Creating a budget is a vital part of managing your finances. It helps you track your income and expenses, prioritize your spending, and reach your financial goals. In this article, we will discuss how to create a household budget that works for everyone.

Step 1: Analyze your income and expenses. Start by gathering all the necessary financial statements, such as your bank statements, bills, and receipts. Go through each transaction and categorize them into different groups, like housing, transportation, groceries, and entertainment. This will give you a clear picture of how much you earn and spend each month.

Step 2: Set your financial goals. Knowing what you want to achieve will help you allocate your money wisely. Whether it’s paying off debt, saving for a vacation, or building an emergency fund, having a goal in mind will give your budget purpose. Determine how much money you need to reach your goals and adjust your spending accordingly.

Step 3: Calculate your monthly income and expenses. Now that you have a clear idea of your financial goals, it’s time to take a closer look at your income and expenses. Add up all your sources of income and subtract your monthly bills, such as rent/mortgage, utilities, and loan payments. This will give you an idea of how much money you have left to cover other needs and wants.

Step 4: Track your spending. Once you have your budget in place, it’s important to track your spending regularly. Keep a record of every transaction, whether it’s cash, credit card, or online purchases. By doing this, you can see where your money is going and identify any areas where you might be overspending. There are many budgeting apps available that can help you keep track of your expenses easily.

Step 5: Stick to your budget. Budgeting requires discipline and commitment. It’s important to stay focused on your financial goals and resist the temptation to overspend. If you find it challenging to stick to your budget, try using cash envelopes or setting up automatic transfers to separate accounts for different expenses. This will help you stay on track and avoid unnecessary spending.

Step 6: Review and adjust your budget. Life happens, and your financial needs and circumstances may change over time. It’s essential to review your budget regularly and make adjustments as needed. For example, if you start a new job or get a pay raise, you may need to allocate more money towards savings or debt repayment. Be flexible and adapt your budget to meet your current needs.

Step 7: Connect with others. Budgeting can be challenging, especially when you’re just getting started. Find support from friends, family, or online communities who share similar financial goals. By discussing your challenges and successes with others, you can stay motivated and exchange ideas on how to better manage your money.

In conclusion, creating and sticking to a household budget is essential for financial success. By analyzing your income and expenses, setting goals, and tracking your spending, you can take control of your financial future and make informed decisions about your money. Remember, budgeting is a continuous process, so be patient and stay committed to achieving your long-term financial goals.

- How to make a household budget

- Download and Print a Budget Worksheet

- Note

- What are the advantages of family budget planning

- Making a spending plan

- Analyse your bank statements

- Consider your spending habits

- Set goals

- Try ‘piggybanking’

- Pay close attention to your spending

- Tips for Creating a Family Budget That Works for Everyone

- 1 Select a budgeting method

- 2 Talk about where you are right now

- 3 Discuss the difference in wants and needs

- 4 Communicate with your kids to prioritize spending that connects to them

- 5 Create money goals together

- 6 Track your goal progress

- 7 Have monthly budget meetings

- 8 Make paying off debt a priority

- 9 Track your spending throughout the month

- 10 Adjust your budget when needed

- 11 Have the kids work on commission

- Videos:

- How I Would Budget $3,600 a Month

How to make a household budget

Managing your family finances can sometimes feel like a daunting task, but with a well-planned budget, you can take control of your money and ensure financial stability for your loved ones. Here are some tips on how to create a household budget that connects everyone and helps you achieve your goals.

1. Start with a plan

Before you begin budgeting, take the time to sit down with your family members and discuss their needs and wants. This will give you a clear idea of where your money should be allocated and how it can best serve everyone’s interests.

2. Track your income and expenses

To create an effective budget, you need to have a clear understanding of your financial situation. Start by tracking your income sources and any money that goes out. Use a paper or an online worksheet to record all your income and expenses. This will help you identify areas where you can cut back or adjust your spending.

3. Set financial goals

Having clear goals can make a big difference in how you manage your finances. Do you want to pay off debt, save for a vacation, or plan for your children’s education? Set realistic goals that are achievable, and make sure to involve your family members in the process. This way, everyone is aware of what the budget means and the importance of sticking to it.

4. Prioritize your expenses

Once you have a clear picture of your income and expenses, it’s time to prioritize your spending. Start by taking care of your basic needs, such as housing, utilities, and groceries. Then, allocate funds for debt payments, savings, and other essential expenses. Only after taking care of these necessities should you consider discretionary spending like entertainment or eating out.

5. Make adjustments

Your budget should never be set in stone. As your circumstances change and your financial goals evolve, you may need to make adjustments to your budget. Review it regularly, especially if your income fluctuates or if unexpected expenses arise. Being flexible and willing to make changes will help you stay on track.

6. Involve your family members

A successful household budget requires everyone’s commitment and involvement. Explain to your family members the importance of the budget and how it can help everyone achieve their goals. Give them tasks or responsibilities that align with their skills and interests, such as tracking expenses or finding ways to save money on everyday items.

7. Stick to the plan

Creating a budget is only the first step; the real challenge is sticking to it. Avoid impulse purchases and be mindful of your spending habits. If you find yourself deviating from the plan, take a moment to reflect on your goals and remind yourself of the bigger picture. It may be helpful to print out your budget and keep it in a visible place to serve as a constant reminder.

8. Pay attention to your debt

If you have debt, whether it’s from credit cards, loans, or mortgages, it’s important to prioritize its repayment. Make a plan to pay off your debts systematically, starting with high-interest debts. Consider consolidating your debts into one payment method that works for you, such as a debt consolidation loan or balance transfer credit card.

9. Save for the future

One of the most important aspects of any budget is saving for the future. Allocate a portion of your income to savings, whether it’s for emergencies, retirement, or your children’s education. Set up automatic transfers to a separate savings account to ensure that you’re consistently putting money away.

