If you are looking to build wealth over the long term, investing in mutual funds can offer you an easy and effective way to achieve your financial goals. But before you start, there are a few things you need to consider. Building a portfolio of mutual funds requires careful planning and understanding of various investment classes, risk appetite, and goals.

Here’s a step-by-step guide on how to create an ideal mutual fund portfolio that aligns with your life goals and risk tolerance:

- 1. Define Your Goals

- 2. Assess Your Risk Appetite

- 3. Spread Investments Across Asset Classes

- 4. Select the Right Funds

- 5. Consider the Details

- 6. Evaluate Regularly

- 7. Understand the Risks

- How to Build a Mutual Fund Portfolio: Here’s a 7-Point Easy Guide to Creating an Ideal Mutual Fund Portfolio for Long Term

- Step 1: Start With your Goals and Tag Each Mutual Fund to Specific Goals

- How to build a mutual fund portfolio

- Things To Consider Before Building a Mutual Fund Portfolio

- Investment Objectives

- Risk Appetite

- Fund Expenses

- Fund Performance

- Video:

- Building a Diversified Portfolio: My 13 Crore Journey | Investing for Beginners 2023 | Warikoo Hindi

1. Define Your Goals

Before you start investing, it’s essential to have a clear understanding of what you are looking to achieve. Identify your short-term and long-term goals, such as buying a house, funding your child’s education, or retiring comfortably. Each goal may require a different investment approach and time horizon.

2. Assess Your Risk Appetite

The next step is to determine your risk appetite. While investing in mutual funds offers the potential for higher returns, it also comes with its share of risks. Consider your age, financial situation, and how much risk you are willing to take. This will help you determine the right balance between growth-oriented funds and fixed income funds.

3. Spread Investments Across Asset Classes

Diversification is a crucial factor in building a successful mutual fund portfolio. Allocate your investments across different asset classes, such as equity funds, debt funds, and hybrid funds. This will help spread the risk and protect your portfolio from the volatility of a single asset class.

4. Select the Right Funds

Once you have defined your goals and risk appetite, it’s time to select the right mutual funds for your portfolio. Look for funds that have a consistent track record of performance, low expense ratio, and a fund manager with a proven track record. Consider factors such as fund size, investment style, and fund house reputation before making a decision.

5. Consider the Details

When selecting funds, pay attention to the fund’s investment philosophy, expense ratio, and fund manager’s strategy. Check if the fund aligns with your investment goals, time horizon, and risk tolerance. Analyze the fund’s historical performance and compare it with its benchmark and peers to get a better understanding of its past performance.

6. Evaluate Regularly

Your job doesn’t end after selecting the right funds. Regularly evaluate your portfolio’s performance and make necessary changes if required. Assess the performance of individual funds and their alignment with your investment goals. Keep an eye on market trends, economic factors, and fund performance. Remember, investing is a long-term commitment, and periodic evaluations are crucial to ensure the desired outcomes.

7. Understand the Risks

Lastly, it’s important to understand the risks associated with mutual fund investments. Mutual funds are subject to market risks, including the possibility of losing a portion or all of your invested capital. It’s essential to consider factors such as market volatility, inflation, and interest rate risks before making investment decisions. Consider consulting a financial advisor to get a better understanding of the risks involved.

Creating a well-diversified mutual fund portfolio may seem overwhelming at first, but by following these steps and considering the factors mentioned above, you can build a portfolio that aligns with your financial goals and risk appetite. Remember, regular evaluation and adjustments are necessary for maintaining the portfolio’s performance and meeting your long-term objectives.

Investing in mutual funds involves risk, including the possible loss of principal. You should carefully consider the investment objectives, risks, charges, and expenses of any mutual fund before investing. Past performance is not indicative of future results. The information provided here is for informational purposes only and should not be considered financial advice. Always consult with a professional advisor before making investment decisions.

How to Build a Mutual Fund Portfolio: Here’s a 7-Point Easy Guide to Creating an Ideal Mutual Fund Portfolio for Long Term

Building a mutual fund portfolio is an essential step for long-term wealth creation for investors. It involves selecting the right mutual fund schemes that align with your specific goals and risk appetite. Here’s a 7-point easy guide to help you create an ideal mutual fund portfolio:

- Identify your goals and objectives: Before you start investing, it is important to determine your financial goals and objectives. Are you looking for regular income, long-term capital growth, or a combination of both? Identify what you want to achieve with your investments.

