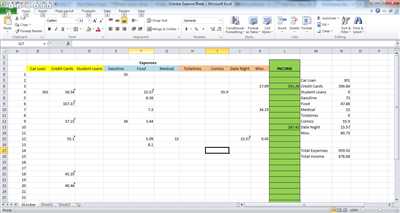

Keeping track of your expenses is important for managing your finances and budgeting wisely. One way to do this is to create an expenses spreadsheet. Microsoft Excel is a good choice for creating such a spreadsheet as it offers various features and components to make the process simple and intuitive.

Before you start creating the spreadsheet, it’s important to know what information you want to record. You can choose to include columns for the date of the transaction, the source of the expense, the type of expense, the amount spent, and any additional notes or reference. These columns can be customized to match your specific needs.

Once you have defined the necessary columns, it’s time to create the main sheet of the spreadsheet. You can start by writing “Expenses” as the title of the sheet. Alongside this title, you can create columns for each month of the year, allowing you to record your expenses on a monthly basis. This makes it easier to track your spending over time and calculate your total expenses for each month.

Having a well-organized spreadsheet is important, as it allows you to categorize your expenses and easily make reports based on this categorization. For example, you can create separate columns for different types of expenses such as groceries, transportation, utilities (electricity, water, etc.), entertainment, and so on. This way, you can easily categorize each transaction and know how much you have spent in each category.

Another important component of your expenses spreadsheet is the ability to create graphs and charts. Excel offers various features to help you create visual representations of your spending habits. You can choose to create graphs that show your monthly expenses over time, or graphs that compare your expenses in different categories. These graphs can provide valuable insights into your spending patterns and help you make better financial decisions.

Once you have designed your expenses spreadsheet with all the necessary components, you can start recording your expenses. Whenever you have a transaction, whether it’s buying a cup of coffee or paying your monthly bills, you can simply enter the relevant information into the spreadsheet. Make sure to always record your expenses as soon as possible to keep an accurate record of your spending.

Syncing your expenses spreadsheet with other financial sources is also important. Many banks and financial institutions offer tools and apps that allow you to transfer your transaction data directly into your spreadsheet. This eliminates the need for manual entry and ensures that your records are always up to date. However, if you don’t have access to such tools, you can always manually input your expenses into the spreadsheet.

In conclusion, creating an expenses spreadsheet is a good way to keep track of your spending and manage your finances effectively. With Microsoft Excel and its intuitive features, you can easily customize your spreadsheet to match your specific needs. Whether you choose to include simple tables or more complex graphs, having an organized and well-designed expenses spreadsheet can help you make better financial decisions and achieve your financial goals.

Income and Expense Tracker Template

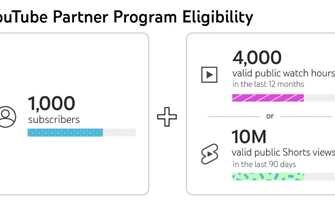

If you’re looking for a simple and intuitive way to track your income and expenses, look no further than the Income and Expense Tracker Template. This spreadsheet, designed to be used in programs like Microsoft Excel or Google Sheets, provides all the necessary components to record and categorize your financial information, making it easier than ever to stay on top of your budget.

One of the key features of this template is the ability to choose from different expense types, such as household expenses, transportation costs, or entertainment expenses. Each expense category has its own table and graphs, allowing you to see at a glance how much you’ve spent in each category. You can also create custom expense categories to better suit your individual needs.

The Income and Expense Tracker Template also has a built-in income tracker, where you can log all your sources of income, such as your salary, freelance earnings, or investment returns. The template automatically calculates your net income by subtracting your total expenses from your total income, giving you a clear picture of your financial health.

Perhaps one of the most important components of the Income and Expense Tracker Template is the reporting feature. With just a click of a button, you can generate detailed reports that show your income and expenses over a certain time period. These reports can be useful for analyzing your spending patterns, identifying areas where you might be overspending, and determining whether you’re on track to meet your financial goals.

The Income and Expense Tracker Template is also smart enough to sync with your bank account, if you prefer to use an online banking system. This means that you can transfer your financial data directly into the template without the need for manual writing or data entry. This makes tracking your income and expenses even easier and reduces the chances of errors in your records.

