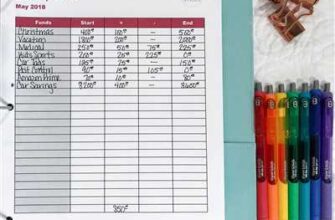

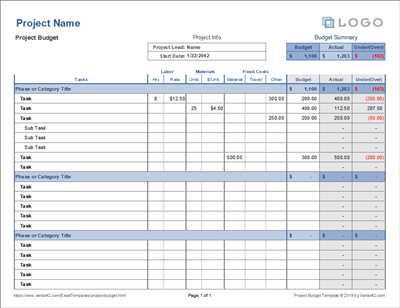

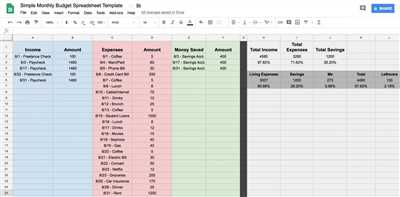

Designing and making a budget template can be a daunting task, but with the right tools and advice, you can easily create your own budget planner. One of the most popular and widely used methods is to use budget templates or spreadsheets. You can find free budget templates online like the one featured here by Lauren at NerdWallet.

The first step in creating a budget template is to determine what data you want to include. You can start by listing all your monthly expenses such as rent or mortgage, utilities, groceries, and transportation. Additionally, you can set goals for saving or paying off debt, and include them in your budget template as well.

Once you have a clear idea of what you want to track, you can start customizing the layout of your budget template. If you are familiar with spreadsheet programs like Excel or Google Sheets, you can create your own budget template from scratch. If you need additional guidance, there are pre-made budget templates available that you can modify to fit your needs.

Getting started with your budget template is as simple as downloading or opening a blank spreadsheet program. You can then input your income and expenses, and customize the categories and formulas to calculate your budget. Here are some tips to help you get started:

- Organize your expenses into categories for easier tracking.

- Monitor your budget regularly to ensure you are staying on track.

- Include a contactless or credit card tracker for easy visibility of your credit card expenses.

- Set achievable goals and track your progress.

- Connect your budget template to your bank or financial program to automatically import transactions.

- Use additional resources like NerdWallet’s budgeting tips or financial advice to assist you in achieving your goals.

That’s it! In a nutshell, creating a budget template is a straightforward process that can provide you with the tools and insights you need to manage your finances effectively. Whether you choose to use a pre-made template or create one from scratch, budgeting is essential for achieving your financial goals. So why wait? Start creating your budget template today and take control of your financial future.

Sources: Lauren at NerdWallet, Tiller, CreditWise

- Free Budget Planner Tips For Getting Started

- Choose a spreadsheet program or template

- Budget template designs you can bank on

- Making a budget spreadsheet in a nutshell

- What is a budget and how do you create one

- 15 monthly expenses to include in your budget

- Financial goals: How to set and achieve them

- Bonus: How to Connect your banks to your spreadsheets

- Sources

- Video

- How to Budget For Beginners – SIMPLE – Using Google Sheets + Free Template Resource in Desc.

Free Budget Planner Tips For Getting Started

If you’re looking to create a budget, you’ve come to the right place. With the help of budgeting tools and templates, you can easily track your income and expenses and achieve your financial goals. In this article, we’ll provide you with some tips on how to get started with a free budget planner.

When it comes to creating a budget, there are many tools and resources available. One popular option is Google Sheets, which offers a variety of budget templates that you can choose from. You can find these templates by searching for “budget template” in the Google Sheets program or by visiting the Google Sheets template gallery.

If you prefer a more customized design for your budget planner, you can also consider using Tiller. Tiller is a budgeting program that connects with your bank to automatically import your financial data into a spreadsheet. This allows you to easily track your income and expenses, set financial goals, and monitor your progress.

Another option is to use the budgeting templates featured on websites like NerdWallet. These templates provide a pre-designed layout for your budget and include additional tips and advice on budgeting. You can customize these templates to fit your specific needs and preferences.

When creating your budget, it’s important to include all of your income and expenses. This includes not only your monthly bills and credit card payments but also any additional expenses you may have, such as dining out or entertainment. By including all of your expenses, you’ll get a more accurate picture of where your money is going.

To monitor your budget, you can use the data from your bank statements or credit card statements. Most banks offer online banking services that provide a detailed breakdown of your transactions. You can also use tools like Mint or CreditWise to track your spending and monitor your credit score.

When it comes to budgeting, there’s no one-size-fits-all approach. What works for one person may not work for another. That’s why it’s important to experiment with different budgeting techniques and find one that works best for you. Whether you prefer using spreadsheets or budgeting apps, the important thing is to find a method that you’re comfortable with and that helps you achieve your financial goals.

