If you’re looking for an easy and convenient way to send money to friends and family, Zelle is a great option. With Zelle, you can quickly and securely transfer funds from your checking account to anyone with a U.S. phone number or email address. Whether you’re splitting the bill, paying back a friend, or sending a gift, Zelle makes it simple and hassle-free.

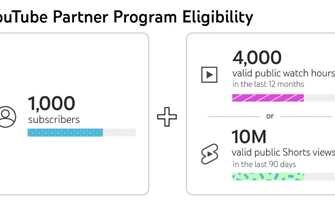

To get started with Zelle, you’ll need to have an account with a participating bank or credit union. If you already have a checking account, check with your bank to see if they offer Zelle. If not, you may need to open a new account or consider switching to a bank that offers this service.

Once you have an account set up, download the Zelle app to your mobile device. This app will allow you to send and receive money directly from your smartphone or tablet. When you open the app, you’ll be prompted to enter your email address or U.S. phone number. This information will be used to verify your identity and link your Zelle account to your existing bank account.

After you enter your email or phone number, you’ll receive a verification code. Enter this code into the app to confirm your identity and complete the enrollment process. Once you’re enrolled, you’ll be able to send money to anyone with a U.S. phone number or email address. Simply enter the recipient’s information, select the amount you want to send, and click “Send”.

It’s important to note that Zelle is a secure platform that uses encryption and other security measures to protect your personal and financial information. However, it’s always a good idea to take additional steps to protect yourself when banking online. Make sure to choose a strong password for your Zelle account and never share it with anyone. Also, be cautious of any emails or phone calls requesting your personal or banking information. Zelle will never ask you for this information and any such requests should be reported to your bank immediately.

In summary, Zelle is a convenient and secure way to send money to friends and family. By following a few simple steps, you can create a Zelle account and start sending money in just a few minutes. So why not give it a try today and experience the ease and convenience of Zelle for yourself!

- Zelle

- Mobile Banking

- Go to Move Money

- Select “Send Money with Zelle®”

- Review & Accept the Terms of Service

- Complete your enrollment

- Enter the verification code

- You’re all set

- Select “Send”

- Select recipient

- Enter the amount

- Enter a note optional

- Submit

- Select “Request” or “Split”

- Select the person you want to receive money from

- Enter the amount of the request

- Follow us

- Checking Accounts

- Savings Accounts CDs

- Credit Cards

- Mortgages

- Auto

- Chase for Business

- Investing by JP Morgan

- Chase Private Client

- About Chase

- Sports Entertainment

- Chase Security Center

- Other Products & Services

- What if I get an error message when I try to enroll an email address or US mobile number

- Sources

Zelle

Zelle is a fast, safe, and convenient way to send and receive money. With Zelle, you can send money to friends, family, and even businesses. The best part is that the money is sent directly to their bank account, making it easy for them to access the funds.

Zelle is insured, so you can have peace of mind knowing that your money is protected. With Zelle, you don’t have to worry about the security of your information or the safety of your transactions.

To use Zelle, you must have a bank account. You can link your checking or savings account to Zelle and choose it as the source of funds when you send money. Zelle also allows you to receive money directly into your bank account.

Using Zelle is easy. To send money, all you need is the recipient’s email address or mobile phone number. You can send money in minutes, and the recipient will receive the funds immediately.

Zelle can be used for various purposes, such as paying bills, splitting expenses, and even sending money for special occasions like birthdays or holidays. It is a versatile tool that can be used by individuals and businesses alike.

If you’re not already enrolled in Zelle, you can easily sign up for it online. Just visit your bank’s website and look for the Zelle section. Follow the instructions to enroll and start using Zelle.

With Zelle, you can also request money from others. If you need someone to pay you back, you can send them a request through Zelle and they can easily complete the payment.

When using Zelle, it’s important to note that there may be limits on the amount of money you can send or receive. These limits vary depending on your bank and the type of account you have.

Zelle is a product of JPMorgan Chase Bank, N.A. (“JPMC”) and its affiliates. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Products and services are offered by JPMC, member FDIC. Please see your bank’s website for more information about Zelle and its benefits.

Mobile Banking

Zelle is a mobile banking service that allows you to send and receive money directly from your bank account. It’s a convenient and secure way to complete transactions when you’re on the go.

With Zelle, you can send money to friends, family, or anyone else who has a bank account in the US. All you need is their email address or mobile phone number to get started.

When you send money using Zelle, the recipient will receive it instantly in their bank account. It’s a fast and easy way to split bills, pay for goods and services, or send money as a gift.

To use Zelle, you must have a checking or savings account with JPMorgan Chase Bank, N.A., or its affiliates. If you’re already a customer, you can enroll in Zelle through the Chase Mobile app or online dashboard.

Once you’re enrolled in Zelle, you can send money by entering the recipient’s email or phone number, selecting the account from which you want to send the money, entering the amount, and submitting the payment. You can also add an optional message to the recipient.

It’s important to note that Zelle is a private service, and it’s not insured by JPMorgan Chase Bank, N.A. or any of its affiliates. To protect your account, please follow the terms and conditions of Zelle and be cautious when sending money to people you don’t know.

If you have any questions or need assistance with Zelle, you can contact the dedicated support center. You can also review the Zelle section of the Chase Mobile app or online dashboard for more information.

In addition to Zelle, JPMorgan Chase Bank, N.A. offers a wide range of mobile banking services, including checking and savings accounts, mortgages, auto loans, wealth management, and more. As a customer, you can access these services through the Chase Mobile app or online dashboard.

To learn more about Zelle and other mobile banking services from JPMorgan Chase Bank, N.A., please visit the official website or contact a customer service representative.

| Benefits of Zelle: | 1. Fast and convenient way to send and receive money |

| 2. Instant money transfer to recipient’s bank account | |

| 3. Easy splitting of bills and payment for goods/services | |

| 4. Secure transactions using email or phone number |

Whether you’re using Zelle for personal or business purposes, it’s a reliable and efficient mobile banking service that can simplify your financial transactions.

Give Zelle a try today and experience the convenience and benefits it offers!

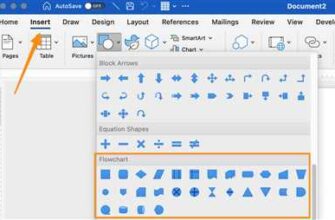

Go to Move Money

To access Zelle® and start sending money to your friends and family, you will need to follow these simple steps:

- Log in to your Chase account online or through the mobile app.