In summary, the Income and Expense Tracker Template is a free and easy-to-use tool that can help you stay on top of your finances. Whether you’re a student trying to keep track of your monthly expenses, a freelancer needing to categorize your income and expenses for tax purposes, or just someone who wants to gain a better understanding of where your money is going, this template has everything you need to succeed.

Create an Expense Tracker with Excel and Glide

If you’re looking to track and manage your expenses in a simple and organized way, creating an expense tracker with Excel and Glide is a great option. Excel is a powerful tool that allows you to customize and calculate your expenses, while Glide provides a user-friendly interface to make the process intuitive and accessible.

To start, you’ll need an Excel spreadsheet where you can record your expense data. You can create your own spreadsheet from scratch or use a pre-designed template. Organize your spreadsheet into columns such as date, category, description, amount spent, and any other necessary information.

Once your spreadsheet is set up, you can start entering your expenses. Each transaction should be recorded in a new row, with the corresponding information entered into the appropriate columns. You can categorize your expenses based on general categories like food, transportation, or entertainment, or create custom categories that suit your needs.

It’s important to validate your data before moving forward. Clicking on a cell in a specific column can help you ensure that the data is correct. For example, if you’ve created a drop-down list for the “category” column, you can easily choose the appropriate category for each transaction.

As you enter your expenses, Excel will automatically calculate the total amount spent for each month, as well as any other necessary calculations. You can create tables, graphs, and reports based on this information, providing you with a comprehensive view of your spending habits over time.

Glide comes into play when you want to transfer your Excel spreadsheet into a smart and intuitive app. With Glide, you can easily import your Excel data and transform it into a user-friendly interface accessible through the internet. This way, you can track your expenses on-the-go without having to open your Excel spreadsheet every time.

One of the great features of Glide is its ability to create custom views and reports. You can customize the app to display specific columns and information that are most important to you and your business. This way, you have a quick reference to important expense information without having to scroll through all the columns in your spreadsheet.

Using Excel and Glide in combination allows you to create a powerful expense tracking system that is flexible, customizable, and easy to use. Whether you’re tracking your personal expenses or managing business reimbursement, this process will help you stay organized and keep a record of all your transactions.

Business Expense Report Template

When it comes to managing the finances of your business, keeping track of expenses is crucial. An expense report template can be a valuable tool in organizing and recording all the necessary information for reimbursement or tax purposes.

A good expense report template is one where you can easily input the relevant information without any hassle. It should have tables or spaces where you can write down the details of each expense, such as the date, the amount, and the type of expense (e.g., coffee, electricity, internet). You can also categorize the expenses by month for easy reference and tracking.

The template should be designed in a way that is intuitive and user-friendly, so that even people who are not well-versed in financial matters can understand and use it. This makes it easier for them to track their expenses and ensure that they are within the allocated budget.

One important component of a business expense report template is the ability to validate and match the expenses with the corresponding receipts. This ensures accuracy and helps in avoiding any errors or discrepancies in the expense reports.

Additionally, a good expense report template should have features such as graphs or charts to provide a visual representation of the expenses. This allows for a quick and easy analysis of spending patterns and helps in making smart financial decisions.

Microsoft Excel is a popular choice for creating expense report templates, as it offers a lot of functionality and flexibility. You can choose to create a simple spreadsheet with columns for each expense category, or you can opt for a more detailed template with additional features.

Before you start writing your expense report template, it is necessary to determine what information needs to be included and how the template should be organized. This will depend on the specific needs of your business and the type of expenses you need to track.

Once you have a basic template in place, you can start testing and fine-tuning it to ensure that it meets your requirements. You can also customize it to include any additional information or sections that are important for your business.

A well-designed business expense report template can save you a lot of time and effort in the expense tracking process. It provides a centralized location to record and track all expenses, making it easier to generate reports and keep everything organized.

Whether you choose to use a pre-designed template or create your own from scratch, having an expense report template is a smart choice for any business. It allows you to keep track of your expenses in a systematic manner and provides a clear and accurate record of your financial transactions.