In a nutshell, creating a budget is an essential step in taking control of your finances. By tracking your income and expenses, you can identify areas where you can save money and make adjustments to achieve your financial goals. So why not give it a try? With the free budget planner tips provided here, you’ll be well on your way to budgeting success.

Choose a spreadsheet program or template

When it comes to budgeting, having a spreadsheet program or template can be an invaluable tool. There are many options available, so you can choose the one that works best for you.

One popular program is Google Sheets, which is free and offers a wide range of budgeting templates. You can customize these templates to fit your specific financial goals and monitor your expenses on a monthly basis. Other spreadsheet programs like Microsoft Excel and Apple Numbers also provide budget templates that you can use.

If you’re looking for additional options, there are many websites like NerdWallet and CreditWise that offer free budget templates. These templates come in various designs and layouts, so you’re sure to find one that suits your needs.

Another option is to connect your bank accounts to a budgeting program like Tiller or Lauren’s Budget Planner. These programs automatically import your bank data, making it easier to track your expenses and set financial goals.

Whichever program or template you choose, it’s important to make sure that it includes all the necessary categories for your budget. This may include expenses like groceries, housing, transportation, and more.

In a nutshell, the choice of a spreadsheet program or template is crucial when it comes to creating a budget. It’s important to choose one that is user-friendly, customizable, and meets your specific needs. Take advantage of the many free resources available and use them to help you achieve your financial goals.

For more tips and advice on budgeting, you can contact your bank or financial institution. They may have featured budgeting tools on their website or can provide you with additional resources.

Budget template designs you can bank on

When it comes to creating a budget template, having a visually pleasing and easy-to-use design can make all the difference. Whether you’re a rookie or an experienced budgeter, having a template that suits your needs is crucial for achieving your financial goals. That’s where Lauren Banks at Google comes in.

Lauren Banks is a financial guru known for her expertise in budgeting. She has scoured the web to find the most user-friendly and efficient budget templates available. With her extensive knowledge and experience, she has compiled a list of templates that you can rely on to manage your finances.

One of the featured budget templates on Lauren Banks’ list is the “Monthly Expenses Tracker”. This template is perfect for those who want to keep track of their monthly spending and monitor their financial health. With this layout, you’ll be able to see where your money is going and identify any additional sources of income.

Another great template that Lauren Banks recommends is the “Contactless Payment Budget”. In today’s modern world, contactless payment methods are becoming more prevalent, and it’s important to keep these expenses in check. This template allows you to connect your credit card data to the spreadsheet and monitor your contactless payments with ease.

If you’re looking for a more customized option, Lauren Banks suggests using Tiller Money. Tiller provides a spreadsheet template that can be tailored to fit your specific needs. This is particularly helpful for those who have unique financial situations or are looking for a more personalized budgeting experience.

For those who prefer a digital approach, Lauren Banks recommends using a budget planner app like CreditWise or NerdWallet. These apps offer a range of budgeting tools and advice to help you create and monitor your budget. They also provide tips and strategies to help you achieve your financial goals.

Getting started with a budget template is easier than you think. Simply choose one that suits your needs from Lauren Banks’ list, or explore other available templates online. Once you have selected a template, you can customize it to fit your financial situation. Whether you need a basic budget or a more comprehensive budget, there are templates available to meet your needs.

With the right budget template, you’ll be on your way to financial success. So, don’t wait any longer – start creating your budget today!

Making a budget spreadsheet in a nutshell

Making a budget spreadsheet is a great way to track and manage your finances. It’s a simple and effective tool that can provide you with a clear layout of your income and expenses. Whether you’re a beginner or an experienced budget planner, creating a budget spreadsheet can help you set financial goals and monitor your progress.

There are various tools and templates available that can help you in creating your budget spreadsheet. One popular option is using Google Sheets, a free program that allows you to create and customize your own budget template. Additionally, there are several free budget templates available online that you can choose from.

To get started, you can find a pre-designed budget template that suits your needs. You can also create a budget spreadsheet from scratch by using the blank template and adding personalized categories for your income and expenses. It’s important to include all relevant financial data, such as your monthly income, bills, credit card payments, and any other expenses you have.

Once you have set up your budget spreadsheet, you can start inputting your financial information. This can include details such as your income, variable expenses, fixed expenses, and savings goals. You can also customize your spreadsheet to include additional categories or columns that are specific to your financial situation.

A budget spreadsheet can help you create a financial plan and track your progress towards achieving your goals. By monitoring your expenses and income regularly, you can make informed decisions about your spending habits and adjust as needed. This can help you save money, reduce debt, and achieve financial stability.

