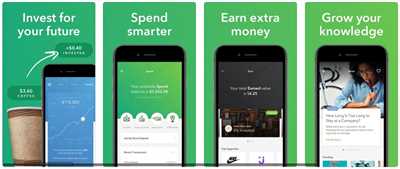

If you are Joe, a savvy investor looking to rapidly grow your portfolio in the fintech era, you should consider creating your own investment app. With the right tools and features, an investment app can help you automate trades, perform financial analysis, and monitor your accounts with ease. By adding smart notifications and customized models, you can stay informed about key stock movements and manage your assets like a pro. At JatApp, we specialize in investment app development and can help you create a user-friendly mobile app that will educate and empower your customers.

With our ready-to-use features, your investment app can provide real-time statistics, delegate transactions, and even generate reports for taxation purposes. Our app features hybrid technologies, making it compatible with both iOS and Android devices, ensuring that your users have the best experience regardless of their mobile platform. Our tools can be used by brokers and customers alike, allowing them to invest in a wide range of stocks and portfolios.

One of the key advantages of using our investment app is the integration of robo-advisors. These AI-powered algorithms can guide your users in making informed investment decisions based on their unique risk tolerance and financial goals. The app will also help millennials invest by simplifying the process and providing educational resources to help them understand the world of investing.

Managing stocks and assets shouldn’t be a daunting task; let our app do the work for you. With the help of our investment app, you can easily monitor the stock market, perform real-time analysis, and execute trades with just a few taps on your mobile device. By utilizing cutting-edge technologies and payment integration, all your transactions can be done securely and efficiently. Experience the benefits of using a modern investment app and start growing your wealth today!

- Investing and Stock Trading Application Development Guide for The Average Joe

- Rapidly growing user base

- Leading mobile banking apps adding investment options

- Millennials are ready to invest if you educate them

- Types of Investment Apps

- Education-centered investment apps

- Apps for conducting trades

- Apps for brokers

- Banking apps

- Types of investment apps

- Banking apps

- Robo-advisors

- Hybrid

- Human advisor apps

- Exchange platforms

- What Is A Good Investment App Key Features

- Delegate the tech part to JatApp

- Источники

Investing and Stock Trading Application Development Guide for The Average Joe

Creating an investment app can be a game-changer for anyone interested in banking, stocks, and trading. With the right features and a solid foundation, you can develop a mobile application that will educate and empower the average Joe to make smart investment decisions.

- Understanding the Basics: Before diving into app development, it’s essential to educate yourself about the world of investing and stock trading. Learn about different types of assets, brokers, and stock analysis tools.

- Choose the Right Development Platform: When developing an investment app, selecting the right tech stack is crucial. Consider using hybrid platforms that support both iOS and Android, ensuring a broader user base.

- Adding Essential Features: A good investment app should include features such as real-time stock quotes, portfolio tracking, and trading capabilities. Users must have access to relevant statistics and notifications about their trades.

- Integrate Payment Gateway: To enable transactions and secure payments within the app, incorporating a reliable payment gateway is a must. This feature ensures smooth transaction flow and enhances user experience.

- Robo-advisors and Financial Advisors: To help users make informed investment decisions, including robo-advisors and financial advisors can be valuable. These automated and human-based services offer investment recommendations based on individual preferences and goals.

- Support for Cryptocurrency: With the growing popularity of cryptocurrency, it is essential to support cryptocurrency trading within the investment app. Provide a secure gateway for users to buy, sell, and trade digital currencies.

- Delegate and Automate: Robo-advisors and trading bots can be integrated into the app to delegate investment decisions and automate trades. Users can leverage advanced algorithms and AI to optimize their investment strategies.

- Stay Updated: Stock trading and investments require staying up-to-date with market trends and news. Integrating real-time news feeds and market analysis can help users make informed decisions.

By following this guide, you can create an investment and stock trading application that caters to the needs of the average Joe. With the right tools and features, your app can empower users to take control of their financial future and navigate the complex world of investing with confidence. If you need professional help with investment app development, consider partnering with JatApp, a fintech development company specializing in creating innovative and user-friendly applications.

