Are you short on cash and need to make a quick $20? With a little bit of time and some online resources, you can easily earn the money you need without breaking a sweat. In this article, we will discuss a few simple steps that can help you make $20 in just a matter of minutes.

The first step is to enter the world of online surveys. Many websites offer paid surveys that reward you with cash for answering a series of questions. By signing up with a reputable survey website, you can start earning money immediately. All you need is an internet connection and a few minutes to spare, and you’ll be on your way to making some extra cash.

Another quick and easy way to make $20 is by taking advantage of online banking services. If you already have an account, navigate to the deposit menu and select the option to make a direct deposit. Enter the details of the deposit, including the amount and the account it needs to go into. Click the “submit” button, and you’re done! The money will be transferred directly into your account, saving you time and effort.

If you’re looking for a way to make $20 on a regular basis, consider setting up automatic deposits. Many banks offer a service where you can set up recurring deposits, such as the 50/30/20 rule, where 50% of your income goes towards needs, 30% towards wants, and 20% towards savings. By automating your savings, you can easily meet your financial goals without having to think about it.

In conclusion, making $20 doesn’t have to be a daunting task. By utilizing the power of the internet and following a few simple steps, you can make some extra money quickly and easily. Whether you choose to take surveys, make direct deposits, or set up automatic savings, the key is to take action. So why wait? Start making $20 today!

- The 503020 Budget Rule Explained With Examples

- Key Takeaways

- 1 Make $20 fast in the next 3 minutes by answering simple questions online and taking surveys

- How to Make a Deposit in NetSuite

- Step 1: Navigate to the Banking Menu

- Step 2: Select the Appropriate Account

- Step 3: Click on the ‘Make Deposit’ Button

- Step 4: Enter the Deposit Details

- Step 5: Save the Deposit

- Yard work

- Get into ‘dropshipping’

- Video:

- The BEST business to start in your 20s (2024)

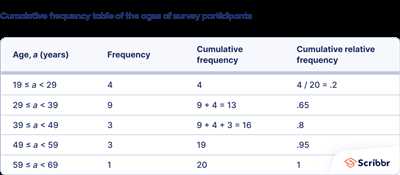

The 503020 Budget Rule Explained With Examples

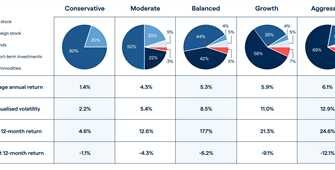

The 503020 budget rule is a straightforward and effective way to manage your money. It helps you make the most out of every paycheck without dealing with complicated financial strategies. In this article, we will dive into the details of this rule and provide examples to help you understand how it can work for you.

What is the 503020 rule? It’s a simple budgeting technique where you allocate 50% of your income towards needs, 30% towards wants, and 20% towards savings. Let’s break it down further:

1. Needs: The first step is to determine your needs. These are essential expenses such as rent, utilities, groceries, and transportation. Allocate 50% of your income towards covering these necessary costs.

2. Wants: The next step is to allocate 30% of your income towards wants. These are non-essential expenses such as entertainment, dining out, and hobbies. This category allows for some flexibility and enjoyment in your budget.

3. Savings: Finally, allocate the remaining 20% of your income towards savings. This can include building an emergency fund, investing for the future, or paying off debts.

Let’s see how the 503020 rule works in practice with some examples:

Example 1:

Ryan earns $4,000 per month. Using the 503020 rule, he would allocate:

– 50% ($2,000) towards needs

– 30% ($1,200) towards wants

– 20% ($800) towards savings

This budgeting approach allows Ryan to cover his necessary expenses, enjoy his lifestyle, and save for the future.

Example 2:

Emily earns $2,500 per month. Using the 503020 rule, she would allocate:

– 50% ($1,250) towards needs

– 30% ($750) towards wants

– 20% ($500) towards savings

Emily’s budget ensures that she can meet her essential expenses, have some fun, and still save a portion of her income.

By following the 503020 budget rule, you can easily navigate your finances and ensure that your money is being used appropriately. This rule helps you prioritize your spending, avoid overspending, and steadily build your savings over time. Whether you’re new to budgeting or looking for a simple and effective money management strategy, the 503020 rule is a key tool to help you make the most of your income.

