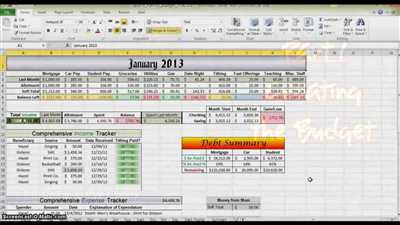

Creating a budget is a crucial step in managing your finances. Whether you want to track your monthly expenses, plan for a special event, monitor your income and expenses for a project, or simply break down your costs, using an Excel budget can help you achieve your financial goals.

When it comes to budgeting, Excel provides a wide range of features and templates that can assist you in quickly and efficiently creating a budget that works for you. With Excel, you have the flexibility to choose from pre-made templates or create your own, allowing you to tailor your budgeting process to your specific needs.

One of the key advantages of using Excel for budgeting is the ability to track your income and expenses within a single spreadsheet. This allows you to easily update and monitor your budget as your financial situation changes. Whether you’re saving for a family vacation, planning a wedding, or managing your monthly expenses, Excel can help you stay on track.

To create an Excel budget, you’ll first need to open a new spreadsheet and choose a budget template that suits your needs. Excel provides a variety of templates, including monthly budget planners, event budget trackers, project budget worksheets, and more. If none of the pre-made templates fit your requirements, you can also create a budget from scratch.

Once you have selected a template or created your own, you can start entering your income and expenses. Excel allows you to easily input your financial data into the appropriate categories and sections, such as income, expenses, or cash flow. You can also add additional categories to customize your budget to your specific needs.

Within Excel, you can use formulas to automatically calculate totals, monitor your spending, and track your progress towards your financial goals. By utilizing formulas, you can save time and ensure accuracy in your budget calculations.

When creating your budget in Excel, it’s important to regularly update and review your expenses. This will allow you to identify any areas where you might be overspending and make adjustments accordingly. By monitoring and tracking your expenses, you can stay on top of your financial health and make informed decisions about your money.

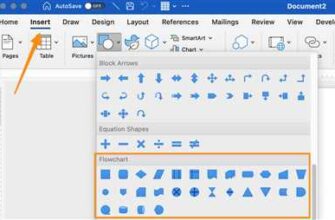

Excel also offers additional features that can help you with budget planning. For example, you can create charts and reports to visualize your budget breakdown, review expected versus actual expenses, and analyze your spending patterns over time. These features can provide valuable insights into your financial habits and help you make more informed financial decisions.

Whether you’re a beginner or an advanced user, Excel offers a wide range of tools and resources to help you create, track, and manage your budget effectively. With its user-friendly interface and customizable features, Excel is a powerful tool for budgeting and financial planning.

In conclusion, using Excel to create a budget is a smart choice for those looking to take control of their finances. Whether you’re a family trying to save for the future, an event planner managing a special occasion, or a small business owner tracking expenses and profit margins, Excel provides the flexibility and functionality to meet your budgeting needs. So why wait? Start creating your Excel budget today and take the first step towards achieving your financial goals!

Project Budget Template for Excel

When it comes to managing a project, tracking its finances is crucial. Creating a budget breakdown for your project can help you quickly and accurately monitor your expenses and stay within your desired financial goals. With the help of a project budget template in Excel, you can easily keep track of your income and expenses, and ensure that you’re making the most of your available funds.

Excel is a powerful software that offers a wide range of features for budgeting and financial planning. Whether you’re planning a small family event or a large-scale business project, Excel has templates that can help you create and update your budget spreadsheets with ease.

One of the most popular budgeting templates in Excel is the Project Budget Template. This template is designed to help you monitor and report your project’s cash flow, expenses, and income. It includes sections for income sources, expense categories, and a summary chart that automatically calculates and displays your profit or loss.

When you open the Project Budget Template, you’ll find 6 main worksheets:

1. Summary: This section provides a quick overview of your project’s financial situation, including your total income, expenses, and profit or loss.

2. Income: Use this worksheet to enter and track all sources of income for your project. You can choose whether to calculate your income on a monthly basis or for the entire project duration.

