Are you looking for an easy way to track your expenses and stay on top of your budget? Look no further! In this article, we will show you how to create a budget template that will help you manage your finances.

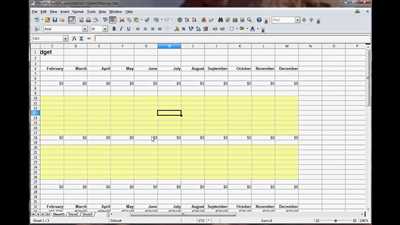

First and foremost, click on the following link to access our budget template. This template consists of several columns that will help you stay organized. It includes 5 categories, such as groceries, planning, savings, and more, which you can edit based on your preferred needs.

Without the need for any advanced knowledge or skills, our budget template is designed to be user-friendly, making it easy for you to fill in your expenses immediately. You can monitor your spending on a monthly basis or even keep a record of your purchases on a daily basis, depending on your preference.

If you prefer a yearly overview, our template has got you covered as well. Simply fill in the listed categories month by month, mirroring your planned and actual expenses. This will provide you with a great visual representation of how your spending is going throughout the year.

When it comes to tracking your expenses, our template goes even further. It comes with 2 additional columns where you can note whether the amount spent was a planned or unplanned purchase. This will help you identify any trends or areas where you may need to cut back on your spending.

Furthermore, our budget template includes graphs that provide a visual breakdown of your personal finances. With just a click of a button, you will be able to see how your spending is shaping up in each category. This allows you to personalize your budget and make any necessary changes to ensure you stay on track.

In conclusion, our easy-to-use budget template is a great tool for those looking to manage their finances in a simple and efficient way. Whether you want to track your expenses on a monthly or yearly basis, our template has got you covered. So, let’s get started and take the first step towards achieving your financial goals!

- Free monthly budget template for Google Sheets

- Keep budget planning simple

- 8 Free Budgeting Templates

- 1 Simple Weekly Budget Template

- 2 Detailed Weekly Budget Template

- 3 Simple Monthly Budget Templates

- Basic Monthly Budget Template

- Detailed Monthly Budget Template

- Yearly Budget Template

- 4 Detailed Monthly Budget Template

- 5 Simple Quarterly Budget Templates

- 6 Detailed Quarterly Budget Template

- 7 Simple Yearly Budget Templates

- 8 Detailed Yearly Budget Templates

- The Importance of a Personal Budget

- Sources

Free monthly budget template for Google Sheets

If you’re looking for a ready-made budget template to help you manage your finances, look no further! This free monthly budget template for Google Sheets is perfect for keeping track of your expenses and staying on top of your financial goals.

This template lets you fill in your income, expenses, and savings goals all in one place. It’s great for both personal and business use. Simply click on the preferred month you want to start budgeting for, and start filling in your details.

First, you’ll see the summary section where you can fill in your monthly income, planned and actual expenses, and calculate your savings balance. Then, there are detailed sections for adding your specific income and spending categories, such as groceries, bills, entertainment, and more.

With the template’s built-in graphs, you can visually track your spending habits and see how your budget is shaping up. You can also insert the dates you prefer for each week or month to stay organized. The template comes with 8 columns, but you can easily add or remove columns depending on your needs.

After filling in all the necessary information, you’re done! The template will automatically calculate your total income, expenses, and savings, giving you a clear overview of your financial situation.

If you prefer to personalize the template, you can change the format, colors, and labels to match your preferences. You can even use the template to track your spending and budget for multiple months or quarters.

What’s great about using Google Sheets for budgeting is that it allows you to easily make changes on the go, as well as access your budget from any device. You can also share it with others if you’re planning your budget with a partner or family members.

So why wait? Start using this free monthly budget template for Google Sheets and take control of your finances today!

Keep budget planning simple

When it comes to budgeting, simplicity is key. Having a simple budget template can help you stay organized and make better financial decisions. Here are some tips on how to keep your budget planning simple:

1. Choose a budget template that works for you: There are many budget templates available online, so choose one that suits your needs. Whether you prefer a weekly, monthly, or yearly budget, make sure the template you’ve chosen allows you to track your income and expenses easily.

2. Fill in your income and expenses: After you’ve downloaded or imported the budget template into a spreadsheet or document, start by filling in your income and expenses. This will give you a clear understanding of how much you earn and how much you spend.

