When it comes to managing your money, creating and sticking to a budget is key. Making a budget allows you to take control of your finances and make sure you’re spending your hard-earned money on the things that truly matter to you. Whether you’re saving for a big purchase, paying off debt, or planning for the future, having a budget in place will help you achieve your financial goals. In this article, we’ll discuss some tips and strategies on how to make a budget that works for you.

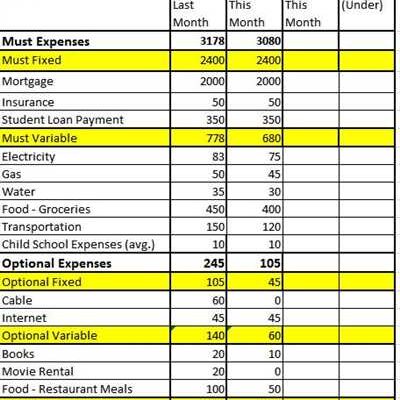

Firstly, it’s important to understand your income and expenses. Take a look at your current financial situation and determine how much money you make each month and how much you spend. This will give you a clear picture of where your money is going and help you identify areas where you can cut back. Keep in mind that your income may fluctuate depending on your job or other sources of income, so it’s important to consider this when creating your budget.

Next, start by prioritizing your expenses. Think about what is truly important to you and where you want to allocate your money. For example, if your goal is to save for a down payment on a house, you may want to reduce your spending on non-essential items like eating out or going to the movies. Instead, redirect that money towards your savings fund. By identifying your priorities and making conscious choices about where you’re allocating your funds, you’ll be able to make progress towards your financial goals.

Another important factor to consider when making your budget is to set aside some money for unexpected expenses. Life can be unpredictable, and having an emergency fund can give you peace of mind knowing that you’re prepared for any unforeseen circumstances. Aim to set aside at least 10% of your income each month into a separate savings account. This will help you build a safety net and ensure that you’re not relying on credit cards or loans in case of emergencies.

Finally, don’t forget to be realistic with your spending goals. While it’s important to make cuts where you can, it’s also important to allow yourself some flexibility. If you love going to the movies or eating out, don’t completely eliminate those expenses from your budget. Instead, find ways to make them cheaper. Look for discounts or alternative activities that are more budget-friendly. By finding a balance between saving and enjoying yourself, you’ll be more likely to stick to your budget in the long run.

- Finally Here’s How to Create a Budget You Can Really Truly Stick To

- Why Budgeting Is Important

- How to save money when you’re on a budget

- Reduce your variable expenses

- Cut your subscriptions or at least some of them

- Here are some simple steps to help you cut your subscriptions:

- Consider the 503020 rule

- Figure out a savings plan that works for you

- Start investing

- Keep going

- Sources

Finally Here’s How to Create a Budget You Can Really Truly Stick To

Creating a financial budget is a task that most people dread. They think it will restrict their spending and make them miss out on all the fun. But the truth is, having a budget is the most effective way to take control of your finances and achieve your goals.

First, you need to assess your monthly income. Take a look at your paycheck and determine how much money you bring in each month. Once you have that number, it’s time to think about your expenses.

Consider which expenses are necessary and which ones you could cut out. Are there some subscriptions you aren’t using? Can you reduce the number of times you eat out? By making small adjustments to your spending, you’ll be surprised at how much money you can save.

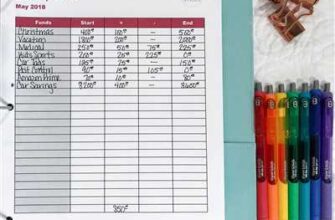

Next, plan where your money will go. Divide it into different categories like rent, utilities, groceries, and entertainment. This way, you’ll know exactly how much money you have left for each area of your life.

It’s also important to consider your future needs. Set some goals for yourself, whether it’s saving for a down payment on a house, paying off debt, or starting an emergency fund. By investing in your future, you’ll be creating a safety net for yourself.

Now, let’s talk about the 50/30/20 rule. This rule suggests that you allocate 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. While everyone’s situation is different, this rule gives you a general guideline to follow.

There are five categories that aren’t going to go away: housing, transportation, food, utilities, and healthcare. Make sure to budget for these essentials first before allocating money towards other expenses.