3. Expenses: Here, you can enter and categorize all your project expenses. The template provides pre-defined categories, but you’re free to add or modify them to fit your specific needs.

4. Breakdown: This section is a more detailed breakdown of your expenses, showing the cost for each individual item or unit. It also includes a formula to automatically calculate the total expense for each category.

5. Cash Flow: This worksheet helps you monitor the flow of cash in and out of your project. It includes columns for calculating opening and closing balances, and can be used to track your credit and debit transactions.

6. Budget vs. Actuals: This section allows you to compare your budgeted expenses with your actual expenses. It helps you identify any discrepancies and make necessary adjustments to stay on track.

Choosing the right budget template for your project can save you time and effort in creating your own spreadsheet from scratch. With the Project Budget Template for Excel, you have a ready-made tool that can help you create, monitor, and report your project’s financials. Whether you’re a seasoned budgeting pro or just starting out, this template can help you stay organized and ensure the success of your project.

Choose a spreadsheet program or template

When it comes to creating an Excel budget, one of the first steps is to choose a spreadsheet program or template that suits your needs. This is an important decision as it will be the foundation for your budgeting process.

If you already have Microsoft Excel, this program can be a great option for creating and managing your budget. Excel provides a wide range of features that can help you effectively plan, track, and monitor your finances. It allows you to easily create multiple worksheets for different money categories, such as income and expenses. You can even break down your expense categories further into sub-categories to have a more detailed breakdown of your expenses.

Alternatively, if you don’t have Microsoft Excel or prefer not to use it, there are many free budgeting templates available online that you can download and use. These templates often come with pre-built formulas and calculations to quickly calculate your income, expenses, and monthly cash flow. They might also include additional features like charts and graphs to help you visualize your budget and track your financial goals.

When choosing a spreadsheet program or template, it’s important to consider your specific needs and goals. If you’re planning a family budget, you might want to choose a template that allows you to input data for multiple family members or projects. If you’re budgeting for a single event or project, a template with a simpler layout might be more appropriate.

Whichever program or template you choose, it’s important to update and keep track of your budget regularly. This will help you stay on top of your finances and make any necessary adjustments. Many budgeting software and templates allow you to save your budget and automatically calculate your profit or loss based on your expected income and expenses.

Overall, choosing the right spreadsheet program or template can make a big difference in your budgeting experience. It can help you save time, stay organized, and gain a better understanding of your financial situation. Take the time to explore different options and find the one that works best for you.

Creating your event budget in Excel

When it comes to planning an event, having a budget is crucial. By creating a budget for your event using Excel, you can track your expenses, monitor your income, and ensure that you stay within your financial goals.

Excel is a powerful tool for budgeting because it allows you to create a single spreadsheet that can be divided into multiple worksheets. This feature enables you to easily breakdown your costs into different categories and track them separately. Whether you’re planning a family gathering, a corporate event, or a wedding, Excel can help you stay organized and keep your finances on track.

To create your event budget in Excel, start by opening a new workbook or choosing a budget template that suits your needs. There are many free templates available online from various sources. Once you have your template, you can customize it to fit your specific event.

Next, you’ll want to set your financial goals and determine how much money you are expected to spend on each expense. This will help you prioritize your spending and identify areas where you can cut costs. For example, if you’re planning a wedding, you might have categories for venue fees, food and drinks, decorations, and music.

Within each category, you can create a summary of expenses and calculate the total costs. Excel has built-in formulas that can automatically update and calculate these numbers for you. This saves you time and ensures that your budget is always up to date.

Excel also has features that can help you track your income and monitor your cash flow. You can create a monthly profit and loss chart to see how much money you’re making and where you might be overspending. This information is critical for making informed financial decisions and staying within your budget.

By creating your event budget in Excel, you can easily track and report on your expenses. Excel allows you to choose from various templates and customize them to fit your needs. You can also break down your costs into different categories and track them individually. This makes it easier to allocate your resources and stay within your financial goals.

Whether you’re planning a small family gathering or a large corporate event, Excel can help you create and update your budget quickly and efficiently. With its powerful features and formulas, you can make sure that your event is a success without breaking the bank.

