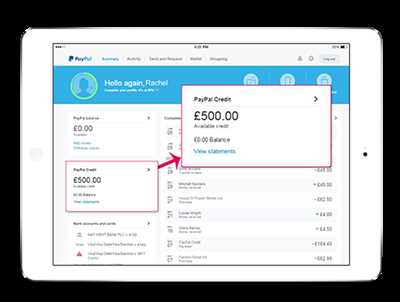

If you want to make PayPal, there are several advantages you should know. First, it is the future of online payments. With PayPal, you can pay for goods and services without revealing your credit/debit card number or your billing address. This gives you security and peace of mind while shopping online. Second, PayPal offers buyer and seller protection, ensuring a quick and cheap resolution if something goes wrong with your purchase. Additionally, PayPal is widely accepted by online sellers, so you can use it to shop on numerous websites.

To create a PayPal account, here are the steps you should follow:

1. Go to the PayPal website.

2. Click on the “Sign Up” button.

3. Choose between a personal or business account.

4. Fill in your name, email address, and create a password.

5. Open your email and click on the verification link PayPal sent.

6. Verify your account by providing a four-digit code that PayPal will charge your credit/debit card with (don’t worry, they will refund you immediately).

After verifying your account, you can start using PayPal to pay for goods and services online. It’s that easy! Sign up for PayPal today and enjoy the security and convenience it offers.

How to use PayPal without a Pay Pal account

PayPal is a widely used online payment platform that allows you to make secure and convenient transactions. While having a PayPal account offers many advantages, there may be instances where you want to use PayPal without actually having an account. Here’s how you can do it:

Step 1: Find a seller who accepts PayPal as a payment option. PayPal is a popular choice for many online sellers, so this shouldn’t be too difficult. Simply click on the PayPal option when you’re ready to make a purchase.

Step 2: Enter your billing information. As a buyer, PayPal allows you to use your credit or debit card to make payments without an account. You should enter your name, billing address, and four-digit verification code, just like you would for any other online payment.

Step 3: Add your card information. PayPal allows you to add multiple debit or credit cards to your account. Just choose the “add card” option and enter your card details securely. This adds an extra layer of security and convenience for future transactions.

Step 4: Verify your card. For security purposes, PayPal may ask you to verify that you are the card owner. This can be done by providing certain details or through a small charge on your card statement. Simply follow the instructions provided on the verification page.

Step 5: Shop and pay. Once your card is verified, you can start shopping and making payments through PayPal without having a PayPal account. The process is quick and seamless, making it a convenient option for online buyers.

Important note: While using PayPal without an account is possible, it’s worth mentioning that having a PayPal account offers additional benefits. These include buyer protection, quick payments, and the ability to link multiple funding sources such as bank accounts and credit/debit cards.

In conclusion, PayPal provides a flexible payment solution for both buyers and sellers. Even if you don’t have a PayPal account, you can still use this widely accepted payment platform to make secure and convenient transactions. Just follow the step-by-step process outlined here, and enjoy the benefits of using PayPal without a PayPal account.

Billing Address

When you shop online, it’s important to provide a billing address for your transactions. This is the address that is associated with your credit/debit card or bank account.

Why is the billing address important? Well, it helps the seller verify that you are the rightful owner of the payment method you are using. When you add a credit/debit card or a bank account to your PayPal account, you should also enter the billing address associated with that payment method.

For security reasons, PayPal doesn’t store your four-digit credit/debit card security code. So, when you make a purchase, the seller won’t see your full credit/debit card number. This adds an extra layer of protection for both buyers and sellers.

Buyers can also choose to pay with their bank account through PayPal. In this case, the billing address is used to verify the account. If the billing address doesn’t match the one on file with the bank, the payment may fail.

One of the advantages of using PayPal is that it offers buyer protection. If you don’t receive an item or if it’s significantly different from what the seller described, you can open a dispute and PayPal will investigate the issue. If the case is resolved in your favor, you may be eligible for a refund.

When you shop through PayPal, you don’t need to enter your billing address on every website you visit. Instead, you simply log in to your PayPal account and choose the payment method you want to use. This makes the checkout process quick and easy.

