Investing in the stock market can be an important step towards building wealth and achieving financial goals. However, successfully managing your investments requires proper planning and the right strategy. One effective approach is to create an equity portfolio that is well-balanced and diversified.

When it comes to investing in stocks, it’s crucial to understand that not all stocks are created equal. There are different classes of stocks, and each decision made in selecting appropriate stocks plays a key role in portfolio management. Investors who have witnessed the success of legendary investor Warren Buffett understand the importance of taking a diversified approach. Buffett’s investment management strategy allows him to take advantage of the up-to-date information he receives via regular phone calls with top business leaders, thus making well-informed investment decisions.

To create a successful equity portfolio, it is important to identify the right companies to invest in. A broad and diversified portfolio reduces the risk of an investor being heavily dependent on a single stock or industry. Moreover, it ensures that the portfolio is positioned to take advantage of future opportunities across different sectors and markets.

One key aspect of managing a successful equity portfolio is regularly rebalancing it. This involves removing stocks that are underperforming and adding new ones that show promise. Rebalancing your portfolio helps reduce risk and maintain a proper balance between different sectors and asset classes.

Another important factor to consider while managing your equity portfolio is to stay up-to-date with the financial markets. Keeping a close eye on economic trends, market movements, and sector-specific news allows you to make more informed investment decisions. It also ensures that your investments are aligned with your long-term financial goals.

Whether you are an individual investor or someone who runs a mutual fund, managing an equity portfolio requires a great deal of time, effort, and knowledge of the market. However, with the right approach and the help of financial experts like Mr. B.V. Kapur, you can ensure that your portfolio is well-managed and positioned for growth.

In conclusion, creating and managing an equity portfolio is not something that should be taken lightly. It requires careful consideration, analysis, and decision-making. By identifying the right stocks, diversifying your portfolio, regularly rebalancing it, and staying up-to-date with market trends, you can build a portfolio that has the potential to achieve your financial goals and witness great success in the ever-changing world of investments.

What Is the Importance of Regular Stock Portfolio Management

Regular stock portfolio management is crucial for investors who want to achieve growth and earn maximum returns from their assets. It involves actively monitoring and making informed decisions about your investments in order to properly manage risks and take advantage of opportunities.

Warren Buffett and Rakesh Jhunjhunwala, like many successful investors, regularly manage their portfolios to reduce risks and support their long-term financial goals. Proper management helps investors understand the performance of their investments and allows them to remove or add stocks as per changing market conditions.

Regularly managing your portfolio allows for up-to-date monitoring of stocks and identifying potential growth areas. It also helps in building a strong diversified portfolio by investing across various asset classes, such as equities, mutual funds, and bonds.

By regularly monitoring and managing your portfolio, you can avoid being exposed to the risks associated with individual stocks. For example, if you only have shares of one company like Amazon, and the stock price goes down significantly, you could lose a substantial portion of your investment. Diversifying your portfolio can help reduce this risk.

Managing your portfolio regularly also helps you understand the business and financial performance of the companies you have invested in. By staying informed about the news and latest developments in the market, you can make better investment decisions.

Regular stock portfolio management provides investors with the comfort of always being in control of their investments. It allows you to capitalize on market opportunities and reduces the chances of making emotionally driven investment decisions.

Moreover, regular management helps you take advantage of market fluctuations by buying low and selling high. By monitoring your portfolio and the market, you can identify the optimum time to make buy or sell decisions.

Properly managing your stock portfolio also supports long-term wealth creation. It helps investors take a disciplined approach to investing and avoid impulsive decisions that may negatively impact their returns.

In conclusion, regular stock portfolio management is important for investors to ensure growth, reduce risks, and capitalize on market opportunities. It helps in building a diversified portfolio, staying up-to-date with market information, and making informed investment decisions. By following a disciplined approach to portfolio management, investors can support their long-term financial goals and witness the benefits of a well-managed equity portfolio.

