If you’re an employer looking to open a PayPal account for your business, here’s everything you need to know.

First, go to the PayPal website and click on “Sign up”. You will be prompted to enter your email address and create a password. Once you’ve done that, you’ll need to provide your business name, employer identification number (EIN), and other information they may ask for.

Next, you’ll need to set up your business profile. This will include details such as your business type, the currency you want to use for transactions, and the website where customers can find more information about your products or services.

PayPal offers different types of accounts for businesses, so depending on your needs, they may charge a fee for some features. But don’t worry, setting up a business PayPal account is free.

Once you have your account set up, you can start accepting payments. PayPal provides a secure and easy-to-use payment method, which is trusted by millions of businesses worldwide.

So, if you’re looking for a reliable and convenient solution for accepting payments, look no further than PayPal. Create your business account today and enjoy the benefits of hassle-free transactions.

How to set up and create a PayPal business account

If you’re a business owner or plan to start your own business, setting up a PayPal business account is a crucial step. PayPal is a widely recognized and secure online payment platform that allows businesses to accept various types of payments from customers.

Here’s a step-by-step guide on how to create and set up your PayPal business account:

Step 1: Visit the PayPal website

Open your preferred web browser and go to the official PayPal website. You can easily find it by searching “PayPal” on any search engine.

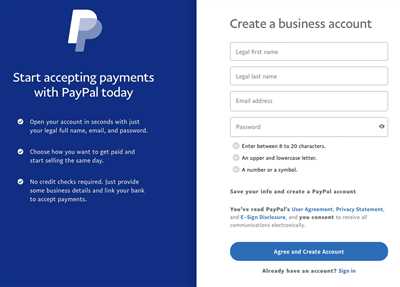

Step 2: Click on “Sign Up”

Once you’re on the PayPal homepage, click on the “Sign Up” button. You will be presented with two options: “Personal Account” and “Business Account.” Choose the “Business Account” option.

Step 3: Provide your business information

Fill in the required information such as your business name, full address, and contact information. Make sure to double-check the accuracy of the information you provide.

Step 4: Choose an account type

PayPal offers different types of business accounts depending on your business needs. Select the account type that suits your requirements. You can choose between a Standard Business Account and a Pro Business Account.

Step 5: Set up your payment method

Choose how you would like to accept payments on your website or online store. PayPal offers various payment methods, including credit/debit cards, PayPal Credit, and Pay After Delivery. Select the appropriate payment methods that you want to offer to your customers.

Step 6: Connect your bank accounts

To transfer funds from your PayPal account to your bank account, you need to link them. Provide the necessary banking information, such as your bank account number and routing number. PayPal uses this information securely and solely for transaction purposes.

Step 7: Customize your profile

Personalize your PayPal business account by adding a profile picture, a brief description of your business, and any other relevant details. This will help customers recognize your business and build trust.

Step 8: Set up currency and transaction preferences

Choose the currency in which your business operates. PayPal supports multiple currencies, allowing you to accept payments worldwide. Additionally, you can adjust your transaction preferences, such as setting payment limits and configuring payment notifications.

Step 9: Verify your account

PayPal may require you to provide additional information or complete verification steps to ensure the security of your account and protect against fraud. Follow the instructions provided by PayPal to complete the verification process.

Step 10: Start accepting payments

Once your PayPal business account is set up and verified, you can start accepting payments from customers. Depending on your business model, you can use PayPal’s payment buttons, QR codes, or request payments directly from customers through email or invoice.

Setting up and creating a PayPal business account is a simple and effective solution for businesses of all sizes. PayPal provides a secure and reliable platform for processing transactions, making it easier for businesses to accept payments from customers.

Does my business need a PayPal account

Operating a business in today’s digital age requires efficient payment solutions and convenient methods for customers to make transactions. PayPal is a highly popular platform that provides a streamlined payment process for businesses of all sizes. But does your business need a PayPal account?

The answer to this question depends on various factors such as the type of business you run, the countries you operate in, and the needs of your customers. PayPal offers different types of accounts, each catering to specific needs. Let’s explore the benefits and features of having a PayPal account for your business.

|

| One of the key advantages of having a PayPal account for your business is that it allows you to accept payments in multiple currencies. If your business operates in different countries or if you have international customers, PayPal can handle currency conversions and facilitate seamless transactions. Another benefit is that PayPal provides a secure payment method for your customers. With PayPal, your customers can make payments using their PayPal balance, credit or debit cards, or bank accounts. This flexibility ensures that you can cater to a wide range of customer preferences and increase the likelihood of completing sales. Setting up a PayPal account for your business is also a straightforward process. All you need to do is provide some basic information such as your business name, address, and federal tax ID (if applicable). PayPal may also require additional information depending on your business type. |

Once you have set up your PayPal account, integrating it into your website or online store is a simple task. PayPal provides easy-to-use tools and resources that allow you to customize your payment buttons, create invoices, and generate QR codes for easy payment. This ensures a seamless user experience and helps you convert leads into paying customers.

PayPal also offers a range of additional features and solutions to meet the specific needs of different businesses. For example, you can set up recurring payments, create subscription plans, or offer Buy Now, Pay Later options to enhance customer convenience and loyalty.

Furthermore, PayPal charges a small fee for each transaction, but the benefits and convenience it offers far outweigh these costs. The fee structure is transparent, and you can find detailed information about their charges on the PayPal website.