Rapidly growing user base

Investment apps are quickly becoming the gateway to banking and managing financial transactions for users all over the world. With the rapid growth of technology, which enables users to monitor their investments on the go, the need for a reliable investment app has never been greater.

Using a mobile app means there is no longer a need for users to rely on traditional financial advisors or robo-advisors to guide their investment decisions. With the right tools and experience, investors can now take control of their investment portfolios from the palm of their hands. This is where JatApp’s investment app comes into play.

JatApp’s investment app provides users with a platform where they can conduct all types of financial transactions, from managing their income to investing in stocks, cryptocurrencies, and more. With JatApp’s app, users can easily add their bank accounts, brokerage accounts, and exchange accounts to the platform, which means they have all their financial sources in one place.

Not only does JatApp’s investment app provide users with a centralized platform for managing their investments, but it also offers a range of smart tools to assist them in making informed investment decisions. Users can receive real-time notifications on market trends, get support from financial experts, and access ready-made investment portfolios tailored to their investment goals.

The rapidly growing user base of JatApp’s investment app is a testament to its effectiveness and user-friendly interface. With the help of JatApp’s investment app, users can easily monitor their investments, make trades, and stay ahead of the game in the ever-changing world of finance.

If you’re ready to take control of your financial future and invest in a technology-driven investment app, JatApp’s investment app is the leading choice. Join the rapidly growing user base and experience the convenience and efficiency it offers.

Leading mobile banking apps adding investment options

As technology continues to advance and consumers become more comfortable with managing their finances through mobile devices, leading mobile banking apps are adding investment options to provide users with more ways to grow their money. These apps are revolutionizing the way people invest, making it more accessible, convenient, and user-friendly.

One of the key investment options that mobile banking apps are incorporating is robo-advisors. These automated investment platforms use algorithms and artificial intelligence to create and manage investment portfolios based on users’ financial goals and risk tolerance. Robo-advisors are a good option for those who are new to investing and want a low-cost, hands-off approach to managing their money.

Mobile banking apps are also adding options for users to invest in cryptocurrency. This is a growing part of the investment landscape, and many people are interested in conducting cryptocurrency transactions through their mobile banking app. By adding a cryptocurrency gateway, mobile banking apps are making it easier for users to buy, sell, and manage their digital assets.

Another popular investment option that mobile banking apps are incorporating is stock trading. With the help of smart technologies and advanced analysis, these apps provide users with real-time stock prices, statistics, and notifications to help them make informed investment decisions. Whether users want to trade stocks themselves or delegate the trading to robots, mobile banking apps provide the tools and resources to make it happen.

Leading mobile banking apps will have a user- friendly interface that is easy to navigate and access. They will offer a variety of investment options, from stocks and cryptocurrency to robo-advisors and traditional banking products. These apps will also provide users with a seamless experience, allowing them to manage their investments, review their portfolios, and conduct transactions all in one place.

In summary, mobile banking apps are quickly becoming the go-to platform for investment management. They offer a wide range of investment options, advanced technologies, and user-friendly interfaces, making it easier than ever for individuals to grow their money. By adding investment options, mobile banking apps are ensuring that their users have the tools and resources they need to make smart financial decisions and achieve their investment goals.

Millennials are ready to invest if you educate them

As more millennials enter the workforce and gain disposable income, they are looking for ways to secure their financial future. Many millennials are turning to investment apps as a means to grow their wealth and achieve their financial goals.

Investment apps are adding new features and tools to help educate users about different investment options and strategies. These education-centered platforms are crucial for millennials who are looking for guidance and are new to the investment world. With the help of these apps, millennials can learn about different investment models, conduct analysis, and make informed trades.

One of the key features that these investment apps offer is easy-to-use interfaces and user-friendly tools. Millennials are tech-savvy and prefer platforms that offer a smooth user experience. These apps provide a user-friendly guide that helps millennials navigate through the investment process, from conducting analysis to managing their portfolios.

Furthermore, these apps are also a gateway to financial education. They provide resources such as articles, videos, and expert advice to help millennials make informed investment decisions. Millennials can learn about different investment types, such as stocks, bonds, and cryptocurrencies, and understand the risks and rewards associated with each asset class.

