If you’ve ever wondered how to take control of your finances and save money, kakeibo might be the answer. Kakeibo is a Japanese method of budgeting that helps you track your expenses, save money, and achieve your financial goals. The word “kakeibo” is pronounced as “kah-keh-boh” and it means “household financial ledger”.

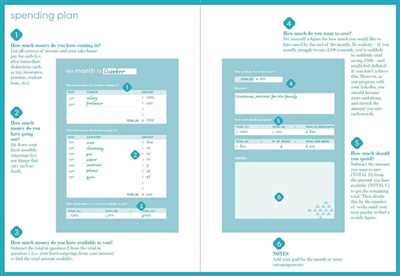

So how does kakeibo work? It’s all about keeping a budgeting journal and being aware of your spending habits. The idea is to write down all your expenses and income sources in a simple and structured way. By doing this, you’ll have a clear overview of your finances and you can better understand where your money is going.

One of the key features of kakeibo is its monthly structure. At the beginning of each month, you’ll think about your financial goals and needs. You’ll set a budget for the month and think about what you want to save and how much you need for bills and other expenses. This helps you plan ahead and ensures that you’re not overspending.

The kakeibo method also encourages you to reflect on your spending at the end of each month. You’ll review your expenses and think about what you could have done differently to save more money. This practice helps you become more mindful of your spending habits and ensures that you’re continuously improving your financial situation.

Kakeibo can be a great help if you’re looking to save money and have a more organized financial life. It’s a method that works for anyone, regardless of how much money you make or how many bills you have to pay. By practicing kakeibo, you’ll be able to take control of your finances and start saving for the things that matter to you.

So if you’re tired of living paycheck to paycheck and constantly worrying about money, why not give kakeibo a try? With its simple yet effective approach to budgeting and saving, it might just be the financial tool you need to achieve your goals and live a more secure and fulfilling life.

Kakeibo – the Japanese budgeting method explained

If you’re looking for a simple yet effective way to improve your financial habits and save money, you might want to consider trying the Kakeibo method. Pronounced “kah-keh-boh”, this Japanese budgeting method is a proven way to track your expenses, analyze your spending habits, and ultimately achieve your savings goals.

So how exactly does Kakeibo work? It’s actually quite simple. Each month, you start by setting specific savings goals and determining how much money you need to save in order to achieve them. You then track your income and expenses by writing them down in a journal, which serves as your Kakeibo. This journal helps you keep a clear record of your financial activities and serves as a visual reminder of your progress.

Kakeibo encourages you to think carefully about your purchases and consider if you really need the item before spending your hard-earned money. It helps you analyze your spending patterns and identify areas where you can cut costs and save more. The main idea behind Kakeibo is to be mindful of your spending and make deliberate choices that align with your financial goals.

One of the key benefits of Kakeibo is that it helps you develop a habit of saving money. By tracking your expenses and seeing where your money goes each month, you become more aware of your spending habits. This awareness can help you make better financial decisions and prioritize your needs over wants.

The Kakeibo method also provides a structured way to handle your bills and financial responsibilities. By regularly updating your Kakeibo and reviewing your spending, you can stay on top of your financial situation and avoid unnecessary debt or financial stress.

The beauty of Kakeibo is that it is a flexible method that can be adapted to fit your individual needs and lifestyle. Whether you prefer to use a physical journal or a digital spreadsheet, you can customize your Kakeibo to work best for you. The ultimate goal is to have a clear understanding of your financial situation and be able to save more money each month.

So if you’re looking for a practical and effective way to manage your finances and save money, give Kakeibo a try. Start by setting clear savings goals, tracking your income and expenses, and evaluating your spending habits. With consistency and practice, you’ll be well on your way to achieving your financial goals and building a healthier relationship with money.

What is kakeibo

Kakeibo is a simple and effective method of budgeting that can help you save money and take control of your finances. Pronounced “kah-keh-boh,” this Japanese budgeting journal has been practiced for over a century and is gaining popularity around the world.

The idea behind kakeibo is to track your expenses and income on a monthly basis. It’s more than just a way to keep track of how much money you’re spending – it’s a method to help you think about your financial needs, save money, and plan for the future.

The kakeibo method works by dividing your monthly income into four categories: needs, wants, savings, and debts. By recording your expenses in these categories, you can easily see where your money is going and identify areas where you might be overspending. This can help you make necessary adjustments and cut back on unnecessary costs.