Key Takeaways

Here are the key takeaways from this article on how to make 20 dollars:

1. There are several ways to make 20 dollars online, and one of the quickest and most straightforward methods is through online surveys. Many websites offer paid surveys that can help you earn extra money in your spare time.

2. Another way to make 20 dollars is by taking advantage of dropshipping. This online business model allows you to sell products without having to carry inventory or handle shipping. By selecting appropriate products, you can earn a profit from each sale.

3. If you have a skill or expertise, you can offer your services online and earn 20 dollars or more for your work. Websites like Upwork and Fiverr provide a platform for freelancers to find clients and showcase their abilities.

4. Saving money is crucial for financial management. By following a budget and cutting unnecessary expenses, you can save 20 dollars or more each month. This can add up over time and help you reach your financial goals faster.

5. Making a deposit directly into your bank account is a quick and efficient way to get 20 dollars. With online banking, you can navigate to the appropriate menu, enter the details of the deposit, and click the “submit” or “confirm” button. The money will be deposited into your account in a matter of minutes.

6. When making a deposit, it’s important to enter the amount accurately, as even a small mistake can result in the funds not being deposited. Double-check the amount before submitting the deposit to ensure it goes through smoothly.

7. If you’re in a rush and need to make a deposit quickly, consider using automatic answering machines or chatbots. These AI-powered systems can help you make deposits and answer any questions you may have without having to wait for a human operator.

8. Ryan explained in his article that the rule 503020 can help you save money and make your financial goals easier to achieve. This rule suggests saving 50% of your income for necessities, 30% for wants, and 20% for savings or debt repayment.

9. Lastly, making an extra 20 dollars can be as simple as finding a way to make money from a hobby or passion. Whether it’s selling handmade crafts or offering tutoring services, turning your skills into income can be both fulfilling and profitable.

Remember, every little bit adds up, so don’t underestimate the power of small savings or earnings. By following these steps and tips, you can easily make 20 dollars and more.

1 Make $20 fast in the next 3 minutes by answering simple questions online and taking surveys

It is by far the fastest way to make money online.

If you’re looking to make some quick cash, answering simple questions online and taking surveys can be a great way to do it. With just a few minutes of your time, you can easily earn $20 or more.

Here’s how:

- Find the right survey website: There are many websites out there that offer paid surveys. Do some research to find a reputable and reliable website that fits your needs.

- Sign up and create an account: Once you’ve found a suitable survey website, sign up and create an account. You may need to provide some personal information, but make sure to check if the website is secure and trustworthy.

- Take surveys and answer questions: After creating your account, navigate to the surveys section and start taking surveys. Be sure to answer the questions accurately and honestly to qualify for the payment.

- Complete the surveys and accumulate your earnings: As you complete each survey, your earnings will be deposited directly into your account. Keep track of your progress to reach the $20 mark.

- Cash out: Once you’ve reached the desired amount, go to the account settings or financial menu and find the ‘withdraw’ or ‘cash out’ button. Follow the appropriate steps to withdraw your earnings.

It’s crucial to budget your time and choose surveys carefully. Some surveys may take longer than others, so make sure to find ones that offer a good balance between time investment and payout. Additionally, some websites may offer other ways to earn money, such as watching videos or participating in online offers.

In conclusion, answering simple questions online and taking surveys is a fast and easy way to make $20 or more in just a few minutes. It’s important to find a reputable survey website, accurately answer the questions, and follow the appropriate steps to withdraw your earnings. Give it a try and start making money online today!

How to Make a Deposit in NetSuite

Making a deposit in NetSuite is a simple and straightforward process. It allows you to deposit money into your NetSuite account, which can then be used for various online transactions. Whether you are a business owner or an individual looking to manage your finances, making deposits into NetSuite can be a key step in your financial management.

Here are the following steps you need to follow in order to make a deposit in NetSuite:

- Log in to your NetSuite account using your username and password.

- Select the “Banking” menu from the main navigation menu.

- Click on the “Make Deposit” button.

- Enter the details of the deposit, including the amount and the account it needs to be deposited into.

- If you have multiple accounts, select the appropriate account from the drop-down menu.

- If you are depositing a check, enter the check number and other relevant details.

- Click the “Save” button to save the deposit. NetSuite will automatically generate a deposit transaction for you.

- If you have any questions or need help, NetSuite’s customer support is available to assist you.