Amazon Top Deals

Amazon, the world’s largest online marketplace, offers a wide range of products and services. From electronics to groceries, you can find almost anything you need on Amazon. However, with so many options available, it’s essential to identify the top deals to make the most of your investment.

When building an equity portfolio, it’s important to diversify your investments to avoid putting all your eggs in one basket. Amazon is a strong company with a proven track record of growth, but it’s always prudent to balance your portfolio with other companies and asset classes.

Amazon’s top deals can be identified based on various factors, such as the company’s financial performance, market trends, and the overall value proposition of the products or services being offered. Regularly following financial news and seeking advice from a financial advisor can help you stay informed about Amazon’s top deals and make the right investment decisions.

Warren Buffett, one of the most successful investors of our time, once said, “Investing is simple, but not easy.” While Amazon may seem like a sure bet for future growth, it’s important to weigh the risks and potential rewards. Depending on your comfort level and financial goals, you can determine whether Amazon’s top deals align with your investment strategy.

Rebalancing your portfolio is also crucial for long-term success. As the market fluctuates, some investments may perform better than others. Rebalancing allows you to adjust your portfolio to maintain an optimum balance of investments and avoid taking on too much risk or missing out on potential gains.

Amazon’s top deals can be a part of your broader equity portfolio, but they shouldn’t be the sole focus. Proper diversification based on your investment goals and risk tolerance allows you to spread the risk and maximize returns.

While Amazon offers many attractive deals, it’s important to approach them with caution. Markets can be unpredictable, and a deal that seems too good to be true may have hidden risks. Doing thorough research and understanding the underlying factors that drive a deal’s value is crucial.

Moreover, it’s important not to panic and make rash decisions based on short-term market events. Warren Buffett also famously said, “Be fearful when others are greedy and greedy when others are fearful.” Taking a long-term view and staying focused on your investment goals can help you navigate through market volatility and make wise decisions.

In conclusion, Amazon’s top deals can present excellent opportunities for growth. However, it’s vital to consider them within the context of your overall investment strategy and the broader market. By following the advice of financial experts, staying diversified, and maintaining a balanced portfolio, you can make the most of Amazon’s top deals while minimizing risk.

| Amazon Top Deals |

|---|

| 1. Silver jewelry at 50% off |

| 2. Electronics deals up to 40% off |

| 3. Home and kitchen appliances at discounted prices |

| 4. Fashion deals for men, women, and kids |

| 5. Books and stationery at great prices |

Weigh your comfort with risk

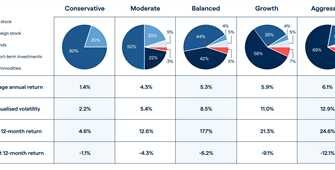

When it comes to building an equity portfolio, one of the most important factors to consider is your comfort with risk. While investing in stocks can earn you higher returns compared to other investment classes like bonds or mutual funds, it also comes with higher risks.

Before you start investing, it’s crucial to understand that the stock market is volatile, and the value of your investments can go up or down. If you’re not comfortable with the idea of witnessing your portfolio’s value fluctuating, stocks may not be the most appropriate investment for you.

However, it’s also important to note that not taking any risks in your investments may impact your potential for growth. You should carefully weigh your appetite for risk and find a balance that suits your financial goals and personal circumstances.

Warren Buffett once said, “Risk comes from not knowing what you’re doing.” Hence, it is crucial to properly understand the business and management of the companies you invest in to reduce the trouble of making the wrong investment decisions. Regularly staying up-to-date with market trends and doing proper research can help you make more informed investment choices.

Diversification is key when it comes to reducing risk in your equity portfolio. By investing in a variety of stocks across different industries and sectors, you can avoid being heavily impacted by the performance of a single company or sector.

Rebalancing your portfolio from time to time is also essential to ensure that it aligns with your risk tolerance and financial goals. If certain stocks or sectors have performed exceptionally well and their weight in your portfolio has increased significantly, it might be appropriate to sell some of those stocks and reinvest in other areas. This helps you maintain a diversified portfolio and avoid being overexposed to a specific market or company.