Leading investment apps also offer hybrid models that combine the expertise of a financial advisor with the convenience of technology. These robo-advisors use algorithms to create personalized investment portfolios based on the user’s financial goals and risk tolerance. This way, millennials can benefit from professional guidance while still having control over their investments.

Additionally, these apps help millennials monitor their investments in real-time. They provide tools for tracking portfolio performance, analyzing market trends, and conducting transactions. This level of transparency and control is appealing to millennials, who are used to having instant access to information and want to actively participate in managing their finances.

Millennials are ready to invest, but they need the right tools and education to do so. Investment apps are filling this gap by providing an easy-to-use platform that offers educational resources, expert guidance, and tools for monitoring and managing investments. With the help of these apps, millennials can confidently start their investment journey and work towards achieving their financial goals.

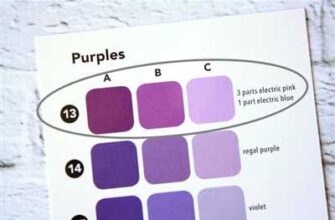

| Key Features of Investment Apps: |

|---|

| – Easy-to-use interfaces and user-friendly tools |

| – Educational resources and expert advice |

| – Hybrid models combining technology and financial expertise |

| – Real-time monitoring and analysis tools |

Types of Investment Apps

Investment apps come in various types and cater to different investment needs. Let’s take a closer look at some of the most common types:

1. Stock Trading Apps: These investment apps allow users to buy and sell stocks on the stock exchange. They provide tools and features to help users make informed investment decisions, track their portfolios, and monitor the market.

2. Robo Advisor Apps: Robo advisor apps use algorithms and technology to provide automated investment advice. They analyze market data and statistics to create and manage investment portfolios for their users. This means that if you’re a busy person or not sure what to invest in, a robo advisor app can be a good place to start.

3. Cryptocurrency Apps: With the growing popularity of cryptocurrencies like Bitcoin and Ethereum, cryptocurrency investment apps have become increasingly popular. These apps allow users to buy, sell, and manage their cryptocurrency assets. They provide real-time market data, notifications, and tools to help users make informed investment decisions in the volatile world of cryptocurrencies.

4. Education-Centered Apps: These apps focus on providing investment education to users. They provide resources, guides, and tutorials to help users understand the basics of investing. They may also offer simulated trading to help users practice their investment strategies.

5. Financial Management Apps: These apps offer a comprehensive solution for financial management. They allow users to track their income and expenses, manage their accounts, and set financial goals. Some financial management apps also offer investment features, allowing users to manage their investment portfolios alongside their personal finances.

6. Hybrid Apps: Hybrid apps combine different investment models to provide a unique experience for users. They may offer a combination of robo advisors, stock trading tools, and other features to cater to different investment preferences.

Choosing the right investment app largely depends on your investment goals, risk tolerance, and level of expertise. It’s important to do your research and educate yourself about the different types of investment apps available. Also, remember that investment apps are tools, and the ultimate responsibility for investment decisions lies with the users themselves.

Whether you’re a seasoned investor or just starting out, there are investment apps out there that can help you make the most of your investments. So, take the time to explore the options and find the investment app that suits your needs and preferences.

At JatApp, we specialize in the development of fintech apps, including investment apps. Our team of experienced developers and designers can create custom investment apps that are tailored to your specific requirements. Contact us today to discuss your project!

Education-centered investment apps

Education-centered investment apps are becoming increasingly popular, especially with millennials who are interested in stocks and growing their financial knowledge. These apps aim to educate users about different investment options and provide them with the tools and means to conduct financial transactions on the go.

By creating user-friendly mobile apps that are ready to be used by the average person, these education-centered investment apps are transforming the way individuals invest. They serve as a gateway to the world of investing, offering a platform where users can manage their assets, explore cryptocurrency and exchange options, and even conduct banking transactions.

What sets education-centered investment apps apart from traditional banking or brokerage platforms is their focus on educating users about investment management. Through features like notifications, payment tools, and educational resources, these apps help users learn more about investing and make smart decisions about their money.

In addition to the educational support they provide, these apps also offer various ways to invest. Users can choose to invest on their own using the tools and analysis provided by the app or delegate their investments to robo-advisors or human brokers. This hybrid approach ensures that users have the flexibility to manage their investments in the way that suits them best.