So, why not give Excel a try for your next event budget? It’s a free program that offers a wealth of budgeting and tracking tools, making it the perfect choice for any budget project. Start creating your budget in Excel today and take control of your finances!

1 Income vs expenses

When it comes to budgeting, it’s crucial to have a clear understanding of your income and expenses. By tracking your income and expenses, you can quickly see where your money is going and make necessary adjustments to stay within your budget.

One way to track your income and expenses is by creating a budget in Microsoft Excel. Excel offers a variety of features and formulas that can help you create a detailed budget and monitor your finances effectively.

To create a budget in Excel, you can start by opening a new spreadsheet or using a pre-made template. Excel has many free budget templates available that you can choose from. These templates have pre-built formulas and categories, making it easier to enter your income and expenses.

When choosing a template, look for one that has categories for both income and expenses. This will help you get a clear breakdown of where your money is going. It’s also helpful to have additional worksheets for tracking different projects or monthly expenses.

To track your income, you can create a separate section within your budget. Here, you can enter your expected income from various sources such as your job, side projects, or rental income. Excel can calculate the total income automatically using formulas.

The same goes for tracking your expenses. You can create a section where you enter your expected expenses, such as rent or mortgage payments, utility bills, groceries, and transportation costs. Excel can calculate the total expense automatically and show you a summary of your budget.

It’s important to update your budget regularly to reflect any changes in your income or expenses. For example, if you receive a raise or a bonus, you’ll want to update your income section to reflect the additional income. Similarly, if you have unexpected expenses, such as medical fees or car repairs, you’ll want to include them in your budget.

Excel also has chart features that can help you visualize your income and expenses. You can create a pie chart or a bar chart to see the breakdown of your income and expenses by category. This can make it easier to see where you’re spending the most and where you can potentially save more.

By using Excel as a budgeting tool, you can easily track your income and expenses, monitor your finances, and plan for future goals. Whether you’re managing your personal finances or planning a family event, Excel can be a valuable tool to help you stay on track with your financial goals.

2 Event income

Creating an event budget in Excel requires careful planning and organization. One of the most important aspects of your budget is estimating the income you expect to generate from the event. Excel offers several templates and features that can help you with this task.

First, you need to choose a template that suits your needs. Excel provides free budget templates that you can use as a starting point. These templates often have pre-built categories and formulas that can calculate your expected income based on the information you provide.

If you prefer to create your own budget from scratch, you can start by setting up a spreadsheet with different income categories. For example, you might have categories for ticket sales, sponsorships, merchandise sales, and additional sources of income. Within each category, you can break down the expected income into subcategories or specific projects.

Once you have set up your income categories, you can use Excel’s formulas to automatically calculate the total income for each category and provide a summary of your event’s expected income. This will help you keep track of your finances and make adjustments if needed.

Another feature of Excel that can help with your event budget is the ability to create charts and graphs. You can use these visual representations to monitor your income and expenses and see how they align with your goals.

If you prefer a more advanced budgeting program, there are also software options available that are specifically designed for event planning and budgeting. These programs often have additional features such as tracking fees, credit card expenses, and monthly expenses. However, they might come with a cost.

Whether you choose to use Excel or a dedicated budgeting program, the most important thing is to have a clear plan in place and regularly update your budget as new information comes in. This will help you stay on track and ensure that you are planning within your expected income and can make adjustments as needed.

3 Event expenses

When planning an event, it’s important to have a clear breakdown of the expenses that you’ll incur. This will help you create a budget and track your spending. Here are the 3 event expenses that you should take into consideration:

- 1. Venue fees: This is usually the most significant expense when organizing an event. You’ll need to choose a venue that fits your budget and meets your needs. Take into account factors such as location, size, and amenities when calculating the cost.

- 2. Catering costs: Food and beverages are an essential part of any event. Depending on the type of event and the number of guests, catering costs can vary significantly. It’s important to choose a reputable catering service within your budget and plan the menu accordingly.

- 3. Marketing and promotion expenses: To ensure a successful event, you’ll need to allocate a portion of your budget towards marketing and promotion. This can include advertising costs, designing promotional materials, and social media campaigns. Having a well-planned marketing strategy can help attract more attendees and increase your event’s profits.