10. Don’t forget to enjoy life

While budgeting is about managing your finances and being responsible with your money, it’s also important to enjoy life and treat yourself occasionally. Factor in small indulgences and rewards into your budget, whether it’s a family outing or a special treat. Finding the balance between saving and spending is key to maintaining a healthy financial lifestyle.

By following these tips and creating a budget that works for your family, you can ensure that your household finances are well-managed and that you’re making the most of your hard-earned money. With proper planning and discipline, you can achieve financial freedom and provide a secure future for yourself and your loved ones.

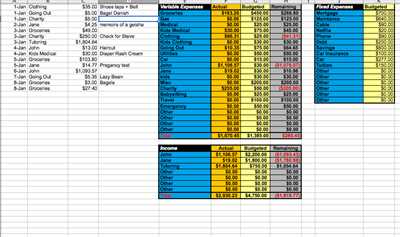

Download and Print a Budget Worksheet

Creating a budget is an essential step towards managing your household finances. One helpful tool is a budget worksheet, which allows you to track your income and expenses on a monthly basis. By documenting your finances, you can gain a better understanding of where your money is going and make adjustments as needed.

There are many budget worksheet templates available online that you can download and print for free. Whether you prefer a simple budget or a more detailed one, these worksheets can provide a clear snapshot of your financial situation. Most worksheets will include categories for expenses such as rent or mortgage, utilities, groceries, transportation, entertainment, and debt payments.

To download and print a budget worksheet, follow these steps:

- Search for “budget worksheet templates” or similar keywords on your preferred search engine.

- Look for reputable sources such as financial websites or reputable blogs that offer downloadable budget worksheets.

- Access the chosen website and find the budget worksheet template that suits your needs.

- Download the template in a format that you can easily work with, such as Excel, Word, or PDF.

- Once downloaded, open the template on your computer or print it out on paper.

- Take the time to carefully fill in all the relevant information. This includes your income, expenses, and any additional financial goals you may have, such as saving for a vacation or paying off debt.

- As you progress through the month, track your spending and income by entering your transactions on the worksheet. This will help you stay on track and make adjustments if necessary.

- Throughout the month, review your worksheet regularly to see how you are doing. If you notice any areas where you are overspending, adjust your habits accordingly.

- At the end of each month, compare your actual spending to what you had budgeted. This will help you identify any differences and make changes moving forward.

By using a budget worksheet, you can be more mindful of your financial habits and ensure that your spending aligns with your long-term goals. Additionally, involving your family in the budgeting process can help everyone understand the importance of financial responsibility. By discussing and connecting on financial matters, you can all work together towards meeting your family’s needs.

Remember, a budget is a flexible tool, and you can adjust it as needed. If you find that your expenses aren’t aligning with your income, consider cutting back on non-essential expenses or finding ways to increase your income. Budgets aren’t meant to be restrictive; they are meant to help you gain control over your finances and make informed decisions.

So, take some time to download and print a budget worksheet that works for you. It may seem daunting at first, but with practice, you will find it easier to track your expenses, pay bills on time, and save for the things you love.

Note

When it comes to making a household budget, it’s important to have a clear understanding of your financial situation. This means having a figure for your income and knowing exactly what your outgoings are. It also means being honest with yourself about your spending habits and being willing to make changes if needed.

One way to get started is by creating a budget worksheet. This can be as simple as writing down all of your income and expenses every month. You can then prioritize your expenses and allocate your income accordingly. This will help you see where your money is going and make adjustments if needed.

Another important aspect of managing your household budget is keeping track of your spending. This can be done by keeping all of your receipts and statements and regularly reviewing them. By doing this, you can identify any areas where you might be overspending and make changes to get back on track.

It’s also important to prioritize your financial goals. Whether it’s paying off debt, saving for a vacation, or putting money into a retirement account, be sure to set goals and work towards them. This will help you stay motivated and focused on your financial progress.

One thing to keep in mind is that budgeting is not about depriving yourself. It’s about being mindful of your spending and making choices that align with your goals. You can still enjoy the occasional restaurant meal or treat yourself to snacks, but it’s important to do so within your budget.

Lastly, it’s important to involve everyone in your household when it comes to budgeting. This means having open and honest conversations about money and making decisions together. By doing this, you can ensure that everyone’s needs are being met and that everyone is on the same financial page.

Remember, budgeting is a process and it may take some time to find a system that works for you. Don’t be afraid to try different strategies and make adjustments as needed. The key is to find a budgeting method that gives you freedom and puts you in control of your finances.

Having multiple meetings to explain what the right household budget looks like and how everything connects is a great way to get everyone on board. Make sure to provide access to your budget so that everyone can see where the money is going and how it’s being allocated.

Always stick to your budget, even if it means saying no to certain wants or delaying certain purchases. Being disciplined with your spending now will pay off in the long run and help you achieve your financial goals.

Remember, it’s okay to ask for help if you’re struggling with your budget. There are many resources available, both online and in person, that can provide guidance and support. Don’t be afraid to reach out and ask for assistance if needed.

Overall, managing a household budget is about being proactive and taking control of your financial situation. It’s about making informed decisions and being mindful of your spending. By following these tips and staying committed to your budget, you can make significant progress towards your financial goals.

What are the advantages of family budget planning

Creating a family budget can have numerous advantages for both parents and children. By tracking every dollar spent, you can keep a close eye on your spending and figure out where your money is going. This helps you identify areas where you can cut back and save for important goals, such as paying off debt or saving for a family vacation.

One of the biggest advantages of family budget planning is that it allows you to communicate and connect with your spouse and kids about money. By involving everyone in the budgeting process, you can teach your children about the value of money and instill good financial habits from an early age.