- Go to the Move Money section, which can be found in the navigation menu.

- Click on the “Send Money with Zelle®” option.

- If you are already enrolled in Zelle®, you can send money directly from your Chase account. If you are not enrolled, you will be prompted to enroll.

- Complete the enrollment process by providing your email address or mobile number, and accepting the terms and services.

- You will receive a verification code via email or text message. Enter the code to complete the enrollment process.

- Once enrolled, you can start sending money to anyone with a Zelle®-enabled account.

- From the Move Money section, select the person you want to send money to and enter the amount you wish to send.

- You can also add a message, if you like, to personalize the transaction.

- Review the details for accuracy and click “Send” to complete the transaction.

It’s important to note that Zelle® is a fast and secure way to send money, but you must have a Chase checking or savings account to use the service. Additionally, it is always a good idea to double-check the email address or mobile number of the recipient to ensure the money goes to the right person.

Select “Send Money with Zelle®”

To enroll in Zelle® through your online banking, follow these steps:

- Log in to your online banking account.

- Go to your dashboard or find the Zelle® option in the menu.

- Select “Send Money with Zelle®”.

- If you haven’t enrolled in Zelle® before, you will need to enter your phone number and a verification code will be sent to you. Enter the code to complete the enrollment process.

- If you are already enrolled in Zelle®, you will see a list of the recipients you have previously sent money to. You can also choose to add a new recipient by entering their email address or phone number.

- Enter the amount you would like to send or request.

- Review the details of your payment, including the recipient’s name and the amount.

- If everything looks good, select “Send” to complete the transaction. If you are requesting money from someone, select “Request” instead.

- You will receive a confirmation message that the payment or request was sent.

Please note that not all banking services or products are available for enrollment in Zelle®. Zelle® is available for customers with a JP Morgan Chase personal or business checking or savings account. If you choose to enroll in Zelle®, you will be prompted to accept the Zelle® terms and conditions. Zelle® is provided and operated by Early Warning Services, LLC. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC, and are used herein under license. Using Zelle® does not require the use of Zelle® from JP Morgan Chase. Standard message and data rates may apply when using Zelle®.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Products and services are provided by JPMorgan Chase Bank, N.A. Member FDIC. ©2021 JPMorgan Chase & Co. All rights reserved.

Review & Accept the Terms of Service

Before you can start using Zelle, you will need to review and accept the Terms of Service. This is an important step to ensure that you understand the agreement between you and the banking agency.

The Terms of Service outline the rules and regulations that you must adhere to when using Zelle. It is important to read them carefully and ask any questions you may have before proceeding.

When reviewing the Terms of Service, here are a few tips to keep in mind:

1. Understand the services offered: The Terms of Service will explain what services are available through Zelle, such as sending and receiving money, linking your bank accounts, and more.

2. Ensure the security of your account: The Terms of Service will also outline the security measures that the banking agency has in place to protect your personal and financial information. This may include encryption, multi-factor authentication, and other security features.

3. Check for any fees: Zelle may charge fees for certain transactions, such as sending money from a credit card or receiving money through a different banking service. Make sure you understand these fees before using the service.

4. Know your rights and responsibilities: The Terms of Service will outline your rights as a Zelle user, as well as your responsibilities when using the service. This includes how to handle errors, what to do if you suspect fraudulent activity, and more.

5. Keep your contact and banking information up to date: In order to use Zelle, you must provide accurate contact and banking information. If any of your information changes, you must update it directly in the Zelle dashboard or mobile app.

6. Review the enrollment process: The Terms of Service will explain how to enroll in Zelle, whether it is through your bank’s online services or through a dedicated Zelle enrollment website. Make sure you understand the process before getting started.

Once you have reviewed the Terms of Service and are ready to proceed, you can select the “Accept” button to indicate your agreement. If you have any questions or concerns about the Terms of Service, please contact us directly for assistance.

By accepting the Terms of Service, you are giving Zelle permission to send and receive money on your behalf. Zelle is a safe and secure way to transfer funds, as it operates within the same banking network that you already trust.

Zelle is backed by JP Morgan Securities LLC (“JPMS”) and is protected by the Federal Deposit Insurance Corporation (FDIC), so you can be confident that your money is insured up to the maximum allowed amount. This means that if anything goes wrong, you will be reimbursed.

So, if you’re ready to start sending and receiving money with Zelle, review the Terms of Service, accept them, and enroll in the service today!

Complete your enrollment

Once you have split from your previous financial institution and enrolled in Zelle®, you can enjoy the benefits of fast and secure money transfers. To complete your enrollment, follow these easy steps:

- Go to the Zelle enrollment page on the Chase website.

- Enter your email address or mobile number to receive a verification code.

- Enter the verification code in the provided field.

- Review and accept the terms and conditions for using Zelle®.

- Choose the account you want to use for sending and receiving money with Zelle®. This can be your checking, savings, or credit card account.

- Review your enrollment details and make any necessary changes.

- Complete the enrollment process by clicking “Submit” or “Finish”.

Once your enrollment is complete, you can start using Zelle® to send money to family, friends, or anyone else you choose. The money will be directly deposited into their account, usually within minutes. Whether it’s splitting a bill, paying back a friend, or sending a gift, Zelle® makes it easy and convenient.

Please note that Zelle® is a service offered by JPMorgan Chase & Co. (JP Morgan) and is only available to customers who have a Chase checking, savings, or credit card account. Other financial institutions may also offer Zelle® as a service. If your financial institution does not offer Zelle®, you may still be able to use it by enrolling directly with Zelle®.

If you have any questions or need assistance with your enrollment, you can contact the Zelle® customer care team. They are dedicated to helping you and are available to answer your questions.

By enrolling in Zelle®, you also get access to other features and services offered by JP Morgan. These include online banking, investment products, mortgage services, auto loans, CDs, and more. You can view and manage all of your financial accounts in one place.

Zelle® is not only about convenience and speed. It also prioritizes security and loss prevention. Zelle® uses encryption and other security techniques to protect your personal and financial information. However, it is always important to follow best practices for online security, such as keeping your login credentials private and using strong passwords.

In addition to its financial services, JP Morgan offers resources and tips on budgeting, saving, and investing. Whether you need help with home budgeting, education savings, or retirement planning, JP Morgan can provide the information and assistance you need.

So don’t wait any longer, complete your enrollment with Zelle® today and start enjoying the convenient and secure way to send and receive money!