In conclusion, if you want to provide your customers with a secure and efficient payment solution, accepting PayPal payments is a must-have for your business. The wide acceptance and recognition of PayPal make it a trusted payment method for customers worldwide. Make your business stand out and increase customer satisfaction by offering PayPal as a payment option.

Does PayPal charge you for setting up a Business account

Creating a Business account on PayPal is a straightforward process and doesn’t involve any charges. Whether you’re a small or large business, setting up a PayPal Business account is free of charge.

To set up a Business account, you’ll need to provide some basic information such as your full name, address, and contact details. Once you have entered this information, PayPal will create your Business account.

One of the benefits of having a PayPal Business account is that it allows you to accept payments in different currencies. Depending on the type of business you have, you can choose the currency that best suits your needs.

PayPal offers various payment methods for businesses to accept transactions. You can set up payments on your website using PayPal’s payment buttons or integrate the Payments API into your website or application.

When customers make a payment to your business through PayPal, the funds will be deposited into your PayPal account. From there, you can transfer the money to your bank account or use it for future online purchases.

PayPal also provides a solution called PayPal Here, which enables businesses to accept payments using QR codes. This method allows customers to scan a QR code displayed at the point of sale, and the payment will be processed directly through the PayPal app.

Setting up a PayPal Business account doesn’t require you to provide any financial information such as your employer identification number (EIN) or Social Security number (SSN), unless you reach certain thresholds for receiving payments.

It’s important to note that while setting up a Business account is free, PayPal charges transaction fees when you receive payments. The fees vary depending on the country and the type of transaction, so it’s essential to review PayPal’s fee structure to understand the charges.

In conclusion, opening a Business account on PayPal is free of charge, and it provides a convenient and secure way for businesses to accept online payments. With various payment methods and currency options, PayPal offers flexibility for businesses of all sizes.

If you’re considering using PayPal for your business, here’s how you can set up a Business account:

- Go to the PayPal website and click on “Sign Up”.

- Choose the “Business” account type.

- Fill in your business information and create a PayPal username and password.

- Confirm your email address by clicking on the link in the verification email sent by PayPal.

- Link your bank account or credit/debit card for payment processing.

- Customize your payment preferences and integrate PayPal into your website or application.

- Start accepting online payments with your new PayPal Business account!

Remember, PayPal provides the tools and resources you need to efficiently manage your business transactions, all in one place.

Which Solution To Use

When it comes to using PayPal for your business, there are several solutions available depending on your specific needs. Here’s a step-by-step guide on different options to create and use a business PayPal account:

1. PayPal Website

- Go to the PayPal website and click on the “Sign Up” button.

- Select the “Business Account” option.

- Fill in your information, such as your name, email address, and business name.

- Provide your business’s address and contact information.

- Set a password for your PayPal account.

- Choose a suitable currency for your transactions.

- Once your account is open, you can customize your profile setting according to your requirements.

2. Payment Buttons

If you have a website, you can use PayPal’s payment buttons to accept payments. You can create different types of buttons, such as “Buy Now,” “Add to Cart,” or “Donate” buttons, and add them to your website.

3. Invoicing

If you need to bill your customers or clients for your products or services, you can use PayPal’s invoicing feature. You can create professional-looking invoices and send them directly to your customers’ email addresses.

4. PayPal Here

For businesses that need to accept payments in person, PayPal Here offers a mobile card reader that connects to your smartphone or tablet. This solution allows you to easily process credit card payments on the go.

5. PayPal Business App

If you prefer to manage your PayPal account on your mobile device, you can download the PayPal Business app. This app allows you to access your account, view transactions, send invoices, and monitor your funds wherever you are.

6. PayPal API Integration

For larger businesses or those with more complex payment needs, PayPal provides an API that allows you to integrate PayPal directly into your website or application. This method gives you full control over the checkout process and can be customized according to your requirements.

Depending on your business type and size, you may use one or more of these solutions in combination to meet your specific needs. It’s important to evaluate each option and choose the solution that best fits your requirements and preferences.

Sources

There are various sources that you can use to create a business PayPal account. Depending on your needs and requirements, you can choose the most suitable method:

1. PayPal website: The official PayPal website is the best place to start. You can sign up for a business account by providing your name, email address, and other relevant information.

2. Federal Employer Identification Number (EIN): If you operate a business that is registered with the federal government, you may need to provide your EIN during the account creation process.

3. Bank accounts: PayPal allows you to link your business bank accounts to your PayPal account to receive and withdraw funds. You will need to provide your bank account details for this option.

4. Credit and debit cards: You can also link your business credit or debit cards to your PayPal account for easy payment processing. PayPal supports a wide range of different card types.

5. PaymentsQR: PayPal offers a solution called PaymentsQR, which allows you to create QR codes that customers can scan to make payments. This can be a convenient method for businesses that want to accept payments in a physical store.

Setting up a business PayPal account is free, and they do not charge any setup or monthly fees. However, keep in mind that they may charge transaction fees depending on the type of business and currency used.

Once you have created your business PayPal account, you can use it to accept payments from customers, make transactions, and manage your profile. PayPal offers a full suite of features for businesses, making it a popular choice among online sellers and entrepreneurs.

Here’s a list of the main features and benefits that PayPal provides for businesses:

– Secure and trusted payment method

– Easy to use and set up

– Accept payments in different currencies

– Ability to send invoices and track payments

– Integration with popular e-commerce platforms

– Fraud protection and dispute resolution

In conclusion, PayPal is an excellent solution for businesses of all sizes. It offers a reliable and easy-to-use platform for managing your financial transactions, accepting payments, and growing your business.