If you’re looking for a fast and secure way to send money, Zelle® is the answer. With Zelle, you can send and receive funds instantly, without the need for cash or checks. Zelle works directly with your bank account, so there’s no need to enter any additional information. It’s a convenient and efficient way to transfer money.

To get started with Zelle, all you need is a bank account that is linked to the Zelle service. Most major banks in the US offer Zelle, so chances are that you already have access to this service. You can check if your bank is a Zelle partner by visiting the Zelle® website or contacting your bank directly.

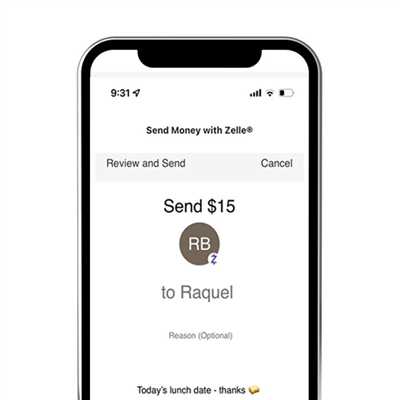

Once you have access to Zelle, you can easily send money to friends, family, or anyone else who has a bank account. Whether you want to split a dinner bill, pay your share of the rent, or send money to a loved one, Zelle makes it easy. Simply enter the recipient’s email address or mobile phone number, select the amount you want to send, and choose the frequency of the payment. You can send one-time payments or set up recurring payments.

Zelle is available for both Android and iOS devices, so you can use it regardless of the phone you have. Zelle doesn’t charge any fees for sending or receiving money, but it’s always a good idea to check with your bank to see if they apply any fees on their end. The funds you send with Zelle are typically available within minutes, so you don’t have to wait for days to see your money in the recipient’s account.

One of the best features of Zelle is its security. Zelle uses the same technology that banks use for online banking, so you can feel confident that your money is safe. Zelle also keeps a record of your transaction history, so you can easily track your payments. If you ever need to cancel a payment, you can do it through the Zelle app or website.

In conclusion, if you’re looking for a fast and secure way to send money, Zelle is the way to go. With Zelle, you can send and receive money instantly, without any fees. It’s a convenient and safe service that works with most major banks. So next time you need to send money, give Zelle a try.

- Send Money Fast with Zelle®

- How do I send money with Zelle

- Is there a fee for Zelle®

- Sending money safely with Zelle®

- Sending money with Zelle FAQ

- Is Zelle safe and secure to use

- Is there a fee to use Zelle

- Does Zelle work internationally?

- Can you use Zelle without a bank account

- Can you cancel a Zelle payment

- Sources

Send Money Fast with Zelle®

Zelle® is a fast and secure way to send money to anyone, anytime, right from your mobile or online banking app. With Zelle®, you can send money instantly from your bank account to a recipient’s bank account. It’s incredibly convenient, and there are no fees to send or receive money using Zelle®.

When you send money with Zelle®, your funds are typically available to the recipient instantly. There is no need to wait for checks to clear or for funds to transfer between banks. Zelle® works directly with your bank account, so you can send money securely without the need for any additional accounts or services.

To use Zelle®, you’ll need to have a bank account that is enrolled in Zelle®. Most major banks in the United States offer Zelle® as a payment option, so chances are your bank supports it. If you’re not sure if your bank offers Zelle®, you can check their website or contact their customer service for further information.

Once you’re enrolled in Zelle®, sending money is easy. Simply select the recipient from your contacts or enter their email or phone number, enter the amount you want to send, and confirm the payment. The recipient will receive a notification and can safely and securely accept the payment directly into their bank account.

Zelle® is intended for sending money within the United States, and it does not currently support international transfers. If you need to send money internationally, you may want to explore other options or contact your bank for advice on the best way to do so.

With Zelle®, you can also set up repeating payments, such as monthly rent or recurring bills. Zelle® makes it easy to schedule these payments, so you can set them up once and forget about them. The funds will be sent automatically each month on the designated day, without any further action needed from you.