Education-centered investment apps also offer customers leading technologies and models for investment analysis. Whether it’s conducting market research, analyzing investments, or adding trades to their portfolio, users have all the necessary tools at their fingertips. This helps them make informed decisions and stay updated on the latest trends and developments in the financial world.

If you are looking to start investing or enhance your investment management skills, education-centered investment apps are a good place to start. With their user-friendly interfaces and educational resources, these apps make investing more accessible and less intimidating. So why not join the millions of people who have already taken advantage of these apps and start growing your financial future today?

Apps for conducting trades

When it comes to growing your investments, having the right tools and platforms is crucial. With the rapid advancement of technology, there are now many apps available that can help you make the most out of your trades. Whether you are an experienced investor or just starting out, these apps provide the necessary features and support to ensure a good income potential.

One of the leading sources for investment app development is JatApp. They specialize in creating hybrid applications that can be used on both Android and iOS platforms. With their expertise, JatApp can create apps that provide a seamless user experience, with features such as stock analysis, investment education-centered guides, and notifications about market trends.

One type of app that is gaining popularity among millennials is robo-advisors. These apps, such as Wealthfront and Betterment, leverage the power of AI and machine learning to manage your investments. They use algorithms to automatically monitor and adjust your portfolio based on market conditions, making sure your investments are always on track.

For those who prefer a more hands-on approach, there are also trading apps available that allow you to conduct trades yourself. Apps like TD Ameritrade and E-Trade provide a wide range of tools and resources for conducting transactions. You can monitor the stock market in real-time, perform technical analysis, and even delegate trades to be executed automatically.

Furthermore, some apps offer social trading features, which allow you to interact with other investors and learn from their experiences. This can be a valuable source of knowledge and insights, especially for those who are new to investing.

When choosing an investment app, it’s important to consider factors such as user interface, security, and customer support. Make sure the app you choose is backed by leading technologies and has a solid base of customers. Additionally, look for apps that offer educational resources to help you improve your investing skills.

In conclusion, these apps for conducting trades are changing the way we invest and manage our financial assets. With their innovative features and user-friendly interfaces, they make investing more accessible and convenient for everyone. Whether you’re a seasoned investor or just starting out, using an investment app can greatly enhance your experience and potentially increase your income.

Apps for brokers

Apps for brokers are essential tools for any financial advisor looking to provide the best service to their customers. In the fast-paced and ever-evolving world of finance, brokers need access to reliable and efficient applications that can help them stay ahead of the curve.

With the leading fintech companies developing these apps, brokers can now analyze a wide range of statistics and data to better understand their customers’ needs and recommend smart investment strategies. These apps provide a user-friendly experience and can be a game-changer for brokers who rely on technology to support their daily work.

One key feature that these apps offer brokers is the ability to delegate investment management to robo-advisors. This means that brokers can rely on sophisticated algorithms and models to help them make informed decisions about their clients’ investment portfolios. With this support, brokers can focus on conducting trades and providing personalized advice, rather than spending hours on portfolio management.

Apps for brokers also provide access to a wide range of financial tools and resources. They offer real-time notifications about market trends and investment opportunities, allowing brokers to stay informed and react quickly to market movements. Whether it’s trading on traditional banking platforms or investing in cryptocurrency, brokers can easily manage their clients’ assets and execute trades in a timely manner.

Hybrid apps, which combine the best features of both robo-advisors and traditional brokerage platforms, are becoming increasingly popular among brokers. These apps provide a balance between automation and human touch, allowing brokers to leverage technology while still maintaining a personal relationship with their clients.

Apps for brokers are especially important when it comes to serving millennials, who are known for their preference for mobile and digital solutions. With a user-friendly app, brokers can attract and retain this tech-savvy demographic by providing them with the tools and features they need for successful investing.

In summary, apps for brokers are an indispensable tool in today’s financial landscape. They offer a range of features and capabilities that help brokers provide the best possible service to their customers. Whether it’s analysis, investment management, or trading tools, these apps ensure that brokers can work smarter, not harder, and stay competitive in the growing world of fintech.