Budgeting also helps you prioritize your spending. When you have a limited amount of money each month, it’s important to decide what needs are the most important and allocate your funds accordingly. This can prevent unnecessary expenses and keep you on track to meet your financial goals.

By keeping a record of your income and expenses, you can also analyze your spending habits and identify areas where you might be overspending. This can help you make better financial decisions and avoid going into debt.

Another advantage of family budget planning is that it helps you plan for unexpected expenses. By having a savings account or an emergency fund, you can be prepared for any unexpected bills or emergencies that might come up.

Moreover, budgeting can help you save money on everyday expenses. By planning your meals and cooking at home, you can save money on restaurant bills. By using coupons and shopping sales, you can save money on groceries. By analyzing your utility bills and trying to be more energy efficient, you can save money on your monthly bills.

In addition, budgeting can help you achieve long-term financial goals, such as buying a house or saving for retirement. By setting specific targets and saving a certain amount of money each month, you can make progress towards these goals.

Overall, family budget planning has numerous advantages and can help you achieve financial stability and peace of mind. It is important to involve your whole family in the process and stick to the budget that you have created. Whether you are just starting out or have been budgeting for years, the benefits of budgeting are worth the time and effort.

Making a spending plan

Creating a spending plan is always a good idea to keep your finances in line and make sure you have enough to cover all your monthly expenses. Here are three tips to help you get started:

| Tip 1: Analyse your income and outgoings Take a close look at your bank statements and note down your monthly income and all your regular bills and expenses. This will give you a clear picture of where your money is going and whether you need to make any adjustments. |

| Tip 2: Prioritize your spending and saving Decide what is important to you and where you want your money to go. Make saving a priority and allocate a certain percentage of your income towards your savings fund. This will help you build an emergency fund and plan for future expenses. |

| Tip 3: Use a budget worksheet Keep track of your spending by using a budget worksheet. Write down all your income and expenses and see if there are any areas where you can cut back. This will help you stay on track and avoid overspending. |

Throughout the month, make sure you are aware of how much you are spending and stick to your budget. Consider using a budgeting app or software that connects to your bank accounts to help you track your expenses more easily.

Don’t forget about the concept of ‘piggybanking’. Set aside a certain amount of money each month for those unexpected expenses that might come up. This way, you’ll be prepared and won’t have to rely on credit cards or loans.

When it comes to debt, make it a priority to pay off any outstanding balances as soon as possible. Pick the debt with the highest interest rate and focus on paying it off first. This will save you money in the long run.

Finally, don’t forget to involve everyone in your household when talking about budgeting. Make sure everyone is on board and understands the importance of managing finances well. Together, you can achieve your financial goals and plan for a brighter future.

Remember, creating a spending plan is not about depriving yourself of the things you enjoy, but rather about being mindful of your spending and making smart financial decisions. By following these tips and staying organized, you can take control of your finances and achieve financial stability.

Analyse your bank statements

One important step in creating a household budget is analyzing your bank statements. This will give you a clear picture of your financial situation and help you identify areas where you can make adjustments to meet your budgeting goals.

To get started, download your bank statements for the past six months. Close them over and examine each transaction. Take note of how much you are spending on different categories such as rent or mortgage payments, groceries, utilities, transportation, entertainment, and dining out. Look for any recurring expenses like gym memberships or subscriptions that you may not need anymore.

By doing this, you can identify where your money is going and determine if there are any unnecessary expenses you can cut back on. It’s important to be realistic about your spending habits and adjust them if needed to meet your financial goals.

For example, if you notice that you are spending a lot of money on eating out at restaurants, you might decide to pick one or two nights a week to eat at home instead. This can help you save money and also improve your health by cooking nutritious meals at home.

Another strategy to consider is ‘piggybanking’, which involves setting aside a certain percentage of your monthly income for long-term goals. For example, you could set aside 10% of your income for a family vacation or saving for your children’s education. By making it a priority to save and discussing these goals with your family, you can create a plan that everyone is on board with and work together to make it happen.

Don’t be afraid to communicate about your financial needs and priorities with your family. Whether it’s a monthly budget meeting or a discussion about a big expense, it’s important to have open and honest conversations about money. This will help you stay on track and make sure everyone is working towards the same goals.

In addition to analyzing your bank statements, you can also use a budgeting worksheet or a budgeting app like “EveryDollar” to track your expenses and monitor your progress. These tools can help you stay organized and give you a visual representation of where your money is going.

The advantages of piggybanking and budgeting are numerous. Not only will you have a better understanding of your financial situation, but you’ll also be able to save money, meet your financial goals, and avoid unnecessary debt. By taking the time to analyze your bank statements and create a budget plan, you can take control of your finances and achieve financial success.

Consider your spending habits

When it comes to creating a household budget, it’s important to take a close look at your spending habits. Before you begin, make note of your goals and what you want to achieve with this budget. Are you trying to pay off debt, save for a big purchase, or simply get a better handle on your finances?

Tracking your spending habits over the course of a few months is a good way to make sure you have a realistic understanding of where your money is going. Download a budgeting app or use a spreadsheet to record your income and expenses. Make sure to include all of your monthly outgoings, such as bills, loan payments, and subscriptions or memberships.

Once you have a clear picture of your spending habits, it’s time to analyze them. Take note of any areas where you may be overspending or where you could make some adjustments. For example, is eating out at restaurants a common occurrence? Are there any unnecessary monthly subscriptions that can be canceled?

Work on creating a budget that aligns with your financial goals and priorities. If you have a family, it’s important to involve everyone in the budgeting process. Have family meetings to discuss your goals and how you can work together to achieve them. It’s also a good time to teach your kids about money and the importance of budgeting.