- Consider your risk appetite: Every investor has a different risk appetite. Some individuals are willing to take high risks for the potential of higher returns, while others prefer more stability. Define your risk tolerance before selecting mutual fund schemes.

- Select the right asset classes: Mutual funds offer various asset classes such as equity, debt, gold, and more. Each asset class has its own characteristics and potential returns. Determine which asset classes will help you achieve your goals and allocate your investments accordingly.

- Work out the right balance: Once you have identified the asset classes, it is important to allocate your investments appropriately. A well-diversified portfolio can help mitigate risks and provide stable returns. Determine the ideal mix based on your goals, risk appetite, and investment horizon.

- Consider index funds: Index funds are passive investment funds that aim to replicate the performance of a specific index, such as the S&P 500. These funds can offer lower expense ratios and can be a good addition to a mutual fund portfolio.

- Keep expenses in check: Mutual fund expenses can eat into your returns. Before investing, consider the expense ratios and other charges associated with the mutual fund schemes you are considering. Lower expenses can significantly impact your overall returns in the long term.

- Follow the 7-point rule: The 7-point rule suggests that you should invest in at least seven different mutual fund schemes. This helps diversify your portfolio and reduces the impact of any individual fund’s performance. Consider a mix of large-cap, mid-cap, small-cap, debt, and other funds to build a strong and well-balanced portfolio.

Building a mutual fund portfolio requires careful consideration of various factors. By following these 7 points, you can create an ideal mutual fund portfolio that aligns with your specific goals and risk appetite. Remember to regularly review and rebalance your portfolio to ensure it stays in line with your objectives.

FAQs:

1. What are the benefits of investing in mutual funds?

Investing in mutual funds offers several benefits, including diversification, professional management, liquidity, and the potential for higher returns compared to traditional bank savings accounts.

2. Should I invest in dividend or growth-oriented mutual funds?

The choice between dividend or growth-oriented mutual funds depends on your financial goals and objectives. Dividend funds provide regular income, while growth-oriented funds focus on capital appreciation. Consider your income needs and investment horizon before making a decision.

3. How do mutual funds work?

Mutual funds pool money from multiple investors and invest it in a diversified portfolio of securities. The fund is managed by professional fund managers who make investment decisions based on the fund’s objectives and investment strategy.

4. What is the role of inflation in mutual fund investing?

Inflation erodes the purchasing power of money over time. When investing in mutual funds, it is important to consider the impact of inflation on your returns. Look for funds that have historically provided returns that outpace inflation.

Step 1: Start With your Goals and Tag Each Mutual Fund to Specific Goals

When it comes to creating a mutual fund portfolio, it’s important to start with your goals in mind. What do you want to achieve with your investments? Are you looking for long-term growth, regular income, or a combination of both?

Take some time to outline your financial goals and determine how much risk you are willing to take. This will help you allocate your investments effectively and choose the right mutual funds to help you reach your objectives.

Once you have a clear understanding of your goals, the next step is to tag each mutual fund in your portfolio to specific goals. For example, if you are planning for retirement, you might allocate a portion of your investments to a mutual fund that focuses on long-term growth. Similarly, if you are saving for your child’s education, you might choose a mutual fund that aims to provide regular income.

It’s important to remember that different mutual funds have different investment objectives and strategies. Some mutual funds may focus on specific asset classes, such as stocks, bonds, or gold, while others may spread their investments across multiple asset classes. By tagging each mutual fund to specific goals, you can ensure that your investments are aligned with your overall financial planning.

Another essential factor to consider when creating your mutual fund portfolio is expenses. Each mutual fund comes with its own expense ratio, which represents the cost of managing the fund. It’s important to compare expense ratios between funds and consider how these expenses may impact your returns over the long term.

Here’s a simple rule to follow: before you buy a mutual fund, make sure you understand its investment objective, strategy, expense ratio, and historical performance. Don’t be afraid to ask questions or seek professional advice if needed.

While building your mutual fund portfolio, it’s also important to diversify your investments. Diversification helps spread the risk across different asset classes and reduces the impact of any single investment on your overall portfolio. Consider including a mix of equity funds, debt funds, and other asset classes to build an ideal portfolio that suits your risk tolerance and goals.

When it comes to investing, there are no guarantees, and it’s important to understand that all investments come with inherent risks. However, a well-planned and diversified mutual fund portfolio can help mitigate some of these risks and potentially provide better returns over the long term.

Here are some FAQs to help guide you:

- What is the most important thing to consider when creating a mutual fund portfolio?