When it comes to discretionary spending, it’s important to ask yourself why you’re making certain purchases. Do you really need that expensive coffee every morning? Can you keep track of your visits to the mall? By being mindful of your spending, you’ll find it easier to stick to your budget.

Another tip is to simplify your life. Cook at home instead of constantly dining out, hang out with friends without spending a fortune. These small changes can make a big difference in your monthly budget.

It’s also wise to track your spending. Keep a close eye on your bank account and credit card statements to see where your money is going. This will help you identify areas where you can cut back and make adjustments.

Finally, it’s time to create a budget that works for you. Start by listing all your income sources and expenses. Depending on your financial goals and needs, decide how much money you want to allocate to each category.

Remember, a budget is not meant to restrict you, but to give you control over your money. It’s a powerful tool that will help you build savings, pay off debt, and create a better financial future for yourself.

Why Budgeting Is Important

Budgeting is an essential tool for managing your money and setting yourself up for a secure future. By creating and sticking to a budget, you can ensure that you have enough money to meet your needs and achieve your financial goals.

For most Americans, budgeting isn’t something they do just for fun. It’s a necessity. Without proper budgeting, you may find yourself in a financial mess sooner than you think. You could end up spending your entire paycheck on expenses, leaving nothing for savings or emergencies.

By budgeting, you can figure out exactly how much money is coming in each month and how much is going out. You’ll be able to identify areas where you can cut back on spending and find ways to save more. For example, maybe you could cook at home more often instead of eating out, reduce your subscriptions or find cheaper utilities.

Having a budget also helps you prioritize your spending. Maybe you have dreams of going on a big international vacation or saving for your child’s college education. A budget can help you allocate your income towards these specific goals, instead of mindlessly spending your money on things that aren’t important to you.

Budgeting also helps you stay out of debt and build up your savings. By keeping track of your expenses and making sure you’re not spending more than you earn, you can avoid taking on unnecessary debt. Instead, you can use your extra money to pay off debts or put it into a savings account.

Speaking of savings, having a budget allows you to build an emergency fund and start investing for the future. By setting aside a portion of your income each month, you can create a cushion for unexpected expenses or start accumulating wealth through investments or high-interest savings accounts.

Overall, budgeting is a simple and effective way to manage your money and work towards your financial goals. It gives you control over your finances and allows you to make informed decisions about how you’re spending your money. So, if you’re not already budgeting, now is the time to start!

How to save money when you’re on a budget

When you’re on a tight budget, it’s crucial to find ways to save money. Building a savings account is important for everyone, regardless of their income level. But how can you save money when it feels like there’s always something that needs to be paid for?

Here’s a plan that works for many people: the 50/30/20 rule. It simply means that you should allocate 50% of your monthly income toward needs, 30% toward wants, and 20% toward savings and paying down debt.

To start saving money, you’ll need to figure out where your money is going. Track your expenses for a month and see how much you’re spending on things like dining out, subscriptions, and entertainment. You may find that you can cut back on some of these expenses.

One way to reduce your expenses is by cooking at home instead of dining out. Not only is it cheaper, but it also allows you to control what goes into your food. Another way to save money is by cancelling subscriptions that you don’t use or aren’t essential.

Another reason why saving money is important is for emergencies or unexpected expenses. If you have enough savings, you won’t have to rely on credit cards or loans when something comes up. This can save you a lot of money in the long run.

Depending on your financial situation, you may also want to consider investing some of your savings. Investing can help your money grow and work for you in the future. There are many options to choose from, depending on your risk tolerance and goals.

Many Americans live paycheck to paycheck, but it doesn’t have to be that way. By managing your spending and saving money, you can start building a solid financial foundation. It may not be easy at first, but with time and discipline, it’ll become easier.

Here are a few tips to help you save money:

- Pay yourself first by automatically depositing a portion of each paycheck into your savings account.

- Consider cutting down on expensive habits like daily coffee visits or eating out.

- Avoid impulse purchases by waiting at least 24 hours before buying something.

- Find cheaper alternatives for things like gym memberships or cable subscriptions.

- Keep track of your savings every month to stay motivated.

Remember, saving money is essential for your financial future. It’s never too late to start, so why not hang up this article and start making a plan today?

Reduce your variable expenses

When it comes to budgeting, one of the most important steps is to reduce your variable expenses. These are the expenses that can vary from month to month, depending on your spending habits and needs. By identifying and cutting back on these expenses, you can make your budget more manageable and free up money to put towards your financial goals.