By following these steps, you can make a deposit in NetSuite in just a few minutes. This way, you can easily deposit your savings or any other funds directly into your NetSuite account for safekeeping and easy access.

NetSuite is a fast and efficient way to manage your financial needs. It provides a secure platform for online banking, making it convenient for every user.

In summary, making a deposit in NetSuite is a simple and straightforward process. By following the steps explained above, you can make a deposit in just a few minutes. It is the fastest and easiest way to deposit money into your NetSuite account, allowing you to manage your finances with ease. So, why wait? Start making your deposits in NetSuite today!

Step 1: Navigate to the Banking Menu

When it comes to saving money, it’s important to have a reliable and straightforward way to make deposits into your account. One way to do this is through online banking, where you can easily transfer funds from your checking account to your savings account.

Follow the steps below to navigate to the banking menu and make a deposit:

- Open your internet browser and go to the banking website.

- Log in to your account with your username and password.

- Once logged in, you will usually find a menu at the top or side of the screen. Look for the option labeled “Banking” or something similar.

- Click on the “Banking” menu to expand it and reveal the available options.

- From the expanded menu, select the option that says “Make a Deposit”.

- You may be asked to answer some security questions or enter additional details to verify your identity.

- Next, you will be presented with a series of options for making a deposit.

- Choose the appropriate deposit method. If you have a check, you can select “Deposit a Check”. If you want to set up automatic savings deposits, you can select “Automatic Savings Deposits”.

- Follow the instructions provided on the screen to complete the deposit process. If you selected “Deposit a Check”, you may need to enter the check details or use a mobile app to capture an image of the check.

- Once you’ve entered all the necessary information, click the “Next” or “Submit” button to initiate the deposit.

By following these simple steps, you can make a deposit into your savings account in just a few minutes. It’s a fast, convenient, and secure way to save money.

It’s important to note that the specific steps may vary depending on the online banking system you are using. Always refer to the instructions provided by your bank for the most accurate and up-to-date information.

Now that you know how to navigate to the banking menu and make a deposit, you can start saving toward your financial goals.

Step 2: Select the Appropriate Account

Now that you’ve taken the necessary steps to make $20 online, it’s crucial to find the right account to deposit and manage your money. In this step, we’ll explain how to navigate through the menu and select the appropriate account in just a few minutes.

1. Log in to your online banking account. If you don’t have one yet, it’s easy to create an account and get started. All you need is a valid email address, your personal details, and some identification like a driver’s license.

2. Once you’re logged in, find the ‘make a deposit’ or ‘deposit’ option in the menu. This may vary depending on your bank, but it’s usually located prominently on the homepage.

3. Click on the ‘make a deposit’ or ‘deposit’ option. Some banks may ask you a few questions to help with their automatic savings management rule, like how much you want to deposit and how often.

4. Enter the details of your deposit. Make sure to check that you have selected the correct account where you want the money to go. If you have more than one account with the bank, it’s important to select the right one.

5. Once you’ve entered all the necessary information, click the ‘enter’ or ‘submit’ button to complete the process. Your money will be deposited directly into your account, and you’ll be one step closer to making your $20 online.

Following these simple steps will ensure that you accurately and efficiently manage your finances. The internet has made it fast and straightforward to handle financial transactions, and online banking is a great tool to help you stay on budget while saving money.

Takeaways:

- Selecting the appropriate account for your deposit is a crucial step.

- Entering the correct details and answering the necessary questions is imperative.

- Clicking the ‘enter’ or ‘submit’ button will initiate the deposit process.

- Online banking provides a fast and convenient way to manage your finances.

By following these steps, you’ll be able to make your $20 online and start working towards your financial goals. Whether you’re saving for a big purchase or just trying to make some extra cash, your online banking account will help you stay organized and on track.

Step 3: Click on the ‘Make Deposit’ Button

Once you have navigated to your online banking account and selected the appropriate savings or checking account, the next step in making a deposit is to click on the ‘Make Deposit’ button. This is a crucial step in accurately and quickly depositing $20 into your account.

If you’re not sure where to find the ‘Make Deposit’ button, don’t worry – it is usually located in the menu on the left or at the top of the screen. Look for a button with the words ‘Make Deposit’ or a similar phrase.