- How do I determine my risk tolerance?

- What are the different types of mutual funds?

- What is an expense ratio?

- Should I invest in index funds or actively managed funds?

- What is the impact of inflation on my investments?

By considering these questions and carefully planning your mutual fund portfolio, you can increase your chances of achieving your financial goals and building a successful investment portfolio.

How to build a mutual fund portfolio

Building a mutual fund portfolio is an important step in your investment journey. It helps you diversify your investments, manage risks, and work towards your financial goals. But what exactly is a mutual fund portfolio, and how can you create one? Here’s a step-by-step guide on how to do it:

1. Define your investment goals: Before you start building your portfolio, you need to determine what your investment objectives are. Do you want to save for retirement, buy a house, or generate regular income? Understanding your goals will help you select the right mutual funds.

2. Assess your risk appetite: Every investor has a different risk appetite. Some are willing to take higher risks for potentially higher returns, while others prefer a more conservative approach. Consider your risk tolerance before selecting the mutual fund classes that align with your goals.

3. Understand the different types of mutual funds: Mutual funds come in various types, such as equity funds, fixed income funds, index funds, and balanced funds. Each has its own investment strategy and objectives. Learn about the different types to determine which ones are suitable for your portfolio.

4. Consider your time horizon: The time period you have before you need to access your funds also plays a factor in building your portfolio. If you have a long-term investment horizon, you might be willing to take on more risk. For short-term goals, you might want to focus on more conservative options.

5. Spread your investments: To reduce risk, it’s important to spread your investments across different asset classes and sectors. This way, if one asset class performs poorly, the others may help balance out the losses. Diversification is key to building a resilient portfolio.

6. Select the right mutual funds: Now that you have defined your goals, assessed your risk appetite, and considered your time horizon, it’s time to select the mutual funds that align with your objectives. Look for funds that have a track record of consistent returns, low expense ratios, and a solid investment team.

7. Monitor and review regularly: Building a portfolio is not a one-time task. You need to monitor your investments and review your portfolio on a regular basis. Keep track of the performance of your mutual funds and make adjustments if necessary. This will ensure that your portfolio remains in line with your goals.

While building a mutual fund portfolio takes time and effort, it can be a rewarding process. Remember to consider your goals, risk tolerance, and time horizon before making any investment decisions. By following these steps and regularly reviewing your portfolio, you can work towards creating a strong and diversified mutual fund portfolio that aligns with your financial objectives.

Here are a few FAQs about mutual fund portfolio building:

Q: What is the difference between a mutual fund and a bank?

A: Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities. Banks, on the other hand, offer various financial services, including savings and checking accounts, loans, and mortgages.

Q: How can a mutual fund portfolio help me with my financial planning?

A: A mutual fund portfolio can help you achieve your financial goals by providing opportunities for long-term growth, income generation, and capital preservation. It allows you to invest in a diversified portfolio of securities managed by professional fund managers.

Q: Should I invest in index funds or actively managed funds?

A: Index funds aim to replicate the performance of a specific market index, while actively managed funds are managed by fund managers who aim to outperform the market. Both options have their pros and cons, so it depends on your investment objectives and preferences.

Q: What are the expenses involved in building a mutual fund portfolio?

A: Mutual funds charge expenses, such as management fees and operating expenses, to cover the costs of managing the fund. These expenses are typically expressed as an expense ratio, which is a percentage of the fund’s net assets.

Q: Are there any guarantees in mutual fund investments?

A: Mutual funds do not offer any guarantees on investment returns. The value of your investment can go up or down based on market conditions and the performance of the underlying securities in the portfolio.

Remember, building a mutual fund portfolio requires careful consideration and planning. Take the time to understand your investment goals, risk tolerance, and time horizon before making any decisions. With proper research and a well-diversified portfolio, you can work towards achieving your financial objectives.

Things To Consider Before Building a Mutual Fund Portfolio

Building a mutual fund portfolio may seem easy, but there are several important factors to consider before you start investing. Here’s a 7-point checklist to help you create an ideal portfolio that aligns with your financial objectives and risk appetite:

| 1. | Understand your investment objectives |

| 2. | Assess your risk tolerance |

| 3. | Select the right fund classes |

| 4. | Determine asset allocation |

| 5. | Consider your time horizon |

| 6. | Factor in expenses and fees |

| 7. | Regularly review your portfolio |

Here’s a breakdown of each step and why it is essential:

1. Understand your investment objectives: Before you start investing, you need to clearly define your goals and what you want to achieve with your investments. Are you looking for long-term growth, regular income, or a combination of both?