If you ever need to cancel a payment sent with Zelle®, you should contact your bank as soon as possible. They will be able to advise you on the best course of action and help you resolve any issues.

If you have any further questions about using Zelle®, you may want to consult the Frequently Asked Questions (FAQ) page on the Zelle® website. They provide a wealth of information about how Zelle® works, including how to use it, what to do if you encounter any issues, and more.

In conclusion, Zelle® is a fast, secure, and convenient way to send money instantly from your bank account. It’s available through most major banks in the United States and is free to use. Whether you’re sending money to a family member, paying a friend back for dinner, or making recurring payments, Zelle® is a reliable and efficient payment service.

How do I send money with Zelle

If you’re enrolled in Zelle through your online banking, you can send money to anyone in the U.S. as long as they’re also enrolled in Zelle. Here’s how you can send money with Zelle:

- Log in to your online banking account.

- Select “Send Money with Zelle”.

- Choose the recipient from your list of eligible contacts or add their email address or U.S. mobile number.

- Enter the amount you want to send.

- If you want, you can also choose the frequency of the payment, such as one-time or recurring.

- Add a message if you want to include one.

- Review the details and select “Send” to complete the transaction.

- The recipient will be notified and the money will be instantly available in their account.

It’s important to note that Zelle is only available for sending money within the U.S. and it doesn’t support international transfers. Additionally, some banks may charge a fee for using Zelle, so it’s recommended to check with your bank for any applicable fees.

If you’re not enrolled in Zelle, you can still receive money sent through Zelle by following the instructions on the Zelle website. However, you won’t be able to send money yourself until you enroll in Zelle through your bank.

With Zelle, you can send money safely and securely without the need for cash or checks. The funds are sent directly from your bank account to the recipient’s bank account, making it a fast and convenient way to transfer money.

If you have any further questions about using Zelle, including its features and how it works, you can refer to the Zelle FAQ section on the Zelle website or contact your bank’s customer service for assistance.

Is there a fee for Zelle®

When using Zelle®, there is typically no fee to send or receive money. Zelle® is a fast, safe, and secure way to send money directly between enrolled banking accounts. You can send money with Zelle® using your bank’s online or mobile banking service.

It’s important to note that while Zelle® itself does not charge a fee, your bank or credit union may apply a fee for using Zelle®. To learn more about any fees associated with Zelle®, it’s recommended to contact your bank directly.

Zelle® is only available for use with bank accounts based in the United States, including those linked to Android and iOS devices. Recipients of Zelle® payments must also be enrolled with Zelle® to receive funds. You can send money to friends, family, and others securely and instantly without the need for any additional action on their part.

If you have any further questions about Zelle®, you can refer to the FAQ page on the Zelle® website for more information. Zelle® works with over 100 participating banks and financial institutions, so you can safely send and receive money with ease.

Sending money safely with Zelle®

When it comes to sending and receiving money, Zelle® is a fast and secure way to do it. With Zelle®, you can easily send money from your bank account to another person’s account, all without the need for cash or checks.

Zelle® works through participating financial institutions, so you’ll need to have an account with a bank that offers Zelle®. Once you’re enrolled, you can use Zelle® to send money instantly to friends, family, or anyone else you choose.

To send money with Zelle®, simply log in to your bank’s online or mobile banking app and look for the Zelle® option. Enter the recipient’s email address or mobile phone number, along with the amount you want to send. You can also include a optional message to the recipient.

One of the benefits of using Zelle® is that it’s a safe and secure service. Zelle® uses advanced encryption and other security measures to protect your financial information. Additionally, you never need to enter your banking information into the Zelle® app or website, which further enhances its safety.

Zelle® is available within the United States, and there are no fees to use the service. You can send and receive money with Zelle® as often as you like, and you can even set up recurring monthly payments if you choose. Zelle® is fast, convenient, and designed to make sending money easier than ever before.