Banking apps

Banking apps are a key part of the investment app development. They provide a gateway for users to manage their banking transactions, monitor their accounts, and conduct various types of financial activities. With the help of modern technologies, such as robo-advisors and smart analysis tools, banking apps enable customers to monitor their assets and make informed decisions about their investments.

One of the leading companies in banking app development is JatApp. They are known for creating user-friendly and secure platforms that allow users to delegate their investment management. JatApp’s banking apps are used by customers of all types, including millennials who are looking to educate themselves about investments and generate additional income.

In banking apps, there are several ways to make investing easier and more efficient. Some of the key features that should be included in a good banking app are:

- Providing a user-friendly interface that guides customers through the investment process

- Offering tools for analyzing and managing investment portfolios

- Enabling users to conduct transactions and make payments

- Integrating with other financial platforms, such as payment gateways and trading exchanges

- Allowing users to track their income and expenses to get a clear view of their financial situation

- Using robo-advisors and smart analysis tools to guide users in making investment decisions

Banking apps are not only good for managing investments, but they also help customers to conduct their banking activities in a more convenient and efficient way. With a banking app, customers can have a one-stop place for all their banking needs, including monitoring their accounts, adding new beneficiaries, and conducting transactions.

Whether you are a novice investor or an experienced one, having a banking app can greatly simplify the management of your investments. It is a tool that combines the benefits of human analysis with the speed and efficiency of technology, allowing you to stay on top of your financial goals.

So, if you are looking to create an investment app, remember that banking apps should be an integral part of it. They provide the necessary tools and platforms for users to manage their investments effectively, educate themselves, and grow their income.

Types of investment apps

Investment apps come in various types, catering to different needs and preferences of users. Here are some of the most popular types of investment apps:

1. Cryptocurrency Apps: These apps allow users to invest in and trade various cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. They provide a platform through which users can buy, sell, and exchange cryptocurrencies.

2. Fintech Apps: Fintech apps, which stands for financial technology, provide a wide range of financial tools and services. These apps can be used for payment transactions, banking services, budgeting, and more.

3. Robo-Advisors: Robo-advisor apps are automated investment platforms that use algorithms and data analysis to provide investment advice and portfolio management. They offer personalized investment strategies and recommendations based on the user’s financial goals and risk tolerance.

4. Stock Trading Apps: Stock trading apps allow users to buy and sell stocks and other securities directly from their mobile devices. These apps provide real-time market data, analysis tools, and notifications to help users make informed trading decisions.

5. Education-Centered Apps: Education-centered investment apps focus on providing knowledge and resources to help users learn about investing. These apps offer courses, tutorials, articles, and other educational materials to enhance the user’s understanding of the investment world.

6. Financial Management Apps: Financial management apps help users manage their finances by tracking and categorizing their income, expenses, and investments. These apps provide tools for budgeting, goal setting, and monitoring financial health.

7. Portfolio Tracking Apps: Portfolio tracking apps allow users to track and monitor their investment portfolios in one place. These apps provide real-time statistics, performance analysis, and notifications for trades and market events.

8. Gateway Apps: Gateway apps act as a bridge between different investment platforms and users. They consolidate information and services from various sources into one user-friendly app, making it easier for users to access and manage their investments.

Overall, these types of investment apps are rapidly evolving and adding new features to meet the diverse needs of customers. Whether you are a beginner investor or an experienced trader, there is an investment app out there to suit your needs and help you achieve your financial goals.

Banking apps

Banking apps have become an essential tool for many users in today’s financial landscape. These apps provide a convenient and efficient way for individuals to manage their finances from the comfort of their own place. With banking apps, users can perform various tasks, such as checking their account balance, making transactions, and setting up notifications for important updates.

One of the key features of banking apps is the ability to trade stocks and other investment options. Users can easily educate themselves about different stocks, average market trends, and investment strategies right from the app. Some apps even offer the option to automate trading and use robots for analysis and execution.

There are different types of banking apps available, each with its own set of features and benefits. Some apps are more focused on traditional banking services, while others are hybrid platforms that combine banking and investment functionalities. Leading financial institutions have their own apps, offering their customers a seamless experience in managing their investment portfolios.

One of the most popular types of banking apps is robo-advisors. These apps leverage modern fintech tools to provide automated support in creating and monitoring investment portfolios. They offer education-centered features that help users understand the investment world better and make informed decisions about their financial future.