2. Assess your risk tolerance: Understanding how much risk you are willing to take is crucial. Some funds offer higher potential returns, but they also come with higher risks. Consider your age, financial situation, and comfort level with market fluctuations.

3. Select the right fund classes: Mutual funds offer different classes, such as equity funds, fixed income funds, index funds, and more. Each class has its own specific details and objectives. Choose the ones that align with your investment goals.

4. Determine asset allocation: Asset allocation refers to the distribution of your investments among different asset classes. It helps to diversify your portfolio and reduce risk. Consider allocating your funds between stocks, bonds, cash, and other types of investments based on your risk tolerance and time horizon.

5. Consider your time horizon: Your investment time horizon is the length of time you expect to keep your money invested before needing it. This will determine the type of investments that are suitable for you. Longer time horizons may allow for more aggressive investments with potentially higher returns.

6. Factor in expenses and fees: Mutual funds charge expense ratios and fees, which can eat into your investment returns. Compare the expenses of different funds and choose ones with lower costs to maximize your returns.

7. Regularly review your portfolio: It is important to monitor the performance of your portfolio and make any necessary adjustments. Market conditions change, and your financial goals may evolve over time. Regular reviews will help ensure your investments stay on track.

Building an ideal mutual fund portfolio requires careful planning and consideration. Following these 7 points will help you create a portfolio that is tailored to your specific needs and objectives. For more information about how mutual funds work and other FAQs, check out our resources section.

Investment Objectives

When building an investment portfolio, it is essential to consider your investment objectives. Your investment objectives are the specific goals you want to achieve through investing. These goals could include long-term wealth accumulation, regular fixed returns, or planning for retirement.

Before you start investing, you need to determine your investment objectives. Are you looking for a high-risk, high-reward portfolio, or a more conservative one? Do you have a specific financial goal in mind, such as buying a house or paying for your child’s education?

Once you have identified your investment objectives, you can then select the asset classes that align with your goals. The most common asset classes include stocks, bonds, mutual funds, and gold. Each asset class offers different levels of risk and potential returns, so it’s important to consider your risk appetite and return expectations.

Here’s a 7-point guide to help you create a portfolio that meets your investment objectives:

- Define your investment goals and risk tolerance

- Consider your time horizon – how long you are willing to invest

- Understand the difference between fixed income and equity investments

- Select the appropriate asset allocation for your portfolio

- Decide on the percentage of funds to allocate for each asset class

- Consider index funds as a low-cost investment option

- Regularly review and rebalance your portfolio to maintain alignment with your investment objectives

It’s important to note that there are no guarantees when investing, and all investments come with their own set of risks. However, by considering your investment objectives and following these steps, you can create an investment portfolio that is tailored to your needs and goals.

If you need help selecting investments, understanding the details of different asset classes, or have any FAQs about portfolio construction, it is advisable to seek guidance from a financial advisor. They can offer expert advice based on your specific circumstances and help you navigate the complexities of investing.

Remember, investing is a long-term commitment, and it’s important to stay focused on your goals, even during market fluctuations. By following a well-thought-out investment strategy and regularly reviewing your portfolio’s performance, you can work towards achieving your investment objectives and building wealth for the future.

Risk Appetite

When building a portfolio, it is essential for investors to consider their risk appetite. Risk appetite refers to an investor’s willingness and ability to take on risk in pursuit of higher returns.

Before creating a portfolio, investors must first determine their risk appetite. This can be done by asking themselves a few key questions:

- What is their investment goal? Are they looking for regular income, long-term growth, or a combination of both?

- What is their time horizon? Are they investing for the short-term or the long-term?

- What is their financial situation? How much risk can they afford to take based on their income, expenses, and other financial obligations?

- What is their knowledge and experience with investing? Are they experienced investors or are they just starting out?

Once investors have a clear understanding of their risk appetite, they can then determine how to allocate their assets and the level of risk they are willing to take on. This can be done by selecting a mix of investments that align with their risk tolerance and investment goals.

A diversified portfolio is ideal for managing risk. By spreading investments across different asset classes, such as stocks, bonds, mutual funds, and fixed income, investors can reduce the potential impact of any one investment on their overall portfolio.

Here’s a 7-point guide to help investors determine their risk appetite:

- Understand the difference between risk tolerance and risk capacity.

- Consider their investment goals and objectives.