What sets kakeibo apart from other budgeting methods is its focus on reflection and mindfulness. Each month, you’re encouraged to reflect on your spending habits and think about how you can improve. By using a kakeibo journal, you can become more aware of your financial habits and develop healthier money management practices.

Kakeibo is more than just a way to save money – it’s a way to cultivate a healthy relationship with money. It offers a simple, yet effective, way to take control of your finances and work towards achieving your financial goals.

The Japanese method of saving money

Kakeibo is a Japanese method of budgeting and saving money pronouned “kah-keh-boh”. It is a simple yet effective way to track your finances and help you save more.

The idea behind kakeibo is to think about your financial needs and expenses in a more mindful way. Each month, you start with a budget which is based on what you have and what you need to save. This budget is then broken down into different categories such as bills, groceries, entertainment, etc.

To practice kakeibo, you will need a kakeibo journal, which can be a simple notebook or a specialized kakeibo journal. This journal helps you keep track of your monthly income, expenses, savings, and more.

At the beginning of each month, you write down your total income and then subtract your fixed expenses such as bills and rent. Next, you allocate a certain amount of money for savings. Whatever is left over can be used for variable expenses such as groceries and entertainment.

Throughout the month, you track your expenses carefully in your kakeibo journal. This helps you have a clear picture of how much you are spending and what you are spending it on. It also helps you become more aware of your spending habits and identify areas where you can cut back.

At the end of the month, you review your kakeibo journal to see how you did. This gives you a sense of accomplishment and motivation to continue saving. It also helps you identify any areas where you might have overspent or could have saved more.

The kakeibo method works on the idea of being more mindful with your money and taking control of your finances. It helps you prioritize your needs and make conscious decisions about how you spend your money. By practicing kakeibo, you can develop good financial habits and start building your savings.

So, if you’re looking for a simple and effective way to save more money, the Japanese method of kakeibo might be just what you need!

How to save money with Kakeibo

Kakeibo, pronounced kah-keh-boh, is a Japanese method of budgeting and saving money. It is a simple and effective way to track your expenses and help you save more.

With Kakeibo, you start by keeping a journal of your daily expenses, bills, and costs for the month. Each day, write down what you spent money on, how much you spent, and what you bought. This helps you become more aware of your spending habits and makes you think twice before making unnecessary purchases.

The idea behind Kakeibo is to think about your needs and wants, and to prioritize saving money. At the end of the month, you calculate your total income and subtract your expenses. This will give you an idea of how much money you have left for savings.

To save money with Kakeibo, you need to set a savings goal for yourself. This could be a specific amount or a percentage of your income. You then allocate this amount toward your savings each month.

It’s important to be disciplined and stick to your savings goal. This might require making some sacrifices and cutting back on unnecessary expenses. But with practice, it becomes easier to save money and reach your financial goals.

Kakeibo also encourages you to think about the sources of your spending and identify areas where you can save more. For example, you might realize that you’re spending more on eating out than cooking at home, and that reducing your dining out expenses can help you save money.

There are many resources and templates available that can help you get started with Kakeibo. Some even include guided prompts and categories to make the process easier. Ultimately, the goal is to find a method that works best for you and helps you save money.

In summary, Kakeibo is a simple and effective method of budgeting and saving money. By keeping track of your expenses and setting savings goals, you can become more mindful of your spending habits and start saving more each month. With practice and discipline, Kakeibo can help you achieve your financial goals and build a stronger financial future.

Sources

The kakeibo method works by helping you save money each month. It is a simple budgeting method that originated in Japan and is pronounced as kah-keh-boh. With kakeibo, you need to think about the sources of your income and how much money you have each month to cover your needs and expenses.

Here are some sources of income that you might have:

- Salary or wages from your job

- Side hustle or freelance work

- Investment income

- Gifts or inheritances

Knowing your sources of income is important because it can help you plan and allocate your money wisely. By understanding how much money you have coming in, you can better manage your expenses and save for the future.

It’s important to start by writing down all of your bills and fixed costs, which are the expenses that stay the same each month. This can include things like rent or mortgage payments, utility bills, and loan payments.

Next, you need to think about your variable expenses, which are the costs that can vary from month to month. This might include groceries, dining out, transportation, entertainment, and personal expenses.

By keeping a kakeibo journal and recording your income and expenses, you can get a clear picture of where your money is going and identify areas where you might be able to cut back on spending. This method can also help you set savings goals and track your progress over time.

Remember, practice makes perfect. The more you use the kakeibo method, the better you will become at managing your finances and saving money.