If you have any questions about using Zelle®, you can refer to the FAQ page on the Zelle® website for more information. Zelle® also provides customer service support to help answer any further questions or address any concerns you may have.

Remember, Zelle® is intended for sending money to people you know and trust. It’s not recommended for use with unfamiliar recipients or for international transfers. Additionally, Zelle® does not offer a cancellation feature, so be sure to double-check your information before confirming the transfer.

With Zelle®, you can send and receive money quickly and securely, making it a convenient option for all your financial needs. Take advantage of this fast and reliable service to easily send money to your friends, family, and others, whenever you need to.

| Some sources | Ссылки |

| Zelle® FAQ | https://www.zellepay.com/support |

| Participating Banks | https://www.zellepay.com/get-started |

| Money Transfer Safety Tips | https://www.consumer.ftc.gov/articles/0198-mobile-payment-apps |

Sending money with Zelle FAQ

Q: What is Zelle?

A: Zelle is a fast and secure payment service that allows you to send money instantly within the United States. It is available through participating banking websites and the Zelle app for Android and iOS devices.

Q: How does Zelle work?

A: Zelle is a service that allows you to send and receive money with friends, family, and others you trust. To send money, you only need the email address or mobile number of the recipient, who must also be enrolled in Zelle. Once the recipient is selected, you can enter the amount you want to send and send the payment. The money is typically available to the recipient instantly.

Q: How much does it cost to use Zelle?

A: Zelle does not charge any fees for sending or receiving money. However, your bank may apply fees for using Zelle, so it is recommended to check with your bank for further information.

Q: Can I use Zelle to send money internationally?

A: No, Zelle can only be used for sending money within the United States. It is not intended for international transfers.

Q: How often can I send money with Zelle?

A: There is no set frequency for sending money with Zelle. You can send money as often as you need to, within the limits set by your bank.

Q: Can I cancel a payment made with Zelle?

A: Once a payment is sent with Zelle, it cannot be canceled. It is important to double-check the recipient’s information before sending the payment.

Q: How secure is Zelle?

A: Zelle is a secure way to send money. It is based on the same technology used by major banks in the United States. Zelle also does not store any sensitive financial information, such as bank account or credit card numbers.

Q: Is there a limit on how much money I can send with Zelle?

A: The limits for sending money with Zelle may vary depending on your bank. It is recommended to check with your bank for specific limit information.

Q: Can I send recurring payments with Zelle?

A: Zelle does not support recurring or scheduled payments. Each payment must be initiated individually.

Q: What happens if I send money to the wrong person?

A: If you send money to the wrong person using Zelle, you should contact your bank as soon as possible. They may be able to help you recover the funds, depending on the circumstances.

Q: Can I view the transaction history of my Zelle payments?

A: Yes, most banks provide a transaction history for Zelle payments on their website or mobile app.

Q: Is my personal information safe with Zelle?

A: Zelle takes the privacy and security of your personal information seriously. However, it is always important to use caution when sharing personal information online and to follow best practices for online security.

Q: How do I learn more about Zelle?

A: For more information about Zelle, including how to sign up for the service and how it works, you can visit the Zelle website or contact your bank.

Is Zelle safe and secure to use

Zelle is a safe and secure way to send and receive money. It is a fast and convenient service that allows you to make payments without the need for cash or checks.

Zelle works by linking your bank account to the Zelle app or website, and then you can send money securely to recipients based on their phone number or email address. Once the payment is sent, the recipient typically receives the funds within minutes.

Zelle is a secure service that uses encryption and other security measures to protect your financial transactions. It is backed by major banks and financial institutions, which adds an extra level of trust and security to the service.

When sending money with Zelle, you can choose to send a one-time payment or set up recurring payments for monthly bills. Zelle is available on both iOS and Android devices, making it convenient for users regardless of their device preferences.