- Assess their financial situation, including income, expenses, and debts.

- Evaluate their knowledge and experience with investing.

- Review their time horizon for investment.

- Identify their preferred investment style.

- Determine the level of risk they are comfortable with.

While risk appetite will vary for each investor, there are options available to help manage risk, such as diversification, regular reviews of the portfolio, and adjusting investments based on changing market conditions.

Creating a portfolio that aligns with an investor’s risk appetite is an essential step in the investing process. By understanding their risk tolerance and considering their investment goals and objectives, investors can build a portfolio that offers a good balance between risk and potential returns.

It’s important to note that different investments carry different levels of risk. For example, stocks tend to have higher volatility and potential for higher returns, while bonds offer more stability and regular income.

Investors should also consider the expenses and guarantee of returns associated with each investment. For example, mutual funds offer professional management and diversification, but also come with expense ratios.

Before investing, investors should also do their due diligence and research the specific details of each investment. This includes understanding the risk factors, expense ratios, dividend and income potential, and any other factors that may influence the investment’s performance.

In summary, determining risk appetite is an essential step in building a portfolio. By considering their investment goals, time horizon, financial situation, and knowledge and experience with investing, investors can create a portfolio that aligns with their risk appetite and offers the potential for long-term growth.

| Investment Option | Risk Level | Potential Returns |

|---|---|---|

| Stocks | High | High |

| Bonds | Low to Medium | Low to Medium |

| Mutual Funds | Varies based on underlying investments | Varies based on underlying investments |

| Fixed Income | Low | Low |

| Gold | Medium to High | Medium to High |

Remember, it’s important to consult with a financial advisor or investment professional to ensure that your portfolio is tailored to your specific risk appetite and investment goals.

Here’s a list of FAQs that can help clarify some common questions about risk appetite:

- What is risk appetite?

- How is risk appetite different from risk tolerance?

- What factors should I consider when determining my risk appetite?

- How can I allocate my assets to manage risk?

- What are some common mistakes to avoid when determining risk appetite?

- What are some investment options that can help manage risk?

- What sources can I use to gather information on investments and their associated risks?

In conclusion, determining your risk appetite is crucial when building a portfolio. By considering factors such as your investment goals, time horizon, financial situation, and knowledge and experience with investing, you can create a portfolio that aligns with your risk appetite and helps you work towards your long-term wealth-building goals.

Fund Expenses

When it comes to building your mutual fund portfolio, one important factor to consider is the fund expenses. These expenses are the costs associated with managing the fund, and they can have a significant impact on your returns.

There are several different types of expenses that you will need to consider when selecting funds for your portfolio. The most common include management fees, administrative expenses, and operating expenses. These expenses can vary between mutual funds and can also vary depending on the specific asset classes and investment strategies that the fund employs.

One essential expense to look out for is the expense ratio. This ratio represents the percentage of a fund’s assets that are used to cover its expenses. Generally, a lower expense ratio is preferred, as it means you get to keep a higher proportion of your returns.

While expenses are not the only factor to consider when selecting funds, they play a crucial role in long-term performance. High expenses can eat into returns and hinder your ability to achieve your financial goals.

Before investing in a mutual fund, it’s important to understand the expenses associated with it. You can find these details in the fund’s prospectus or online. The expense ratio should be clearly stated, along with any other fees or expenses that may apply.

It’s worth noting that index funds typically have lower expenses compared to actively managed funds. This is because index funds aim to replicate the performance of a specific index, which requires less active management. Additionally, certain asset classes, such as fixed income or dividend-focused funds, tend to have higher expenses due to their specific investment strategies or the additional work involved in managing these portfolios.

When it comes to creating your portfolio, it’s important to allocate your assets wisely. A well-diversified portfolio can help spread the risk and potentially improve your overall returns. Consider your investment goals and risk appetite when selecting funds for your portfolio.

Here’s a 7-point guide to help you build your ideal mutual fund portfolio:

- Define your investment goals and risk tolerance.

- Understand the different types of mutual funds and their investment strategies.

- Research and select funds that align with your goals.

- Diversify your holdings across different asset classes.

- Consider the fund’s past performance and track record.

- Monitor and review your portfolio regularly.

- Adjust your portfolio as needed to stay on track with your goals.

Keep in mind that while mutual funds can offer a great way to invest, they also come with risks. It’s important to understand these risks and consider them before investing your money. If you’re unsure, it’s always a good idea to consult a financial advisor or do further research.