There are many tips and advice available from various sources, such as NerdWallet or Lauren Greutman, to help you create an effective budget spreadsheet. They can provide you with guidance on how to connect your bank accounts to your spreadsheet, use contactless payment methods, and find featured budgeting tools that can assist you in managing your finances.

Remember, making a budget spreadsheet is just the start. It’s important to regularly update and review your budget to ensure that it remains accurate and reflects your current financial situation. By utilizing a budget spreadsheet, you can gain a clearer understanding of your financial goals and take steps towards achieving them.

Whether you choose to use a pre-designed template or create your own, a budget spreadsheet can be a valuable tool in helping you stay on track with your finances. Start making your budget spreadsheet today and take control of your financial future!

| Sources: | – CreditWise by Capital One | – Google Sheets | – NerdWallet | – Tiller |

| Contactless Payment Methods | – Banks offering contactless payment methods | |||

| 15 Free Budget Templates | – Various websites offering free budget templates | |||

| Tips and Advice for Budgeting | – Financial experts providing tips and advice on budgeting |

What is a budget and how do you create one

A budget is a financial roadmap that helps you track your income and expenses. It provides an organized overview of your financial situation and helps you make informed decisions about your spending. By creating a budget, you can set financial goals, monitor your progress, and make adjustments as needed.

To create a budget, you can either design your own spreadsheet template or find pre-made templates online. There are many websites and banks that offer budgeting templates for free, such as Google Sheets, NerdWallet, and Tiller. These templates provide a basic layout and structure to get you started, and you can customize them to fit your specific needs and financial goals.

When creating a budget, it’s important to include all of your sources of income and expenses. This may include your monthly salary, freelance income, and additional sources of revenue. On the expense side, be sure to include both fixed expenses (such as rent, utility bills, and loan payments) and variable expenses (such as groceries, entertainment, and dining out).

One useful tip is to categorize your expenses. This can help you identify areas where you may be overspending and allow you to make adjustments accordingly. For example, you can create categories for groceries, transportation, entertainment, and savings. By monitoring your spending within each category, you can ensure that you’re staying within your budget and making progress toward your financial goals.

In addition to spreadsheets, there are also budgeting apps and programs available that can help simplify the budgeting process. These apps often provide additional features such as goal tracking, financial advice, and the ability to connect with your bank accounts and credit cards to automatically import transactions. Some popular budgeting apps include Mint, YNAB (You Need a Budget), and CreditWise.

Regardless of the method you choose to create your budget, the most important thing is to get started. Setting financial goals and monitoring your progress can help you achieve a more stable and secure financial future. So, whether you’re a budgeting beginner or an experienced planner, finding a budget template that works for you is the first step towards financial success.

15 monthly expenses to include in your budget

When creating a budget, it’s important to include all of your monthly expenses. This will help you get a clear picture of where your money is going and how you can achieve your financial goals. Here are 15 monthly expenses that you should consider including in your budget:

- Housing: Rent or mortgage payments, property taxes, and insurance.

- Utilities: Electricity, water, gas, internet, and phone bills.

- Transportation: Car payment, insurance, gas, and maintenance.

- Food: Groceries, dining out, and takeout.

- Debt payments: Credit card payments, student loans, and personal loans.

- Insurance: Health insurance, life insurance, and car insurance.

- Entertainment: Streaming services, movie tickets, and hobbies.

- Clothing and personal care: Clothing purchases, haircuts, and toiletries.

- Childcare and education: Daycare costs, school fees, and supplies.

- Subscriptions: Gym memberships, magazine subscriptions, and other recurring expenses.

- Home maintenance: Repairs, renovations, and cleaning supplies.

- Savings and investments: Retirement contributions, emergency fund, and investment accounts.

- Charitable giving: Donations to your favorite causes or organizations.

- Gifts and celebrations: Birthdays, holidays, and special occasions.

- Travel: Vacations, flights, and hotel stays.

Including these expenses in your budget will give you a comprehensive look at your monthly spending habits. You can use this data to monitor your spending, set financial goals, and make adjustments to achieve those goals. Whether you choose to use a budgeting app or create a spreadsheet of your own, make sure you find a layout that works best for you. Many banks and financial institutions provide free budgeting templates or you can customize your own using programs like Google Sheets or Microsoft Excel. Additionally, there are contactless budgeting tools like Tiller and NerdWallet that can help automate your budget and provide additional advice on making the most of your money.

Financial goals: How to set and achieve them

Setting financial goals is an important step in managing your budget and achieving financial success. Whether you want to save for a vacation, pay off debt, or build an emergency fund, having clear goals can help you stay focused and motivated. Here are some tips to help you set and achieve your financial goals:

1. Define your goals: Start by determining what you want to achieve. Be specific and realistic about what you want to accomplish. For example, rather than saying “save money,” set a specific savings target like “save $500 per month for a down payment on a house.”