When creating your event budget, you can use Excel or other budgeting software to track these expenses. Excel’s built-in templates or budgeting formulas can help you quickly calculate and update your expenses and monitor your finances. You can also use Excel’s charts and summary features to get a breakdown of your expenses by category or project.

By choosing the right budgeting tools and tracking your event expenses diligently, you can ensure that your event stays within budget and achieves its goals. Whether you prefer to use a spreadsheet program like Excel or opt for more specialized event planning software, it’s important to find a program that works best for you and your needs.

4 Event profit

When it comes to creating a budget for an event, one of the most important sections is the “Event profit” category. This section is where you’ll calculate how much money you expect to make from your event and compare it to your expenses, to determine the profit or loss.

To create an event budget, start by choosing a budgeting template or spreadsheet that works for you. There are many free templates available online that can help you quickly track your expenses and income. You can also use budgeting software or create your own template in Excel.

Within your budget, allocate a category for the event profit. This will be the section where you calculate the expected income from the event. If you’re planning multiple events, you can create a breakdown by unit or choose a single category to track the overall profit.

To calculate the event profit, you’ll need to take into account the expected income from ticket sales, sponsorships, and any additional fees you might charge for special features or programs. Subtract these income sources from the total expenses to get a clear picture of your event profit.

It’s important to monitor your event profit closely throughout the planning process. As your expenses or income change, update your budget to reflect these changes. This will help you stay on track and make any necessary adjustments to meet your financial goals.

One helpful feature of budgeting in Excel is the ability to create charts and reports that automatically update as you make changes to your budget. This can give you a visual representation of your event profit and help you see where your money is going.

When it comes to budgeting for an event, having a clear understanding of your expected profit is essential. By choosing the right budget template and tracking your expenses and income accurately, you can make better financial decisions and ensure the success of your event.

So, whether you’re planning a small family gathering or a large-scale program, don’t forget to include the “Event profit” section in your budget to help you track and monitor your finances!

5 Expense Breakdown Chart

When it comes to planning your budget, it’s important to have a clear understanding of where your money is going. Creating an expense breakdown chart can help you track and monitor your expenses, making it easier to stay within your budget.

There are several features you can choose from when creating an expense breakdown chart. You can use free budget templates or create your own from scratch. You can also use budgeting software or a spreadsheet program like Excel to calculate and track your expenses.

The first step is to categorize your expenses. You might choose categories such as monthly bills, groceries, transportation, entertainment, and personal expenses. By breaking down your expenses into categories, you can quickly see where your money is going and make adjustments if needed.

Next, you’ll want to track your expenses within each category. You can do this by using a single spreadsheet or creating separate worksheets for each category. In the spreadsheet, you can input your expenses and calculate the total for each category using formulas.

Once you have your expenses tracked, you can create a summary section that shows your total income, total expenses, and the profit or loss for each month. This section can help you see if you’re spending more or less than expected and adjust your budget accordingly.

When choosing a budgeting program or software, look for features that allow you to automatically update your expense breakdown chart. This can save you time and make it easier to stay organized.

Finally, don’t forget to set goals for your budget. Whether you’re saving for a big event or trying to pay off credit card debt, having clear goals can help motivate you to stick to your budget.

By creating and utilizing an expense breakdown chart, you can effectively track and manage your finances. It’s a powerful tool that can help you make informed financial decisions and achieve your financial goals.

6 Event budget report

When you’re planning an event, it’s important to keep track of your finances to ensure that you stay within budget. One way to do this is by creating an event budget report. This report will help you monitor your income and expenses and provide a breakdown of costs in various categories.

To create an event budget report, you can use a spreadsheet program like Excel. There are templates available that can automatically calculate and update your expected income and expenses. You’ll find free budget templates online that cater specifically to event planning, or you can choose to create your own from scratch.

The event budget report typically consists of several sections. The first section is a summary of the overall budget for the event, including projected income and expenses. This section might also include a chart or graph to visually represent the budget breakdown.

The next section is the breakdown of expenses. This section lists all the categories of expenses, such as venue rental fees, catering costs, decorations, and marketing expenses. For each expense category, you’ll want to make a note of the estimated cost and the actual cost, so you can track any discrepancies.