3. Categorize your expenses: Categorize your expenses into different categories, such as groceries, bills, entertainment, etc. This will help you get a clearer breakdown of where you spend your money the most.

4. Track your spending: The next step is to monitor your day-to-day spending. Keep a log of all your purchases and fill in the amount spent in the corresponding category in your budget template. This will help you see where your money is going and identify areas where you can save.

5. Visualize your budget: Many budget templates provide graphs and visual representations of your financial situation. This is especially helpful for those who prefer a more visual way of understanding their budget. With just a few clicks, you can see how much you’ve spent and how close you are to achieving your financial goals.

6. Maintain your budget template: Keep your budget template up to date by logging your expenses regularly. This will give you a clear picture of your spending habits and help you make adjustments when needed.

7. Personalize your budget: Make the budget template your own by adding or removing categories that are relevant to your financial situation. By personalizing it, you can ensure that it aligns with your specific needs and goals.

In conclusion, keeping your budget planning simple is of utmost importance. By using a budget template that is easy to follow and understand, you can effectively manage your finances and achieve your financial goals. So start by choosing the best template for you, fill in your income and expenses, and monitor your spending to maintain a healthy balance in your financial life.

8 Free Budgeting Templates

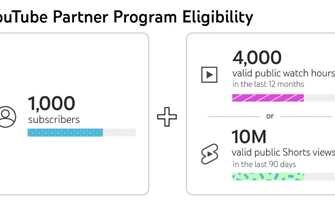

If you’re looking to track your spending and create a budget, there are plenty of free budgeting templates available. These templates can be a great resource for individuals and families alike who want to take control of their finances. Here are 8 free budgeting templates that you can use:

- Google Sheets Budget Template: Google Sheets offers a free budget template that allows you to enter your income and expenses, categorize them, and see an overview of your finances. With this template, you can easily track your day-to-day expenses and stay on top of your budget.

- Simple Budget Template: If you prefer a more basic budgeting template, this simple budget template might be just what you need. With only a few columns, it allows you to quickly fill in your income and expenses without getting into too much detail.

- Detailed Budget Template: On the other hand, if you want a more detailed budget template, this one has you covered. It has multiple columns for different categories of income and expenses, and you can customize it to fit your specific needs.

- Weekly Budget Template: Some people prefer to budget on a weekly basis rather than monthly. This weekly budget template allows you to track your income and expenses week by week, helping you better manage your finances on a shorter time frame.

- Monthly Budget Template: For those who prefer a monthly budgeting approach, this template is a great option. It helps you plan your income and expenses for the entire month, giving you a clear picture of where your money is going.

- Yearly Budget Template: If you prefer to plan your finances for the entire year in advance, this yearly budget template is the perfect choice. It allows you to set financial goals and track your progress throughout the year.

- Quarterly Budget Template: This budget template is designed for individuals or families who prefer a quarterly budgeting approach. It gives you a detailed overview of your income and expenses for each quarter of the year, helping you stay on track with your financial goals.

- Importance of Budgeting Template: This unique budgeting template focuses on the importance of budgeting and helps you understand how budgeting can help you achieve your financial goals. It comes with graphs and charts that visually represent the impact of budgeting on your finances.

With these ready-made budgeting templates, you can easily get started on tracking your income and expenses. Simply choose the template that fits your needs, click the download button, and start filling in the details. Whether you want a quick and simple template or a more detailed one, these free budgeting templates are here to help you without the hassle of starting from scratch.

1 Simple Weekly Budget Template

When it comes to budgeting, having a template can be a great help. If you want to keep track of your weekly expenses and income in a simple and organized way, a weekly budget template can be just what you need. Here is a simple weekly budget template to get you started:

- Download the template: You can find many ready-made budget templates available for free online. Simply search for “weekly budget template” on Google or any other search engine, and you’ll find a variety of options to choose from.

- Choose a template that suits your needs: Look for a template that has columns for both income and expenses. The template should also provide space for you to fill in the amount for each category. Some templates may even have graphs or visual overviews to help you monitor your spending.

- Fill in the template: Once you’ve downloaded and chosen a template, open it in your preferred format (e.g. Microsoft Excel, Google Sheets). Start by filling in the dates of the week, as well as the income and expenses for each category.