Finally, don’t let greed or fear drive your investment decisions. Emotional decision-making during market downturns can lead to significant losses. Instead, focus on a long-term perspective and stick to your investment strategy unless there is a fundamental change in the underlying factors that initially drove your investment.

Investing in stocks allows you to take advantage of the growth potential of various businesses and the overall market. However, it’s important to understand and accept the risks involved. By weighing your comfort with risk, diversifying your portfolio, staying up-to-date with market trends, and adopting a proper investment strategy, you can increase your chances of building a strong and profitable equity portfolio.

Phone a Friend

When it comes to managing your investment portfolio, it’s always important to have the support and guidance of a trusted financial advisor or a knowledgeable friend. Making investment decisions can be difficult and it’s crucial to have someone to turn to when you need advice or reassurance.

One of the advantages of having a phone a friend system in place is that it helps remove the panic factor from your decision-making process. It’s natural to feel uneasy or uncertain during times of market trouble or when there are black swan events. Having someone to talk to can provide the comfort and confidence you need to stay focused on your long-term investment strategy.

The importance of regularly monitoring your portfolio cannot be stressed enough. By regularly checking in with your phone a friend, you can adjust your portfolio based on market trends and new information. This allows you to take advantage of growth opportunities and remove underperforming assets from your portfolio.

When it comes to the equity market, diversification is key. Investing in a variety of asset classes and companies helps reduce the risks associated with individual stocks or sectors. Your phone a friend can provide guidance on how to achieve the right balance of investments across different asset classes.

Warren Buffett once famously said, “Be fearful when others are greedy and greedy when others are fearful.” Your phone a friend can help you witness market trends and identify potential investment opportunities. With their knowledge and experience, they can support you in making well-informed decisions during times of market volatility.

The impact of regular communication with your phone a friend can’t be overstated. By discussing your investment strategy with them, you can ensure that you’re staying on track towards your financial goals. They can help you evaluate the impact of different investment decisions on your returns and guide you towards an optimum portfolio allocation.

While doing research and staying informed is important, managing your investments doesn’t have to be a solo endeavor. By reaching out to your phone a friend, you can tap into their expertise and gain insights that you might have otherwise missed.

So, whether you’re a seasoned investor or just starting out, don’t underestimate the value of having a phone a friend system in place. It can make all the difference in helping you navigate the ups and downs of the market and achieve long-term financial success.

Sources

When it comes to managing equity portfolios, it is important to understand the sources that can assist you in making informed investment decisions.

One of the most important sources is market research. Regularly monitoring the market and staying up-to-date with the latest news and trends can help you identify the right companies to invest in. Support from experts like Warren Buffett and Rakesh Jhunjhunwala can prove to be invaluable in maximizing your investment returns.

Another important source is financial publications and websites. These platforms provide extensive information about different asset classes and investment opportunities. They can help you diversify your portfolio and reduce the risk of losing your investments.

Moreover, it is always advisable to follow proper stock market investment strategies. This includes regularly rebalancing your portfolio, taking into consideration the growth potential of different companies, and following a disciplined approach to investing.

Additionally, it is crucial to have a well-defined investment plan and constantly evaluate whether you are on the right track. Regularly adjust your portfolio based on market conditions and your personal investment goals.

In managing equity portfolios, it is also important to avoid making rushed decisions based on short-term market fluctuations. Instead, take a long-term view and focus on the fundamentals of the companies you invest in. Remember, investing is a marathon, not a sprint.

While it is important to seek advice and support from various sources, never forget the importance of conducting your own research and due diligence. This way, you can ensure that your investment decisions are based on your comfort level and risk tolerance.

Lastly, it is always useful to have a diverse portfolio. Investing in a broad range of companies across different sectors and geographies can help reduce risk while maximizing potential returns.

By following these principles and utilizing the right sources, you can create and manage an equity portfolio that is well-positioned for success in the future.