2. Break it down: Once you’ve defined your goals, break them down into smaller, manageable steps. This will make them more attainable and easier to track. For example, if your goal is to save $6,000 in a year, break it down into monthly savings of $500.

3. Create a budget: To achieve your financial goals, you’ll need to create a budget that aligns with your goals. A budget is a plan that helps you track your income, expenses, and savings. There are many tools and resources available to help you create a budget, such as online budgeting programs, mobile apps, or spreadsheets. You can also find free budget templates and layouts online that you can customize to suit your needs.

4. Monitor your progress: Once you have a budget in place, it’s important to regularly monitor your progress. This will help you stay on track and make adjustments as needed. Use a financial planner or budgeting program to track your expenses, income, and savings. This will give you a clear picture of where your money is going and where you can make adjustments.

5. Seek additional advice: If you’re unsure about how to set or achieve your financial goals, don’t be afraid to seek additional advice. Many banks offer free financial planning services or credit counseling programs. You can also reach out to financial experts or use online resources like NerdWallet or CreditWise to get tips and advice on budgeting and financial goal setting.

6. Stay motivated: Achieving financial goals takes time and discipline, so it’s important to stay motivated along the way. Set periodic milestones or rewards to celebrate your progress. For example, if you’re saving for a vacation, plan a mini-vacation once you reach a certain savings milestone. This can help keep you motivated and on track.

In a nutshell, setting and achieving financial goals is a crucial part of budgeting. By defining your goals, creating a budget, monitoring your progress, seeking advice, and staying motivated, you can successfully achieve your financial goals and improve your financial well-being.

Bonus: How to Connect your banks to your spreadsheets

If you’re on a budget, tracking your expenses and staying on top of your financial goals can be essential. One effective way to do this is by creating a budget template using spreadsheets. But what if you want to take it a step further and have your financial data automatically imported into your budgeting program? That’s where connecting your banks to your spreadsheets comes in.

By connecting your banks to your spreadsheets, you can have all your financial data in one place, making it easier to monitor your expenses and stay on track with your budgeting goals. Here, you’ll find a bonus tutorial on how to connect your banks to your spreadsheets so you can streamline your budgeting process.

One option for connecting your banks to your spreadsheets is to use a program like Tiller. Tiller is a financial tool that integrates with Google Sheets, allowing you to automatically import your financial data from your banks into your spreadsheet. With Tiller, you can set up a connection to your banks, customize your budgeting template, and have your financial transactions automatically updated in real-time.

Another popular choice is NerdWallet’s CreditWise. CreditWise is a free credit monitoring program that also offers budgeting features. With CreditWise, you can connect your banks to track your expenses, set financial goals, and get personalized tips and advice on how to achieve them.

Regardless of which program you choose, connecting your banks to your spreadsheets can provide you with an additional level of automation and convenience when it comes to budgeting. By having your financial data automatically imported, you can save time and effort when it comes to tracking your expenses and making adjustments to your budget.

So, if you’re ready to take your budgeting to the next level, consider connecting your banks to your spreadsheets. Not only will it make the process more efficient, but it will also give you a clearer picture of your financial health and progress towards your financial goals.

Sources

When it comes to creating a budget template, there are several sources that you can turn to for help. These sources include online platforms, budgeting apps, financial advisors, and personal finance websites. Here are a few options to consider:

NerdWallet: NerdWallet is a popular personal finance website that offers a variety of budgeting tools and resources. They provide free budget templates that you can choose from and customize to fit your goals and financial situation.

Tiller Spreadsheet: Tiller Spreadsheet is a program that allows you to connect your bank accounts and automatically import your financial data into a budget template. They offer a variety of budgeting templates that you can choose from and customize to fit your needs.

Google Sheets: If you’re looking for a free option, Google Sheets is a great choice. They offer a wide range of budget templates that you can choose from and customize to fit your needs. You can also find additional templates created by users within the Google Sheets community.

Financial Apps: Many banks now offer their own budgeting apps that allow you to monitor your expenses and set financial goals. These apps often include budget templates that you can use to get started.

CreditWise by Capital One: CreditWise is a free credit monitoring program offered by Capital One. They also provide a budget planner tool that can help you create a budget and track your expenses.

Personal Financial Advisors: If you’re looking for more personalized advice and guidance, consider contacting a personal financial advisor. They can provide you with customized budgeting advice and help you create a budget that aligns with your financial goals.

These are just a few sources to get you started on creating a budget. Depending on your needs and preferences, you may choose to use one or more of these sources, or explore other options that are available to you.