If you’re interested in building a property portfolio, there are several sources you can tap into to get started. One option is to buy properties that need repair, which will often come at a lower price and give you the opportunity to increase their value. Another option is to purchase properties in particular markets that have high demand and low supply, opening up the potential for higher rental income. You can also consider borrowing funds from multiple lenders to finance your investment, spreading the risk and increasing the chances of getting approved.

One way to start building your property portfolio is by working with estate agents who specialize in investment properties. They can guide you through the process and help you find the right properties that fit your budget and investment goals. Another option is to attend courses or workshops that teach you about property investment, including important terminology and strategies for success. These resources can give you the knowledge and tools you need to make informed decisions and protect yourself from potential pitfalls.

When starting your property portfolio, it’s important to carefully consider its structure and how you will protect your investment. One common approach is to set up a limited company, which offers certain tax advantages and separates your business liabilities from your personal assets. This can give you peace of mind and help you manage your taxes more effectively. It’s also important to keep track of your overheads and budget for any necessary repairs or maintenance that may come up.

Diversification is key to building a sustainable property portfolio. Rather than putting all your eggs in one basket, consider investing in a variety of properties, such as houses, apartments, or commercial spaces. This will help spread the risk and increase the potential for profitability. Additionally, it’s important to stay updated on market trends and demographics, as these factors can greatly impact the performance of your portfolio. Regularly reviewing and assessing your properties will help you make informed decisions about when to buy, sell, or make any necessary changes.

Building a property portfolio takes time and careful planning, but with the right approach and knowledge, you can create a profitable and sustainable investment. By following the steps outlined in this guide, you’ll be well on your way to creating a diverse and successful property portfolio.

- How To Build A Property Portfolio: 11 Tips For Buy-To-Let Success

- Step-by-Step Guide to Building a Property Portfolio

- 1 Start Small

- 2 Understand Property Portfolio Investment Terminology

- 3 Continue to Familiarise Yourself with Landlord Legislation

- 4 Structure Your Property Portfolio Business

- 5 Understand Your Tax Liabilities

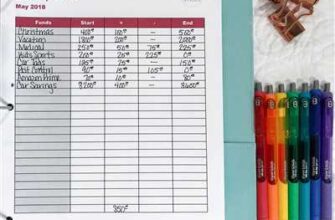

- 6 Budget Carefully

- 7 Multiple Streams of Property Income

- 8 Financing Your Property Portfolio

- 9 Stick to a Particular Property Type to Start

- 10 Diversify Your Portfolio Holdings

- 11 Get the Right Insurance

- 12 Find the Right Tenants

- 13 Keep on Top of Portfolio Maintenance and Management

- 14 Stress Test Your Property Portfolio

How To Build A Property Portfolio: 11 Tips For Buy-To-Let Success

Different Types of Investment

Building a property portfolio is a step-by-step process that could lead to financial success. However, building a successful property portfolio takes time, effort, and careful planning. That’s why it’s important to do your homework and carry out the necessary checks before making any investment.

When starting out, it’s essential to have a clear understanding of the local property market and know what types of properties are in demand. Consider different property streams, such as residential, commercial, or buy-to-let, to diversify your investments and increase your chances of profitability.

Know the Legislation and Legal Responsibilities

Before embarking on the journey of building a property portfolio, it’s crucial to familiarize yourself with the legal responsibilities and regulations surrounding property ownership. From tenant rights to health and safety requirements, understanding the legislation will help you navigate the process smoothly and avoid potential legal issues.

Financing Your Investments

One of the key factors in building a property portfolio is securing financing for your investments. Whether it’s through a mortgage, loan, or other forms of financing, make sure you conduct thorough research and seek professional advice to find the most suitable option for your needs.

Building a Reliable Network

Having a network of professionals, such as real estate agents, contractors, and property managers, is essential when building a property portfolio. These individuals can provide valuable insights and support throughout the process, helping you find the right properties, handle maintenance and repairs, and ensure the overall success of your investments.

Consider the Condition of the Property

When buying properties for your portfolio, it’s important to carefully assess their condition. Conduct thorough inspections and consider any necessary repairs or renovations that may affect the profitability of your investment. A well-maintained property not only attracts tenants but also reduces the risk of ongoing maintenance and repair costs.

Insurance and Liability

Protecting your investment is crucial when building a property portfolio. Make sure to have appropriate insurance coverage to safeguard your assets and mitigate liability risks. Consult with insurance professionals to determine the right coverage for your properties and ensure that your insurance policies are up-to-date.