Enter the verification code

After selecting the amount you want to send, choosing the account or card to send from, and entering the recipient’s email or phone number, you will need to enter the verification code to complete the transaction. The verification code is a unique security measure that helps protect your funds and ensures that you are the authorized user.

Once you enter the verification code, Zelle will review the information you provided and check it against their records to ensure accuracy. If the code you entered is correct, the transaction will be processed. If you enter an incorrect code, you may receive an error message and will need to try again.

The verification code is typically sent via email or SMS message to the email address or phone number associated with your Zelle account. You will receive a message with the code and instructions on how to enter it. It is important to double-check the email or phone number you entered and make sure it is accurate before requesting the code.

If you have already enrolled in Zelle and have verified your email or phone number, enter the code into the designated field on the Zelle dashboard. If you are enrolling for the first time, be sure to check your email or phone for the code and follow the prompts to complete the enrollment process.

Entering the correct verification code is important for the security of your Zelle account. It helps ensure that only authorized users can access and use the funds. If you receive a verification code that you did not request or are having trouble receiving the code, contact Zelle customer care for assistance.

- Double-check the email or phone number you entered to ensure accuracy

- Check your email or phone for the verification code message

- Enter the code accurately into the designated field on the Zelle dashboard

- If you encounter any issues or errors, reach out to Zelle customer support for help

By entering the verification code correctly, you can complete your Zelle transaction and send money to the intended recipient with confidence and security. Zelle is committed to helping their customers with the highest level of care and security when it comes to banking online.

You’re all set

Congratulations! You have successfully completed the enrollment process for Zelle®. You can now enjoy the convenience of sending and receiving money directly from your Chase mobile banking app or online dashboard.

With Zelle, you can easily send money to friends, family, or anyone else with a U.S. bank account. Simply choose the person you want to send money to, enter the amount, and submit the request. The recipient will receive a notification and can accept the money in just minutes.

Zelle also offers a “split” feature, allowing you to divide the amount you’re sending among multiple people. This can be helpful when sharing costs for entertainment, group expenses, or business needs.

It’s important to note that Zelle is a service provided by JPMorgan Chase Bank, N.A. Your Zelle transactions are protected by the same security measures and terms as your other Chase banking services. Additionally, your Zelle transactions are not insured by any government agency.

If you have any questions or need assistance with your Zelle account, you can find helpful tips and information on the Zelle website. You can also contact customer care through a dedicated phone number or send them a message online. They’ll be happy to help you with any concerns or feedback you may have.

Thank you for choosing Zelle to manage your money and stay connected with the people who matter most to you. We’re here to help you with your banking, lending, investing, and wealth management needs. Apply for a mortgage, open a checking or savings account, or explore our other products and services available to enrolled Zelle clients.

Again, congratulations on enrolling with Zelle. Sit back, relax, and enjoy the convenience of secure and easy money transfers.

Select “Send”

To start sending money through Zelle, follow these simple steps:

- Log in to your online banking or mobile banking app.

- Select “Send” or the Zelle icon from the home screen.

- If you haven’t enrolled in Zelle, you will be prompted to accept the terms and conditions. You will also need to verify your email address or mobile number.

- Enter the email address or mobile number of the person you want to send money to.

- Choose the account you want to send money from, whether it’s your checking, savings, or credit card account.

- Enter the amount you want to send.

- Optionally, you can add a message to your recipient.

- Review your payment details and click “Send”.

- If you have already enrolled in Zelle, you will skip the enrollment process and go straight to the screen where you can enter the recipient information.

- Once you click “Send”, the money will be instantly transferred to the recipient’s bank account if they are already enrolled with Zelle. If the recipient is not enrolled, they will receive a notification with instructions on how to enroll and can then receive the funds.

Sending money through Zelle is a quick and secure way to transfer funds. You can use it to pay back a friend, split bills, send money to family, or make payments for services. With Zelle, you can send money to anyone with a bank account in the U.S., even if they don’t use the same bank as you. Plus, it’s all protected by the banks’ security and verification process, so you can trust that your money is safe.

Select recipient

If you want to send money to someone using Zelle®, you’ll need their email address or U.S. mobile phone number. You can only send money to someone who is already enrolled in Zelle® with JPMorgan Chase and has a U.S. bank account.

To get started, select the recipient you want to send money to. From your Chase mobile app dashboard, select the “Send” button. If you don’t see Zelle® in your Chase mobile app, make sure you have the latest version and enroll in Zelle® by following the prompts.

Once you select the recipient, you will be prompted to enter the amount you want to send. Please review your transfer details and note that you can select “Split” to send money to multiple recipients at once.

After reviewing the transfer details, you will be asked to verify your identity for security purposes. Please enter the verification code you received and submit. If you don’t receive a verification code, please check your email or mobile phone for more information.

Once you have completed the verification process, your payment will be sent directly to the recipient’s JPMorgan Chase bank account. If the recipient is not enrolled in Zelle®, they will receive an email or a text message with instructions on how to enroll and receive the money.

If you have any questions or encounter an error, our dedicated customer service team is available to help. Sending money with Zelle® is a convenient and secure way to move funds between Chase accounts and other banks.

Note: Zelle® is available for personal and business banking customers. Some services, like verification for larger amounts or direct payments for investments, mortgages, or credit card payments, may only be available for certain customers. Please review the Zelle® terms and conditions to learn more about the benefits and limitations of this service.

Enter the amount

When using Zelle, you have the option to send money directly from your bank account to another person. To do this, you will need to enter the amount you wish to send.

It is important to enter the correct amount to avoid any errors or loss of funds. Zelle allows you to send money in various amounts, depending on your needs and the recipient’s requirements. Whether it’s for a payment, an investment, or other purposes, Zelle provides a convenient way to move money quickly and securely.

To enter the amount, follow these steps:

- Log in to your Zelle account. If you are not already enrolled, you will need to apply for enrollment.

- Select the option to send money.

- Enter the recipient’s email or phone number.

- Enter the amount you wish to send.

- Review the terms and conditions for sending money through Zelle.

- Click on the “Send” button to initiate the transfer.

It’s important to note that the availability of Zelle and the terms and conditions may vary depending on your bank and the services they offer. Some banks may require additional verification or have certain restrictions on the amount you can send.

Zelle provides a secure and insured service for sending and receiving money, giving you peace of mind knowing that your funds are protected. It’s also a convenient way to make payments for various purposes, such as bills, entertainment, education, or even sending money to friends and family.

So, when you want to send money using Zelle, remember to enter the correct amount and review all the details before finalizing the transaction. Zelle’s easy-to-use platform and dedicated customer service ensure a smooth and hassle-free experience for all users.