Here are five ways you can reduce your variable expenses:

1. Track your spending: Start by figuring out where your money is going. Keep a detailed record of all your expenses, including those that may seem insignificant. This will help you identify any spending patterns you have and find areas where you can cut back.

2. Cut back on subscriptions: Many people have subscriptions to services like streaming platforms, gym memberships, or meal delivery services. While these can be convenient, they can also add up quickly. Consider canceling or downgrading any subscriptions that you don’t truly need or use regularly.

3. Find cheaper alternatives: Look for ways to save on everyday expenses. For example, instead of going out for dinner, try cooking at home. Instead of going to the movie theater, have a movie night at home. By finding cheaper alternatives, you can still enjoy the things you like while spending less.

4. Reduce utility bills: Utilities like electricity, water, and gas can be a significant expense. Look for ways to reduce your usage, such as turning off lights when you’re not in a room, lowering the thermostat, or fixing any leaks. Small changes can add up and result in significant savings over time.

5. Cut down on discretionary spending: Take a close look at your discretionary expenses, such as eating out, shopping for clothes, or going to amusement parks. While it’s important to enjoy life, it’s also essential to find a balance. Consider setting limits on these expenses and finding more affordable options.

By reducing your variable expenses, you can free up more money to put towards building an emergency fund, paying off debt, or investing for the future. Remember, everyone’s financial situation is different, so it’s crucial to find a budgeting strategy that works for you. Stay committed to your goals, and soon you’ll see the benefits of your efforts.

Cut your subscriptions or at least some of them

When it comes to managing your budget, one of the simplest and most effective ways to save money is by cutting down on your subscriptions. There aren’t many people out there who don’t have at least a few monthly subscriptions. Whether it’s streaming services, gym memberships, or magazine subscriptions, these recurring expenses can quickly add up and eat into your budget.

Take a moment to think about all the subscriptions you’re currently paying for. Are you really using all of them? Is there any service that you rarely or never use but are still spending money on each month? If so, it’s time to find some ways to reduce or eliminate those expenses.

Start by going through each subscription one by one and determine if it’s truly worth the cost. Look for any alternatives or cheaper options that can provide similar benefits. For example, if you’re paying for multiple streaming services, maybe you can choose just one or two that you enjoy the most. You might be surprised at how much you can save by cutting back on these unnecessary expenses.

Another reason to cut subscriptions is that the money you save can be invested in something more meaningful. Rather than spending $20 a month on a streaming service you rarely use, why not put that money towards a savings fund or an investment that can help you build toward your future goals?

Remember, creating a budget is all about making choices and prioritizing your expenses. By cutting subscriptions, you can free up funds for things that truly matter to you. It’s a simple rule to live by: if a subscription isn’t adding value to your life, it’s time to let it go.

Depending on your income and financial goals, you can decide how many subscriptions you can afford to keep. Maybe you love your streaming services and can’t imagine life without them. That’s perfectly fine, as long as you’re aware of how much you’re spending and adjust your budget accordingly.

When it comes to managing your budget, it’s important to stay disciplined and not let your subscriptions become a hang-up. While they may seem like small expenses individually, they can quickly add up and eat into your monthly income. By reducing or eliminating unnecessary subscriptions, you can keep your expenses down and work towards your financial goals.

Here are some simple steps to help you cut your subscriptions:

| 1. Figure out which subscriptions you can trim or eliminate. |

| 2. Research alternative options or cheaper plans for the subscriptions you want to keep. |

| 3. Cancel the subscriptions that you no longer need or use. |

| 4. Monitor your bank statements regularly to ensure no subscriptions are sneaking back in. |

| 5. Take the money you’re saving from cutting subscriptions and put it towards your financial goals or savings. |

By following these steps, you’ll be on your way to building a budget that works for you and your financial future. Remember, it’s all about prioritizing your needs and wants, and being mindful of where your money is going. Cut those subscriptions that aren’t adding value to your life and redirect those funds towards something that truly matters to you.

Consider the 503020 rule

When it comes to creating a budget, it’s important to have a plan in place. One popular method that many financial experts suggest is the 503020 rule. This rule is a simple guideline that can help you allocate your income and manage your expenses effectively.