Consider using one of the many budgeting methods available to help you stay on track. Whether it’s the 50/30/20 rule, envelope method, or zero-based budgeting, find the one that works best for you and your family. You can also use budgeting apps or software to help you stick to your budget and track your progress.

Remember, budgeting is about creating financial freedom and being in control of your money. It’s not about depriving yourself, but rather making intentional choices about how you want to spend your money. Take advantage of the advantages of budgeting, such as being able to save for long-term goals or having a safety net for unexpected expenses.

If you find that you’re having trouble sticking to your budget, don’t get discouraged. It’s normal to have setbacks and make mistakes. Just pick yourself up and learn from those experiences. Look for additional tips and resources online or seek advice from a financial advisor if needed.

Creating a household budget is a process, but it’s one that can make a big difference in your financial well-being. Take the time to plan and set goals, and then work towards them. With the right budgeting tools and mindset, you’ll be on your way to achieving financial success.

Stay focused, stay consistent, and don’t give up on your goals. The progress you make over time will be well worth the effort.

Remember, you have the power to take control of your finances and create a better future for yourself and your family.

So why wait? Start your budgeting journey today and see the difference it can make in your life!

10 tips to get started:

- Set clear financial goals

- Track your income and expenses

- Download a budgeting app or use a spreadsheet

- Analyze your spending habits

- Involve your family in the budgeting process

- Choose a budgeting method that works for you

- Take advantage of budgeting tools and apps

- Don’t get discouraged if you have setbacks

- Seek additional tips and resources

- Stay focused and consistent

Remember, budgeting is a long-term commitment, but the benefits are well worth it. Start your journey to financial freedom today!

Set goals

Setting goals is an important step in creating a household budget. It gives you something to work towards and helps you prioritize your spending. Whether you’re saving for a specific item or working towards long-term financial freedom, having goals in mind will help you stay motivated throughout the budgeting process.

Start by figuring out what you want to achieve with your budget. Do you want to pay off debt, save for a vacation, or simply have more money for day-to-day expenses? Write down your goals and be specific about how much money you need to achieve them.

Once you have your goals in place, it’s time to create a budget that will help you reach them. Take a look at your income and expenses and determine how much you can realistically save or allocate to each goal. Consider your monthly bills, such as rent or mortgage payments, utilities, and groceries. Also, factor in any irregular expenses like car repairs or medical bills that might come up.

Be sure to prioritize your goals. If you have multiple goals, decide which ones are most important to you and allocate more of your budget towards them. It’s okay to start small and adjust as you go along.

One helpful tool to stay on track with your goals is to use a budgeting app or software. There are many options available, such as EveryDollar or Mint, that can help you connect your bank statements and track your spending. These tools can give you a clear picture of where your money is going and make it easier to adjust your budget if needed.

It’s also important to regularly review and update your budget. Sit down with your partner or family members and discuss your goals and progress. Look at what’s working and what’s not, and make adjustments accordingly.

Remember, being on a budget doesn’t mean you can’t enjoy yourself. It’s all about finding a balance between saving and spending. Allocate some money for entertainment or eating out at a restaurant, but keep it within your budgeted amount. If you find yourself overspending in a certain category, take note of it and try to find ways to cut back.

Lastly, don’t be afraid to ask for help. If you’re having trouble sticking to your budget or are unsure of how to make it work, reach out to a financial advisor or a friend who is good with finances. They can provide guidance and support to help you stay on track.

Try ‘piggybanking’

One of the best ways to create a successful household budget is to make sure you are setting aside money for specific goals. This is where the concept of ‘piggybanking’ comes into play.

Before you can adjust your budget, you need to know exactly how much money you have coming in and going out. Create a worksheet that outlines your monthly income and outgoings. This will help you to see where your money is going and identify areas where you can cut back.

Once you have a clear understanding of your financial situation, you can start ‘piggybanking’. This means setting aside money for specific purposes or goals, like a vacation or a special purchase.

Here’s how ‘piggybanking’ works:

- Pick a goal or goals that you want to save for. It could be a vacation, a new car, or even a home renovation.

- Decide how much money you want to save for each goal. Be realistic about what you can afford to save each month.

- Create separate ‘piggybanks’ or savings accounts for each goal. This will help you to keep track of how much you have saved for each specific purpose.

- Make it a priority. Set aside a specific amount of money for each goal, and make sure that it is the first thing you do when you receive your monthly income.

- Stick to your plan. Don’t dip into your ‘piggybank’ for other expenses unless it is an emergency.

- Review your goals regularly. Check in on your progress and adjust your savings plan as needed.

- Get the whole family involved. If you are saving for a family vacation, for example, explain to your family members what you are doing and get their input on how to save as a group.

- Be consistent. Make saving a habit by setting aside a specific amount of money each month. Even if it’s a small amount, it will add up over time.

The key to successful ‘piggybanking’ is to be disciplined and committed to your savings goals. By having separate ‘piggybanks’ for each goal, you will be able to see the progress you are making and stay motivated.

A good tip is to connect your ‘piggybanking’ with your monthly budget. When you create your budget, put the money you want to save for each goal in a separate category. This will help you to stay on track and ensure that you are saving enough each month.

Having multiple ‘piggybanks’ also means that if something unexpected happens, like a car repair or medical bill, you won’t have to take money from your other savings goals. Each ‘piggybank’ is its own priority, and you should only dip into it when absolutely necessary.

Don’t be afraid to adjust your ‘piggybanking’ goals if something comes up. Life happens, and it’s okay if you need to redirect your savings towards a different goal. The important thing is to keep saving and stay committed to your financial well-being.

The ‘piggybanking’ approach is a great way to take control of your finances and work towards your financial goals. It helps you to plan and analyse your spending, giving you the freedom to decide what is most important to you.

So, if you haven’t tried ‘piggybanking’ before, now is the perfect time to get started. Take the first step towards financial freedom by creating your own ‘piggybanks’ and watch as your savings grow.