- Manage your budget: The template will automatically calculate the total income and expenses for the week, giving you a detailed overview of your financial situation. You can continue filling in the template each week to keep track of your spending and monitor your progress.

- Importance of budgeting: Budgeting helps you achieve your financial goals by keeping your spending in check. By logging your income and expenses, you can identify areas where you can save or cut back, and make adjustments accordingly.

By using a simple weekly budget template, you can easily record and monitor your income and expenses, making budgeting a breeze. Whether you prefer a detailed spreadsheet or a ready-made template with graphs, finding the best template for your personal needs will make budgeting much easier.

2 Detailed Weekly Budget Template

When it comes to managing your finances, having a budget in place is essential. Whether you want to accomplish specific financial goals or simply keep track of your expenses, a budget template helps you stay on track.

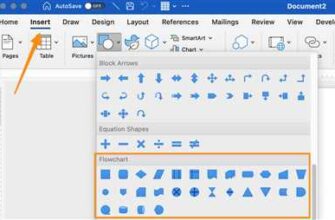

Google Sheets provides a convenient platform for creating your own budget template. First, download a budget template from the Google Sheets template gallery or start from scratch by creating a new spreadsheet.

In your template, create columns that will shape the structure of your budget. Fill in the necessary details such as income and expenses for each week.

Keep in mind the dates and months, as you can customize the format to look the way you prefer. You can also add additional columns for categories or specific needs.

Each week, you can note the planned and actual amount of money spent for different categories. This allows you to monitor your spending and make any necessary adjustments.

By logging your expenses on a weekly basis, you can keep a detailed record of your financial habits. This information can then be used to monitor your progress over time and provide a breakdown of your spending habits.

The budget template is designed to automatically calculate totals and provide a visual representation of your spending. With just a few clicks, you can save and update the template to reflect your current financial situation.

Moreover, if you want to analyze your finances on a monthly or quarterly basis, you can create separate sheets within the same document. This allows you to track your spending over a longer period of time and identify any trends or patterns.

By using a budget template, you can easily manage and monitor your personal finances. The template provides a clear structure and helps you stay organized without the need for any fancy software or devices.

So, whether you’re just starting to budget or looking for a more detailed breakdown of your expenses, this 2 detailed weekly budget template is a great tool to get you started. Save time and work smarter with this customizable document.

3 Simple Monthly Budget Templates

If you’re looking to track your monthly expenses and manage your budget, having a budget template can be extremely helpful. With a budget template, you can easily keep track of your income, expenses, and savings goals. Here are three simple monthly budget templates to help you get started:

-

Basic Monthly Budget Template

This template is designed for those who are new to budgeting or prefer a simple format. It provides an overview of your income, expenses, and savings goals for the month. You can easily fill in the income and expense categories that are most relevant to you, such as rent, groceries, transportation, and entertainment.

To use this template, simply click on the link provided and download it to your computer. Fill in the income and expense columns with the specific amounts for each category, and the template will automatically calculate how much you’re spending and saving.

-

Detailed Monthly Budget Template

If you want a more detailed breakdown of your expenses, this template is for you. It includes additional categories, such as utilities, insurance, and debt payments. This template allows you to track your expenses on a more granular level.

To use this template, follow the same steps as the basic monthly budget template. Click on the link to download the template, then fill in the income and expense columns with the specific amounts for each category. The template will automatically calculate your total income, expenses, and savings.

-

Yearly Budget Template

This template is designed for those who prefer to plan their budget on a yearly basis. It allows you to monitor your income, expenses, and savings goals throughout the year. This template also helps you keep track of any changes in your income or expenses over time.

To use this template, simply download it from the link provided. Fill in the income and expense columns with the specific amounts for each month, and the template will automatically calculate your total income, expenses, and savings for the year.

Regardless of which budget template you choose, budgeting can shape your financial planning. These templates provide a structured way to keep track of your income and expenses and help you stay on track with your savings goals. Start by filling in your income and expense categories, and let these budget templates do the rest of the work for you. Whether you’re just starting out or looking to improve your financial management, these templates can help you get started on the right track.

4 Detailed Monthly Budget Template

If you’re looking to manage your finances effectively and keep track of your expenses, creating a monthly budget is a great first step. A budget template helps you break down your income and expenses, allowing you to see where your money is going and how much you have left.