When you click on the ‘Make Deposit’ button, a new window or menu will appear. In this window, you will be asked to enter the details of your deposit. You may need to enter the deposit amount, the account you want to deposit into, and any additional information requested by your bank. Make sure to enter the amount as $20.

Some banks offer automatic deposit options where you can set up regular deposits of $20 or more. If your bank offers this feature and you want to save $20 every week or month, check the box or select the appropriate option to enable automatic deposits.

Before finalizing the deposit, double check all the details you have entered to make sure they are correct. It’s always a good idea to review your deposit and make any necessary corrections before submitting.

When everything looks accurate, click the ‘Submit’ or ‘Confirm’ button to complete the deposit. Your $20 will be deposited directly into your account.

By following these simple steps, you can make a $20 deposit into your account quickly and easily. Remember, this method can be used for any amount you wish to deposit, not just $20. It’s a fast way to put money into your savings or checking account without the need to visit a physical bank branch.

Takeaways:

- Click on the ‘Make Deposit’ button in your online banking account to start the deposit process.

- Enter the necessary details, including the deposit amount of $20.

- Check the box or select the option for automatic deposits if you want to save $20 regularly.

- Review all the details you have entered before submitting the deposit.

- Click the ‘Submit’ or ‘Confirm’ button to complete the deposit.

Making a deposit online is a simple and straightforward way to manage your financial accounts. It can help you save time by avoiding trips to the bank and allow you to deposit money directly from the comfort of your own home.

Now that you know how to make a $20 deposit, why not start applying this knowledge and begin saving for that next yard sale, a special purchase, or even a well-deserved vacation? Remember, every deposit counts!

Step 4: Enter the Deposit Details

Once you have set up your savings account and have successfully made your way through the previous steps of this guide, it’s time to dive into the details of making your $20 deposit. This step is crucial in ensuring that you accurately enter all the necessary details so that the money is deposited correctly.

Follow the simple steps below to enter the deposit details:

1. Log in to your online banking account using the appropriate login details and navigate to the menu that allows you to make deposits.

2. Click on the “Deposits” option from the menu. If you can’t find this option, you may need to check with your banking provider or read their FAQs for more information.

3. Next, you will be presented with a series of questions or options to choose from, depending on the online banking platform you are using. Select the option that best fits your needs, such as “Make a Deposit” or something similar.

4. Now, you will be asked to enter the deposit amount. In this case, enter “20” as the amount you want to deposit.

5. After entering the deposit amount, you may have the option to select whether this is a one-time deposit or an automatic recurring deposit. Choose the appropriate option based on your preference.

6. You will then be prompted to enter additional details, such as the account you want the money deposited into. If you have multiple accounts, make sure you select the correct one for this deposit.

7. Once all the required details have been entered, double-check everything to ensure accuracy. This is particularly important when it comes to entering the account number, as any errors could result in the money being deposited into the wrong account.

8. Finally, click the “Submit” or “Save” button to initiate the deposit process. Depending on your banking provider, you may need to confirm the deposit by entering a one-time password or selecting an additional security rule before the transaction is completed.

That’s it! By following these steps and entering the deposit details accurately, you will successfully make your $20 deposit into your savings account. Remember, this is just one way of making a deposit, and the process may vary slightly depending on your bank or online banking platform.

Now that you know how to make a deposit, you can continue saving money every year. Ryan, a financial management expert, recommends setting a goal to save $20 every week. By doing this, you’ll have saved over $1,000 in a year, which can be used to achieve your financial goals or invest in your future.

Key takeaways:

- Entering the deposit details correctly is crucial to ensure the money is deposited into the right account.

- Follow the step-by-step instructions provided by your online banking platform.

- Always double-check all details before submitting the deposit.

- Consider setting a savings goal and regularly depositing money to achieve it.

Step 5: Save the Deposit

Now that you’ve done all the necessary steps to make $20 online, it’s time to save your hard-earned money for future use. Saving the deposit is crucial for financial management and achieving your financial goals.

Here are the simple and appropriate steps to follow:

- Open your online banking account.

- Select the savings account where you want to deposit the money.

- Navigate to the ‘Make a Deposit’ menu, usually located on the main page.

- Enter the amount of money you want to deposit. In this case, it’s $20.

- Click on the ‘Deposit’ button to proceed.

Depending on your bank and the specific online banking system you use, the process may slightly vary. However, the general rule remains the same.