Pay close attention to your spending

When it comes to managing your household budget, one of the most important things you can do is pay close attention to your spending. It’s easy to lose track of where your money goes, especially if you’re not keeping a close eye on it. That’s where the concept of ‘piggybanking’ comes in.

Piggybanking is a method that connects your bank accounts and transactions all in one place, making it easy to see where your money is going. By creating a budget and tracking your spending, you can take note of every transaction and figure out where you may be spending too much. This method will also help you to communicate and connect with your partner or family members about your financial goals and habits.

Here are some steps you can take to better manage your spending:

- Analyse your income and outgoings: Take the time to evaluate your monthly income and all your expenses. Consider all sources of income and make sure you’re accounting for everything.

- Set a goal: Determine how much you want to save each month and adjust your outgoings accordingly. This will help you prioritize your spending and ensure you’re putting enough money aside for savings.

- Create a budget: Use a budgeting tool like EveryDollar to track all of your expenses. This will allow you to see where your money is going and identify areas where you might need to cut back.

- Track your spending: Monitor your spending on a regular basis. Keep a record of all your transactions and review them to see if you’re sticking to your budget.

- Communicate with your partner or family members: If you’re not the only one contributing to the household income, it’s important to talk to your partner or family members about your financial goals and make sure everyone is on the same page.

- Take note of your ‘wants’ vs ‘needs’: When evaluating your expenses, distinguish between what you want and what you actually need. Cut back on unnecessary expenses and focus on essentials.

- Try the 10-4-10 rule: If you’re having trouble deciding whether or not to make a purchase, try the 10-4-10 rule. Take 10 seconds to consider if you really need it, $10 to document the purchase in your budget, and wait 10 hours before making a final decision.

- Consider multiple income streams: If your current income isn’t enough to cover all your expenses, consider finding additional sources of income. This could be through a side job, freelancing, or monetizing a hobby.

- Don’t be afraid to adjust: As your financial situation changes, it’s important to adjust your budget accordingly. Be flexible and willing to make changes as needed.

By paying close attention to your spending and implementing these strategies, you’ll have a better understanding of where your money is going and be able to make more informed financial decisions. Remember, financial freedom is worth the effort!

Tips for Creating a Family Budget That Works for Everyone

Creating a family budget can be a daunting task, but with careful planning and consideration, it can become a tool that helps bring financial freedom and connects everyone in the household. Here are some tips to help you get started:

- Take the time to sit down with your family and discuss your financial goals. Whether it’s saving for a vacation, paying off debt, or simply having extra money for everyday expenses, it’s important to communicate and prioritize your needs and wants.

- Figure out your monthly income. Look at all your income sources, including salaries, bonuses, and any other sources of income. This will give you a clear picture of how much money you have coming in each month.

- Track your expenses. Keep a record of all your outgoings. This can be done on paper, using a budgeting app, or even through online banking statements. Whatever method you choose, make sure you have easy access to this information.

- Analyze your spending patterns. Once you have a record of your expenses, take the time to analyze where your money is going. Are there any areas where you could cut back? Are there subscriptions or services that you no longer need?

- Make a plan. Based on the information you gathered in the previous steps, create a monthly budget. Prioritize your expenses and allocate your income accordingly. Be realistic and ensure that you have enough funds for both essential needs and some discretionary spending.

- Download a budgeting app. There are numerous apps available that can help you keep track of your budget and progress. Some popular options include EveryDollar, Mint, and You Need a Budget.

- Consider having a separate bank account for specific goals. You can create a fund for emergencies, a vacation fund, or a fund for your children’s education. This “piggybanking” method can help you stay focused on your goals and ensure that the funds are not accidentally spent on other expenses.

- Connect with your family regularly to discuss your budget. It’s important to keep everyone in the loop and make sure that everyone is on board with the budgeting plan. This will help avoid any surprises or conflicts down the line.

- Don’t be afraid to make adjustments. Budgeting is an ongoing process, and what works for one month may not work for another. Be flexible and willing to adapt as needed.

- Always communicate and explain the budget to your kids. It’s never too early to teach them about financial responsibility. By involving them in the budgeting process, you can help them understand the value of money and the importance of making informed financial decisions.

By following these tips, you can create a family budget that works for everyone. Remember to prioritize your goals, keep track of your progress, and always communicate openly with your family about your financial situation. With a little planning and discipline, you can achieve your financial goals and enjoy the peace of mind that comes with having a solid budget in place.

1 Select a budgeting method

When it comes to managing your household budget, it’s important to have a plan in place. This will help you stay on track and reach your financial goals. One of the first steps in creating a budget is to select a budgeting method that works for you. Here are three methods you can consider:

- The 50/30/20 method

- The envelope system

- The zero-based budgeting method

The 50/30/20 method: This budgeting method involves dividing your monthly income into three categories: 50% for needs, 30% for wants, and 20% for savings. This method allows you to prioritize your expenses and allocate your income accordingly. It’s a great way to ensure you’re meeting your financial goals while still enjoying the things you want.

The envelope system: This method involves allocating cash to different envelopes based on your budget categories. For example, you may have an envelope for groceries, one for utilities, one for entertainment, etc. This method can help you visually see where your money is going and keep you accountable for how much you’re spending in each category.

The zero-based budgeting method: This method requires you to give every dollar a job. You start by listing all your sources of income and then subtracting your expenses until you reach zero. This method forces you to be intentional with your spending and ensures that every dollar is accounted for.

Each budgeting method has its own advantages, and what works for one person may not work for another. Take the time to evaluate your financial habits and goals before choosing a budgeting method. It’s also important to adjust your budget as needed and stay flexible with your spending.