If you ever need to cancel a payment, Zelle does offer the option to do so as long as the recipient hasn’t enrolled with Zelle. However, if the payment has already been processed and sent, you won’t be able to cancel it.

Zelle also has a frequently asked questions page on their website, where you can learn more about the service and get answers to any questions you may have. They also provide tips and advice for using Zelle safely, including not sending money to people you don’t know or trust, and not sharing your Zelle account information with anyone.

In conclusion, Zelle is a safe and secure service to use for sending and receiving money. It is fast, convenient, and offers additional security measures such as encryption and the backing of major banks. However, it is always important to be cautious and use your own judgement when making financial transactions online.

Is there a fee to use Zelle

Using Zelle® is a financial service intended to make sending and receiving money fast, safe, and secure. Zelle is based on the concept of transferring funds electronically between bank accounts. When you use Zelle to send money to family, friends, or other individuals, there typically isn’t a fee to use the service.

Zelle is available through a number of banks and financial institutions, and each bank may have its own policies and fees for using Zelle. It’s important to note that Zelle itself doesn’t charge any fees for its service.

When you use Zelle, the money is sent directly from your bank account to the recipient’s bank account, without the need for any intermediaries or third-party services. This means that the transaction is typically instant and secure.

It’s important to read the terms and conditions of your specific bank or financial institution to learn more about any potential fees that may apply to Zelle transfers. You can often find this information on your bank’s website or by contacting their customer service.

Additionally, if you’re sending money internationally using Zelle, there may be additional fees or restrictions based on the country you’re sending money to. It’s always a good idea to check with your bank or financial institution for more information.

Some banks may also offer additional features, such as recurring payments or the ability to cancel a payment. These features may have specific terms and fees associated with them, so it’s important to review your bank’s policies and consult with their customer service if you have any questions.

In summary, while Zelle itself doesn’t charge any fees for its service, your bank may have its own policies and fees for using Zelle. It’s important to review your bank’s terms and conditions, including any fees that may apply, to ensure you’re fully informed when using Zelle to send and receive money.

Does Zelle work internationally?

- Zelle is only available for use within the United States. It is not intended for international transfers.

- If you’re sending money through Zelle, make sure both you and the recipient have enrolled with Zelle and have a bank account with a U.S. financial institution.

- When you send money with Zelle, it is typically available to the recipient within minutes.

- There is no fee to use Zelle, but keep in mind that your bank may apply a fee for using their service.

- Zelle is a fast and secure way to send payments, recommended by many banks and the Federal Reserve.

- To send money, simply enter the recipient’s email address or mobile number, select the amount, and choose the frequency of the payment (one-time or recurring).

- Before you complete the transaction, you can review the details and make sure everything is correct.

- Zelle does not allow for canceling or repeating payments. Once the money is sent, it cannot be canceled or retrieved.

- If you have any questions or need further assistance with Zelle, it is recommended to contact your bank or visit their website for more information.

- Please note that Zelle is a service provided by your bank, and the content and availability of Zelle may vary based on your bank.

For more information and to learn how to safely use Zelle, visit the official Zelle website or consult with your bank.

Can you use Zelle without a bank account

No, you cannot use Zelle without a bank account. Zelle is a digital payment service that allows you to transfer money to friends, family, and other recipients. However, to use Zelle, you will need a bank account that is linked to the Zelle service.

When you want to send funds using Zelle, you will typically need to have the recipient’s email address or mobile phone number. Once you have that information, you can select the recipient from your contact list (if they are already enrolled with Zelle) or enter their email address or phone number manually. You can then enter the amount you want to send and confirm the payment. The recipient will usually receive the funds within minutes and can access them through their linked bank account.

Zelle is a safe and secure service that is available through many banks and financial institutions. It is backed by the security and fraud protection measures of the banks that offer it. Zelle is a convenient and fast way to send money instantly to recipients, including those who do not have a Zelle account. However, the recipient will need a bank account in order to receive the funds.