Maintain a Profitable Cash Flow

As a property investor, it’s important to have a clear understanding of your ongoing financial commitments. Consider both income streams and overheads, such as mortgage payments, taxes, insurance, and maintenance costs, to ensure that your properties generate a profitable cash flow. Regularly review your financial statements to identify areas for improvement and maximize your overall profitability.

Expand Your Portfolio Over Time

Building a property portfolio is an ongoing process. As you gain experience and financial stability, consider expanding your portfolio by acquiring additional properties. However, be mindful of your capacity to manage multiple properties effectively and ensure that each new investment aligns with your long-term goals.

Stay Updated on Market Trends

The property market is constantly changing, and staying informed about market trends is essential when building a successful property portfolio. Keep an eye on local market conditions, property values, and rental demand to make informed buying decisions and adjust your strategies accordingly.

Accountancy and Tax Considerations

As a property investor, understanding accountancy and tax principles is crucial. Seek professional advice to ensure that you comply with tax regulations, maximize your deductions, and optimize the financial management of your portfolio. Having accurate and up-to-date financial records can also provide valuable evidence of your investment activities.

Work with Qualified Professionals

Finally, building a property portfolio involves a wide range of skills and expertise. While it’s important to educate yourself about the property market and investment strategies, working with qualified professionals, such as property lawyers, accountants, and financial advisors, can provide valuable guidance and support throughout your journey.

By following these 11 tips, you can start building a successful property portfolio and increase your chances of buy-to-let success. Remember, building a property portfolio is a long-term commitment, so be patient, stay informed, and continuously adapt your strategies to achieve your investment goals.

Step-by-Step Guide to Building a Property Portfolio

Building a property portfolio can be an effective way to grow your wealth and generate a passive income. However, it requires careful planning and strategic decision-making. In this step-by-step guide, we will walk you through the process of creating a property portfolio.

- Get familiar with property investment: Before you start, it’s essential to familiarize yourself with property investment basics. Understand the different types of properties, the market conditions, and the financing options available.

- Evaluate your financial position: Assess your financial situation to determine what you can afford. Consider your income, savings, and borrowing capacity. This will help you set a realistic budget for your property investments.

- Define your investment strategy: Decide on the purpose and structure of your property portfolio. Are you looking for long-term capital growth, rental income, or both? Determine the areas you want to invest in and the type of properties that align with your goals.

- Research the property market: Conduct thorough research on the property market in your chosen areas. Analyze factors such as rental yields, property prices, and growth potential. This will help you identify promising investment opportunities.

- Secure financing: Explore different financing options to acquire your first property. This may involve applying for a mortgage, borrowing against other assets, or starting a property investment company. Ensure you have evidence of your financial stability and permission to borrow.

- Start small and diversify: When starting your property portfolio, it’s advisable to begin with a small investment. This will minimize risk and allow you to gain experience in property management. As you grow more confident, you can diversify by acquiring additional properties.

- Manage your property holdings: Take good care of your properties to maintain their value and attract tenants. Regularly inspect them for any necessary repairs or maintenance. Keep track of your expenses and ensure you have funds to cover ongoing costs, including annual taxes and insurance.

- Monitor and review: Continuously monitor the performance of your property portfolio. Regularly review your investments and make adjustments as needed. Look for opportunities to increase your rental income or grow your portfolio through remortgaging or principal repayments.

- Deal with regulations and legal requirements: Stay updated on the local regulations and laws governing property investments. Understand the tax implications and ensure you comply with all necessary documentation and reporting requirements.

By following this step-by-step guide, you can build a successful property portfolio that provides a steady stream of income and potential capital growth. Remember to seek professional advice when needed and make informed decisions based on your investment goals and risk appetite.

1 Start Small

When it comes to building a property portfolio, it’s important to note that starting small can be a wise strategy. This is because the property market is volatile and can fluctuate, therefore it’s best to begin with a limited budget to test the waters and gain experience before diving into larger investments.

One common way to start small is by purchasing a buy-to-let property. This type of investment allows you to become a landlord, which in turn generates rental income for you. It’s important to understand the rights and responsibilities of being a landlord, including the regulations and legislation that governs this type of business operation.

Before jumping into a deal, it’s crucial to effectively calculate the costs and potential returns of the property. This includes considering various factors such as maintenance expenses, sourcing good tenants, and remortgaging the property to boost your portfolio. It’s also important to consider the liabilities and risks associated with owning property, such as dealing with difficult tenants or unforeseen repairs.

To effectively grow your property portfolio, you should carefully select the right properties to invest in. This means considering the location, demographics, and condition of the property. Buying properties in areas with high demand and growth potential can be a great way to increase the value of your portfolio over time.