When it comes to budgeting, there are many different approaches you can take. Some people prefer to keep things simple and use a basic spreadsheet to track their income and expenses. Others want a more detailed breakdown of their finances, including specific categories for different types of expenses.

Luckily, there are plenty of ready-made budget templates available that can help you achieve your financial goals. Here are four detailed monthly budget templates that you could use:

- Simple Budget Template: This template is perfect for those who want a quick and easy way to track their income and expenses. It consists of two columns – one for income and one for expenses. Simply fill in the amount you earn and the amount you spend, and the template will automatically calculate your remaining balance.

- Groceries Budget Template: If you want to keep track of your weekly grocery purchases separately, this template is for you. It lets you log your grocery expenses on a weekly basis, breaking down your spending into specific categories like fruits, vegetables, meat, and more. This helps you visualize how much you’re spending on groceries in advance and plan your purchases better.

- Financial Planning Template: For those who want a more comprehensive budgeting tool, this template is a great choice. It gives you a breakdown of your income and expenses across multiple categories, such as housing, transportation, entertainment, and more. This allows you to monitor your money more closely and make adjustments where needed.

- Income and Expense Tracker Template: If you prefer a more visual approach to budgeting, this template is the one for you. It comes with a customizable sheet that lets you list your income and expenses in different columns. You can personalize the sheet to suit your needs and track how much you’re spending in each category. The template also has a handy “clicks” button that automatically calculates your total income and expenses.

Note that whether you choose to use these templates or create your own, the importance lies in regularly logging your income and expenses, analyzing the results, and making adjustments as needed. Budgeting is a tool that helps you manage your finances and achieve your financial goals, so finding a budgeting method that works best for you is key.

Don’t forget that there are many sources online where you can find free budget templates to suit your needs. Take the time to explore different options and choose the one that best fits your financial situation and goals.

5 Simple Quarterly Budget Templates

If you’re looking to manage your expenses and achieve your financial goals, having a budget template can be a helpful tool. It allows you to track and monitor your spending, ensuring you stay on track and don’t overspend. In this article, we’ll introduce you to five simple quarterly budget templates that can assist you in accomplishing these goals.

1. Google Sheets Budget Template: Google Sheets offers a free spreadsheet that you can use to create and personalize your budget. It’s easy to use and allows you to insert your own income and expenses. The template will even provide you with graphs to breakdown your spending by category, helping you get a clear picture of where your money is going.

2. Monthly Budget Template: If you prefer to track your expenses on a monthly basis, this template is for you. It allows you to log your purchases and categorize them to see how much you’re spending in each category. The template is designed to provide you with a detailed overview of your monthly expenses and can help you plan for future needs.

3. Quarterly Budget Template: This template is similar to the monthly budget template, but it’s specifically designed to track your expenses over a three-month period. It’s a great option if you like to plan in advance and want to have a shorter timeline to keep your budget in check.

4. Personal Budget Template: The personal budget template is a comprehensive tool that allows you to manage your finances in a detailed manner. It helps you track your income, expenses, and even your savings goals. With this template, you can monitor your spending and ensure you’re achieving your financial objectives.

5. Customizable Budget Template: If none of the above templates suit your needs, you can create a customizable budget template. With this option, you can tailor the template to your preferred format and add or remove sections based on what you want to track. It’s a flexible option that allows you to have complete control over your budgeting process.

Regardless of which template you choose, the importance of having a budget cannot be overstated. It helps you stay on top of your finances, tracks your expenses, and ensures you’re making progress towards your financial goals. With these simple quarterly budget templates, you can easily get started and continue to manage your money effectively.

6 Detailed Quarterly Budget Template

If you’re looking for a quick and easy way to manage your finances, a budget template can be a great solution. Having a budget helps you stay on track with your spending, and also gives you an overview of how much money you have coming in and going out. In this article, we’ll provide you with 6 detailed quarterly budget templates to help you achieve your financial goals.

1. Weekly Budget Template: This template lets you fill in your income and expenses on a weekly basis. You can log your chosen items in the provided columns, and the template will automatically calculate the balance for you.

2. Monthly Budget Template: If you prefer to plan your budget on a monthly basis, this template is perfect for you. It gives you an overview of your income and expenses for each month, and helps you track your spending.