If you have any further questions about using Zelle, you can check the Zelle website for an FAQ page or contact your bank for more information. It is important to use Zelle responsibly and only send money to people you know and trust. Zelle does not offer any advice or further assistance if you send money to the wrong person or if there is a dispute over a payment.

It is also worth noting that Zelle does not support recurring or monthly payments. Zelle is intended for one-time payments, so if you need to make regular payments to someone, you may need to use another method. Additionally, Zelle does not charge a fee for sending or receiving money, but your bank may apply fees based on their policies.

Overall, Zelle is a convenient and secure way to send money to friends and family, but it does require a bank account to work. If you do not have a bank account or prefer not to use one, there are other digital payment services available that may be more suitable for your needs.

Can you cancel a Zelle payment

Yes, you can cancel a Zelle payment, but there are some important factors to consider.

First and foremost, it’s important to note that Zelle payments are typically fast and secure. Once you send a payment through Zelle, it is sent directly from your bank account to the recipient’s bank account, without any intermediaries. This means that the funds are typically available to the recipient within minutes.

However, if you find yourself in a situation where you need to cancel a Zelle payment, you can do so as long as the payment has not been already accepted by the recipient. To cancel a payment, you need to follow these steps:

1. Log in to your banking app or website that is linked to your Zelle account.

2. Navigate to the Zelle page or section within your banking app or website.

3. Find the payment in question within your payment history.

4. Select the payment and choose the option to cancel or stop the payment.

5. Follow any further on-screen instructions to complete the cancellation.

It’s worth noting that Zelle is intended for sending money to friends, family, and people you trust. Zelle does not offer a protection program for authorized payments, and once the funds are sent, they’re typically not recoverable. It’s important to only send money to people you know and trust.

If you have any questions or need further assistance, it’s recommended to reach out to your bank’s customer service or Zelle customer support.

It’s always good to know how to cancel a Zelle payment, but it’s even better to take precautions to avoid the need for cancellation. Make sure to double-check the recipient’s information before sending money, and only send money to recipients who are enrolled with Zelle to ensure a secure and successful transfer.

Sources

- When sending or receiving money through Zelle®, it is important to use only trusted sources, including the official Zelle website, your bank’s website, or the Zelle app on your Android or iOS device.

- Zelle is a safe and fast way to send money, as it is based on the financial network of your bank. Your funds are instantly sent and received without the need for any physical action on your part.

- For frequently asked questions and further information about how Zelle works, you can visit the Zelle FAQ page on their official website.

- If you have any questions about using Zelle or need advice on how to safely send or receive money, we recommend contacting your bank directly for assistance.

- When using Zelle, it’s important to note that there may be fees associated with certain transactions or services. Be sure to check with your bank or the Zelle website to learn more about any applicable fees.

- Zelle allows you to send money to anyone with a US bank account, as long as they are enrolled with Zelle. You can select the recipient from your contact list or enter their email address or mobile phone number.

- Zelle also offers the option to set up recurring payments for monthly or repeated transactions. This can be useful for bills or other regular expenses.

- If you no longer wish to use Zelle or want to cancel a recurring payment, you can typically do so through your bank’s online banking service or by contacting customer support.

- It is important to note that Zelle transactions cannot be reversed or canceled once funds have been sent. Ensure you are sending money to the intended recipient before completing the transaction.

- Zelle is a secure service and has measures in place to protect your financial information. However, it’s always important to use caution when sharing personal or financial information online.

- Zelle does not have access to your banking history or account number, as it is only linked to your bank for the purpose of sending and receiving money.

- If you are unsure about the legitimacy of a Zelle message or request, it is best to err on the side of caution and not disclose any personal or financial information. Zelle will never ask for your username, password, or other sensitive information.

- Learning how to use Zelle effectively can help you make secure and fast payments to friends, family, or anyone else with a US bank account.