In addition to the expense breakdown, you might also want to include a section for income sources. This section will help you keep track of all the sources of income for the event, such as ticket sales, sponsorships, and merchandise sales.

When creating your event budget report, it’s important to be as detailed as possible. Break down your expenses and income into as many specific categories as possible. This will help you have a more accurate and realistic representation of your event’s financial situation.

By monitoring your event budget through a budget report, you can easily see if you’re on track or if you need to make adjustments. You can use formulas within the spreadsheet program to calculate the total income and expenses and compare them to your goals or profit targets.

Creating an event budget report can help you save money and make more informed decisions when planning your next event. By having a clear understanding of your finances, you can better allocate your resources and ensure a successful event.

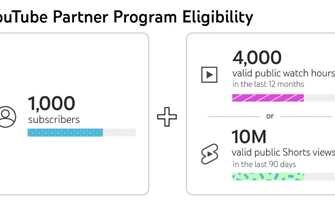

Budget Templates

When it comes to budgeting, having a template can make the process much easier. Budget templates are pre-designed spreadsheets or worksheets that you can use to track your income and expenses, plan for future projects or events, and monitor your overall finances. They often come with pre-defined categories and formulas that automatically calculate totals and provide a summary of your budget.

There are various sources where you can find budget templates, both free and for a fee. One of the most popular programs for creating and managing budgets is Microsoft Excel. Excel has a wide range of budgeting features and templates that you can choose from. Whether you’re looking for a monthly budget planner, a family budget tracker, or a project budget breakdown, Excel has a template that can suit your needs.

When you open an Excel budget template, you’ll find sections for income, expenses, and budget breakdown. The income section allows you to enter your expected and actual income sources, while the expense section helps you categorize and track your costs. The budget breakdown section provides a visual chart of your expenses and income, allowing you to see where your money is going and how much you’re saving.

Excel budget templates also come with additional features that can help you with your budgeting. For example, you can use formulas to automatically calculate totals and percentages, or create reports to monitor your progress. You can also update your budget template regularly, either manually or by linking it to your bank accounts or credit cards, so that your budget always reflects your current financial situation.

Choosing the right budget template depends on what you’re looking to achieve. If you’re new to budgeting, you might want to start with a simple template that has basic categories and features. On the other hand, if you have more complex financial goals or projects, you might need a template that allows for more detailed budget planning and tracking.

One of the advantages of using Excel for budgeting is that it provides a flexible platform that can be customized to fit your specific needs. You can create new categories, add or remove sections, and modify formulas to make the budget template work exactly the way you want it to. This flexibility makes Excel a popular choice for both personal and business budgeting.

Overall, having a budget template can help you make better financial decisions, track your expenses, and plan for the future. By using a budget template in Excel, you can quickly and easily create a budget that works for you, whether you’re managing your personal finances or working on a business project.

Sources

When it comes to creating an Excel budget, there are several software options available to help you track your income and expenses. One of the most popular choices is Microsoft Excel itself, as it offers a single program with multiple features that can be used to create and monitor your budget.

If you choose to use Excel, you can start by opening a new spreadsheet or using a budget template. There are many free templates available online, or you can create your own custom template.

Once you have your spreadsheet set up, you can start by entering your income and expense categories. It’s important to break down your budget into specific categories, such as rent, groceries, transportation, and entertainment. This will make it easier to track your spending and see where your money is going.

Next, you can use formulas to calculate your total income, total expenses, and the profit or loss for each month. You can also create a summary chart or a cash flow chart to visualize your budget breakdown.

For more advanced budgeting, you might want to consider using a budgeting program or software that automatically tracks and updates your expenses. There are several software options available that can help you with budget planning and goal setting, such as Quicken, Mint, or YNAB (You Need a Budget).

Another source of budgeting help is financial planners or advisors. They can help you create a budget plan based on your specific financial goals and circumstances.

Whether you use Excel, a budgeting program, or seek professional help, the most important thing is to start budgeting and stick to it. Budgeting can help you save money, pay off debt, and achieve your financial goals.

So don’t wait any longer, open Excel and start creating your budget today!