One strategy is to start small with a single property and gradually increase your portfolio as you gain more experience and resources. This allows you to focus on the operations of managing a property and effectively dealing with any issues that may arise. It also helps to protect your credit since borrowing too much too quickly can have a negative effect on your financial stability.

In addition, when starting small, it’s important to have a sustainable budget in place. This means ensuring that you have enough funds to cover any unexpected expenses and to weather any market fluctuations. This will help you avoid overextending yourself and getting into financial trouble.

Overall, starting small is a smart way to enter the property market and build a portfolio. It allows you to learn the ins and outs of property investing, understand the common terminology and practices, and develop the necessary skills to effectively manage multiple properties. So, if you’re considering entering the property market, start small and ensure you have a solid foundation to support your future growth.

2 Understand Property Portfolio Investment Terminology

When starting to build a property portfolio, it’s crucial to understand the common terminology associated with property portfolio investment. This will help you navigate through the various aspects of managing your portfolio and make informed decisions.

1. Expenses: These are the costs that you would incur in managing your properties, such as maintenance, repairs, insurance, and property management fees. It’s important to carefully note and budget for these expenses to ensure that they don’t eat into your income.

2. Income: This refers to the money you receive from your properties, such as rental payments. Calculating your annual income is essential for assessing the performance of your portfolio.

3. Market Structure: Understanding the market structure means knowing the current conditions of the property market, including trends, supply and demand, and price fluctuations. This knowledge will help you make informed buying and selling decisions.

4. Mortgage: Property portfolio investment often involves borrowing money to buy properties. A mortgage is a loan that is secured against the property being purchased. It’s important to carefully consider the terms of the mortgage, such as interest rates and repayment periods.

5. Tax and Regulations: Every property portfolio investment must adhere to tax regulations. This means keeping track of tax payments, including income tax and property taxes. It also involves understanding the tax benefits and deductions that you can avail of to minimize your tax liability.

6. Portfolio Sourcing: Building a property portfolio involves carefully sourcing properties that fit your investment criteria. This means conducting thorough research, viewing houses, and analyzing the potential of each property.

7. Assets: Your properties are the assets held in your property portfolio. They have value and can appreciate over time, providing you with a boost in wealth.

8. Annual and Property Performance: Assessing the annual and property performance of your portfolio is essential for tracking its growth. This involves calculating metrics such as annual income, return on investment (ROI), and property value appreciation.

9. Landlord Rights and Responsibilities: As a landlord, you have certain rights and responsibilities towards your tenants. It’s important to understand these and fulfill them to maintain a good landlord-tenant relationship.

10. Company Structure: If you choose to create a company to manage your property portfolio, understanding the company structure and legal requirements is crucial for complying with regulations and protecting your assets.

11. Borrowing and Financing Options: To expand your property portfolio, borrowing and financing options are available. This can include leveraging the value of existing properties to secure additional funds for buying new properties.

12. Stress Testing: Stress testing involves assessing how your property portfolio would perform under different economic and market conditions. This helps you gauge its resilience and make contingency plans.

13. Keeping Up with Common Terminology: The property investment industry is constantly evolving, and new terms and concepts emerge regularly. It’s important for investors to keep up with the latest trends and terminology to stay informed and adapt to changing market conditions.

In conclusion, understanding the terminology associated with property portfolio investment is vital for anyone looking to build a successful and lucrative portfolio. It allows you to make informed decisions, manage your assets effectively, and maximize your returns. Take the time to familiarize yourself with these key terms and concepts, and you’ll be well-equipped to navigate the property investment landscape.

3 Continue to Familiarise Yourself with Landlord Legislation

When it comes to building and growing your property portfolio, it is important to stay informed about the landlord legislation that applies to your investments. Understanding the laws and regulations in your area will help you navigate any potential issues or liabilities that may arise.

As a landlord, you have certain responsibilities and obligations to your tenants. This includes ensuring that your properties are safe and habitable, making any necessary repairs in a timely manner, and protecting the tenants’ rights.

One common area of legislation that landlords need to be familiar with is tenant rights and lettings regulations. This includes understanding the rules and regulations surrounding rental payments, evictions, and dispute resolution. Familiarising yourself with these laws will help you avoid any legal pitfalls and ensure a successful tenancy.

In addition to tenant rights, it is also important to be familiar with tax legislation and terms related to property ownership. This includes understanding the tax implications of rental income, as well as the tax benefits and deductions available to landlords. By knowing the financial aspects of property ownership, you can better assess the profitability of your investments and make informed decisions.