PayPal accepts various payment sources, including credit/debit cards and other financial accounts. When you make a payment, PayPal will charge your selected payment source. If you have multiple payment sources linked to your PayPal account, you can choose which one to use for each transaction.

It’s important to note that PayPal offers a secure browsing experience. This means that when you shop online, the confidential information you enter, including your billing address, is encrypted and protected. This provides an additional layer of security for your personal and financial information.

So, if you want a quick and secure way to make online payments, PayPal is a great option. Sign up today to create your PayPal account and start enjoying the convenience and security it offers.

Wells Fargo Online Add cards to PayPal on your browser

Wells Fargo Online provides an easy and convenient way to add your cards to PayPal directly from your browser. With just a few simple steps, you can link your Wells Fargo credit or debit cards to your PayPal account and enjoy the advantages of secure online payments.

Verifying Your Account

In order to add your Wells Fargo cards to PayPal, you will need to verify your account. Here’s how:

- Log in to your Wells Fargo online banking account.

- Go to the “Add cards to PayPal” page.

- Choose the card you want to add from the list.

- Enter the four-digit code, which can be found on your billing statement.

- Click “Add” and follow the on-screen instructions.

Security and Protection

Wells Fargo takes security seriously, and that’s why we’ve implemented strong password protection and address verification for your online banking transactions. When you add your Wells Fargo cards to PayPal, you can shop with confidence knowing that your financial information is safe and secure.

Advantages for Buyers and Sellers

By adding your Wells Fargo cards to PayPal, you open up a world of possibilities. For buyers, you can make quick and easy online payments without having to enter your card details every time you make a purchase. For sellers, PayPal provides a secure and reliable platform to receive payments from buyers around the world.

Don’t have a PayPal account? No worries! You can easily create one for free on the PayPal website and start enjoying the benefits of hassle-free online payments.

How It Works

When you make a purchase online using your Wells Fargo card linked to PayPal, the payment will be charged directly to your Wells Fargo account. You don’t need to worry about entering your card details on different websites, as PayPal securely stores your information.

If you’re a seller, you can also choose to offer PayPal as a payment option to your buyers. By doing so, you provide them with a trusted and convenient way to pay for their purchases.

Remember, adding your Wells Fargo cards to PayPal is quick and easy, and it opens up a world of possibilities for secure online transactions. Take advantage of this feature today and enjoy the benefits of hassle-free payments!

How to Verify Your PayPal Account

Verifying your PayPal account is an essential step to enhance the security and credibility of your online transactions. By completing the verification process, you unlock various advantages and gain the trust of buyers and sellers on PayPal.

Here is a step-by-step guide on how to verify your PayPal account:

- Login to your PayPal account using your email address and password.

- On the navigation menu, click on “Bankers” and then choose “Add”.

- Select your bank from the options provided. If your bank is not listed, click on “Other” and enter the details manually.

- Enter your bank account number, name, and the four-digit code provided by PayPal.

- Confirm that the billing address associated with your bank account is correct.

- Click on “Verify” and PayPal will send a small amount of money to your bank account.

- Within 2-3 business days, check your bank statement and note the exact amount deposited by PayPal.

- Return to the PayPal verification page and enter the amount deposited in the appropriate field.

- Click on “Confirm” and your PayPal account will be successfully verified.

Once your PayPal account is verified, you can enjoy the following benefits:

- Increased security: Verified PayPal accounts are better protected against unauthorized access and fraudulent activities.

- Buyer protection: When you shop using PayPal, you have the advantage of PayPal’s buyer protection policy, which offers refunds and protects your purchases.

- Seller reputation: As a verified seller, buyers are more likely to trust your business and make quick payments.

- Access to more features: Verified PayPal accounts have access to additional features and tools to manage transactions and payments.

By verifying your PayPal account, you can shop and sell online with confidence, knowing that your transactions are secure and protected. Don’t miss out on the advantages of a verified PayPal account.