Remember, creating a budget is a long-term commitment. It may take a few months of trial and error before you find a method that works best for you. Don’t be afraid to seek help or connect with experts if you’re struggling. Managing your finances can create a sense of freedom and open up new opportunities for you and your family.

If you’re not sure where to start, there are many online tools and resources available to help you manage your budget. You can download apps like “PiggyBanking” or print out budgeting templates to keep track of your income and expenses. Whatever method you choose, the important thing is to take the first step towards financial freedom.

2 Talk about where you are right now

Before you start creating a household budget, it’s important to assess your current financial situation. This step will help you understand where you stand financially and determine the necessary steps to manage your money effectively.

First, gather all your financial documents, such as bank statements, credit card bills, and receipts. Take a close look at your income and expenses for the past month. Analyze how much you spent on various categories like groceries, utilities, transportation, eating out, and entertainment.

Print out your bank statements or use online banking features to track your expenses. Look for any unnecessary or excessive spending habits that can be adjusted. Pay attention to monthly subscriptions and memberships that you may not use or need anymore, as these can eat into your budget.

Once you have a clear picture of your income and outgoings, it’s time to connect with your family members or housemates. Schedule budget planning meetings where you discuss your financial goals and priorities. This step is essential for everyone to be on the same page and work towards a common goal.

During these meetings, try to communicate openly and honestly about your wants and needs. Prioritize your expenses and give attention to the things that are worth your money. Create a plan that aligns with your long-term financial goals and helps you save for the future.

It’s also important to talk about any outstanding debts or loans that need to be paid off. Discuss strategies to tackle them and work towards becoming debt-free. This will give you the freedom and flexibility to allocate more funds towards savings or other important expenses.

Throughout this process, track your progress and connect with your family members regularly. Analyze your budget to see if it’s working well for everyone and make adjustments as needed. Stick to your plan and find ways to cut down on unnecessary expenses.

Remember, having a household budget is not about restricting yourself or your family from enjoying life. It’s about making informed decisions and being in control of your finances. By staying organized and committed, you can achieve your financial goals and create a better future for yourself and your loved ones.

3 Discuss the difference in wants and needs

When it comes to budgeting, it’s important to distinguish between wants and needs. Understanding the difference can help you prioritize your expenditures and make informed financial decisions.

Needs are essential items or services that are necessary for your basic survival and well-being. These include things like housing, food, healthcare, transportation, and utilities. Meeting your needs should be your top priority when creating a budget.

Wants, on the other hand, are things that you desire but are not essential to your survival. They are typically non-essential or luxury items, such as dining out, entertainment, vacations, and shopping for non-essential goods. While wants can bring enjoyment and pleasure, they should be considered after your needs are met.

To discuss the difference in wants and needs with your household, consider having open and honest conversations about your financial goals and priorities. Talk about what is most important to each member of the household and where they are willing to make sacrifices. By openly discussing and aligning your priorities, you can create a budget that reflects your shared values and goals.

One advantage of discussing wants and needs together is that it creates a sense of connection and teamwork within the household. When everyone is involved in the budgeting process, they feel a sense of ownership and responsibility. This can lead to better adherence to the budget and a greater willingness to make sacrifices when needed.

Keep in mind that wants and needs can also change over time. What may have been a want in the past may become a need in the future, or vice versa. It’s important to regularly review and adjust your budget to reflect any changes in your circumstances or priorities.

One method of tracking your expenses and progress towards your goals is to use a budgeting tool like EveryDollar. This app allows you to input your income and expenses, and it will help you stay on track with your budgeting goals. You can also use pen and paper or a spreadsheet if you prefer a more traditional approach.

Remember, budgeting is a long-term commitment, and it may take some time to get started and find a method that works best for you and your household. But with open and honest discussions about wants and needs, you can create a budget that aligns with your goals and helps you achieve financial success. So, don’t be afraid to get started and connect with your household members to discuss the difference in wants and needs!

4 Communicate with your kids to prioritize spending that connects to them

When it comes to budgeting, it’s important to involve your kids and teach them about managing money. By including them in the process, you can help them develop good financial habits from a young age. Here are some tips on how to communicate with your kids and prioritize spending that connects to them:

- Discuss budgeting openly: Talk to your kids about the importance of budgeting and why it’s necessary. Explain that a budget helps to track income and outgoings, and ensures that there is enough money for everything.

- Create a budget together: Sit down with your kids and create a budget that includes their needs and wants. This will help them understand the difference between necessary expenses and discretionary spending.

- Stick to the budget: Once you’ve created a budget, encourage your kids to stick to it. Remind them of the importance of prioritizing their spending and not overspending.

- Discuss spending choices: Talk to your kids about the value of their purchases. Encourage them to think about whether something is worth the money and if it aligns with their values and priorities.

- Give them a say: Allow your kids to have a say in the budgeting process. Consider giving them a small commission for completing tasks or chores, and let them decide how they want to allocate their earnings.

- Keep track of spending: Help your kids track their spending by keeping a record of their transactions. This can be done on paper or using budgeting apps or tools. Regularly review their spending with them to ensure they are staying on track.

- Teach long-term goals: Discuss with your kids the importance of saving and planning for the future. Help them set long-term financial goals, such as saving for college or a big purchase. This will instill the habit of thinking ahead and being mindful of their financial decisions.

- Discuss wants vs needs: Teach your kids to differentiate between wants and needs. Help them understand that it’s okay to spend money on things they love, but it’s also important to prioritize necessities.

- Encourage saving: Encourage your kids to save a portion of their earnings or allowance. Discuss the benefits of saving and how it can help them achieve their goals or handle unexpected expenses.

By communicating openly with your kids about budgeting and involving them in the process, you are setting them up for a lifetime of financial responsibility. Not only will they learn valuable money management skills, but they will also develop a sense of accountability and independence when it comes to their finances.