If you have any questions or need assistance, please contact your bank or Zelle support for further assistance.

Enter a note optional

When you complete a Zelle® payment, you have the option to add a note. This note is optional and can be used to provide additional information or a personal message to the recipient.

If you are sending a payment to a friend or family member, you can use the note to let them know what the payment is for, such as “birthday gift” or “repayment for dinner”. It can also be a way to send a simple message, like “thank you” or “thinking of you”.

Adding a note is easy. During the payment process, there will be a section where you can enter the note. Simply type your message in the designated box. Keep in mind that there is a character limit for the note, so be concise.

It’s important to note that the note is for your recipient only. It will not be shared with anyone else and is intended to be a private message between you and the recipient.

Additionally, when entering a note, please make sure to double-check the recipient’s email address or mobile phone number. This is to ensure that the payment is being sent to the correct person. Making an error in the recipient’s contact information could result in the payment being sent to the wrong person, and it may be difficult to retrieve the funds.

If you’re already enrolled in Zelle® and have enabled the “request” and “split” features, you may find it helpful to use the note feature when requesting payments from others or splitting payments among a group of people. The note can provide clarity on the payment request or how the payment should be split.

Finally, if you have any feedback or need assistance with the note feature or any other aspect of Zelle®, you can reach out to Chase Customer Care directly. They are dedicated to providing excellent service and will be able to address any questions or concerns you have about using Zelle®.

Please remember that when using Zelle®, it’s important to follow safe practices to protect your account and personal information. Be cautious when sharing your Zelle® user ID and password, and only use Zelle® with people you trust.

With Zelle®, you can enjoy the convenience of transferring money directly from your JPMorgan Chase bank account to other people. It’s a fast and easy way to send and receive money, whether it’s for splitting a bill with friends, paying a service provider, or sending money to a family member.

So, if you haven’t already enrolled in Zelle®, why not give it a try? It’s a secure and convenient way to move money. Plus, it’s available for Chase customers and is free to use.

Submit

When using Zelle, the process of submitting a payment is quick and easy. Whether you are a business or an individual, you can conveniently send money through Zelle to anyone with a U.S. bank account.

To submit a payment using Zelle, follow these steps:

- Enroll in Zelle: If you haven’t already done so, you need to enroll in Zelle through your bank’s online or mobile banking platform. This process usually takes only a few minutes.

- Select your source account: Once you are enrolled, you will need to select the bank account from which you want to send money.

- Enter recipient details: Provide the recipient’s email address or phone number, depending on their Zelle enrollment. If the recipient is not enrolled in Zelle, you can still send money by entering their bank account information.

- Enter payment details: Specify the amount of money you want to send and include an optional message or note.

- Review and submit: Before finalizing the transaction, review all the entered information to ensure accuracy.

- Confirm the payment: Once you are satisfied with the details, confirm the payment to initiate the transfer. You will typically receive a confirmation code or email as proof of the transaction.

- Follow up and track: You can view the status of your payment by checking the transaction history in your Zelle account or contacting customer support if needed.

It is important to note that Zelle should only be used for sending money to friends, family, or trusted individuals. It is not recommended for making payments related to business transactions, mortgage payments, or other commercial purposes. If you need to move larger amounts or require additional security measures, consider using a dedicated business payment service or consult with your bank for alternative options.

By using Zelle, you can enjoy a convenient and fast way to send money to someone using their email address or phone number, without the need to share sensitive financial information. Keep in mind that each bank may have its own terms and conditions, so make sure to review them before enrolling in Zelle.

For further information about sending and receiving money with Zelle, please refer to the Zelle® service section on your bank’s website or reach out to their customer care. They will be happy to assist you and provide any necessary support.

Select “Request” or “Split”

Once you’ve enrolled in Zelle®, you can start using it to send and receive money online. To initiate a transaction, follow these steps:

- Log in to your Zelle® account using your email address or phone number.

- Go to the main dashboard where you will find options for various banking products.

- Select the option to “Send” or “Request” money.

- If you choose “Send”, enter the recipient’s email address or phone number.

- If you choose “Request”, enter the email address or phone number of the person you want to request money from.

- Set the amount you wish to send or request.

- Optionally, you can include a message to accompany the transaction.

- Click on the “Send” or “Request” button to initiate the transaction.

- If it’s your first time sending or requesting money with a new contact, a verification code will be sent to your email or phone number, which you need to input to proceed.

- If you have already sent money to or received money from the recipient before, you can skip step 9.

- Review the transaction details and click on “Submit” to complete the transaction.

- Wait for the recipient to accept the transaction.

That’s it! You have successfully sent or requested money using Zelle®. Please note that Zelle® is not responsible for any loss or unauthorized transactions, so it’s important to only send money to people you trust.

Select the person you want to receive money from

When using Zelle for online banking, you can easily send or request money from other individuals who are enrolled in the Zelle service. To get started, follow these simple steps:

- Log in to your online or mobile banking app from your banking institution.

- Select the option that allows you to send money with Zelle.

- Choose a recipient from your contacts or enter their email address or mobile phone number.

- If the recipient is already enrolled in Zelle, the information will be displayed. If not, you will be prompted to send a verification code to their phone number or email address to complete the enrollment process.

- Enter the amount you want to send or request. You can also use the Zelle “split” feature to divide the amount between multiple recipients.

- Review the details and confirm the transaction.

- A confirmation message will be displayed, and the recipient will receive a notification about the money transfer.

It’s important to note that the availability of Zelle may vary depending on your banking institution and the terms and conditions of your account. Zelle is a service provided by Early Warning Services, LLC, a private company owned by a consortium of banks including JPMorgan Chase Bank, N.A. (“JPMCB”), JP Morgan Securities LLC (“JPMS”), and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), and is subject to the approval and terms and conditions of these banking institutions.

In order to protect your financial information and ensure the security of your transactions, it is recommended to only use Zelle to send money to people you know and trust. Zelle is not responsible for any loss or damage resulting from the use of the service. To find out more about Zelle and its security features, please visit the official Zelle website or contact your banking institution.

Enter the amount of the request

When using Zelle to send money to friends or family, one of the first steps is to enter the amount of the request. This is the amount of money you would like to send to the recipient.

To enter the amount, simply type the numerical value in the designated field. Make sure to double-check that the amount is correct before submitting the request. If you make an error, you may need to re-enter the correct amount.