Click with smart choices and start using an expense report template today. Sync your expense tracking with your accounting system and say goodbye to manual data entry. With the right template, you’ll have all the space and tools you need to track and validate your expenses, ensuring that your business stays on track.

Remember, the main purpose of an expense report template is to provide accurate and reliable information for reimbursement or tax purposes. It’s a reference point that helps you stay organized and makes the process much easier for everyone involved.

So, choose a business expense report template that suits your needs and get started on tracking and managing your expenses with ease. Whether you prefer the simplicity of a basic template or the functionality of a more advanced one, having a template in place will save you time and ensure that your expense reports are error-free.

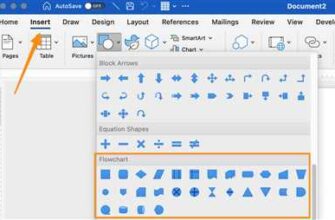

Testing your Custom Microsoft Excel Template

When it comes to creating a custom Microsoft Excel template for expenses tracking, it is always important to test it to ensure that it works as intended. Testing your template allows you to validate the data input and output, as well as check for any errors or inconsistencies that might arise.

One way to test your template is by inputting sample expenses data into the tables and checking if the calculations are correct. Input various types of expenses, such as your electricity bill, coffee expenses, or business transactions that you need to track. Make sure that the total expense for each month matches the amount you spent in real life.

Another method is by having reference sources or other expense trackers that you can compare with. Check if the expenses in your template match the ones in these external sources. This will help validate the accuracy of your template and ensure that it is designed to match your specific needs.

Creating graphs and charts based on the data input in your template is also a good way to test its functionality. Graphs can help you visualize the trends and patterns in your expenses, making it easier to identify any discrepancies or anomalous transactions that might need further investigation.

Remember to test your template for different scenarios and edge cases. For example, what happens if you have a reimbursement transaction? What if you need to track expenses for multiple accounts or for different components of your business? Testing your template with these different scenarios will help you identify any flaws or areas for improvement.

Once you have tested your template extensively and you are confident that it matches your needs, you can start customizing it further. Add any additional columns or components that you might need, or make changes to the layout or design to make it more visually appealing or user-friendly.

In conclusion, testing your custom Microsoft Excel template for expenses tracking is an important step in ensuring that it functions correctly and meets your specific needs. By testing its functionalities and comparing its results with external sources, you can validate the accuracy of your template and make any necessary adjustments in the process.

Sources

When it comes to tracking your expenses, it’s important to have a total picture of where your money is going each month. For those who want a simple and intuitive way to keep track of their expenses, there are several options available.

An existing spreadsheet template is a good choice for those who are already familiar with Microsoft Excel or other spreadsheet software. There are many templates available on the internet that you can customize to match your specific needs.

If you prefer a more interactive and visual way to track your expenses, there are also online tools and apps available. These tools often offer features such as graphs and charts to help you categorize and analyze your expenses.

One popular choice is a smart expense tracker app that syncs with your bank accounts and credit cards. This type of app can automatically track your transactions and categorize them for you, making it easier to see where your money is going.

Another option is to create your own expense spreadsheet from scratch. This can be done using a program like Microsoft Excel, or you can even use a free online spreadsheet tool. By creating your own spreadsheet, you have full control over the layout and features, allowing you to customize it exactly how you like.

When designing your expense spreadsheet, it’s important to choose the right columns and components to track your expenses effectively. Some common components to include are date, description, category, amount, and payment method. You may also want to include additional columns for any specific types of expenses that you frequently incur.

Having a space to record notes or any relevant information about each expense is also helpful to avoid any errors or confusion later on. For example, you might want to note whether an expense is for personal or business use, or if it’s a reimbursement that needs to be tracked separately.

It’s always a good idea to have a general reference guide or report that summarizes your expenses. This can be helpful for tax purposes, budgeting, or simply to get a better understanding of your spending habits. With an expense spreadsheet, you can easily create these reports by using built-in functions and formulas.

Overall, there are many sources and tools available to help you create an expense spreadsheet that suits your needs. Whether you prefer a simple layout or a more advanced tracking system, the choice is yours. By taking the time to set up a well-designed expense spreadsheet, you’ll have a comprehensive record of your expenses that will make it easier to manage your finances and achieve your financial goals.