Verifying Credit And Debit Cards

In order to use PayPal, you need to verify your credit or debit card. This process is quick and easy. Here’s how:

| By verifying your credit or debit card, you are ensuring the security of your PayPal account and making it easier to shop online. Verifying your card has several advantages:

|

Please note that the verification process may vary depending on your card issuer. If you encounter any issues or your verification fails, you should contact your bank or card issuer for assistance.

With PayPal, you can enjoy the advantages of secure and easy online shopping. Start the verification process today and join millions of satisfied PayPal users!

Advantages for buyers and sellers

When you shop with PayPal, it’s quick and easy to make payments online. With just a few clicks, you can pay using your credit/debit cards or through a bank account. You don’t have to worry about entering your card details every time you make a purchase. PayPal securely stores your information, so you can make payments without sharing your financial information with sellers.

For buyers, PayPal offers additional advantages. When you pay through PayPal, your financial information is not visible to sellers. This provides an extra layer of security for your transactions. In case there is a problem with your purchase, PayPal’s Buyer Protection ensures that you can get a refund. If the item you receive is not as described or doesn’t arrive at all, PayPal will reimburse you for the full purchase amount.

As a seller, there are also many benefits to using PayPal. It’s easy to create an account and start accepting payments online. PayPal allows you to accept payments from buyers all around the world, making it a convenient option for selling internationally. You can also choose to verify your account for added security. By verifying your account, you can confirm your identity and build trust with your customers.

When a buyer makes a payment through PayPal, you receive the payment instantly. There are no delays or waiting periods like with some other payment methods. PayPal also offers seller protection, which safeguards you against unauthorized payments and chargebacks. This ensures that you, as a seller, are protected from fraudulent activities and potential losses.

PayPal provides a user-friendly interface for buyers and sellers. You can easily navigate through the menu options and access important features. Whether you need to view your transactions, manage your billing information, or resolve any issues, PayPal provides a seamless experience.

In addition, PayPal offers cheap and competitive transaction fees for sellers. You can keep more of your earnings when you use PayPal as your payment gateway. It’s a cost-effective solution for individuals and businesses alike. Furthermore, PayPal offers a variety of tools and resources to help you grow your business. From marketing tools to invoice management, PayPal supports your business needs.

In conclusion, PayPal is a trusted and reliable payment platform that brings advantages for both buyers and sellers. It provides security, convenience, and ease of use for online transactions. Whether you are a buyer or a seller, PayPal is a valuable tool to help you navigate the world of e-commerce.

Buyer and shop owner protection

When you open a PayPal account, you can add your credit or debit cards to it as your funding sources. This way, you can choose how you want to pay, without having to worry about your credit or debit card number being compromised.

One of the advantages of using PayPal is buyer and shop owner protection. For buyers, PayPal offers a quick and easy way to pay for your online purchases, without having to enter your billing address or credit card information every time. This adds an extra layer of security to your payments, ensuring that your financial information is not exposed to potential risks.

For shop owners, PayPal provides protection against fraudulent buyers. PayPal verifies buyer accounts to ensure that they are legitimate, reducing the risk of chargebacks and fraudulent transactions. This protects the shop owner from financial loss and allows them to focus on providing quality products and services to their customers.

When a buyer pays through PayPal, they can be confident that they are protected against scams and fraudulent sellers. If a seller fails to deliver the purchased goods or the goods are significantly different from the description, the buyer can file a dispute with PayPal. PayPal will then conduct an investigation and, if necessary, provide a refund to the buyer.

PayPal also offers a four-digit code, known as the PayPal Code, which buyers can use to verify their debit or credit card. This additional step ensures that only the card owner can add the card to their PayPal account. By verifying the card, buyers can have peace of mind that their purchases are secure.

As a shop owner, you can have confidence in the payment system provided by PayPal. The company works closely with banks and other financial institutions to ensure the security of your transactions. PayPal’s Seller Protection policy aims to protect sellers from fraudulent chargebacks and unauthorized payments.