When buying or remortgaging properties, it is important to factor in any potential changes in legislation that may affect your investment. This includes considering any new regulations or permissions that may be required for certain types of properties, such as listed buildings or properties with planning permission. By keeping up-to-date with the latest legislation, you can ensure a smooth process and avoid any delays or issues.

In summary, familiarising yourself with landlord legislation is an essential part of successfully managing a property portfolio. By understanding the rights and responsibilities of both landlords and tenants, as well as the financial and tax implications of property ownership, you can protect your investments and ensure long-term success.

4 Structure Your Property Portfolio Business

When it comes to building a property portfolio, it’s important to have a clear structure in place. This will ensure that you can effectively manage your investments and make the most out of them. Here are some steps to help you structure your property portfolio business:

1. Create a Budget: Before you start investing in properties, it’s important to create a budget. This will help you determine how much money you have available to invest and what areas you should focus on. It’s also important to consider other financial factors, such as taxes and maintenance costs, when creating your budget.

2. Identify Your Investment Goals: What are your investment goals? Do you want to buy-to-let properties for rental income or are you looking for properties that will appreciate in value over time? Identifying your investment goals will help you make informed decisions about what properties to buy and where to invest.

3. Research Demographics and Rental Yields: When choosing properties to invest in, it’s important to research the demographics of the area and the potential rental yields. This will give you an idea of the demand for rental properties and how much rental income you can expect to receive.

4. Test the Market: Before making a big investment, it’s important to test the market. This can involve starting with smaller investments to see how they perform or conducting market research to gauge the demand for rental properties in a certain area.

5. Develop a Sourcing Strategy: Having a reliable sourcing strategy is essential for building a property portfolio. This may involve working with estate agents, using online tools like Rightmove, or building relationships with sellers. The key is to find a strategy that works for you and helps you find good deals on properties.

6. Stay Updated on Market Trends: The property market is constantly changing, so it’s important to stay updated on market trends. This will help you make informed decisions about when to buy, sell, or hold onto properties. It’s also important to keep an eye on interest rates and the economy, as these factors can impact property prices.

7. Protect Your Investments: It’s important to protect your property portfolio from potential risks. This may involve having the right insurance coverage, setting up a limited company to hold your properties, or having the right contracts and agreements in place with tenants and contractors.

8. Manage Your Properties: Managing your properties effectively is key to the success of your property portfolio. This involves taking care of repairs and maintenance, finding and screening tenants, and collecting rental payments. It’s important to have systems in place to ensure that everything runs smoothly and to keep track of the performance of your properties.

9. Review and Adjust: Regularly review the performance of your property portfolio and make adjustments as needed. This may involve selling underperforming properties, acquiring new properties, or making changes to your financing or management strategies.

10. Seek Professional Advice: If you’re new to property investing or if you have a large portfolio, it may be beneficial to seek professional advice. This could be from property investment advisors, accountants, or solicitors who can help you navigate the complexities of property investment and ensure that you’re making the most out of your investments.

By following these steps and structuring your property portfolio business carefully, you can increase the chances of success and grow your investment holdings over time.

5 Understand Your Tax Liabilities

Understanding your tax liabilities is crucial when building a property portfolio. It is common for property investors to work with accountancy professionals who are familiar with the rules and regulations that apply to rental income and property investments.

Different tax liabilities can arise depending on the structure of your property portfolio. For example, if you have buy-to-let properties, you may have to pay income tax on the rental income you receive. On the other hand, if you have commercial buildings, you may be liable for business rates and corporation tax.

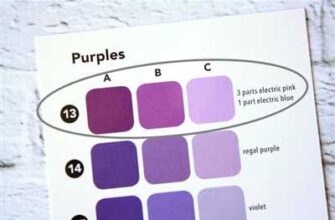

It is important to carefully structure your property portfolio in a way that minimizes your tax liabilities. This involves understanding the various tax rules, such as the 2% rule and the 13-year rule, which could result in different tax treatments for your assets.

Having a good grasp of your tax liabilities can help you make informed decisions when buying new properties or making repairs and improvements. For example, understanding the tax implications of borrowing funds for property investments can help you calculate how much it would cost over time and if it would be a sustainable option for your business.

Furthermore, keeping up to date with changes in tax legislation is essential to ensure you are always in compliance and taking advantage of any tax benefits that are available to you. This may include tax allowances for repairs, insurance, or even the transfer of property rights within your portfolio.

In summary, understanding your tax liabilities is key to building a successful and sustainable property portfolio. Make sure to familiarize yourself with the tax rules and seek professional advice when needed. Always keep track of your income, expenses, and tax obligations to stay on top of your financial responsibilities and maximize your returns.