5 Create money goals together

Creating money goals together is an essential part of household budgeting. By involving all members of your family or household in the budgeting process, you can ensure that everyone has a say in how money is allocated and spent.

Start by having a talk with your family or household members about the importance of budgeting. Explain that having a budget helps you make the most of your money and achieve your financial goals. Make sure to consider everyone’s input and priorities when creating the budget.

One way to create money goals is to make a list of everything you need to budget for and prioritize them. Consider both your short-term and long-term financial goals. For example, you might have a goal to pay off debt, save for a vacation, or build an emergency fund.

Once you’ve set your goals, allocate funds from your monthly budget to meet those goals. Connect with your financial institutions to access transaction data and track your progress. There are multiple sources and tools available, such as EveryDollar or budgeting worksheets you can download, that can help you with budgeting and tracking your expenses.

When prioritizing your goals, don’t be afraid to adjust and reconsider your budget. You may find that some expenses are worth sacrificing in order to meet a more important goal. For example, you might decide to cut back on dining out or snacks to save more money towards a family vacation.

Managing a household budget is an ongoing process. It’s important to have regular meetings to discuss your financial progress and make any necessary adjustments. By keeping an open line of communication and involving everyone in the process, you can ensure that your budget works for everyone.

Remember, budgeting is not about restricting yourself from spending money. It’s about being aware of where your money is going and making intentional choices about how to allocate it. By creating money goals together, you can make sure that your budget aligns with your priorities and helps you achieve financial success.

6 Track your goal progress

Tracking the progress of your financial goals is an important part of effective budgeting. By keeping an eye on your goals, you can stay motivated and on track to meet them. Here are some tips for tracking your goal progress:

- Create a goal worksheet: Start by writing down your financial goals in a worksheet. Include the amount you need to save, the timeframe you want to achieve it, and any specific details about the goal.

- Track your savings: Keep track of how much you save each month towards your goals. This could be through a separate savings account, a ‘piggybanking’ system, or any other method that works for you.

- Analyse your transactions: Pay close attention to your spending and analyse whether it aligns with your goals. If you find yourself spending too much on unnecessary items, make adjustments to ensure you have enough funds to meet your goals.

- Check in regularly: Schedule regular check-ins with yourself or your family members to review your goal progress. This could be weekly, monthly, or quarterly meetings where you discuss your progress and make any necessary adjustments.

- Communicate with your family: If you’re budgeting together as a family, make sure to communicate about your goals and progress. This helps everyone stay on the same page and work towards the shared goals.

- Use a budgeting app or tool: There are many budgeting apps and tools available for download that can help you track your goal progress. These tools often have features such as goal tracking, savings calculations, and budget management.

By tracking your goal progress, you can ensure that you’re staying on track and making the necessary adjustments to meet your financial goals. It also helps you stay motivated and focused on long-term financial success.

7 Have monthly budget meetings

One crucial step in managing your household budget is to have regular monthly budget meetings. These meetings provide an opportunity for everyone in the household to discuss and align their financial goals and priorities.

During these meetings, you can review your bank statements and go through your budgets line by line to see how much you have spent and on what. It’s important to close this gap between your wants and needs and figure out how much you can save.

A popular budgeting method that many households use is the “everydollar” or “piggybanking” method. This method connects your bank accounts and creates a budget for every dollar you earn, including savings and goals.

By having these monthly budget meetings, you are able to communicate your financial goals to your family members and prioritize your spending accordingly. You can also discuss any changes or adjustments that need to be made to your budgets.

During the meetings, try to print out your budgets and have them on paper so that everyone can physically see the progress you’re making and where you stand. This visual representation can make a difference in how everyone perceives their spending habits and the need to prioritize certain expenses.

Before the meeting, take some time to track your expenses throughout the previous month. This will give you a clear picture of where your money went and help you identify any areas where you might be overspending. It’s important to be totally transparent and honest about your spending habits during these meetings.

Having these monthly budget meetings also allows you to set new financial goals and discuss any upcoming expenses or events that you need to save for, like a vacation or a big purchase. By having everyone on the same page, you can collectively work towards these goals.

Remember, the goal of these meetings is not to point fingers or assign blame, but rather to work together as a team to manage the household finances. By picking a time that works for everyone and consistently having these meetings, you can establish good budgeting habits and ensure that everyone’s needs are being met.

8 Make paying off debt a priority

If you have debt, whether it’s from credit cards, loans, or other sources, it’s important to make paying it off a priority. Debt can hold you back from achieving your financial goals and can cause stress and worry. Here are some tips to help you prioritize paying off your debt:

- Analyse your budget: Take a look at your income and expenses to determine how much you can allocate towards debt payments each month. It might require cutting back on some non-essential expenses or finding ways to increase your income.

- Track your spending: To effectively pay off debt, you need to know where your money is going. Keep a record of all your transactions, whether it’s through a tracking app or a simple pen and paper. This will help you identify areas where you can cut back and save.

- Prioritize your debts: If you have multiple debts, such as credit card balances or loans, prioritize them based on interest rates or outstanding balances. Paying off high-interest debts first can save you money in the long run.

- Create a debt repayment plan: Once you know how much you can allocate towards debt payments and which debts to prioritize, create a plan to pay them off systematically. This could involve paying minimum payments on all debts and allocating any extra money towards the highest-priority debt.

- Make debt payments automatic: Set up automatic payments for your debts to ensure they are paid on time. This helps you avoid late fees and penalties.

- Track your progress: Regularly review your debt payoff progress to stay motivated and see how far you’ve come. Celebrate small milestones along the way to keep yourself motivated.

- Discuss your goals with family members: If you have a spouse or kids, it’s important to discuss your debt payoff goals with them. This ensures everyone is on the same page and can help you cut back on unnecessary spending.