3. Quarterly Budget Template: This template is great if you want to plan your budget in advance for the next 3 months. It has columns for each month, making it easy to keep track of your finances throughout the quarter.

4. Yearly Budget Template: If you like to have a detailed breakdown of your finances for the whole year, this template is for you. It provides an overview of your income and expenses on a yearly basis, and helps you stay on top of your financial goals.

5. Ready-Made Budget Template: If you don’t want to spend time filling in the details, this template is the best choice for you. It comes with pre-filled categories like groceries, bills, and entertainment, so you can simply insert your own amount and you’re done.

6. Graphs Budget Template: If you’re a visual person and like to see your budget in graphs, this template is the one you should download. It provides easy-to-read graphs based on your income and expenses, mirroring the details you’ve filled in.

Having a budget template helps you stay organized and on top of your finances. It allows you to track your spending, plan for the future, and make sure you’re not overspending. By clicking on the download button, you’ll have the template downloaded to your device, ready for you to personalize. So don’t wait, start managing your money effectively and achieve your financial goals!

7 Simple Yearly Budget Templates

If you want to keep track of your income and expenses throughout the year, having a yearly budget template can be a quick and easy way to achieve this. With ready-made templates available, you can start logging your financial details without the need to create a spreadsheet from scratch.

Here are 7 simple yearly budget templates that are designed to help you monitor your day-to-day spending, save for big purchases, and shape your financial goals:

- Monthly Budget Template: This template breaks down your income and expenses on a monthly basis, allowing you to fill in the amounts you expect to earn and spend each month.

- Weekly Budget Template: If you prefer to keep track of your finances on a weekly basis, this template is a great option. It lets you monitor your income and expenses week by week.

- Quarterly Budget Template: For a more detailed overview of your finances, this template divides the year into four quarters, helping you see how your income and expenses fluctuate throughout the year.

- Yearly Budget Template for Personal Expenses: This template is specifically designed for tracking personal expenses, making it easy to see where your money is going and identify areas where you can save.

- Yearly Budget Template for Business Expenses: If you run a business, this template can help you monitor your day-to-day expenses and plan for future investments.

- Yearly Budget Template for Savings: Saving money is crucial, and this template is designed to help you set savings goals and track your progress throughout the year.

- Yearly Budget Template for Investments: If you have investments, this template lets you monitor your investment income and analyze your portfolio’s performance.

Each template provides different columns and categories based on what you need. You can easily fill in the dates and amounts, mirroring your financial goals. With just a few clicks, you’ll have a clear overview of your budget for the entire year.

Not only do these templates help you monitor your finances, but they also let you import your transactions directly from your bank statements, saving you time and effort. They are designed to make budgeting easy, even if you’re not familiar with spreadsheet work.

So, whether you’re a personal or business budgeter, these yearly budget templates are a great tool to help you achieve your financial goals. Start filling in the details and get started on your budget today!

8 Detailed Yearly Budget Templates

If you’re looking for a quick and simple way to format your yearly budget, we’ve got you covered. With these detailed templates, you can easily copy and fill in the necessary information to get a clear picture of your financial situation for the year. Whether you prefer a short and concise overview or a more detailed breakdown, these templates have it all.

When it comes to budgeting, the importance of having a yearly plan cannot be overstated. With these templates, you can plan your monthly expenses and balance them against your planned income. The monthly sheet provides a detailed overview of your expected income and expenses, helping you stay on track throughout the year.

One of the great features of these templates is the ability to insert specific dates for each month, allowing you to fill in the necessary information for your personal financial goals. Whether you’re tracking your weekly expenses or logging major purchases, these templates can help you achieve your financial objectives.

There are 8 ready-made templates to choose from, each tailored to fit different budgeting preferences. Whether you like a simple spreadsheet layout or a more advanced format, you can find a template that suits your needs. Simply click on the link of your preferred template and import it into your preferred spreadsheet software.

Once you have the template in front of you, you can personalize it to your liking. Add or remove categories, customize the layout, and even add notes to help you stay organized. The templates are designed to help you track and manage your spending, giving you a clear overview of where your money is going.