6 Budget Carefully

When building a property portfolio, it’s essential to budget carefully to ensure the success and longevity of your investments. Here are some key factors to consider:

1. Research the market: Understand the current conditions of the local property market and assess the demand for rental properties in the area. This will help you determine the potential rental income and occupancy rates.

2. Calculate annual expenses: Consider all the costs that come with owning properties, such as mortgage payments, insurance, property management fees, repairs, and maintenance. By understanding these expenses, you can budget accordingly and ensure your portfolio remains financially viable.

3. Assess financing options: Evaluate different sources of financing and compare interest rates, terms, and conditions. This will help you choose the most suitable financing option that works for your budget and long-term goals.

4. Factor in additional costs: Besides the purchase price of the property, there are other expenses to consider, such as legal fees, stamp duty, and conveyancing costs. Take these into account when calculating the overall expenses.

5. Understand limited liability: If you’re operating as a limited liability company or corporation, you have certain protections against personal liability. However, it’s essential to understand the limitations and ensure you comply with all legal and financial obligations.

6. Get professional advice: Consult with an accountancy firm or financial advisor who specializes in property investments. They can assist you in understanding tax implications, financing options, and finding the best structure for your portfolio.

7. Conduct thorough property inspections: Before purchasing a property, make sure to conduct a viewing and thorough inspection. This will help you identify any potential issues or repairs that may arise, protecting your investment.

8. Screen tenants carefully: Finding reliable and responsible tenants is crucial for the success of your portfolio. Conduct thorough background checks, including credit and reference checks, to ensure you choose tenants who will pay their rent on time and take care of the property.

9. Consider remortgaging: As your portfolio grows, remortgaging properties can provide additional financing to expand your investments. This can help you unlock equity and use it to purchase additional properties.

10. Keep an eye on market performance: Stay informed about market trends, changes in demographics, and economic factors that can influence property prices. This will help you make informed decisions when buying or selling properties.

In conclusion, budgeting carefully is a crucial step in building and maintaining a successful property portfolio. By understanding your expenses, financing options, and market conditions, you can make informed decisions and grow your portfolio over time. Remember to always factor in potential risks and liabilities, and regularly evaluate the performance and profitability of your investments.

7 Multiple Streams of Property Income

Building a property portfolio involves many different sources of income. By diversifying your income streams, you can protect yourself from potential financial risks and ensure a steady flow of profits from your investments. Here are seven types of property income that you may consider for your portfolio:

1. Rental Income: This is the most common and well-known source of property income. By renting out your properties to tenants, you can generate a regular cash flow. It’s important to carefully manage your rental properties, including finding and screening tenants, conducting regular maintenance checks, and obtaining necessary insurance coverage.

2. Capital Gains: When property values rise, you can make a profit by selling your properties at a higher price than what you originally paid for them. This type of income can come from either residential or commercial properties, and it relies on market conditions and the timing of your sales.

3. Refurbishment and Resale: Another way to make money in the property market is to buy properties in need of renovation, refurbish them, and then sell them for a higher price. This involves careful calculations and inspections to ensure the profitability of such deals.

4. Financial and/or Business Investments: You can also invest in property-related financial instruments or businesses, such as real estate investment trusts (REITs), property development companies, or property management firms. These investments can provide additional income and diversify your portfolio.

5. Renting out Tools and Equipment: If you have equipment or tools that are useful for property maintenance or refurbishment, you could rent them out to other property owners or construction companies. This source of income can supplement your existing property income.

6. Accountancy and Consultancy Services: If you have expertise in property law, accounting, or other related fields, you can offer your services to other property investors or businesses. This additional revenue stream can come from consulting, providing professional advice, or handling financial and legal matters for clients.

7. Multiple Units within a Property: Instead of renting out whole houses, you can divide your property into multiple units, such as apartments or bedsits, and rent them out separately. This can boost your rental income and maximize the use of your property.

Having multiple income streams within your property portfolio will not only help you to grow your investments, but also provide a safety net in case one or more sources of income are temporarily disrupted. It’s important to continually assess the profitability and sustainability of each income stream and make adjustments as needed.

Remember, building a property portfolio is a step-by-step process. Start with one property and carefully consider the financial and market factors before adding more to your portfolio. And always protect yourself by conducting thorough due diligence, calculating the potential risks and rewards, and seeking expert advice when necessary.

8 Financing Your Property Portfolio

Financing your property portfolio is a crucial part of becoming a successful landlord. It’s important to have the funds available not only for purchasing properties but also for ongoing maintenance and repairs. In particular, you need to note that every property has its own unique set of expenses and liabilities, so it’s essential to budget accordingly.

