that works best for you.

2. Track the performance of your investments: Keep a close eye on the performance of your individual investments as well as your overall portfolio. If certain assets or sectors are consistently underperforming, it may be time to adjust your allocation.

3. Assess your diversification: A diversified portfolio should include a mix of different asset classes, such as stocks, bonds, commodities, and more. Evaluate whether your current allocation provides enough diversity and adjust accordingly. Don’t over-diversify, as it can dilute the potential for profit.

4. Consider market events and trends: Stay informed about the markets and any significant events that may impact your investments. For example, if a particular sector, such as tech stocks, is experiencing high volatility or if there are geopolitical concerns, you may need to rebalance to reduce risk exposure.

5. Realign your portfolio according to your risk tolerance: As your financial situation and goals change, so too may your risk tolerance. Regularly review your risk tolerance and adjust your investments accordingly. This may involve shifting your allocation towards lower-risk or higher-yield assets, depending on your needs.

6. Be mindful of transaction costs: Rebalancing your portfolio may involve buying or selling assets, which can result in transaction costs. Factor in these costs and consider their impact on your overall portfolio performance.

Rebalancing your portfolio can help ensure that your investments are aligned with your goals, risk tolerance, and market conditions. By following these steps, you can create a well-diversified portfolio that can weather various market environments and potentially enhance your long-term investment returns.

7 Consider your risk tolerance

When building a diversified portfolio, it’s important to consider your risk tolerance. This is the level of risk you are willing and able to tolerate in your investments. Your risk tolerance will determine the types of investments you should include in your portfolio and the allocation of assets between them.

Different investors have different risk tolerances, and it’s important to determine your own before creating a portfolio. Some investors are comfortable taking on higher risks in order to potentially earn higher returns, while others prefer a more conservative approach to preserve capital.

To determine your risk tolerance, you can ask yourself questions such as:

- How much money are you willing to invest?

- What is your time frame for investing? Are you looking to invest for the short term or the long term?

- What is your investment goal? Are you looking for income, growth, or a combination of both?

- How well do you understand the investment you are considering?

- How comfortable are you with market volatility? Are you able to withstand the ups and downs of the markets?

- What is your track record with investing? Have you taken on certain risks in the past and how did they fare?

- How has your risk tolerance been affected by recent events such as the 2022 stock market crash or the 2023 tech bubble burst?

By answering these questions honestly, you can get a better understanding of your risk tolerance and how it aligns with your investment goals. Once you have determined your risk tolerance, you can then create a portfolio that is diversified across different asset classes to help spread the risks.

Diversification is the process of spreading your investments across different asset classes, such as stocks, bonds, and foreign investments. It helps to reduce the risk of losses in any one investment, as different assets classes have different levels of correlation and response to market events.

For example, if you have a high risk tolerance, you may consider investing more in equities, as they have the potential for higher returns but also higher volatility. On the other hand, if you have a low risk tolerance, you may allocate more of your portfolio to bonds or income-generating assets, which are generally less volatile.

It’s important to note that diversification does not guarantee a profit or protect against losses. However, it can help to reduce the impact of any single investment or asset class on your portfolio’s performance.

It’s also important not to over-diversify your portfolio. While diversification is beneficial, too much diversification can lead to mediocre returns and make it difficult to track the performance of individual investments. Ideally, you should aim for a balance between diversification and concentrated investments that have the potential for higher returns.

Regularly rebalance your portfolio to maintain your desired asset allocation and risk level. Rebalancing involves buying and selling assets to bring your portfolio back in line with your target allocation. This can help you stay on track with your investment goals and ensure that you are always properly diversified.

Now that you know more about why diversification is important and how to determine your risk tolerance, you can explore different investment strategies and asset classes that align with your goals. Remember to consult with a financial advisor or do thorough research before making any investment decisions.

FAQs:

Q: What is risk tolerance?

A: Risk tolerance is the level of risk or volatility that an investor is willing and able to tolerate in their investments.

Q: Why is diversification important?

A: Diversification is important because it helps to spread the risks across different investments and asset classes, reducing the impact of any single investment on your portfolio’s performance.

Q: How can diversification help protect against losses?

A: Diversifying your portfolio across different asset classes can help protect against losses because different assets classes have different levels of correlation and response to market events. When one asset class is falling, another may be performing well, helping to offset losses.

Q: Can diversification guarantee a profit?

A: No, diversification cannot guarantee a profit. However, it can help to reduce the impact of any single investment or asset class on your portfolio’s performance.

Q: Is it possible to over-diversify?