Having a detailed yearly budget is a leading tool when it comes to financial planning. It allows you to break down your expenses and income into manageable chunks, making it easier to achieve your financial goals. By logging your expenses and adding up your income, you can see whether you’re on track or need to make adjustments.

These templates are not only free to use but also easy to work with. Whether you’re a budgeting novice or a pro, they can help you stay organized and achieve your financial objectives. So why wait? Start planning for the year ahead and take control of your finances today!

The Importance of a Personal Budget

Planning for your financial future is crucial, and one of the most effective tools you can use is a personal budget. With a budget, you can carefully track your income, expenses, and savings in order to stay on track and achieve your financial goals.

Having a personal budget allows you to save for both short-term and long-term goals. By breaking down your expenses into categories such as groceries, utilities, transportation, and entertainment, you can allocate your income accordingly and ensure that you are not overspending in any particular area. This will help you monitor your spending habits and make adjustments if necessary.

Creating a personal budget is easy with the help of budget templates, which can be downloaded online. These templates come in various formats and can be customized to fit your needs. Some templates even have built-in formulas and linked cells, so calculations are automatically done for you.

When starting your budget, you can choose between a monthly or weekly breakdown. Depending on your preference and the frequency of your income, you can select the format that works best for you. For those who prefer a more detailed approach, a monthly budget template may be ideal. This template allows you to track your income and expenses on a monthly basis, providing a comprehensive overview of your financial situation.

On the other hand, if you prefer a more day-to-day tracking, a weekly budget template may be more suitable. This template allows you to fill in your income, expenses, and savings on a weekly basis, giving you a clearer picture of your financial situation.

Regardless of the format you choose, having a personal budget helps you stay organized and accountable for your spending. It allows you to see where your money is going and identify areas where you can cut back. By tracking your expenses consistently, you can uncover patterns and adjust your budget accordingly.

Using a budget template is simple and straightforward. After downloading the template of your choice, you can simply start filling in the relevant columns with your income, expenses, and savings. There may also be a notes section where you can add any additional details or reminders. Each template is designed to mimic a traditional budget document, making it easy to navigate and understand.

Once you’ve filled in all the necessary information, you can monitor your spending by regularly updating the template. This can be done by adding new items or adjusting existing ones. By doing so, you’ll be able to track your progress and ensure that you are staying within your budget.

It’s important to note that a personal budget is not a one-time activity. It needs to be regularly reviewed and updated as your financial situation changes. Your income, expenses, and savings can fluctuate from month to month or year to year, and your budget should reflect these changes.

Overall, having a personal budget is an essential tool for managing your finances effectively. It helps you prioritize your spending, stay on track, and achieve your financial goals. By using a budget template, you can easily create a budget that mirrors your preferred format and meets your specific needs. So, why wait? Start budgeting now and take control of your financial future!

Sources

When creating a budget template, it’s important to have a clear understanding of your sources of income. This will help you manage your finances more effectively and stay on track with your financial goals. Here are some sources you may consider when creating your budget template:

1. Yearly Income: This category should include any income you receive on a yearly basis, such as bonuses or tax refunds.

2. Monthly Income: This category should include your regular monthly income, such as your salary or wages.

3. Weekly Income: If you have a job that pays you on a weekly basis, you can include this category to track your weekly income.

4. Additional Income: This category can be used to track any additional sources of income, like freelance work or rental income.

By listing all your income sources in detail, you can better manage your finances and know exactly what to expect each month. Some people like to use specific templates that can be downloaded from leading budgeting websites, while others prefer to create their own templates using spreadsheet software like Google Sheets or Microsoft Excel.

Once you have your income sources listed, you can insert the dates and amounts into your budget template. This will give you a clear breakdown of your income and help you see how much you can save or spend in each category.

Using a budget template is a great way to stay on top of your day-to-day expenses without having to constantly track and log every single purchase. It allows you to easily monitor your spending and make any necessary adjustments to achieve your financial goals. With the right template, you can even create graphs and charts to visualize your progress.

Whether you choose to download a pre-made template or create your own, the main goal is to have a budget template that is simple and easy to use. A well-filled budget template will help you stay on track and accomplish your financial goals.

So, start by clicking on the preferred template or simply use a free template found in Google Sheets or Excel to get started. With just a few clicks, you can have a budget template that helps you manage your money, balance your expenses, and achieve your financial goals.