When it comes to growing your property portfolio, there are several financing options you can consider. One common strategy is the 12-2 rule, where you aim to purchase 12 properties within a 2-year period. This can help you diversify your assets and increase your potential for profitability.

Before you start buying houses, it’s important to familiarize yourself with the terminology and the legal and financial aspects of property investment. This will ensure that you are well-prepared and able to make informed decisions.

One important aspect of financing your property portfolio is the ability to keep up with ongoing expenses and taxes. You should also keep in mind the costs associated with any repairs or damages that may arise. Having a safety net of funds set aside for these occasions is crucial.

If you are starting with limited funds, one option is to consider remortgaging your existing properties to release equity and use it towards purchasing new properties. This can help you expand your portfolio without relying solely on your own savings.

Another financing option is to consider a limited company structure for your property portfolio. This can have tax advantages and can also help protect your personal assets in case of any legal liabilities.

When owning multiple properties, it’s important to have a good understanding of the rental market in your area. Knowing the right price to set for rent is crucial for attracting tenants and ensuring a steady monthly income.

Keeping up with ongoing maintenance works is important to protect the value and condition of your properties. Regular inspections and repairs can help prevent any larger issues down the line.

Using tools such as Rightmove can be helpful in finding the right properties to add to your portfolio. It allows you to filter properties based on your criteria and stay up-to-date with the latest listings and sale prices.

Calculating the return on investment (ROI) for each property is essential to ensure that you are making profitable decisions. This involves calculating the annual rental income, deducting any expenses, and comparing it to the property’s purchase price.

Overall, financing your property portfolio requires careful planning and consideration. By following a step-by-step guide and taking into account all the factors mentioned above, you can effectively grow your portfolio and achieve long-term success as a landlord.

9 Stick to a Particular Property Type to Start

Building a property portfolio is a course that requires careful planning and strategy. One useful tip for beginners is to stick to a particular property type when starting out. This means focusing on a specific type of property, such as houses or commercial structures, rather than diversifying right from the beginning.

By concentrating on one type of property, you can become familiar with the specific rules, regulations, and maintenance requirements that come with it. This in-depth knowledge will help you make informed decisions about your investments and ensure the profitability and success of your portfolio.

When choosing a property type, consider the needs of your target tenant or buyer. If you’re aiming for long-term tenancies, houses may be a good choice as they offer stability and a sense of home. On the other hand, commercial properties may provide higher rental income, but they come with additional responsibilities and obligations.

Once you have chosen a property type, it’s important to do thorough research on the market conditions and demand in the area where you plan to invest. Look at the annual rental yields, potential for capital growth, and any upcoming developments that could affect the value of your investment.

It’s also worth keeping an eye on the rental property listings on platforms like Rightmove to see what types of properties are in high demand. This can give you an idea of what properties are likely to generate higher rental income and attract tenants quickly.

When it comes to financing your property portfolio, having a specific property type can make it easier to secure lending from banks and other lenders. They often prefer to work with investors who have a clear focus and a track record of success in a particular property sector.

Furthermore, having a clear property type can also help when it comes to your tax obligations. Each property type has its own set of tax rules and regulations, and by specializing in one type, you can ensure you are fully compliant and make the most of any tax breaks or incentives available.

In addition, by concentrating on a particular property type, you can build a network of reliable and trustworthy professionals who specialize in that area. This includes real estate agents, handymen, and property managers who can help you with the buying, selling, and maintenance of your properties.

As your property portfolio grows, you may decide to expand into other property types and diversify your investments. However, starting with a focused approach can help you establish a sustainable and profitable foundation for your business as a landlord.

Remember that success in property investment depends on thorough research, careful planning, and continuous learning. By sticking to a particular property type to start and following the above-mentioned tips, you can increase your chances of achieving long-term success and financial stability.

10 Diversify Your Portfolio Holdings

When creating a property portfolio, it’s important to diversify your holdings to mitigate risk and increase profitability. By spreading your investments across different types of properties and locations, you can ensure that your portfolio is well-rounded and capable of withstanding market fluctuations.