When it comes to developing a banking app, JatApp is one of the most reliable sources. The company specializes in robo-advisors app development and has a proven track record in creating cutting-edge banking solutions. They provide technical support and ensure all necessary integrations, such as payment gateways and rapid account linking.

Banking apps are particularly useful for millennials who are used to managing their finances using technology. These apps offer an intuitive and user-friendly interface, making it easy for users to navigate and access the information they need. Whether it is checking their balance, making transactions, or monitoring investments, banking apps have become an indispensable part of their financial journey.

In addition to traditional banking services, some apps even offer support for cryptocurrency investments. This means users can diversify their portfolios and explore the world of digital assets. With the rapid advances in technology, banking apps are continuously adding new features and enhancements to improve the user experience and stay ahead of the competition.

While banking apps provide a high level of convenience and automation, they also recognize the importance of human support. Many apps offer access to financial advisors who can guide users in their investment journey. These advisors provide personalized guidance and education to help users achieve their financial goals.

In conclusion, banking apps have revolutionized the way individuals manage their finances. With their user-friendly interfaces, educational tools, and automation features, these apps have become essential for users of all age groups. Whether it’s monitoring stocks, making payments, or investing in cryptocurrencies, banking apps offer the necessary tools and support to help users navigate the complex world of finance.

| App Type | Features |

|---|---|

| Traditional Banking Apps | Checking balances, making transactions, account monitoring |

| Hybrid Banking Apps | Combines banking and investment functionalities |

| Robo-Advisors | Automated support, education-centered features, portfolio analysis |

| Cryptocurrency Apps | Support for cryptocurrency investments, portfolio diversification |

Robo-advisors

Robo-advisors are automated investment platforms that use algorithms and computer models to manage and monitor your investment account. They have become one of the most popular ways for individuals to invest, especially for millennials.

With robo-advisors, you no longer need a human financial advisor to guide you through the investing process. These apps provide education-centered platforms, where you can educate yourself on different investment options and make informed decisions.

Robo-advisors work by adding technology and rapid development to the traditional way of conducting investment transactions. They use advanced analytics and portfolio management features to support their users in making the best investment choices.

Some robo-advisors also offer hybrid models that combine the benefits of automated investing with personalized support from human advisors. This means that you get the best of both worlds: low-cost, efficient investing with the option to consult with a professional when needed.

Robo-advisors are not only used for traditional investments, such as stocks and bonds, but also for alternative assets like cryptocurrency. They offer payment and account management features, allowing you to easily invest and monitor your portfolio from your mobile device.

Furthermore, robo-advisors provide notifications and alerts to keep you informed about changes in your portfolio, market trends, and any other relevant information. This helps you stay on top of your investments and make adjustments when necessary.

Robo-advisors are rapidly growing in popularity due to their user-friendly interfaces, low fees, and transparent investment strategies. They provide an accessible way for customers to start investing, even with limited funds or investment experience.

If you are new to investing or want a hassle-free way to manage your assets, robo-advisors can be a good option for you. They will help you make the most out of your income and guide you in reaching your financial goals.

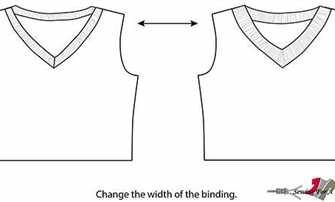

Hybrid

The “How to create investment app” guides you on how to build a hybrid investment app. A hybrid app is a combination of a native app and a web app. It combines the best of both worlds, providing a seamless experience for users.

A hybrid app helps you to place your app in multiple app stores and can be used on different platforms such as iOS and Android. This means you can make your app available to a wide range of users.

By adding hybrid app development to your arsenal, you can use powerful tools and frameworks like React Native or Ionic, which can make the development process faster and easier. This allows you to leverage the skills and knowledge of your development team to create a high-quality app.

Using a hybrid app also enables you to provide a human touch to your app. You can send personalized notifications to your users, provide them with educational content, and offer support through in-app chat or phone calls.

Hybrid apps can also integrate with banking and investment gateways, allowing users to invest directly through the app. They can connect with various brokers and exchanges to conduct investment transactions.

