Creating a dummy portfolio is a process that can be done in a few simple steps. In this article, we will explain how you can create a dummy portfolio using Morningstar’s analytics and ratings.

First, you need to sign up for a personal account with Morningstar. Once you have done that, you will be able to access their interactive tools and functions that can help you build your own dummy portfolio.

With Morningstar’s analytics, you can assign different stocks and assets to your portfolio. You can choose from a wide range of investment vehicles, such as stocks, mutual funds, and exchange-traded funds. Morningstar’s ratings and analytics will also help you optimise your portfolio by providing you with data on the performance and risk of each asset.

It is important to note that a dummy portfolio is not a real portfolio and should not be used as a basis for making investment decisions. It is simply a tool to help you practice and gain experience in managing a portfolio.

While Morningstar’s analytics and ratings are a great starting point, you may also want to consider using other sources of information. There are many websites and freelance writers who can provide insights and analysis on different asset classes and investment strategies. By accessing multiple sources, you can get a more well-rounded view of the investments you are considering.

Creating a dummy portfolio is a great way to start your investment journey. It will help you get familiar with the process of filling out a portfolio and evaluating different assets. Remember, though, that a real portfolio represents actual investments and should be evaluated and chosen with care.

In addition to Morningstar’s analytics and ratings, it is also necessary to understand the role of cookies and beacons in the process. These are small files that store users’ preferences and allow websites to track their activities. This information can help optimise the user’s experience and provide them with tailored content.

By creating a dummy portfolio, you will gain valuable experience and knowledge that will help you make more informed investment decisions in the future. Whether you are just starting out or have been investing for years, a dummy portfolio can be a useful tool in your investment journey.

How to Start a Freelance Writing Portfolio with No Experience

- Know your potential clients: Before you begin, it’s essential to understand the types of clients you want to work with and the topics you’re interested in. This will help you tailor your portfolio to their needs.

- Start by writing for yourself: If you don’t have any writing samples to showcase, you can create your own blog or website to publish your work. This will demonstrate your writing skills and give potential clients a sense of your style.

- Offer to write for websites or publications: Many websites and publications accept guest posts or contributions. Reach out to them and offer to write articles on topics that you’re knowledgeable about. This will help you gain exposure and build your portfolio.

- Take advantage of online platforms: There are several websites that connect freelance writers with clients. Sign up for these platforms and complete writing assignments to build your portfolio. Some examples include Upwork, Fiverr, and Freelancer.

- Showcase your work: Once you have a few writing samples, create a portfolio to showcase them. You can do this by creating a website or using platforms like Clippings.me or Journo Portfolio. Make sure to organize your samples by category or topic.

- Network with other writers: Join writing communities and attend networking events to connect with other writers. They may have valuable insights and advice on how to succeed in the freelance writing industry.

- Seek feedback and testimonials: Ask your clients to provide feedback on your work and request testimonials. Positive ratings and testimonials can significantly help you attract new clients.

- Keep improving: Continuously work on enhancing your writing skills. Consider taking writing courses, reading books on writing, or following industry blogs to stay up to date with the latest trends and techniques.

Remember, building a freelance writing portfolio is a process that takes time and effort. By following these steps and staying committed to honing your skills, you can start a successful freelance writing career even without prior experience.

How to Build a Successful Investment Portfolio

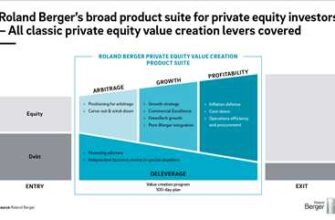

Building a successful investment portfolio is a crucial step towards achieving your financial goals. Whether you are a beginner or an experienced investor, creating a well-diversified portfolio is essential to maximize returns and minimize risks.

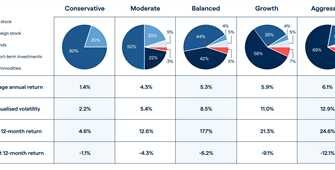

The first step in building an investment portfolio is to determine your investment objectives. Do you want to preserve capital, generate income, or grow your wealth? This will help you decide on the asset allocation and investment vehicles that align with your goals.

Once you have defined your investment objectives, it’s time to start the process. There are several ways to build a portfolio, but one commonly used approach is to use an online broker. There are many websites available that allow you to open an account and start investing with just a few clicks.

Before you start investing, it’s important to do your research. Look for reliable sources of information such as Morningstar’s website, where you can find in-depth analysis and ratings of various investment products. This will help you make informed decisions and choose suitable investments for your portfolio.

When building your portfolio, it’s crucial to diversify your investments. This means spreading your investments across different asset classes, such as stocks, bonds, and alternative investments. Diversification helps reduce the risk of your portfolio and increases the potential for returns.

Furthermore, interactive websites like Freelance Writing Group can help you assign writing jobs and earn income through freelance work. This additional income can be a valuable source to invest in your portfolio.