Here are 10 strategies you can use to diversify your property portfolio:

| 1. Familiarise yourself with property terminology Make sure you understand the key terms and concepts in the property business. This will help you make more informed decisions and navigate the market effectively. | 2. Financial planning and budgeting Take the time to create a financial plan and budget for your portfolio. This will help you understand your principal and liabilities, as well as your income and expenses. |

| 3. Financing options Carefully consider your financing options when purchasing properties. Remortgaging, securing a loan, or using other financing methods can help you grow your portfolio without tying up too much of your own capital. | 4. Property sourcing Do your homework and find the best properties to add to your portfolio. Make sure to assess the potential profitability and rental income of each property before making a purchase. |

| 5. Maintenance and repairs Keeping your properties well-maintained is crucial for the success of your portfolio. Regular maintenance and repairs ensure that your properties remain attractive to tenants and in good condition. | 6. Property management Consider hiring a property management company to handle the day-to-day operations and overheads of your properties. This can free up your time and ensure that your properties are well-managed. |

| 7. Explore different rental markets Don’t limit yourself to a single type of rental property. Explore different rental markets such as residential, commercial, or vacation rentals to diversify your income sources. | 8. Tax planning Make sure you understand the tax implications of owning a property portfolio. Familiarize yourself with the tax laws and regulations and take advantage of any tax incentives that may be available to property investors. |

| 9. Build a network Networking with other property investors, sellers, agents, and professionals in the industry can provide valuable insights and opportunities. Building a strong network can help you find potential investments and navigate the market more effectively. | 10. Stay informed and adapt The property market is constantly changing, so it’s important to stay informed about market trends and adjust your portfolio strategy accordingly. Regularly review your portfolio’s performance, and be prepared to make changes if necessary. |

Diversifying your property portfolio is essential for long-term success. By following these strategies and staying proactive, you can increase the stability and profitability of your investments.

11 Get the Right Insurance

When building and growing your property portfolio, it is essential to have the right insurance coverage in place. Property ownership comes with potential liabilities, and having the right insurance can provide protection against these risks.

There are several types of insurance that you should consider when owning properties, including landlord insurance, building insurance, and contents insurance. Landlord insurance specifically covers you for any potential damages caused by tenants, such as malicious or accidental damage. You must ensure that you have the right type and amount of insurance to cover your portfolio.

When it comes to commercial properties, such as commercial buildings or multiple rental properties, the insurance requirements may be more complex. In addition to standard insurance, you may need policies that cover liabilities, ongoing maintenance, and other specific aspects of property management.

Insurance premiums can be a significant expense, so it’s essential to budget for them accordingly. You may also be able to reduce costs by shopping around for the best deals and considering higher excess levels. It’s crucial to understand your insurance policy and any exclusions or limitations that may apply.

Furthermore, if you’re financing any of your properties with a mortgage, your lender may require evidence of insurance coverage. Without the right insurance, your lender may view it as a breach of the mortgage terms, which can lead to higher interest rates or even a possible sale of the property.

When it comes to selling properties in your portfolio, you’ll need to notify your insurance provider and cancel the relevant policies. It’s essential to keep them updated on any changes in your property holdings to ensure you have adequate coverage at all times.

In addition to property insurance, you may need to consider additional coverage for potential risks and liabilities associated with property management operations. This can include liability insurance for accidents or injuries that occur on your property, as well as coverage for potential legal disputes.

Overall, having the right insurance in place is a crucial factor in building and managing a successful property portfolio. It provides peace of mind, protects your income, and can help mitigate the financial impact of unforeseen events. Don’t underestimate the importance of insurance – it’s a vital part of safeguarding your investments and ensuring the ongoing success of your property portfolio.

12 Find the Right Tenants

Finding the right tenants is crucial for landlords. It is important to follow regulations and obtain the necessary permissions to rent out properties. Landlords should also be familiar with the various liabilities and responsibilities that come with being a landlord.

When looking for tenants, it is essential to do thorough background checks and vet potential tenants. This involves checking references and conducting credit checks to ensure that tenants have a reliable and sustainable income.

One factor to consider is whether to rent to businesses or individuals. Renting to commercial businesses may involve higher rental income, but there are also additional regulations and responsibilities to consider.

Another factor is the location and type of property. Some areas may have higher demand for rental properties, making it easier to find tenants. Additionally, certain properties may be more appealing to particular tenants, such as families or young professionals.

Landlords should also have a budget in mind for property management, including repairs and maintenance. It is important to factor in these costs to ensure the property remains in good condition and to address any issues that arise.

Overall, finding the right tenants requires careful consideration and effective marketing. Landlords should be proactive in promoting their properties and familiarise themselves with local rental market trends. By starting with a strong foundation and taking care in tenant selection, landlords can improve their chances of success in growing their property portfolio.