In summary, fund expenses are an important factor to consider when building your mutual fund portfolio. They can have a significant impact on your returns and should be carefully evaluated before making any investment decisions. By taking the time to understand and compare the expenses associated with different funds, you can improve your chances of achieving your financial goals.

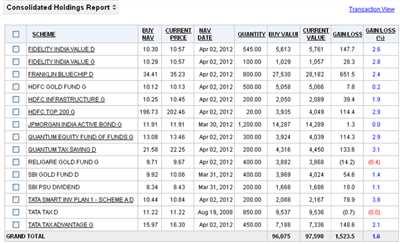

Fund Performance

When it comes to investing, one of the key factors to consider is fund performance. The performance of a fund is a measure of how well it has performed over a specific time period, typically in terms of returns.

Fund performance is important because it allows investors to assess the track record of a fund and determine if it aligns with their investment goals and objectives. It also helps investors compare different funds and select the ones that have consistently delivered good returns.

There are several factors that could impact a fund’s performance. One of the key factors is the investment strategy adopted by the fund manager. Different funds follow different investment strategies, such as active management or passive management. Active management involves selecting individual stocks and bonds in an attempt to outperform the market, while passive management involves tracking a specific index.

Another important factor is the allocation of assets within the fund. A well-diversified portfolio that spreads investments across different asset classes is generally considered less risky than a concentrated portfolio. Asset classes could include stocks, bonds, real estate, commodities like gold, and others.

The expense ratio of a fund is also an important consideration. The expense ratio is the annual fee charged by the fund company to cover the costs of managing the fund. This includes expenses like administrative costs, marketing expenses, and the fees paid to the fund manager. Investors should pay attention to the expense ratio because it directly reduces the returns of the fund.

Investors must also take into account other fees and expenses associated with investing in mutual funds. These could include sales commissions, account maintenance fees, and transaction costs.

To help investors make informed decisions, most mutual funds offer detailed information about their returns and expenses. This information is usually presented in a standardized format called a fund fact sheet. The fact sheet provides details about the fund’s investment objective, the benchmark it is compared against, performance data, and other key information.

When looking at fund performance, it’s important to consider the long-term returns rather than just focusing on short-term performance. Short-term performance can be influenced by factors like market volatility or short-term fluctuations in specific sectors. Long-term performance, on the other hand, provides a more accurate measure of a fund’s ability to generate returns over a longer period.

Creating a diversified portfolio is an ideal way to spread the risks and create wealth over the long term. A diversified portfolio typically includes a mix of asset classes, such as stocks, bonds, and real estate. It’s important to note that diversification does not guarantee profits or protect against losses, but it can help manage risk.

Before investing in a fund, investors should carefully consider their investment goals and risk tolerance. They should also read the fund’s prospectus, which provides important details about the fund’s investment strategies, risks, and expenses. Additionally, seeking help from a financial advisor can be beneficial, especially for investors who are new to investing or need guidance in selecting suitable investments.

Here’s a 7-point guide to help investors in creating a well-performing fund portfolio:

- Identify your investment goals: Before investing in a fund, determine your short-term and long-term investment goals. This will help you select funds that align with your objectives.

- Understand your risk tolerance: Different funds come with different levels of risk. Assess your willingness and ability to bear risks before investing.

- Select fund types based on your goals: Based on your goals and risk tolerance, select the type of funds that are suitable for you. This could include equity funds, debt funds, balanced funds, or others.

- Consider fund performance: Review the historical performance of the funds you are considering. Look for funds that have consistently generated good returns over a long period.

- Check expense ratios: Compare the expense ratios of different funds. Lower expense ratios can have a positive impact on your overall returns.

- Diversify your portfolio: Allocate your investments across different asset classes and funds to spread the risks and take advantage of various investment opportunities.

- Regularly review and rebalance your portfolio: Monitor the performance of your fund portfolio and make necessary adjustments to ensure it remains in line with your goals and risk tolerance.

By following these steps and considering the factors mentioned above, investors can create a well-performing fund portfolio that helps them achieve their financial objectives over the long term.

Here’s a list of frequently asked questions (FAQs) related to fund performance:

- What is the difference between index funds and regular mutual funds?

- How do dividend distributions impact fund performance?

- What factors should I consider before investing in a fund?

- Do mutual funds guarantee returns?

- What are the sources of income for mutual funds?

- How do expenses affect fund performance?

- What are the risks associated with investing in mutual funds?

These FAQs will help investors gain a better understanding of fund performance and make informed investment decisions.