In addition to diversifying your portfolio, it’s important to regularly review and rebalance your investments. Market conditions and your own financial situation may change over time, so it’s essential to adjust your portfolio accordingly.

Remember that building a successful investment portfolio is a long-term process. It requires patience, discipline, and knowledge. By following these steps and continuously educating yourself about the investment process, you can optimize your investments and work towards your financial goals.

It’s worth noting that investing in stocks and other financial vehicles involves risk. You should carefully consider your risk tolerance and investment preferences before making any investment decisions.

Finally, it’s important to understand that there are no guarantees when it comes to investing. The value of your investments may fluctuate, and there is always a possibility of financial loss. It’s advisable to consult with a financial advisor or investment professional who can provide personalized guidance based on your individual circumstances.

In conclusion, building a successful investment portfolio requires careful planning, research, and ongoing monitoring. It’s essential to choose investments that align with your goals, diversify your holdings, and regularly review your portfolio. By following these principles and staying disciplined, you can increase your chances of achieving long-term financial success.

Optimise Your Portfolio

When it comes to building a successful investment portfolio, it is important to optimize it to ensure maximum returns. Here are some tips on how to optimise your portfolio:

- Start by filling your portfolio with a mix of asset classes. Diversification is key to mitigating risk, so make sure to include stocks, bonds, mutual funds, and other investment vehicles.

- Focus on those assets that align with your personal investment goals and risk tolerance. Choose assets that you understand and have experience with.

- Analyse the performance metrics of different assets, such as Morningstar’s ratings or interactive analytics, to evaluate their past performance and future potential.

- Assign a target allocation for each asset class based on your investment strategy and adjust it periodically to maintain the desired balance.

- Consider investing in index funds or ETFs, which offer low costs and broad market exposure. They often outperform actively managed funds over the long term.

- Stay informed about market trends and news that can impact your portfolio. This means regularly reviewing economic data, company earnings reports, and other relevant information.

- Be mindful of fees and expenses associated with your investments. High fees can significantly eat into your returns over time, so choose brokers or platforms that offer competitive pricing.

- Regularly rebalance your portfolio to ensure that it remains aligned with your investment strategy. Rebalancing involves selling some assets and buying others to maintain the desired asset allocation.

- Monitor the performance of your portfolio on an ongoing basis. This will help you identify any underperforming assets and make necessary adjustments.

- Seek professional advice if necessary. A financial advisor or investment expert can provide guidance based on your specific needs and goals.

Optimising your portfolio is an ongoing process that requires careful monitoring and adjustment. By following these tips and staying disciplined, you can maximise your investment returns and work towards your long-term financial goals.

Interactive Brokers Group Cookie Policy

At Interactive Brokers Group, we understand the importance of your privacy and value the trust you place in us. This Cookie Policy explains how we use cookies and similar technologies to enhance your experience on our website.

Cookies are small text files that are placed on your device when you visit a website. They are widely used to store and retrieve information about you, your preferences, and your browsing habits. Cookies help us to improve our website, tailor our offerings to your needs, and provide a more personalized experience.

By accessing or using our website, you consent to the use of cookies as described in this policy. If you do not agree to the use of cookies, you may block or disable them by adjusting your browser settings accordingly.

- Types of cookies we use:

- Functional cookies: These cookies are necessary for the website to function properly and cannot be switched off in our systems. They are usually only set in response to actions made by you, such as setting your privacy preferences, filling in forms, or logging in.

- Analytics cookies: These

Sources

- Morningstar’s website: Morningstar is a renowned investment research firm. They provide ratings and analysis for various investment vehicles such as mutual funds, stocks, and ETFs. Their site can be a valuable resource to start evaluating your investment options based on your preferences and goals.

- Financial news websites: There are numerous financial news websites that cover the stock market and investments. Some popular ones include CNBC, Bloomberg, and Yahoo Finance. These websites can provide you with the latest news and updates on various assets and help you stay informed.

- Brokerage firms: If you have an account with a brokerage firm, they often provide research and analysis tools for their clients. These tools can help you evaluate different investment options and make informed decisions. Check with your broker to see what resources they offer.

- Investment forums and communities: Online communities and forums dedicated to investing can be a great source of information and discussion. Interacting with experienced investors can provide valuable insights and help you learn from their experiences.

- Financial advisors: If you want professional guidance, working with a financial advisor can be a smart choice. They can help you build a portfolio that represents your investment goals and risk preferences. Make sure to choose a reputable advisor who has your best interests in mind.

- Books and educational resources: There are various books and educational resources available on investment strategies and portfolio construction. These resources can help you gain a deeper understanding of different investment vehicles and how to build a diversified portfolio.

Remember, no single source should be solely relied upon when making investment decisions. It’s important to gather information from multiple sources, evaluate them based on your own analysis and risk tolerance, and make decisions that align with your financial goals.