In addition to providing security and protection, PayPal offers a user-friendly interface for buyers and sellers. With just a few clicks, buyers can pay for their purchases, and sellers can receive payments directly into their PayPal account. PayPal’s menu is easy to navigate, allowing users to manage their transactions and account settings without any hassle.

Wells Fargo, one of the largest banks in the United States, has partnered with PayPal to offer a seamless payment experience. Buyers can link their Wells Fargo accounts to PayPal and enjoy the benefits of quick and secure transactions.

Whether you are a buyer or a shop owner, PayPal has your security and protection in mind. From credit/debit card security to buyer and seller protection policies, PayPal ensures that your online transactions are safe and reliable. Click here to open a PayPal account and start enjoying the advantages of secure online payments!

Cheap and quick

When you create a PayPal account, you also have the option to add your credit/debit card information. This allows you to choose from multiple sources when making payments through PayPal. The advantages of adding your card include quick and secure online transactions, buyer protection, and the ability to pay without disclosing your card information to the seller.

Here’s how you can quickly and cheaply link your credit/debit card to your PayPal account:

| Step 1: | Open your web browser and go to the PayPal website. |

| Step 2: | Click on “Sign Up” or “Open an Account” to start the registration process. |

| Step 3: | Provide your personal details such as your name, address, and email address. |

| Step 4: | Create a strong password for your account. |

| Step 5: | Verify that you’re the account owner by entering the four-digit code sent to your credit/debit card. |

| Step 6: | Once verified, you can add your credit/debit card to your PayPal account by clicking on the “Wallet” menu. |

| Step 7: | On the Wallet page, click on “Add a Card” and enter your card details, such as the card number, expiration date, and billing address. |

| Step 8: | Click on “Save” to link your card to your PayPal account. |

| Step 9: | You can now use your credit/debit card for future PayPal payments without having to re-enter your card information. |

| Step 10: | Buyers can shop with confidence, knowing that PayPal provides security and protection for their purchases. |

| Step 11: | Banks like Wells Fargo, Bank of America, and others also support PayPal integration, making it convenient for their customers to use PayPal for online transactions. |

| Step 12: | With PayPal, you can pay in just a few clicks, no matter where you are. |

In summary, creating a PayPal account and adding your credit/debit card is a quick and cost-effective way to shop online. You can enjoy the security and convenience of PayPal without the need to enter your card information every time. Take advantage of this cheap and quick payment option and start using PayPal for all your online purchases!

Sources

When using PayPal, there are several sources you can use to make payments or add funds to your account. These sources include credit/debit cards, bank accounts, and the balance in your PayPal account.

For credit/debit cards, you can add them to your PayPal account and use them to make purchases online. When adding a card, you will need to provide the card number, expiration date, and the four-digit code on the back of the card. PayPal also offers buyer protection for purchases made with credit and debit cards.

If you choose to add a bank account, you can link it to your PayPal account. This allows you to transfer funds between your bank account and PayPal for quick and easy payments. PayPal will also verify your bank account by depositing a small sum of money and then requiring you to confirm the amount deposited.

In addition to credit/debit cards and bank accounts, you can also use the balance in your PayPal account to make payments. This balance can be sourced from funds received from other PayPal users, sales as a seller, or by adding money directly to your PayPal account. The advantage of using your PayPal balance is that it doesn’t require you to enter any card or bank account information when making a payment.

PayPal takes the security of your account and personal information seriously. When creating a PayPal account, you will need to choose a strong password and provide accurate information, such as your name and address. PayPal will also ask you to verify your email address and phone number for added security.

For sellers, PayPal offers additional features and protection. As a seller, you can receive payments from buyers and easily withdraw those funds to your bank account. PayPal also provides seller protection, which helps safeguard against fraudulent chargebacks and unauthorized payments.

If you encounter any issues with PayPal, such as a failed payment or verifying your account, you should contact PayPal’s customer support. They can assist you with any problems or questions you may have.

In summary, PayPal offers various sources for making payments and adding funds to your account. These sources include credit/debit cards, bank accounts, and the balance in your PayPal account. PayPal prioritizes security and offers buyer and seller protection. If you have any issues or questions, PayPal’s customer support is available to assist you.