If you’re new to online banking or not familiar with the process, it’s good to check the ‘Frequently Asked Questions’ or ‘Help’ section on your bank’s website. They usually have detailed explanations and step-by-step instructions on how to navigate the system.

Once you’ve successfully made the deposit, you can rest assured that your $20 is safely saved in your savings account. Remember, every little step counts, and saving even small amounts regularly can add up over time.

Takeaways:

- Saving the deposit is crucial for financial management and achieving your financial goals.

- Follow the simple steps mentioned above to save your deposit in your online banking account.

- If you’re unsure about the process, consult the bank’s website or contact their support for assistance.

By saving your deposit, you’re taking a step towards building a good financial future. Keep up the good work!

Yard work

When it comes to making some quick cash, yard work can be a fantastic option. Many people are willing to pay for help with various tasks such as mowing the lawn, pulling weeds, or trimming hedges. By offering your services, you can turn your time and effort into automatic income. Here are the necessary steps to follow:

| Step 1 | Select a good time of year to start offering your yard work services. In general, spring and summer are the best seasons for this type of work. |

| Step 2 | Get the appropriate tools and equipment you will need to efficiently and accurately complete the job. |

| Step 3 | Advertise your yard work services online by creating a simple website or posting on online classifieds. This will help you reach a wider audience and attract potential customers. |

| Step 4 | Take the time to answer any questions potential customers may have regarding your services. Provide them with all the necessary details and examples of your work. |

| Step 5 | Once you have secured a job, make sure to arrive on time and complete the work to the customer’s satisfaction. |

| Step 6 | After completing the job, don’t forget to ask for payment. Directly banking the payment into your account is the fastest and simplest way to get paid. |

| Step 7 | If you have a yard work business license, you may need to navigate different rules and regulations for tax and financial management. It is crucial to follow the appropriate steps to ensure you are staying compliant. |

| Step 8 | Save a portion of your earnings for future goals. Having a savings account can help you build financial security and plan for the next year. |

| Step 9 | Find new clients by asking for referrals or promoting your services through word of mouth. Satisfied customers are more likely to recommend you to their friends and neighbors. |

By following these steps, you can make yard work a profitable and enjoyable way to earn some extra income. Remember, the key is to provide excellent service and exceed your customers’ expectations.

Get into ‘dropshipping’

If you’re looking to make an extra $20 online, taking the time to get into the world of dropshipping can be a straightforward and lucrative option. Dropshipping is an e-commerce model that allows you to sell products from suppliers without having to store inventory or ship items yourself. Here are the steps to get started:

- Navigate to an online dropshipping platform: Start by selecting a dropshipping platform that fits your needs. Make sure to do your research and read reviews to find a reliable one.

- Set up your account: Once you’ve found a platform, sign up and create your account. Provide all the necessary details and complete any required verification processes, such as obtaining a business license if needed.

- Select your products: After setting up your account, browse through the available product categories and select the ones you want to sell. Look for products that are in high demand and have good profit margins.

- List your products: Once you’ve chosen your products, it’s time to list them on your online store. Provide accurate descriptions, high-quality images, and all the necessary details for your customers to make a purchase.

- Promote your store: To attract customers and make sales, you’ll need to market your online store. Utilize social media, search engine optimization, and other marketing strategies to drive traffic to your store and increase your chances of making a sale.

- Manage your orders: As orders come in, it’s crucial to stay organized and manage them efficiently. Use an order management system, such as NetSuite, to streamline the process and ensure timely order fulfillment.

- Offer excellent customer service: Providing exceptional customer service is key to building a successful dropshipping business. Respond to customer inquiries, address concerns promptly, and resolve any issues that may arise.

- Scale your business: Once you’ve established a successful dropshipping store, you can consider scaling your business by expanding your product offerings, reaching new markets, or optimizing your operations to increase efficiency.

By following these steps and putting in the necessary time and effort, you can enter the world of dropshipping and start making money online. Remember, success will come with persistence, learning from your mistakes, and continuously adapting your strategies.

Key takeaways:

- Dropshipping is a way to sell products online without storing inventory or shipping items yourself.

- Select a reliable dropshipping platform and set up your account.

- Choose high-demand products with good profit margins.

- List your products on your online store, market your store, and manage your orders efficiently.

- Provide excellent customer service and consider scaling your business once it’s established.