It’s important to note that Zelle is primarily used for person-to-person payments and is not recommended for business transactions or for sending money to unknown individuals. Zelle is also not intended for use in requesting or sending cash, as the transactions are conducted through your bank account.

Additionally, Zelle is only available for customers who have a checking or savings account with a participating financial institution, such as JP Morgan Chase. If your bank does not offer Zelle, you may need to enroll directly with Zelle to use the service.

When you enter the amount of the request, Zelle will also provide you with a source code. This code is used for verification purposes and is an added layer of security for your transaction.

Once you have entered the amount and any additional necessary information, such as the recipient’s email address or mobile phone number, you can review your request and then click on the “send” button to submit it. After that, you will receive a confirmation message, and the recipient will be notified of the payment.

In addition to sending money, Zelle also offers a wealth of other products and services to help you with your finances. For example, you can use Zelle to pay bills, view your account balances, and even set up automatic payments for recurring expenses like mortgages or car payments.

If you would like to learn more about Zelle and its various features, you can visit the JP Morgan Chase website or reach out to their customer service center. They have a wealth of educational resources available to help you navigate the world of banking and financial services.

So, if you need to move money quickly and securely, give Zelle a try. Whether you’re sending money to a friend or paying a bill, Zelle can help you get it done in just a few minutes.

Follow us

Stay connected with us and make the most out of your Zelle experience by following us on social media. Be insured to receive helpful tips, updates, and important information about our services. Whether you want to send money to a friend, split bills, or request money from someone, we are here to help.

Follow us on our dedicated Zelle page on Facebook and Twitter to stay up-to-date with the latest news, customer feedback, and feature releases. Our customer care team is also available on these platforms to address any questions or concerns you may have.

Additionally, visit our online Help Center for step-by-step guides and frequently asked questions about Zelle. From setting up your account to reviewing your transaction history, the Help Center is a valuable resource that can assist you in navigating the Zelle platform.

If you are new to Zelle and would like to learn more about its benefits, this is the place to be. Our educational resources provide insights into the security features of Zelle, how to protect your account from fraud, and best practices for sending and receiving money safely.

Follow us today and join millions of people who are already enjoying the convenience and speed of Zelle for their everyday financial needs. Give Zelle a try, and experience a seamless money transfer service that is fast, secure, and reliable.

To get started, simply download the Zelle mobile app from your app store and sign up with your mobile number and email address. Once enrolled, you can send and receive money directly from your linked bank account using just a recipient’s mobile number or email address.

For more information about Zelle and our services, visit our website or contact your local Chase branch. We are here to help you achieve your financial goals and provide peace of mind when it comes to managing your wealth.

| About Us | Careers | Feedback | Privacy & Security |

| Code of Conduct | Enrollment | Terms of Use | Source Code |

Checking Accounts

Checking accounts are a type of bank account that allows customers to deposit and withdraw money on a regular basis. They are often used for day-to-day expenses such as paying bills, making purchases, and receiving income.

When opening a checking account, it is important to choose a bank that you trust and feel comfortable with. Some banks offer additional benefits such as free checks, online banking, and access to a network of ATMs.

One popular feature of checking accounts is the ability to set up automatic payments and direct deposits. This allows customers to have their bills paid automatically and their income deposited directly into their account.

Checking accounts also offer the convenience of debit cards, which can be used to make purchases and withdrawals at ATMs. However, it’s important to keep track of your spending and make sure you have enough funds in your account to cover any transactions.

Another important aspect of checking accounts is the availability of mobile banking. Many banks offer mobile apps that allow customers to check their account balances, view transaction history, and make transfers from their smartphone or tablet.

Most checking accounts are insured by the Federal Deposit Insurance Corporation (FDIC), which protects deposits up to $250,000 per depositor, per bank. This provides an added level of security and peace of mind for customers.

If you decide to open a checking account, you will need to provide some personal information, such as your name, address, and social security number. You may also need to provide identification and proof of address.

Once your account is open, you can start using it to manage your finances. This includes depositing checks, making payments, and tracking your expenses. Many banks also offer budgeting tools and financial education resources to help you stay on track.

In summary, checking accounts are a convenient and secure way to manage your day-to-day finances. They offer a variety of features and benefits, such as online banking, mobile apps, and FDIC insurance. If you are looking to open a checking account, be sure to compare different options and choose one that meets your needs.

Savings Accounts CDs

At JPMCB, we offer a wide range of banking products to help you manage your money and reach your financial goals. One of our featured services is the Savings Accounts CDs. With this account, you can enjoy competitive interest rates while keeping your money secure and easily accessible.

When you open a Savings Accounts CDs with JPMCB, you will have a dedicated account to store your funds. You can view and manage your account through our user-friendly online and mobile banking platforms. Simply log in to your account using your username and password, and you will have access to a wide range of features and tools to help you stay on top of your finances.

With our Savings Accounts CDs, you also have the option to receive notifications and alerts regarding your account. We offer a convenient “request” feature that allows you to send and receive money from other people who are also enrolled in Zelle®. It only takes a few minutes to complete the enrollment process, and you can start using Zelle® right away to move money between your accounts or send money to friends and family.

For added security, we provide a code to protect your account and verify your identity when you make certain requests. This helps to ensure that only you have access to your account and funds. If you ever need assistance or have any questions about our Savings Accounts CDs, our dedicated customer service team is available to help you.

| About Savings Accounts CDs | With our Savings Accounts CDs, you can choose from various investment options to help grow your wealth. We offer competitive interest rates and flexible terms, allowing you to find the best option for your financial needs. |

| Auto Savings | If you’re looking to build your savings effortlessly, our Auto Savings feature is perfect for you. With Auto Savings, you can set up automatic transfers from your checking account to your savings account at regular intervals. This helps you save without even thinking about it. |

| Education Savings | Planning for your child’s education? Our Education Savings account can help you save for their future. This account offers tax advantages and flexible contribution options, making it easier for you to give your child the best education possible. |

Whether you’re saving for a special purchase, building an emergency fund, or planning for a comfortable retirement, our Savings Accounts CDs provide a secure and convenient way to grow your savings. Apply online or visit your nearest branch to open an account and start enjoying the benefits today!

Credit Cards

When it comes to managing your finances, having a credit card can be a valuable tool. Whether you’re using it for everyday expenses, big purchases, or emergencies, having a credit card gives you the flexibility and convenience to pay for goods and services without directly using the funds from your checking or savings account.

With credit cards, you’re able to review your purchases and payments online, helping you keep track of your spending habits and manage your budget. Additionally, many credit cards offer rewards programs, cash back benefits, and other perks that can save you money in the long run.