Furthermore, hybrid app development allows you to incorporate data analysis and monitoring tools. This helps users to analyze their investments, monitor their portfolio, and make informed decisions.

Key features of a hybrid investment app include user-friendly interfaces, secure login and authentication, real-time data updates, and investment tracking.

With a hybrid investment app, you can educate users about different types of investments, such as stocks, bonds, or cryptocurrencies. You can also provide robo-advisors or robots to help with investment management.

These types of apps are particularly helpful for millennials who are ready to start investing but may not have much experience.

Hybrid apps also provide options for customization, allowing users to tailor their investment portfolio to their specific goals and risk tolerance.

The fintech industry is growing rapidly, and there is a growing base of tech-savvy customers who are looking for more convenient ways to manage their investments.

A hybrid investment app is a leading platform for these customers, providing them with easy-to-use tools, educational resources, and access to the most up-to-date investment statistics.

If you’re looking for a comprehensive guide on creating a hybrid investment app, this “How to create investment app” is all you need.

Human advisor apps

When it comes to investing, there are various ways to go about it. One popular option is to use human advisor apps, which provide monitoring and guidance for your investments. These apps are different from robo-advisors, as they have a team of expert advisors who utilize their knowledge and experience in the stock market to make informed investment decisions.

Human advisor apps are often education-centered, and they aim to educate users about how investing works and the key statistics and tools to consider. They help millennials and other users who may be new to investing to navigate the complex world of finance. With these apps, you can delegate the investment decisions to professionals while still being actively involved in the process.

One of the leading human advisor app development companies is JatApp. They have extensive experience in creating mobile apps for the fintech industry, with a focus on investment and banking options. JatApp’s development team will guide you through the process, from adding income sources to your account to creating and monitoring investment portfolios.

Human advisor apps also offer features that go beyond what robo-advisors and traditional brokers provide. They help users understand the different types of assets and investments available, and they provide notifications about trades and market analysis. This means that users can make informed decisions about their investments based on real-time information.

In addition to investment support, human advisor apps also educate users about other aspects of finance. They provide guidance on budgeting, saving, and even cryptocurrency trading. By using these apps, you can gain a better understanding of how the financial world works and become more confident in managing your money.

While robo-advisors can be a good starting point for beginners, human advisor apps offer a more personalized and hands-on approach to investing. They combine the benefits of automation with the expertise of human advisors, giving you the best of both worlds. Whether you are new to investing or have experience in the market, human advisor apps can help you achieve your financial goals.

Exchange platforms

Exchange platforms are essential for any investment app. They provide a base for buying, selling, and trading various financial assets. In a fintech-driven world, these platforms help users invest and manage their portfolios using modern technologies.

With the help of exchange platforms, users will have access to a wide range of investment options. They can invest in stocks, cryptocurrencies, and other types of assets. Such platforms offer different ways to invest, ensuring that users can choose the method that suits them best.

One of the key features of exchange platforms is their education-centered approach. They have tools and resources to help users learn about financial markets, investment strategies, and analysis. This type of education helps users make informed decisions and mitigate risks in their investments.

Exchange platforms also provide various management tools to aid with portfolio monitoring and statistics. Users can track their investments, set up notifications for price changes, and manage their trades. These tools provide a seamless experience for users to stay on top of their investments.

Moreover, exchange platforms are mobile-ready, allowing users to access them from anywhere using their smartphones. This feature caters to the fast-paced lifestyle of millennials and makes investing more convenient than ever. Users can trade on-the-go and stay updated with real-time market information.

Exchange platforms also serve as a gateway to banking-like services. They offer payment options, allowing users to deposit and withdraw funds from their accounts. Some platforms even provide integration with traditional banks for added convenience.

For those who prefer a human touch, exchange platforms often have customer support services. They can assist users in navigating the app, answering questions, and providing guidance. This hybrid approach combines the benefits of technology with the human element for a holistic investing experience.

In summary, exchange platforms are the backbone of any investment app. They help users manage their investments, educate themselves about financial markets, and provide access to a wide range of investment options. Whether you’re a beginner or an experienced investor, these platforms are a vital tool for making the most of your financial journey.