So, what exactly is the 503020 rule? Well, it’s a budgeting technique that breaks down your monthly income into three main categories: needs, wants, and savings.

- 50% for needs: The first part of your income, 50% of it, should be allocated towards your needs. These include essential expenses such as rent or mortgage payments, utilities, groceries, transportation, and healthcare.

- 30% for wants: The second part, 30% of your income, can be used for wants. These are non-essential expenses that you enjoy or find value in, like dining out, going to the movies, or shopping for new clothes.

- 20% for savings: The final part of your income, 20% of it, should be saved. This money can be used to build an emergency fund, pay off debt, or invest in your future.

Following the 503020 rule can help you prioritize your spending and ensure that you’re saving enough for your financial goals. It’s a simple and easy-to-remember approach that can work for everyone, regardless of their income level.

Here’s why you should consider the 503020 rule:

- It helps you figure out your priorities: By breaking down your spending into these categories, you can clearly see where your money is going and determine what you value the most.

- It encourages saving: Saving 20% of your income may seem like a lot, but it’s essential for building an emergency fund, planning for retirement, or achieving your long-term financial goals.

- It forces you to cut unnecessary expenses: If you find yourself spending too much money on things you don’t really need, the 503020 rule can help you identify those expenses and cut them down.

- It creates a budget that works for you: Instead of trying to fit your spending into a generic budget, the 503020 rule allows you to customize your budget to your needs and values.

- It simplifies the budgeting process: Managing your finances can be overwhelming, especially if you have multiple accounts and variable expenses. The 503020 rule simplifies the process by giving you a clear plan to stick to.

So, if you haven’t already, give the 503020 rule a try and see how it can help you manage your money more effectively. It’s a simple yet powerful strategy that could have a significant impact on your financial future.

Figure out a savings plan that works for you

When it comes to budgeting, one of the most important rules to follow is to figure out a savings plan that works for you. Saving money is not always the easiest task, but with a well-thought-out plan, it can become easier to manage your financial goals and future needs.

The first step in creating a savings plan is to determine how much money you can realistically set aside each month. Take a look at your income and expenses to see where your money is going and find areas where you can reduce spending. Instead of spending money on unnecessary items, park that money into a savings account.

Once you have a clear understanding of your expenses, it’s time to set some goals. Whether it’s saving for a down payment on a house, building an emergency fund, or saving for college, having specific goals will give you something to work towards. By prioritizing your goals, you can figure out how much money you should allocate toward each one.

It’s important to keep in mind that saving is a variable expense, meaning it can fluctuate from month to month. Some months you may have unexpected expenses, and other months you may have a surplus of money. It’s important to adjust your savings accordingly and not beat yourself up if you can’t save as much as you would like.

Here’s a simple savings plan that could work for you:

- Start by setting aside 5% of your income for savings. This is a good starting point and allows you to build momentum.

- Once you become more comfortable with saving, try to increase that percentage to 10% or even 15% if you can.

- If you find it difficult to stick to a specific percentage, try setting a fixed amount of money to save each month. This can make it easier to budget and track your progress.

Remember, the most important thing is to consistently save and stay committed to your savings plan. It’s easy to get caught up in the present and spend your money on immediate wants, but think about the future and the peace of mind that comes with having a healthy savings account.

Once you have some money saved, you may want to consider investing it. Investing can be a great way to grow your wealth and work towards long-term financial goals. However, if you’re just starting out, it’s important to do your research and seek advice from a financial professional.

Lastly, don’t forget to reduce your expenses where you can. Look for cheaper alternatives or find ways to cut back on unnecessary spending. By making small changes in your daily habits, you can free up more money to put towards your savings.

Building a savings plan takes time and effort, but it’s a crucial step towards achieving financial stability. Once you have a solid plan in place, stick to it and make adjustments as needed. Soon enough, you’ll start seeing the benefits of your savings as you work towards your financial goals.

Remember, you’re in control of your financial future, and by taking the time to create a savings plan that works for you, you can truly give yourself the financial freedom and security you deserve.

Start investing

Once you’ve truly mastered the art of budgeting and have cut back on unnecessary expenses (like going to the movies most nights or dining out every day), it may be time to start thinking about investing. There are many reasons why you should consider investing, and it can be a way to make your money work for you.