When you apply for a credit card, there are a few things to keep in mind. First, it’s important to consider the interest rates, annual fees, and any other terms and conditions that may apply. You’ll also want to protect your credit card information and only enter it on secure websites. It’s always a good idea to review your credit card statements regularly to check for any unauthorized charges or suspicious activity. If you do notice any issues, be sure to report them to your credit card company immediately.

Another important aspect of credit cards is payment security. Many credit card companies offer services like fraud protection and zero-liability policies, which can protect you from fraudulent charges or loss of funds. It’s also recommended to enroll in online or mobile banking to take advantage of features like email or mobile alerts, which can notify you of any suspicious activity on your account.

If you’re interested in investing, some credit cards offer investment benefits as well. For example, JPMorgan Chase offers a range of credit cards that allow you to earn rewards that can be used towards investments or other financial goals. These cards also come with dedicated customer service and a dedicated online dashboard to help you track and manage your investments.

Overall, credit cards can be a valuable financial tool if used responsibly. They provide a convenient way to pay for goods and services, offer security features to protect your funds, and often come with additional benefits and rewards. If you’re thinking of applying for a credit card, be sure to do your research, compare options, and choose the one that best fits your financial needs and goals.

Mortgages

Are you looking to buy a new home? At JPMorgan Chase, we offer a variety of mortgage options to help you finance your dream home. Our mortgages are designed to meet the needs of all clients, whether you’re a first-time home buyer or a seasoned investor.

When you apply for a mortgage with us, you can also enroll in Zelle, a fast and convenient way to send and receive money. With Zelle, you can easily send payment to your mortgage lender or receive funds from other people.

To enroll in Zelle, all you need is a checking account with JPMorgan Chase. Simply submit a request through our online portal or directly through our mobile app. Once enrolled, you can easily send money using just the recipient’s email or phone number.

One of the benefits of using Zelle is that it offers an optional feature called “Quick Pay”. With Quick Pay, you can choose to send money directly to your mortgage lender or to another person’s Zelle account. This makes the payment process even faster and more convenient.

With Zelle, you don’t have to worry about the security of your payments. JPMorgan Chase uses state-of-the-art encryption and security measures to protect your financial information. Your transactions are always private and secure.

If you’re already enrolled in Zelle, you can easily find your mortgage lender in the list of available recipients. Just search for their name or enter their email or phone number. If you can’t find your lender, you can contact our dedicated customer service center for assistance.

At JPMorgan Chase, we’re dedicated to helping you every step of the way. That’s why we also offer a variety of online tools and services to help you manage your mortgage. From our mortgage calculator to our wealth management services, we have everything you need to stay on top of your finances.

To find out more about our mortgage options and how Zelle can help you, please visit our website or speak to a mortgage specialist. We’re always here to help you achieve your homeownership goals.

Auto

With Zelle, you can send or receive money from people you know and trust using just their email address or U.S. mobile phone number. Whether you’re sending money to a person or a business for mortgages, auto payments, entertainment, or any other purpose, Zelle makes it easy and convenient.

When you enroll with Zelle, you’ll have access to a dedicated dashboard where you can view all your Zelle transactions, including when you’ve received money and when you’ve sent money. You can also set up notifications to receive feedback on your transactions and stay up-to-date on any activity in your Zelle account.

If you’re already a JPMorgan Private Wealth client, you can enroll in Zelle and start sending and receiving money right away. It’s a great way to consolidate all your financial needs in one place and make managing your money easier. Plus, Zelle offers a secure platform that protects your money and personal information.

When you enroll in Zelle, you can also take advantage of some additional benefits. For example, you can try out Zelle’s “split” feature, which allows you to easily split expenses with friends or family by sending them a message through Zelle. You can also set up automatic payments to pay bills or make recurring transfers to your savings or investment accounts.

Enrolling in Zelle is quick and easy. Simply complete the online enrollment form, provide some basic information, and follow the prompts to verify your email address or U.S. mobile phone number. Once you’re enrolled, you can start sending and receiving money right away.

If you’re not sure if the person or business you want to send money to is enrolled in Zelle, don’t worry. Zelle will automatically check their email address or U.S. mobile phone number to see if they’re enrolled. If they’re not, you can still send them a payment and they’ll receive a notification to enroll and claim the money.

With Zelle, you have the convenience and flexibility to send and receive money whenever and wherever you want. Whether you’re helping a friend with a mortgage payment, paying for a car loan, or sending money to a family member for their education, Zelle can help make the process quick and easy.

So why wait? Enroll in Zelle today and start enjoying the benefits of fast, secure, and convenient money transfers.

Chase for Business

If you are a business owner, Chase for Business offers a variety of benefits for you to take advantage of. With Chase for Business, you can easily send and receive money, protect your cash, and even view and manage your accounts online from the convenience of your mobile phone.

One of the key features of Chase for Business is the ability to send and receive money quickly and securely. You can send money to anyone with a Chase account or an account at another participating bank in just a few minutes. Plus, with Chase QuickPay®, you can send or request money from anyone using just their email address or mobile phone number.

To ensure the security of your transactions, Chase for Business provides dedicated security measures. All transactions must go through a thorough verification process and are insured up to the maximum allowed by law. Plus, you can set up alerts to notify you of any suspicious activity on your account.

In addition to the convenient money-sending features, Chase for Business also offers a wealth of other services to help you manage your business. You can apply for a business credit card, find tips for managing your cash flow, use the online banking calculator to review and track your expenses, and even set up automatic payments for recurring bills.

When it comes to customer service, Chase for Business has you covered. You can access a dedicated team of business banking specialists who are available to answer your questions and provide personalized assistance. In addition, Chase for Business offers educational resources to help you make informed decisions about your business finances.

Whether you’re a small business owner, a medium-sized enterprise, or a large corporation, Chase for Business has the services and features to meet your needs. Sign up today and start taking advantage of all the benefits Chase for Business has to offer.

Investing by JP Morgan

JP Morgan offers a range of investing products and services to help individuals and businesses grow their wealth. With JP Morgan, you can invest in a variety of investment options, from stocks and bonds to mutual funds and ETFs. Whether you’re a seasoned investor or just starting out, JP Morgan has solutions to meet your financial goals.

When it comes to investing, JP Morgan is known for its dedication to customer service and security. With a JP Morgan account, you can manage your investments online, access a wide range of research and analysis tools, and receive personalized investment advice from experienced professionals.