13 Keep on Top of Portfolio Maintenance and Management

Maintaining and managing your property portfolio is crucial for long-term success. Here are some essential tips to follow:

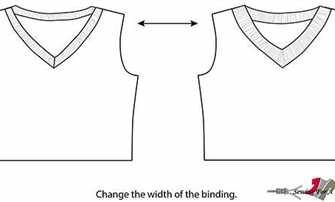

- Refurbish properties: Regularly refurbishing your buildings, both big and small, will not only keep them in good condition but also make them more appealing to potential tenants or buyers.

- Focus on profitability: Keep an eye on the financial aspects of your portfolio. Higher interest rates, for example, may affect your cash flow, so it’s important to take note of any changes.

- Expense management: Be mindful of your expenses since different properties may have varying maintenance costs. Plan accordingly to ensure your portfolio remains profitable.

- Property prices: Stay informed about the property market and be ready to act when the right price comes along. Making smart buying decisions will positively impact your portfolio’s yield.

- Insurance coverage: Protect your assets by having appropriate insurance coverage. This will cover any unforeseen damages or incidents that could affect your portfolio’s value.

- Borrowing wisely: If you need to borrow funds to expand your portfolio, choose your lenders carefully. Familiarize yourself with the terms and conditions and select the right lender.

- Demographics and trends: Keep an eye on changes in demographics and market trends. This information can help you diversify your investments intelligently and navigate the property market effectively.

- Safety and compliance: Stay updated with legislation and any changes in property regulations. Adhering to safety standards and legal requirements will protect your investments and avoid penalties.

- Property maintenance tools: Invest in the right tools to assist with property maintenance tasks. This will save you time and money in the long run.

- Rising costs and overheads: Be prepared for rising costs and overheads associated with property ownership. Plan your finances wisely to ensure your portfolio remains profitable.

- Principal payments: If you have mortgages or loans on your properties, ensure that principal payments are being made on time. This will help build equity and strengthen your financial position.

- Familiarize yourself with the market: Continuously educate yourself about the property market. Stay updated with industry news and developments to make informed decisions.

- Expand strategically: When expanding your portfolio, consider the locations and types of properties that align with your investment goals. Don’t overextend yourself; grow at a manageable pace.

Keeping on top of portfolio maintenance and management is essential for the success and growth of your property portfolio. Following these tips will help you navigate the complexities of property ownership and ensure long-term profitability.

14 Stress Test Your Property Portfolio

Managing a property portfolio can be both rewarding and challenging. It is important to regularly assess the performance of your portfolio to ensure its long-term success. Here are 14 tips on how to stress test your property portfolio:

1. Review your rental income: Analyze the rental income you receive from each property in your portfolio. Ensure it covers your overheads and allows for a decent yield.

2. Assess your management efficiency: Evaluate how well you are managing your properties. Are there any areas that need improvement? Consider outsourcing or streamlining your operations if necessary.

3. Check your tenant arrangements: Make sure your tenants are reliable and paying on time. Look for any signs of potential trouble and take action as needed.

4. Keep abreast of regulations: Stay updated with the latest legislation and regulations in the property market. Ensure you are compliant and avoid any legal issues.

5. Review property insurance: Check that your insurance coverage is adequate and up to date. Protecting your portfolio from unexpected damage or loss is crucial.

6. Evaluate borrowing costs: Assess your borrowing costs, including mortgage interest rates. Explore options to reduce your interest payments and increase cash flow.

7. Consider expanding or selling: If you have the means, consider expanding your portfolio by acquiring more properties. Alternatively, selling underperforming assets can help boost your overall returns.

8. Assess tax implications: Understand the tax implications of owning a property portfolio. Consult with professionals to maximize your tax efficiency and minimize liabilities.

9. Evaluate market conditions: Monitor market trends and conditions that could affect your portfolio’s performance. Keep an eye on property prices, rental demand, and economic factors.

10. Analyze the impact of interest rate changes: Consider the potential impact of interest rate changes on your mortgage repayments. Plan ahead and be prepared for fluctuations.

11. Conduct regular property inspections: Carry out regular inspections of your properties to identify any maintenance or repair issues. Addressing problems promptly can save you from bigger headaches down the line.

12. Keep track of property values: Monitor the value of your properties over time. This will help you assess the overall growth of your portfolio and identify opportunities for capital gains.

13. Have evidence for refinancing: If you plan to refinance your properties, gather the necessary evidence such as rental agreements and financial statements. Lenders will require this information to assess your eligibility.

14. Stick to your investment strategy: Maintain a clear investment strategy and stick to it. Avoid making impulsive decisions based on short-term market fluctuations.

By following these tips and regularly stress testing your property portfolio, you can ensure its long-term success and maximize your returns.