- Seek professional advice if needed: If you’re feeling overwhelmed or struggling to make progress, consider seeking professional advice from a financial planner or counselor. They can help you develop a customized plan and provide guidance throughout your debt repayment journey.

By making paying off debt a priority, you can take control of your finances and work towards a debt-free future. It may take time and effort, but the advantages are worth it. Don’t be afraid to ask for help and remember to celebrate each milestone along the way!

9 Track your spending throughout the month

Tracking your spending is an essential part of managing your household budget. By keeping an accurate record of where your money is going, you can gain a better understanding of your financial habits and make necessary adjustments to ensure that you stay on track.

There are several ways you can track your spending throughout the month. One popular method is to create a budget worksheet. This can be done either on paper or using an online tool or app. The key is to make sure that you have a clear and organized way to record your income and expenses.

If you prefer using a paper worksheet, you can create one yourself or find templates online that you can print out. In your worksheet, have different lines for different categories such as groceries, bills, entertainment, etc. This will help you keep track of your spending in each area.

Another way to track your spending is by using your online bank account. Most banks offer tools and features that allow you to see your transactions and categorize them. Take advantage of this and regularly check your bank account to see where your money is going.

For those who prefer a more hands-on approach, you can also track your spending by keeping a spending diary. This involves writing down every single expense you make throughout the month. While this method may be time-consuming, it can give you a closer look at your spending habits.

Regardless of the method you choose, make sure to track your spending consistently. This means recording every expense, no matter how small. By doing this, you will have a comprehensive view of your spending habits and can identify areas where you may need to cut back.

Once you have tracked your spending for a few months, take the time to analyze your progress. Look for patterns and trends in your spending habits. Are there areas where you are consistently overspending? Are there any expenses you can reduce or eliminate?

If you find that you are consistently spending more than you make, it may be time to make some adjustments to your budget. Look for ways to decrease your expenses or increase your income. This may involve making some sacrifices or finding additional sources of income.

Tracking your spending throughout the month is an important step in managing your household budget. It allows you to have a clear view of where your money is going and gives you the freedom to make necessary adjustments. By taking the time to track your spending, you can ensure that you are on the right track towards your financial goals.

10 Adjust your budget when needed

As you track your expenses and income with a budgeting tool like EveryDollar, it’s important to regularly review and adjust your budget as needed. Life is constantly changing, and your budget should reflect those changes. Here are some tips for adjusting your budget:

- Take note of any major life events or changes that will affect your finances, such as a new job, a pay increase, or a change in living arrangements.

- Communicate with your family members or roommates about any changes that may impact the household budget. It’s important to be on the same page and work together when managing finances.

- Create a line item in your budget for long-term goals, such as saving for a down payment on a house or paying off debt. Make it a priority to allocate enough money towards these goals each month.

- If you’re having trouble sticking to your budget, try tracking your expenses in more detail. Break down your spending into categories and analyze where your money is going.

- If you find that you’re consistently going over budget in certain areas, consider making adjustments. For example, if you’re spending too much money eating out at restaurants, try setting a limit or finding less expensive alternatives.

- Don’t be afraid to trim unnecessary expenses or subscriptions. Evaluate whether you’re getting enough value out of them and cancel those that are not essential.

- When adjusting your budget, always prioritize your financial obligations and necessities first. Make sure you have enough set aside for bills, groceries, and other essential expenses before allocating funds to other categories.

- Stay connected with your bank accounts and track your transactions regularly. This will help you stay aware of how much you’re spending and whether you’re staying within your budget.

- Keep in mind that everyone’s budget will look different. What works for one person or family may not work for another. It’s important to find a budgeting system that fits your needs and habits.

- Finally, don’t forget to communicate and discuss your budget with your partner or spouse. Set aside regular meetings to talk about your financial goals, progress, and any adjustments that may need to be made.

Remember, creating and managing a household budget is an ongoing process. It’s normal for your budget to change over time as your financial situation and goals evolve. The key is to stay proactive, track your spending, and adjust your budget as needed to ensure you’re on the path to financial success.

11 Have the kids work on commission

One way to get the whole family involved in budgeting is to have the kids work on commission. Instead of just giving them an allowance, you can assign tasks and pay them a small amount for completing each task. This not only teaches them the value of money but also provides them with an opportunity to earn some extra cash.

Having the kids work on commission can also help them understand the importance of meeting financial goals. They will learn that in order to get paid, they need to complete their tasks and contribute to the overall progress of the household. This can instill a sense of responsibility and help them develop good financial habits from a young age.

To implement this system, you can create a series of tasks or chores that each child can choose from. Make sure these tasks are age-appropriate and align with the needs of the household. For example, younger children can be responsible for picking up toys or setting the table, while older children can help with more complex tasks like mowing the lawn or doing laundry.

It’s important to communicate with your kids about the budget and the financial goals of the family. Explain to them that by working on commission, they are helping to manage the household’s income and outgoings. This will not only give them a better understanding of the family’s financial situation but also teach them about the importance of planning and budgeting.

A great way to get started is by having a family meeting and discussing the household budget together. Sit down with pen and paper or use a budgeting worksheet to track your income and expenses. Get everyone’s input on how to prioritize spending and discuss any financial goals or needs that might require attention.

Once you have a budget in place, encourage your kids to set financial goals of their own. Help them understand the difference between needs and wants, and encourage them to save a portion of their earnings towards something meaningful to them, like a new toy or a vacation. This will teach them the importance of saving and the value of delayed gratification.

By having the kids work on commission, you are not only involving them in the budgeting process but also teaching them valuable life skills. They will learn how to manage money, analyze their spending habits, and prioritize their financial goals. It’s always worth the effort to get the whole family on board with budgeting and create a financial plan that everyone can stick to.