JP Morgan offers a variety of banking products and services to support your investing efforts. From checking accounts and credit cards to mortgages and auto loans, JP Morgan has everything you need to manage your finances and reach your financial goals.

JP Morgan’s investing platform, Zelle, allows you to send money directly to other people from your JP Morgan account. With Zelle, you can easily split bills, pay back friends, or send money as a gift. To use Zelle, simply enter the recipient’s phone number or email address, select the amount you want to send, and hit “send”. The recipient will receive the money in minutes.

One of the key benefits of using Zelle is its speed and convenience. You don’t need to write a check or wait for the recipient to cash it. Zelle allows for instant and secure money transfer, making it ideal for situations where time is of the essence.

Another benefit of using Zelle is its security. When you send money with Zelle, your transaction is encrypted and monitored for potential fraud. This helps to protect your money and personal information from unauthorized access.

It’s important to note that Zelle is only available to JP Morgan customers who have enrolled in the service. If you’re not currently enrolled in Zelle, you can easily do so through your JP Morgan online banking account.

To enroll in Zelle, simply go to your JP Morgan online banking account and follow the instructions to set up Zelle. Once enrolled, you can start sending and receiving money with Zelle immediately.

In addition to Zelle, JP Morgan offers a range of other online banking services, such as bill payment, direct deposit, and mobile banking. These services allow you to manage your finances from anywhere, at any time.

If you’re interested in investing with JP Morgan or would like to learn more about their products and services, you can visit their website to review the available options and terms. From there, you can apply online or request a call from a dedicated JP Morgan representative to discuss your investing needs.

JP Morgan is committed to helping people achieve their financial goals through investing and banking. With a wide range of products and services, they strive to provide options that meet the needs of all customers.

| Investing with JP Morgan | Zelle | Online Banking |

|---|---|---|

| Stocks | Send money to other people | Bill payment |

| Bonds | Split bills or pay back friends | Direct deposit |

| Mutual Funds | Send money as a gift | Mobile banking |

| ETFs | Fast and secure money transfer |

Chase Private Client

Chase Private Client is a banking and investment service offered by JPMorgan Chase Bank, N.A. and its affiliates (“JPMC”), including JPMorgan Chase & Co. and its subsidiaries worldwide. As a Chase Private Client, you’ll have access to a full range of products and services to help you manage and grow your wealth.

With Chase Private Client, you can move money between your Chase accounts and to other recipients using the Zelle® service. Zelle allows you to send cash directly to another person’s bank account using their email address or mobile phone number. It’s a convenient and secure way to send money without the need for cash or checks.

To send money through Zelle, simply log in to your Chase Private Client account, go to the “Payments & Transfers” section, and select “Send Money with Zelle”. Enter the recipient’s email address or mobile phone number and the amount you want to send. Review the payment details and click “Send” to complete the transaction.

Chase Private Client also offers additional benefits to help you manage your accounts and protect your financial information. The Zelle service includes built-in security features, such as authentication codes, to safeguard your transactions. You can review and track your Zelle requests in the “Payment Center” section of your account dashboard.

If you have any issues or need assistance with Zelle or any other Chase Private Client services, you can contact the customer service center for help. The customer service representatives are available to assist you with any questions or concerns you may have.

Chase Private Client is not only for individuals, but also offers services for businesses. If you’re a business owner, you can enroll your business accounts in Chase Private Client to take advantage of the benefits and features. You can choose from a variety of Chase Private Client accounts, including checking, savings, credit cards, mortgages, and investment products.

To apply for Chase Private Client, you must meet certain eligibility requirements, including a minimum asset threshold. You can find more information and submit an application on the Chase Private Client website or by contacting your local Chase branch.

Chase Private Client aims to provide exceptional service and value to its customers. If you have any feedback or suggestions, you can provide them to the customer service center or through the Chase Private Client website. Your feedback helps us improve our products and services to better serve you.

About Chase

Chase is a bank that offers a wide range of financial services. Whether you need a checking account, savings account, credit card, or even investment products, Chase has you covered. They also provide services like mortgages, personal loans, and auto loans to help you achieve your financial goals.

One of the standout features of Chase is their mobile banking app. With the app, you can easily manage your accounts, pay bills, check your credit score, and even make investment trades. It’s a convenient way to stay on top of your finances no matter where you are.

Chase is dedicated to helping their customers protect their wealth and achieve their financial dreams. They offer a variety of security features to keep your personal and financial information safe. From encryption to identity verification, Chase has you covered.

If you’re already a Chase customer, you can easily enroll in their Zelle service. Zelle is a convenient way to send and receive money from friends and family directly through your Chase app. You can even use Zelle to request money from people who owe you or “split” the cost of an expense.

Chase also offers a range of investment products through J.P. Morgan Securities LLC (JPMS), including accounts like CDs and managed portfolios. If you’re interested in investing, Chase can help you find the right options for your financial goals.

When it comes to customer service, Chase is known for their dedicated support team. If you have any questions or need assistance, you can contact their customer service center or utilize their online resources for more information.

In conclusion, Chase is a trusted bank that offers a wide range of financial services to meet your needs. Whether you’re looking to open a new account, apply for a loan, or invest in your future, Chase has the tools and resources to help you succeed.

Sports Entertainment

If you’re a fan of sports and entertainment, Chase offers a range of services and products to help you enjoy your favorite activities while managing your finances. Whether you’re looking to set up a checking account, apply for a mortgage, or try out our investment products, we have options that will suit your needs and preferences.

One of our popular services is Zelle, a fast and secure way to send and receive money. With Zelle, you can easily split bills with friends or send money to family members. It’s available for both personal and business accounts, and you can enroll in Zelle through our mobile app or online banking.

In addition to Zelle, we offer other banking services like checking and savings accounts, CDs, and mortgage products. Our customer service team is always available to help you with any questions or requests you may have.

If you’re worried about the security of your transactions, rest assured that we take the necessary measures to protect your information. We use encryption and other security protocols to ensure that your money and personal details are safe.

When it comes to sports and entertainment, we understand that timing is important. That’s why we offer fast and efficient services that allow you to complete your transactions in minutes. Whether you need to send money to a sports agency or submit a mortgage application, we make sure that you’re able to do so quickly and easily.

If you’re interested in our sports and entertainment services, please get in touch with our customer service team. They will be happy to review your needs and offer you guidance on how to best manage your finances.

At Chase, we’re committed to helping you enjoy your favorite sports and entertainment activities while providing you with the financial services you need. We understand that sports and entertainment can be expensive, and that’s why we offer tips and advice on how to save money and make the most of your budget.