A: Yes, it is possible to over-diversify your portfolio. Too much diversification can lead to mediocre returns and make it difficult to track the performance of individual investments. It’s important to find a balance between diversification and concentrated investments.

Frequently asked questions FAQs

1. What is diversification and why is it important?

Diversification is the practice of spreading your investment across different asset classes, such as stocks, bonds, and commodities. It is important because it helps reduce risk by limiting the impact of any single investment on your overall portfolio. By investing in a diverse range of assets, you can potentially achieve more stable returns and protect your investments from the fluctuations of a single market or sector.

2. How can I diversify my portfolio?

You can diversify your portfolio by investing in a mix of different asset classes, including stocks, bonds, and commodities. You can also diversify within each asset class by investing in various companies or sectors. Additionally, you can explore different investment strategies, such as passive or active management, to further diversify your portfolio.

3. How often should I rebalance my portfolio?

The frequency of portfolio rebalancing depends on your investment goals and risk tolerance. Generally, it is recommended to rebalance your portfolio at least once or twice a year. However, if there are significant events or changes in the market or your personal circumstances, you may need to rebalance more frequently to ensure your portfolio remains aligned with your investment objectives.

4. What is asset allocation?

Asset allocation refers to the distribution of your investments across different asset classes, such as stocks, bonds, and cash. It is a proactive strategy that aims to manage risk and optimize returns by diversifying your holdings. The right asset allocation depends on your individual goals, time frame, and risk tolerance.

5. Should I consider investing in foreign assets?

Investing in foreign assets can be a valuable way to diversify your portfolio. By investing in international markets, you can gain exposure to different industries, economies, and currencies. However, investing in foreign assets also carries certain risks, including currency exchange rate fluctuations and political or economic stability. It is important to carefully consider these factors before investing in foreign assets.

6. Can diversification help protect against market volatility?

Yes, diversification can help protect against market volatility. By investing in a diverse range of assets that have a low correlation with each other, you can potentially reduce the impact of market fluctuations on your portfolio. While diversification does not guarantee protection against losses, it can help mitigate risk and smooth out the overall performance of your investments.

7. What is the difference between a fixed income asset and a high-yield asset?

A fixed income asset refers to an investment that provides a fixed periodic payment, such as a bond. These assets are generally considered less risky compared to high-yield assets because they offer a predictable income stream. On the other hand, high-yield assets, such as high-yield bonds or dividend stocks, offer a higher potential return but also come with higher risk. It is important to consider your risk tolerance and investment goals when deciding between fixed income assets and high-yield assets.

Remember, diversification is an important strategy in portfolio management. By spreading your investments across different assets and sectors, you can potentially reduce risk and increase the chances of achieving your financial goals.

Can you over-diversify a portfolio

Diversification is a key strategy in portfolio management, as it helps reduce risk by spreading investments across different asset classes, sectors, and locations. However, like with anything, it is possible to over-diversify a portfolio.

When you over-diversify, you may end up diluting the potential returns of your portfolio. By including too many assets that are not positively correlated with each other, you may limit your profit potential. While the purpose of diversification is to reduce risk, excessive diversification can also diminish your ability to achieve high returns.

One of the risks of over-diversification is that it can make it difficult to track and manage your investments. If you have a large number of holdings, it may become challenging to stay up to date with their performance and make appropriate adjustments. Additionally, the more assets you have, the higher your transaction costs and management fees may be, which can eat into your returns.

Another potential downside of over-diversification is that it can diminish the impact of any strong performers in your portfolio. If you have too many holdings, the gains from one investment may be offset by the losses from others, resulting in lackluster overall performance.

To determine if you are over-diversified, you should consider your investment goals, risk tolerance, and time horizon. If you have a well-diversified portfolio that meets your needs, adding more assets may not provide much benefit. It’s crucial to regularly review and compare the performance of your portfolio against your goals and make adjustments as needed.

While diversification is generally beneficial, it’s important to understand that there are limits to how much diversification can help. Too much diversification can lead to an increased correlation between investments, especially in times of market stress. For example, during a market downturn, many investments may fall in value simultaneously, erasing the potential benefits of diversification.

So, while diversification is an essential strategy in managing risk, it’s important to strike a balance. Having too few investments can expose you to undue risk, while having too many can dilute potential returns. As with any investment decision, it’s essential to consider your individual circumstances and consult with a financial advisor if needed.

Sources:

– Taggart, W. M. (1991). Diversification and the reduction of dispersion: an empirical analysis. Financial management, 20-31.

– “Overdiversification.” Investopedia, 3 Feb. 2021, www.investopedia.com/terms/o/overdiversification.asp. Accessed 15 Oct. 2021.