What Is A Good Investment App Key Features

When it comes to investing, having a good investment app is essential. There are a growing number of options available, each with their own set of features and benefits. Whether you’re a seasoned investor or just starting out, finding the right investment app can help you make the most of your financial goals.

Here are some key features that a good investment app should have:

- User-Friendly Interface: A good investment app should be easy to navigate, with a clean and intuitive design. This will ensure that even beginners can use it without any trouble.

- Multiple Asset Classes: The app should provide access to a wide range of investment options, including stocks, bonds, cryptocurrencies, and more. This will allow investors to diversify their portfolio and maximize their potential returns.

- Real-Time Trading: The app should have real-time trading capabilities, allowing users to buy and sell assets at any time. This will enable them to take advantage of market opportunities and make informed investment decisions.

- Portfolio Management Tools: A good investment app should offer robust portfolio management tools, such as tracking investment performance, setting financial goals, and generating performance reports. This will help investors stay organized and monitor their progress.

- Financial Education: The app should provide educational resources and tools to help users learn about investing and improve their financial knowledge. This can include articles, tutorials, videos, and more.

- Security: Security is a top priority when it comes to investment apps. The app should use advanced security measures, such as encryption and two-factor authentication, to protect users’ sensitive information and assets.

- Notifications: The app should send timely notifications to users, keeping them informed about market trends, portfolio changes, and other important updates. This will help users stay on top of their investments and make well-informed decisions.

- Customer Support: A good investment app should have reliable customer support, offering assistance and guidance to users when needed. This can be through live chat, email, or phone support.

By considering these key features, you can ensure that you choose a good investment app that meets your specific needs. Whether you’re a seasoned investor or just starting out, having the right tools and technology at your disposal can make a significant difference in your investment journey.

Delegate the tech part to JatApp

Are you interested in creating a trading or investment application? Do you want to provide your customers with a user-friendly and reliable platform to invest in stocks, cryptocurrency, and other financial instruments?

Delegate the tech part of your application to JatApp. With our expertise in mobile app development and experience in the fintech industry, we can help you build a robust and secure investment app that will cater to your specific needs.

By choosing JatApp, you can ensure that your investment app is ready to handle transactions, conduct real-time trading, and provide your users with valuable insights and statistics about their investments. Our team can integrate payment gateways, set up secure transaction protocols, and implement smart analysis tools to make your app stand out in the market.

| Trades | Our investment app development will enable real-time trading of stocks, cryptocurrency, and more. |

| Robo-advisors | We can integrate robo-advisors, a hybrid of human expertise and automation, to educate and assist your customers in making informed investment decisions. |

| Mobile Management | Your users will have the convenience of monitoring and managing their investment portfolios right from their mobile devices. |

| Notifications | We can implement a notification system to keep your customers updated about important market events and changes in their investments. |

| Secure Transactions | Our development team will ensure that all financial transactions conducted through your app are secure and protected. |

Don’t let the tech part hold you back from creating a successful investment app. Delegate it to JatApp and let us take care of the development process, while you focus on other aspects of your business.

Contact JatApp today and start building a cutting-edge investment application!

Источники

The “How to create investment app” is an education-centered app that helps users learn about investments and how to make good trades. It uses hybrid technologies, combining mobile app development and banking gateway technologies to create a user-friendly and feature-rich platform.

One of the main sources of education in this app is the statistics and monitoring tools. Users can access real-time financial data and stock exchange information to educate themselves on the current market trends and make informed investment decisions.

The app also provides users with smart trading tools, such as asset management and income tracking. These tools help users monitor their investments, analyze their financial performance, and optimize their portfolio for maximum returns.

In addition to the education-centered features, the app also serves as a gateway to leading brokerage platforms. Users can connect their investment accounts from various brokers to track and manage their investments in one place. This means users can delegate the work of monitoring and managing their investments to the app, while still retaining control and oversight.

There are several ways in which the app supports users in their investment journey. It provides access to educational resources, real-time market data, and tools for portfolio analysis. It also offers support in the form of a community forum, where users can connect with other investors and share insights and best practices.

Overall, the “How to create investment app” is a comprehensive tool for individuals who want to learn about investments and have the means to manage their own portfolio. It combines education, technology, and support to create a user-friendly platform that empowers users to take control of their financial future.