Firstly, investing is a great way to grow your wealth over time. Instead of letting your money sit in a low-interest savings account where it’ll likely just earn a fraction of a percent in interest each month, you can put it toward investments that have the potential for much higher returns. If you’re not sure where to start, there are plenty of resources available to help you figure out which investments would work best for you.

Investing is also a way to build wealth for the future. Whether you’re saving for retirement, your children’s college education, or any other long-term goals you have, investing can be a key component in reaching those goals. By consistently investing a portion of your monthly budget, you can take advantage of compound interest, which allows your investments to grow exponentially over time.

Some people may be hesitant to start investing because they think it’s too complicated or expensive. However, there are plenty of options available that make it easier than ever to start investing yourself. With online platforms and apps, you can easily manage your investments and make changes as needed. Additionally, many popular investments, like index funds, have low fees, so you don’t have to worry about expensive broker fees eating into your returns.

Finally, investing is an important step in building long-term financial security. While budgeting and saving money are crucial, they can only get you so far. By investing, you have the opportunity to grow your wealth and give yourself a buffer in case of unexpected expenses or emergencies.

So, if you’re ready to take your budgeting skills to the next level, consider starting to invest. It won’t happen overnight, but with consistent effort and discipline, you can start building a financial future that will give you the freedom and security you’ve been working toward.

Keep going

Once you’ve created a budget and started saving, it’s important to keep going. Many people find it difficult to stick to their budget and continue saving over time, but there are a few simple strategies that can help you stay on track.

First, make sure you have a designated savings account. This will make it easier to separate your savings from your other expenses and ensure that you don’t accidentally spend money that needs to be saved. Set up automatic transfers from your checking account to your savings account each time you receive a paycheck. This way, you won’t even have to think about saving – it will happen automatically.

Next, consider setting specific goals for your savings. This could be something as simple as a target amount you want to save each month or a larger goal, like saving up for a down payment on a house. Having concrete goals can help keep you motivated and focused on your savings journey.

If you find that you’re struggling to cut expenses, think about where you can make some changes. Maybe you could cook at home more often instead of eating out, or find cheaper alternatives for things like movie tickets or gym visits. Small changes like these can add up over time and help you free up more money to save.

Remember, it’s not just about saving money – it’s also about managing your expenses. Take a close look at your monthly bills and see if there are any areas where you can cut back. For example, do you really need that expensive cable package or could you find a cheaper alternative? Are there any subscriptions or memberships that you’re not using and could cancel?

When it comes to investing, there’s a phrase that many financial experts like to say: “Time in the market is more important than timing the market.” What this means is that it’s better to start investing early and consistently, rather than trying to pick the perfect time to jump in. Even if you can only invest a small amount each month, it’s better than not investing at all.

Finally, don’t be too hard on yourself if you have a setback or a month where you’re not able to save as much as you’d like. Life happens, and there may be unexpected expenses that come up. The important thing is to keep going and stay committed to your long-term financial goals. Remember why you started saving in the first place and remind yourself that every little bit counts.

With time, discipline, and determination, you’ll find that budgeting and saving become easier and more natural. And before you know it, you’ll have built up a nice savings fund that you can use for important things like emergencies, vacations, or even retirement.

So keep going and stay focused on your financial journey – you’ve got this!

Sources

When it comes to building a budget, it’s important to consider the sources of your income and the various expenses you’ll need to manage. Here’s a breakdown of some common sources to help you get started:

1. Paycheck: The most common source of income for working individuals is their paycheck. Depending on your income, you should allocate a certain percentage towards your budget.

2. Investments: If you have investments, such as stocks or mutual funds, you may receive dividends or capital gains. It’s important to include any income from investments in your budget to ensure you’re managing your overall financial picture.

3. Savings account: If you have a savings account with interest, this can be another source of income. While the interest earned may not be substantial, it’s still important to factor it into your budget.

4. Side hustle: Many people have a side hustle or a part-time job to supplement their income. If you have any additional sources of income, you should include them in your budget as well.

5. Gifts or windfalls: Occasionally, you may receive unexpected money in the form of gifts or windfalls. While you can’t rely on these sources, it’s important to consider them when they occur and decide how you’ll allocate the funds.

By including these various sources in your budget, you’ll have a clearer understanding of how much money you have to work with. This will make it easier to set financial goals, allocate funds towards your expenses, and ultimately, build a budget that works for you.