So, whether you’re a sports fan looking to protect your investments or an entertainment enthusiast wanting to make the most of your savings, Chase has the services and products that will suit your needs.

Chase Security Center

The Chase Security Center is a dedicated resource to help protect your personal and business accounts. We offer a range of security services and features to ensure the safety of your money and personal information.

When you enroll in Chase Online, you can take advantage of our advanced security measures, including two-factor authentication and biometric login options. This helps to ensure that only you can access your accounts, even if your login information is compromised.

Our security center also offers a variety of tools and resources to help you stay informed and protected. You can sign up for security alerts via email or text message, review and manage recent account activity, and find tips on how to recognize and avoid common scams.

If you ever suspect fraudulent activity on your account, our dedicated team of fraud specialists is available to help. We have a comprehensive process in place to investigate and resolve any issues, and we will work with you every step of the way to protect your financial security.

In addition to our online security measures, we also offer optional services to further protect your accounts. You can choose to set up alerts for specific transactions or account activity, apply for a credit freeze to prevent unauthorized access, or enroll in identity theft protection services.

At Chase, we understand the importance of safeguarding your financial information. That’s why we are constantly enhancing our security measures to stay ahead of emerging threats. We invest in advanced technology and employ a team of cybersecurity experts to keep your information safe.

Our commitment to security extends to our mobile banking app as well. With our mobile app, you can securely access your accounts, complete transactions, and manage your finances on the go. We use industry-standard encryption and security protocols to protect your data.

Whether you’re sending money to a friend, paying bills, or managing your investments, you can have peace of mind knowing that your transactions are secure with Chase. We have implemented the Zelle® feature, which allows you to easily send money to recipients using just their email address or mobile phone number.

In the Chase Security Center, you can also find information about our other products and services, such as credit cards, auto loans, and mortgage options. We offer a wide range of financial solutions to meet your needs.

So if you’re looking for a bank that prioritizes your security and offers a complete suite of banking services, look no further than Chase. We are dedicated to helping you protect your money, manage your finances, and achieve your financial goals.

Other Products & Services

In addition to Zelle, we offer a range of other products and services to meet your needs. Whether you’re looking for banking solutions, investment options, or wealth management services, we have you covered. Our dedicated team is here to help you every step of the way.

If you would like to explore our other products and services, please visit our website or contact our customer service center. Our knowledgeable representatives will be happy to assist you and address any questions or concerns you may have.

For individuals looking to manage their finances, we offer a variety of checking and savings accounts, CDs, and credit options. With easy-to-use online banking and a mobile app, you can conveniently view your accounts, move money, and pay bills from anywhere, at any time.

If you’re interested in investing, our wealth management services provide access to a wide range of investment options. From auto-investing to personalized portfolio management, our team will help you find the right solution for your financial goals.

For business clients, we offer a range of services to help you manage your finances and grow your business. From business checking accounts to payment processing options, we have the tools and resources you need to succeed.

In addition to Zelle, we also offer other convenient payment options, such as wire transfers and bill pay. Whether you need to send money to a friend or make a payment to a vendor, we have you covered.

We understand that security is a top priority for our customers. That’s why we have implemented robust security measures to protect your personal and financial information. When using our services, you can rest assured knowing that your data is encrypted and your transactions are secure.

As a part of JP Morgan Wealth Bank, we are backed by a strong financial institution. Our customers benefit from the expertise and resources of one of the world’s leading banks, ensuring that their financial needs are met with the highest level of service and professionalism.

Whether you’re already a customer or new to JP Morgan Chase, we are here to help. Follow the links below to learn more about our products and services, or contact us directly to speak with a representative.

Thank you for choosing JP Morgan Chase. We look forward to serving you and helping you achieve your financial goals.

What if I get an error message when I try to enroll an email address or US mobile number

If you receive an error message when trying to enroll an email address or US mobile number with Zelle®, there could be a few reasons for it:

1. Verification: JPMorgan Chase Bank, N.A. and JPMorgan Chase Bank, N.A. JPMS, CIA and JPMCB, is a subsidiary of JPMorgan Chase Bank, N.A., a member of FDIC, and a licensed insurance agency, which is licensed to receive fees for its services. Investment products and related services are offered through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor. You can verify the source of the request by contacting our customer care services.

2. Already enrolled: If the email address or US mobile number you are trying to enroll is already associated with another Zelle® account, you may receive an error message. Please check the Zelle® dashboard to see if you are already enrolled.

3. Security concerns: To enroll in Zelle®, ensure that the recipient email address or US mobile number is correct. It is important to protect your personal information and only provide it to trusted sources. If you are still receiving an error message, please check with your bank or financial institution for further assistance.

4. Address verification: Some banks require address verification when enrolling in Zelle®. If you are having trouble enrolling, check with your bank to ensure that your mailing address is up to date.

5. Payment declined: If you are trying to enroll a business account, some banks may decline the enrollment. Zelle® is primarily meant for personal use, so it may not be available for business accounts.

If you continue to experience issues or receive error messages, it is recommended to give feedback to the Zelle® customer care service. They can review the error and provide you with further assistance to complete the enrollment process. Remember to provide as much information as possible about the error message you are receiving.

Sources

When it comes to creating a Zelle account, there are several sources you can turn to for information and assistance. Here are some key sources:

- JPMorgan Chase: As the source and provider of Zelle, JPMorgan Chase offers a wide range of services and products, including checking accounts, savings accounts, mortgages, investment services, wealth management, and more.

- Zelle® website: The official Zelle website is a valuable source of information. You can find details about how to enroll, complete an application, and send or receive money using Zelle.

- Customer support: If you have any questions or need assistance, you can contact the customer support team at JPMorgan Chase or the Zelle customer support team. They can provide guidance and address any concerns you may have.

- Terms and conditions: Understanding the terms and conditions of using Zelle is important. Make sure to review and familiarize yourself with the terms to protect yourself and your accounts.

- Security tips: To ensure the security of your Zelle transactions, it’s important to follow security tips provided by JPMorgan Chase and Zelle. These tips may include advice on setting up strong passwords, protecting your personal information, and being cautious when receiving requests to send money.

- Online resources: There are various online resources available that provide tips and insights on using Zelle effectively. You can find articles, videos, and tutorials that can help you learn more about Zelle and its features.

By utilizing these sources, you can make informed decisions and have a better understanding of how to create a Zelle account and use it for sending and receiving money with ease.